Everyone should know this - financial statements under the simplified tax system are submitted once a year - until March 30. A few years ago, organizations (LLC) specialized in this. regime, they did not think about compiling it, since they were relieved of the obligation to keep accounting records. But, a couple of years ago, the preparation of financial statements under the simplified tax system became mandatory for everyone except individual entrepreneurs. And accounting reporting under the simplified tax system is not at all simple, it is the calculation of taxes and contributions of the simplified tax system, accounting is needed here, and tens of thousands of entrepreneurs connect to the Elba Circuit online service every year, and the owners of LLCs are faced with an understandable problem. Elba was not designed for accounting, so all she could offer were crutches in the form of generating financial statements during the period of submitting these statements. This was enough for some, but others had to contact accountants or look for another online service.

Composition of an accountant's official calendar

The official calendar can be used by accountants of all organizations, including those keeping records on the simplified tax system.

The calendar presented in legal reference systems usually consists of 4 parts:

- A calendar based on set dates that are the same for everyone. It looks like a regular calendar with dates marked with hyperlinks. You can go through them and see what type of reporting or payment falls on this date and which payer it concerns.

- Calendar for unspecified dates. These dates refer to specific events. Here is a list of all official regulations in which you can clarify questions regarding reporting and payment. But if we are talking about the simplified tax system, such a calendar is not suitable.

- Grouping dates by events. This spreadsheet can be very useful if you have a list of taxes in front of you that need to be paid or for which the taxpayer must report. All events are listed here and dates are given. The simplified taxation system is highlighted in a separate line.

- Rules for rescheduling. Contains a list of all regulations related to these rules.

In general, navigating an accountant’s calendar is quite simple. However, if we are talking only about the simplified tax system, then you need to carefully monitor which dates relate exclusively to this regime. Many of its dates are easy to remember, because the options for deadlines for the simplified tax system are not very diverse. For them, as for all deadlines relating to the submission of reports and payment of taxes, the rule applies to the transfer of a date that falls on a weekend to the next working day.

Please note that the calendar does not provide information about payment deadlines:

- Personal income tax, subject to its own special rules;

- regional taxes and fees, the terms of which are established by the laws of the constituent entities of the Russian Federation and may vary significantly.

A version of the official accountant calendar is presented in our “Accountant Calendar” service.

If you do not submit reports to the Federal Tax Service or the Funds in a timely manner, sanctions will be imposed on both the company and its officials. Find out about liability for late submission of declarations and settlements in the ConsultantPlus ready-made solution by getting trial access for free.

Rules for filling out the balance sheet for the simplified tax system in 2020–2021.

The assets of the simplified balance sheet reflect in aggregate, without detailing:

- Tangible non-current assets, including:

- fixed assets (account 01 minus depreciation accumulated on account 02);

- property provided for a fee for temporary use (account 03 minus depreciation accumulated on account 02);

- equipment for installation (account 07);

- capital investments (account 08, except for investments in intangible assets and R&D);

- advances related to the construction of fixed assets (account 60) (see letter of the Ministry of Finance of the Russian Federation dated January 24, 2011 No. 07-02-18/01).

- Intangible, financial and other non-current assets, which include:

- Intangible assets (account 04 minus depreciation accumulated on account 05);

- long-term financial investments (account 58 minus the reserve for their depreciation formed on account 59);

- investments in intangible assets and R&D (subaccounts 08-5, 08-8), etc.

- Inventories consisting of:

- from raw materials and materials (count 10);

- work in progress (debit balances on cost accounts 20, 21, 23, etc.);

- goods (account 41);

- finished products (account 43).

Attention! From 2021, reserves must be accounted for in accordance with FSBU 5/2019 “Reserves”.

ConsultantPlus experts explained how an organization can switch to inventory accounting in accordance with FAS 5/2019. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

- Cash and cash equivalents, including:

- balances on cash, settlement, currency, special accounts (accounts 50, 51, 52, 55-3);

- transfers on the way (count 57).

- Financial and other current assets developing:

- from short-term financial investments (account 58 minus the reserve for impairment formed on account 59);

- debit balances on settlement accounts (60, 62, 68, 69, 70, 76, etc.)

