When starting a business, every entrepreneur hopes that everything will go well and big profits are just around the corner. But life often makes its own adjustments, sometimes for various reasons you have to pause. How to suspend the activities of an individual entrepreneur for a while so that you do not have to pay for the period of inactivity?

Is it possible to suspend the operation of an individual enterprise without closing it?

From the point of view of legislation, the concepts of “opening” and “closing” an individual entrepreneur are incorrect - an individual can register as an individual entrepreneur or register the fact of termination of entrepreneurial activity.

That is why the closure of an individual entrepreneur should be understood as the procedure for filing an application to terminate the activities of an individual as an entrepreneur. However, closing an individual entrepreneur is not always advisable - in practice, situations may arise in which an entrepreneur needs to suspend work for a certain time in order to return to it later. In this case, the question arises: how to suspend the activities of an individual entrepreneur and get rid of the responsibilities that arise when creating your own business, for example, paying taxes and insurance premiums, preparing reports, etc.

The list of actions of an entrepreneur that are subject to state registration is clearly regulated by the Law “On State...” dated 08.08.2001 No. 129-FZ. A future entrepreneur can register an individual entrepreneur by submitting to the tax service an application drawn up in form P21001 (Article 22.1 of Federal Law No. 129), and an already registered one:

- make changes to information about individual entrepreneurs in the Unified State Register of Individual Entrepreneurs by submitting an application in form P24001 (Article 22.2 of Federal Law No. 129);

- register the fact of termination of activities as an individual entrepreneur by submitting an application in form P26001 (Article 22.3 of Federal Law No. 129).

Accordingly, the suspension of the activities of an individual entrepreneur is not provided for by law - an entrepreneur cannot submit a free-form application to the tax authorities with a request for a temporary freeze of the business.

This means that the individual entrepreneur will have to independently find and use all the benefits and opportunities provided by law and use them in order to minimize the number of responsibilities that arise for a businessman from the moment of his state registration.

Practical experience

Stopping an individual entrepreneur's business is illogical. The law does not establish deadlines for starting and finishing activities; the registration procedure may even be unlimited. While the case is stopped in fact, the law still obliges the business owner to fulfill his obligations .

If the individual entrepreneur has not worked for a long time, but this form of ownership is still registered, then there are obligations to submit reporting forms. Moreover, it is required to make fixed contributions to the Pension Fund, as well as transfer other amounts to the required accounts.

If the entrepreneur does not receive income , a zero declaration . If you have hired employees, you should not forget about the duties of a tax agent and respect the labor rights of employees.

If we talk about the consequences , then during the suspension of activities they were not observed. The main thing is that there are no violations of the current legislation. But in life there are various situations that force an individual entrepreneur to end his activities.

How to reduce the fiscal burden if individual entrepreneurs do not operate?

Suspension of the activities of an individual entrepreneur without liquidation implies a temporary cessation of all business processes and, as a result, a lack of income and profit. The calculation of the amount of tax payments payable to the budget depends on which tax regime the individual entrepreneur has chosen. All types of tax regimes can be divided into two groups:

- the amount of tax depends on the income received by the entrepreneur - OSNO, Unified Agricultural Tax, simplified tax system;

- the amount of tax depends on the type of activity of the entrepreneur, the region in which he operates, as well as on a number of other factors; in this case, the amount of revenue received by the businessman is not taken into account - UTII and PSN.

UTII has been canceled since 2021. Find out what taxpayers should do in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

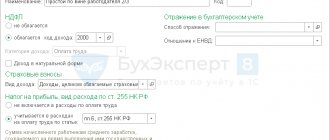

Registered individual entrepreneurs are often interested in how to suspend an individual entrepreneur so as not to pay taxes. If an entrepreneur works in any of the regimes included in the first group, he can submit zero tax returns - this will be enough to comply with the law and not pay extra money to the budget.

If the entrepreneur has chosen a tax regime with a fixed amount of mandatory payment, he will still have to transfer money to the Federal Tax Service.

