Purpose of opening balance

Definition 1

The balance sheet is an economic model that links the assets, equity capital and liabilities of an organization and allows users of financial statements to assess the financial position of a business entity as of a certain date.

There are many types of balance sheets. The formation of a balance sheet of one type or another depends on the purpose pursued by the persons interested in this information. In the case when it is necessary to reflect data on the organization’s property and the sources of their origin at the time of the start of its activities, an opening balance sheet is formed.

What is the annual balance sheet?

The annual balance sheet is the final report for the year. It is compiled for a specific date. This report indicates changes that occurred in asset and liability items for the year.

This type of report is compiled on the basis of inventory, data from the previous annual balance sheet, as well as accountant calculations. Each line of the report reflects exclusively real data about the state of the enterprise.

This can only be done if the accountant adheres to uniform accounting principles. If these principles are not followed, the balance sheet will be drawn up incorrectly.

In order to draw up an annual balance sheet, it is necessary to take inventory, make adjustments and close the current year.

So, to draw up a balance sheet, you will need to carry out year-end closing procedures.

Before this, absolutely all accounting transactions must be reflected, and mandatory taxes must be calculated. It is also necessary to sum up the financial results of the last month of the year.

In essence, the year-end closing procedure represents a reformation.

It boils down to the fact that certain accounts are reset to zero, as well as the mandatory closure of accounts that record sales operations and financial results.

These accounts include:

- 90 "Sales";

- 91 “Other income and expenses”;

- 99 "Profits and losses."

Before closing these accounts, all transactions must be verified. This is necessary in order to eliminate possible errors.

If errors are found, they can be corrected using normal adjustments. They are carried out on the last date of the report.

After completing these procedures, you can begin to work on drawing up the annual balance sheet.

Indicators for individual expenses and income are presented separately only if they are significant.

If they do not provide any value to users, then they can be given as a single amount.

Assets and liabilities must be divided into urgent and long-term. The balance is filled in thousands of rubles. In this case, rounding must be carried out. Moreover, they are carried out in each line.

It is very important to know that the date indicated in the report is the next date after the end of the (reporting) period.

There may be lines in the form that are not filled out. The values in these lines can also be zero. These lines are marked with dashes.

If any values are calculated in foreign currency, they must be converted at the current exchange rate into national currency.

It is worth remembering that the amount of accounts receivable does not include debts for which the statute of limitations has expired.

It also does not include debt that is considered uncollectible. They are taken into account in the “Other expenses” column.

The annual balance sheet is provided not only to government bodies, but also to founders and shareholders. This must be done without fail.

It is noteworthy that according to this scheme, enterprise balance sheets are compiled for various periods.

It is also worth knowing that minor discrepancies between assets and liabilities may occur as a result of rounding. Usually they range from one to three thousand rubles.

It is also very important to understand that even the most experienced professionals make mistakes when preparing an annual report.

Therefore, the next day after all calculations have been completed, it is recommended to check them.

Features of the opening balance

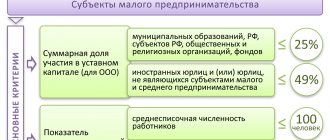

According to the provisions of Russian accounting standards, economic entities are required to form an opening balance sheet in the following cases:

- When creating a new legal entity.

- During reorganization, that is, the formation of a legal entity by:

- transformations;

mergers;

- discharge;

- divisions;

- accession.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

The opening balance sheet, both when creating a new legal entity and its emergence as a result of the reorganization of two or more organizations, is compiled as of the date of state registration. This date is considered to be the date of entry of the relevant information into the Unified State Register of Legal Entities (USRLE).

Foreign trade balance: in what cases is its preparation required?

If an enterprise is engaged in conducting trade operations with organizations from other countries (export or import), then it needs to draw up a foreign trade balance .

This type of balance sheet can also be compiled for different periods: a year, nine or six months, as well as a quarter.

The balance sheet of this type displays the ratio of import and export transactions carried out by the enterprise for the specified period.

