VAT on balance

VAT in the balance sheet is displayed in 3 lines:

- 1220 “VAT on acquired values”;

- 1230 “Accounts receivable”;

- 1520 “Accounts payable”.

Lines 1220 and 1230 are in the “current assets” section, since these are current assets with increased liquidity - their turnover occurs during the year or during the normal operating cycle for the organization. Based on the same reasoning (calculations occur during the year), line 1520 is located in the “Short-term liabilities” section of the balance sheet liability.

There are certain features of reflecting tax for each of these lines.

ConsultantPlus experts explained how to correctly reflect VAT in accounting. Get trial access to the system and upgrade to the Ready Solution for free.

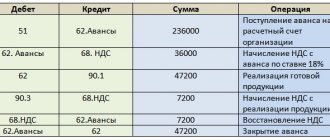

Reflection of advance transactions in the declaration: postings, restoration

In accounting, VAT is charged on the advance received from the buyer using the following entries:

To reflect the accrual of VAT on advance payments, the chart of accounts provides a subaccount “VAT on advances received (prepayments)” to account 62 “Settlements with buyers and customers” and account 76 “Settlements with various debtors and creditors”. This allows:

- keep in accounting data on advances received and VAT on them (according to Kt 62, 76);

- in the balance sheet, reflect the amounts of advances received (excluding VAT, accounted for on the Dt of the relevant accounts) as accounts payable.

Please note that the previously received advance payment at the time of sale of goods (services or work) is counted towards the prepayment amount. An invoice is issued for the shipped product (service or work). On the date of offset of advances, the company accepts for deduction VAT on advances received. Please note that the deduction is made in the amount of tax calculated on goods (services or work) shipped for which advances were received. It is understood here that if VAT on advances is charged at a rate of 20/120%, and the product (service or work) is shipped at a rate of 10%, then VAT on advances received is credited at a rate of 10/110%.

In the VAT return, the advance received is reflected in section 3 on line 070 in column 3, and the amount of tax on the advance is reflected in column 5.

The deduction of VAT on advances received is reflected in section 3 of the declaration on line 170 in column 3 for the tax period in which the goods were shipped.

Reflection in accounting of VAT on the advance paid to the supplier is reflected by postings.

Account 19 is used for the purpose of separating VAT from an advance, when the issuance of an advance and the deduction of VAT are separated in time. If advance VAT on the reporting date is not accepted for deduction, then the tax reflected in account 19 is recorded in the balance sheet as a current asset separately from the “receivables” for the transferred advance payment.

To separate VAT from advances issued, you can use separate subaccounts “VAT on advances issued (prepayments)” to account 60 “Settlements with suppliers and contractors” or to account 76 “Settlements with various debtors and creditors”. Thereby:

- the accounting stores data on advances paid, including VAT (according to Dt 60, 76);

- the balance sheet shows “receivables” (minus VAT accounted for in the KT of the relevant accounts) in the form of advances issued.

VAT on advances received, accounted for under Dt 62-VAT (76-VAT), is not indicated in the balance sheet, as well as VAT on advances issued, accounted for under Kt 60-VAT (76-VAT). In the balance sheet, tax amounts are reduced by the “debtor” in the form of advances issued and the “creditor” in the form of advances received.

Reflected in account 19 from the advance VAT issued, which was not accepted for deduction by the end of the reporting period, must be included in the balance sheet. This VAT is indicated in line 1220 “VAT on acquired assets.”

Advances issued are not reflected in the VAT return, but the tax on these advances accepted for deduction is indicated in section 3 on line 130.

Please note that for the advances listed by the suppliers, the buyer acts according to the following scheme:

1) receives an invoice for the advance payment, records it in the purchase book, and accepts the advance VAT for deduction;

2) after shipment of goods (services, works), records the shipping invoice in the purchase book;

3) indicates the previously registered advance invoice in the sales book, thus recovering VAT from the advance payment issued.

Kontur.VAT+ allows you to avoid discrepancies in the quotas and reconciles invoices for transactions with advances for all quarters.