Is this real

Within the framework of the legislation of the Russian Federation, the possibility of suspending individual entrepreneurship is not envisaged . It is incorrect to believe that in case of termination of business, entrepreneurs are exempt from taxes, fees and other contributions to the state treasury. No one exempts you from submitting documents - declarations, reports, certificates, etc.

If you look at the situation from the other side, fulfilling your duties is not a difficult process, especially considering the fact of filing zero returns and not paying taxes on revenue/profit.

What to do if the amount of the tax payment does not depend on the amount of income received?

If the suspension of the activities of an individual entrepreneur without activity is planned for a long time, the entrepreneur should think about changing the applicable tax regime.

In accordance with paragraph 1 of Art. 346.28 of the Tax Code of the Russian Federation, entrepreneurs who have chosen UTII as the applied tax regime can switch to any other taxation system only from the beginning of the new year following the year of filing the corresponding application. This means that until the transition to another tax regime, you will still have to pay tax.

If an entrepreneur works using PSN, he must wait until the expiration of the patent he acquired. The patent may expire early under the conditions provided for in paragraph 6 of Art. 346.45 Tax Code of the Russian Federation. The patent is canceled, and it is considered that from the beginning of the tax period in which the patent was acquired, OSNO is applied if:

- the taxpayer’s income for the specified period exceeded 60 million rubles, or

- The number of employees included in the organization is more than 15 people.

The first condition for an early transition to OSNO cannot be used in the situation under consideration - the presence of revenue from an individual entrepreneur indicates that he is conducting activities, and very successfully. The second option can be used in practice, although it is unlikely - the staff of an actually non-functioning small enterprise cannot consist of 15 employees.

This means that the chance of an early transition to OSNO for an individual entrepreneur is extremely small, so he will have to wait for the official expiration of the patent and only after that choose any taxation system that assumes that the amount of the tax payment depends on the amount of income or profit received.

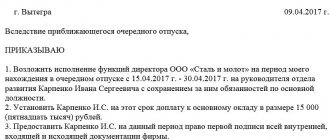

Sample application and content requirements

If the documents are submitted independently , then it is enough to ensure that paragraphs 1 and 2 of the form are filled out and signed later. Form P26001 was adopted in July 2013. A sample application paper looks like this.

- The first line - strictly in the center - is the title of the document, the second line is an explanation. It is written “Statement on...”.

- Clause 1 - information about the individual entrepreneur - OGRN, full name, INN.

- Please issue the documents to the applicant or send them by mail. Provide contact information – phone number, email address.

- Information about the person who certified the authenticity of the signature by a notary - notary, deputy, official who has the appropriate authority.

How to avoid paying insurance premiums?

In accordance with the provisions of paragraph 1 of Art. 430 of the Tax Code of the Russian Federation, individual entrepreneurs are required to pay insurance premiums for compulsory pension and medical insurance. The amount of such contributions is fixed. However, with an income of 300,000 rubles, all money earned above this amount increases the load by 1%. For example, if you earn 320,000 rubles, you must pay an additional 200 rubles for pension insurance in addition to the fixed contribution. It will not be possible to get rid of the obligation to pay insurance premiums even if the individual entrepreneur does not actually conduct business.

If an individual entrepreneur was temporarily deregistered during the year, insurance premiums are calculated in proportion to the days worked. Find out exactly how to calculate the amount of fixed contributions in ConsultantPlus. To do everything right, get trial access to the system and study the material for free.

However, there are a number of cases in which an individual entrepreneur is temporarily exempt from the need to make contributions to the Pension Fund and the Compulsory Medical Insurance Fund. This list is established by clauses 6 and 7 of Art. 430 Tax Code of the Russian Federation. In accordance with the provisions of the norm, you will not have to pay:

- persons undergoing military service;

- a parent caring for a child until he reaches 1.5 years of age;

- persons caring for a disabled child, a person who has reached 80 years of age, or a group I disabled person;

- spouses of military personnel living together with them in those territories where business activities are impossible;

- spouses of diplomats living abroad due to the need for the diplomat to carry out his professional activities.

If an entrepreneur falls into one of these categories, he should take advantage of his legal right to exemption from payments.

