In this article we will look at the deadline for submitting a balance sheet. We will find out what is included in the organization’s financial statements in addition to submitting the balance sheet. Let's talk about responsibility for non-delivery and delay.

The presentation of balance sheets is carried out by persons who are responsible for maintaining accounting records. Reporting is presented regardless of the organizational form. Enterprises registered in the form of individual entrepreneurs are exempt from accounting. The reporting period for the formation of balances is the calendar year.

Reporting deadlines

Financial statements are submitted once a year, within 3 months after the end of the calendar year . Enterprises have the obligation to prepare balance sheets for reporting periods. Indicators generated within the year are used by internal consumers of information - the manager, founders, shareholders.

Accounting statements are submitted to the territorial office of the Federal Tax Service and Rosstat authorities. Evasion of submitting reports to the Federal Tax Service or missing the deadline for submission entails the imposition of fines on the organization and responsible persons. The absence of activity at the enterprise does not relieve the obligation to submit balance sheets and appendices to them.

Delivery in 2021

The time for submitting the balance sheet in 2021 to the tax authority and the deadline for its submission to the statistical authority are the same. For 2021, the balance is sent to the tax and statistical authorities by 04/01/2019. From 2021, SMEs are required to use TCS when sending reports.

It is worth noting that there is no need to submit an interim balance sheet and reports, even if the company maintains them regularly. It is also recommended that organizations for which a mandatory audit has been assigned note that, along with the reporting documentation for 2021, they must submit the audit report to Rosstat.

The time to provide the required data this year is 10 working days. The countdown will begin on the next day from the date specified in the papers (must not be later than 12/31/2018). Mandatory audit is required for companies that meet a separate list of criteria.

Reporting deadlines for non-profit organizations

The reporting period for budgetary, autonomous, and government institutions is determined from the day the organizations are included in the register of recipients of budgetary funding. When conducting business during a financial year, reporting is presented for an annual period. Public sector enterprises are not required to submit balance sheets to statistical authorities. The recipient of the reporting is the higher authority (budget manager) and the Federal Tax Service. The forms differ from the forms of commercial enterprises.

Organizations of budgetary, state-owned, autonomous types submit reports:

- Monthly – to a higher authority;

- Quarterly - to a higher authority;

- Annually – to a higher authority and the Federal Tax Service.

The deadline for submitting annual forms to the budget manager is January of the year following the reporting year. Dates are set depending on the type of form submitted. To the Federal Tax Service, the deadline for submitting data coincides with the generally established one - 3 months after the end of the reporting year. The composition of the forms for organizations and budget managers differs.

Non-profit organizations are required to submit annual reports in accordance with the generally established procedure. NPOs have the right to report on forms established by law or independently developed forms. In the absence of activity, NPOs may have zero balances due to the absence of the need to form an authorized capital. Balance sheets are presented regardless of the conduct of business.

Preparation of interim reporting

Like annual reporting, interim reporting must meet the requirements of reliability, timeliness, verifiability, integrity, simplicity and relevance. Preparation of interim reporting has its own characteristics.

- In the interim reporting there is no balance sheet reformation - write-off of profit or loss received for the previous financial year. At the end of a quarter or half a year, profit (loss) remains in account 99 and must be written off to account 84 only at the end of the reporting year.

- When preparing interim reporting, inventory is not required.

- Income tax is calculated using the tax rate that will be applied to annual earnings.

- Planned but not incurred expenses do not need to be recognized, just like income not received. As in the annual accounts, they should only be recognized when the recognition criteria are met.

- Assets are valued without the involvement of appraisers by extrapolation of data or independent calculation by the financial department of the organization.

- In interim reporting, employee bonuses can only be recognized early if, at the reporting date, the amount of the payment can be reliably measured or if the company has a legal obligation to pay that cannot be avoided.

Deadlines for submitting reports for new and liquidated organizations

The period for which reporting is presented has different deadlines for newly formed enterprises, liquidated enterprises, and reorganized enterprises.

