Home — Articles

- Calculation and payment of trade tax amounts

- Reducing taxes on trade tax amounts General provisions

- Reducing personal income tax amounts

- Reducing the amount of calculated tax during simplification

On January 1, 2015, Ch. 33 “Trade fee” of the Tax Code of the Russian Federation. For several months now, regulatory authorities have been explaining the procedure for applying certain provisions of the new chapter. In the article we will consider the issues of paying trade fees, as well as the procedure for reducing the amounts of calculated taxes under different tax regimes by the amounts of trade fees.

Trade tax payers

The obligation to independently calculate and pay the trade fee in accordance with clause 1 of Art. 411 of the Tax Code of the Russian Federation is entrusted to entrepreneurs and organizations that conduct trading activities within the municipality that has adopted a regulatory act introducing this fee on its territory.

It is necessary for organizations and individual entrepreneurs located on the OSNO and the simplified tax system to transfer the trade tax, subject to its validity in the territory of trading activities. Institutions and entrepreneurs paying the Unified Agricultural Tax are exempt from the obligation to charge the trade tax. Individual entrepreneurs working on the patent system also do not pay it. UTII does not apply to those types of activities for which a trade tax is levied based on a decision of local authorities.

IMPORTANT! The accrual of trade fees is expected only in cases where the entity uses movable/immovable property when carrying out trade operations. That is, there is an object of trade.

The Tax Code of the Russian Federation does not provide a clear definition of the object of trade. Letter of the Ministry of Finance of Russia dated July 15, 2015 No. 03-11-10/40730 contains provisions defining the responsibilities for paying trade fees by entities engaged in various sales activities. The following types of work are not subject to tax:

- Sales of products of own production, if the sale does not use retail facilities (retail outlets).

- Food products sold through catering facilities.

- Sales of collateral by pawnshops.

- Use of premises for concluding trade contracts and agreements, if the area is not equipped for displaying goods and making cash settlements with clients.

- If, during the provision of household services, related goods are sold.

Another point of view of officials on determining the object of sale can be found in the material “Should I pay a sales tax when selling through an office?” .

The transfer of the contribution to the budget should be made every quarter no later than the 25th day of the month following it, if cases of trade have been recorded that meet the requirements of Art. 413 Tax Code of the Russian Federation. There are no separate reporting forms for the calculation and payment of fees.

If tax is paid on income

So, if you have chosen income as the object of taxation, then the tax base for the single tax is the monetary expression of the income of your organization. Income includes (clauses 1, 2 of Article 248 of the Tax Code of the Russian Federation):

- income from sales of products (goods, works, services);

- income from the sale of property and property rights;

- non-operating income.

In this case, the single tax is calculated using the formula.

Formula for calculating the single tax under the income simplified tax system

Income from sales is determined in the manner established by Article 249, and non-operating income - in the manner established by Article 250 of the Tax Code.

Read also “How to choose a tax payment method under the simplified tax system”

EXAMPLE OF CALCULATING A SINGLE INCOME TAX

LLC “Passive” switched to the simplified tax system and pays a single income tax. The company's sales income for the year amounted to 3,100,000 rubles, non-operating income - 45,000 rubles. The tax amount for the year will be: (RUB 3,100,000 + RUB 45,000) × 6% = RUB 188,700.

Income is determined on an accrual basis from the beginning of the tax period until the end of the first quarter, half year, 9 months. The tax period for a single tax is a calendar year. Reporting periods – first quarter, half year and 9 months.

During the year, “simplified” people pay advance tax payments.

The amount of the quarterly advance payment is calculated based on the results of each reporting period based on the tax rate (6%) and actual income received. EXAMPLE OF CALCULATION OF ADVANCE PAYMENTS UNDER THE SUSTAINED STANDARD SYSTEM (USN

) LLC Passiv has switched to the simplified tax system and pays a single tax on income. The company's income for the first half of the year amounted to 3,100,000 rubles, including 1,100,000 rubles for the first quarter. The amount of the advance payment for the single tax, which was accrued and paid based on the results of the first quarter, is as follows: 1,100,000 rubles. × 6% = 66,000 rubles. The amount of the advance payment for the single tax, calculated based on the results of the first half of the year, is: 3,100,000 rubles. × 6% = 186,000 rubles. For the first quarter, Passive has already paid 66,000 rubles. This means that for the first half of the year you need to pay an additional 120,000 rubles. (186,000 – 66,000).

