Taxes and fees are the main sources of the state budget. Issues related to establishing the procedure for taxing economic entities are a priority in the business life of every taxpayer.

Changes in legislation, increased duties for individuals and legal entities, different interest rates in certain countries contributed to the emergence of the concept of tax residency. For example, the income tax rate in Bulgaria is 10%, in Montenegro - 9%, and in France it varies from 0 to 49%; the obvious difference provides a wide field for choosing and planning your investments.

Concept and features

Tax residence of individuals is a term denoting the status of a subject of economic relations, that is, a person’s membership in the tax system of a particular state.

The origin of the term comes from the Latin language - "residens", which means "sits" or "remains in place."

In immigration law, the concept of residence is used to identify the presence of a permit (permit) to reside in the country of persons with permanent residence and registration, as well as foreigners and people of undetermined citizenship, subject to the laws of the state.

There are often cases when it is beneficial for federations and republics to establish criteria so that as many persons as possible are recognized as residents, and therefore pay interest on all their income.

Some liberal criteria result in no full obligations in any of the countries in which individuals reside and are active. Therefore, it is important to know what tax residency is.

In tax law, a resident is a person or company that is registered with the government agency of the selected country and makes the necessary contributions in accordance with the accepted norms of the law.

That is, you can have a residence permit in one state, but be a resident of another, while paying taxes to the treasury of the chosen place, where it is most profitable.

And vice versa - being a tax subject, you may not have a residence permit, that is, not be a citizen in the migration sense.

The objects from which funds are withdrawn are:

- scholarships;

- salaries;

- pensions;

- profit from the company.

Taxation of residents and non-residents under personal income tax

According to the law, a single personal income tax rate is provided for all individuals in the state. For residents it is thirteen percent of earnings, for non-residents it is thirty percent. This is a very significant difference both in percentage and in the numbers obtained. Moreover, standard types of benefits are provided for tax residents of the country who are officially employed by Russian companies. For example, parents who have one or two heirs receive 1 thousand 400 rubles for each, and 3 thousand rubles for the third child and subsequent ones. The amount of calculated personal income tax is reduced by these amounts. Non-residents, despite the tax percentage being 2.3 times higher, are deprived of these concessions. Let's look at examples.

| Example No. 1 | Example No. 2 |

| Ivan Konstantinovich Sonin is a resident of Russia and earns monthly 25 thousand rubles, from which he pays 3 thousand 250 rubles in income tax. And Sergey Petrovich Varfolomeev is not a resident of the country, but works at the same enterprise and earns the same 25 thousand rubles, but already pays 7 thousand 500 rubles in personal income tax on it. The monthly difference in the tax amount for a resident and a non-resident is 4 thousand 250 rubles, for a year - 51 thousand rubles, which is very significant. | Marina Ivanovna Tropina earns 50 thousand monthly, raises two young children and has the status of a resident of the country. After the standard “children’s deduction” (1 thousand 400 rubles for the first child and the same for the second), Tropin’s taxable salary is 47 thousand 200 rubles, and the monthly tax amount is 6 thousand 136 rubles. Her colleague Irina Stepanovna Kuznetsova, without resident status, but also with two children, will pay personal income tax in the amount of 15 thousand rubles at a 30 percent rate and without tax benefits. |

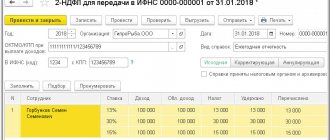

If during the reporting period a non-resident of Russia acquired resident status, the 30 percent personal income tax calculated by him will be offset. That is, from the beginning of the calendar year, income tax will be recalculated at a 13 percent rate, and the excess money will be taken into account against the next payments. If the surplus “does not fit in” at the end of the year, the employee can receive the overpayment in person by submitting to the Federal Tax Service the 3-NDFL declaration and a statement about the withheld tax fee in the excess amount.

To confirm your status, the Federal Tax Service will not ask for a large package of documents

Tax residency of legal entities

In the Russian Federation, legal entities may be subject to taxation:

- corporations, companies, enterprises and the like that were created and registered on the territory of the Russian Federation, in accordance with the requirements of national legislation;

- branches of Russian enterprises located abroad, but registered in the Russian Federation and fulfilling the necessary tax obligations (payment of interest to the treasury of the Russian Federation and submission of a declaration to record this fact to the Federal Tax Service).

In the practice of other countries, there are cases when the status of legal entities is determined according to the following criteria:

- The place where the main office of the company is located.

- The country where boards of directors are held, that is, the actual management of the company is carried out.

- The place where the financial departments of the company are located;

- The state where the company's global activities take place (receiving a larger share of profits).

This is interesting

To avoid double taxation, when an organization is registered in one country but operates in several, an international agreement is drawn up. It defines the criteria for income taxation and regulates conflicts of interest in a contractual manner.

The Russian Federation has an international agreement with most other countries that exempts legal entities from tax abroad if they file a declaration on the territory of the Russian Federation. Additionally, it is worth noting that the collection occurs not only from the profit received in Russia, but also in foreign countries.

Tax conditions

According to the Code of the Russian Federation, the income tax rate between carriers of one and another status is different. Foreign migrants, non-residents, with certain exceptions, are subject to income tax of 30%. The exceptions are people who are highly professional specialists, as well as immigrants. These categories of people pay the state in the same way as official holders of internal Russian passports.

In accordance with the Tax Code of the Russian Federation, residents pay a duty of 13% of total income, but there are exceptions here too.

Attention! The legislation of the country provides for cases when it is possible to return overpaid taxes to a person. If a person worked at work for more than 183 days without leaving Russia, he is without a doubt a resident. But, often, employers charge income tax at a rate of 30% for their reinsurance. In this case, the foreigner has the opportunity to receive back from the state 17% of the total wages for the entire period of payment of the duty at an inflated rate.

Tax residence of an individual

A tax resident in the status of an individual is a citizen of the state, a foreigner or a stateless person who fulfills obligations to the regulatory authority of the state, in accordance with the current national legislation.

Different countries set their own criteria for determining and calculating taxes for individuals.

For example, in order to have the status of a tax subject in the Russian Federation, you need to meet the following requirements:

- non-stop continuous residence in the Russian Federation for 183 or more calendar days during the year;

- have permanent registration and fulfill tax obligations provided for by the regulations;

- Both citizens of our country and people who are not citizens of our country, or stateless persons who fulfill tax obligations due to their long stay and activities in the territory of the Russian Federation, can have this status;

- military personnel and civil servants staying abroad on duty or work, regardless of the duration of absence.

According to Article 224 of the Tax Code of the Russian Federation, for resident individuals, the income tax rate is 13%, and for non-resident individuals - 30%. In some cases the percentage may vary. So, for example, it is envisaged to reduce the interest rate on personal income in the form of dividends to 9%.

Below in tabular form is the percentage of taxation for different categories of the population.

| Status of an individual | Tax rate, % |

| Resident | 13 |

| Non-resident | 30 |

| Individuals receiving income in the form of dividends as participants in resident companies | 15 |

| Foreign citizens working under a patent and classified as highly qualified specialists | 13 |

Other states may be guided by additional criteria when issuing tax resident status, among which citizenship, own or rented housing, family registration, length of stay in a particular place and economic interests of individuals and legal entities play a significant role.

Also, as in the case of companies, an ordinary person can be considered a tax subject of several countries, this is also regulated through the conclusion of contractual agreements to avoid double taxation.

In addition to this common status, the term "domicile" is often used. This concept, which makes it possible to specify the payer’s connection to the jurisdictional zone, usually characterizes the place of residence or registration.

Results

So, who is a resident and non-resident of the Russian Federation?

Tax resident. The status of a tax agent is an individual who, in accordance with the legislation of the Russian Federation, has the right to a reduced personal income tax rate (13%). To obtain the status of a tax resident of the Russian Federation, it is necessary to spend most of the time in the country during the year and confirm this with the appropriate documents. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to determine a tax resident

Russian legislation does not require mandatory compliance with certain rules in order to determine a tax resident. If an individual or legal entity meets the criteria, then its status must be confirmed with the following documents:

- certificates confirming the place of residence and registration of individuals;

- ID card (passport);

- a note in the passport about the passage of border control and border crossing;

- migration card data;

- a control document that records the time spent working in the country;

- applications to the institution (Interregional Inspectorate) of the Federal Tax Service.

It is important

Determining tax status is very important because its presence directly affects the amount of final income of individuals and legal entities and the interest rates they will pay.

Status confirmation options

According to the text of the above-mentioned Order of the Federal Tax Service, the status of a tax resident of the Russian Federation is confirmed by the appropriate document (form KND 1120008), issued by the authorized division of the Federal Tax Service at the request of the taxpayer.

Form KND 1120008

This document covers the one-year tax period, either preceding the applicant’s application, or the current calendar year. In the latter case, a request for confirmation should be submitted no earlier than July 3 of the current year.

Thus, according to the above Order, the procedure for obtaining confirmation includes the following steps:

- Drawing up an application to provide confirmation of the tax status of the applicant (whether an individual or a legal entity);

- Sending the said application by the taxpayer or his legal representative to the authorized body;

- Receipt by the applicant of confirmation of the presence (or certificate of absence) of status based on the results of consideration by the authorized body of the received request.

The deadline for consideration of such applications is 40 calendar days from the date of receipt by the Federal Tax Service. Confirmation is issued for each declared source of income and/or property. Confirmation form – paper or electronic document.

Confirmation (or a certificate of absence) of the status in question is sent to the applicant by mail or via the Internet. The desired delivery method is indicated in the application.

Confirmation options

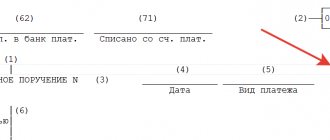

The first possible option for obtaining the confirmation in question is to submit a petition (form 1111048) to the territorial branch of the Federal Tax Service at the place of registration of the taxpayer. If confirmation is required for the current year, the applicant only needs to submit a petition - in person or by post with acknowledgment of receipt.

Form 1111048

The form is filled out by hand in block letters, information is provided in accordance with the economic status of the taxpayer (individual entrepreneur, individual or legal entity) and documents confirming this.

If the validity of the confirmation must cover a period earlier than three years preceding the current (at the time of filing) year, then the application must also be completed with other documents (the exact list depends on the specific situation that requires the availability of KND form 1120008):

- For legal entities and individual entrepreneurs: bank statements and canceled payment orders, copies of tax returns, memorial orders, tax accounting registers, or other documents (including those establishing the need to obtain the confirmation in question);

- For physical persons: copies of declarations (in Form 3-NDFL) with marks from the Federal Tax Service, or other documents confirming the facts of payment of taxes on other financial transactions carried out during the accounting period.

The second possible option is to send a request via the Internet. From the beginning of 2021, a taxpayer can request confirmation of his own tax status online - through the website service.nalog.ru.

To do this you need:

- Register on this website (you can create a new account, use existing accounts on the Federal Tax Service or State Services websites, or an electronic signature) and fill out a user profile;

- Fill out an electronic confirmation form similar to the one above (in this case, the applicant does not need to submit any additional documents);

- Register and submit a request.

The applicant can track the processing status of the request. The result can be sent to the applicant both electronically (document in PDF format) and on paper. The general procedure for considering a request and sending confirmation to the applicant is completely similar to the above.

How to become a tax resident

In addition to clarifying the legal relations of individuals and legal entities with tax authorities within the country, you can obtain confirmation of residence so that there is no conflict of interest and the need to prove it while conducting active activities abroad.

Many states already issue appropriate certificates. You can also obtain them on the territory of the Russian Federation by contacting the Federal Tax Service in person or by filling out an application online. It must contain the following information:

- Full name of the individual or company name;

- tax identification number (TIN);

- the country to which the certificate will be presented.

The deadline for responding to an application is a calendar month. If your request is granted, you can receive this certificate in paper or electronic form.

When does a person become a resident?

The key factor determining resident status, other than the residence permit, is the time spent within the country's borders. Provided that a person does not live outside the Russian state for more than 183 days in one year, he will be a resident.

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

For example, if it is necessary to determine whether a foreign citizen holding a residence permit is considered a resident or non-resident on a certain date. Let's say next month. To do this, you need to count 365 days ago from the expected date. And calculate how much time the migrant spent in Russia during this period, and how much abroad. If the period of stay in the Russian Federation exceeds 183 days, then this is undoubtedly a resident. Otherwise, the foreign migrant does not have such status.