When submitting balance sheets of new enterprises:

- In the year of establishment of the enterprise, the period is calculated from the date of registration to the end of the year;

- Companies registered in the 4th quarter do not submit balance sheets for the current year period. The first reporting period is the next calendar year;

- Reporting is also submitted in the absence of activity.

The reporting period of a liquidated company is limited to the date of making an entry in the register about the termination of activities. Organizations undergoing liquidation submit 3 types of reporting. Generally established balance sheet forms in their original form or forms modified by enterprises are used.

| Form | Peculiarities |

| Interim liquidation balance sheet | Formed after the deadline for submitting creditor claims has expired |

| Final liquidation balance | Compiled after settlements with creditors |

| Latest reporting | The filing deadline is set no later than the day the entry on liquidation and exclusion of the organization from the register is made |

For liquidated organizations, the reporting period is calculated from January 1 of the year of liquidation to the date of filing the last reports. In the latest financial statements of the enterprise there are no indicators of economic activity. Standards for the composition of forms and the preparation of recent reports have not been established.

Approval procedure

Before reporting can be presented to interested users, it must be approved. So, in accordance with the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies,” the annual reporting of a joint-stock company is approved by the general meeting of shareholders, and of limited liability companies by the general meeting of participants (Federal Law of February 8, 1998 No. 14 - Federal Law “On Limited Liability Companies”).

The annual general meeting of shareholders is held within the time limits established by the company's charter, but no earlier than two months and no later than six months after the end of the company's financial year.

Reporting of reorganized enterprises

In the process of reorganization in the form of merger, transformation, division or accession, a new organizational form is created. The reorganized enterprise is obliged to submit the latest financial statements resulting from the transformation - the introductory ones. The deadline for submitting balance sheets is tied to the date of changes, the day before the information is entered into the register. Features of reporting depend on the form of reorganization. Conditions for submitting reports during reorganization in the form:

- Divisions. Rights and obligations are transferred to the new organization on the basis of the separation balance sheet. The reorganized enterprise closes its accounts the day before making an entry in the register;

- Discharge. The indicators of the reorganized organization are divided. If the financial year is continuous and only property and liabilities are separated, final reporting is not generated. Interim reporting is presented;

- Accessions. The final reporting is prepared by the merging organization the day before the entry is made in the register. An enterprise joined by another person continues the financial year without closing accounts and submitting final reports with the presentation of interim indicators.

- Mergers. The final reporting is submitted by the reorganized organization with the closure of accounts and reflection of the costs of the procedure. The initial indicators of the newly organized company are formed on the basis of the transfer deed;

- Transformations. Reporting is submitted by the transformed enterprise the day before the change of organizational form. The transfer of the remains of the transformed enterprise is carried out according to the act.

The form for submitting final reports (electronically, on paper) does not differ from the traditional presentation of balance sheets by an enterprise.

Who is obliged to hand over the balance

Absolutely all enterprises are required to maintain accounting records.

It doesn't matter what form of taxation they use. As a result, all commercial and non-profit companies must submit a balance sheet for a certain period along with the rest of the reporting documentation. According to the norms of tax legislation (Article 23 of the Tax Code of the Russian Federation), all organizations must submit financial statements on time to the following authorities:

- Inspectorate of the Federal Tax Service;

- to the statistical regional office;

- to the owners of the enterprise (shareholders, investors) - at their first request.

The type of reporting is not strictly regulated. It turns out that the organization has the right to independently decide whether to submit documentation for the company’s annual activities on paper or in digital format.