The passive includes lines such as:

- Capital and reserves. These are authorized, additional, reserve capital and retained profit or uncovered loss (accounts 80, 82, 83, 84).

- Long-term borrowed funds (with a repayment period of more than 12 months - account 67).

- Other long-term liabilities (credit balances on accounts 60, 62, 68, 69, 76 (in terms of long-term accounts payable).

- Short-term borrowed funds (with a repayment period of less than 12 months - account 66).

- Accounts payable (credit balances on accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 (in terms of short-term “creditor”).

- Other short-term liabilities.

Just like in a regular balance sheet, the abbreviated one provides information for 3 years: the reporting year, the previous one and the one preceding the previous one. That is, in the balance sheet for 2021 you need to show the balances as of 12/31/2020, 12/31/2019 and 12/31/2018.

As you know, balance lines are encoded. Their codes are contained in Appendix No. 4 to Order No. 66n. The simplified balance sheet contains aggregated indicators that include several indicators (without detail), so the line code in it must be indicated by the indicator that has the largest share in the aggregated indicator (clause 5 of Order No. 66n).

Please note that only the head of the organization signs the balance sheet; the signature of the chief accountant is not required.

What and when to submit to the Pension Fund using the simplified tax system

Reporting submitted to the Pension Fund concerns only employers. It consists of:

- from reporting on the length of service of employees (forms SZV-STAZH and EDV-1), submitted at the end of each year no later than March 1 of the following year;

- information about insured persons who worked for the employer in the past month (form SZV-M), submitted no later than the 15th day of the month following the reporting month.

- information on the labor activity of employees (SZV-TD), sent monthly before the 15th (except for hiring and dismissal of an employee, when the report is submitted no later than the next day).

Read about the rules for preparing and submitting annual reports in the article “How to fill out and submit reports to the Pension Fund for the year?”

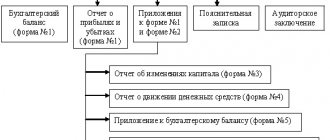

Requirements for financial statements under the simplified tax system

Accounting statements under the simplified tax system must be:

- Reliable - reflects the real picture of accounting for assets and liabilities, which is based on accounting in accordance with legal requirements, which also reflects the true financial results of the company’s activities.

- Holistic - an organization can have branches and separate divisions. Information about their activities, assets and liabilities should also be reflected in the reporting.

- Essential - those indicators must be reflected without which it is impossible to have a complete and clear picture of the financial and property condition of the company. The organization calculates materiality indicators independently, guided by PBU 4/99.

- Neutral - in this case, it means that the information contained in the reporting should not affect the assessment of its users in order to achieve benefits.

- Consistent - reporting is submitted in accordance with the forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n. The reports themselves must provide data both for the reporting period and for previous periods. In columns for which information is missing, dashes are placed.

In addition to these basic requirements, financial statements under the simplified tax system must be expressed in rubles and drawn up in Russian, be rational and timely.

What and when to submit and pay to the Social Insurance Fund using the simplified tax system

To the Social Insurance Fund, employers still need to submit a quarterly report on contributions for injuries (Form 4-FSS), submitting it in the month following the end of each quarter, no later than:

- on the 20th, if the report is submitted on paper (this is available to policyholders with an average number of employees of no more than 25 people);

- 25th, if submitted electronically.

And they are still paid to the Social Insurance Fund with the same frequency (monthly) and within the same period (no later than the 15th day of the month following the reporting month).

Read more about these contributions in this material.

The need for annual confirmation of the type of activity carried out by the policyholder also remains. Documents for this, compiled according to the data of the previous year, must be submitted to the Social Insurance Fund no later than April 15 of the following year.

What and when to submit and pay to the Federal Tax Service using the simplified tax system

Taxpayers using the simplified tax system submit a simplified tax return to the Federal Tax Service once a year (at the end of the year). The deadline for its submission for firms and individual entrepreneurs differs: organizations submit the declaration earlier - no later than March 31 of the year following the reporting year, and entrepreneurs have more time to prepare it and submit this report no later than April 30. In 2021, both dates are working, and therefore no postponements are expected.

