The financial result contains all the necessary information on the organization’s activities and is classified into certain categories of income and expenses provided for the reporting year.

Depending on the efficiency of the entire company, the object of checking the financial result is the accounting items of income or expenses, which are the financial result determined for each reporting period of time on the basis of accounting.

The financial result is considered to be the degree of efficiency of the company in the field of production and economic activities, the increase or decrease in the amount of income (loss) over a certain period of time. The final financial result is calculated in accordance with the amount of goods or services sold, the volume of fixed assets of the corporation, as well as non-operating income.

Attention! Income or expenses in the activities of an organization are nothing more than the difference between the amount of income from sales of goods or services at market prices and the costs of production and sales!

The financial results of the organization are presented in several forms - profit and expenses. And if the enterprise’s income exceeds production costs, then all the organization’s activities are considered effective. If a level of costs exceeds the amount of income of the enterprise, the work is treated as unprofitable.

Profit is the final positive financial result of the organization’s performance, and loss is negative.

The profit of any organization is generated through the following sources:

- From the sale of goods or provision of services, which is the operating activity of the company. It shows the final result from the organization’s main field of activity in the market and its profile;

- From the sale of property - characterized by the sale of tangible and intangible assets, securities, and so on;

- From non-operating transactions. This includes interest on shares purchased, income from the use of debt obligations, etc.

The following types of profit are distinguished:

- Gross profit (the main type of profit among others) is income from the sale of goods, services or work minus the cost of the object sold;

- Revenue from sales. To determine what profit from sales is, it is necessary to subtract expenses (both managerial and commercial) from gross profit;

- Balance sheet profit – income from sales excluding the balance of other items of income and expenses;

- Profit from taxation;

- Net profit of the reporting period.

The main functions of profit include:

- Estimated - the essence of which is that with the help of relative and absolute parameters of profitability you can find out the actual efficiency of the organization, quality and overall activity. In addition, by looking at the income item, you can find out such aspects as the quality of the enterprise’s resources (labor, material and production) and labor productivity;

- Stimulating , which shows the degree of satisfaction of the organization’s employees with their work, whether their social needs are taken into account, as well as the procedure for paying dividends.

Financial result from product sales

The financial result from the sale of products is income.

The income of enterprises is formed from proceeds from the sale of products, goods, performance of work and provision of services.

Sales revenue is the main income of the enterprise, the main source of its cash receipts, reflects the results of the production and economic activities of the enterprise for a certain period of time (year, quarter, month).

Revenue from sales of products accounts for 90% of all income in production. It is the main source of cost recovery for production and sales of products and is used by the enterprise for:

- — payment of supplier bills for material assets;

- — payment of wages to workers and employees;

- — creating a depreciation fund;

- — creation of economic incentive funds;

- — contribution of payments to the budget (turnover tax, payment for production assets, fixed payments, free balance of profit);

- — payment of interest on the loan;

- — repayment of a bank loan, etc.

In a market economy, making a profit is the immediate goal of production. Profit creates certain guarantees for the further existence of the enterprise, since only its accumulation in the form of various reserve funds helps to overcome the consequences of the risk associated with the sale of goods on the market.

On the market, enterprises act as relatively isolated commodity producers. Having set the price for the product, they sell it to the consumer, receiving cash proceeds, which does not yet mean making a profit. To identify the financial result, it is necessary to compare revenue with production and sales costs, which take the form of production costs.

If revenue exceeds cost, the financial result indicates a profit. An enterprise always sets profit as its goal, but does not always make it. If revenue is equal to cost, then it is only possible to reimburse the costs of production and sales of products. When costs exceed revenue, the company exceeds the established amount of costs and receives losses - a negative financial result, which puts the company in a rather difficult financial situation, which does not exclude bankruptcy.

For an enterprise, profit is an indicator that creates an incentive to invest in those areas where the greatest increase in value can be achieved. Profit as a category of market relations performs the following functions:

- — characterizes the economic effect obtained as a result of the enterprise’s activities;

- - is the main element of the financial resources of the enterprise;

- - is a source of formation of budgets at different levels.

Losses also play a role. They highlight the mistakes and miscalculations of the enterprise in the areas of using financial resources, organizing production and marketing of products.

The successful financial and economic activities of the enterprise will depend on how accurately the revenue is planned. The calculation of planned revenue must be economically justified, which will allow for timely and complete financing of investments, an increase in own working capital, appropriate payments to workers and employees, as well as timely settlements with the budget, banks and suppliers.

Changes in the volume of sales revenue have a great impact on the financial results of operations and on the financial stability of the enterprise, therefore the financial department of the enterprise organizes daily operational control over the shipment and sale of products.

Therefore, proper revenue planning in an enterprise is of key importance.

What is net profit?

Commerce is inextricably linked with the concept of net profit. To get it, people found new enterprises, open production facilities, and constantly look for effective ways to increase the company’s income, and not only the owners and managers of companies are interested in maximizing net profit.

