Features and limitations of UTII

UTII is quite often used by entrepreneurs who have their own taxi fleet. But it is not always possible to switch to this type of taxation; there are restrictions:

- This system is not valid for passenger transportation everywhere. The exception is Moscow; in addition, local authorities of other regions can independently introduce a ban on the use of UTII.

- You can use UTII only if the staff of the service is no more than 100 people.

- The number of cars for business does not exceed 20 units.

Features of UTII:

- financial statements are submitted quarterly;

- literacy and correct execution of all financial documents are required (this is problematic when the individual entrepreneur himself acts as a driver);

- valid until 2021;

- the optimal choice for a taxi fleet with hired staff.

Online cash register in a taxi on UTII

According to the law of the Russian Federation, the presence of an online cash register is mandatory for individual entrepreneurs engaged in passenger transportation by taxi. At the end of the trip, the client is given a receipt or shown a QR code of the receipt. However, this condition is only mandatory for those who hired employees for work. If you are self-employed, you are allowed to work without a cash register until mid-2021. If there is no online cash register, the client is still issued a document confirming payment - a strict reporting form. You can stamp it using a taximeter. For the absence of such forms, the individual entrepreneur is deprived of the right to apply preferential forms of taxes, is subject to a penalty of 10,000 rubles, and the driver is subject to a fine of 1,000 rubles.

What requirements must taxi drivers comply with?

“Checkers” on board the car and an orange light on the roof are mandatory - this is the main requirement in a taxi, otherwise the driver will be fined 3 thousand rubles, the entrepreneur - 10 thousand. The driver must have a total experience of at least 3 years, before each trip the technical vehicle condition for transportation safety, maintenance - at least 2 times a year. A taximeter does not need to be installed in the cabin if travel fares are fixed. You can pay for trips in cash or by bank transfer, but in any case, the client is given a payment receipt indicating the details of the carrier, the name of the taxi driver and the cost of the service, otherwise they will be fined. An individual entrepreneur's vehicle must be serviced twice a year. The following information is required for the client inside the car:

- carrier details, driver details with photo;

- activity license;

- taxi transportation rules;

- address and telephone number of the supervisory authority for receiving passenger complaints.

The taxi driver must have the required documents with him: a compulsory motor vehicle liability insurance policy, a maintenance ticket, a waybill with a mark on passing a medical examination.

UTII for taxis in 2021: how to calculate and how to pay

The UTII payment is fixed and is not affected by the amount of income. The legislation establishes potential imputed income depending on the number of staff and the number of cars.

UTII for taxi: calculating car tax for a month

In accordance with the Tax Code of the Russian Federation, UTII is calculated using the formula: Basic profitability (imputed income) * number of seats in the car minus the driver's * deflator coefficient * correction factor * UTII rate, where:

- The basic profitability for this area of activity in 2021 is 1,500 rubles;

- The number of seats in the car minus the driver’s seat is usually 4;

- The deflator coefficient depends on the inflation rate and in 2019 is 1.915.

The correction coefficient for the basic profitability is set for each region; its values are displayed on the official resource of the Federal Tax Service.

The rate for UTII is 15%. However, this figure may be reduced by regional authorities. You can also check its value on the Federal Tax Service website.

Selecting OKVED

The OKVED definition means a unique code that an entrepreneur must choose in the process of legal registration of his work activity.

In simple words, this code is necessary exclusively for government agencies that will verify the activities of the holder of a patent for working in a taxi.

The codes are selected based on a special list of types of economic activity. If the patent is issued for a taxi, when drawing up the application it will be necessary to indicate the code “60.22 Taxi activities”.

Is it possible not to indicate the code?

Current legislation does not prohibit this, but if work activity is identified that is not specified in the patent, a fine of up to 5,000 rubles is provided.

Is it possible to specify several types of activities?

According to current legislation, an unlimited number of activity codes is allowed, but is this necessary? For example, a person filed a patent for a taxi - why then would he indicate the code for running a hairdressing business?

Taxi: payment of tax 2021 according to UTII

Quarterly, before the 20th day of the next month, a tax return is submitted to the regional department of the Federal Tax Service. Payment is due by the 25th of the same month.

UTII for taxis: tax reduction

For individual entrepreneurs with a taxi fleet, it is possible to reduce the amount of tax on the amount of sick leave payments, insurance premiums, and benefits to their employees. The maximum reduction amount is 50%. If an individual entrepreneur works alone, without hired workers, then 100% of the contributions to compulsory medical insurance and the Pension Fund of the Russian Federation.

