Home — Articles

The organization is registered with one of the Federal Tax Service Inspectors of the city, divided into districts, and each district has its own OKATO code (as, for example, in Moscow or St. Petersburg). In the same city, she opened a separate division (OP). It was registered with another Federal Tax Service Inspectorate of the same city, not the one in which the organization itself is registered. At the same time, the OKATO codes of the territories where the organization and the OP are located are different.

Note By the way, the following situation is also possible: the organization and its OP are located in different cities in the region, each city has its own OKATO, but they are all registered with the same inter-district Federal Tax Service Inspectorate of the region. For example, interdistrict Inspectorate of the Federal Tax Service of Russia No. 17 for the Moscow region includes the urban settlements of Lyubertsy, Kraskovo, Malakhovka, Oktyabrsky, Tomilino, the urban districts of Kotelniki, Dzerzhinsky, Lytkarino. And each of them has its own OKATO code.

The organization transferred personal income tax for all employees only at its location and indicated the details of the organization itself on the payment slips: TIN, KPP and OKATO. Did she do the right thing? Will the tax authorities have any complaints in this case? And if claims are possible, how to avoid them?

How to pay personal income tax for employees of a separate division

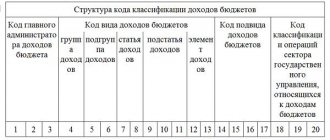

According to the law, personal income tax withheld from the income of employees of an OP must be transferred to the budget precisely at the location of the OP (Clause 7, Article 226 of the Tax Code of the Russian Federation). Therefore, tax authorities have long insisted on issuing separate payments for the transfer of personal income tax for each OP. In payment slips they recommend indicating the details of a specific OP, namely its checkpoint and the OKATO code of the municipality in which the OP is located (Letter of the Federal Tax Service of Russia dated 03.08.2011 N AS-4-3/12547; Letters of the Federal Tax Service of Russia for Moscow dated 07/01/2010 N 20-15/3/068888, dated 01/24/2008 N 28-11/006047). As tax officials explain, this is necessary so that personal income tax gets into the budget of the municipality where the OP is located. In general, the Ministry of Finance adheres to the same position. True, only if each OP is registered with its own Federal Tax Service (Letters of the Ministry of Finance of Russia dated December 9, 2010 N 03-04-06/3-295, dated March 29, 2010 N 03-04-06/55, dated March 29 .2010 N 03-04-06/54). In the situation we are considering, personal income tax for all employees of the organization was transferred in one payment slip with the details of the organization itself. That is, based on the position of the tax authorities, the organization paid personal income tax incorrectly. After all, the OKATO codes of municipalities (for example, in Moscow - intracity municipalities), in the territories of which the organization and the OP are located, are different.

OP on a separate balance sheet or not

A separate division (SU) is not a legal entity - it is only a part of an organization with certain functions. To implement them, it may be endowed with property that belongs to the company. The OP does not have its own assets, and conducts all its operations on behalf of the parent organization.

When creating a separate division, the company must approve its regulations, which, among other things, prescribe the nuances of document flow. One of the questions is whether the OP is allocated to a separate balance sheet or not.

The allocation of a division to a separate balance sheet means that it must calculate some indicators of its activities, generate reports and transmit them to the parent organization for management purposes. The internal reporting (balance sheet) of a separate division in this case is not accounting reporting and is not submitted to the Federal Tax Service. However, OPs are required to keep accounting records on a separate balance sheet.

A division without a dedicated balance sheet does not keep accounting records - it is organized centrally in the company. In the course of its activities, the OP draws up primary documents and transmits them to the head office. Based on them, the business operations of the division are taken into account and included in the overall indicators.

Regardless of whether the OP is allocated to a separate balance sheet or not, the financial statements are submitted by the parent organization. It contains performance indicators of all its separate divisions. Thus, the OP should not submit accounting reports, that is, a balance sheet, on their own.

What happens if you transfer personal income tax incorrectly?