The simplified tax system is paid quarterly (advance payments) no later than the 25th day of the month following the end of the next quarter. Payment at the end of the year is carried out within a time frame that coincides with the dates of filing simplified tax reporting and therefore differs for legal entities and individual entrepreneurs.

If an organization has grounds for the assessment and payment of land, transport or water tax, property tax based on cadastral value, then it submits reports on them (transport and land taxes are not declared) and makes payments within the legally established time frame. For individual entrepreneurs, the Federal Tax Service makes the calculation of property taxes, and he pays them in the same way as other individuals - once a year on the basis of a notification sent from the tax office, within the uniform period established for payments by individuals (until December 1 of the year following the billing year) .

Employers submit to the Federal Tax Service:

- a quarterly summary report on insurance premiums, submitted no later than the 30th day of the month following the reporting quarter;

- a quarterly report reflecting the amounts and timing of personal income tax due (form 6-NDFL), which is submitted no later than the last day of the month following the corresponding quarter, and no later than March 1 of the year following the reporting year, if the report refers to about the last quarter of the reporting year;

- annual reporting on employee income (Form 2-NDFL), submitted within the same deadline established for the submission of the last report for the year, Form 6-NDFL, if it concerns withheld tax, and submitted earlier (no later than March 1 of the year following the reporting period) ), if we are talking about unwithheld tax. For 2021, form 2-NDFL is submitted for the last time. Information on income for 2021 will be included in the annual 6-NDFL.

Payment of insurance premiums paid to the Federal Tax Service is carried out monthly no later than the 15th day of the month following the month being paid.

At the end of the year (no later than January 20), employers submit an annual report containing information on the average number of its employees.

Zero balance sheet according to the simplified tax system

Formation of a zero balance sheet according to the simplified procedure will be required if the enterprise is registered, but no activity was carried out. The obligation to provide reporting remains with the company, regardless of actual activity, until the moment it is deregistered with the Federal Tax Service.

In order to figure out how to correctly fill out a balance under the simplified tax system in the absence of activity, the simplifier will need to clarify the following data:

- The amount of the authorized capital: its creation occurs at the time of the start of activity, therefore, information must be present even in the zero document.

- Debt of investors: if the shares are not repaid, then this fact is reflected in the liability side of the simplified balance sheet.

- Debt to the budget - to determine its size, the company’s accountant should contact the Federal Tax Service and other government agencies and carry out a reconciliation of payments and obligations. A company that has not started operations may have debts to the budget, for example, due to state duties when changing information in the charter.

You can find a sample and nuances of drawing up a zero balance on our website.

Accountant calendar 2021 for individual entrepreneurs and organizations using the simplified tax system

| Month | Receiving authority | Reports and payments | Deadline for submission (payment) |

| January | Pension Fund | Reports SZV-M and SZV-TD for December 2021 | 15.01.2021 |

| FSS | Payment of contributions for injuries for December 2021 | 15.01.2021 | |

| 4-FSS report for 2021 on paper | 20.01.2021 | ||

| Report 4-FSS for 2021 electronically | 25.01.2021 | ||

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for December 2021 | 15.01.2021 | |

| Unified calculation of insurance premiums for 2021 | 01.02.2021 | ||

| February | Pension Fund | Report SZV-M and SZV-TD for January 2021 | 15.02.2021 |

| FSS | Payment of contributions for injuries for January 2021 | 15.02.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for January 2021 | 15.02.2021 | |

| March | Pension Fund | SZV-STAZH and EDV-1 reports for 2021 | 01.03.2021 |

| Report SZV-M and SZV-TD for February 2021 | 15.03.2021 | ||

| FSS | Payment of contributions for injuries for February 2021 | 15.03.2021 | |

| Inspectorate of the Federal Tax Service | 2-NDFL certificates for 2021 | 01.03.2021 | |

| Report 6-NDFL for 2021 | 01.03.2021 | ||

| Payment of insurance premiums for February 2021 | 15.03.2021 | ||

| Accounting for 2021 for legal entities | 31.03.2021 | ||

| April | Pension Fund | Report SZV-M and SZV-TD for March 2021 | 15.04.2021 |

| FSS | Payment of contributions for injuries for March 2021 | 15.04.2021 | |

| Confirmation of the type of activity carried out | 15.04.2021 | ||

| 4-FSS report for the 1st quarter of 2021 on paper | 20.04.2021 | ||

| Report 4-FSS for the 1st quarter of 2021 electronically | 26.04.2021 | ||

| Inspectorate of the Federal Tax Service | USN declaration and payment of simplified tax system for 2021 for legal entities | 31.03.2021 | |

