Regulatory regulation of tax reporting of an organization

The main document regulating the composition and timing of reporting is the Tax Code. Based on reporting, organizations pay the required taxes, fees and contributions.

There are two reporting categories: taxpayers and tax agents. Legal entities and individuals who, according to the Tax Code of the Russian Federation, are required to pay taxes are called taxpayers. Persons charged with the responsibility for calculating, withholding from the taxpayer and transferring taxes to the budget are recognized as tax agents.

In addition to the Tax Code, regulatory documents include:

- orders of the Federal Tax Service on approval of reporting forms and instructions for filling them out;

- official explanations of the Federal Tax Service on the application of legislation;

- internal documents of the company (accounting policies).

Composition of an organization's tax reporting

The composition of tax reporting depends on the taxation system and type of activity.

Companies submit the most reports to OSNO. Organizations that use special regimes spend a little less time filling out declarations.

Conventionally, tax reporting can be divided into categories:

- Declarations on tax paid in connection with the application of the special regime.

- Declarations on property taxes (transport, land, property).

- Personal income tax reporting.

- Reporting on insurance premiums.

- Declarations on taxes paid under the general regime.

- Declarations on taxes paid for the use of resources (for example, water tax).

In special modes, they submit a declaration on UTII, a declaration on the tax paid in connection with the use of the simplified tax system, or a declaration on the Unified Agricultural Tax.

On OSNO, the main tax reports are VAT and income tax returns.

Please note that the deadlines for the same reporting may be different for individual entrepreneurs and LLCs. For example, entrepreneurs submit a declaration under the simplified tax system by April 30, and companies must report a month earlier.

What forms are required for submission?

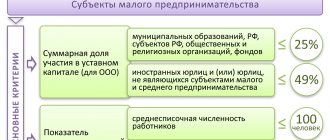

All enterprises submit a full package of the specified reports with the completion of all forms, with the exception of small organizations, which are allowed to provide a simplified version of the balance sheet and statement of financial results. Information in the documentation must be relevant, truthful, and complement each other.

For other companies, in addition to the mandatory forms of balance sheet and income statement, a statement of changes in capital or cash flow may be generated. As explanatory documentation, an enterprise can provide an explanatory note and an audit report:

The responsible person - an accountant or manager - must begin generating reports after the end of the reporting period, when all the results of the company’s work have been summed up. The reporting period in this case is set to the calendar year. In this regard, the reporting date in the documentation will be indicated as December 31 of the year for which the report is being prepared. Only after this date can you begin to fill out financial statements and generate a complete package of documents.

General tax reporting

There are reports that are submitted regardless of the taxation regime. This applies to reports on personal income tax and insurance premiums. All companies must submit forms 2-NDFL, 6-NDFL and calculation of insurance premiums to the Federal Tax Service.

If a company owns property, separate declarations are submitted for it.

There is a report that contains no data on income or taxes. Every year, organizations submit information to the tax office about the average number of employees. The reporting deadline is January 20 inclusive. When opening a new company, you must fill out and submit headcount information by the 20th day of the month following the month of registration.

Calculation 4-FSS

Who is renting? All insurers: organizations and individuals who hire workers under employment contracts and civil and industrial agreements, if they have such a condition.

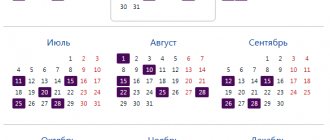

Deadlines for delivery . The deadlines depend on the form of payment submission: paper or electronic. In 2021, the deadlines are as follows:

| Period | For electronic form | For paper form |

| 2020 | The 25th of January | January 20th |

| I quarter 2021 | 26 April | 20 April |

| half year 2021 | 26 July | July 20 |

| 9 months 2021 | the 25th of October | The 20th of October |

Form and delivery format. The 4-FSS calculation form was approved by FSS Order No. 381 dated September 26, 2016. The delivery method depends on the average number of employees in 2021. If it exceeds 25 people, you need to report electronically; if not, you can choose a paper format.

LLC tax reporting

Let's look at two popular modes and the features of reporting in each of them.

LLC on OSNO

First of all, in this mode you need to generate a VAT return. Organizations report taxes four times a year: April 25, July 25, October 25 and January 25. If the deadline falls on a weekend, you can submit the declaration on the next working day. In some cases, a log of received and issued invoices must be sent to the Federal Tax Service. It is rented out by intermediaries, developers and freight forwarders who are not VAT payers. The journal must be submitted by the 20th day of the month following the reporting quarter.

In general, the income tax return is submitted every three months on an accrual basis. Deadlines: March 28 (annual declaration), April 28, July 28 and October 28. Some companies calculate income tax on a monthly basis, so once a month they must submit a tax return and send an advance payment to the budget.

When paying income to individuals, the LLC submits quarterly calculations in Form 6-NDFL. The form must be submitted by the 31st day of the month following the reporting quarter. Report 6-NDFL is filled out with an accrual total. Once a year, form 2-NDFL is submitted (for each employee) until March 1 inclusive.

For insurance premiums, you need to submit a corresponding calculation to the Federal Tax Service. Due dates: April 30, July 30, October 30 and January 30.

The listed reports are an integral part of the work at OSNO. If a company has transport or land, it must pay taxes. But there is no need to submit returns for these taxes from 2021.