A special feature of this type of balance sheet is the fact that it also includes those transactions that were carried out on credit.

Paid transactions that are reflected in the foreign trade balance are an integral part of the balance of payments.

If export operations exceed imports in value, then the balance is called active. In the opposite situation, the balance is called passive.

Opening balance when creating a new organization

When a new legal entity is formed, the first step is to form the authorized capital. Data on the size of the authorized capital and the property with which it was formed are reflected in the opening balance sheet.

Let's look at the formation of the authorized capital and its reflection in the opening balance sheet using an example.

Example 1

On July 3, 2017, an entry was made in the Unified State Register of Legal Entities about the state registration of Sever LLC. The founders of Sever LLC were 3 individuals, who contributed the following property as their contributions on 07/03/2017:

- Ivanov I.I. – equipment worth 500 thousand rubles;

- Petrov P.P. – materials worth 250 thousand rubles;

- Sidorov S.S. – funds in the amount of 250 thousand rubles to the organization’s cash desk.

The accounting records should reflect the following facts of the economic life of Sever LLC as of 07/03/2017:

As of July 3, 2017, the opening balance sheet of Sever LLC was formed (simplified version):

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Accounting is maintained without any pauses or omissions all the time during which the business structure carries out economic activities, right up to the liquidation of the enterprise.

The right balance sheet, which determines the amount of property of the newly created enterprise, is called the opening balance sheet. At the end of the next reporting period, based on the results of the transactions performed, a final balance sheet is drawn up, which, as it were, sums up the reporting period. It is compiled according to current entries in accounting accounts. All balances from these accounts are transferred to the closing balance. [p.43] Opening (organizational) balance - indicates the emergence of a new organization, i.e. Essentially, this is the balance sheet of the newly created organization. The property mass shown in it turns out to consist mainly of monetary contributions of the founders (participants) and organizational expenses. Drawing up the opening balance sheet essentially opens up accounting in a given organization. [p.60] For what purpose is the opening balance drawn up [p.115]

Answers 1. 2. 3. 4. Introductory balance. Balance is gross. Final balance. Net balance. [p.115]

Information connections of financial statements in dynamics are characterized by continuity of balance sheet indicators, opening balances of certain forms of the annual report. In particular, the balances of the items of the opening balance sheet at the beginning of the year must coincide with the data of the same items of the final balance sheet at the end of the previous year. Possible discrepancies associated, for example, with changes in the nomenclature of balance sheet items, with changes in the methodology for calculating individual items, or with organizational restructuring of the organization, should be commented in detail in the explanations to the report. [p.13]

The opening balance is drawn up at the time of establishment of the organization. It determines the sum of values with which an organization begins its activities. [p.25]

Column 3 provides data at the beginning of the year on the opening balance, i.e. data in column 4 of the previous annual balance sheet, taking into account the reorganization carried out, as well as changes related to the application of the Regulations on accounting and financial reporting and PBU 1/98. [p.28]

Opening balances are drawn up at the time of organization of enterprises (registration of the charter). Accounting for a given business entity begins with the opening balance sheet. There are opening balance sheets of newly created enterprises and business units formed on the terms of succession of previously operating ones. In the first case, the opening balance sheet reflects the authorized capital registered in the charter of the enterprise, and inventory lists of actually contributed property and property (mainly monetary) obligations of the founders for contributions to the authorized capital. [p.282]

In the second case (the newly created enterprise is organized on the basis of a previously operating one), the opening balance sheet may correspond to the final liquidation balance sheet of the enterprise, of which the newly created enterprise is the legal successor, however, with clarification of the assessment of individual items of the liquidation balance sheet. Finally, when the opening balance sheet is prepared for a company acquired at auction at a price that exceeds (understates) the net value of identified tangible and intangible assets, it is necessary to enter into the opening balance sheet an indicator of the positive or negative reputation of the company. [p.282]