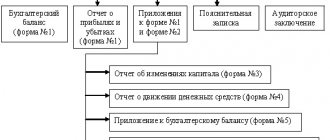

Deadline for submitting the balance sheet: composition of the submitted financial statements

The list of financial statements is established depending on the category of taxpayer. Small businesses submit reports to the control authorities as part of Form 1 and Form 2 balance sheets. Other enterprises, with the exception of individual entrepreneurs, are required to submit attachments in addition to the main forms:

- Statement of changes in equity;

- Cash flow statement;

- Report on the intended use of funds;

- Explanations for the information provided in the forms.

An audit report is additionally submitted to Rosstat as part of the mandatory forms for enterprises subject to mandatory audit. The Federal Tax Service does not have the obligation to submit a conclusion, which does not relieve one from responsibility for refusing to carry it out.

The legislation establishes a list of conditions under which enterprises are required to order an audit from a specialized organization. Joint-stock companies, LLCs with assets at the end of the year of more than 60 million rubles, political parties, microfinance organizations and other types are subject to mandatory audit.

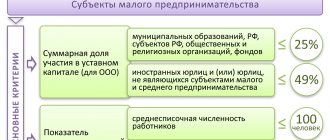

What does a small business submit to Rosstat?

The obligation to submit statistical reports for small and medium-sized businesses is enshrined in Art. 5 of the Federal Law of July 24, 2007 No. 209-FZ. Such organizations most often submit reports to Rosstat using a simplified scheme, and some do not report at all.

Rosstat conducts two types of monitoring of the activities of companies and individual entrepreneurs:

- continuous, when accounting forms are submitted with a mark of acceptance from the tax authorities;

- selective, when the company is included in the sample and already submits statistical reporting in addition to accounting.

Situation 1. Your company is included in the sample

Statistical reporting forms in a situation where your company is included in the sample are provided to the statistical authorities, along with explanations and comments on their completion. As a rule, this is a report in Form No. 1-IP, but statistical authorities may ask you to provide additional forms. Therefore, we will not focus on submitting statistical reports.

How to submit reports to statistical authorities? There are 3 ways:

1) via electronic communication channels, using an electronic digital signature. The same forms of financial statements are provided to Rosstat as to the tax authorities. To transfer data, just enter “Kontur-Extern” (tab “Statistical reporting” - “Accounting statistical reporting”), check the boxes next to the required forms, select the recipient and click “Submit”. The deadline for submission, as for the tax office, is no later than three months after the end of the year, that is, before March 31, 2017, you need to submit the balance sheet for 2021 to the tax and statistical authorities;

2) by mail, reports can be submitted to statistical authorities by simple registered mail without an inventory and notification;

3) personally or through an authorized representative bring reports to the statistical authorities.

Situation 2. A company on special regime was not included in the sample

If the company has not received notification from the statistical authorities that it was included in the sample, it is necessary to prepare financial statements for submission in the usual form. You provide the statistical authorities with a certified copy of the balance sheet (without explanations) and a copy of the financial results statement, with a note from the tax authority about the acceptance of the statements, until March 31, 2021.

Question: This is our first time submitting reports to the statistical authorities and we don’t know which department to submit them to. The statistics codes do not indicate which statistics department we belong to, and there is no such information on the Goskomstat website either. Where can I find this information?

Answer: indeed, in the statistics codes there are no identifying marks indicating which statistical body the company should submit reports to. If you submit reports to statistical authorities via electronic communication channels, then they are automatically submitted to the required department. But if you submit a report to the statistical authorities in person or by mail, then you can find out your branch using simple logical deductions:

- first you need to know which tax office you are registered with;

- Next, look at which district your inspection belongs to. It is in the same district that you need to submit reports to the statistical authorities.

Example

A company that uses the simplified tax system is registered with Federal Tax Service Inspectorate No. 25. We look at the tax inspectorate’s website to see which district the inspection belongs to—the Southern Autonomous District. Consequently, reports must be submitted to the Department of State Statistics in the Southern Administrative District of Moscow.

A complete list of statistics departments can be found on the Goskomstat website. For example, all contacts of statistics departments in Moscow can be seen on the website of the Moscow Department of Statistics.

