There are many contradictory aspects in the taxation of EAEU citizens in Russia. This is due to the fact that the positions of international and Russian law are defined in different terminology and therefore do not create a formal disagreement, but in practice they lead to ambiguity in the rules for applying the tax rate when calculating personal income tax. In the article, 1C experts explain the intricacies and consequences of choosing an algorithm for calculating personal income tax for citizens of the EAEU and talk about the procedure for reflecting the tax status of employees from the EAEU, applying the personal income tax rate and calculating tax in “1C: Salaries and Personnel Management 8” edition 3.

The norms of international law link the citizenship of an individual and the rate for calculating personal income tax. In the Tax Code of the Russian Federation, the personal income tax rate and benefits depend on the status of a tax resident. Tax resident status automatically determines both the tax rate of 13% and the right to benefits. The opposite is not true: the 13 percent personal income tax rate does not provide resident status and the right to tax deductions.

Contrasting the rights of citizens of the EAEU with the rights of citizens of the Russian Federation seems incorrect, because the Russian Federation is part of the EAEU. Adding to the complexity is the use in the Treaty on the Eurasian Economic Union, signed in Astana on May 29, 2014 (as amended on March 15, 2018), of the concept of “employment,” which is not defined either by Russian legislation or international law.

Knowing about the contradictions in applying the personal income tax rate to the income of employees from the EAEU countries, the employer has the opportunity to make an informed decision when calculating tax and applying deductions.

Russian residency status

How is the residence status of the Russian Federation determined?

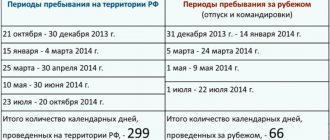

Paragraph 2 of Article 207 of the Tax Code of the Russian Federation determines the procedure for determining whether or not a taxpayer has the status of a resident of the Russian Federation. A resident of the Russian Federation becomes a person who is actually in Russia for at least 183 calendar days over the next 12 consecutive months.

Note

About the tax status of an individual, about the calculation of personal income tax for non-residents and accounting in the 1C: Salaries and Personnel Management 8 program, edition 3, read the article “Personal Income Tax for Non-Residents: Accounting in 1C: ZUP 8”.

Consequently, a foreigner can become a tax resident of the Russian Federation only six months after entering Russia, and a Russian can lose the status of a resident of the Russian Federation by leaving the country for six months.

Letters of the Ministry of Finance of Russia dated 06.06.2014 No. 03-04-05/27351, dated 22.11.2012 No. 03-04-06/6-331, dated 21.03.2011 No. 03-04-05/6-157, Federal Tax Service of Russia dated 05.03 .2013 No. ED-3-3/ [email protected] and others explain the specifics of calculating 183 days of stay on the territory of the Russian Federation.

To determine the status of an individual, all calendar days in which the individual was actually in the Russian Federation for the next 12 consecutive months are summed up. These 12 months may begin in one tax period and end in another. During these 12 months, all calendar days of the taxpayer’s presence in the Russian Federation should be added up. The legislation does not contain period continuity requirements. In addition to direct stay on the territory of the Russian Federation, the calculation of 183 days includes the following days (in accordance with Article 207 of the Tax Code of the Russian Federation):

- treatment or study abroad, if the period does not exceed six months;

- work on offshore hydrocarbon fields abroad;

- arrival in the Russian Federation and days of departure from the Russian Federation.

For some categories of citizens (for example, Russian military personnel and government employees sent abroad), tax residency is determined regardless of the time spent in the Russian Federation.

What does Russian residency status provide?

Article 224 of the Tax Code of the Russian Federation establishes a personal income tax rate of 13% for most types of income of residents of the Russian Federation, and 30% for non-residents of the Russian Federation.

In accordance with paragraph 3 of Article 210 of the Tax Code of the Russian Federation, tax deductions for personal income tax are applied to the income of only residents of the Russian Federation.

When and why to review the status of residence of the Russian Federation

A review of the tax status is necessary to clarify the legality of applying the personal income tax rate and tax deductions.

The Ministry of Finance of Russia and the Federal Tax Service of Russia insist on the need to clarify the final status of an individual based on the results of the calendar year and recalculate the tax at a different rate when acquiring the status of a tax resident and when losing this status (see letters of the Ministry of Finance of Russia dated April 22, 2016 No. 03-04-06/23366 , dated 19.03.2013 No. 03-04-06/8402, dated 28.03.2012 No. 03-04-06/6-81, dated 28.10.2011 No. 03-04-06/6-293, Federal Tax Service of Russia dated 22.10.2012 No. AS-3-3/ [email protected] , dated 08/14/2012 No. ED-3-3/ [email protected] ). At the same time, the Tax Code of the Russian Federation does not contain norms that require determining the tax status of an individual at the end of the year and recalculating the previously calculated personal income tax in this regard.