Read in the taker

How to calculate the “simplified” tax if the object of taxation is “income”, read in the “STS in practice” berator

The accrued tax (advance payment) can be reduced, but not more than 50% of its value:

- the amount of contributions paid for compulsory pension, social and health insurance;

- for the amount of contributions “for injury”;

- for the amount of temporary disability benefits paid at the expense of the company’s own funds (with the exception of benefits paid in connection with an industrial accident and occupational disease);

- for the amount of payments under voluntary personal insurance contracts concluded in favor of employees in the event of their temporary disability with insurance companies licensed for this type of insurance (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation).

In addition, in addition to this list of deductions that are provided for all “simplified” people, those who are engaged in trade can reduce the accrued tax by the amount of the trade fee paid for the reporting period or year (clause 8 of Article 346.21 of the Tax Code of the Russian Federation).

Read in the taker

Read about the nuances of reducing the single tax on the listed deductions in the “STS in practice” guide.

Reducing the simplified tax system

There are some features of reducing the single tax.

- The accrued tax is reduced by the amount of insurance premiums that were actually paid (within the calculated amounts) in a given tax (reporting) period, and not for the same period (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). It does not matter for what period the contributions were paid. For example, insurance premiums for December 2015, paid in January 2016, reduce the advance payment under the simplified tax system for the first quarter of 2016.

EXAMPLE OF REDUCING TAX ON INSURANCE PREMIUMS

Passive LLC has been applying the simplified tax system since January 1 of the current year. The company chose income as an object of taxation. The company's income for the first quarter amounted to 600,000 rubles. During this period, “Passive” transferred contributions in the amount of 21,000 rubles to extra-budgetary funds, including for December 2021 – 7,000 rubles, for January 2021 – 7,500 rubles, for February 2021 – 6,500 rubles. The amount of the single tax for the first quarter of the current year is 36,000 rubles. (RUB 600,000 × 6%). This amount can be reduced by the amount of contributions paid for compulsory pension, social and medical insurance and “injury” contributions, but not more than 50%: RUB 36,000. × 50% = 18,000 rubles. The amount of contributions transferred to extra-budgetary funds exceeds 50% of the single tax (21,000 rubles > 18,000 rubles). Therefore, “Passive” can reduce the tax by only 18,000 rubles. This means that for I quarter of the current year, the Passiv accountant must pay 18,000 rubles to the budget. (36,000 – 18,000).

- The single tax can be reduced by the amount of sick leave benefits paid to employees only at the expense of the organization, that is, for the first three days of illness (clause 2, clause 3.1, article 346.21 of the Tax Code of the Russian Federation).

note

If an additional payment was accrued from the employer’s funds to the employee’s temporary disability benefit up to the actual average earnings, it is impossible to reduce the “simplified” tax by the amount of such additional payment (letter of the Ministry of Finance of the Russian Federation dated February 6, 2012 No. 03-11-06/2/20).

AN EXAMPLE OF REDUCING THE TAX ON THE AMOUNT OF HOSPITAL BENEFITS

From January 1, Aktiv LLC switched to the simplified tax system, and chose income as the tax base. For the first quarter, the amount of income amounted to 400,000 rubles. The amount of the “simplified” tax for the first quarter will be equal to: 700,000 rubles . × 6% = 42,000 rubles. In the first quarter, Aktiv transferred contributions to extra-budgetary funds and “injury” contributions in the total amount of 10,000 rubles. During the same period, the company paid sick leave to an employee - 10,000 rubles, including: - 3,700 rubles. - payment of benefits for the first three days of illness; - 4100 rubles. - payment of benefits from the fourth day of illness; - 2200 rubles. – additional payment up to the employee’s actual average earnings. Contributions to extra-budgetary funds, “injury” and sick leave contributions can reduce the “simplified” tax, but not by more than 50%. The amount of additional payment before actual earnings does not reduce the single tax. “Active” did not conclude voluntary personal insurance contracts in case of temporary disability of employees: RUB 10,000. + 3700 rub. = 13,700 rub., and 13,700 rub. This means that the amount of single tax that needs to be paid to the budget for the first quarter is equal to 28,300 rubles. (42,000 rubles – 13,700 rubles).

