According to the legislation of the Russian Federation, repayment of a loan issued not in money, but in things, can only be carried out in things. It is unacceptable to include in the contract a clause about the possibility of repaying this type of loan with money. If a loan agreement is concluded with the participation of a legal entity, it includes a clause on the possibility of repaying the debt with money, then such a transaction will certainly raise questions from inspectors and tax authorities. Taxpayer organizations that use OSNO should be especially attentive to transactions on commodity loans with individuals. With large amounts, there is a high probability of spending a lot on taxes.

If a goods loan agreement is concluded between an individual and a legal entity, then the individual receives income from the provision of materials, while receiving a certain benefit, and the organization continues to operate and produce its products. Thus, all parties to the commodity loan agreement get what they want. Therefore, organizations should think through in advance all the tax problems that await them in the future, since a commodity loan agreement has a certain accounting feature and when the goods are returned, their actual sale occurs.

In tax accounting, the return of an in-kind loan for legal entities - borrowers will look like the sale of goods. Accordingly, you will have to pay the necessary taxes on this amount. A commodity loan is popular from the company founder if he can provide it. A commodity loan also has disadvantages, the most striking of which is the rather inconvenient return of goods. After all, in essence, a commodity loan is repaid in the same goods as interest, and it will be impossible to do this with money, except to purchase with its help the material necessary for repayment. A commodity loan will be an excellent way for both legal entities and individuals to obtain materials or goods necessary for life or activity. At the same time, absolutely any people and companies can enter into contracts. The loan is both taken and given in kind, but it must be taken into account that the characteristics and condition of the returned goods must be the same as at the time of receipt. And in case of tax calculations, it is necessary to follow IFRS.

Differences between a trade loan agreement and a loan in kind: the moment the agreement comes into force (loan - transfer of property, credit - day of signing), the loan is interest-free by default, the loan is only provided that this is stated in the agreement. From a tax and accounting point of view, an interest-free loan and a commodity loan are identical. Trade credit is an agreement under which one party (the creditor) transfers into ownership the other party (the borrower) things defined by generic characteristics.

What is a commodity loan?

Standard loans are usually taken out to purchase any goods or material assets. However, instead of money, the entrepreneur can immediately take these goods/things. In this case, there is an obligation to return them. Typically, an agreement on such loans is concluded between two legal entities.

Commodity loan agreement: what affects taxes and accounting for the borrower ?

The transfer of things, not money, is the main characteristic of commodity loans. Other nuances are determined by the specific agreement:

- The presence or absence of interest.

- The obligation to return the same asset or similar thing.

Commodity loans are a special form of lending. Drawing up an agreement on such a loan requires compliance with a number of rules.

How is the lender's accounting done when the borrower repays a commodity loan ?

Personal income tax for an individual (lender)

In accordance with Art. 209 of the Tax Code of the Russian Federation, the object of taxation for personal income tax is income received by taxpayers:

- from sources in the Russian Federation and (or) from sources outside the Russian Federation - for individuals who are tax residents of the Russian Federation;

- from sources in the Russian Federation - for individuals who are not tax residents of the Russian Federation.

In connection with the transfer of funds under an interest-free loan agreement, as well as in connection with their return (letter of the Federal Tax Service of Russia for Moscow dated September 30, 2009 No. 20-14/3/101546), an individual (employee, founder) does not receives economic benefits within the meaning of paragraph 1 of Art. 41 of the Tax Code of the Russian Federation, accordingly, he does not have income subject to personal income tax. Economic benefit (income), subject to personal income tax, arises from the lender - an individual in the event that the borrower returns an amount of money exceeding the loan amount received by him (for example, letters of the Ministry of Finance of Russia dated April 29, 2016 No. 03-04-05/25264, dated 02/15/2016 No. 03-04-05/8113).

Read more

Legislative justification

Obtaining commodity loans is regulated by Chapter 42 of the Civil Code of the Russian Federation. Article 807 of the Code states that in case of commodity (non-monetary) loans, a person is provided with a certain item. He is obliged to return an item with similar generic characteristics. The latter refers to these characteristics:

- Volume of production.

- Quality.

- Type of packaging.

- Width of assortment, etc.

When describing the objects provided, you can use the standard rules that are relevant when concluding a purchase and sale agreement.

What does it mean to borrow goods?

Nowadays, people cannot do without loans or various loans. Enterprises use lending to grow their business, and civilians use money to buy expensive things or solve material problems.

This type of lending is most widespread among enterprises.

