The accounting policy (AP) is a “particularly important” document that contains aggregate information on the maintenance of accounting and tax accounting methods at the enterprise (primary observation, cost measurement, current grouping and generalization of the results of economic activity facts).

The purpose of creating a management program is to ensure the possibility of combining all accounting information about the situation in the company. The UP contains the financial and economic indicators of the company, the procedure for their formation and what these indicators reflect.

The regulations of the legislation of the Russian Federation stipulate that the UE is formed by the chief accountant, or the person responsible for this area of work.

Each individual economic entity independently forms its own management system, which is based on the facts/conditions of conducting business activities.

When drawing up the UE, the following regulations must be applied:

| • Law “On Accounting” dated December 6, 2011 No. 402-FZ; • PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n; • Tax Code of the Russian Federation (Article 313); • other regulations (Standard recommendations for organizing accounting for small businesses, approved by Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, letters and clarifications of the Ministry of Finance, etc.); |

These regulations set out the basic principles and requirements for drawing up accounting policies necessary for the implementation of certain activities of the entity.

Many companies formulate accounting policies separately, i.e. on tax accounting and accounting, but the law does not prohibit the formation of a single UP, so it is possible to form one policy with tax and accounting sections.

| It should be noted that Article 313 of the Tax Code of the Russian Federation contains requirements for the need to establish a procedure for maintaining tax accounting in the UP and approval of the UP for NU by order (instruction) of the head of the company. At the same time, Law No. 402-FZ determines that in the UE for accounting it is necessary to concentrate the accounting methods used by the entity. However, there are no clear instructions about what the structure of this document should be, by whom, when and in what form it should be approved. These issues are discussed in PBU 1/2008, but it does not mention the need for annual approval of the UP. PBU 1/2008 prescribes the application of the management program consistently from year to year, maintaining its continuity and comparability with data from previous years. That is, if there are no factors forcing the entity to change the accounting policy it has adopted (innovations in legislation, new types of activities), then there is no need to change it. UP for the purposes of tax accounting in the Tax Code of the Russian Federation (Article 11) is characterized as a system for recording indicators that are significant for the correct determination of the tax base. Accordingly, if the methodology for accounting for these indicators does not require changes, then changes in the tax management system will not be required. |

The organization's accounting policies must be changed every year

It is not true. Change accounting policies as necessary. To do this, it is not necessary to approve a new accounting policy annually. It is enough to make additions or changes to the current accounting policy by issuing an appropriate order.

Of course, if you wish, you can approve the accounting policy every year. In this case, the approval date must be no later than December 31 of the previous year. For example, the accounting policy for 2017 should be approved before December 31, 2021 inclusive. That is, the approval date must be exactly December 31 or earlier.

But let us repeat once again - it is enough to draw up an accounting policy once when creating an organization, and then only make additions or changes.

Company accounting policy: when to supplement and when to change? - article

Changing accounting policies and adding to them are different concepts. Unlike changes, the procedure for additions to an organization’s accounting policies is not clearly regulated. Let's compare and see the differences using an example.

- The accounting policy (AP) is approved by the head of the organization.

- The UP is mandatory for use by all branches, representative offices and other divisions of the company (it is prohibited for different divisions to apply different accounting rules).

- does not apply to accounting reporting forms ! In this case, the main elements of the adopted accounting policy should be reflected in the explanatory note included in the annual financial statements.

- The management program is formed once - when the organization is created - and is applied consistently from year to year. It is not at all necessary to formulate accounting policies for accounting every year. But this is necessary if the legislation of the Russian Federation has changed.

- The UE can be supplemented or changed. What is the difference?

Systematize or update your knowledge, gain practical skills and find answers to your questions in advanced training courses at the School of Accountancy. The courses are developed taking into account the professional standard “Accountant”.

Add or change. What is the difference?

The accounting policy is supplemented if something new has appeared in the company’s activities, for which there are no accounting rules in the UP (clause 10 of PBU 1/2008):

| Unlike additions, the procedure for making changes to the accounting policy is strictly regulated:

|

Cases of changes in accounting policies:

- The legislation of the Russian Federation or regulatory legal acts on accounting have changed (for example, a new law on accounting has come into force).

- The organization has developed or chosen new methods of accounting in order to improve the quality of information about the accounting object (for example, it changed the method of calculating depreciation, considering it more profitable).

- The business conditions have changed significantly (the company has been reorganized, the types of activities have changed, etc.) (Clause 6, Article 8 of Law 402-FZ).

Example. When to make changes to the accounting policy, and when to add additions?

Imagine the situation... In 2012, the Proryv store made good money selling nano-donuts. Profits tripled! Inspired by the dizzying success, director Ignatiy Vasechkin decided to expand his business horizons and start wholesale trade in the new year. I thought - I did it! In February, the director hired five new employees, rented two new warehouses, and made sales arrangements with the right people.

Be sure to write in great detail about accounting for insurance premiums.

This is not true, but something will still have to be written down in the accounting policy. Undoubtedly, the most important change of 2021 is that insurance premiums will now be administered by the Federal Tax Service instead of the Pension Fund and the Social Insurance Fund. We are talking about two federal laws dated July 3, 2016: No. 243-FZ and No. 250-FZ.

Read also “Limits and base for insurance premiums for 2021”

The only thing that must be written down in the accounting policy is to approve the form of an individual accounting card for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums. Now everyone uses the card form given in the joint letter of the Pension Fund of Russia, the Federal Insurance Fund of Russia dated December 9, 2014 No. AD-30-26/16030, 17-03-10/08/47380. The Tax Service does not plan to develop a form of the card. They say that this is a regular tax register, which each company can maintain in its own way. That is, everything is similar to personal income tax - once there was a form 1-NDFL, then it was canceled and taxpayers began to use a new register, using 1-NDFL as a basis.

Clause 4 of Article 431 of the Tax Code of the Russian Federation obliges to keep records of the amounts of accrued payments of insurance premiums and other remunerations, the amounts of insurance premiums related to them in relation to each individual recipient of payments. Therefore, it is necessary to supplement the accounting policy by issuing an order.

Read also “The accounting policies of organizations are being prepared for changes”

Sample order to make additions to the accounting policy for accounting and taxation purposes

You can take as a basis the same register that was recommended by the Pension Fund and the Social Insurance Fund. During inspections, tax officials, if necessary, will also require accounting cards from companies. For absence - a fine of 200 rubles for each register (Article 126 of the Tax Code of the Russian Federation).

One more thing. If your company does not practice types of work that affect the length of service for early retirement and are subject to pension contributions at additional rates, the card can be reduced. Leave only the sections about payments and insurance coverage.

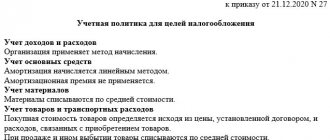

Structure of LLC accounting policy using the simplified tax system: income minus expenses

If the enterprise has simplified taxation, it is allowed to draw up accounting policies in an abbreviated form.

But often the simplified tax system is combined with other tax regimes - OSNO or UTII. In addition, if there is a possibility of exceeding the acceptable limits of revenue for the application of simplification, professionals give preference to full accounting at the enterprise and, therefore, the accounting policy also covers all possible situations.

The accounting policy of the LLC on the simplified tax system of 15% describes in detail the rules for accounting for income and expenses, fixed assets, inventory items, and all other accounting provisions.

In the tax part, the main thing is approval of the chosen tax regime. If this is the simplified tax system for income minus expenses, then it is stipulated which business transactions fall under this regime. When combining the simplified tax system with the OSN or UTII, separate accounting is clarified. In addition, the rules for the formation of charges, accounting and payment of taxes are stipulated.

The situation when a simplified enterprise receives targeted funding, subsidies and subsidies from any sources, including state and extra-budgetary ones, deserves special attention. The procedure for crediting and spending them must also be reflected in the accounting policy of the LLC on the simplified tax system.