According to tax authorities, violation of the procedure for transferring personal income tax leads to the formation of arrears in the budget of a particular municipality. After all, despite the fact that personal income tax is a federal tax (Article 13 of the Tax Code of the Russian Federation) and is transferred to a single treasury account, it is subsequently distributed according to standards between budgets of different levels. And part of the tax goes to the municipal budget (Clause 2 of Article 56, paragraph 2 of Article 61, paragraph 2 of Article 61.1, paragraph 2 of Article 61.2 of the Budget Code of the Russian Federation). And since the tax is distributed according to the OKATO code, part of the personal income tax (due to the municipality) will go to the budget of the municipality whose OKATO code is indicated in the payment order (Clause 16 of the Procedure for accounting by the Federal Treasury of revenues to the budget system of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated 05.09 .2008 N 92n). For example, if an organization and its OP are located in Moscow and when transferring tax, the organization indicated the OKATO code at its location, then personal income tax will only go to the budget of the intra-city municipality of Moscow on whose territory the organization is located. And the budget of another intra-city municipal formation, where the OP is located, will not receive anything (Subclause 1, clause 1, clause 2, article 8 of the Moscow Law of December 8, 2010 N 53 “On the budget of the city of Moscow for 2011”; Appendix N 9 to this Law). And tax officials believe that there is arrears in this budget. Therefore, when checking, they charge penalties (Clause 1 of Article 75 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia dated January 17, 2006 N 04-1-03/21). By the way, previously inspectors also imposed a fine of 20% of the amount to be transferred on the organization for incorrect transfer of personal income tax (Article 123 of the Tax Code of the Russian Federation). But lately they haven't been doing that. After all, the Supreme Arbitration Court of the Russian Federation, first in 2005 and then in 2009, indicated that the Tax Code of the Russian Federation does not provide for liability for violation of the procedure for transferring withheld personal income tax. And if the organization withheld tax from all employees and transferred it in full to the budget in a timely manner (even if only at its location), then it should be fined for failure to transfer personal income tax under Art. 123 of the Tax Code of the Russian Federation is impossible (Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 24, 2009 N 14519/08, dated August 23, 2005 N 645/05). But if suddenly the Federal Tax Service Inspectorate tries to fine your organization, you can challenge this fine, referring to the position of the Supreme Arbitration Court of the Russian Federation.

What to object to in court

If the tax authorities demand that you re-translate your personal income tax with the OKATO details of each division and charge you a penalty, you can try to resolve this issue first in a pre-trial manner (at the stage of considering disagreements on the audit report). Well, if this fails, then you can argue in court. The chances of success are high. 1. To the request to re-translate personal income tax to the location of the OP, you can argue that, in fact, you have already withheld tax from employees and transferred it to the budget, even if using the wrong details. If you remit the tax again, you will have to do it at your own expense. And this is directly prohibited by Ch. 23 of the Tax Code of the Russian Federation (Clause 9 of Article 226 of the Tax Code of the Russian Federation). As an additional argument, you can refer to the explanation of the Federal Tax Service itself, which indicated that if an organization transferred to the budget an amount of personal income tax that exceeds the amount of tax withheld from the income of employees, then this amount is not personal income tax . This is simply money belonging to the organization, “erroneously transferred to the budget system of the Russian Federation.” And the organization can only return them to its current account by writing a statement (Letter of the Federal Tax Service of Russia dated July 4, 2011 N ED-4-3/10764). And when you re-translate the tax, this is exactly the situation you get. After all, in this case, you will no longer transfer to the budget the tax withheld from the income of employees (you have already transferred it to the location of the organization itself), but your own money. And then they will have to be returned from the budget according to your application. 2. In response to the requirement to pay penalties, you can give the following arguments: - penalty - compensation for budget losses as a result of non-receipt of tax amounts on time (Determination of the Constitutional Court of the Russian Federation dated July 4, 2002 N 202-O; Resolution of the Constitutional Court of the Russian Federation dated December 17, 1996 N 20-P) . And when personal income tax was transferred to the location of the organization, and not the OP, the budget of the municipality as a whole received the tax in full. For example, the budget of the city of Moscow has a special status, and the budgets of intracity municipalities are an integral part of the unified budget of the city of Moscow. And personal income tax is credited to the city budget in the amount of 100% (Clause 2, 3 of Article 56, paragraph 2 of Article 61.2 of the Budget Code of the Russian Federation; paragraph 1 of Article 2, paragraph 1 of Article 1, paragraph 2 of Article 8 of the Law Moscow dated December 8, 2010 N 53; Appendix N 9 to this Law). And since there is no arrears on personal income tax, then there are no grounds for calculating penalties (Clause 1 of Article 75 of the Tax Code of the Russian Federation). And many courts share this position (Resolutions of the Federal Antimonopoly Service of the Far Eastern District dated October 11, 2011 N F03-4920/2011; FAS SZO dated October 20, 2010 in case N A66-15290/2009; FAS ZSO dated May 13, 2010 in case N A45-9320/2009 ). But we want to warn you that there are courts that consider it legal to charge penalties for non-receipt of personal income tax to the local budget (Resolutions of the Federal Antimonopoly Service of Ukraine dated 12/22/2010 N F09-10219/10-С2; FAS Central District dated 02/13/2009 in case No. A64-2317/ 08-26); — the obligation to pay tax is considered fulfilled from the moment the order is presented to the bank to transfer money to the appropriate account of the Federal Treasury (if the required amount is available in the current account) (Subclause 1, clause 3, clause 8, Article 45 of the Tax Code of the Russian Federation). So, if the treasury account is correctly indicated, the tax amount goes to the budget system, and in this case there is no arrears. And the fact that the wrong OKATO code is indicated in this payment does not matter. The courts also agree that there are no grounds for accruing penalties if the OKATO code is incorrectly indicated in payment slips for the transfer of personal income tax (Clause 7 of Article 45 of the Tax Code of the Russian Federation; Resolution of the Federal Antimonopoly Service of the Moscow Region dated July 29, 2011 N KA-A40/7917-11, dated June 30 .2011 N KA-A40/6142-11-2, dated 10/08/2010 N KA-A40/11919-10, dated 02/17/2010 N KA-A40/368-10; FAS VSO dated 09/01/2011 in case N A33- 3885/2010, dated 04/26/2010 in case N A19-13821/09, dated 11/11/2008 N A33-2043/08-F02-5509/08; FAS SZO dated 03/14/2011 in case N A05-4762/2010; FAS Central Election Commission dated July 8, 2010 in case No. A64-6646/09; Eighteenth AAS dated May 25, 2010 No. 18AP-3779/2010).