In such a situation, the creditor can transfer items into ownership, which must be determined by generic characteristics. This type of loan is different in that it is possible to obtain the most preferential terms, since the supplier can act as a lender.

Documenting

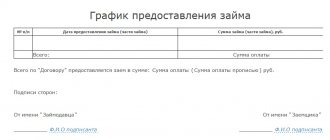

The main document that governs the receipt of a commodity loan is an agreement. When drawing up it, you need to take into account the nuances of the form of lending in question, as well as the rules for drawing up a purchase and sale agreement. Let's consider all the nuances of drawing up a contract:

- A clause is indicated on the right to transfer ownership of a thing from one legal entity to another.

- The provisions of a standard purchase and sale agreement are prescribed: type of asset, its characteristics, quantity.

- Additional items are indicated: availability of interest, loan repayment terms.

As a rule, the contract contains information about the real value of the transferred object.

FOR YOUR INFORMATION! The agreement is recognized as concluded from the date of transfer of the thing on the basis of Article 760 of the Civil Code of the Russian Federation. If an agreement is concluded between legal entities, it must be drawn up in writing (clause 1 of Article 761 of the Civil Code of the Russian Federation). The debtor must return the object within the time period specified in the agreement.

Nuances of a commodity loan agreement

On June 1, 2018, amendments to the Civil Code of the Russian Federation came into force, including those related to borrowing relations. These include changes to the definition of a loan agreement. Now a loan can be not only a real, but also a consensual transaction. So, according to paragraph 1 of Art. 807 of the Civil Code of the Russian Federation under a commodity loan agreement:

- one of the parties (the lender) transfers or undertakes to transfer to the other party (the borrower or the person specified by him) goods characterized by generic characteristics;

- the borrower undertakes to return similar items provided under the conditions specified in the contract.

Since this norm is dispositive, determining the nature of the contract depends on the discretion of the parties. An exception is made for a citizen lender. In this case, the loan agreement will always be real, that is, concluded from the moment the subject of the agreement is transferred to the borrower (paragraph 2, paragraph 1, article 807 of the Civil Code of the Russian Federation).

The application of the consensual construction to a loan agreement allows the parties to use the possibility of unilateral refusal to fulfill the agreement in whole or in part (clause 3 of Article 807 of the Civil Code of the Russian Federation).

The transaction can be either oral or written. A written form of a commodity loan agreement is provided when (Article 808 of the Civil Code of the Russian Federation):

- goods are loaned by a legal entity (individual entrepreneur);

- a transaction is made between citizens for the transfer of property worth more than 10,000 rubles.

As a general rule, a commodity loan agreement is assumed to be interest-free. If the parties want to enter into a paid transaction, this should be mentioned in the text of the document (clause 4 of Article 809 of the Civil Code of the Russian Federation).

Taxation

The item received and returned does not affect the calculation of income tax. Objects are not required to be included either in the structure of income (clause 1 of Article 251 of the Tax Code of the Russian Federation) or in the structure of expenses (clause 12 of Article 270 of the Tax Code of the Russian Federation). Commodity loans sometimes involve interest charges. In this case, the accumulated interest is included in the structure of non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation). However, it is necessary to take into account the restrictions listed in Article 269 of the Tax Code of the Russian Federation. If you receive an interest-free loan, no income is generated from the lack of interest.

The actual value of the item received and returned may vary. How to take into account the difference when determining income tax? There is no clear explanation in the law on this matter. The term “amount differences” is in Chapter 25 of the Tax Code of the Russian Federation, but it does not apply to the lending operations under consideration.

When determining income tax on a commodity loan, the difference is not taken into account. This is explained by the fact that a loan in kind does not need to be included in the structure of income (clause 1 of Article 251 of the Tax Code of the Russian Federation) and the structure of expenses (clause 12 of Article 270 of the Tax Code of the Russian Federation).

The issuance and receipt of commodity loans is subject to VAT. Can it be taken as a deduction? Not long ago, paragraph 4 of Article 168 of the Tax Code of the Russian Federation appeared, according to which VAT will be deductible on standard grounds.

Let's look at the transactions that allow you to take VAT into account:

- DT10 KT66, 67. Obtaining a commodity loan.

- DT19 KT66, 67. Allocation of VAT on assets received.

- DT68 KT19. Acceptance of VAT deduction.

VAT will also be charged on interest. However, this only applies to those interests whose amount exceeds the limit. The latter is determined by the Central Bank refinancing rate (subparagraph 3, paragraph 1, Article 162 of the Tax Code of the Russian Federation). The VAT rate is established by calculation method (clause 4 of Article 164 of the Tax Code of the Russian Federation).