Current balances. Unlike opening balances, which are compiled only once (at the time of organization of the enterprise), current balances are developed in accordance with the principle of the accounting period periodically throughout the operation of the enterprise and are divided into initial (incoming), intermediate and final (outgoing). [p.282]

What is the difference between opening balances and incoming balances [p.296]

When constructing the static equation for the opening balance sheet, the balancing indicator is considered to be the advanced (initially invested) capital, or participant contributions (CAC). Consequently, at the stage of the opening balance sheet, the owner’s capital (OC) consists of only one component - the capital declared in the constituent documents (KSA), or [p.372]

At the stage of the opening balance sheet, the organization has no accounts payable (PS liabilities - 0), which allows equation (14.16) to be written as follows [p.372]

It seems appropriate to divide the stages of the procedure into one-time ones, performed at the time of organization of the enterprise and initialization of accounting (which, according to the principle of continuity, is maintained from the moment of the emergence of an economic entity - registration of the charter and until its liquidation without omissions or interruptions), aimed at building the opening (organizational) balance sheet ( i.e. inventory and opening balance), and the stages implemented and repeated from reporting period to period (the remaining stages). [p.486]

It is the value of net assets, calculated from inventory, that is used in the formation of opening balance sheets compiled for organizations that, for some reason, have not kept records since the start of their activities. Similarly, a recovery balance is constructed in cases where organizations violate the principle of accounting continuity and allow failures in the sequence of reflecting the facts of economic life, for example, loss, theft or destruction in the event of a fire or natural disaster of a significant number of supporting documents, the renewal of which does not seem realistic. [p.487]

In the above formula there are no obligations of the economic entity to second and third parties, since at this point in time production, economic and financial activities have not yet been carried out, the owners’ capital has not been contributed, but only declared, obligations (accounts payable) have not been formed and there are obligations (accounts receivable debt) of the founders for contributions to the authorized capital. Consequently, for organizations that build an opening balance sheet according to the charter at the time of organizing an economic entity, the inventory should contain only a list of obligations (debts to the organization) for the founders’ contributions to the authorized capital and a list of property actually contributed by the participants at the time of registration of the charter. The opening balance is constructed using a formula similar to (14.20) [p.487]

The column At the beginning of the reporting year shows data at the beginning of the year (opening balance sheet), which must correspond to the data in the column At the end of the reporting period of the previous year (closing balance sheet), taking into account the reorganization carried out at the beginning of the reporting year, as well as changes in the assessment of financial reporting indicators related to with the application of the Regulations on accounting and financial reporting in the Russian Federation and the Regulations on accounting Accounting policy of the organization PBU 1/98. [p.341]

For Pacioli, there was no explicit opening balance. The initial records arose on the basis of [p.270]

Based on the Memorial, Journal articles were compiled reflecting the facts of economic life. They were located behind the articles, previously transferred from the Inventory and showing the state of affairs of the partnership at a certain moment. In our interpretation, these items, as stated earlier, are separated into a separate opening balance sheet. [p.273]

It is easy to see that one of the main functions of an accountant is recording the facts of economic life. He resorts to it when compiling inventory and the opening balance sheet, and the journal, and the General Ledger (in the latter case partially). The grouping is concentrated in the General Ledger and the turnover sheet, the interpretation is in the final balance sheet and partially in the General Ledger. [p.49]

With the opening of an enterprise, an opening balance sheet is drawn up, which is nothing more than converted inventory, but in a different form, more convenient for financial analysis, assessment of given resources and available opportunities. [p.51]

Qualification begins with posting the opening balance data to the accounts. If the data is taken from an asset, then it is recorded on the left side of the corresponding account - a debit, if from a liability - on the right side - a credit. [p.52]

Let's look at the opening balance sheet and try to understand (interpret) the economic situation reflected in it using three criteria: leverage, liquidity and profitability. [p.63]

Profitability. The opening balance sheet does not provide grounds for assessing profitability, since the economic activity of the enterprise has not yet begun. It can be stated that the owners, mainly at the expense of their own funds, having incurred huge initial costs, strive to obtain sufficient profit. [p.64]

