Structure of account 90 “Sales”, subaccounts

Account 90 “Sales” consists of several subaccounts, the main subaccounts that are always used are:

- subaccount 1 - the credit of this subaccount reflects the proceeds from the sale.

- 2 - debit reflects the cost of finished products, goods, services, that is, what we sell.

- 3 - the debit reflects VAT accrued on products sold.

- 9 - this subaccount calculates the total financial result for the month, the debit reflects the profit for the month, and the credit reflects losses.

An accounting account is a table with two columns Debit and Credit, let's present account 90 in the form of a table:

During the month, all sales made are reflected in the account. 90.

Postings to account 90 “Sales”

D62 K90/1 - revenue from the sale of products, goods, services is reflected.

D90/2 K41 (43, 45, 20) - reflects the cost of goods sold, products, services.

D90/3 K68 - VAT is charged on products sold.

At the end of the month, based on the account data. 90 is considered a financial result.

For this:

- The debit turnover for the month is calculated (the values of subaccounts 2 and 3 are summed up)

- The loan turnover for the month is calculated (subaccount 1).

- From the debit turnover we subtract the credit turnover:

a) if the result is a negative number, then this is a profit, we reflect it in the debit of subaccount 9 of account 90 in correspondence with the account. 99 “Profit and loss”, posting D90/9 K99 ,

b) if the result is a positive number, then these are losses reflected on the credit of subaccount 90/9 in correspondence with account 99, posting D99 K90/9 .

At the end of the year in December, the account is completely closed in such a way that the balance for each subaccount becomes equal to 0. All subaccounts are closed to the 90/9 subaccount.

Subaccount 1: all entries are reflected only on credit, accordingly, the balance on this subaccount is always credit, to make it equal to 0, you need to calculate the loan balance and make an entry for this amount D90/1 K90/9 . As a result, the ending balance on this subaccount becomes 0.

2: all entries are reflected only in debit, the balance is always debit. This means we count the turnover and debit balance and make the entry D90/9 K90/2 . As a result, the debit and credit balances are the same, and the ending balance is 0.

3: similar to subaccount 2.

9: as a result of the above transactions, the balance on this subaccount also becomes equal to 0.

Account 90 is closed, its balance is 0, from January of the new year we will re-open account 90 “Sales” and again begin accounting for the sale of products, services and goods.

In order for the principle of accounting for sales on the account. 90 has finally become clear, I propose to consider an example in numbers. Let's take 3 months as an example: October, November and December. Let's see what transactions we make on the account during the months. 90, and how the account will close. 90 at the end of the year in December.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Lesson 14.7

Lesson 14

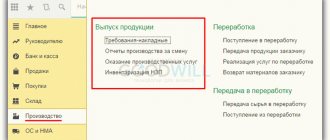

Features of tax accounting in 1C: Accounting.

For the purposes of tax accounting, 1C: Accounting provides a special tax chart of accounts. It is very similar to the chart of accounts, which is used for accounting - in particular, the same system objects are used when creating them.

In the figure below you can see a fragment of the Chart of Accounts window for tax accounting (Operations > Charts of Accounts > Chart of Accounts for Tax Accounting (for income tax)).

The chart of accounts for tax accounting is linked to the chart of accounts that is used for accounting. This connection is established using the information register Correspondence between accounting and national accounting accounts (Operations > Information registers > Correspondence between accounting and national accounting accounts).

Access to this register, as well as some other useful tools for working with charts of accounts, can be found in the Enterprise menu > Charts of accounts .

Not all accounting accounts have analogues among tax accounts. Some data (such as, for example, VAT calculations) are not of interest to tax accounting.

Therefore, special accounts are provided in tax accounting. For example, this is the PV “Receipt and disposal of property, work, cleared” of VAT.

Please note that tax accounting entries, in our case, are made with the NU type, which stands for Tax Accounting. There are other types of entries in tax accounting that directly relate to PBU 18/02. These are records with the types PR (Permanent differences) and TD (Temporary differences). In general, when comparing accounting and tax accounting, the following equality is satisfied:

BU = NU + PR + VR

Here you can see a certain paradox - permanent and temporary differences are needed for accounting, but they are reflected in tax accounting. However, this approach allows, on the one hand, to comply with the requirements of PBU 18/02, and on the other hand, not to “clutter up” accounting for those organizations that do not use PBU 18/02.