A patent for an individual entrepreneur for a taxi: what is the limitation?

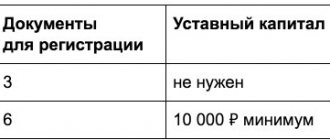

- The use of this system is allowed only in the status of an individual entrepreneur; when registering a legal entity, choosing a PSN is not possible.

- The staff should not have more than 15 people.

- Annual income is less than 60 million rubles.

- Validity period: from 1 month to 1 year.

How much does a taxi license cost and how to pay for it?

Depending on the region, the cost of a patent depends on the number of passenger seats or on the number of cars. You can accurately calculate it using the online calculator on the official website of the Federal Tax Service.

The price will also be affected by the validity period:

- for a period of 1-6 months. the full cost is paid before the expiration date;

- for a period of 6-12 months. one third of the cost is paid within the first 90 days, the rest until the expiration date.

Taxi patent in 2021: how to obtain

This year you just need to submit an application to the territorial department of the Federal Tax Service. This is done either together with documents for registration of individual entrepreneurs, or no later than 10 days before the start of activity. The patent is issued within 5 days.

Taxi patent application sample

To submit an application, you need to fill out three pages out of a possible five. The application form has the established form No. 26.5-1 and is presented on the Federal Tax Service website; when submitting online, you do not need to download it. In this case, the application for a patent at a zero rate is filled out on a special form with a different barcode. The first two pages are required to be completed: “About the applicant and the expected validity period of the patent”, “Name of the type of activity” and the fourth: “About the vehicles used by individual entrepreneurs whose business is related to the transportation of cargo or passengers.” All entries are made in strictly capital letters in black.

On the first page indicate:

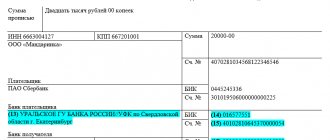

- TIN (also written on the following sheets);

- UFNSK code. In order to find out, you need to open the calculation of the cost of a patent on the official website of the Federal Tax Service and find your region in the list of the Federal Tax Service. The required code will be indicated next to it;

- your full name;

- ORGNIP, if the individual entrepreneur is already registered;

- address of the place of registration;

- validity. It varies from 1 to 12 months, but must fit within the reporting year. To obtain a 12-month patent, it must be issued no later than January 1;

- number of pages. There are three of them, two mandatory for everyone and one in the field of activity.

Next, fill out the left part: mobile phone number, date of application and signature. The right part remains for the inspection to fill out. On the second sheet, fill out a line indicating the type of activity and its identification code. It consists of six digits. The first two of them are the code of the type of activity, then - the code of the subject of the Russian Federation, the last - the type of activity according to the Classifier. Below is the number of employees and the tax rate - 6%. On the fourth sheet, information about all vehicles that will be involved in the work is filled out. Next, the completed but unsigned application is sent to the tax office, where it is signed and submitted in the presence of an inspector. After 5 days, a patent is issued or it is refused.

Deadlines for obtaining and procedure of the patent system

Nobody forces you to purchase a patent for a year at once. You have the right to buy a patent for any period, for example for a month, then another, for example for two months and so on, i.e. you can plan those months in which you are not going to work, the main thing is that the transfers to your account are at the time the patent is valid. A patent is issued within 10 days from the date of filing the application.

It is always possible to refuse and not purchase a patent for the next period, it is up to you to decide.

The received patent for taxi activities allows you to transfer money for taxi services up to 300,000 rubles per year, and everything over 300,000 rubles you need to pay only one percent to the pension fund, so this is a very profitable and official opportunity to reduce your payments to the tax office, and save yourself from reporting (under the patent system there is no reporting).

We understand that non-cash orders are of better quality and there is a sufficient quantity of them. They are also safer from the point of view of canceling an order (you will always be compensated for a non-cash order), the customer himself compensates for the delivery of the car, the mileage outside the Moscow Ring Road upon delivery, payment for parking, etc. Some drivers refuse to fulfill cash orders because the client has not come out and there is no one to ask. The burden of costs falls on the driver who submitted his car.

simplified tax system

The simplified taxation system for entrepreneurs has a number of advantages:

- The individual entrepreneur independently chooses the subject of taxation: income or income minus expenses;

- accounting documentation does not require special knowledge and does not take much time;

- Individual entrepreneurs are exempt from paying personal income tax and personal property tax. persons and VAT.