Net profit is one of the main final indicators of the activity of any business entity. This indicator includes the entire balance sheet profit of the company, from which the amounts of expenses (for staff salaries, managerial, production and others), taxes, fees and other contributions to the budget are subtracted.

The net profit belongs to the enterprise in full; it can be managed by renewing the company's funds from it, paying interest to shareholders, and expanding working capital. That is, this money can be spent on expanding the business, covering current needs, introducing innovations, updating equipment, etc.

Any enterprise regularly faces the need to calculate the amount of net profit, but the criteria for assessing the effectiveness of business management differ in different companies. Among them the main ones are:

- capital turnover;

- economic efficiency;

- increase in assets.

By calculating the company's net profit, we can accurately determine how much money remains in the ownership of the business entity.

Calculating the amount of net profit is also necessary for non-profit organizations (state-owned, budgetary, etc.), since the concept of operational efficiency is applicable to them as well.

A direct indication of the legislation regulating the work of Limited Liability Companies (LLC) and Joint Stock Companies (JSC) prescribes that net profit should be directed to:

- payment of dividends to shareholders (or distribution among members of the company);

- business development, increasing the volume of working capital;

- other company needs.

Thus, it is important for the accounting department of any joint stock company to know how to calculate net profit and also to pay dividends in full and correctly.

We recommend

“Calculating Enterprise Profit: A Complete Guide for Beginners” Read more

How to calculate financial results

Related publications

The final operation for the reporting period in accounting is the determination of the financial result, the size of which always determines the viability of the company. In a mathematical sense, it is represented by the result obtained from the difference between the company’s income and expenses, and can be either a positive value, i.e., profit, or a negative value, i.e., loss. Let's figure out how the financial result is calculated in practice.

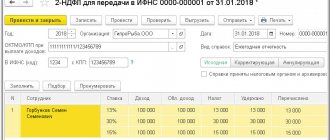

Example 1. Calculation of SFR for filling out line 2500 fin. report of Olmis LLC for the period 2017–2018.

The calculation of the SFR value is based on data from the financial. report No. 2 of Olmis LLC for the period 2017–2018. The general calculation formula is applied. The indicator values used in the proposed example are conditional.

| The name of the indicator and the corresponding financial line. report No. 2 Olmis LLC | Data on it for 2021 from the report of Olmis LLC (thousand Russian rubles) | Data on it for 2021 from the report of Olmis LLC (thousand Russian rubles) |

| State of emergency (loss), page 2400 | 15 000 | 9 980 |

| Result from revaluation of VA, not attributed to emergency (loss), line 2510 | 89 | 130 |

| Result from other operations not classified as an emergency (loss), line 2520 | – | – |

The calculation of the SFR value for Olmis LLC is carried out for each period separately (first for 2021, then for 2021). Since there is no information on line 2520 (there are dashes for it in the financial report), the values that are available are substituted into the general formula for calculation.

SFR calculation for 2021: 15,000 + 89 = 15,089. By analogy, calculation for 2021 is made: 9,980 + 130 = 10,110.

According to the results obtained in Fin. in the report of Olmis LLC on page 2500 for the period 2021, the amount “15,089” should be recorded, and for the period 2021 on the same line - the amount “10,110”.

What is the result of the company's work?

This indicator depends on the volume of sales of goods/services, the productivity of the company's property, income from transactions not related to sales and many other indicators. The financial result can be expressed as follows: the company receives either income or loss. Therefore, the activities of the enterprise are considered as:

- Profitable if the income received covers the costs incurred;

- Unprofitable when costs (production and other) exceed income.

However, they begin to analyze the company’s activities after they have already received the results of the work. We will look at how to calculate the financial result.

Financial result: formula

The result of the company's work in the period under review is displayed as revenue from the sale of the manufactured product, and the final financial result - as profit and net profit. It is the amount of net profit, which is the final result, that the economist focuses on. The calculation is carried out in stages, since profit is an ambiguous concept and there are several types of it:

- Gross;

- From implementation;

- Before tax;

- Clean.

When starting the calculation, the accountant uses the following formulas:

- Gross profit (GP) = Вр - Срт, where Вр - sales revenue, Срт - cost of goods sold;

- Profit from sales (Pr) = VP – KR – UR, where KR and UR are commercial/administrative costs;

- Profit before tax (Pdon) = Pr + Dvo – Pvo, where Dvo and Pvo are operating/non-operating expenses and income;

- Net profit (NP) = Pdon – N, where N – taxes and tax liabilities.

This is interesting: Why you can fire a director

The formulas used make it possible to calculate the financial result, which shows how efficiently the company operated in the reporting period. Now let’s figure out what accounting records this indicator is recorded in.

Formula for calculating net profit with examples

To calculate net profit using the formula, use the following algorithm:

- Calculate the sales profit (revenue) that the business generated over the past period. To do this, include accounting data in the formula.

- Subtract variable expenses from the resulting indicator - this way you will find out the level of the company’s marginal profit.

- Next, in accordance with the formula, from the result of the previous step it is necessary to subtract the amount of fixed expenses and determine the operating profit.

- Subtract all other expenses using the formula, all this is done to calculate the amount of profit before taxes are paid.

- Subtract taxes to get the required figure using our formula.

In fact, net profit has a fairly simple calculation formula, as you will see in the examples. Roughly speaking, you will get the required figure by adding up all your income and subtracting from it the amount of expenses for the same period. Next, you need to subtract the tax from the result - this is the entire calculation formula.

Let's discuss in more detail how to calculate net profit using the calculation formula with examples. Let's say you become an individual entrepreneur and sell laptops using a small online store. For example, in three months of work you achieved the following results:

| Income | |

| Income from the sale of laptops | 480 000 |

| Total | 480 000 |

| Expenses | |

| Purchase of laptops | 250 000 |

| Website creation and maintenance | 50 000 |

| Product (website) promotion | 50 000 |

| Other expenses (return of defective products, discounts, computer repairs) | 50 000 |

| Total | 400 000 |

Now we find out the net profit using the calculation formula for this example: 480,000 (income) – 400,000 (expense) – tax % = the required amount.

In this example of calculation, everything is extremely simple, and the result shows that the entrepreneur receives income and can spend it on his own needs or business development.

However, let us make a reservation that the calculation formula becomes much more complicated as soon as we talk about, for example, large companies. First of all, the components of income and expenses are calculated, and only after that the required indicator is calculated.

There are several calculation formulas. They differ in appearance, but have the same meaning: they add up all income and expenses separately, after which the latter are subtracted from the former, and tax must be subtracted from the result. As an example, we give the basic calculation formula:

PP = FP + OP + VP – N

, Where

- PE – net profit;

- FP – financial profit, that is, financial income minus financial expenses;

- OP – operating profit, that is, operating income minus operating expenses;

- VP – gross profit, that is, sales income minus costs (cost);

- N – tax percentage (established by law).

Let's consider an example of calculation for the organization “My Company” using the above formula:

| Sales of products | 2 450 000 |

| Product cost | 1 256 000 |

| Warehouse space rental | 300 000 |

| Financial investments | 10 000 |

| Income from financial investments in securities | 260 000 |

| Other costs | 200 000 |

According to the table, the calculation of gross profit using the formula looks like this:

2 450 000 — 1 256 000 = 1 194 000.

Financial profit in this case is 0 = 250,000, and operating profit: 300,000 - 200,000 = 100,000.

Taxes: (250,000 + 1,194,000) × 20% = 288,800.

Then the required indicator, according to the formula and data from the example, is: 250,000 + 1,194,000 - 288,800 = 1,155,200.

How to determine financial results in accounting

The calculation involves sales accounts (90), other income and expenses (91). The accountant makes monthly calculations of the total values, summarizing the turnover on these accounts and transferring them to the effective profit and loss account - 99.

Account 90 is used to account for the results obtained from the main activities of the company. All transactions are generated on it according to certain subaccounts. Revenue is accumulated on the account loan. 90/01. This amount is reduced by generalized costs:

- Cost of products sold (account 90/02);

- Sales costs (account 90.07);

- Management expenses (90.08);

- VAT/excise taxes (90.03);

- Customs duties if the company carries out export operations (90.05).

The calculation results are displayed on subaccount 90.09. When closing a monthly period, the amount is offset from the account. 99, and at the end of the year the entire account is reset to zero.

Accounting for the results obtained by the company from other activities is carried out on the account. 91. Such income is accumulated according to K-that account. 91/01. For example, these could be:

- Receipts from leased property;

- Interest received on deposits placed in banks;

- Fines received into the company’s accounts, paid by partners for various types of obligations, etc.

According to D-that account. 91/02 records other non-production costs: fines, penalties, taxes assessed by regulatory authorities, amounts of penalties paid to counterparties and other costs.

At the end of the month, the result from the listed operations is calculated and displayed on the subaccount 91/09, and then corresponds with the account. 99 count. At the end of the year the account is closed.

On the account 99 net profit is calculated as the final result for all types of activities for the year. According to K/t accounts reflect the profit, according to D/t – the total loss. In addition, account 99 is used to reflect extraordinary income and expenses, as well as sanctions from tax authorities and income tax.

Summarized data is generated monthly on the account. 99. By comparing its turnover, the amount of profit or loss, i.e., financial result, is calculated. The credit balance reflects the amount of profit, and the debit balance reflects the loss. At the end of the year, the calculated balance on the account. 99 goes to the retained earnings account - 84, and all indicated accounts (90,91,99) are closed. This operation is called balance reformation.

The main accounting entries will be as follows: