What is the Unified Federal Register of Information on the Activity of Legal Entities?

The Unified Federal Register of Information on the Facts of the Activities of Legal Entities (hereinafter referred to as the EFRSFYUL) is a federal information resource that contains legally significant information about the facts of the activities of legal entities, individual entrepreneurs and other economic entities (for example, the value of the net assets of a joint-stock company or the pledge of movable property by a legal entity property).

Some of the information in the EFRSFYUL is entered by the registration authority (for example, on the creation of a legal entity), and some - by the legal entity itself (for example, on obtaining a license).

If liability for non-disclosure of information in the Fedresource were limited to Article 14.25 of the Code of Administrative Offenses of the Russian Federation, then nothing could be written about this type of liability for the Fedresource. In fact, if you don’t open a message in Fedresurs, you can lose almost everything you have. Moreover, when we say everything, we mean exactly all the property you have, with only rare exceptions. But how can you lose all your property for such a small violation as simply not disclosing a message in the Federal Resources Agency? Let's figure it out together. On the one hand, many are mistaken in good faith that liability for failure to submit facts of activities of legal entities to the Unified Federal Register is really limited by paragraphs. 6-8 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation. It provides only minimal punishments - from a warning to a fine of 50 thousand rubles, and only in exceptional cases - in case of repeated violations - disqualification of the head of the company. But there is not a word here about the fact that there are other types of liability for non-disclosure of information in the Federal Resources Agency. Where then does the conclusion come from that you can lose all your property?! Unfortunately, they often look at the EFRSFYUL and responsibility for non-disclosure of information therein very superficially, limiting the degree of consequences for non-disclosure of information only to Article 14.25 of the Code of Administrative Offenses of the Russian Federation. Meanwhile, the list of upcoming consequences is much wider. For example, if information about the reorganization or liquidation of a company or termination of the status of an individual entrepreneur is not disclosed on time, the tax service has the right to refuse. (see the list of grounds for refusal by the Federal Tax Service in 129 Federal Law). Until you post on the EFRSFYUL website information about the intention of the creditor or debtor to file a bankruptcy claim, the court does not have the right to accept your application. But not even all courts know about this. This change came into effect on January 1, 2018. If a notice is published in the EFRS in relation to one applicant for a pledge of movable property, but not in relation to another. The first one will have the priority right to collect the collateral. And finally, the latest changes to the law, from which it follows that it is possible to impose a penalty on all the property of the owner if he has not disclosed information to the Federal Resources Agency. These are changes from mid-summer 2021 to the Bankruptcy Law. Article 61.11 appeared, according to the requirements of which, the controlling person of the debtor is automatically found guilty and brought to subsidiary liability, hereinafter quoted “...2. Until proven otherwise, it is assumed that full repayment of creditors’ claims is impossible due to the actions and (or) inaction of the controlling debtor in the presence of at least one of the following circumstances: ...5) on the date of initiation of the bankruptcy case, mandatory deposits in accordance with the federal by law, information or false information about a legal entity has been entered: into the Unified Federal Register of Information on the Facts of the Activities of Legal Entities in terms of information, the obligation to enter which is assigned to the legal entity.” As we see, the law does not make exceptions for types of messages, so even for failure to publish any type of message you can be held vicariously liable. If you still have questions about liability for non-disclosure of information in Fedresurs, you can contact us and ask them by phone

How many times per year should I submit information about my net assets?

The deadline for submitting information is three working days after the occurrence of the relevant fact. When does a fact of interest to the EFRS arise in the case of net assets?

“The occurrence of the fact of the value of net assets as of the last reporting date,” and most importantly, the date of occurrence of such a fact, are very mysterious concepts. As a matter of fact, the cost arises on this reporting date. So the net asset value as of December 31 (reporting date) must be reported in the first three business days of January? Of course this is not true. In the context of the law, the “date of occurrence of information” is the date of signing by the head of the annual report, where for the first time this figure becomes legally significant.

Therefore, information on the value of net assets should be provided within three working days after the head of the organization signs the annual report.

However, the controversial issue of interim reporting remains. Now you don’t have to hand it over anywhere, but you can’t ignore the fact that the net asset value has arisen on the reporting dates of March 31, July 30 and September 30, as they say. It turns out that only annual reports are submitted to the tax office and statistics once a year, and information about net assets must be transferred to the EFRS quarterly?

To answer this question, let's turn to the primary source - Federal Law dated December 6, 2011 No. 402-FZ on accounting (hereinafter referred to as Law No. 402-FZ), namely, Article 15 of this law. Clause 6 of Article 15 of Law No. 402-FZ defines the “reporting date”. This is the last day of the reporting period. It is on this date that annual and interim accounting (financial) statements are prepared.

According to paragraph 1 of Article 15 of Law No. 402-FZ, the reporting period for annual reporting is the calendar year. That is, the period from January 1 to December 31 inclusive.

Paragraph 4 of Article 15 of Law No. 402-FZ states that the reporting period for interim financial statements is the period from January 1 to the reporting date of the period for which these interim financial statements are prepared.

Now let's look at Article 13 of Law No. 402-FZ.

An economic entity prepares annual accounting (financial) statements (clause 2, article 13 of Law No. 402-FZ).

Interim accounting statements are prepared by an economic entity in cases established by the legislation of the Russian Federation or regulatory legal acts of state accounting regulatory bodies, i.e. Ministry of Finance (clause 4 of article 13 of Law No. 402-FZ).

There is such a regulatory legal act - this is the order of the Ministry of Finance of Russia dated 07/06/99 No. 43n. With this order, the Ministry of Finance approved the Accounting Regulations “Accounting Statements of an Organization” or the familiar PBU 4/99 to all of us. At the end of the PBU, in Section XI “Interim Accounting Reports” we read:

Clause 48: “The organization must prepare interim financial statements for the month, quarter on an accrual basis from the beginning of the reporting year, unless otherwise established by the legislation of the Russian Federation.” Law No. 402-FZ does not establish “otherwise”. It turns out that the “reporting dates” for interim reporting are the last day of each month. Imagine how much money it would cost to transfer information to the EFRS twelve times a year! But let's not worry ahead of time.

We read paragraph 49: “Interim financial statements consist of a balance sheet and a profit and loss account, unless otherwise established by the legislation of the Russian Federation or the founders (participants) of the organization.”

Where do we have information about net assets? In the form “Statement of changes in capital”. Neither the Balance Sheet nor the Income Statement, as the Income Statement is now called, contains information about net assets. Consequently, when preparing monthly or quarterly interim reporting, the “fact of the occurrence of net asset value” does not arise.

So, studying PBU 4/99 allows us to conclude that information on the value of net assets should be submitted to the EFRS only once a year.

However, does this conclusion apply to everyone or are there any exceptions?

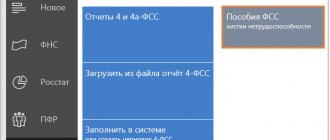

How to place information in the EFRS?

Information can be submitted to the EFRS only in electronic form with a qualified electronic signature. Please note: the signature used to sign reports to tax authorities or funds is not suitable for posting information. It does not contain one of the object identifiers that determine the scope of the certificate, namely access to Registry data. Therefore, it is necessary to obtain a separate certificate from one of the certified certification centers, for example, from the SKB Kontur CA. After receiving the certificate, you are given access to your personal account on the Registry website, where you can submit information.

Responsibility

Despite the fact that the law “On State Registration of Legal Entities and Individual Entrepreneurs,” which introduced the rules for the formation of the EFRS, was adopted back in 2011, there are no “accompanying” legislative acts and by-laws.

In particular, liability for violation of the obligation to submit information to the Register has not been introduced for most legal entities. Currently, it is established for issuers, that is, for joint-stock companies, as well as for LLCs placing bonds, and is provided for in Part 2 of Art. 15.19 of the Code of Administrative Offenses of the Russian Federation (for legal entities this is a fine from 700 thousand to 1 million rubles). At the same time, there is no mechanism for bringing administrative liability for failure to submit information to the EFRS. In the two months that are allotted for the adoption of a resolution in the case of an administrative offense (Article 4.5 of the Code of Administrative Offenses of the Russian Federation), it most likely will not even be identified. However, there is no need to relax. It is necessary to clearly monitor all changes in legislation, news and messages regarding the placement of information in the Register, so as not to miss the emergence of relevant risks.

License information

All legal entities that have licenses to carry out a specific type of activity must submit this information. The submission of such information does not depend on the organizational and legal form of the legal entity. All changes to the license must be reported to:

- obtaining a license;

- license suspension;

- license renewal;

- renewal of license;

- revocation of license;

- termination of the license for other reasons.

Naturally, there is no requirement to report the availability of a license as of January 1, 2013. You only need to notify about changes that occurred or will occur after January 1, 2013.

