When was the BCC for insurance premiums last updated?

Since 2021, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities.

As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs. The presence of a situation where, after 2021, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2021, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2021 and for periods after January 2021. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

From January 2021, BCC values were determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2021 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2021 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

However, from April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2021 BCC.

In 2021, the list of BCCs is determined by a new order of the Ministry of Finance dated November 29, 2019 No. 207n, but it has not changed the BCC for contributions. Find out which BCCs have changed here.

Thus, the last update of the BCC on insurance premiums took place on April 14, 2019. Nothing else has changed yet, and these same BCCs will be in effect in 2021 (Order of the Ministry of Finance dated 06/08/2020 No. 99n).

What BCCs for FFOMS contributions are established in 2021–2021

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using BCC 18210202103081013160 (if related to the period from 2021) and BCC 18210202103081011160 (if related to the period until 2021).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2021) and KBK 18210202101081011160 (for accruals made before 2021).

What BCCs for insurance premiums are established for the Social Insurance Fund in 2021–2021

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

KBK 18210202140060000160

How is KBK 18210202140060000160 deciphered in 2021? What tax payment is hidden behind this decoding. The procedure for applying this budget classification code.

Legal entities and individuals regularly encounter budget classification codes, abbreviated KBK, when it is necessary to make a particular payment to the budget. These may be taxes, contributions, duties, interest on them, as well as fines, penalties, surcharges and other payments.

As a rule, the tax code differs from the codes for penalties and fines by only two digits. In this regard, it is very convenient to use templates for a particular collection.

Such a template is KBK 18210202140060000160. It stands for a code for an individual entrepreneur without any employees, for transferring contributions to compulsory pension insurance for oneself at a fixed rate and other payments for this contribution.

Using the template is not difficult. The main thing to remember is that the variable part is 14-17 digits. By substituting the desired combination of numbers there, you can make any payment under the OPS.

For example, if an individual entrepreneur wants to contribute the amount of the contribution to the budget, the 14-17 category is converted into the number 1110. If we are talking about a penalty for the compulsory social security contribution - 2110, and if you need to pay a fine, then - 3010.

The main thing is not to mix it up, then the money will definitely reach the address.

KBK 18210202140061200160 in 2021 for individual entrepreneurs

The article covers the topic of KBK 18210202140061200160 for the payment of insurance premiums for compulsory pension insurance by individual entrepreneurs until 2021, as well as in 2021 and 2021. The text provides for individual entrepreneurs the decoding of KBK 18210202140061200160 for 2021.

Let's analyze what tax individual entrepreneurs will be able to pay under BCC 18210202140061200160 in 2021 and 2021, and what name of payment should be indicated.

In determining the scope of application in 2021 and 2021, KBK 18210202140061200160 will be helped by deciphering the code, which will tell you what tax and for what period the individual entrepreneur can pay under this KBK.

Other KBK from this category:

| 18210202140061100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of the payer’s income, not exceeding the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” for periods expired before January 1, 2021) |

| 18210202140061200160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of income of the payer received in excess of the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” for periods expired before January 1, 2021) |

| 18210202140062100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (penalties on the corresponding payment for billing periods expired before January 1, 2017) |

| 18210202140062200160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (interest on the corresponding payment for billing periods expired before January 1, 2017) |

| 18210202140063000160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods expired before January 1, 2021)”; |

| 18210202140061110160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones, for billing periods starting from January 1, 2017) |

| 18210202140062110160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (penalties on the corresponding payment for billing periods starting from January 1, 2017) |

| 18210202140062210160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (interest on the corresponding payment for billing periods starting from January 1, 2017) |

| 18210202140063010160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods starting from January 1, 2021)”; |

| 18210202150061000160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) |

| 18210202150062100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (penalties on the corresponding payment) |

| 18210202150062200160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (interest on the corresponding payment) |

| 18210202150063000160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| 18210910010061000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2010) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210910010062000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2010) (penalties and interest on the corresponding payment) |

| 18210910020061000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2010) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210910020062000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2010) (penalties and interest on the corresponding payment) |

| 18210202140061100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) for billing periods expired before January 1, 2021 ) |

| 18210202140061100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of the payer’s income, not exceeding the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” for periods expired before January 1, 2021) |

All about the budget classification code 18210202140060000160: what is this KBK

Budget classification code 18210202140060000160 is needed by entrepreneurs to pay contributions. Which ones - read in the article, here is a table of all contribution codes, sample documents, reference books and useful links.

Attention! Especially for accountants, we have prepared free guides that will help you correctly calculate and pay insurance premiums:

A practical guide to calculating insurance payments in 2019. All the nuances in one document. Free download Handbook on changes in the work of an accountant in 2021 Free download Memo on the payment of social benefits in 2021 Free download KBK Handbook 2019 All codes in one document. Download for free

As you know, entrepreneurs pay insurance premiums even if they do not have employees. Such payments for pension and health insurance contributions are called “fixed”. Entrepreneurs do not have to report fixed payments “for themselves” to the tax office. However, they are not exempt from reporting taxes under their tax regime.

In the Russian Federation, contributions for pension and health insurance must be transferred in non-cash form. To make such a non-cash tax payment, an entrepreneur needs to know its KBK - that is, the budget classification code containing all the information about the transfer that the bank needs to credit the amount for its intended purpose.

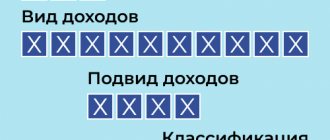

Any BCC consists of 20 digits, which are divided into semantic parts that reflect information about the state administrator of the payment, the type of transfer, its recipient, etc. The typical structure of the KBK is shown in the diagram below:

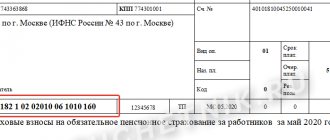

KBK encoding is mandatory for indication in a payment order when transferring obligatory payments to the budget.

