Home / Labor Law / Employment / Part-time and part-time work

Back

Published: 08/10/2016

Reading time: 8 min

0

5849

Labor legislation allows additional work activity for those working citizens who want to get a part-time job and increase their monthly income. There are two main types of such activities - part-time and combination.

Combination usually means three types of work functions: temporarily replacing an absent colleague, expanding the area of responsibility (the employee is busy with additional work in his own profession) or classic combination (performing duties in two professions at once - his own and those related to the vacancy).

In all of these cases, the employee copes with additional responsibilities without interrupting his main activity, that is, during working hours limited to one shift.

- Additional payment amounts

- Formula and calculation examples For part-time work

- Full time

- When paying for production

- If the employee did not work all working days

Is it a right or a duty?

Establishing a combination is the right of the employer to assign additional responsibilities to the employee. At the same time, a person has the right to refuse such a fate, since an agreement has already been concluded with him to perform specific job duties.

There are several types of additional work:

- Combining positions is often found to perform duties in another profession (position). For example, the company does not have a specialist for the position and employees are forced to work at essentially two rates.

- Expansion of the service area is associated with the implementation of expanded tasks, but not specified in the main job description. This may be temporary, for example, during repair work in production.

- An increase in work volume is usually temporary during the period of production growth. For example, seasonal increase or new product launch.

- Fulfilling the duties of a temporarily absent employee means temporarily replacing an absent employee and performing his functions in full or in part.

For such work, an additional agreement to the contract must be drawn up and an order is issued. A job description is written, which indicates a list of new responsibilities. When temporarily replacing duties, an employee can fully perform the work assigned to him and devote only part of his time to his position. If there is a complete transition to a replacement rate, you need to arrange a temporary transfer of the person until the main employee leaves.

In accordance with the law, any combination or increase in work must be additionally paid (Article 151 of the Labor Code of the Russian Federation). In this case, the period for completing duties can take from several days to several months.

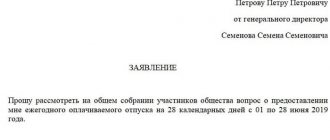

If the dates are known, it is better to immediately reflect them in the documents. The employee has the right to refuse additional workload early. To do this, he writes a corresponding statement to the manager with a request to remove the combination from him.

Is there always a surcharge?

It would seem that they must pay extra for someone else’s work. However, when the question arises of how to calculate the bonus, employees often receive a refusal from their managers. There will be nothing illegal in refusing if, under the terms of the contract, the specialist is required to perform additional functions. Therefore, before signing the agreement, you should carefully read the terms and conditions. If there is a disagreement regarding the amount of payments or other provisions, it is better to immediately tell the employer about it.

The allowance is due if it was not initially intended that the person would perform other functions. In other words, the contract specifies only the main responsibilities, and new functions are added to them. An additional payment is made in the amount of the salary of the absent specialist, while the person’s main job responsibilities remain the same.

Combination restrictions

The code does not contain information about restrictions on combining positions. Almost any employee in an organization can be assigned this type of work. There are two important factors to consider:

Any combination must be included in working hours, and not in excess of its norm.

It is advisable to combine positions of similar professions or employee qualifications. This is due to more competent performance of duties without wasting time on training.

However, we should not forget about the privileged category of citizens: pregnant women, disabled people, minor employees and mothers with children under three years of age. Although the law does not prohibit them from increasing the load, it is better to insure against unpleasant consequences. To do this, you can discuss all working conditions, assess their applicability to these individuals and sign all the necessary documents.

Size in 2021 according to the Labor Code of the Russian Federation

The law does not define the scope of payment for performing work involving combining professions or replacing a temporarily absent employee. But when setting compensation, you should remember some rules:

- working conditions and remuneration should not worsen the validity of the employee’s main employment contract;

- for each combination or performance of duties, a certain amount of additional payment is assigned, which is specified in the additional agreement. It can be expressed either as a percentage of the employee’s salary or as a fixed amount;

- the additional payment is equal to compensation payments and income tax is withheld from it;

- the additional payment is included in the average salary and a regional coefficient and a percentage increase are applied to it;

- It is logical to establish an additional payment, the amount of which will not exceed the payment for the position being filled.