You only need to submit information about permits for those types of activities that are subject to licensing in accordance with Federal Law dated May 4, 2011 No. 99-FZ “On licensing of certain types of activities” (hereinafter referred to as Law No. 99-FZ) or other laws that provide for licensing specifically types of activities (for example, Federal Law No. 171-FZ dated November 22, 1995 “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products”).

This means that licenses not covered by these laws are not required to be reported. For example, you do not need to submit information about permits for professional activities in the securities market, which is licensed on the basis of Federal Law No. 39-FZ dated February 25, 1999 “On the Securities Market.” There is also no need to report licenses of credit institutions, insurers, clearing organizations, joint-stock investment funds, investment fund management companies, specialized depositories of investment funds and other licenses in those areas of activity that are excluded from the scope by paragraph 2 of Article 1 of Law No. 99-FZ on licensing operation of this law.

In recent years, in a number of industries, for example, in construction or auditing, licensing has been replaced by mandatory membership in self-regulatory organizations (SROs). Since such membership, in fact, is not a licensing, it is not necessary to report it to the EFRS. Unless it is submitted as “information that a legal entity enters at its own discretion.”

What information needs to be submitted to the EFRS?

The main part of the information for the EFRS operator is provided by the tax authorities, in particular, information on the creation of a legal entity, changes in its authorized capital, address, sole executive body, etc. Organizations must submit the following data to the Register:

1. About the value of net assets.

Joint-stock companies are obliged to send them in any case. The exemption from the obligation to report this information did not last long. Previously, information on the value of the net assets of a joint-stock company as of the last reporting date was reflected in the Unified State Register of Legal Entities in accordance with paragraphs. "f" clause 1 art. 5 of Law No. 129-FZ, however, from January 1, 2012, this subparagraph lost force.

But with LLCs everything is not so simple: they must provide information on the value of net assets only in cases provided for by the Federal Law “On Limited Liability Companies”, but this law does not directly establish such an obligation for the company.

On the one hand, this needs to be done by issuers of securities, because they are required to publish annual reports and balance sheets, which must indicate the size of net assets (see paragraph 2 of Article 49, paragraph 3 of Article 30 of the LLC Law) .

On the other hand, the financial statements of all organizations are publicly available, and any interested person can familiarize themselves with them and receive a copy (clause 89 of the Regulations on Accounting and Financial Reporting in the Russian Federation). Then it turns out that all LLCs are required to provide information about their net assets as of the end of the financial year.

There are no official clarifications at the moment. All that remains is to wait for developments. If the situation does not change by the end of the year, there is no point in putting the company at risk; it is better to submit information. In addition, this is additional proof of the company’s integrity, including for counterparties. Information will need to be submitted even if liability is established for failure to provide it, because, since there is responsibility, there is a corresponding obligation.

The law does not contain clear instructions on the frequency of submission of information. For organizations that are not issuers, publishing information as of the end of the year will be sufficient. If the organization's securities are traded on the ORS, information should be posted as of the end of each month (since this is the reporting date in accounting). But for issuers of securities that are not traded on the Securities Market, until official clarification appears, it is reasonable and least risky to post information quarterly. Information is provided within three working days from the date of signing the relevant financial statements.

2. On receipt, suspension, renewal, renewal of a license, cancellation or termination for other reasons of a license to carry out a specific type of activity.

Let us note that in Art. 7.1 of Federal Law No. 129-FZ does not contain a reference to Federal Law dated May 4, 2011 No. 99-FZ “On licensing of certain types of activities.” This means that it is necessary to report changes that relate to any licenses issued to the organization, including “alcohol” licenses, and licenses of professional participants in the securities market, and others. The message must be sent within three working days from the date of the change.

3. On the decision of the arbitration court to introduce surveillance.

The introduction of supervision is the first “official” step in the bankruptcy procedure of a company. The remaining steps were not deliberately mentioned by the legislator, because the Unified Federal Register of Bankruptcy Information is part of the Unified Federal Reserve System, so the relevant information will be placed in the Register, but using other mechanisms. The message must be sent within three working days from the date the court ruling comes into force.

4. Information, the entry of which is provided for by other federal laws, and other information that a legal entity enters at its own discretion, with the exception of information, access to which is limited in accordance with the legislation of the Russian Federation.

At the moment, additional grounds for reporting to the Register are not defined in the legislation, which means that organizations do not yet have the corresponding responsibilities.