- It is possible to reduce the single tax on the amount of insurance payments for employees only if the insurance payment under voluntary insurance contracts in case of temporary disability does not exceed the amount of sick leave benefits for the first three days of the employee’s illness, determined in accordance with the law (clause 3, clause 3.1, art. 346.21 Tax Code of the Russian Federation).

- The “simplified” tax can be reduced by the amount of insurance premiums paid using borrowed funds. From what funds insurance premiums for employees are transferred - their own or attracted through a loan or credit - does not matter. The main thing is that contributions are paid in the same tax (reporting) period for which the “simplified” tax was calculated (letter of the Ministry of Finance of Russia dated July 20, 2015 No. 03-11-06/41618).

- In addition to the amount of insurance premiums paid (within the limits of the calculated amounts), the arrears of insurance premiums paid in the same period can also be deducted from the calculated amount of the “simplified” tax. But again, provided that the tax is reduced by no more than 50% (letter of the Ministry of Finance of Russia dated August 7, 2015 No. 03-11-11/45839).

- An individual entrepreneur without employees who uses the simplified tax system with the object “income” can reduce the amount of tax on overpayment of insurance premiums. But only after the Pension Fund decides to offset the overpayment (letter of the Ministry of Finance of Russia dated November 16, 2021 No. 03-11-11/67299).

- On July 1, 2015, a trade tax was introduced in Moscow, the payment of which also applies to “simplified”.

Those of them that apply the object of taxation “income” in addition to the amounts by which the amount of the single tax can now be reduced (insurance premiums, hospital benefits, payments under voluntary personal insurance contracts) can reduce the “simplified” tax by the amount of the trade tax actually paid . With the condition that the tax is transferred to the budget of the city in which the trade tax was introduced (clause 8 of Article 346.21 of the Tax Code of the Russian Federation).

This conclusion is confirmed by financiers. For example, if an entrepreneur on a “simplified tax” lives in the Moscow region and at the same time trades in Moscow through a real estate property, he does not have the right to reduce the amount of the simplified tax system by the amount of the trade tax paid to the budget of the city of Moscow (letter of the Ministry of Finance of Russia dated July 15, 2015. No. 03-11-09/40621).

Firms and entrepreneurs using the simplified tax system have the right to conduct several types of business. But in this case, those of them that use the “income” object can reduce the single tax by the amount of the trade fee only for the activity in respect of which this fee was paid. Such “simplifiers” are required to keep separate records of income and the amount of single tax that is paid in relation to activities that fall under the trade tax (letter of the Ministry of Finance of Russia dated March 27, 2015 No. 03-11-11/16902).

Unlike the “simplified” ones with the object “income,” the simplified tax system does not have any difficulties taking into account the trade tax. Since subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code stipulates that under the simplified tax system with the object “income minus expenses,” “simplified people” have the right to take into account taxes and fees paid in accordance with the legislation of the Russian Federation as expenses.

Read also “Minimum tax under the simplified tax system”

Therefore, they do not need to keep separate records of income and expenses related to “simplified” activities and the type of activity for which the trade fee is paid (letter of the Ministry of Finance of Russia dated October 30, 2015 No. 03-11-06/2/62729).

By the way, if a “simplified person” with the object “income” deducts from the amount of the calculated single tax paid insurance premiums, sick leave and payments under voluntary personal insurance contracts, but not more than 50% of the tax (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation), the entire he can reduce the remaining half of the tax by the amount of the paid trade tax, down to zero (clause 8 of Article 346.21 of the Tax Code of the Russian Federation).

EXAMPLE OF REDUCING TRADE TAX

An organization applies the simplified tax system with the object “income”.