Results

Personal income tax must be paid separately for each separate division and separately for the parent enterprise.

From 2021, it is possible in some cases to pay personal income tax centrally. Tax transfers are usually carried out by the parent company. But if the division is allocated to an independent balance sheet, then the branch has the right to transfer the tax independently. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to clarify the payment?

The Tax Code provides that if an error in a payment order does not result in the tax not being transferred to the budget to the required Federal Treasury account, it can be corrected. To do this, you must submit an application to the Federal Tax Service with a request to clarify the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation). As we have already found out, if the OKATO code is indicated incorrectly, the tax still goes to the budget. And, for example, the court of the West Siberian District, examining a similar dispute, indicated that an error in the OKATO code when transferring personal income tax to the location of the organization, and not the OP, can be corrected by filing an application to clarify the payment (Resolution of the Federal Antimonopoly Service ZSO dated June 23, 2010 in case No. A27-19112/2009, dated June 23, 2010 in case No. A27-14315/2009). As a rule, tax authorities clarify the entire payment. And in the situation under consideration, only part of the incorrectly listed personal income tax needs to be clarified. That is, in the application for clarification of payment, it is necessary to indicate that such and such an amount of personal income tax from the payment slip, to which the tax was transferred to the location of the organization, is due for payment by employees of the OP with such and such OKATO code. The Federal Tax Service Inspectorate, in principle, can decide to partially clarify the personal income tax payment; there are no obstacles to this (Order of the Federal Tax Service of Russia dated April 2, 2007 N MM-3-10 / [email protected] ). If the tax authorities refuse to partially clarify your payment and say that they can transfer only the entire personal income tax amount indicated in the payment to another OKATO code, then you should not agree to this. After all, if you make such a clarification, you will have an underpayment of personal income tax at the location of the organization. It also makes no sense to make clarifications only for some payments (for example, transfer the entire January personal income tax to the OP, leave the entire February one to the organization). At first glance, it seems that this will help distribute payments between the organization and the OP and reduce the amount of penalties. But in reality, difficulties will arise if at some point there is an overpayment for the OP’s employees. As we have already said, the Federal Tax Service believes that the amount transferred to the budget and exceeding the tax withheld from employees is not an overpayment of personal income tax (Letter of the Federal Tax Service of Russia dated July 4, 2011 N ED-4-3/10764). And the tax authorities will not count such overpaid amounts against future personal income tax payments.