Federal Law No. 302-FZ dated August 3, 2021 made adjustments to Ch. 21 of the Tax Code of the Russian Federation and outlined some changes in VAT, affecting mainly exporters and designed to simplify certain procedures for legal entities and individual entrepreneurs confirming the zero VAT rate. Changes in VAT for exporters from October 1, 2021 can only be applied to the sale of goods (implementation of work, services) for transactions carried out from October 1, 2021 (i.e., starting from the fourth quarter of 2021).

Features of export to the EAEU countries (changes in VAT for exporters from October 1, 2021)

Taxpayers now have the right to apply a 0% rate when exporting goods to the territory of the EAEU in cases provided for by the Treaty on the EAEU. A set of documents to confirm the zero rate is approved by the international treaty under consideration.

As for the specifics of submitting such documents, exporters to “near abroad countries” and EAEU countries can submit transport and shipping documents simultaneously with the declaration in order to confirm the 0% VAT rate, if the List of applications for the import of goods and payment of indirect taxes is submitted in electronic form. The Federal Tax Service reserves the right to request any documents from the List selectively.

Export in Russian

The vast majority of Russian organizations conduct trading activities with our closest neighbors. These are mainly Belarus, Kazakhstan, Armenia and Kyrgyzstan . The listed countries, together with Russia, form the Eurasian Economic Union ( EAEU ). In addition, Tajikistan is a candidate for membership in the EAEU, and Moldova has observer status in the union.

The member states of this union agreed to establish uniform rules for taxation of export transactions . Let us note that we are talking about VAT - companies pay other taxes when exporting in exactly the same way as when selling in Russia.

Sales to the EAEU countries and exports to other countries have few differences. In both cases, a 0% VAT rate is applied, to confirm which the taxpayer submits a certain package of documents to the Federal Tax Service.

Answers to common questions about VAT changes for exporters from October 1, 2021

Question #1:

Have the deadlines for submitting documents confirming the zero VAT rate to the tax authorities changed?

Answer:

No, documents must be submitted simultaneously with the declaration.

Question #2:

For operations performed after October 1, 2021, copies of customs declarations are allowed to be provided without marks from the customs authority of the place of departure in order to confirm the 0% VAT rate for (re)exporting goods outside the EAEU. In what cases may it turn out that the application of a zero VAT rate will be considered unconfirmed?

Answer:

This can happen if the documents submitted to the tax service do not contain information about the information provided by the customs service. The taxpayer will be given 15 calendar days to provide explanations and at least some documents (they will be included in the request sent to the customs authorities). If confirmation of the export of goods does not follow even after submitting this request to the Federal Customs Service, the validity of applying the 0% VAT rate is considered unconfirmed.

What and who is subject to “export” VAT

Let us immediately note that taxpayers using the simplified tax system are not subject to the requirement to confirm the VAT rate for exports . According to paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation, “simplifiers” are recognized as VAT payers only in relation to goods that they import into the territory of Russia. As for exports, for companies and entrepreneurs using the simplified tax system, this type of transaction in terms of taxation does not differ in any way from working with domestic buyers.

But organizations that use the classical taxation system (OSNO) need to remember the specifics of export operations to the EAEU countries. And first of all, that it is necessary to confirm the 0% VAT rate for any goods, even for those that, in accordance with Article 149 of the Tax Code of the Russian Federation, are not subject to this tax. The thing is that in terms of export transactions, taxation is regulated by the norms of international treaties. And according to Article 7 of the Tax Code of the Russian Federation, such agreements have priority over the norms of the Tax Code of Russia.

The EAEU operates on the basis of the Treaty on the Eurasian Economic Union dated May 29, 2014 . The rules governing the procedure for taxation during exports are specified in paragraph 1 of Article 72 of this agreement, as well as in paragraph 3 of Appendix No. 18 to it “Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services." So, according to these standards, for goods listed in Article 149 of the Tax Code of the Russian Federation, exemption from VAT at a rate of 0% is not provided.

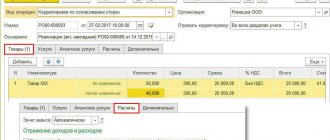

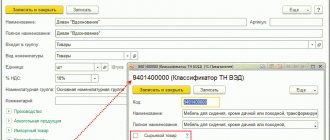

So, any product, work or service sold to the EAEU countries is subject to this tax at a rate of 0% . This is confirmed by letters from the Ministry of Finance dated 03/16/12 No. 03-07-13/01-15 and dated 09/12/11 No. 03-07-13/01-40. At the same time, in the invoice, in addition to the 0% rate, the code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU must be indicated - this is required by subclause 15 of clause 5 of Article 169 of the Tax Code of the Russian Federation. In accordance with the requirements of subclause 1.1 of clause 3 of Article 169 of the Tax Code of the Russian Federation, it is also necessary to draw up an invoice in the case of export sales of goods named in Article 149 of the Tax Code of the Russian Federation.