Based on the results of 9 months, the company’s income amounted to 2,485,600 rubles. During this period, she paid insurance contributions to extra-budgetary funds, including for “trauma,” in the amount of 165,437 rubles. Simultaneously with the payment of insurance premiums for September, the organization also transferred the trade fee for the third quarter - 31,150 rubles. The amount of the calculated advance payment for the tax paid under the simplified tax system for 9 months based on the income received is equal to 149,136 rubles. (RUB 2,485,600 × 6%). Its “simplified” has the right to reduce it by the amount of insurance premiums paid, but not more than 50% of the calculated amount of the advance payment. Therefore, 74,568 rubles are taken as the deductible. (RUB 149,136 × 50%). The remaining half is RUB 74,568. (149,136 – 74,568) can also be reduced by the amount of the paid trade fee (RUB 31,500). Thus, the amount of advance payment calculated for payment for 9 months will be 43,418 rubles. (74,568 – 31,150). The accountant will make the following entries in accounting: DEBIT 44 CREDIT 68 subaccount “Trading fee”

- 31,150 rubles.

– trade fee charged; DEBIT 68 subaccount “Trade fee” CREDIT 51

- 31,150 rub.

– the amount of the trade fee is transferred to the budget; DEBIT 68 subaccount “Single tax under the simplified tax system” CREDIT 99

- 31,150 rubles. – the amount of calculated tax is reduced by the amount of the trade tax paid.

The trade tax was introduced on July 1, 2015, so far only in Moscow. According to Article 415 of the Code, the tax period is a quarter. It must be paid no later than the 25th day of the month following the reporting quarter (clause 2 of Article 417 of the Tax Code of the Russian Federation).

Reflection of trade tax in the income statement

If an enterprise is located on OSNO and at the same time pays a trade tax, it becomes possible to reduce the final amount of income tax or advance payments on it (clause 10 of Article 286 of the Tax Code of the Russian Federation). However, this will require the following conditions to be met:

- In profit tax, you can only reduce that part of it that is subject to transfer to the regional budget, where the trade tax is also paid.

- The trading fee for a certain period must not only be accrued, but also paid on time.

- The subject provided notification of registration as a trade tax payer.

If the amount of the paid trade fee is greater than the income tax accrued for payment for the reporting period to the regional budget, then the remaining amount of the fee can be taken into account in the next reporting period or in the profit declaration for the year. The company's lack of profit in the reporting period is not a reason for non-payment of the trade tax.

If a legal entity has separate divisions, then the profit tax on branches can be reduced in the part that they transfer to the same budget as the amount of the trade fee.

To reflect the trade fee in the profit declaration, approved by order of the Federal Tax Service of Russia on October 19, 2016 No. ММВ-7-3 / [email protected] , lines 265-267 on sheet 02 and lines 095-097 in Appendix 5 to sheet 02 are intended.

Read about some of the nuances of filling out the declaration in the article “Income Tax Declaration for the 2nd Quarter of 2017.”

Declaration according to the simplified tax system 6% - samples of completion for individual entrepreneurs and LLCs in 2021

All simplified tax payers at the end of the year are required to submit a declaration according to the simplified tax system to the Federal Tax Service (at the place of registration). The composition of the reporting depends on the object of taxation that the simplifier applies.

Individual entrepreneurs and organizations using the simplified tax system of 6% (object - “income”) submit a declaration consisting of the following sheets:

- Title.

- Section 1.1.

- Section 2.1.1.

- Section 2.1.2 – if the activity is carried out in Moscow and the individual entrepreneur or LLC is the payer of the trade tax.

Note: section 3 is filled out by an individual entrepreneur or LLC in case of receiving targeted financing, targeted income and other funds specified in paragraphs 1 and 2 of Art. 251 Tax Code of the Russian Federation.

Declaration form

The declaration form for the simplified taxation system, valid in 2021, was approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected]

forms for KND 1152017 tax return for tax paid in connection with the application of the simplified taxation system.

Step-by-step instructions for filling out the simplified taxation system income declaration

The official instructions developed by the Ministry of Finance for filling out reports under the simplified tax system can be downloaded here.

Initial data

Organization: Kurs-invest LLC

Reporting period: 2021

Inspectorate of the Federal Tax Service: for the city of Mytishchi, Moscow region

Type of activity: Retail sale of other food products in specialized stores

OKVED: 47.29

Revenue (quarterly):

1st quarter – 920,000 rub.

2nd quarter – 820,000 rub.

3rd quarter – RUB 1,020,000.

4th quarter – RUB 1,560,000.

Insurance premiums for employees – 108,000 rubles each. every quarter

Title page

| Column/Row | Note |

| INN/KPP | TIN and checkpoint of the organization |

| Correction number | If the declaration is submitted for the first time (primary), then the adjustment number will be “0—”. If the second and subsequent times (in order to correct an error in previously submitted reports), then the number “2—” , “3–” , etc. depending on which updated declaration is submitted |

| Taxable period | “34” – if reporting is submitted for the year “50” – when submitting a declaration after the liquidation of the organization “95” – when switching to a different taxation regime “96” – when terminating activities under the simplified tax system |

| Reporting year | Year for which the declaration is submitted |

| Submitted to the tax authority | Four-digit code of the tax authority with which the LLC is registered |

| By location (code) | “210” – at the location of LLC “215” – at the location of the legal successor |

| Taxpayer | Full name of the organization in capital letters. Please note that there must be one empty cell between LLC (in decrypted form) and the name itself, even if the name falls on the next line |

| OKVED code | Code of the main activity, in accordance with OK 029-2014 (NACE Rev. 2) |

| Contact phone number | An up-to-date telephone number by which the inspector can contact the taxpayer and clarify any questions he has. The phone number is indicated in the format + 7 (…)……. |

| On... pages | If the organization is not a payer of the trade tax and has not received targeted financing, the number of sheets will be«003» |

| I confirm the accuracy and completeness of the information... | “1” – if the declaration is filled out and submitted by the director of the LLC, his full name is indicated in the lines below. “2” – if the declaration is submitted by a representative, the full name of the representative and the name of the document that confirms his authority are indicated below |

| date | Date the document was completed |

Section 1.1

| Column/Row | Note |

| 010, 030, 060, 090 | If the OKTMO code has not changed during the tax period, it is indicated once on line 010, in the remaining lines 030, 060 and 090 dashes are placed |

| 020 | The advance amount to be paid to the budget. It is calculated using the formula: p. 130-p. 140 |

| 040 | The amount of the advance payment based on the results of the half-year, calculated using the formula: (line 131 – page 141) – line 020 |

| 050 | If the formula: (p. 131-p. 141) – p. 020 results in a negative value (overpayment), it is entered in this line. |

| 070 | Amount of advance payment for 9 months: line (132 – line 142) – (line 020 + line 040 – line 050) If the value comes with a minus sign (overpayment), it must be entered in line 080 |

| 100 | The amount of tax payable to the budget for the year, taking into account previously paid advance payments: (line 133 – line 143) – (line 020+line 040-line 050 + line 070 – line 080) If the value turned out to be positive, it is entered in line 110. Please note that the organization can return the amount of overpayment on line 110 to the account or offset it against future payments |

Section 2.1.1

| Column/Row | Note |

| 102 | Organizations always indicate code “1”, since they have at least one employee to whom insurance premiums are paid - the general director |

| 110 | The amount of income received for the 1st quarter, excluding insurance premiums |

| 111 | Cumulative income for the half year (1st quarter + 2nd quarter) |

| 112 | Income for 9 months from the beginning of the year |

| 113 | The total amount of income received for the year |

| 120-123 | The tax rate (if preferential is not applied) is indicated in the format: 6.0 |

| 130 | Advance amount payable for the 1st quarter, excluding insurance premiums: line 110: 6% |

| 131 | Advance amount payable for half a year: page 111: 6% |

| 132 | Advance amount payable for 9 months: page 112: 6% |

| 133 | Tax amount at the end of the year: page 113: 6% |

| 140 | The indicated lines reflect the amount of insurance premiums paid on an accrual basis. Please note that the value for these lines will be calculated using the formula: p. 140 = p. 130:2 p. 141 = p. 131:2 p. 142 = page 132:2 pages. 143 = page 133:2 |

| 141 | |

| 142 | |

| 143 |

How entrepreneurs can reduce personal income tax payable

Subjects that are subject to the general taxation system and have the right to reduce tax payments through trade fees include not only organizations, but also individual entrepreneurs. Entrepreneurs have the right to offset the paid contribution against the amount of accrued personal income tax for the tax period (clause 5 of Article 225 of the Tax Code of the Russian Federation).