Regarding the recovery of VAT from an advance received, the situation is as follows. The seller, having received an advance payment, charges VAT on it. Having sold the goods (service, work), he draws up an invoice for the sale and accepts VAT from the previously received advance for deduction. That is, in this case the term “restoration” is incorrect to use. The seller records an advance invoice in the sales book, and later, after shipment of the goods (service, work), an invoice for sales. At the same time, the seller registers an invoice for the advance payment in the purchase book, thereby deducting advance VAT. Oh, that is, the deduction, VAT on the advance received is not limited, the main thing is that the deduction is declared in the quarter in which all the conditions for the deduction are met.

Input VAT

Line 1220 “VAT on purchased assets”

Line 1220 reflects the amount of tax that the company will be able to deduct in the future. The remaining value (debit balance) for account 19 is transferred to this balance line.

To exercise the right to deduction, a number of conditions must be simultaneously met:

- the acquired assets are intended for the type of activity that is subject to VAT;

- the cost of acquired assets is reflected in accounting;

- there is a correctly issued invoice from the supplier.

You can see how to fill out line 1220 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

For many organizations, account 19 is reset to zero at the end of the year, and in this case a dash is added to line 1220 of the balance sheet. The balance on account 19 may arise in such cases (all of them follow from the text of Articles 171 and 172 of the Tax Code of the Russian Federation):

- when exporting raw materials (the delay in accepting VAT for deduction is due to the fact that it is necessary to go through the procedure of confirming the fact of export);

- if the acquired assets are used by a company with a long production cycle (VAT is deductible only after the finished product is shipped to the buyer);

- if the supplier did not provide an invoice or the invoice was issued with significant violations;

- when the taxpayer decides to deduct it at a later period (before the expiration of 3 years from the date of registration of the acquired property).

NOTE! For organizations with large balances on account 19, it is better to detail the value of line 1220. This right is provided for in clause 6 of PBU 4/99 “Accounting statements of an organization” (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n). This can be done by adding lines 12201, 12202, etc. Detailing is possible in the context of operations (purchase) by fixed assets, inventories, intangible assets and others.

Standardized expenses

A debit balance on account 19 can also be formed when paying expenses, which are normalized when calculating income tax. Thus, there are expenses that cannot be fully taken into account in the tax base when calculating income tax.

Read about what expenses are regulated and what the limits for rationing are in the material “Standards provided for by the Tax Code of the Russian Federation” .

Hand in hand, taking into account standardized expenses, comes the problem of deducting value added tax. That is, if these expenses are normalized, then the right to deduct VAT on them is also curtailed.

In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the VAT amount as the base from which the standard is determined increases.

At the end of the year, some amounts of undeductible VAT may accumulate. Their last day of the year should be written off as other expenses, since tax amounts exceeding the amount corresponding to the calculated value of the standard will no longer be accepted for deduction.

Features of accounting for an advance given to an employee as remuneration

The reflection of an advance given to an employee as remuneration is recorded in the debit of account 70 and the credit of current accounts. The specific date for payment of the advance is not established by the legislation of the Russian Federation. Article 136 of the Labor Code of the Russian Federation determines that wages must be paid at least every half month.

The minimum advance payment for wages cannot be lower than the employee’s salary for the time worked. Accordingly, the minimum that an employee can count on is a tariff rate or salary in an amount proportional to the time actually worked for the first half of the month.

When determining the amount of the advance, it is necessary to take into account all components of the employee’s monthly income, including additional payments, allowances for special working conditions, payment for additional work, payment for combining positions, and substitutions.

You can calculate the advance without taking into account weekends and holidays, or you can calculate it based on the number of working days in the first half of the month.

Regardless of the algorithm for calculating the advance, personal income tax must be withheld only once during the final calculation of wages for the past month. The date of receipt of income as wages is recognized as:

- the last day of the month for which it was accrued;

- the last day of work in the employee’s organization if he quits before the end of the month.

Note 1

There is often a need to issue funds on account to employees to carry out business transactions. Amounts received by an accountable person can only be used for the purposes for which they were issued. Later, the accountable person will have to report to the organization on the advances spent. Settlements with accountable persons are reflected in account 71. If there are unused funds remaining, they must be returned to the enterprise’s cash desk. In accounting, funds issued against the funds account are reflected by the entry: Debit 71 Credit 50 (51). The funds spent, according to accepted and approved advance reports, are reflected by debit entries in accounts 25, 26, 10, etc. and credit 71 accounts.