Drawing up accounting policies requires a careful approach and special knowledge in the field of accounting and taxes. You can order the finished document here.

Features of drawing up an LLC’s accounting policy using the simplified tax system - what needs to be taken into account

According to Article 2 of Federal Law-402 “On Accounting”, all LLCs are required to maintain it, regardless of the chosen taxation system.

In this case, income accounting is carried out in the same way as on the OSN:

from the sale of goods and provision of services;

when selling property;

But, according to clause 1 of Article 346.17 of the Tax Code of the Russian Federation, they are taken into account only upon receipt.

The following receipts cannot be income for the simplified tax system:

reflected in Article 251 of the Tax Code of the Russian Federation;

subject to income tax (Article 284 of the Tax Code of the Russian Federation);

being income of individual entrepreneurs and subject to personal income tax;

subject to UTII or falling under the patent system;

advances returned to the LLC.

Advances must be reflected in the accounting policy of the LLC on the simplified tax system, income minus expenses, namely:

they must be economically justified;

relates to the given commercial activity of the enterprise or be social payments for employees;

contained in Article 346.16 of the Tax Code of the Russian Federation;

taken into account only after payment has been made.

The following cannot be attributed to LLC expenses with a simplified tax system of 15%:

entertainment and some other expenses (346.16 Tax Code of the Russian Federation);

tax paid in connection with the application of the simplified tax system.

Read more about accounting for income and expenses in an LLC under the simplified tax system here.

An LLC accountant using the simplified tax system must provide for income minus expenses in the accounting policy:

Payment of interest. Costs may include interest on loans and borrowings within the current refinancing rate;

Accounting for business trips. Daily allowances are written off as expenses in full upon expenditure, if their amount and methods of approval are agreed upon by special acts;

Losses from overpayment of tax under the simplified tax system. The difference between accrued and paid tax in the previous financial period can be attributed to losses;

Accounting for losses. The tax base can be reduced by the amount of losses from previous tax periods, provided that the simplified tax system is applied;

The procedure for maintaining and registering the Book of Income and Expenses.

Changes to the accounting policies of enterprises in 2021

From January 1, 2021, the list of regulations that must be taken into account when drawing up accounting policies also includes the provisions of IFRS.

In addition, new rules for creating a reserve for doubtful debts will be adopted, according to which the debt on accounts receivable must first be reduced. This may affect the determination of the tax base of the LLC.

The remaining changes apply only to companies operating under OSNO.

There have been minor changes in the list of expenses that reduce the tax base of an LLC on the simplified tax system for income minus expenses. For example, as expenses, you can take into account the excess of the payment for damage to heavy trucks on federal roads over the transport tax.

Since last year, the costs of assessing personnel compliance with qualification standards can also be taken into account to reduce the tax base of the simplified tax system.

Accounting policy is an ironclad argument in case of disputes

A common misconception is this: if you write down certain provisions in your accounting policies, this guarantees victory in a dispute with the tax authorities. Unfortunately, it is not.

Indeed, accounting policy can become an additional argument according to the principle “all ambiguities are interpreted in favor of taxpayers.” But in case of a dispute, it is necessary to rely on the norms of legislation.

note

Small enterprises may not create a reserve in accounting for a decrease in the cost of inventories if they stipulate this in their accounting policies (clause 25 of PBU 5/01).

For example, now there is some “controversy” around whether or not compensation for delayed wages should be subject to insurance premiums. According to the Ministry of Labor and inspectors, this is a different payment within the framework of labor relations. That is, it formally falls under the object of taxation.

Read also “Insurance contributions from compensation for delayed wages”

At the same time, the judges say in unison that not all payments in favor of the employee fall under the scope of contributions.

In particular, compensation for delayed wages is not related to how a person works. This is a payment for the fact that the employer has poorly fulfilled its obligation to pay wages on time. At the same time, regarding personal income tax, officials have long recognized that compensation is not taxed. But while there are no official letters or judicial practice, there is no need to include anything about insurance premiums and salary delays in the accounting policies.