| Payment of insurance premiums for March 2021 | 15.04.2021 | ||

| Payment of advance payment for the simplified tax system for the 1st quarter of 2021 | 26.04.2021 | ||

| Unified calculation of insurance premiums for the 1st quarter of 2021 | 30.04.2021 | ||

| Report 6-NDFL for the 1st quarter of 2021 | 30.04.2021 | ||

| USN declaration and payment of simplified tax system for 2021 for individual entrepreneurs | 30.04.2021 | ||

| May | Pension Fund | Report SZV-M and SZV-TD for April 2021 | 17.05.2021 |

| FSS | Payment of contributions for injuries for April 2021 | 17.05.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for April 2021 | 17.05.2021 | |

| June | Pension Fund | Report SZV-M and SZV-TD for May 2021 | 15.06.2021 |

| FSS | Payment of contributions for injuries for May 2021 | 15.06.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for May 2021 | 15.06.2021 | |

| July | Pension Fund | Report SZV-M and SZV-TD for June 2021 | 15.07.2021 |

| FSS | Payment of injury fees for June 2021 | 15.07.2021 | |

| 4-FSS report for the first half of 2021 on paper | 20.07.2021 | ||

| 4-FSS report for the first half of 2021 electronically | 26.07.2021 | ||

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for June 2021 | 15.07.2021 | |

| Payment of advance payment for the simplified tax system for the 2nd quarter of 2021 | 26.07.2021 | ||

| Unified calculation of insurance premiums for the first half of 2021 | 30.07.2021 | ||

| Report 6-NDFL for the half year 2021 | 02.08.2021 | ||

| August | Pension Fund | Report SZV-M and SZV-TD for July 2021 | 16.08.2021 |

| FSS | Payment of contributions for injuries for July 2021 | 16.08.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for July 2021 | 16.08.2021 | |

| September | Pension Fund | Report SZV-M and SZV-TD for August 2021 | 15.09.2021 |

| FSS | Payment of injury fees for August 2021 | 15.09.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for August 2021 | 15.09.2021 | |

| October | Pension Fund | Report SZV-M and SZV-TD for September 2021 | 15.10.2021 |

| FSS | Payment of contributions for injuries for September 2021 | 15.10.2021 | |

| 4-FSS report for 9 months of 2021 on paper | 20.10.2021 | ||

| Report 4-FSS for 9 months of 2021 electronically | 25.10.2021 | ||

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for September 2021 | 15.10.2021 | |

| Payment of advance payment for the simplified tax system for the 3rd quarter of 2021 | 25.10.2021 | ||

| Unified calculation of insurance premiums for 9 months of 2021 | 01.11.2021 | ||

| November | Inspectorate of the Federal Tax Service | Report 6-NDFL for 9 months of 2021 | 01.11.2021 |

| Pension Fund | Report SZV-M and SZV-TD for October 2021 | 15.11.2021 | |

| FSS | Payment of contributions for injuries for October 2021 | 15.11.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for October 2021 | 15.11.2021 | |

| December | Pension Fund | Report SZV-M and SZV-TD for November 2021 | 15.12.2021 |

| FSS | Payment of contributions for injuries for November 2021 | 15.12.2021 | |

| Inspectorate of the Federal Tax Service | Payment of property taxes for 2021 individual entrepreneurs | 01.12.2021 | |

| Payment of insurance premiums for November 2021 | 15.12.2021 |

The accountant's calendar for other taxation systems was developed by ConsultantPlus experts. Get trial access to K+ for free and submit your reports on time.

Results

Taxpayers using the simplified tax system can use the accountant’s general official calendar to determine the deadlines for filing the necessary reports and making payments. However, only certain dates of this calendar are significant for him, depending on who the taxpayer is (legal entity or individual entrepreneur), and on whether the individual entrepreneur has employees.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.