The transfer of things and their shipment to repay the loan do not constitute expenses on the basis of paragraph 12 of Article 270 of the Tax Code of the Russian Federation. Only interest on the loan will be recorded in tax accounting.

Judicial practice on commodity loans

In practice, situations are possible when legal relations similar to borrowed ones develop between the parties. In such cases, judges indicate that a loan relationship arises only when one party transfers into the ownership of the second things characterized by generic characteristics, and the second party undertakes to return an equal or greater number of such things.

For example:

- An agreement obliging the borrower to transfer to the lender not the same homogeneous goods, but other things, is not recognized as a commodity loan. In this case, the relationship is qualified as a commodity exchange and is regulated by the rules on the barter agreement (decisions of the Court of Justice of the Republic of Bashkortostan dated May 18, 2016 in case No. A07-4584/2016, Court of the Kurgan Region dated November 21, 2016 in case No. A34-7331/2013).

- Often the parties, guided by paragraph 3 of Art. 421 of the Civil Code of the Russian Federation, enter into agreements that contain elements of various contracts, for example, combining delivery and trade credit. However, if the agreement does not contain an essential condition of the trade loan agreement, the court may recognize the transaction in terms of the conditions for payment of the trade loan as not concluded (see the decision of the Voronezh Region Court of January 25, 2018 in case No. A14-12595/2017).

- If the lender makes a demand to repay a commodity loan in money rather than in goods (an essential condition of the transaction), there is a possibility that it will be rejected by the court due to the use of an inappropriate method of protecting violated rights (decision of the Irkutsk Region Court of Justice dated July 25, 2011 in case No. A19-10681/2011 ). However, it is necessary to note the presence of an opposite opinion (see the resolution of the 4th AAS dated October 26, 2017 in case No. A58-2122/2017).

Accounting

The debtor must keep records of the loan on the basis of PBU 15/01 “Accounting for Loans”, established by Order of the Ministry of Finance No. 60n dated August 2, 2001. Calculations will be recorded on accounts 66 and 67. Debt is taken into account in the valuation of acquired assets (clause 3 of PBU 15/01).

The resulting assets must be capitalized at a value determined using the same algorithm that is used when valuing similar objects. However, an accountant can make his job easier. For the posting price, you can take the amount specified in the agreement. If no amounts appear in the contract, you can take the cost stated in the invoice.

The transfer of ownership rights to objects is considered a sale on the basis of paragraph 1 of Article 39. The operation is considered an object of taxation. In particular, it is subject to VAT.

Often, with a commodity loan, the debtor receives one item and returns another item with similar characteristics. In this case, the real value of the transferred assets may differ from the real value of the returned items. The difference that arises is attributed either to income or to expenses, depending on its positive or negative value. Differences are accounted for on the basis of PBU 18/02, approved by Order of the Ministry of Finance No. 114n dated November 19, 2002.

The lender must also take into account the commodity loans provided. Accounting is carried out on the basis of PBU 19/02, approved by the Ministry of Finance No. 126n dated December 10, 2002. Paragraph 3 of this act states that a trade loan will be considered a financial investment. The amount must be recorded in account 58. The loan is assessed based on the actual value of the transferred assets. After classifying things as financial investments, the cost of the objects is compared with their cost during regular sale without VAT. The resulting difference is attributed either to income or expenses.

Definition

Very often, a loan is needed specifically for the purchase of some goods. But you don’t have to borrow money to purchase them. You can also borrow the things themselves.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Banking institutions rarely issue commodity loans, trying to issue loans in money. After all, the law says that the borrower must repay the commodity loan to the lender in the same form in which he took it. This means that you need to give away similar items, in which almost everything must match - from color to size.

Most often, this type of loan is issued between legal entities. Such conditions are more favorable for organizations than for individuals, since the role of the lender is usually played by an organization that is interested in the development of the borrower enterprise.

Return of goods to the supplier of wiring upon registration

Let's look at a specific example. Veda LLC received 10 chairs from Tonus LLC at a price of 118 rubles. with VAT per piece. The entire batch turned out to be defective, and this was discovered only after the goods were recorded in the “Receipt of goods and services” document.

It is the return of goods, and not their sale, that is confirmed by the methodology for reflecting these operations in the accounting records of TD "Promstroy", that is, by the following entries: debit account 41 credit account 60 - reversal, debit account 41 credit account 42 - reversal, that is When returning goods, reversing entries were made.”