In the absence of an agreement on additional payment or non-payment, the work is considered illegal, as it violates the rules of the Labor Code. Such an action by the employer must be suppressed by regulatory authorities, and the employee has the right not to carry it out.

Formula and calculation examples

When working part time

It should be noted that an employee working as a part-time worker may insist on establishing a partial shift or day . This right is granted to him by Article 93 of the Labor Code.

For such employees, when calculating additional payments, you should focus on the hours actually worked.

For example, if the amount of additional payment was established in the agreement at 10% of the salary, the calculation will be made using the following formula:

- the full salary is multiplied by the number of hours actually worked and divided by 160 hours (the number of working hours per month at full time);

- the resulting value (salary amount without additional payment) is multiplied by the amount of additional payment (10%) and divided by 100%;

- the salary for part-time work (the value obtained in the first action) is summed up with the amount of additional payment (the value obtained in the second action) - as a result, the accountant will receive the exact amount of the salary due to this employee.

If an employee’s salary is set at 20,000 rubles, and he worked 80 hours in an additional workplace in a month, the calculations will look like this:

- 20,000 x 80: 160 = 10,000 (salary for part-time work);

- 10,000 x 10 (%): 100 (%) = 1,000 (surcharge amount for combination);

- 10,000 + 1000 = 11,000 (salary).

One more example:

An engineer receives 36,000 rubles for his main position. At an additional workplace, the salary is set at 40,000 rubles (for an 8-hour working day). At the same time, at the request of this employee, a part-time day is established (in fact, half of the established norm is spent on work - 4 hours a day). 15 days were worked per month until the absent employee returned to the workplace. The amount of additional payment is set at 30% of the salary. To calculate an employee's salary you must:

- 40,000: 2 = 20,000 (salary for an additional position per month);

- 20,000 x 60: 80 = 15,000 (salary for 15 days actually worked (60 hours));

- 15,000 x 30 (%): 100 (%) = 4,500 (surcharge amount);

- 36,000 + 15,000 + 4,500 = 55,500 (monthly salary).

As a result, the engineer’s salary will be the basic salary plus additional payment for part-time work.

Full time

For a full working day (shift), the same simple calculations are made. For example:

The analyst also held the position of cashier. The employee was accrued 25,000 rubles at his main workplace. Based on the signed agreement, management established an additional payment of 20% of the basic salary. The employee replaced the absent cashier for exactly 12 days, and the entire working month included 24 days. The calculations look like this:

- 25,000 x 20 (%): 100 (%) = 5,000 (amount of additional payment for combination per month);

- 5,000: 2 = 2,500 (surcharge amount for 12 days);

- 25,000 + 2,500 = 27,500 (monthly salary).

When paying for production

Payment can also be made for production - the number of products manufactured. For example:

According to the additional agreement, the turner was given an additional payment of 25 rubles for each additional part. At an additional place of work, he was able to produce 30 products. To determine the amount of the surcharge, you need to multiply 30 manufactured products by 25 rubles. That is, as an additional payment, the accounting department will add another 750 rubles to the turner’s basic salary.

If the employee did not work all working days

If an employee did not work all working days in the current month, the additional payment is also calculated based on the hours actually worked. For example:

The employee worked 127 hours and was on leave for four more days at his own expense. According to the additional agreement, this employee was given an additional payment within 50% of the salary of the absent colleague, whose work functions must be performed. The standard working time for the current month was set at 159 hours. Tariff rates were distributed as 225 rubles per hour of work at the main place and 332 rubles per hour of work at the additional place. The calculations look like this:

- The size of the basic salary is determined - 127 hours multiplied by 225 rubles.

- The amount of additional payment is determined - 127 hours multiplied by 332 rubles, and then multiplied by 0.5 (50%);

- The total amount is established - the two values obtained as a result of calculations are added.

You will find out the length of service for retirement in Russia under the new law in our article. In 2021, Russian military pensions will be increased! Find out more about this event in the article. There are some changes to unemployment benefits in 2021. Our material has all the information you need.

From what salary is it calculated?

The question of establishing compensation for performing temporary duties or combining professions often arises when such a situation arises. When performing duties, compensation is calculated based on the salary of the absent employee.