You should be very careful: if something is prescribed in the accounting policy, be sure to strictly follow it. The same applies to norms that are applied optionally. For example, they began to use bonus depreciation or a reserve for doubtful debts in tax accounting. But the accounting policy did not mention the possibility of using this. Then even the judges will not help (resolution of the Federal Antimonopoly Service of the Moscow District dated November 19, 2013 No. A40-17925/13).

Signatures and approval

There is no indication in the accounting legislation that the chief accountant must sign or approve the accounting policy. The chief accountant or other responsible employee develops an accounting policy, and it is approved by the head of the institution. Therefore, when considering whether a document was signed by the proper person, the auditor must be guided by the requirements of the manager, a higher organization or the document flow procedure.

The rules for recording transactions in accounting that are not established by federal standards, accounting instructions or other legal acts on accounting are agreed upon with the founder. For example, if correspondence of accounts is entered, which is not included in the accounting instructions. In other cases, there is no need to agree on the accounting policy with the founder or GRBS. But a higher organization has the right to require approval in order to exercise departmental control. The founder does this to ensure comparability of accounting data of subordinate institutions in consolidated reporting. Accounting entries for institutions are established by instructions No. 162n, No. 174n, No. 183n; there is no need to register them in the accounting policies.

Small businesses may not draw up accounting policies at all

Alas, this is not true. For small businesses there are many concessions in terms of accounting and reporting. In particular, they can keep records and prepare reports in a simplified form. But the opportunity to take advantage of this indulgence should be spelled out in the accounting policy.

By the way, in the summer of 2021, new amendments and relaxations in terms of accounting came into effect. And it’s more convenient to use them right from the beginning of the year. Let us remind you that we are talking about amendments that were made to the PBU by order of the Ministry of Finance of Russia dated May 16, 2016 No. 64n.

Firstly, you can now take into account raw materials and materials at the supplier’s price. Previously, the value of assets additionally included transportation costs, fees to intermediaries, etc. Moreover, according to the new rules, all inventories can be written off at a time if the activities of a small enterprise do not involve significant balances on them. Each company determines the level of materiality independently. For micro-enterprises there are no these additional conditions; they can write off any inventories without restrictions (clause 13.2 of PBU 5/01).

Secondly, depreciation on fixed assets can be calculated once a year - on December 31. In this case, depreciation on production and business equipment can be written off at a time (clause 19 of PBU 6/01).

Read also “Small businesses will have to submit statistical form No. TZV-MP”

Checking the partitions

It is necessary to make sure that the accounting policy establishes the methods by which estimated values are determined - useful life and fair value of property, the amount of reserves, depreciation charges, income and expenses of future periods.

The section “Valuation Methods” should include a general rule for determining the estimated value of an indicator in case it becomes necessary to use an indicator whose estimated value is not provided for in the accounting policy. For example, you can indicate that the accountant evaluates the indicator based on professional judgment.

Accounting policies must be submitted to the tax office

In fact, there is no need to submit accounting policies to the Federal Tax Service. This does not need to be done either when creating a company or after each addition/change to accounting policies. There is simply no such obligation in tax law.

However, this does not mean that there may be no accounting policy at all. After all, the right to choose is given on many issues. This includes depreciation, write-off of goods and materials, reserves, and so on. Accordingly, without accounting policies it is impossible to control the correctness of tax calculations. Therefore, as part of an on-site inspection, the inspection has the right to require this document. The request form is given in Appendix 15 to the order of the Federal Tax Service of Russia dated 05/08/2015 No. ММВ-7-2/189. Within 10 working days from the date of receipt of such a request, it is necessary to provide the inspectors with a copy of the order approving the accounting policy (clauses 1-3 of Article 93 of the Tax Code of the Russian Federation).

Have you decided to ignore the inspectors' demands? Then get ready to pay a fine of 200 rubles for each document not submitted. This is provided for in paragraph 1 of Article 126 of the Tax Code of the Russian Federation.