Advances listed

Line 1230 “Accounts receivable”

This line reflects the full amounts of buyer (debtor) debts remaining at the end of the year, including VAT. Here we summarize the data corresponding to the balances (debit) of accounts 60, 62, 76, as well as the total values for the debit of the “Settlements with ...” accounts: 68, 69, 70, 71, 73 and 75, reduced by the balance (credit) of the account 63.

Starting from 2011, organizations are required to form a reserve for doubtful debts (account 63, the balance of which is subtracted from the value accumulated in line 1230 of the balance sheet). This includes those debts of debtors for which they no longer hope to receive payment.

The organization independently determines such debts by assessing the likelihood of full or partial non-repayment (letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01).

According to the explanations of the Ministry of Finance of Russia, when the buyer transfers an advance to the supplier, receivables are reflected in the balance sheet minus VAT, subject to deduction or accepted for deduction (attachment to the letter of the Ministry of Finance of Russia dated 01/09/2013 No. 07-02-18/01).

This means that in line 1230, in addition to existing accounts receivable with VAT, the amount of advances transferred to suppliers against a future transaction (shipment of goods, provision of work (services), transfer of property rights) is reflected minus VAT.

For a sample of filling out the balance sheet for 2021, see here.

Significant indicators

All indicators in the standard form of the Balance Sheet are divided into groups of items (for example, “Fixed assets”, “Financial investments”, “Accounts receivable”). You can determine their details yourself, based on the significance of a particular indicator.

When can an indicator be considered significant? In the event that without information about it it is not possible to correctly assess the financial position of the organization. Determine the level of materiality yourself (for example, 5 percent of homogeneous assets or liabilities), registering it in the accounting policy for accounting purposes.

In this case, for each line whose indicator is significant, substrings are introduced. They indicate the numerical values that are part of the aggregated indicators provided for in the standard form.

But unimportant indicators need not be separated into substrings. They can be given as a total amount and deciphered in the explanations to the Balance Sheet.

This procedure follows from Note 2 to the Balance Sheet, approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, and paragraph 11 of PBU 4/99.

Organizations that have the right to use simplified accounting methods (for example, small businesses) can draw up a Balance Sheet by groups of items. It is not necessary to detail the indicators, regardless of their significance (subparagraph “a”, paragraph 6 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010, Part 4 of Article 6 of the Law of December 6, 2011 No. 402-FZ).

An example of how to reflect non-essential indicators on the balance sheet

The accounting policy of Alpha LLC establishes that information about assets (liabilities) is significant if their amount is at least 7 percent of homogeneous assets (liabilities). Information about non-essential assets (liabilities) is disclosed based on the results of the reporting period in the Explanations to the Balance Sheet and the Statement of Financial Results.

As of March 31, 2021, accounts receivable from buyers and customers amounted to RUB 250,000, including overdue accounts of RUB 2,000. The expected repayment period of the debt is less than 12 months.

The ratio of overdue debt to the total amount of debt of buyers and customers is 0.8 percent ((2,000 rubles: 250,000 rubles) × 100).

Information on the amount of overdue debt of buyers and customers is insignificant (0.8% < 7%).

Therefore, in the balance sheet, the Alpha accountant did not separately indicate the amount of overdue debt (he did not enter a new subline into the balance sheet), but included it in the total amount of receivables on line 1230 “Accounts receivable”.

In the Explanations to the Balance Sheet and the Statement of Financial Results, Alpha's accountant indicated the amount of overdue receivables.

Advances received

Line 1520 “Debt to creditors”

The line “Debt to creditors” (balance sheet liability) summarizes the balances (credit) on the following accounts: 60, 62, 68, 69, 70, 71, 73, 75 and 76, including VAT. These are all the debts of the enterprise that it is obliged to repay within a year, or during the production cycle if it exceeds a calendar year.

IMPORTANT! The amounts of debts to the budget must be verified with the fiscal authorities. It is strictly prohibited to arbitrarily calculate unsettled debts to the budget (clause 74 of the PBU on accounting and accounting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

When forming line 1520 of the balance sheet, you should take into account a certain nuance with the reflection of advances received. Here there is a situation similar to that of the advances listed. The Russian Ministry of Finance also recommends that advances received be reflected in the balance sheet minus VAT (attachment to the letter of the Russian Ministry of Finance dated January 9, 2013 No. 07-02-18/01).