However, if a taxpayer is registered in one region, but pays a trade tax at the place of business in another territory, it will not be possible to reduce the final costs of transferring personal income tax. Individual entrepreneurs will also need to register as a trade tax payer by submitting a corresponding notification to the Federal Tax Service.

In the declaration in form 3-NDFL, approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11 / [email protected] (as amended on October 10, 2016), the trade tax, which reduces the amount of accrued income tax, will be shown on the line 091 section 2.

For the 3-NDFL declaration form, which contains a line to reflect the trade fee, see the article “New 3-NDFL tax return form.”

Who exactly is required to pay the fee?

This responsibility is imposed not only on individual entrepreneurs, but also on the heads of organizations. But only if they use permanently located objects in the trading floors, or without them.

Managers of retail markets are also recognized as payers of this tax. The rate is set separately for each of the objects, if trade is carried out in halls with an area of less than 50 square meters, or when there is no trading floor at all. At the same time, the bet itself has a strictly fixed value. But the basis for its determination is the area if trade is carried out on an area of more than 50 square meters, in markets.

The sales tax depends not only on the size of the premises where the activity is carried out, but also on the district of Moscow where the facility is located. In this case, the payment is made for a full quarter, even if the store opened only at the end of the reporting period. The amount of profit and loss received also does not have any impact on tax. The payer must receive as much income as possible so that paying the tax is not associated with serious losses in cash.

Therefore, when planning the construction or purchase of a particular commercial premises, for example, a warehouse for an online store, you should immediately plan the tax burden. All the rest of the work on the design and construction of warehouse premises can be undertaken by design and construction specialists. You can check out these offers and opportunities on their official website.

The maximum period for reporting and payment is 25 days after the end of the reporting period.

Reduction of tax under the simplified tax system by the amount of trade tax

A number of business entities have the right to reduce tax payments at the expense of previously paid trade tax. We are talking about individuals and legal entities who have chosen a simplified taxation system.

If entrepreneurs work on a simplified basis and take into account only income as an object of taxation, then the tax (advance payment) under the simplified tax system can be reduced by the amount of the fee paid (clause 8 of Article 346.21 of the Tax Code of the Russian Federation). This requires that the actual payment of the levy be made in the same accounting period in which the tax is assessed. The taxpayer himself must be registered in the region where the trade tax applies.

When calculating the final tax according to the simplified tax system, there is no limit of 50% for reducing the amount due to the fee (clause 8 of article 346.21 of the Tax Code of the Russian Federation).

The opinion of officials on this matter is reflected in the material “Trade tax can reduce the “simplified” tax by more than half .

Simplified taxation with the object of taxation “income minus expenses” takes into account the listed trade fee in the costs that reduce the tax base (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

For other expenses that can be legally taken into account under this taxation object of the simplified tax system, read the article “List of expenses under the simplified tax system “income minus expenses”” .

In a simplified declaration, only taxpayers who have chosen “income” as the object of taxation need to reflect the trade tax in specially designated lines. To reflect this fee, they use lines 150–153 and 160–163 in section 2.1.2 of the simplified taxation system declaration, approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

Tax return under the simplified tax system for 2021 | Sample filling and new form

In 2021, the same form of declaration under the simplified tax system continues to be used, according to which they reported in the previous year (bar code of the title page 0301 2017), as in the previous year. In this article we will look at a sample of filling out a declaration under the simplified tax system for 2021 (form KND 1152017).

Declaration under the simplified tax system for 2021

Declaration form

The tax return form under the simplified tax system, effective in 2021, was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

The tax return for the tax paid in connection with the application of the simplified taxation system is the only tax reporting that simplified tax payers submit.

At the same time, despite the different objects of taxation (Income or Income minus expenses), the annual reports are submitted the same, only the sheets are filled out differently.

USN IncomeUSN Income minus expenses

| — Title page— Section 1.1— Section 2.1.1— Section 2.1.2, if the taxpayer pays a trade tax (so far only in Moscow)— Section 3, if the targeted funds specified in paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation are received | — Title page— Section 1.2— Section 2.2— Section 3, if the targeted funds specified in paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation are received |

The tax return form under the simplified tax system for 2021 differs from the previous form by a different barcode on the title page (0301 2017 instead of 0301 0013) and new fields for entering data on payment of the trade tax.

Download the free form to fill out in pdf format

Please note: if you fill out a declaration for the simplified taxation system using an invalid form, the reporting will be considered not submitted! For such a violation, the tax inspectorate will not only impose a fine, but may also block the current account of an individual entrepreneur or LLC.

Deadlines for submitting reports

All simplifiers must report for activities under preferential treatment in 2021 and pay tax at the end of the year within the following deadlines:

- organizations - no later than March 31, 2021, but this year, due to this date falling on a weekend, the deadline for submission is postponed to the next working day, i.e. as of April 2, 2018;

- individual entrepreneurs – no later than April 30, 2018.

Those taxpayers who did not conduct any real activities must also report within these deadlines; reporting in this case will be zero.

|

If during 2021 an organization or individual entrepreneur voluntarily ceases to operate on the simplified tax system, then in addition to reporting for 2021, it is necessary to submit a declaration for the time worked. The deadline for delivery in this case is no later than the 25th day of the next month after the termination of activity.

If the right to a simplified regime is lost due to non-compliance with the requirements (the number of employees or the income limit has been exceeded, an unauthorized line of business has been started, a branch has been opened, the share of a legal entity participant in the company has increased, etc.), the declaration must be submitted no later than the 25th day of the month, following the quarter of loss of the right to the simplified tax system.

General filling rules

The procedure for filling out the declaration is established by Appendix No. 3 to Order N ММВ-7-3/ [email protected] These are mandatory requirements that must be followed, otherwise the report will be refused. Among them:

- The text fields of the form are filled with capital printed characters;

- All values of cost indicators are indicated in full rubles according to rounding rules;

- Each field contains only one indicator, except for the date and tax rate. To indicate the date, three fields are used in order: day (two familiar places), month (two familiar places) and year (four familiar places), separated by “.” For the tax rate indicator, two fields are used, separated by a “.”;

- When manually filling out a field with a missing indicator, a dash is entered;

- The data is entered in black, purple or blue ink;

- Correction of errors, blots, and deletions is not allowed;

- Only one-sided printing of the document is allowed;

- Pages must not be stapled or stapled;

- The pages are numbered consecutively, starting from the title page; only completed pages are numbered;

- If you use a computer, this makes it easier to fill out the reports, but it must be taken into account that only Courier New font with a height of 16 - 18 points is allowed. Numerical indicators in this case are aligned to the last right familiarity; dashes in empty cells are optional.

The necessary codes (tax period, place of presentation, forms of reorganization, method of presentation, property received as part of targeted financing) are indicated in the text of the Appendix. If in your case the codes do not correspond to our filling example, then they must be selected from the original source.

Example of filling out a declaration

Let's look at an example of how a declaration of an individual entrepreneur on the simplified tax system is formed in 2018, which operated without employees. We will indicate the data for individual entrepreneurs without employees in the table in rubles on an accrual basis, as required by the filling instructions. It is necessary to calculate the amount of tax paid in connection with the application of the simplified tax system.

PeriodIncome for the period on a cumulative basisCalculated advance payment (tax)Paid insurance premiums

| First quarter | 159658 | 9579 | 9579 |

| Half year | 373783 | 22427 | 22427 |

| Nine month | 595673 | 35740 | 26077 |

| Calendar year | 823154 | 49389 | 27990 |

For individual entrepreneurs without employees, it is possible to reduce the calculated advance payment in full by the entire amount of contributions, which the entrepreneur took advantage of. As can be seen from the table, for the first quarter and for the first half of the year, advance payments were completely reduced by the amount of contributions paid.

Based on the results of nine months, i.e. in the period from October 1 to October 25, the entrepreneur paid another 3,650 rubles in insurance premiums. Since the advance payment turned out to be more than this amount, an additional 9,663 rubles were paid.