Postings for returning goods from the buyer

The difference between these procedures lies in one nuance, namely, whether the contract has been executed or not. Delivery of low-quality products is clearly a violation of the terms of the contract. This means that we are talking about a return. If they return a quality product, the situation is more complicated.

When carrying out trading activities, quite often there are situations when the buyer refuses the purchase and sale transaction and returns the goods. Let's consider how to reflect a return from a buyer in accounting, what accounting entries are generated when returning goods from a buyer.

Providing a loan: registration, taxation and accounting entries

- Personal income tax is calculated on the last day of each month throughout the loan term;

- Personal income tax is transferred to the budget no later than the next day after the next cash payment to the borrower (for cash payments) and on the day of payment (for non-cash payments).

The amount of natural borrowed resources is determined by the book value of assets that the enterprise has already transferred or will transfer (clause 10 of PBU 5/01). And here, too, you need to remember about VAT on the amount of assets transferred for use.

How to return the loan?

5 Directive of the Bank of Russia dated October 7, 2013 No. 3073-U). Therefore, if the founder is a citizen, the organization can accept any amount of cash from him as a loan.

When receiving or repaying a loan in cash, draw up an outgoing or incoming cash order (forms No. KO-2 and No. KO-1, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88).

Notification by the bank of the financial monitoring service

On receipt by the organization of a loan (credit) in non-cash form in the amount of at least 600,000 rubles. banks must notify the financial monitoring service. This happens in the following cases:

– if the organization received an interest-free loan;

– if one of the parties to the loan (credit) agreement is an organization or citizen that is registered, domiciled or located in a state (territory) that does not participate in international cooperation in the field of combating legalization (laundering) of proceeds from crime and financing terrorism;

– one of the parties to the loan (credit) agreement is the person who owns an account in a bank registered in the specified state (in the specified territory).

The list of such states (territories) is established by the Government of the Russian Federation.

This is stated in Article 6 of the Law of August 7, 2001 No. 115-FZ, letter of the Bank of Russia dated April 11, 2006 No. 12-1-3/804.

Repayment of loan (credit)

The organization is obliged to repay the received loan (credit) on time and in the manner prescribed by the agreement. If the repayment period is not established, the organization must repay the loan no later than 30 days after the lender (creditor) made such a demand.

An organization has the right to repay an interest-free loan (credit) early. Early repayment of interest-bearing loans (credits) is allowed only with the consent of the lender (creditor). This procedure is established by Article 810 and paragraph 2 of Article 819 of the Civil Code of the Russian Federation.

The loan can be returned in cash or by bank transfer (Clause 1, Article 810 of the Civil Code of the Russian Federation). A loan received in cash can only be repaid by bank transfer (clauses 2, 3 of Bank of Russia Regulations dated August 31, 1998 No. 54-P).

Issuance and repayment of a loan (credit) in cash

When receiving a loan or returning borrowed funds in cash, draw up an incoming or outgoing cash order (forms No. KO-2 and No. KO-1, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). Receipt of a loan (credit) in non-cash form can be confirmed by an extract from the organization’s current account. Repay the loan (credit) by non-cash method using a payment order in form No. 0401060.

Situation: is it necessary to use cash register when receiving and returning cash loans (credits), as well as when paying interest on them?

Answer: no, it is not necessary.

The use of cash registers is mandatory for cash payments for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003). When receiving (repaying) cash loans (credits), the sale of goods (work, services) does not occur (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of August 3, 2004 No. 3009/04). Therefore, neither when receiving a cash loan (credit), nor when returning it, nor when paying interest on the loan, do not use cash registers. The regulatory agencies also agree with this conclusion (letters from the Ministry of Finance of Russia dated May 10, 2011 No. 03-01-15/3-51 and the Federal Tax Service of Russia dated June 10, 2011 No. AS-4-2/9303).

Issuance and repayment of a loan (credit) in kind

In addition to money, the lender (creditor) can lend the organization property that belongs to him. In this case, the transaction is a loan in kind or a trade loan.

From an accounting perspective, there are no differences between a loan agreement in kind and a commodity loan agreement. There are only a few legal specifics.

For example, a loan agreement will come into force at the moment of transfer of things (clause 1 of Article 807 of the Civil Code of the Russian Federation). Trade loan agreement – on the day of signing (paragraph 1 of Article 822 of the Civil Code of the Russian Federation). This means that from the moment the trade credit agreement is signed, the employee will have the obligation to transfer the property specified in it to the organization.

