Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 09/06/2019

Reading time: 4 min

0

324

In financial relations between various types of legal entities and individual entrepreneurs, there are mutual obligations of debtors and creditors. They all boil down to the emergence of receivables and payables.

- Limitation period for accounts receivable Moment of occurrence, taking into account weekends and holidays

- Determining the beginning of the limitation period for late obligations

- How to determine the beginning of the statute of limitations if the deadline for fulfilling the obligation is not determined

Accounts receivable is a type of debt when a company does not receive payment for services provided to it or goods supplied. That is, in this case, the company acts as a creditor to whom its counterparties have debts.

Accounts payable are debts that a company has to its counterparties.

One company simultaneously has both receivables and payables. Repayment of these types of debts must occur in accordance with the conditions formulated in the concluded agreement. At the same time, the use of the word “debt” cannot always be interpreted as a delay in fulfilling a financial obligation - in financial and economic relations, this term is used to determine mutual settlements with counterparties. The use of the term “debt” lasts until all calculations are fully completed.

Limitation period for accounts receivable

The limitation period for accounts receivable (RA) is set at 3 years from the date of its formation.

This time period is established by Article 196 of the Civil Code of the Russian Federation. Here, in addition, a 10-year maximum duration of such a period is defined. Exceptions are possible, but only in circumstances specified by law. You can learn what accounts receivable is from the article “Accounts receivable is...”.

The limitation period for accounts receivable should be counted from the day following the day when the contractual terms were violated. The start date for the limitation period for receivables depends on whether the deadline for fulfilling the obligation (debt repayment period) has been established. In particular, the following situations are possible.

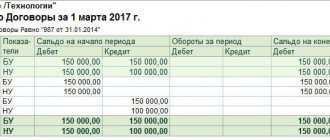

Each obligation must be separately reflected, even if there is only one counterparty. This is the only way to properly organize remote control accounting.

The following is a description of the features that must be taken into account when determining the limitation period for receivables.

See also “How to view accounts receivable in 1C correctly.”

EXAMPLES of determining the expiration date of accounts receivable from ConsultantPlus: 1. The lease agreement stipulates that rent is transferred within 10 calendar days from the date of invoice by the lessor. The invoice for January was issued to the tenant on January 30, 2021... For the continuation of the example, see the Ready-made solution from K+.

What about debts in other currencies?

Accounts receivable often arise on the basis of transactions, the price of which was established in conventional units or currencies of foreign countries.

In this case, the debt must be converted into rubles, based on the official exchange rate of the Central Bank of Russia. After this, the debt is written off in a new amount.

The exchange rate difference then relates to expenses or income outside the sale of the main product.

Recalculation of debt expressed in conventional monetary units is not provided. Only on the day when the income or expense arose, it is necessary to identify the difference in the amount.

back to menu ↑

Interruption of the limitation period

The period during which a claim must be filed may be interrupted in the following circumstances:

- the debtor acknowledged the debt;

- the debtor has repaid some of the debt;

- the debtor acknowledged the existence of the debt and asks to change the agreement so that it includes clarifications on debt restructuring.

The full circumstances and grounds for the legal interruption of the statute of limitations are given in the Resolution of the Plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43.

At the end of the break, the period discussed in the article starts anew, and the period that passed before the break is not excluded from the new period. There is an explanation on this matter given in the letter of the Federal Tax Service of Russia dated December 6, 2010 No. ШС-37-3/16955. To document the fact of debt recognition, a statement of reconciliation of calculations should be drawn up. The document must bear the signatures and seals of both parties.

If we are talking about repaying part of the debt or recognizing some of its share, such actions will not be considered recognition of the full amount of the debt.

It may happen that the court leaves the creditor's claim without consideration. In such circumstances, according to the provisions of Art. 203 of the Civil Code of the Russian Federation, the limitation period will continue to run without interruption, as usual.

If the court makes a decision in which the debt is recognized in a certain amount, then it is not allowed to write off the debt after the expiration of the statute of limitations. This PD can be recognized as hopeless only in 2 cases (clause 2 of Article 266 of the Tax Code of the Russian Federation):

- Enforcement proceedings have been completed. The basis is the order of the bailiff.

- The debtor organization went through the liquidation procedure. The basis is a sheet of record about the withdrawal of this organization from the Unified State Register of Legal Entities.