The names PR and VR, when used in postings, indicate the type of accounting.

For example, in the figure below you can see the result of posting the document Closing the month for tax and accounting.

Here we present a specially simulated situation where the useful life of a fixed asset differs in tax and accounting.

The following entry was made in the accounting records for the OS object “Epson color laser printer”:

| D20.01 K02.01 833.33 rub. |

The following entry was made in tax accounting:

| D20.01.1 K02.01 555.56 rub. with accounting type NU |

| D20.01.1 K02.01 277.77 rub. with VR accounting type |

Let's check the equality:

BU = NU + PR + VR.

833.33 (BU) = 555.6 (NU) + 277.77 (BP).

In the document Acceptance of fixed assets for accounting , we indicated that for accounting purposes the object is depreciated over 48 months, and for tax purposes - 72. Hence the resulting temporary difference.

Let us recall that permanent differences (PD) lead to the formation of permanent tax liabilities (PNO) and permanent tax assets (PNA) (PNO (PNA) = PR*Income tax rate), temporary differences (TD) - to the formation of deferred tax liabilities ( IT) and deferred tax assets (IT) (IT (IT) = BP * Income tax rate).

In order to calculate conditional income (expense) for income tax, PNO, ONA and ONO, you need to use the document Closing the month with options enabled in the group Income Tax Calculations (PBU 18/02). When posted, the document performs the following operations.

PNO calculation

Calculation of permanent tax liability - PNO, reflected in accounting by posting of the form

| D99.02.3 K68.04.2 |

Account 99.02.3 takes into account permanent tax liabilities.

Account 68.04.2 is intended for calculating income tax. This account contains the amounts that must be transferred to the budget.

PNA calculation

Calculation of a permanent tax asset - PTA, reflected in accounting by posting of the form:

| D68.04.2 K99.02.3 |

SHE calculation

Calculation of deferred tax asset (DTA), which is subject to recognition in the current period. Such SHA is accounted for in the accounting accounts as follows:

| D09 K68.04.2 |

Account 09 “Deferred tax assets” is used to account for IT

Also, the document Closing the month calculates ONA, which is subject to write-off in the current period. This is reflected in the following entry:

| D68.04.2 K09 |

IT calculation

Calculation of deferred tax liability (DTL), which should be recognized in the current period:

| D68.04.2 K77 |

Account 77 “Deferred tax liabilities” is used to account for IT.

Also, the document Closing the month calculates IT, which should be written off in the current period:

| D77 K68.04.02 |

Calculation of conditional income tax expense (income)

To reflect the conditional income tax expense, the following entry is used:

| D99.02.1 K68.04.2 |

To reflect conditional income tax income, the following entry is used:

| D68.04.2 K99.02.2 |

Let's look at a small example. Above, we considered the operations of calculating depreciation of an asset, which illustrated the formation of BP, as well as the sale operation. Let's continue the example - we will create a Month Closing document in which the following parameters are set.

We want this document to do the following:

- Calculation of depreciation of fixed assets;

- Write-off of expenses accumulated on account 26 to account 90 (the accounting policy establishes the use of the direct costing method when writing off general business expenses);

- Closing sub-accounts of account 90 in order to identify the financial result;

- Calculation of PNA and PNO, ONA and ONO, conditional income tax expense (income), and, ultimately, the formation of the amount of profit tax and its distribution among budgets in accordance with current legislation.

You can configure the income tax rate and its distribution among budgets by executing the command Enterprise > Income Tax Rates.

Let's run the document Closing the month , the form of which we reviewed above and see what transactions it will generate. The figure below shows the records that the document generated in accounting.