Unlike a loan agreement, in a trade loan agreement it is necessary to more clearly indicate the characteristics of the transferred values (paragraph 2 of Article 822 of the Civil Code of the Russian Federation). In addition, a trade loan agreement is recognized as interest-free only if this is directly stated in its text (clause 1 of Article 819 of the Civil Code of the Russian Federation). A loan agreement in kind is such by default (clause 3 of Article 809 of the Civil Code of the Russian Federation).

The loan must be repaid in kind (commodity credit) with property - an equal amount of other things of the same kind and quality (clause 1 of Article 807, Article 822 of the Civil Code of the Russian Federation).

The transfer of goods under a trade credit agreement is a sale and is not included in the list of VAT-exempt transactions. The tax authorities insist on this. What if the trade credit is returned? It turns out that in this case the object of VAT taxation occurs again? Such transactions also raise questions when determining the income tax base.

Under a trade credit agreement, one party (the creditor) undertakes to provide the other party (the debtor) with things determined by generic characteristics. Moreover, the same rules apply to such an agreement as to a lending agreement. The requirements established for the purchase and sale agreement also apply to them. In turn, the rules provided for the loan agreement apply to relations under the loan agreement. That is, in the general case, the debtor is obliged to return an equal number of things of the same kind and quality, as well as pay interest. This follows from the provisions of Art. 822, paragraphs 1 and 2 of Art. 819, paragraph 1 of Art. 807 and art. 809 of the Civil Code. But most importantly, by virtue of the provisions of Art. 807 of the Civil Code, under a loan agreement, one party (the lender) transfers money and other things into the ownership of the other party. At the same time, according to paragraph 1 of Art. 39 of the Tax Code for tax purposes, sales are transactions related to the transfer of ownership of goods (work, services). And if you consider that in accordance with Art. 146 of the Tax Code, transactions involving the sale of goods (work, services) on the territory of the Russian Federation are recognized as subject to VAT, then the transfer of goods under a trade credit agreement automatically falls into the VAT base. But due to the specified norms of the Civil Code, the trade loan will eventually need to be returned. And, accordingly, again according to Art. 146 of the Tax Code, will there be an object of VAT taxation? That is, in fact, the product, simply returning to the lender, “passes” twice through the VAT base. Are there any signs of double taxation here?

Double “standards” for VAT

This was dealt with by the Supreme Court of the Russian Federation in its Ruling dated March 13, 2015 No. 303-KG14-3334. The judges considered the following situation. A trade loan agreement was concluded between a certain entrepreneur (borrower) and a citizen of the People's Republic of China (lender). According to this agreement, the creditor transfers 724 tons of soybeans to the merchant, and the merchant undertakes to return it in the same quantity. In pursuance of the contract, the individual entrepreneur received the specified quantity of goods in June 2012, and returned them in November of the same year. Both of these operations were confirmed by soybean acceptance and transfer acts, but... The return of the trade credit was not reflected in the businessman’s tax records. The entrepreneur insisted that the transfer of ownership of goods under a trade credit agreement is repayable in nature, and therefore the cost of the goods should not be included again in the VAT base. However, neither tax authorities nor judges shared this approach. The judges indicated that in accordance with paragraph 3 of Art. 38 of the Tax Code, a product for tax purposes is any property that is sold or intended for sale. And according to Art. 39 of the Code, the sale of goods is the transfer of ownership of goods to another person on a paid and gratuitous basis. The return of goods to the creditor under a trade credit agreement entails the transfer of ownership of the goods to the creditor (Article 822, paragraph 2 of Article 819, paragraph 1 of Article 807 of the Civil Code). This means that in this case there is implementation (Article 39 of the Tax Code). And this, in turn, is recognized as subject to VAT (Article 146 of the Tax Code). The arbitrators noted that transactions that are not subject to taxation, as well as those exempt from VAT, are defined in clause 2 of Art. 146, art. 149 of the Tax Code. However, alas, the return of goods to the creditor under a trade credit agreement is not mentioned in these standards. The judges also emphasized that in this case there is no double taxation. The rationale for this is simple - the transfer of goods when issuing a trade loan and its return are different sales operations. And taxation of each of them is carried out according to the rules established by paragraph 2 of Art. 154 Tax Code.