>Useful documents

After reading the KBK 18210202140060000160, do not forget to look at the following documents, they will help in your work:

For which contributions are thresholds relevant?

The most frequently considered threshold value is the level of annual income of 300 thousand rubles, since when income reaches this mark, it becomes relevant for individual entrepreneurs to consider a new formula for calculating a fixed insurance contribution for pension insurance.

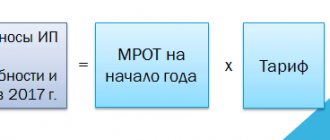

When the entrepreneur’s income does not reach the threshold amount or is equal to it, then the calculation of contributions is simple. The minimum wage is multiplied by the interest rate, and then by the number of workers for a given individual entrepreneur months.

If the individual entrepreneur has high income, then the contribution amount will increase accordingly. But how much depends on the income itself. Indeed, to determine the amount added to the standard formula, they do not use the entire amount of income, but the amount by which it exceeds 300 thousand.

So, if an individual entrepreneur has an income greater than 300 thousand, then to determine the amount of the contribution he will need the following indicators:

- The current minimum wage. For 2021 it is 7,500 rubles.

- Interest rate. For pension insurance it is 26%.

- Work time. This refers to the number of working months.

- The difference between the income received and the threshold amount.

- The rate is 1%. It is this that is used to determine the amount added to the standard contribution.

Payment procedure

So, when the amount of the contribution to be paid to the budget has been calculated, the entrepreneur should decide how he will pay this amount: once or in parts.

There is a certain deadline for paying standard fixed fees. It is one year from the beginning of the reporting annual period. That is, regular fixed contributions must be paid before December 31, 2021.

In the event that the threshold income value is exceeded, the fixed contribution from this amount has a different, final date for payment, which falls at the end of the first quarter of the new reporting period. Simply put, you must pay a fixed amount before April 1, 2021.

As for payment documents, the decoding KBK39210202140061200160 remains the same and means fixed insurance contributions for pension insurance at an increased level of income. The KBK, which is current for 2021, will be: 18210202140061200160. As you can see, only the structure of the code has changed here. But it must be noted that this code should be used to pay fees for the period until December 31, 2021. Contributions for subsequent periods will be made using a different BCC.

So, information for those who were looking for the transcript of KBK39210202140061200160 for 2021. This code is losing its relevance due to changes in the structure of legislation, or rather the transfer of insurance premiums under the management and control of the Federal Tax Service. In order to pay a fixed contribution for an amount of income over 300 thousand rubles for the period after December 31, 2021, in payment orders it is worth indicating KBK 39210202140061210160, which is relevant for the new year 2021.

Changes in the KBK for pension contributions of individual entrepreneurs for themselves from 04/23/2018

From 01/01/17, KBK 18210202140061200160 was cancelled, code 18210202140061210160 was approved instead, and from 04/23/18, the codes for all types of individual entrepreneur income were replaced by a single KBK, the decoding of which determines the purpose of the payment in the form of “Fixed contributions for the payment of an insurance pension”.

The table provides comparative information on the BCC for the transfer of contributions under compulsory pension insurance for individual entrepreneurs in the period before and after 04/23/18.

| Payment | KBK until April 23, 2018 | KBK from 04/23/18 |

| With an income of up to 300,000 rubles. | 182 1 0210 160 | 182 1 0210 160 |

| With an income of over 300,000 rubles. | 182 1 0210 160 |

KBK 18210202140060000160: what tax does it mean?

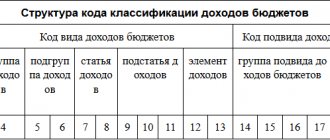

In accordance with the standard BCC scheme, if you divide the budget classification code 18210202140060000160 into semantic parts, you can understand what mandatory payment this code is intended for. For a transcript, see Table 1.

Table 1. KBK 18210202140060000160: what tax does it mean?

| KBK categories | Decoding | KBK 18210202140060000160 |

| From 1st to 3rd | Payment administrator | “182” - the payment is administered by the Federal Tax Service |

| From 4th to 6th | Group and subgroup of state budget revenues | “102” - budget revenues in the form of mandatory insurance contributions |

| From 12th to 13th | Where should the bank send the payment? | “06” - to the Pension Fund budget |

| From 14th to 17th | Payment type | “0000” - not defined, this could be the payment itself, a penalty or a fine on it |

| From 18th to 20th | State budget income or expenditure | “160” - admission to the extra-budgetary fund |

As can be seen from the table, KBK 18210202140060000160 is a template that can correspond to codes for paying mandatory insurance pension contributions, arrears on them, penalties, fines and debts on them. It all depends on what is indicated in the KBK categories from 14 to 17.

The numbers in categories from 7 to 11 determine that BCC 18210202140060000160 is used when transferring pension fixed contributions by entrepreneurs “for themselves.” The exact code for the entrepreneur’s contributions to the OPS is indicated in the payment orders given below. These samples can be downloaded.

Results

Insurance premiums intended for extra-budgetary funds are required to be paid by both individual entrepreneurs and legal entities. BCC for insurance premiums for 2021–2021 when making payments, you should use only current ones - this is an important factor in the timely recording of payment by its recipient.

Sources

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/kbk_po_strahovym_vznosam_tablica/

- https://NalogObzor.info/publ/kakoi-nalog-po-kbk-18210202140061200160-rassifrovka-2018-2019-dla-ip

- https://kbk1.ru/ip/18210202140061200160.php

- https://saldovka.com/nalogi-yur-lits/kodi-kbk/39210202140061200160.html