In addition, at the request of the Federal Tax Service, the court may impose administrative liability measures on the responsible employees of the organization (for example, its head). The fine will range from 300 to 500 rubles (part 1 of article 23.1, part 1 of article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Accounting policy for an LLC using the simplified tax system – a necessity or a waste of time?

A large organization that maintains full-fledged accounting records and is on the general taxation system cannot do without an accounting policy. In addition to the mandatory nature of its application, which is prescribed by law, the accounting policy acts as the organization’s most important reference book on accounting methods.

If the enterprise is small, accounting is not required and a simplified taxation system is applied, then a logical question arises: is an accounting policy needed at all? Maybe there is an opportunity to do without it altogether? Let's look for the answer to it together. What is it, the LLC's accounting policy using the simplified tax system?

Is accounting policy necessary for tax purposes?

The Tax Code of the Russian Federation, namely Chapter 26.2, dedicated to the simplified taxation system, does not oblige organizations and individual entrepreneurs working on the simplified tax system to develop and approve accounting policies. However, even “simplified” people have the right to choose: to use the object of taxation “income” or “income – expenses”. Despite the fact that the selected object is indicated in the application for transition to this tax regime, it is worth indicating it in the accounting policy.

For taxpayers who have chosen the “income” object, nothing else will have to be specified in the accounting policy, since there are no options for selecting tax elements for this object.

But when choosing an object “income - expenses” the situation is different. In order to recognize expenses under clause 1 of Art. 346.16 Tax Code, options appear from which you need to choose the ones you will use. It is these options that are approved as part of the accounting policy for tax purposes.

Creating an accounting policy in an organization: accounting aspect

Accounting policy... Any accountant knows for sure that the organization definitely needs it. But why is it needed and to whom - this question will make many think.

Creating an accounting policy in an organization is a creative process that results in a “who knows what” situation. Some use ready-made templates downloaded from websites and forums, others borrow from colleagues. Still others are content with what the program allows them to concoct. All this can be used, but you will have to bring it to mind yourself.

The scope of accounting policies varies from a minimum set of accounting rules to rewriting the Tax Code and Chart of Accounts. And if you happen to believe that the main thing in accounting policy is “to be”, and how well it corresponds to the profile and structure of the organization is a matter of minor importance, then this article is for you.

The content of the article:

1. On what basis is the organization’s accounting policy formed?

2. Creation of accounting policies in the organization

3. Forms of primary accounting documents

4. Working chart of accounts in the accounting policies of the organization

5. Document flow rules

6. Control procedure, information processing technology and inventory in accounting policies

7. Accounting for fixed assets in accounting policies

8. Accounting for materials in accounting policies

9. Accounting policy for production costs

10. Finished and shipped products in accounting policies

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic further in the article in more detail than in the video.

On the basis of which the accounting policy of the organization is formed

The accounting policy of the organization is formed on the basis of the rules set out in:

- — PBU 1/2008 “Accounting policies of the organization” (for accounting purposes)

- — Tax Code (for profit tax purposes)

Therefore, accounting policy includes at least two concepts - accounting policy and tax policy. Let's see what definitions the regulatory documents give it:

“The accounting policy of an organization is understood as the set of accounting methods adopted by it - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity” (clause 2 of PBU 1/2008).

“Accounting policy for tax purposes is a set of methods (methods) permitted by this Code for determining income and (or) expenses, their recognition, assessment and distribution, as well as taking into account other indicators of the taxpayer’s financial and economic activity necessary for tax purposes” (Article 11 NK).

As you can see, there are no fundamental differences, and the essence is the same. Both accounting and tax accounting policies are a list of accounting methods chosen by an organization (accounting and tax), when it has such a right to choose.

Creating an accounting policy in an organization

In this article we will take a closer look at accounting policies for accounting purposes. PBU 1/2008 does not contain detailed instructions on how to compose it and does not provide ready-made formulations. We can only find a list of information required for disclosure (clause 4 of section II) and principles of formation (clause 5 of section II).