If an OSNO LLC has real estate, it will have to submit a property tax return for the year by March 30.

LLC on the simplified tax system

The simplified tax replaces the income tax, so simplified tax returns are not submitted.

Companies must submit a declaration under the simplified tax system. The reporting deadline is March 31. In this case, the composition of the declaration depends on the selected object of taxation. If a company operates on the simplified tax system with the object “income minus expenses,” the declaration should include a title page, sections 1.2, 2.2 and section 3 (for targeted financing). Organizations with the object “income” fill out all sections of the declaration, except 1.2, 2.1.2, 2.2. Section 3 is completed if the relevant data is available.

When paying income to individuals, the LLC submits quarterly calculations using the simplified tax system using Form 6-NDFL. The form must be submitted by the 31st day of the month following the reporting quarter. Report 6-NDFL is filled out with an accrual total. Once a year, form 2-NDFL is submitted (for each employee) until March 1 inclusive.

Simplified workers, like all companies, submit calculations regarding insurance premiums. Due dates: April 30, July 30, October 30 and January 30.

A property tax return must be submitted if you own real estate.

Calculation of insurance premiums

Who is renting? Organizations and individual entrepreneurs who pay insurance premiums from the income of individuals. Heads of peasant farms.

Deadlines for delivery . Calculations must be submitted for the first quarter, six months, 9 months and a year. In 2021 the deadlines are as follows:

- for 2021 - February 1, 2021;

- for the first quarter of 2021 - April 30, 2021;

- for the first half of 2021 - July 30, 2021;

- for 9 months of 2021 - November 1, 2021.

Form and delivery format. The method of submitting the calculation depends on the number of individuals to whom you have accrued contributions in the current period. If their number does not exceed 10 people, the calculation can be submitted both on paper and electronically. For the rest, only electronic format is available.

Submission of tax reporting on paper

More and more companies and individual entrepreneurs are switching to electronic reporting. First of all, it's convenient. Secondly, few taxpayers have the right to submit reports on paper.

Paper tax returns can be submitted in two ways: visit the Federal Tax Service or send reports by mail. The declaration can be submitted by the director of the company or an authorized person with a power of attorney. If you decide to send reports by mail, do not forget to make an inventory of the attachment.

The reporting date is equal to the date the letter was sent or the date it was delivered to the inspector during a personal visit.

Submission of tax reporting in electronic form

Electronic reporting is sent via telecommunication channels (TCC). To send reports, you need to verify them with a qualified electronic signature. You can obtain a signature from electronic document management operators.

Advantages of submitting tax reports according to TKS:

- no need to visit the Federal Tax Service;

- you can send a report at any time of the day;

- reduction of errors, as the built-in verification system will detect technical errors and warn the user;

- there is no need to monitor the relevance of reporting forms, since electronic reporting systems are constantly updated;

- notification of receipt of the Federal Tax Service reports is sent directly to the system;

- reporting is protected from viewing and correction by third parties.

Taxpayers are required to submit a tax return in electronic form if one of the factors is present (clause 3 of Article 80 of the Tax Code of the Russian Federation):

- the average number of employees exceeds 100 people;

- the obligation to report electronically is provided for a specific tax.

Only electronic VAT returns are accepted. Numbers don't matter.

The method of submitting reports in form 2-NDFL and 6-NDFL depends on the number. Companies in which 10 or fewer people received income have the right to report taxes on paper. Other organizations submit these reports electronically (clause 2 of article 230 of the Tax Code of the Russian Federation).

What's happened?

The Federal Tax Service of Russia reminded all organizations that the legislation of the Russian Federation provides for the obligation of economic entities that maintain accounting records to submit annual accounting (financial) statements according to the general rule:

- to Rosstat;

- to the Federal Tax Service.

In addition, other legislative acts provide for the submission of accounting (financial) statements in the event that an organization carries out certain types of economic activities, to other supervisory authorities, for example, the Central Bank of the Russian Federation. But for the vast majority of organizations, the excess administrative burden has been removed. Now they can submit annual financial statements using the “one window” principle. For the first time, economic entities will report according to this scheme for 2021. Therefore, the Federal Tax Service explained how it works.

Tax reporting storage

Tax records must be kept for several years. The storage periods for tax accounting documents are established in paragraph 1 of Art. and clause 3 of Art. Tax Code of the Russian Federation. The storage periods for tax reporting are fixed in the Order of the Federal Archive of December 20, 2019 No. 236.

Tax returns and calculations must be kept for five years. There is a caveat for individual entrepreneurs: all declarations for 2002 and earlier must be stored for 75 years. The calculation of insurance premiums is stored for 50 years from the date of its preparation.

In order not to waste time on visits to the Federal Tax Service, or to stand in queues at the post office, send your reports via the Internet. The Kontur.Extern system will help you submit any tax reporting electronically. When you log into the system, you will always have only current forms that comply with the law. All you have to do is select the desired declaration and fill it out. The system will check compliance with the control ratios and suggest which lines of the report must be filled out. You will see the entire reporting cycle: from sending to acceptance by the tax authority. If the declaration does not go through for some reason, go to Kontur. A notification will appear externally, as well as a clear explanation of the reasons for the refusal and recommendations for correcting the error. You can also create and fill out reports in the accounting program and upload a ready-made form to Extern.