So on line 1520 you should include:

- accounts payable including VAT,

- advances received minus VAT.

You can see how to fill out line 1520 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

Read about the nuances of working with advances received in the material “What is the general procedure for accounting for VAT on advances received .

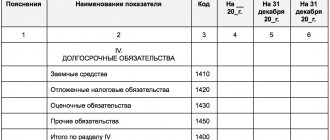

Line numbering

Fill out the “Code” column in accordance with Appendix 4 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. You only need to number the lines if you submit reports to the statistics department and the tax office. However, there are specific features for certain categories of organizations. Thus, organizations that have the right to use simplified accounting methods (for example, small businesses) reflect aggregated indicators in the balance sheet, which include several indicators. In this case, enter the line code according to the indicator that is larger in value than others included in this line.

If you prepare reports for shareholders or other users who are not representatives of state control, it is not necessary to number the balance sheet lines.

This follows from paragraph 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n and part 4 of Article 6 of the Law dated December 6, 2011 No. 402-FZ.

Results

VAT is reflected in the balance sheet as follows:

- in the asset - in two lines (1220 and 1230),

- in the passive - in one line (1520).

The Russian Ministry of Finance advises including in lines 1230 and 1520 receivables and payables for advances minus VAT. Note that the taxpayer has the right to act differently and not deduct the amount of tax from the debt. However, in this case you need to be prepared to argue your position.

Sources:

- Tax Code of the Russian Federation

- PBU 4/99, approved. by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 N 43n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Empty lines and negative exponents

If there are no values in the balance line, put a dash. Do the same in the case when, as a result of rounding to whole digits, the values of some balance lines are equal to zero. At the same time, assets and liabilities that were not reflected in the balance sheet due to rounding can be disclosed in the Explanations to the Balance Sheet and the Statement of Financial Results. This follows from paragraph 11 of PBU 4/99.

When the balance indicator has a negative value, display it in parentheses, without the minus sign. Proceed in the same way if, when calculating the totals of the balance sheet section, any indicator needs to be subtracted from the total amount. This follows from Note 7 to the Balance Sheet, approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. For example, in parentheses show the amount of uncovered loss on line 1370.

VAT on advance: postings

The VAT payer, upon receipt of payment for the upcoming supply of goods (performance of work, provision of services) subject to VAT, must calculate VAT for payment on the prepayment (clause 1 of Article 146, clause 1 of Article 154, clause 2 of clause 1 of Art. 167 Tax Code of the Russian Federation).

And when transferring an advance payment, the VAT payer has the right, subject to certain conditions, to accept VAT from the transferred payment for deduction (clause 12 of Article 171, clause 9 of Article 172 of the Tax Code of the Russian Federation).

We will tell you in our consultation how to reflect VAT on advances received and issued in the accounting and reporting of the seller and buyer.

Application of CVO for advances

All advances issued and received are formalized by an invoice, the details of which are recorded in the books of purchases and sales under the corresponding KVO transaction type codes.

In the sales book, the seller indicates the invoice data when issuing an advance to the contractor, and the buyer recovers VAT from the advance to the seller.

The seller makes an entry in the purchase book on the invoice from the advance payment issued to him in order to accept VAT for deduction, and the buyer makes an entry on the invoice from the advance payment issued to him in order to accept VAT from the seller for deduction.

At the same time, for the advance received, the seller records an invoice in the sales book according to KVO “02”, and the buyer with the same code in the purchase book indicates an invoice for the advance payment that he issued.

When the transaction has been completed, the buyer accepts VAT deduction from the received advance payment, which is possible only after the invoice for the advance payment is recorded by the seller in his purchase book with KVO “22”.

The seller, having shipped the goods, is obliged to restore the VAT deduction from the advance payment after the buyer indicates in his sales book an invoice from the advance payment with KVO “21”.

Upon shipment, the sales invoice is recorded by the seller and the buyer in the sales and purchases book, respectively, with the KVO “01”.

To avoid confusion about which QUOs to indicate when registering invoices, use the cheat sheet below. It clearly shows how the seller and buyer should act when recording transactions in the purchase and sales books.