| 1C:ITS In the “Legislative Consultations” section, see more about whether personal income tax needs to be recalculated if the status of an individual changes during the calendar year: from resident to non-resident; from non-resident to resident - follow the link. |

Tax system

The main disadvantage of non-resident status is the need to pay personal income tax of 30%. However, immigrants under the State Program and highly qualified specialists are exempt from this (Article 224 of the Tax Code of the Russian Federation). Resident status may affect whether a loan to a foreign citizen with a residence permit is approved or not. Non-residents are usually denied loans. Bank employees treat foreigners with residence permits more leniently, but the conditions for them will still be stricter than for Russians:

- higher interest on the loan;

- mandatory presence of a guarantor from the Russian Federation;

- limited loan terms.

Many personnel departments, when employing a migrant, a priori register him as a non-resident (with 30% personal income tax), but after he has worked for six months (that is, spends the required 183 days in the country), they give him a tax refund (17%). This practice is generally accepted, so it is important for a foreigner with a residence permit to monitor the situation and, if necessary, be able to defend his rights.

EAEU citizen status

Article 73 “Taxation of personal income” of the Treaty on the EAEU provides a special rule, according to which in the EAEU member countries (Belarus, Kazakhstan, Armenia, Kyrgyzstan and the Russian Federation), income from the first day of work is taxed at the same rate as for citizens a state in which citizens of other EAEU states are employed.

Thus, when working in Russia, EAEU citizens pay personal income tax, like Russians - tax residents, at a rate of 13% and have a privilege compared to foreigners from other countries - non-residents, whose income is taxed at a rate of 30%.

Withholding tax on earnings of citizens working under a patent

The procedure for withholding income tax in the situation under consideration differs from the general procedure. It can be schematically depicted in the following order:

- Payment of a fixed advance by an employee holding a patent (1200 rubles).

- Receipt by the employer of a document confirming payment by the employee of a fixed payment. This implies the possibility of reducing personal income tax by the amount of the advance paid.

- Reducing the amount of the tax payment by the amount of the advance paid by the employee (performed by the tax agent).

The fixed advance amount is indexed. The advance amount is recalculated based on the current deflator coefficient and the regional coefficient. Both multipliers are set for the current calendar year.

Thus, for 2021 the following have been determined: 1.623 (deflator) and, accordingly, 2.3118 for Moscow. By default, the regional multiplier is equal to one.

The patent applies only to the region in which it was issued. The tax withholding scheme presented applies during the life of the patent.

Example 2. Calculation of a fixed personal income tax contribution for a foreigner with a patent

A foreign citizen works on the basis of a patent in Moscow. A fixed advance payment of 1,200 rubles is transferred to them monthly.

| Data for calculation | Calculation and amount of advance payment |

| Indicators relevant for 2021: 1.623 — deflator multiplier for personal income tax; 2.3118 is the regional multiplier for Moscow. Fixed advance 1200 rub. | Tax payment amount: 1200 * 1.623 * 2.3118 = 4502.4 rubles. |

When should the norms of the Treaty on the EAEU, and not the Tax Code of the Russian Federation, be applied?

Part 4 of Article 15 of the Constitution of the Russian Federation establishes the unconditional priority of international norms over the norms of the national legislation of our country. This applies to both tax legal relations and social insurance. For example, if the international norm of Article 73 of the Treaty on the EAEU contradicts the internal law of the Russian Federation - Article 207 of the Tax Code of the Russian Federation, then it is the international rules that should be applied. The personal income tax rate of 13% should be applied to the income of EAEU residents received from the first day of employment in the Russian Federation. Work under employment and civil law contracts can be classified as employment work in accordance with Article 96 of the Treaty on the EAEU and Article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation.”

The concept of “income in connection with employment” includes any income provided for in an employment or civil law contract. Moreover, the activities are carried out directly on the territory of the Russian Federation. This is a mandatory condition for applying the personal income tax rate of 13% (see letters from the Ministry of Finance of Russia dated June 10, 2016 No. 03-04-06/34256, dated July 17, 2015 No. 03-08-05/41341). In a letter dated 06/10/2015 No. OA-3-17/ [email protected] the Federal Tax Service of Russia clarifies that the fact that an employee is located and working in Russia is confirmed by copies of passport pages with marks from border control authorities about crossing the border, information from the work time sheet, data migration cards, registration documents at the place of residence (stay).

Please note that this taxation procedure does not apply to EAEU residents working under an agreement with a Russian employer in another state (for example, remotely in Belarus). In this case, the general rules apply: the employer must not withhold personal income tax from the remuneration of a non-resident employee of the Russian Federation received outside the Russian Federation (clause 6, clause 3, article 208, clause 2, article 209 of the Tax Code of the Russian Federation).