It is quite rare for a deputy to be paid a full salary; usually a certain percentage is established. When combining professions, it is quite appropriate to pay the full salary or part of it, depending on the time spent. When the volume of work increases, it is worth calculating the percentage of the bonus from the employee’s salary.

It should be noted that there are no specific payment rules, upper and lower limits of compensation. The decision is made on the basis of a collective agreement or internal local documents of the company.

Nuances

Remuneration when combining professions is a pressing issue for employees. After all, you have to work more, so you need a reward for your work.

You can draw up an additional agreement to the contract. Indicate exactly what duties the employee will additionally perform.

Based on the agreement, an order is issued, which states how much the increase to the employee’s salary will be. When there is no longer a need to work for the absent employee, a second additional agreement to the contract is signed.

The order is issued again. This time the meaning of the document will be different. An order is issued stating that the combination is terminated in a budgetary or commercial institution.

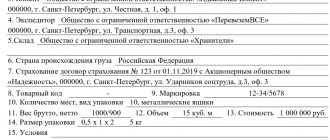

5 steps to legally register a combination:

- To fix by local act the amount of the premium for performing additional work.

- Prepare an additional agreement on assigning the functions of the absent specialist.

- Issue an order indicating the duration of duties, the amount of the bonus, position, as well as the last name, first name and patronymic of the specialist.

- Upon completion of the work, sign the agreement to the contract again.

- Issue an order to complete the work.

There is a second option for preparing personnel documentation. Combination is considered to be work that is not included in the scope of responsibilities outlined in the contract. Therefore, it is not necessary to sign additional agreements. The premium will depend on the complexity and intensity of the work. Calculated from the salary of the absent employee.

To “load” a specialist with work, it is enough to do two steps:

- Issue an order. Indicate the number of new functions and the duration of their implementation.

- Draw up an agreement. Indicate from whose salary the amount of payments is taken, how the bonus is determined, and clarify how the calculation is made.

If all documents are completed correctly, the combination will be completed according to the rules.

Calculation procedure

Additional payment can be set in two ways: a fixed amount or a percentage of the salary for the position being filled.

When choosing compensation that is a certain percentage of salary, you must first calculate the amount based on the established percentage.

Example: for combining a position, a person receives 50% of 20 thousand rubles. This amounts to 10 thousand rubles. The employee's salary is 30 thousand rubles. Thus, wages are calculated as (30,000 + 10,000) – 13% personal income tax = 34,800 rubles.

It is important to remember that compensation is calculated in proportion to the time worked if the month was not fully worked.

During vacation

The most common occurrence when it is necessary to register a combination of positions is the vacation of one of the company’s employees. Most often, a temporary executor is appointed for the period of vacation of the main employee.

In any case, an additional agreement and an order for combination or replacement are drawn up. The job responsibilities that the employee must perform during his working hours are specified separately. The peculiarity of such work is its short duration.

Usually the vacation dates are known and are written down in all documents. This type of combination is called “for the period of vacation of the main employee.” Compensation for the bonus is paid for the entire period of work. If it lasts less than a month, it is calculated in proportion to the time worked.

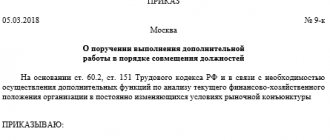

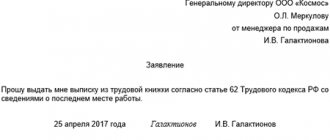

Application, order for combination

Any employee’s work duties must be documented. The employer issues an order for this purpose. The document contains information about the employee who is responsible for combining, replacing or increasing the area of responsibility.

If deadlines are known, they must be indicated or the justification for increasing the workload and expanding job responsibilities is written down. An agreement is also drawn up with the employees, which specifies all the working conditions, including payment.

To prevent conflicts, it is better to take a statement from the employee in which he gives his consent to perform additional work. This is especially important to do with a privileged category of workers (pregnant women, disabled people, minors, mothers of young children).

Payment

According to Art. 151 of the Labor Code of the Russian Federation in the new edition, an employee who performs for the same employer, in addition to his work, additional work in a different profession or who carries out labor activities for a temporarily absent employee (again, along with his main activity), has the right to additional payment for combination.

The amount of additional funds paid is established by agreement of the parties. In terms of remuneration when combining art. 151 of the Labor Code of the Russian Federation is a continuation of Art. 149 code.