As for deductions, it is no longer necessary to separately take into account the “input” VAT on goods that will be sold for export and restore it upon shipment. Now the procedure for deducting VAT (on commodities) corresponds to the usual one. That is, if there is an invoice, the “input” tax on such goods is accepted for deduction in the period when they are accepted for accounting. This rule has been in effect since July 1, 2021, when the corresponding amendments to the Russian Tax Code came into force.

When the zero VAT rate for export becomes non-zero

In accordance with Art. 165 of the Tax Code of the Russian Federation, if sellers selling goods for export do not collect a package of documents justifying the 0% rate, they will have to fulfill their obligation to pay tax. You will have to pay tax at rates of 10 or 20%. This is discussed in more detail in the article “What to do if the export is not confirmed within the prescribed period .”

At the same time, the VAT tax base will be increased by the cost of goods for unconfirmed exports. Its method of determination is discussed in the article “ Tax base for export - market value of goods under the contract .”

Nuances of food supply to EU countries

The European Union is a major importer of food products. Russian manufacturers supply the following products to Europe:

- sweets, other chocolate products;

- alcoholic beverages, mineral water;

- rapeseed oil;

- Bay leaf;

- pasta;

- fermented milk products, cheeses, cottage cheese;

- juices;

- ice cream;

- food raw materials.

But the import of food products is subject to strict hygiene and safety rules. All imported products are tested to the same high standards as in the EU internal market. Products of animal and plant origin undergo mandatory border control and therefore require preliminary preparation. This process can be divided into stages.

- Market analysis, which examines consumer interest in a specific food group, features of competitors’ products, as well as government regulations. During the research, it is recommended to find out whether the components of the exported product are allowed in the country of the counterparty, and whether their quality meets EU requirements. In addition, it is necessary to clarify the rules of packaging, labeling, the order and form of accompanying documentation, whether notifications, authorization, etc. are needed. Based on the results of the first stage, the exporter decides whether or not to promote his product to Europe.

- Preparation and registration of goods (documents). At this step, the package of documents required for export to Europe is collected and finalized, labels are developed, and the cost of laboratory tests is calculated. The same stage involves passing analyzes/tests according to the quality control system DIN EN ISO 17025, for the content of GMOs, toxins, metals, and pesticides in the composition. Also, the product must undergo identification and certification according to the Common European System (ECIS). The process for obtaining EU certification differs depending on the product category (eg internal production control, sample examination, testing).

There is an opinion that Europe sets the most stringent requirements for the quality of food products. But the European Commission works closely with international organizations to ensure the safety of food supplies. Together with them, she helps to bring the product to a high level of quality to trading partners from countries outside the European Union.

M&J Logistic, specializing in international trade in food products since 2014, will provide comprehensive assistance in entering your organization into the European market. We cooperate with transport companies, departments, certification centers, and foreign partners to organize the entry of Russian manufacturers into the international arena. We control compliance with the rules of transportation/storage of products, and fully take care of the issues of customs clearance of deliveries.

Return of defects during export

The shipment and return of defective goods occurs not only in the domestic market, but also when sold for export. If a defective product is returned by a foreign supplier, the exporter faces questions: can such a return be regarded as an import and is it necessary to pay VAT in this case? You will find answers to them in the materials:

- “A contractor from the EAEU returned substandard goods—should I pay VAT when importing defective items back to Russia?”;

- “Is returning a defective export product an import?”.

Tax deduction for prepayment

In most cases, for foreign trade deliveries, prepayment is practiced. When transferring an advance payment for the upcoming receipt of goods, the buyer pays VAT on the advance payment amount.

In order to avoid duplicate taxation, VAT on advances made can be declared as a tax deduction during customs clearance of goods delivery and payment of the final amount of VAT.

Many Russian companies prefer not to deal with customs clearance of imported goods themselves, but delegate this procedure to intermediaries. If VAT at customs was paid by a third party, but at the expense of the importer and on his behalf, then the amount paid can be recorded as a tax deduction.

Refusal of tax refund

In some cases, the tax service may refuse the exporter a VAT refund. A negative decision by the Federal Tax Service may be caused by the following reasons:

- the presence of obvious errors in recording export transactions and drawing up primary documents;

- transactions were made by related companies;

- unreasonable, from the point of view of the Federal Tax Service, registration of goods.

If a refusal is received, the taxpayer can challenge the decision of the Federal Tax Service inspector in a higher inspection or in court.

Value added tax is a turnover tax. This means that for its correct calculation, one should take into account not only the revenue that a legal entity receives into its current account, but also costs, the amount of tax on which reduces the total amount of VAT that the taxpayer will have to pay to the budget.

Difficulties in trade with European countries

The process of organizing exports, regardless of direction, requires elaboration of financial, organizational, and legal issues. The exporter has to comply with all procedures and formalities (payment of duties, certification, declaration, knowledge of regulations, deadlines, prohibitions, restrictions). When exporting to the countries of the European Union, the procedure is complicated by the presence of non-tariff barriers:

- technical norms and standards;

- quantitative restrictions, quotas;

- anti-dumping duties.