When opening the General Ledger according to the opening balance sheet, the indicators of its asset are recorded in debit. [p.293]

The opening balance is evidence of the establishment of the company. It is drawn up either after registration of the company’s charter, or after adding assets to the authorized fund. [p.406]

The balancing indicator in the opening balance sheet is the authorized capital, since at this stage there is no other source of income due to the lack of economic activity. [p.66]

Inventory balances are compiled according to inventories (inventories) of individual assets and sources of their formation (for example, an opening balance sheet confirmed by the constituent documents of a legal entity). [p.74]

Opening balances are directly related to the acquisition of the status of a legal entity by an organization, i.e., after its state registration. [p.78]

Depending on the time of preparation, balance sheets can be opening, current, liquidation, separation and consolidation. The opening balance sheet is drawn up at the time of the company’s inception, or more precisely, after registration of its constituent documents. It records the amount of values and the sources of their formation with which a given company begins its activities. Current balances are compiled periodically throughout the existence of the organization. They are divided into initial (incoming), intermediate and final (outgoing). The concepts of initial and final most often refer to the annual balance sheet - the initial balance is formed at the beginning, and the final balance - at the end of the reporting year. Obviously, in dynamics over the years, any balance can be considered simultaneously both as final (in relation to the past year) and as initial (in relation to the coming year). Interim balances are compiled for a period of less than one year. The main difference between the interim and initial (closing) balance sheets is that interim balance sheets are compiled, as a rule, only on the basis of current accounting data, whereas before drawing up the final balance sheet, a complete inventory of all balance sheet items must be carried out, with its results reflected in the accounting and reporting, as a result of which the closing balances are more realistic. The liquidation balance sheet is formed during the liquidation of an organization. Most often, the liquidation balance sheet is compiled twice - at the beginning of the liquidation period (introductory liquidation balance sheet) and at the time of completion of the liquidation process (final liquidation balance sheet). The separation balance sheet is compiled at the time of division of a large organization into several smaller structural units or the transfer of one or more structural units of this organization another organ- [p.207]

We will try to consider the various stages of the production, economic and financial functioning of an organization in the form of separate models (opening balance sheet, static-dynamic book accounting equation, closing balance sheet). [p.372]

Opening balance model. The opening balance at the beginning of the activity is characterized by limited capital of the owner, the absence of debt obligations to third parties and refers to inventory balances. It is built using two inventories [p.372]

According to prof. Y. V. Sokolova [99. P. 62], the procedure provides for the following stages: inventory, opening balance, journal, general ledger, turnover sheet and closing balance. -s- [p.486]

In parallel with the Journal, in which all entries are placed in chronological order, the General Ledger was maintained. In it, all the facts of economic life are systematized by grouping their data into accounts. The difference between the General Ledger described by Pacioli and a modern similar register is that the opening balances of accounts are not distinguished as such and are shown as account turnover1. The reason is the lack of an opening balance, which was already mentioned above. [p.282]

Carrying out analysis

The analysis of the balance sheet is carried out in several stages. To begin with, a preliminary assessment is made, which identifies “sore” areas in the organization’s activities.

Their presence may indicate either poor performance in general, or specific shortcomings that, if repeated several times, will negatively affect the financial position of the company.

The following is analyzed:

- movement and balance structure;

- material stability;

- liquidity and solvency;

- state of assets;

- enterprise turnover;

- financial situation.

At the last stage, the possibility of restoration or deprivation of solvency and the likelihood of insolvency are diagnosed.

In total, balance provides an opportunity to understand a huge amount of information, systematizing and classifying it in certain directions.

This document is incredibly important for any organization.

Mainly because it allows you to develop a strategy for further actions in the work of the enterprise, as well as as a main assistant in making management decisions.

How to make a balance sheet - example (step by step instructions)

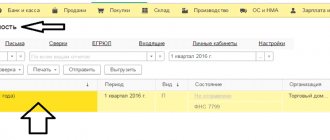

The procedure for drawing up the balance sheet is based on filling out the corresponding lines according to the balance sheet data for the reporting period, taking into account the requirements of PBU 4/99. To fill out the balance sheet, indicators are taken from the “turnover” in the form of an expanded balance for all accounting accounts. Fixed assets and intangible assets are reflected in the balance sheet minus depreciation. If the company's work results in a loss, its amount is reflected in parentheses as a negative number.

Each column of the balance sheet has a special encoding specified in Appendix No. 4 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Based on the line names, you can understand how to fill out the balance sheet.

Example of a balance sheet form

Let's look at an example of how to fill out the balance sheet of an enterprise created in 2021.

To do this, we will need input data based on the indicators of the balance sheet of Iskra LLC for 2017:

| № | Name | Balance line | Amount, thousand rubles |

| 1 | Fuel | Reserves | 2720 |

| 2 | Production equipment in workshops | Fixed assets | 9000 |

| 3 | Items for resale | Reserves | 734 |

| 4 | Tara | Reserves | 215 |

| 5 | Buyers' debt | Accounts receivable | 7 |

| 6 | Cash register | Cash | 70 |

| 7 | VAT on purchases | VAT on purchased assets | 1700 |

| 8 | Production materials | Reserves | 2200 |

| 9 | Securities | Financial investments | 113 |

| 10 | Computer programs | Intangible assets | 750 |

| 11 | Money in the current account | Cash | 4000 |

| 12 | Advance issued to employees for reporting purposes | Accounts receivable | 12 |

| 13 | Transfers on the way | Cash | 112 |

| 14 | Debt to suppliers | Accounts payable | 1250 |

| 15 | Tax debt | Accounts payable | 1600 |

| 16 | Wage arrears | Accounts payable | 1000 |

| 17 | Obtained a long-term bank loan | Long-term borrowed funds | 120 |

| 18 | Authorized capital | Authorized capital | 10 123 |

| 19 | Reserve capital | Reserve capital | 5800 |

| 20 | revenue of the future periods | revenue of the future periods | 340 |

| 21 | Profit received in the reporting year | retained earnings | 1400 |

How to fill out the balance sheet in this case: the indicators need to be posted on the corresponding lines of the balance sheet form and the totals must be summed up.

Which businesses need to draw up a balance sheet of cash income and expenses?

The balance of cash income and expenses is developed by banking institutions. This is due to the fact that this type of balance allows us to assess the state of money circulation between the population and legal entities.

This balance reveals the sources of cash income of the population. At the same time, it is possible to estimate the volume of this indicator.

This type of balance allows you to understand what the population spends their money on. At the same time, the remaining amounts in their accounts are also indicated.

This type of report is part of the national economic balance sheet, which is compiled at the state level.

All indicators that are presented in the balance of cash income and expenses are used in special calculations devoted to the forecast of cash turnover in the country.

This report is of particular importance. The thing is that a rational balance between income and expenditure of the population is a fundamental part of the rapid economic development of the region and the country as a whole.

Service Temporarily Unavailable

Russian accounting practice is characterized by the arrangement of asset items in order of increasing liquidity. First, indicators of the heaviest assets are given, then current assets and cash, which are the most liquid assets.

Liabilities include three sections: “Capital and reserves”, “Long-term liabilities” and “Short-term liabilities”. Liabilities are arranged according to the urgency of their repayment: long-term liabilities are listed first, and then short-term accounts payable to suppliers, to our own personnel for wages, etc.

Own capital (Section III) is shown in order of its constancy.

In a market economy, the balance sheet serves as the main source of information for a wide range of users. Thus, according to the balance sheet, owners, managers and other persons associated with management become familiar with the property status of the business entity. From the balance sheet they learn what the owner owns, that is, what is the quantitative and qualitative state of the stock of property that the enterprise is able to dispose of, and who took part in the creation of the property.