What is included in the accounting policy:

- — working chart of accounts;

- — forms of primary accounting documents, documents for internal reporting;

- — forms of accounting registers;

- — the procedure for conducting inventory;

- — methods for assessing assets and liabilities;

- — document flow rules and technology for processing accounting information;

- — the procedure for monitoring business transactions;

- — other solutions necessary for organizing accounting.

How all this information will be described is a personal matter for the organization.

When drawing up an accounting policy, include in it only rules for those transactions that are currently occurring in the organization . For example, if you do not have intangible assets or financial investments, and this is also not planned in the near future, then there is no need to write about it.

Why? It is possible that by the time these operations finally appear in the organization, the accounting rules will change. Or in general, the option chosen in advance will not work. But if you haven’t chosen methods in advance, then when new operations appear, you can describe the rules for their reflection at the moment of their appearance. And this will not be considered a change in accounting policy (clause 10 of PBU 1/2008).

Forms of primary accounting documents

As can be seen from the list above, one of the components of the accounting policy is the approval of the forms of primary accounting documents. Law No. 402-FZ “On Accounting” gives the organization the right to use, at its discretion, standard forms approved by the State Statistics Committee or its own forms. You can also use the forms recommended by the Federal Tax Service - UPD (universal transfer document) and UCD (universal adjustment document).

But both those, and others, and the third should be approved in the accounting policy. All forms you use must be printed and attached. What does this look like in practice?

Working chart of accounts in the accounting policies of the organization

The chart of accounts and instructions for its use, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, contain accounts that are used for accounting. Synthetic accounts from the Plan cannot be changed, and you can use your own subaccounts.

How can a working chart of accounts in an organization’s accounting policy differ from the Chart of Accounts:

- The Working Chart of Accounts should contain details on subaccounts, depending on the specifics of the activity. Moreover, subaccounts can be not only of the first, but also of the second, third and hundredth order. It all depends on your needs for detailed accounting and the possibilities of their implementation.

- The Working Chart of Accounts may not contain accounts that the organization does not use, for example, 15, 16, 23, 29, 40, etc.

- In addition, if the accounting department needs to prepare any internal reports, for example, for making management decisions, then this also needs to be taken into account in the working chart of accounts.

The working chart of accounts usually takes the form of a table, for example, like this:

| Account number and name | Subaccount number and name |

| 20 "Main production" | 20-1 “Product release A” |

| 20-2 “Product release B” |

Document flow rules

Document flow rules are a document that states who draws up what primary documents, in how many copies, how they are drawn up, when, who hands them over and to whom, who signs them, etc. And if in a tiny organization you can still try to justify the absence of these rules, citing unnecessaryness and bureaucracy, then in a large company without an approved procedure you will not find any solutions.

Still, accounting is based on documents, and they must be drawn up in a timely manner, during a business transaction or immediately after it. Document flow rules will not allow someone to “forget” about documents.

Document flow rules are drawn up as an annex to the accounting policies or as a separate provision to which a link is given.

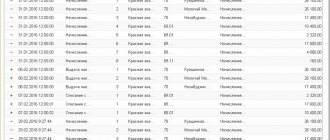

What do the document flow rules look like? This is a voluminous table, the form of which can be seen in the “Regulations on documents and document flow in accounting”, approved by the USSR Ministry of Finance of July 29, 1983 No. 105 (not repealed and is valid to the extent that does not contradict current legislation).

The Regulations simply provide an example of a form that you can edit to suit your needs. Here's what it might look like.

Control procedure, information processing technology and inventory in accounting policies

Three more issues that the creation of an accounting policy in an organization does not avoid, but which we will not discuss in detail:

- The procedure for monitoring business operations : depends on the organizational structure of the company and its size:

In a large organization, for example, an internal audit service is created, which functions in accordance with the Regulations on Internal Control.

“The rules for internal control of the facts of economic life are established in the Regulations on the rules of internal control dated December 10, 2021 No. 10, as well as in the Regulations on the internal control service dated December 10, 2021 No. 11.”