If a product or supplier does not meet the requirements of the selected European state, this will be a major barrier to entry into the international market. Another obstacle is Western sanctions, which have an indirect impact on the export activities of Russian entrepreneurs.

You can reduce the negative impact of external factors and risks by ordering the services of M&J Logistic.

Documents for customs clearance of exports

The success of passing the customs control procedure depends on the correctness and completeness of the package of accompanying documentation and its compliance with the cargo being transported.

Cargo clearance during export takes place in three stages.

- Concluding a foreign trade contract with a foreign counterparty from Europe, opening a transaction passport in the bank. The document contains information on foreign economic cooperation. One copy of the passport remains with the bank, the second - with the applicant.

- For contracts involving self-pickup of goods, the exporter should obtain from the counterparty information about the transport and the driver who will transport the order. This data is needed for customs clearance of cargo.

- Goods produced in the Russian Federation and exported to the European Union are certified in Form A. To obtain this certificate, the exporter applies to the Chamber of Commerce with an application, which is accompanied by an invoice, quality certificate, certificate of production nomenclature, contract, additional agreements, power of attorney .

These are the basic steps for exporting. But in addition to them, the seller will need to prepare a voluminous package of accompanying documents.

When crossing the state border, the customs authority is presented with an export declaration and papers confirming the correctness of its completion:

- documents confirming the powers of the declarant;

- papers on foreign economic transactions;

- transport documents (CMR-6 and TIR Carnet - for transportation by road, bill of lading and loading order - for transportation by sea);

- licenses, conclusions of the State Sanitary and Epidemiological Service, other papers confirming compliance with prohibitions and restrictions;

- documents on the origin of the cargo (certificates of conformity, passports, etc.);

- certificate in form A;

- information about the product to confirm the classification code according to the Commodity Nomenclature of Foreign Economic Activity;

- payment orders, bank statements, other documents confirming the payment of customs duties;

- documents to justify the commodity value, the method of determining it (invoices, technical descriptions, purchase contracts, accounting statements);

- transaction passport, other documentation on compliance with currency control rules.

You may also additionally need documents confirming the payment of export duties, information about the number of places occupied, dimensions, cargo packaging, insurance certificates, and advance payment receipts.

You receive the entire list of documents for export from Russia to Europe when ordering services from M&J Logistic.

Confirmation procedure

In order to collect the entire package of documents, the exporter has 180 calendar days from the date of shipment . This rule is established in paragraph 5 of the Protocol on the Collection of Indirect Taxes. If the documents are not submitted to the Federal Tax Service within the prescribed period, you will have to pay regular VAT at a rate of 18 or 10%. It should be accrued in the period in which the export transaction took place. Beginning on the 181st day after shipment, penalties will be assessed if the zero rate is not confirmed and tax is not paid.

It happens that documents can still be collected, albeit late. In this case, the paid VAT can be offset or returned according to the rules of Article 78 of the Tax Code of the Russian Federation.

But if there is no way to confirm the zero rate, it is worth knowing that the VAT paid can be written off as income tax expenses. This right was confirmed by the Federal Tax Service in letter dated December 24, 2013 No. SA-4-7/23263 and by the Ministry of Finance in letters dated October 20, 2015 No. 03-03-06/1/60045 and dated July 27, 2015 No. 03-03-06/1/ 42961. The explanation is simple: in this case, the tax was not presented to the buyer, but was paid by the supplier from his own funds, therefore the prohibition from paragraph 19 of Article 270 of the Tax Code of the Russian Federation does not apply.

Export invoices

When selling goods, works, services both on the domestic market and for export, it is necessary to draw up an invoice. When selling on the domestic market, an invoice can be drawn up electronically or a universal transfer document (UTD) can be issued.

Is it possible to create an electronic invoice or UTD when selling for export? Read the materials:

- “Is electronic invoice acceptable for export?”;

- “UPD can be used for export - as a replacement for an invoice”.

Rules in force until July 1, 2021

The above applies to both goods and works and services.

If export operations are carried out, then the “zero rate” rule applies. This means that the exporter does not charge VAT on goods supplied abroad, and the foreign buyer does not pay it (the goods are sold without VAT).

At the same time, the exporter incurs expenses as part of its economic activities within Russia. This creates a situation in which the taxpayer does not have accrued VAT on export transactions (in other words, it is accepted at a rate of 0), but the tax imposed can be quite significant.

As a result, if the taxpayer’s share of export operations is significant, then he will constantly generate negative VAT payable to the budget. That is, the state will have a permanent debt to it, which will be collected by the taxpayer from the budget.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

This situation applies to both the export of goods and works and services. However, as of July 1, 2021, changes were made to the Tax Code of the Russian Federation, which changed the rules for accounting and calculating VAT on export transactions.