Receivable is the debt of another company or individual in relation to the enterprise. Such debts may arise due to failure to fulfill contractual terms, non-repayment of advances, subordinated amounts or loans, etc. Such debt is an asset of the company, i.e. property or money that the company will receive in the future. Debt, the repayment terms of which, established by the contract, have expired, becomes overdue. It will also be taken into account on the balance sheet of the enterprise until the debtor repays it. If payment is not made due to various circumstances (for example, due to the partner’s loss of solvency, its liquidation), the debt is considered uncollectible. This is preceded by an inventory of settlements, based on the results of which the existence of debt of insolvent debtors for each obligation is established, in accordance with the terms of the agreements and repayment periods.

The concept of accounts receivable and its types

The very concept of accounts receivable includes the amount of a certain debt that an organization or individual owes to your company. There is always a receivable, without it the company practically cannot function; someone takes the goods in advance, paying later, and only then does this debt arise.

| Types of debt | classification |

| By date | 1. Short-term, a type of debt that must be repaid within a year 2. Long-term - it is planned to be repaid in more than one year |

| For debts | 1. Normal - when the product or service is paid in advance 2. overdue - the buyer received the goods, but did not pay the invoice on time · Doubtful: due to the unstable financial condition of the buyer, his debt falls under the category of doubtful, but is subject to repayment in the future · Non-refundable - in case your counterparty goes bankrupt · unclaimed |

How to write off MC from an off-balance sheet account?

Good afternoon . I read a lot of materials, and a rather vague opinion formed in my head. We have an account MTs 04. The following are in use: - telephone handset - laptop - water dispenser - printer - mouse - payment terminal

I can’t fully understand how I can write this off (it is planned to close the legal entity in the future). As far as I understand from what I've read. 1) we need a commission (of whom it can consist, if we have one director to work for the good) and we simply draw up an act and sign it (an act for writing off low-value materials) 2) we need to hire (since there is no one on staff) for the disposal of org. technology company.. have reasons..

Let's say this product is not available. I came, the booze was working before me. another. There is neither a laptop nor a telephone handset... but they are listed on MC 04. What are my actions? (tell me what to support for the act?)

In what cases are the debts of counterparties considered bad?

Uncollectible accounts receivable is the amount of money that the company cannot collect from the debtor for any reason.

1. The statute of limitations on the case has expired; it is three years and begins from the moment the client is notified and can reach ten years.

2. the debtor’s obligation is terminated, according to a decision of a higher authority, or the organization is liquidated

3. there is a decree from the bailiffs about the impossibility of writing off the debt, this may happen due to the debtor’s lack of property and funds in the accounts on which collection can be imposed

Important! If there are several grounds for recognizing the receivables as uncollectible, for example, the statute of limitations has expired and the client cannot be found at the actual address, then the debt can be recognized as uncollectible in the period when the first confirmation arose.

Legal regulation

According to clause 77 of the “Regulations on Accounting and Reporting in the Russian Federation”, all bad debts of an enterprise must be written off at a loss.

Debt obligations are written off after the expiration of the limitation period (see Article 196 of the Civil Code of the Russian Federation), that is, after 3 years.

However, this rule applies only to a claim for which the creditor has done everything possible to return the asset.

In other cases, receivables are considered unclaimed and are taken into account on the enterprise’s balance sheet in accordance with legal requirements after 4 months from the date the debtor receives the loan and there is no payment at all.

Algorithm for writing off receivables to off-balance sheet

If a receivable is deemed uncollectible, it can be written off.

- First you need to take inventory of all accounts

- Provide a written rationale

- Issue an order from the manager to write off

Order to write off accounts receivable:

If, based on the results of the inventory, the commission determines that there really is a receivable for which the debt can be considered bad, it is necessary to issue an order to write it off. There is no specific form of this order enshrined in regulations. The company itself develops a form that is convenient for itself.

| Name | Content |

| Top of the order | Full name of the enterprise; Last name, first name and patronymic of the manager; Date and number of the order to write off receivables. |

| Text part | The name of the debtor's enterprise or last name, first name, patronymic if it is an individual is written down; The amount of accounts receivable, which, based on the results of the inventory, is considered unrealistic to be collected; Documents that are the basis for debt write-off; How will the write-off be carried out? If a reserve for doubtful debts has been formed, then the write-off must be made from the reserve. If the company does not have such a fund, then the amount of debt should be included in other expenses. |

Important! Each organization is required to create a reserve for doubtful debts

Even a receivable written off to an off-balance sheet account is not considered cancelled; it will hang there for at least five years, until the situation with the counterparty improves to collect it.

Off-balance sheet accounts

Off-balance sheet accounts

– these are accounts intended to summarize information about the presence and movement of values that do not belong to an organization-economic entity, but are temporarily in its use or disposal.

Off-balance sheet accounts are subsidiary accounts of accounting.

They are used when the accountant needs information that is not on the balance sheet accounts.

Balances on off-balance sheet accounts are not included in the balance sheet, but are shown after its total, i.e. behind the balance.

The data from these accounts does not affect the financial result and does not need to be reflected in the company’s reporting.

Accounting for accounts receivable on the balance sheet

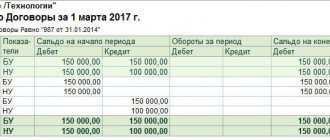

The accountant records this amount of debt on account 007 as the debt of insolvent debtors written off at a loss. If the debtor has the financial ability to repay the debt, it is necessary to reflect this in the organization’s other income.

In accounting, reflect the write-off of accounts receivable from the reserve for doubtful debts by posting:

Debit 63 Credit 62 (58-3, 71, 73, 76...) – accounts receivable are written off from the created reserve.