Suspension of activities

Business liquidation as an alternative

Due to certain circumstances due to the lack of orders, buyers, clients or legislative restrictions or prohibitions, the activities of an individual entrepreneur may be ineffective. If a business representative sees certain prospects for his activities in a short period of time, then there is no point in closing down. He has the right not to conduct business, but at the same time must fulfill the duties determined by his business status. Its obligations are:

- submission of reports to authorized bodies;

- transfer of mandatory payments for yourself to the Pension Fund and insurance funds.

Despite the lack of activity, and, as a consequence, profit, the entrepreneur will have to pay insurance premiums.

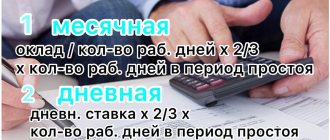

Failure to make payments to a designated account will result in bringing the business representative to administrative liability. If there are hired workers, the financial situation may worsen. The entrepreneur does not have the right to fire them, since by law the head of the company is required to notify about the upcoming layoff at least two months before the event. During this time, the entrepreneur will have to pay wages to his employees and transfer mandatory payments to the state treasury.

Results

So, the answer to the question of how to suspend the activities of an individual entrepreneur for a while is clear: it will not be possible to officially suspend the activities of an individual entrepreneur and get rid of all the obligations associated with this status - the legislator does not provide for such a possibility.

An entrepreneur can only minimize the tax burden by using any suitable tax regime and submitting zero tax returns to the Federal Tax Service. It will not be possible to get rid of the obligation to pay insurance premiums at all, with the exception of certain cases not directly related to the actual termination of individual entrepreneurial activity. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Suspension (extension, renewal) of tax reporting

How to get the service online

- Log in to the portal and click on the “Order a service online” button.

- Fill out the application and sign it with an electronic signature (electronic digital signature).

- In your personal account (in the “History of receiving services”), read the notification about the processing of your application, which will arrive within the specified time.

*To receive the service, the applicant must be previously registered as an individual entrepreneur or legal entity. Residents of the city of Nur-Sultan can receive the online service.

How to obtain a service from the service provider or from the NJSC “State Corporation “Government for Citizens” (

Service recipients with the exception of individual entrepreneurs applying a special tax regime for small businesses based on a patent:

- Tax application for suspension (extension, renewal) of the submission of tax reporting - in the event of a decision to suspend or resume activities or extend the period of suspension of the submission of tax reporting.

- Tax reporting from the beginning of the tax period until the date of suspension of activities indicated in the tax application - in case of a decision to suspend activities.

- Tax application for registration accounting for value added tax - in case of a decision to suspend the activities of a service recipient who is a payer of value added tax.

Service recipients applying a special tax regime for small businesses based on a patent:

- Tax application for suspension (extension, renewal) of the submission of tax reporting - in the event of a decision to suspend activities or extend the period of suspension of the submission of calculation of the value of a patent.

- Calculation for the upcoming period from the date of resumption of activity - if a decision is made to resume activity before the end of the period of suspension of activity.

To identify the identity of the service recipient, an identity document is presented.

Result of service provision

Information on the suspension (extension, renewal) of the submission of tax reporting or the refusal to suspend (extend, resume) the submission of tax reporting published on the Internet resource of the authorized body no later than the date of adoption of such a decision

Registration of an individual entrepreneur

All individuals have the right to run their own business only after registering as an individual entrepreneur.

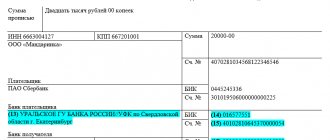

Registration of a newly created individual entrepreneur is carried out by the tax authorities on the basis of completed form No. 21001, to which it is necessary to attach a document confirming payment of 800 rubles of state duty, as well as attach a copy of the passport and proof of registration in Russia.

If the citizen has correctly filled out the form and attached a full package of documents to it, the tax authority makes an entry about the newly formed entity of economic relations in the Unified State Register of Individual Entrepreneurs. The new entrepreneur is assigned a OGRNIP and issued an entry sheet No. 60009.

And it is from this moment that the individual entrepreneur has the obligation to transfer taxes to the domestic budget system, as well as to make contributions to extra-budgetary funds. This obligation remains until the liquidation of the entrepreneur’s status.