In December, the remaining part of the fixed contributions was paid in the amount of 1913 rubles.

Based on the results of 2021, an additional tax of 11,736 rubles must be paid, and the entrepreneur decided to pay an additional 1% contribution on income over 300,000 rubles by July 1, 2018.

Entrepreneurs with employees, as well as organizations using the simplified tax system Income can also reduce calculated advance payments and the tax itself by the amount of contributions paid for individual entrepreneurs and for employees, but the tax payment can only be reduced to 50%. So, the individual entrepreneur from our example, if he had employees, would not be able to completely reduce advance payments through contributions, so the declaration would reflect other figures.

For payers of the simplified tax system Income minus expenses, the use of benefits in the form of a reduction in the calculated tax itself is not allowed. In this taxation option, all insurance premiums (for employees and individual entrepreneurs for themselves) are taken into account in expenses, i.e. reduce the tax base.

Below are free files that you can download for review.

Source: https://www.regberry.ru/nalogooblozhenie/novaya-forma-nalogovoy-deklaracii-po-usn

Results

The trade tax is currently only valid in Moscow.

In other regions, a corresponding decision by local authorities has not been made. Entities engaged in trading activities subject to the tax are required to register as tax payers with the Federal Tax Service. In the future, there is no need to report for completed transactions. Timely paid trade fees are taken into account when preparing tax reports for profits, personal income tax or simplified taxation system to reduce tax liabilities. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Step-by-step instruction

On October 01, the Organization registered its own retail outlet - the Edelweiss Retail Store - with the Federal Tax Service at the location of the organization (Moscow). The retail outlet is located in a common building. The sales area is 25 square meters. m. Tax benefit provided for in paragraph 3 of Art. 410 of the Tax Code of the Russian Federation, does not apply.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Registration of a retail outlet | |||||||

| — | — | Registration of a retail outlet | Directory Retail outlets | ||||

| Calculation of trade fee | |||||||

| March 31 | 44.01 | 68.13 | 30 000 | Calculation of trade fee | Closing the month - Calculation of trading fee | ||

| Payment of trade tax | |||||||

| 20 April | 68.13 | 51 | 30 000 | Payment of trade tax | Debiting from a current account – Tax payment | ||

| Income tax calculation | |||||||

| 30 June | 44.01 | 68.13 | -30 000 | Reversing the amount of accrued trading fee | Closing the month - Income tax calculation | ||

| 90.07.1 | 44.01 | -30 000 | Reversal of expenses by the amount of the recorded trade fee | ||||

| 99.01.1 | 90.09 | -30 000 | Recalculation of the financial result of the trading fee accrual period | ||||

| 68.04.1 | 68.13 | 30 000 | Reduction of income tax calculated to the regional budget by the amount of trade tax | ||||

| 99.01.1 | 68.04.1 | 35 599 | Calculation of income tax to the federal budget | ||||

| 99.01.1 | 68.04.1 | 190 392 | Calculation of income tax to the regional budget | ||||

Registration of a retail outlet

Registration of a new outlet, as well as making legal changes to an existing outlet, are made in the directory Retail outlets in the section Directories - Taxes - Trade fee - Retail outlets.

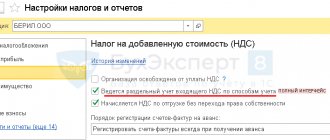

The trade tax is provided for in cities of federal significance (Moscow, St. Petersburg and Sevastopol) and is established by the law of the constituent entity of the Russian Federation (Article 411 of the Tax Code of the Russian Federation). As of 2021, the trade tax has been introduced only in Moscow (Moscow Law of December 17, 2014 N 62).

Please pay attention to filling out the fields:

- Outlet type - Store .

- Date of registration - the date of occurrence of the object of taxation (date of commencement of trading activities).

- Address - the address of the location of the retail outlet.

- The area of the sales area is 25 sq. m.

- Registration - At the location of the organization , since in this case the Federal Tax Service Inspectorate at the location of the retail outlet corresponds to the Federal Tax Service Inspectorate at the location of the organization.

- Trading fee for the quarter - 30,000 rubles, the amount of the trading fee payable for the quarter is calculated automatically.

Find out more about Registration of a taxable object