Kharkovchane.ru

Until the moment of departure from the country, the document is kept by the foreign citizen.

- The passport (identity card) provided to the receiving party must be exactly the one with which the foreign citizen crossed the border. This is very important if the foreigner has two valid passports.

- back to contentHow can citizens of Kyrgyzstan check whether they are on the blacklist? Due to numerous cases of expulsion of citizens of the Kyrgyz Republic from Russia for administrative or criminal offenses, those who are planning to cross the border of the Russian Federation again should find out how to check the blacklist of migrants from Kyrgyzstan on the Internet.

When should the Tax Code of the Russian Federation be applied, and not the norms of the Treaty on the EAEU

The regulatory authorities of the Russian Federation believe that the personal income tax rate for employees from the EAEU countries at the end of the year still depends on their status, which does not contradict the letter of the Treaty on the EAEU. The Ministry of Finance of Russia, in letter No. 03-04-06/3032 dated January 22, 2019, reminds that the procedure for determining tax status applies to individuals regardless of citizenship. For the case when, by the end of the year, a citizen of the EAEU acquires the status of a tax resident of the Russian Federation, a revision of the tax status makes it possible to apply tax deductions and recalculate personal income tax in connection with this. Obviously, if a citizen of the EAEU does not have time to obtain tax resident status during the tax period, then, in accordance with the requirements of the Ministry of Finance, at the end of the year, personal income tax is recalculated at a rate of 30%. If possible, the tax should be withheld, and if there is no corresponding income, the impossibility of withholding should be reported in the report on Form 2-NDFL.

For citizens who arrived in the Russian Federation after 07/02/2019 (183rd day of the year), it will no longer be possible to become a tax resident in the current tax period, since there are less than 183 days left in the year. From the first day of work, a 30% rate cannot be applied to their income - this will violate the requirements of an international treaty, and at the end of the tax period, a 13% rate will contradict the requirements of the Ministry of Finance. In addition, the inability to foresee the future must be taken into account: the employer does not know whether the employee will be working for him at the end of the tax period and whose responsibility it will be to determine the tax status at the end of the tax period.

At the same time as explaining the need to recalculate personal income tax at the end of the tax period in accordance with the tax status, the Ministry of Finance of Russia in its letter dated January 22, 2019 No. 03-04-06/3032 reports that the specified letter does not contain legal norms, does not specify regulatory requirements and is not regulatory legal act, has an informational and explanatory nature and does not prevent taxpayers, tax authorities and tax agents from being guided by the norms of the legislation of the Russian Federation on taxes and fees in an understanding that differs from the interpretation set out in the letter.

The letter of the Federal Tax Service of Russia dated November 28, 2016 No. BS-4-11/ [email protected] reflects the opposite position that there is no need to recalculate the tax.

Neither the opinion of the Russian Ministry of Finance nor the Federal Tax Service of Russia can be considered more or less beneficial for EAEU citizens. A revision of the tax status will lead to an increase in the personal income tax rate on non-resident income, and the absence of a revision will entail the non-application of deductions due to residents.

| 1C:ITS For recommendations on choosing the option for calculating personal income tax of EAEU citizens for tax agents who are cautious and ready to defend their position, see the “Legislative Consultations” section. |

Regardless of the choice of calculation option, at the end of the tax period, the reporting should reflect the actual data - the personal income tax rate, citizenship and tax status of the individual.

Thus, in the case when a non-resident citizen of the EAEU is taxed at a rate of 13%, the 2-NDFL certificate should indicate the citizenship of the non-resident of the Russian Federation and the taxpayer status code “2”.

Insurance premiums from non-residents

In Art. 420 of the Tax Code of the Russian Federation provides that the object of taxation with insurance premiums is payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance. These include the laws “On compulsory pension insurance in the Russian Federation” dated December 15, 2001 No. 167-FZ, “On compulsory medical insurance in the Russian Federation” dated November 29, 2010 No. 326-FZ, “On compulsory social insurance in case of temporary disability and in connection with maternity" dated December 29, 2006 No. 255-FZ. These laws establish, in particular, a list of persons who are recognized as insured under these types of insurance.

Contributions for injuries are still regulated by the law of July 24, 1998 No. 125-FZ.

The calculation of contributions for compulsory pension and compulsory health insurance, as well as contributions for temporary disability and injury to a foreign worker depends not on his tax status (resident or non-resident), but on his legal status in Russia:

- refugee;

- received temporary asylum in the Russian Federation;

- citizen of a member state of the EAEU;

- permanently residing in the Russian Federation;

- temporarily residing in the Russian Federation;

- temporarily staying in the Russian Federation;

- highly qualified specialist.