What to do if the documents have not been saved?

If there are no documents in the main department that processed the transaction, you can think about whether there is at least some evidence in the adjacent departments. And you can always find a way out of such a situation.

Advice! One of the possible evidence is an extract from the Unified Register of Legal Entities stating that the debtor was excluded from this register.

But, in any case, it is advisable to save primary documents when making transactions. They serve as the main evidence in debt collection. Otherwise, it will be very difficult to prove that you are right.

back to menu ↑

Suspension of the limitation period

The limitation period may be suspended if the following circumstances arise:

- Emergencies such as natural disasters, accidents, strikes, etc.

- Obligations are not fulfilled due to the introduction of a moratorium.

- The law on the basis of which the relations between the parties were regulated is temporarily not in force (suspended).

- One of the parties is part of the Russian Armed Forces, and they have been placed under martial law.

The limitation period can be suspended if the circumstances leading to the delay arose in the last six months of its course. If the statute of limitations is six months or less, then at any time during it.

It is also possible to suspend the limitation period in a situation where the parties intend to resolve the dispute out of court (clause 3 of Article 202 of the Civil Code of the Russian Federation). According to paragraph 16 of the resolution of the Plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43, the suspension of this period is carried out for the period provided for by law for an out-of-court procedure. If such a period is not established, then you should focus on a 6-month period. The countdown starts from the moment this procedure begins.

According to the norm contained in paragraph 4 of Art. 202 of the Civil Code of the Russian Federation, the claim period starts again from the moment when the suspension occurred.

Formation of reserve

The reserve for doubtful debts (RSD) refers to the amount that is created in order to ensure that the accounting data on debt is reliable. It has an evaluative value. The amounts of its changes are reflected in the company's expenses and income.

The basis for its creation is the procedure for conducting an inventory of remote control. The amount in respect of each debtor is assessed and determined individually depending on his financial situation.

Methodology for forming RSD:

- determination of amounts of debts to counterparties in case of violation of repayment terms and absence of guarantees;

- For each doubtful debt, the reserve value is calculated.

Basic methods of creating reserves:

- interval method;

- expert method;

- statistical.

In the first option, the RSD can be determined for each quarter in the amount of a percentage of the amount of debt and depending on the duration of the delay.

In the second method, the amount is created according to the opinion of experts, as they believe, what amount will not be repaid. To do this, the state of the counterparty is studied.

The third method uses data over many years to determine the share of bad debts on debt.

Receivables can be written off at the expense of the RSD formed for the company.

It is created immediately as soon as a dubious confidentiality problem arises after an inventory has been taken. The RSD can be calculated using the formula:

RSD = 0.5 * C1 = C2,

where C1 is a questionable liability for a period of 45 to 90 days;

C2 – questionable liability for a period of more than 90 days.

However, it should be noted that the size of the generated RSD cannot be more than 10% of the company’s revenue.

The entry for the accounting entries will be as follows:

Dt 91.1 Kt 63 - creation of RSD.

In the process of writing off debt for RSD amounts, the following entry is made:

Dt 63 - Kt 62 - the DZ was written off on the RSD.

Amounts included in the RSD can be included in operating expenses in accounting or in non-operating expenses when accounting for taxes.

Reinstating the statute of limitations

For this period, it is possible to restore it if the plaintiff has good reasons for missing it. Usually, in this capacity, the court perceives circumstances related to illness, serious condition and other personal situations.

The court will consider the reason for omission to be valid when the circumstances leading to the violation of the regulations arose during the last 6 months of the limitation period. If this period is six months or less, then at any time during its course. The corresponding norm is contained in Art. 205 of the Civil Code of the Russian Federation.

Let us point out separately that all the above preferences apply only to individuals. There is no such possibility for organizations and individual entrepreneurs, and restoration will not be made - regardless of the reasons why the deadline was missed. The rationale for this rule is contained in the resolution of the Plenum of the RF Armed Forces and the Plenum of the Supreme Arbitration Court of the Russian Federation dated February 28, 1995 No. 2/1.

Outstanding employee loans

The Civil Code of the Russian Federation regulates the relations that arise between the parties who have entered into an agreement to issue or receive a loan. Organizations and individuals can enter into such agreements in writing, the amount does not play a special role.

