An individual entrepreneur is an individual who has the right to conduct an independent business and receive income from it. Ordinary income of an individual (salary, sale or rental of own property) is taxed at a rate of 13%. If we talk about business income, then you can choose a more favorable taxation system for individual entrepreneurs.

There is no such thing as a “tax rate for individual entrepreneurs,” just as there is no single tax for all entrepreneurs. You have the right to choose the most profitable taxation option and switch to preferential tax regimes.

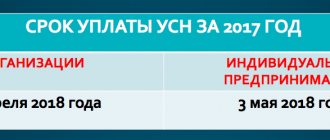

When to pay simplified taxes

To switch to the simplified tax system, an individual entrepreneur must submit a notification before December 31, 2020, in which the selected tax object must be reflected:

- “income” - the tax rate will be from 1 to 6 percent depending on the region;

- “income minus expenses” - tax rate from 5 to 15 percent depending on the region.

From 2021, new restrictions apply for the use of the simplified tax system: no more than 130 employees and no more than 200 million rubles, respectively.

Entrepreneurs using the simplified tax system pay the following mandatory payments to the budget:

- simplified tax system;

- personal income tax for your employees;

- insurance premiums for your employees and for yourself;

- property tax for individuals;

- transport tax;

- land tax.

Advance payments of the simplified tax system must be transferred to the budget quarterly, no later than the 25th day of the month following the reporting period (Q1, half a year and 9 months) (Clause 7 of Article 346.21 of the Tax Code of the Russian Federation).

The budget must be paid no later than April 30 of the following year.

In this regard, in 2021, individual entrepreneurs using the simplified tax system will pay a “simplified” tax within the following terms:

- for 2021 - 04/30/2021;

- for the first quarter of 2021 - 04/26/2021;

- for the first half of 2021 - 07/26/2021;

- for 9 months of 2021 - 10/25/2021;

- for 2021 - 05/02/2022.

Tax calculation and comparison 2021

To understand how much to pay for individual entrepreneurs in taxes under a particular tax regime, you should make a detailed calculation taking into account:

- potential income and expenses;

- mandatory individual entrepreneur contributions for himself;

- contributions for your employees, if any;

- current tax incentives;

- other nuances inherent in each individual tax regime and type of activity.

The information is most clearly perceived visually, so let’s look at a comparison of all types of taxation for individual entrepreneurs in 2021 using the example of typical indicators in the graphs below.

The following should be added for clarification:

- Despite the fact that the patent system has a similar rate to the simplified tax system (6%), it is calculated from the basic profitability, which is set depending on the type of activity. Therefore, you can compare specific numbers only after calculations using real data from your business as an example.

- Calculations for UTII are carried out based on imputed income, which is determined based on the type of activity and coefficients (deflator and adjustment coefficient). Therefore, the tax received in the calculations will not be related to real income.

- Under any of the above tax regimes, an individual entrepreneur must pay mandatory contributions for himself and his employees. In some cases, taxes can be reduced by part or the entire amount of contributions (the latter is only relevant for individual entrepreneurs without employees). But you cannot fail to pay your dues. That is, there will always be a minimum threshold of fees. For 2021, the amount is 40,874 rubles. (32,448 rubles contribution to the Pension Fund, 8,426 rubles for the Compulsory Medical Insurance Fund). For 2021, contributions amounted to 36,238 rubles.

More specific example:

- Income - 600,000 rubles.

- Expenses - 200,000 rubles. (including contributions for yourself - to facilitate calculations).

- Type of activity: retail trade.

- Retail area - 25 sq. m.

- Salaried employees - no.

- Region - Moscow region, city of Dmitrov (K2 coefficient for UTII is 1).

| Payments | simplified tax system 6% | simplified tax system 15% | UTII | PSN | Unified agricultural tax | BASIC |

| Tax calculation | 36000 (600 thousand * 6%) | 60,000 rub. (15% of the difference between income and expenses) | RUR 40,682.25 (basic profitability 1800 rubles * (physical indicator of activity for the first three quarters 25 sq. m. + 25 sq. m. + 25 sq. m.) * 2.009 (deflator in 2021) * 1 (K2 for the city of Dmitrov ) * 15%) | 13500 rub. (calculated for 1 month, patent for 12 months for stationary retail trade with a floor area of no more than 50 sq. m. - 162,000 rubles) | Not available for the selected activity type. | VAT - 0 thousand rubles (at a discount). Personal income tax - 52,000 rub. (13% * (600 thousand-400 thousand) as a resident) |

| Mandatory contributions | RUB 43,874 (minimum contributions RUB 40,874 + 1% of the amount exceeding income of 300 thousand) | RUB 40,874 (minimum contribution for 2021, since imputed income did not exceed 300 thousand rubles) | RUB 40,874 (minimum contribution, since potential income did not exceed 300 thousand rubles) | RUB 41,874 (40,874 rubles + 1% of the amount exceeding income of 300 thousand, but the final income here is the difference between total income and all expenses, that is, from 400 thousand - 300 thousand = 100 thousand) | ||

| Total amount | RUB 43,874 (since an individual entrepreneur without employees can deduct 100% of contributions from taxes) | RUB 103,874 (contributions are included in expenses, but are not deducted from taxes) | RUR 40,874 (since an individual entrepreneur without employees can deduct 100% of contributions from taxes) | RUR 54,374 (contributions are added to the patent) | — | RUB 93,8740 (contributions are included in expenses, but are not deducted from taxes) |

Data from the 2021 table in graphical form:

Can be compared with data for 2021:

Based on the results, it is clear that in this situation the most beneficial would be the use of UTII. For lower incomes, the optimal form is the simplified tax system of 6% (detailed calculation for simplification).

With other initial parameters and nuances, the situation can change dramatically.

Tax payment schedule for 2021 according to OSN

Organizations and individual entrepreneurs apply the general taxation system (GTS) by default. On the OSN, the entrepreneur pays VAT, personal income tax, property tax and all other taxes, except those provided only for special regimes.

We present the deadlines for payment of the main taxes payable when applying the OSN in 2021.

Personal income tax

Individual entrepreneurs pay advance payments for personal income tax for 2021 no later than the 25th day of the first month following the first quarter, half year, 9 months (clause 8 of article 227 of the Tax Code of the Russian Federation). In this regard, in 2021, individual entrepreneurs must transfer personal income tax advances to the budget within the following periods: 04/26/2021, 07/26/2021, 10/25/2021.

The tax at the end of the year is paid no later than July 15 of the following year (clause 6 of Article 227 of the Tax Code of the Russian Federation). Thus, the tax for 2021 will need to be paid no later than 07/15/2021, for 2021 - 07/15/2022.

Individual entrepreneurs transfer personal income tax from payments to employees in the usual manner.