Writing off receivables allows you to reduce the tax base for the organization's profit tax, but only receivables that are recognized as unrealistic to collect can be written off for profit tax purposes. Accounts receivable is considered hopeless under one of the conditions

(Clause 2 of Article 266 of the Tax Code of the Russian Federation):

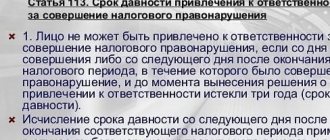

- the statute of limitations has expired;

- the debtor went bankrupt, was liquidated, excluded from the Unified State Register of Legal Entities;

- the obligation is terminated on the basis of an act of a government agency;

- notification was received from the bailiff about the end of enforcement proceedings (it is impossible to find the debtor, there is no property to collect, etc.).

In some cases, the debt cannot be considered uncollectible. Thus, during the reorganization of the debtor company, the debt is transferred to the legal successor. If the debtor is an individual entrepreneur, an extract from the Unified State Register of Individual Entrepreneurs on the termination of activities as an individual entrepreneur will not be considered a basis for recognizing the debt as bad, since the individual retains property liability to creditors.

Beginning of the limitation period

According to the content of Article 200 of the Civil Code of the Russian Federation, the starting point for the limitation period is the day when the person whose right was violated learned about it.

If an obligation with a precisely designated date for its final fulfillment has been violated, the limitation period begins to run from the moment the obligation is completed.

Example

On April 1, 2019, an agreement for the purchase and sale of property was concluded between two individuals, under the terms of which the property must be transferred to the buyer on the day the agreement is signed, and funds to pay for the purchased property must be transferred in two parts - 04/1/2019 and 1/12. 2019. In case of violation by the buyer of the terms of the agreement regarding payment, the seller’s right to go to court for protection of the violated right arises from the date of violation and is limited to three years from the date when the last payment should have been made, that is, not from September 1, 2019 , and from December 1, 2019

If a right has been violated that has arisen as a result of an obligation with an indefinite period of fulfillment, the limitation period must be calculated from the moment the creditor submits a demand for fulfillment of the obligation.

If the creditor, before going to court, gave the debtor a period of time to fulfill his claim, the calculation of the limitation period begins at the end of the period specified by the creditor.

How to write off arrears from counterparties and overpayments of taxes

When reflecting debts in account 91.2, accounts receivable are simultaneously written off to the off-balance sheet account: Dt 007, for each counterparty separately. The written-off receivables on the off-balance sheet account are taken into account for 5 years, during which time opportunities are sought to collect the arrears. At the end of the 5-year period, you can make a final write-off of receivables from off-balance sheet account 007 with the entry: Kt 007.

The balance sheet asset (line 1230) reflects the overpayment of taxes and fees; it should be regularly confirmed by a joint reconciliation report with the Federal Tax Service. If the company has not applied for a refund of the overpayment within 3 years, it will be difficult to return the excess amount.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

According to financiers, overpayment of taxes is not a liability; it cannot be considered hopeless and reflected in non-operating expenses (letter of the Ministry of Finance of Russia dated 08.08.2011 No. 03-03-06/1/457). To write off tax receivables in accounting, the entries will be as follows (clause 14 of PBU 22/2010): Dt 91.2 Kt 68.

Changing the limitation period

Question one: is it possible to change the statute of limitations to suit the situation, even if it is beneficial to the parties?

I categorically declare - no. This directly contradicts the legislation of the Russian Federation.

From practice

Once I had the opportunity to see with my own eyes an agreement, under the terms of which the parties arbitrarily set the statute of limitations for going to court in case of violation of obligations under the agreement by one of the parties at 1 year. This was due to the one-time supply of goods under the contract and the supplier’s intention to move for permanent residence outside the Russian Federation in the near future. And in support of this clause of the contract, the supplier referred to the freedom of contract stipulated by Article 421 of the Civil Code of the Russian Federation.

Do you think this agreement has legal force? Of course not!

Yes, freedom of contract is a postulate.

Yes, according to paragraph 2 of Article 421 of the Civil Code of the Russian Federation:

the parties may enter into an agreement, either provided for or not provided for by law or other legal acts.

Yes, the parties have the right to independently establish the terms of the contract they need. But at the same time, the powers of the parties in determining the terms of the contract are limited by paragraph 4 of Article 421 of the Civil Code of the Russian Federation:

4. The terms of the agreement are determined at the discretion of the parties, except in cases where the content of the relevant term is prescribed by law or other legal acts.

and paragraph 1 of Article 422 of the Civil Code of the Russian Federation:

1. The agreement must comply with the rules obligatory for the parties, established by law and other legal acts (imperative norms) in force at the time of its conclusion.

as well as Article 198 of the Civil Code of the Russian Federation:

The limitation periods and the procedure for calculating them cannot be changed by agreement of the parties.

Question two: does the limitation period begin to be calculated anew in the event of the transfer of the right to claim under an obligation to another person?

No and no again.

According to Article 201 of the Civil Code of the Russian Federation:

A change of persons in an obligation does not entail a change in the limitation period or the procedure for calculating it.

As an example

Between Ivanov I.I. and a microfinance organization entered into a loan agreement in 2021 under which there is debt.

In 2021, a certain Sprut LLC files a claim in court for recovery from Ivanov I.I. debt under the loan agreement on the basis of the transfer to Sprut LLC of the right to claim under the specified agreement as a result of the conclusion in 2021 of an assignment agreement between the original creditor and Sprut LLC.

The first thought is – what about the statute of limitations? Did its course begin anew from the moment the right of claim was transferred?

No and no again – the statute of limitations has not changed.