In a small enterprise, control is exercised by the manager himself or his deputy, and specific responsibilities and control measures are prescribed in the job description. In the accounting policy, it is enough to indicate who is assigned control responsibilities.

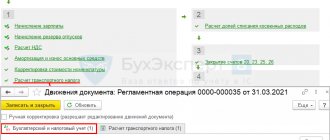

- Technology for processing accounting documentation : in the accounting policy you need to indicate whether accounting and tax accounting is carried out manually, using a special program, or in combination (program + additional registers compiled manually).

It is the chosen technology that determines which registers will be considered approved for use - those compiled manually or generated by an accounting program, or both. In addition, a list of registers and their samples are provided in a separate provision or annex to the accounting policy.

“Use registers generated by the accounting computer program “1C: Accounting 8th ed.” as accounting registers. 3.0". The forms of these registers are given in Appendix No. 3 to this order.”

- Inventory procedure. In the last article we discussed this topic in detail, please read it. And here I will briefly remind you that the accounting policy for inventory must reflect the frequency and timing of inventory.

So, we have covered general issues.

Where is the accounting policy in 1s 8.3 and how to set it up, see the video tutorial.

Now let's take a closer look at some of the methods for valuing assets and liabilities in accounting.

Accounting for fixed assets in accounting policies

Just as no company can do without fixed assets, so the creation of an accounting policy in an organization cannot do without the corresponding section. PBU 6/01 will tell us what exactly to include in it.

1) We determine what will be taken into account as fixed assets , i.e. We set a cost limit for recognizing an object as a fixed asset.

In paragraph 5 of PBU 6/01 there is a clause - if an object can be considered a fixed asset, but it costs less than the limit provided for by PBU (currently 40 thousand rubles), then it can be taken into account as inventories. Regardless of service life.

2) Whether or not an inventory card is created for the rented object and whether an inventory number is assigned (clause 14 of the Methodological Guidelines for Accounting for Fixed Assets, it says “recommended”).

3) What is the initial cost of the OS formed from (actual costs or purchase + installation)

4) Materiality threshold for accounting for fixed assets consisting of several parts. For example, if you set the useful life of fixed assets in accounting according to the Classifier, then the materiality criterion may be that parts of the object fall into different depreciation groups (for example, elevator equipment and utility networks in a multi-story building).

5) Is revaluation . If so, when (annually or once every few years), what (which specific groups of fixed assets, for example, buildings) and how is revalued (by indexation or direct recalculation at market prices).

6) Methods for calculating depreciation of fixed assets. Usually one method is chosen for all basic assets, but those who like the “zest” can set different methods for groups of homogeneous objects. Frequency of depreciation calculation (monthly, once a year or other period).

7) Determination of the useful life of fixed assets. It is usually established that the period will be determined on the basis of Government Decree No. 1 of 01/01/2002, which is used in tax accounting.

Accounting for disposal of real estate . Real estate is removed from the fixed assets at the time of signing the transfer and acceptance certificate, and income and expenses from the sale must be recognized on the date of transfer of ownership to the buyer (date of state registration). Until the transfer of ownership, real estate can be accounted for on account 01 “Disposal of fixed assets” or 45 “Goods shipped”.

Accounting for disposal of real estate . Real estate is removed from the fixed assets at the time of signing the transfer and acceptance certificate, and income and expenses from the sale must be recognized on the date of transfer of ownership to the buyer (date of state registration). Until the transfer of ownership, real estate can be accounted for on account 01 “Disposal of fixed assets” or 45 “Goods shipped”.

Accounting for materials in accounting policies

Materials are another type of asset that will be found in any organization. Accounting for materials in the accounting policy should be especially carefully prescribed if the field of activity is production. So, what points should be included in the creation of an accounting policy in an organization:

1) Is there a single methodology for accounting for materials and goods , or are they different?

2) Formation of the cost of inventories at actual cost - on account 10 (41 for goods) or 15 “Procurement and acquisition of material assets.” Or the formation of cost based on the supply price.