Here we see the following entries:

| D26 K02.01 833.33 rub. — Depreciation accrued |

| D90.08.1 K26 833.33 rub. — General business expenses written off |

| D90.09 K99.01.1 149166.67 rub. — Financial result determined |

| D09 K68.04.2 55.55 rub. - recognized by SHE |

| D99.02.1 K68.04.2 29833.33 rub. — a contingent income tax expense is recognized |

| D68.04.2 K68.04.1 2988.89 rub. — reflects the amount of income tax payable to the federal budget |

| D68.04.2 K68.04.1 26899.99 rub. — reflects the amount of income tax payable to the regional budget. |

Before we understand the peculiarities of calculating the amounts reflected in accounting, let’s look at what entries the document generated in tax accounting.

| D26.02 K02.01 555.56 rub. — Depreciation of fixed assets (NU) |

| D26.02 K02.01 277.77 rub. — Depreciation of fixed assets (VR) |

| D90.08 K26.02 555.56 rub. — General business expenses (OU) written off |

| D90.08 K26.02 277.77 rub. — General business expenses (VR) written off |

| D99.01 K90.09 277.77 rub. — Loss written off (VR) |

| D90.09 K99.01 149444.44 rub. — The financial result is reflected |

Now let’s look at linking the amounts reflected in tax and accounting records. Let's start with the financial result reflected in the accounting records:

149166.67 - accounting financial result;

In tax accounting, we see the following picture: the amount of 149,444.44 rubles was credited to account 99, and the amount of 277.77 was credited to account 99. Let's find the difference between these amounts - 149444.44 - 277.77 = 149166.67. That is, thanks to the adjusting indicator reflected with the BP accounting type, we can compare the data for tax accounting and accounting. As you can see, the profit reflected in tax accounting is greater than the profit reflected in accounting. This occurs due to the difference in depreciation of an asset, and this difference is reflected in accounting with the BP accounting type. The amount of 149,444.44 rubles will be included in the income tax return.

The amount 277.77 will be useful to us later. A deferred tax asset in the amount of 55.55 rubles is recognized in accounting. It increases the current income tax amount. We obtained the amount of IT by multiplying the size of the VR by the tax rate. In our case, the income tax rate was 20%, let’s check: 277.77 * 0.2 = 55.55. This amount goes to the debit of account 09 and to the credit of account 68.04.2.

The contingent income tax expense recognized in accounting is equal to RUB 29,833.33. This is 20% of the profit recognized in accounting:

149166,67 * 0,2 = 29833,33.

The conditional expense is credited to account 68.04.2. After all the necessary amounts have been collected in this account, they need to be distributed between the federal and regional budgets. Let us recall that in our case the tax rate for the regional budget is 18%, for the federal budget - 2%. In the debit of account 68.04.2 you can see the following amount.

In the account credit we have two amounts: 55.55 rubles. and 29833.33 rubles. In total this is 29888.88 rubles.

The amount of 26,899.99 rubles was written off to the regional budget, and 2,988.89 rubles to the federal budget.

To obtain these amounts we can use the following reasoning:

In the credit account we have an amount that is 20% of the amounts of profit and temporary differences recognized in the accounting records. 18% of this amount should be transferred to the regional budget, 2% to the federal budget. Let's solve the proportion to find the amount due to the regional budget:

100/20 = x/18

x = 90

Thus, 90% of the amount that is currently in the credit of account 68.04.2 should be transferred to the regional budget, 10% to the federal budget. Let's check:

29888,88 * 0,1 = 2988,88

In the program, the number is rounded to 2988.89.

The regional budget includes an amount equal to: 29888.88 * 0.9 = 26899.99.

The same amounts can be obtained in another way. The tax base for income tax is 149,444.44 rubles. - this amount is reflected in tax accounting, and in accounting it is obtained from two amounts: 149,166.67 and 277.77.

149444.44*0.18 = 26899.99 rubles.

149444.44*0.02 = 2988.88 rubles.

As you can see, calculations made “from different sides” give the same results. It is no coincidence that we have given several ways to obtain the final amounts - practice shows that such calculations allow students to better understand the features of income tax accounting in 1C: Accounting 8.

As a result, we do not have a balance in account 68.04.2, but in the credit of account 68.04.1 with detailing by budget levels, we can see the organization’s income tax debt.