73 and 73-1 – accounts intended for settlements with employees for loans provided to them. The company must defend the right to receive money if an employee quits but does not repay his debt.

Debt is included in the financial results if management has exhausted all possible methods of influence, but has not been able to repay the debt.

The main thing is not to forget to submit information to the tax service that this particular person has received income. It consists of two parts:

- material benefit;

- unpaid debt.

back to menu ↑

Write-off of accounts receivable with expired statute of limitations

In accounting, debt is written off on the basis of documents specified by regulations. The following have been approved in this capacity:

- inventory act,

- certificate from the accounting department,

- order of the director, which contains an indication of the need for write-off.

The given list of documents is indicated in paragraph 77 of the Regulations on accounting and reporting of the Russian Federation, approved. by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

According to clause 11 of PBU 10/99, receivables with an expired statute of limitations should be classified as other expenses. As for tax accounting, in accordance with the norms of sub. 2 p. 2 art. 265 of the Tax Code of the Russian Federation, such DZ should be recognized as a non-operating expense.

How to account for the write-off of accounts receivable in accounting, see here.

A ready-made solution from ConsultantPlus will help you write off debt in tax accounting. Trial access to the system can be obtained for free.

You can learn about the specifics of calculating VAT when writing off receivables from the article “How to take into account VAT amounts when writing off receivables?”

What to do with the Uniters?

It’s interesting that similar situations arise for those who pay only a single tax; they work only on this principle.

Important: the payment of this tax, according to the law, is not supposed to be from written-off amounts. The tax authorities insist only on the fact of the payment itself.

This is due to taking into account the cases provided for by law, which generally include the very fact of the existence of receivables.

In fact, the enterprise must receive money, and according to general rules, such money is considered profit. This is just non-operating income.

The legislation does not clearly indicate that taxes are charged only on income actually received. It is thanks to this rule that tax officials can demand payment of taxes on bad accounts receivable.

Taxpayers can refuse a tax if they have a clear reason or explanation. But for advice, it is better to contact the tax office at your place of residence.

back to menu ↑

Results

The general limitation period for receivables is 3 years. Moreover, this period is legally allowed to be interrupted, suspended, and even restored if it is missed with justification (though only for individuals).

At the end of the period (if there was no court decision), the company has the right to write off the debt as an expense.

Such an operation will be legal both in accounting and tax accounting. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What are the effective ways to return property before it is written off?

Work with overdue debts must be carried out very painstakingly and actively in order to prevent the moment of its being written off.

In the process of such work, the following basic principles are adhered to:

- maintaining contact with the counterparty;

- rational measures to influence the counterparty.

Among the most popular methods of dealing with overdue loan payments are:

- initial measures: correspondence, letters of complaint, calls, meetings;

- filing a complaint with the court;

- writ of execution from the FSSP.

To prevent such situations at the time of concluding the contract you must:

- examine your partner carefully;

- secure collateral or some kind of security from the counterparty;

- get advice from lawyers;

- carry out insurance.

Order to write off DZ

An order to write off overdue receivables has its own rules for drawing up. An order can be created:

- if there are grounds that were permitted by law;

- with relevant documentation;

- based on the results of the completed debt inventory.

The order must be executed in accordance with the accepted form or in accordance with its template, specially developed by the company.

In addition to general information (company name, order number and date, manager’s signature), the example order to write off overdue receivables reflects data related to this type of document:

- debtor's name;

- the amount of debt to be written off;

- basis for debt relief;

- explanation of the procedure for canceling a contract (at the expense of a reserve or part of the costs).

Analysis of Russian companies

Russian statistics over the past 25 years allow for additional analysis for all companies as a whole:

As you can see, companies are experiencing a continuous increase in accounts receivable, which by 2021 exceeded 50 trillion. rubles The growth dynamics can also be seen in overdue receivables, but it is completely different: for example, in 1995 they accounted for almost half of the total amount due, while in 2021 only about 5% of it.

In addition, since 2000, accounts receivable as a whole have increased by more than 20 times, while overdue debt has only tripled. All this speaks of both the inflation of the last quarter of a century and the stabilization of the business of Russian companies, which during this time managed to reduce overdue receivables by about 10 times.