3) Accounting for transportation and procurement costs (TZR). The first point is the reflection of the costs of maintaining the procurement and warehouse apparatus. They can be included in the TZR or written off as part of current expenses. The second point is the procedure for writing off the fuel and equipment themselves. For example, with their small share, they are immediately included in current expenses.

4) Assessment of inventories when released to production or externally. The first point is that the selected write-off method will apply to all groups of inventories or a different method will be set for each group. The second is the choice of the write-off method itself (unit cost, average - weighted or moving, FIFO). Or the inventories are immediately written off as current expenses.

5) At what price should containers be taken into account : at actual cost or at accounting prices (types of accounting prices - at contract prices, actual cost of past periods, planned prices, average group price). Reusable collateral packaging - you will have it accounted for on account 10/4 (or 41/3 for trading) or 002 on the balance sheet.

6) Formation of the cost of goods for trading organizations: the costs of procuring and delivering goods to central warehouses until they are transferred for sale are taken into account as sales expenses or included in the actual cost of goods.

7) Accounting for goods in retail trade - at the purchase price or at the sales price (taking into account the markup).

By what principle is the product accounted for – by type (grade) (suitable for average write-off methods) or by batch (suitable for unit cost and FIFO write-off methods).

By what principle is the product accounted for – by type (grade) (suitable for average write-off methods) or by batch (suitable for unit cost and FIFO write-off methods).

9) The procedure for the formation and restoration of a reserve for a decrease in the value of material assets: when it is created (at each reporting date, if interim reporting is generated, or at the end of the reporting year), in what context (for a specific type of materials or group), where to restore (attributed to composition of income or reduce the amount of expenses). Or the reserve is not created.

Accounting policy for production costs

This is one of the most important sections of accounting policies, which we will also consider. Here it is important to distinguish between expenses for core activities and other expenses, list which expenses are direct, and how general business expenses will be written off. So, we continue to create an accounting policy in the organization, an accounting policy for production costs is being formed:

1) Distribution of expenses between main and other activities (this is usually stated in the section on income). If the activity of providing property for temporary use, granting rights for the use of intellectual property, participation in the authorized capital of other organizations is the main one, then this should be noted.

2) Cost accounting methods - whether costs are allocated between specific types of products. Which accounts are used for cost accounting -20, 21, 25, 26. If expenses are distributed, then what is chosen as the basis for distributing expenses - in proportion to direct cost items, salaries of key production personnel, the cost of materials released for production, standard costs, or your option . How are general business expenses written off - distributed between types of products or written off in full to account 90 “Sales”.

3) Assessment of work in progress : by direct cost items, by actual cost (inventory is carried out), by the cost of raw materials, materials, semi-finished products, by standard cost.

4) If there is an auxiliary production , then you need to decide whether the costs for it are taken into account on account 23 (usually if there are separate divisions) or on account 25 (auxiliary productions are not separately allocated). If costs are collected on account 23, then indicate the method by which they are distributed by type of product (preferably similar to the distribution of overhead costs).

Finished and shipped products in accounting policies

And the last section of the accounting policy, which we will consider in the article, is the accounting policy of finished and shipped products. Consider the following questions:

1) In what account are the manufactured products - 43 or 40 “Product Output”, and how are they valued - at planned or actual cost. Maintain continuity, choose the same method as when assessing work in progress.

2) The procedure for creating a reserve for reducing the cost of finished products : frequency of creation and adjustment, principle of creation (by groups or by accounting units), restoration procedure. This point is generally similar to the one we discussed above for materials and goods, and it is desirable that the rules for them coincide.

3) Methodology for writing off business expenses : distributed between sold and unsold products or completely written off as expenses.

Thus, creating an accounting policy in an organization is a painstaking and extremely responsible process. We will discuss the formation of accounting policies, including tax policies, in more detail at the December Club of Professional Accountants. Details of participation in the Club are here. If you have questions about accounting policies, ask them in the comments.

Creating an accounting policy in an organization: accounting aspect