The use of the reserve is possible only within the limits of the reserved amounts, and if during the year the amount of expenses exceeds the created reserve, the difference must be reflected in other expenses for 91 accounts. Then you should make the following wiring:

Debit 91-2 Credit 62 (58-3, 71, 73, 76...) – accounts receivable not covered by the reserve are written off.

Accounting for write-offs

A special feature of accounting for write-off of receivables in the accounting system is the reflection of the written off receivables behind the balance sheet, in account 04 “Debt of insolvent debtors”. Off-balance sheet accounts for accounting systems work the same way as for others, that is, receipts are reflected only by debit, and disposals - only by credit, without correspondence.

A posting to account 04 is made when the commission for writing off the debt is made accordingly. Amounts in account 04 are reflected for as long as the debt collection procedure may begin again or the insolvent debtor may have the means to repay the debt. The chart of accounts for organizations other than credit and government (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), for example, provides a five-year period for monitoring the possibility of returning debt.

The bailiff service may again begin collection actions, for example, if the plaintiff re-transferred to them a writ of execution issued by the court, which was already before the bailiffs, but for some reason the enforcement proceedings were completed. In the event of the resumption of the procedure for collecting or returning the debt by an insolvent debtor, the debt is written off from account 04 and reflected on the corresponding balance sheet accounts.

The final write-off of debt from an off-balance sheet account must be approved by the commission on the basis of legally established reasons: death of the debtor, liquidation of the organization, etc.

Analytics for account 04 is carried out in the context of the types of income/expenses for which the debt was taken into account, and the debtors, indicating all their data necessary to repay the debt. Below are the main transactions for reflecting the write-off of receivables. More typical entries can be found in the instructions for the chart of accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

| Wiring Description | Dt | CT |

| Write-off of debt that is impossible to collect | 040110173 “Extraordinary income from transactions with assets”, and is also reflected on the balance sheet 04 “Debt of insolvent debtors” | 020500000 “Income calculations” |

| Write-off of bad debt on advance payments | 040120273 “Extraordinary expenses for transactions with assets”, and is also reflected on the balance sheet 04 “Debt of insolvent debtors” | 020600000 “Settlements for advances issued” |

| Write-off of bad debt on issued loans | 040110173 “Extraordinary income from transactions with assets”, and is also reflected on the balance sheet 04 “Debt of insolvent debtors” | 020700000 “Calculations for credits, borrowings (loans)” |

| Write-off of uncollectible debt on mutual settlements with accountable persons | 040120273 “Extraordinary expenses for transactions with assets”, and is also reflected on the balance sheet 04 “Debt of insolvent debtors” | 020800000 “Settlements with accountable persons” |

| Write-off of damages due to the fact that the court did not recognize the guilt of the person who caused the damage or the culprit was declared insolvent | 040110173 “Extraordinary income from transactions with assets”, and is also reflected on the balance sheet 04 “Debt of insolvent debtors” | 020900000 “Calculations for damage and other income” |

| Write-off of damages due to the impossibility of identifying the person responsible for causing the damage, as well as if the damage was compensated in kind | 040110172 “Income from operations with assets” | 020900000 “Calculations for damage and other income” |

| Restoration of liability for damages in the case where the guilty party covered the costs incurred, while the liability was already recognized as hopeless | 020900000 “Calculations for damage and other income” | 040110173 “Extraordinary income from transactions with assets”, and is also written off from off-balance sheet account 04 “Debt of insolvent debtors” |

Write-off of accounts receivable from off-balance sheet

The decision to write off the debt from the balance sheet after a period of time must be made by a commission. The debt must be considered uncollectible. Prepare the grounds for this, namely:

1. supporting documents upon the death of the creditor or its complete liquidation

2. the period by which it was possible to resume the collection process has expired

3. You can also get rid of off-balance sheet receivables if the debtor contributed funds in another way, but for this it is necessary to restore the debt on the balance sheet account

Important! If you have full confirmation of the fact that the debtor is more likely not to appear and you have sent requests to all possible authorities to find him and received official answers, only then can you write off the debt.

How to write off materials from an off-balance sheet account?

Postings for capitalization and write-off from the account. 002 look like this:

Acceptance of inventory items for storage

Disposal of inventory items accepted for storage

Write-off of inventory items from the account. 002 is carried out on the basis of:

- form MX-3 or a similar document developed by the organization (taking into account the requirements of paragraph 2 of Article 9 of Law No. 402-FZ) to record the return of valuables accepted under a storage agreement;

- TORG-12, UPD or other documents - upon disposal of inventory items that were taken into account on the account. 002 within the framework of the supply agreement.

For operations with customer-supplied raw materials, the executing organization uses an off-balance sheet account. 003:

Received materials for processing

Recycled materials were transferred to the customer

If products are made from customer-supplied raw materials, then the entries in off-balance sheet accounting may be as follows:

Received materials for processing

Customer-supplied raw materials are transferred to production

Products made from customer-supplied materials have been capitalized

Manufactured products were transferred to the customer

With account 003 materials are written off based on:

- report on the consumption of customer-supplied raw materials (Article 713 of the Civil Code of the Russian Federation);

- work acceptance certificate;

- invoice M-15 or other similar documentation agreed upon by the parties.

When selling goods under a commission agreement, the commission agent is accounted for according to the account. 004 there will be the following accounting entries:

Goods received under a commission agreement were capitalized

Products accepted for commission were sold

Write-off of inventory items from an off-balance sheet account. 004 is carried out on the basis of the primary document drawn up upon the sale of valuables - TORG-12, invoice, UPD or other documentation agreed upon by the parties to the commission agreement.