However, Sprut LLC has the right to count on the satisfaction of its stated requirements, since, according to paragraph 24 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015, “On some issues related to the application of the provisions of the Civil Code of the Russian Federation on the limitation period”,

The statute of limitations for claims for overdue time payments (interest for the use of borrowed funds, rent, etc.) is calculated separately for each payment.

Question three: does this mean that the statute of limitations is unchanged?

And again no! The limitation period may extend beyond the three-year period in cases of its suspension (for example, if the filing of a statement of claim was prevented by a force majeure circumstance) or interruption in its course, as well as the restoration by the court of the limitation period in connection with the recognition of valid reasons for the omission. For example, the plaintiff’s serious illness or being in a helpless state may become such a reason.

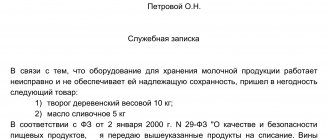

Documents for writing off bad debts

Write-off of uncollectible receivables is carried out according to the data of the inventory of calculations. Documentary justification for the write-off is:

- act of inventory of payments;

- manager's order to write off;

- documents confirming that the debt is recognized as uncollectible (extract from the Unified State Register of Legal Entities, resolution of the bailiff, etc.);

- documents on the occurrence of debt (invoices, acceptance certificates, agreements with counterparties, invoices for payment, etc.).

For the inventory act, you can develop your own form or use the recommended unified form No. INV-17.

Order a free legal collection

“Correcting errors in tax and accounting” and get access to materials on the topic: errors in the calculation of individual taxes, filing updated returns, overpayment of taxes, refund and offset of overpayments, errors in primary documents, when calculating wages, etc.

If the statute of limitations has expired, do we put an end to justice?

In accordance with paragraph 1 of Art. 296 of the Civil Code of the Russian Federation, a debtor or other obligated person who has fulfilled an obligation after the expiration of the limitation period does not have the right to demand that it be returned, even if at the time of execution the specified person did not know about the expiration of the limitation period.

But!

Wait a minute!

In accordance with the content of paragraph 2 of the same article:

If, after the expiration of the limitation period, the debtor or other obligated person acknowledges his debt in writing, the limitation period begins anew.

This paragraph was introduced into the Civil Code of the Russian Federation by Federal Law dated March 8, 2015 No. 42-FZ “On Amendments to Part One of the Civil Code of the Russian Federation.”

However, its usefulness is unconditional only if the debtor has a conscience or does not have even minimal knowledge in the field of Russian legislation on the running of the limitation period.

Reflection of the transaction in tax accounting

Article 266 of the Tax Code states that a debt can be written off only if there is at least one characteristic of hopelessness. Here, just as in accounting, much depends on the availability of a reserve for bad debts. If such a reserve is created, then the unpaid debt is covered at its expense. In the absence of a reserve, the outstanding debt is classified as a loss that the enterprise incurred during the specified reporting period. And this, in turn, helps to reduce the tax base.

Then all documents about this must be kept for at least five years. Otherwise, the tax inspector checking the documentation may increase the income tax based on the lack of evidence of the validity of the non-operating expense.

Claims not covered by the statute of limitations

According to Article 208 of the Civil Code of the Russian Federation, the limitation period does not apply to:

- requirements for the protection of personal non-property rights and other intangible benefits, except as provided by law;

- depositors' demands to the bank for the issuance of deposits;

- claims for compensation for harm caused to the life or health of a citizen.

- demands of the owner or other possessor to eliminate any violations of his rights, even if these violations were not associated with deprivation of possession

Timely payments and interest

The limitation period for a claim to collect a penalty or interest for the use of someone else's funds is calculated separately for each late payment, determined for each day of delay. At the same time, recognition by a person of the principal debt in itself cannot serve as evidence indicating the recognition of additional claims of the creditor, and cannot be regarded as a basis for interrupting the limitation period for additional claims and claims for damages.

Submission of the main claim to the court does not affect the limitation period for additional claims. For example, if a claim is brought to collect only the amount of the principal debt, the statute of limitations on the claim to collect a penalty continues to run.

With the expiration of the limitation period for the main claim, the limitation period for additional claims is considered to have expired. This provision does not apply to cases where the loan (credit) agreement stipulates that the interest payable by the borrower is paid later than the due date for repayment of the principal amount of the loan (credit). The limitation period for the payment of interest in this case is calculated separately from the limitation period for claims for repayment of the principal amount of the loan (credit).

Application of the limitation period

The statute of limitations itself will not work. It becomes an instrument for protecting rights only after a petition for its use has been filed.

Why is this happening? Because Article 199 of the Civil Code of the Russian Federation establishes that the court is obliged to accept a statement of claim for proceedings, even if it is filed after the statute of limitations has expired. And the court has the right to apply it only after the defendant has filed a motion to apply the statute of limitations. Moreover, he not only has the right, but also the obligation, since clause 2 of Art. 199 of the Civil Code of the Russian Federation states:

2. The limitation period is applied by the court only upon the application of a party to the dispute made before the court makes a decision. The expiration of the limitation period, the application of which is declared by a party to the dispute, is the basis for the court to make a decision to reject the claim.

My dear friends and subscribers! If you have any questions, I invite you to discuss them in the comments below the article.

If the article was useful to you, give it a “like”, the author will be pleased!

When the calculation is interrupted

Article 203 of the Civil Code of the Russian Federation provides a key basis for which the calculation of SID is interrupted. This is an acknowledgment of debt by the debtor.

The following methods of recognition are provided:

- signing the reconciliation report;

- changing the terms of the transaction in which the debtor acknowledges the debt;

- request for deferment or installment payments from the debtor;

- recognition of the claim.

After the break, the calculation of the time period for collecting debts through the court begins anew. The time elapsed before the break does not count toward the new deadline.

Find yourself in a difficult situation? A guide to corporate disputes and a search for judicial practice will help you find a solution. Use them for free.

to read.