For compulsory pension insurance of foreign workers of all listed statuses (except for highly qualified specialists), contributions are accrued from payments not exceeding RUB 1,292,000 in 2020. at a rate of 22%, and from the excess amount - at a rate of 10%. Contributions to compulsory pension provision for highly qualified specialists are not accrued (including for bonuses paid to such employees after their dismissal).

Find out whether to pay pension contributions for EAEU citizens temporarily staying in Russia here .

Contributions for compulsory temporary disability insurance for payments exceeding RUB 912,000. (in 2021) are not awarded to all specialists, regardless of status.

Contributions from payments not exceeding RUB 912,000. are accrued at a rate of 2.9% to foreigners of all statuses, except those temporarily staying in the Russian Federation. For payments to foreigners temporarily staying in Russia, contributions for temporary disability are calculated at a rate of 1.8%, and for payments in favor of temporarily staying highly qualified specialists, insurance premiums are not calculated.

Contributions for compulsory health insurance are paid at a rate of 5.1% of payments made to refugees, citizens - members of the EAEU, foreign workers permanently or temporarily residing in the Russian Federation. Contributions for this type of insurance are not paid from payments made in favor of highly qualified specialists temporarily staying in the Russian Federation.

In accordance with the law of July 24, 1998 No. 125-FZ, foreigners, along with citizens of the Russian Federation, are subject to insurance against industrial injuries. Contributions for insurance against industrial accidents are charged at the same rates as for payments to employees - citizens of the Russian Federation.

You can read more about insurance premiums for payments to foreign employees working remotely in the article “Insurance premiums are not charged for payments to “remote” foreigners .

About insurance premiums from foreigners

Tax status of an employee and personal income tax in “1C: Salary and Personnel Management 8” (rev. 3)

The 1C: Salary and Personnel Management 8 program, edition 3, provides the ability to calculate personal income tax in accordance with the Treaty on the EAEU. The ability to manage the tax status of an employee in the program allows you to recalculate personal income tax.

Example 1

| Employee A.M. Klubnik, a citizen of Belarus (part of the EAEU), came to the Russian Federation and has been working in Russia since July 10, 2018 under an employment contract. |

When applying for a job in the 1C: Salaries and Personnel Management 8 program, edition 3, in the employee’s card, click on the Personal data link in the Country Citizenship field, select BELARUS. There are less than 183 days left until the end of the year, and A.M. Strawberries will not receive resident status in the 2021 tax period and, therefore, will not receive standard personal income tax deductions. From the first day of work, a rate of 13% is applied to calculate personal income tax in accordance with Article 73 of the Treaty on the EAEU. For correct calculation in the employee’s card, using the Income Tax link, in the Status field, you should select Citizen of a country that is a party to the Treaty on the EAEU (Fig. 1).

Rice. 1. Filling out the data in the employee card

How personal income tax is withheld from foreign workers in 2021

What follows is a long process of coordinating databases between tax and migration authorities on registering a migrant and calculating the period of his stay in the Russian Federation. They also check the honesty of the employee himself: whether he has made a similar demand to anyone else at his place of work as a part-time employee. Then the tax authorities prepare a personal notice for the employer with information about which period can be recalculated. So, before returning the overpaid personal income tax on a patent to a foreigner for the previous tax period, you need to carefully study the data received from the tax office.

We recommend reading: Family Vacation Packages to the Black Sea for Large Families

Another option is also possible: a foreigner comes to the Russian Federation with the intention of working, but begins searching for a vacancy upon arrival. Residents of the CIS and other countries with which a visa-free regime has been established have an advantage in this regard. It is enough for them to issue a labor patent and, by paying advance payments on personal income tax, extend its validity and their legal stay in Russia for up to a year, without visiting migration officials.

Hiring citizens from Kyrgyzstan in 2021: documents

In 2021, a number of countries signed the Treaty under which the Eurasian Economic Union began to operate. The latter includes these countries: Russia, Belarus, Kazakhstan. A little later, Kyrgyzstan (Russians habitually call this state Kyrgyzstan) and Armenia joined it. Such a union was created for a reason, but with the aim of in-depth integration of the economic sphere of all its member states:

We recommend reading: The amount of compensation for recovery as a participant in Chernobyl

Employment of citizens of Kyrgyzstan on the territory of our state in 2021 is carried out in accordance with the Labor Code, that is, on the basis of an employment contract between a foreign worker and the employer.

Filling out a 2-NDFL certificate for a foreigner

- confirm your credit solvency;

- to receive an annual tax deduction;

- to participate in trials, filing claims, arbitration disputes and proceedings;

- when changing jobs;

- when applying for a residence permit and receiving a Russian passport by a foreigner as a resident.

For example, citizen Petrov had a bonus for good work. Such payments are assigned the code “2021” (similar to the salary code). If the basis for the bonus is a holiday event, then this is a different code, “4800,” since such an incentive is classified in tax accounting documents as other income. There are no separate codes for them.