Situation 3. The company did not operate under special regime

If you are one of such companies, you need to report to the statistical authorities on a general basis. You submit a certified copy of the balance sheet (without explanations) and income statement. The copies must bear a mark from the tax authority confirming the acceptance of the reports.

Even if the company did not conduct business, the balance sheet cannot be zero!

The balance sheet must contain values for some lines. For example, each LLC under the simplified tax system, like all LLCs applying other tax regimes, has an authorized capital (at least 10,000 rubles). Another example: every company must have at least one current account (regardless of the chosen tax regime). Agree that no bank will open a current account for you and maintain it for free. And to do this, you will need to deposit a certain amount of money into your account, which, as a rule, is debited monthly (depending on the conditions specified in the terms of the agreement with the bank). You will also have to show this amount on your balance sheet.

Situation 4. An individual entrepreneur is exempt from accounting, but keeps a ledger of income and expenses

Individual entrepreneurs, if they are not included in the sample, do not need to submit anything to the statistics authorities!

Question: Previously, we submitted to the statistical authorities a copy of the tax return (with a tax mark) paid in connection with the use of the simplified tax system. Do I need to take it now?

Answer: no, such an obligation is not prescribed by law anywhere.

The Letter of Rosstat dated April 15, 2016 No. SE-01-3/2157-TO contains the following explanations on this situation. Organizations are not required to submit statistical reports with zero indicators. Rosstat specialists believe that instead of a zero report, an official letter can be submitted to the statistical authorities about the absence of a particular indicator in the organization.

The instructions for filling out some statistical reporting forms include a provision: these forms do not need to be submitted to territorial state statistics bodies in the absence of relevant indicators. These forms include:

- information about overdue wages (form No. 3-F);

- information on suspension (strike) and resumption of work of labor collectives (form No. 1-PR);

- information on financial investments and liabilities (form No. P-6);

- information on the implementation of scientific research and development (form No. 2-science).

But instructions for filling out other forms of statistical reporting do not contain a similar provision.

Responsibility for violation of deadlines for submitting reports to the Federal Tax Service

Enterprises that violate the requirements for meeting reporting deadlines are subject to tax and administrative liability. The fine is set in accordance with Art. 126 of the Tax Code of the Russian Federation in the amount of 200 rubles for each unsubmitted document. Administrative liability is established in the amount of 300 to 500 rubles with the involvement of an official - manager or chief accountant - in punishment.

Organizations that misrepresent balance sheet data are also held accountable. The Federal Tax Service interprets incorrect data as a gross violation of accounting procedures. A gross violation of the Tax Code of the Russian Federation means systematic untimely or incorrect reflection of the facts of business transactions on accounting and reporting accounts. Gross misstatement of data is estimated to be within 10% of correct reporting figures. The amount of the administrative fine imposed on an official for distorting data ranges from 2 to 3 thousand rubles.

Who needs it and why?

The balance sheet serves as the face of the company.

It is needed so that persons who are already cooperating or are just planning to enter into a relationship with the organization can correctly assess its condition, how well things are going and whether the company is facing imminent bankruptcy. For example, all banks carefully study the balance sheet to ensure the borrower's solvency. Reporting documentation is submitted to tax and statistical institutions. The balance sheet is also provided to the owners and shareholders of the company as a financial report on the work done.

All financial analysis is based on the balance sheet. It helps determine the sustainability of the company’s current position, the possibility of its operation and future prospects. As a rule, the balance sheet is studied together with the profit and loss statement (automated programs are most often used). As a result, all the required coefficients will be obtained, fully reflecting the current state of affairs.

Responsibility for failure to submit reports to Rosstat offices

Statistical bodies do not have the right to apply tax penalties. The institution applies punishment for failure to provide data or violation of deadlines in the form of administrative liability under Art. 19.7 Code of Administrative Offences.

The table shows the amounts of fines:

| Face | Fine amount |

| Official of the organization | From 300 to 500 rubles |

| Repeated violation | Disqualification from 1 year to 2 years |

| Organization | From 3 to 5 thousand rubles |

Reporting to Rosstat is submitted electronically. An exception to the reporting form is provided to micro-enterprises that have the right to submit forms in paper form.

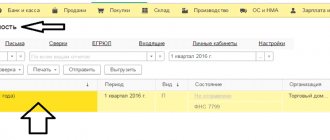

Reporting Options

Enterprises have the opportunity to present reports in several ways. Methods used:

- Personal representation or through a representative. The advantages include the possibility of contact with the receiving party. If there are obvious errors, there will be the possibility of additional consultation, without the need for payment. The disadvantages of visiting the Federal Tax Service include the need for a large investment of time;

- Unloading via 1C. Electronic exchange is possible upon concluding an agreement with a 1C partner and receiving electronic keys. The advantages include the ability to upload documents directly from the program when using it for accounting. The disadvantages include the need to pay;

- Representation via VLSI. Submission of reporting via the Internet is carried out when using the resource or by downloading from another program. The advantages include efficiency, reliability of delivery, the ability to consult and download offline. The downside is the need to conclude an agreement with payment for services;

- Using the government services website. Submitting reporting through the resource precedes the creation of a personal account and registration of keys, which is a disadvantage of this method. The advantages include the absence of fees for using the resource and prompt feedback.

The choice of method depends on the priorities of the enterprise employee responsible for submitting reports.

Common reporting errors

Errors may occur when preparing to submit financial statements.

| Index | Error | Explanations |

| Balance price | Inequality of liability and asset indicators form 1 | Data inconsistencies may arise due to incorrect rounding, incorrect transfer of the balance of retained earnings (uncovered loss), or an arithmetic error. Elimination of inequalities is carried out by checking the indicators of the general ledger, account turnover and information from primary forms |

| Explanations | Lack of information on the correction of errors of previous periods that arose after the reporting was submitted | Enterprises must disclose information in an explanatory note about the nature of the error, period, amount and procedure for adjustment |

| Linking forms | Inconsistency between indicators of different forms | To check the data, you need to use formulas for the mutual linkage of articles of the submitted reporting forms |

An example of an error in the balance sheet, which resulted in a discrepancy between assets and liabilities. The Micron organization has long-term receivables, the amount of which at the end of the year amounted to 360 thousand rubles up to 90 days. The unused reserve created by the enterprise was restored. At the same time, a new reserve was created in the amount of 180 thousand rubles. In the balance sheet, the organization reflected the amount of receivables and reserves in full. As a result, balance sheet indicators were distorted. Correct indication of the debt minus the reserve. After correcting the errors, the discrepancies were eliminated.

How to build

The balance sheet consists of assets and liabilities. Ultimately, the numbers should be equal. The asset includes only two sections:

- non-current assets (they are operated for a long time, more than 12 months: buildings, equipment, intangible assets, etc.);

- current assets (they are exploited in a short time: raw materials for production, financial resources, etc.).

It is generally accepted that the liquidity of current assets is higher than that of non-current assets. The point is that they can be converted into cash.

With an asset, everything is simple, it displays what property the organization owns. The passive shows the sources of obtaining this property. It includes three sections:

- reserve and capital (resources owned by the organization);

- long-term liabilities (credits, borrowings and other forms of debt, the repayment period of which does not exceed 12 months);

- short-term obligations (debt to employees, suppliers, partners, and other obligations that must be fulfilled within 12 months).

At this point in time, enterprises have a balance sheet form established in the Order from the Ministry of Finance (dated 06/02/2010). All aspects are regulated in the section “On the forms of financial statements of companies”.

However, it is worth noting that the form described by the Ministry is recommended rather than mandatory. The company has the right to add its own lines and notes, highlighting and explaining the data presented, or remove any items for which it does not have information.