Payment modes of the simplified tax system

The percentage tax rate is 6% of income or 15% of the difference between income and expenses. The simplified tax system is paid in advance payments quarterly until the 25th day of the month following the quarter. At the end of the year, a declaration of annual income is submitted, payment is made until April 30 for individual entrepreneurs (March 31 for organizations). You can change the simplified tax system to another system only at the end of the tax year.

Taxi at the object "STS income"

When choosing the tax object “Income”, the rate will be 6%. Regional authorities can reduce the rate down to 1%. The amount for calculating tax is taken for the reporting period. For example, if reporting is for a quarter, then income for 3 months is summed up.

Taxi taxation: what tax systems are there?

The taxi business in Russia pays taxes like any other activity related to generating income. The procedure for collecting taxes and the amount of taxes are determined by the Tax Code of the Russian Federation. Tax conditions will differ depending on the tax system used by the taxi service.

UTII is a single tax on imputed income. This system is applicable only to certain types of activities, including taxis, but this type of taxation does not apply to Moscow. All features of UTII are defined in Chapter 26.3 of the Tax Code. The amount of tax in this system is fixed; the actual amount of income is not important for its calculation: the state establishes and imputes the expected income from a business depending on the number of employees and machines.

PSN - patent taxation system. Suitable for individual entrepreneurs only. Work on this system is regulated by Chapter 26.5 of the Tax Code. To work under this system, you need to buy a patent, which will be equal to paying a tax. The amount of tax depends on the number of cars the individual entrepreneur has.

STS is a simplified taxation system. Suitable for small and medium-sized businesses, as it has restrictions on the number of employees and income. The specifics of working under the simplified tax system are recorded in Chapter 26.2 of the Tax Code. There are two options for calculating tax: 6% of income or 15% of the difference between income and expenses.

OSNO - general taxation system. It is applicable to all types of activities and forms of business organization. Set by default unless another special system is selected. Under this system, the company will pay value added tax, profit/income tax, and property tax.

Let's look at the nuances of each tax system and decide which one is right for your taxi service.

In this case, the rate will be 15%. At the same time, depending on the region, the rate may be reduced. There are cases when only 1% of taxes are paid:

- If the amount of expenses exceeds the amount of income. That is, if you find yourself at a loss, you will still have to pay tax.

- If the amount of tax calculated according to the standard scheme does not exceed the minimum tax for this period.

Individual entrepreneur on the simplified tax system for taxi 2021: conditions

Not every individual entrepreneur can apply the simplified tax system. This must be taken into account when deciding which taxation to choose for an individual taxi. To switch to the simplified tax system, you need to comply with limits on income and fixed assets, as well as a number of restrictions:

- The number of employees is no more than 100 people;

- Annual income is not more than 150,000,000 rubles;

- The residual value of fixed assets does not exceed RUB 150,000,000.

Organizing a taxi on the simplified tax system: conditions

For the transition of legal entities to the simplified tax system, the same restrictions apply as for individual entrepreneurs, but there are additional ones:

- the taxi company has no branches;

- participation of other legal entities in the authorized capital is no more than 25%;

- income for January-September of the previous year is not more than 112,500,000 rubles.

If any of these criteria are not met, the simplified tax system cannot be applied.

Rules for the application of UTII for organizations and individual entrepreneurs providing taxi services to the population

Taxi companies and individual entrepreneurs can apply various tax regimes, including UTII. Their use is subject to local laws. Before choosing the appropriate budgeting method, you need to study the financial consequences of implementing each of them. The most preferable from this position will be UTII and simplified tax system.

The control parameters for the use of UTII are:

- the existence of a law permitting the use of UTII in the relevant territory;

- use of transport on the right of ownership or possession, registered accordingly;

- the total number of vehicles involved is no more than 20 units.

To switch to the UTII regime or to start operating in this regime, it is necessary to register with the tax authorities as an impostor:

- for legal entities - at the location address;

- for private entrepreneurs - at the place of residence.

Taxi tax according to OSNO

If, when answering the question: “Which taxation should I choose for an individual taxi?”, an entrepreneur leans towards the basic system, then he will have to pay VAT, personal property tax and personal income tax. This system is complex and expensive; it requires a complete accounting workflow. It is necessary to correctly process all financial transactions and observe all the nuances when submitting reports. Therefore, there is a need to hire an accountant and oblige drivers to fill out primary cash documents every time.