"Profitable" problems

And now regarding the procedure for determining the income tax base. In this part, everything is quite clearly regulated. By and large, two situations are possible here: - the agreement provides for the payment of interest; - the cost of purchased goods to be returned to the creditor exceeded the cost of goods received under the contract. And, by the way, such differences are now far from uncommon, since prices for goods, work, and services can change... almost several times a day. In the future, of course, the situation should normalize, but... The Ministry of Finance of Russia, in Letter dated February 13, 2007 N 03-03-06/1/82, indicated that for profit tax purposes, a trade loan is a debt obligation. And, accordingly, in this case all the provisions of Chapter. 25 of the Code, regulating the specifics of taxation of transactions related to a loan agreement. So, first of all, it is necessary to take into account the provisions of paragraph 12 of Art. 270 Tax Code. This norm establishes that when determining the tax base, expenses in the form of funds or other property that are transferred under credit or loan agreements (other similar funds or other property, regardless of the form of registration of borrowings, including debt securities), as well as in the form of funds, are not taken into account or other property that is used to repay such borrowings. In other words, no such “differences” can be taken into account for profit tax purposes. Moreover, this is true for both negative and positive differences. On the other hand, since there is a debt obligation, then when calculating the company’s income tax, nothing prevents you from taking into account the corresponding interest. The procedure for recognizing them is established by Art. 269 Tax Code.

Returning goods to the supplier: accounting entries

- DT76 KT90.1 -2.5 thousand rubles. – reversal of sales proceeds.

- DT90.2 KT41 – 2 thousand rubles. – reflects the purchase price of the goods.

- DT90.3 KT68 — 381.36 rub. – VAT included.

- DT76 KT50 — 2500 rub. – money was returned to the buyer.

- DT41 KT76 – 2021 rub. – the goods have been received.

- DT90.2 KT42 – 0.5 thousand rubles. – the trade markup has been restored.

The procedure for settlements under retail purchase and sale agreements is regulated by Ch. 30 Civil Code of the Russian Federation. Textiles, perfumes, jewelry, etc. cannot be returned. In other cases, the seller cannot refuse to accept the sold items. Let's take a closer look at how the return of goods is processed.

Commodity loan between legal entities

The most active use of commodity loans in economic activity is wholesale and retail trade enterprises and companies with a seasonal type of work, which include agricultural and construction companies. They have the opportunity, in the absence of funds, to obtain the necessary goods, materials, fuel, and raw materials. All this can be sold or used in the production process, and later pay off with the creditor with a batch of similar goods.

Manufacturing and repair enterprises are increasingly drawing up agreements to borrow raw materials or fuel. Typically, such goods are urgently required for the manufacture of finished products or for repair work if the supplier for some reason missed delivery deadlines. Such transactions are often conducted between affiliated counterparties operating in the same industry.

In order to optimize costs and reduce the amount of tax payments from agreements on commodity loans, it is important that the parties to the agreement are on the same taxation system. In tax accounting, the return of a loan in goods looks like the sale of goods. This may be a general, simplified or patent system, a single agricultural tax system, or a single tax system on imputed income. In any case, the cost of paying taxes will be minimized or reduced to zero.

Important! An agreement on a commodity loan must be drawn up in writing and countersigned by official representatives of the parties.

More often, loans between legal entities are interest-free. Sometimes the lender demands remuneration for the use of borrowed materials, raw materials or goods. This is discussed by the parties at the initial stage of the transaction. Interest is always paid in cash, and payment methods are selected taking into account the preferences of the lender:

- payment at the end of the contract;

- monthly payment in equal installments according to the established schedule;

- payment of the entire amount after a specified time upon expiration of the contract.

If the text of the agreement does not contain information on the procedure for paying interest, the borrower is obliged to transfer them to the lender on a monthly basis.

Loan repayment

According to the current legislation, the repayment of a commodity loan occurs exclusively in similar goods. This position cannot be disputed. Materials, raw materials, fuel, goods must be returned to the lender not only in similar volumes, but also with identical quality and technical characteristics.

Adding a clause to the content of the contract about the possibility of returning not in items, but in money in an equivalent amount, violates the current law. The regulatory authorities will not ignore this fact; the company faces many unscheduled inspections.

The loan was returned with goods, what should I do?

Moreover, from January 1, 2015, this norm is in effect in an updated version. In general, the legislator abolished the rationing of interest to account for interest in income (expenses). These are now recognized based on the actual rate. Exceptions to this rule include cases where the debt obligation arose as a result of controlled transactions. In such situations, income (expense) is recognized as interest calculated on the basis of the actual rate, taking into account the provisions of Section. V.1 of the Code on Controlled Transactions or subject to falling within the intervals that are defined in the same article for debt obligations, depending on the currency in which they are issued.

If you do not find the information you need on this page, try using the site search: