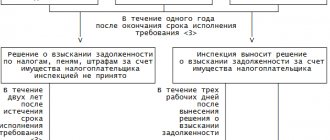

All tax payers often face the fact that the payment they transferred does not arrive as intended, due to the fact that the KBK code changes and the amount seems to hang in the air. This event is not very pleasant, since it provokes the loss of hard-earned funds, which, instead of repaying budgetary debts, create additional problems for the payer to return them, and this is not an easy process. What changes have overtaken KBK 39210202010061000160 in 2020, we will consider below.

List of new KBK from PF

Legal entities

CodeName KBK39210202010061000160insurance premiums39210202010062000160penalties39210202010063000160finesfor compulsory pension insurance, enrolled in the Pension Fund for payment of the insurance part of the labor pension39210202020061000160insurance premiums39210202020062000160penalties39210202020063000160fines

for compulsory pension insurance in the Russian Federation, enrolled in the Pension Fund for payment of the funded part of the labor pension39210202080061000160insurance premiums39210202080062000160penalties39210202080063000160fines

organizations using the labor of flight crew members of civil aviation aircraft to pay supplements to pensions39210202041061000160Additional contributions to the funded part of the labor pension and employer contributions in favor of insured persons paying additional insurance contributions II. IndividualsCodeName KBK 39210202030061000160insurance premiums39210202030062000160penalties39210202030063000160fines

in the form of a fixed payment, credited to the Pension Fund for payment of the insurance part of the labor pension39210202040061000160insurance premiums39210202040062000160penalties39210202040063000160fines

in the form of a fixed payment, credited to the Pension Fund for payment of the funded part of the labor pension39210202100061000160insurance premiums39210202100062000160penalties39210202100063000160fines

for compulsory pension insurance in the amount determined based on the cost of the insurance year for payment of the insurance part of the labor pension39210202110061000160insurance premiums39210202110062000160penalties39210202110063000160fines

for compulsory pension insurance in the amount determined based on the cost of the insurance year, penalties, fines for the payment of the funded part of the labor pension39210202041061000160Additional contributions to the funded part of the labor pension and employer contributions in favor of insured persons paying additional payments. insurance premiumsIII. Legal entities and individualsCodeName KBK 39210202100081000160insurance premiums39210202100082000160penalties39210202100083000160fines

for compulsory health insurance in the federal budget of the Compulsory Medical Insurance Fund39210202110091000160insurance premiums39210202110092000160penalties39210202110093000160fines

for compulsory health insurance, to the budgets of territorial compulsory health insurance fundsIV. Penalties, fines CodeName KBK 39211620010060000140Fines

for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation39211620050010000140Fines

, imposed by the Pension Fund of the Russian Federation and its territorial ones in accordance with Articles 48-51 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds”

SOCIAL INSURANCE FUND

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity | |

| 393 1 0200 160 | insurance premiums |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

| Contributions for compulsory social insurance against accidents at work and occupational diseases | |

| 393 1 0200 160 | insurance premiums |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

What is the code

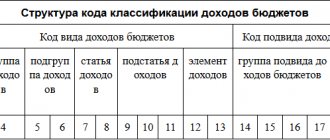

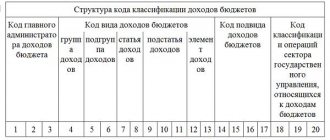

Such a code is not a simple set of numbers, since each part of it carries certain specific information, the gradual disclosure of which helps to determine not only the purpose of the payment in a general format, but even the level of its implementation in the state concept. Therefore, this encoding is very extensive and contains a lot of encrypted data.

KBK is used not only by entrepreneurs who make payments to the budget. This system is used by the Treasury itself for the purpose of correctly distributing funds that have been received, as well as carrying out statistical activities.

The code consists of four parts:

- Administrative

- Profitable

- Software

- Classifying

With their help, it is determined that the received amount belongs to a certain area of the budget, and then it is redirected to another area. For example, to finance certain industries, etc.

Pension Fund insurance premium rates

The branch of the Pension Fund of the Russian Federation informs about changes

c Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, coming into force

on January 1, 2021 in accordance with order of the Ministry of Finance of Russia dated June 8, 2015 No. 90n.

We draw your attention to the fact that for all BCCs for insurance premiums for compulsory pension insurance

(except for canceled KBK), the income subtype code “2000” (14-17 KBK categories) is excluded, instead of which two subtype codes are introduced:

2100 - penalties on the corresponding payment;

2200 - interest on the corresponding payment.

Excludes KBK 39210202010061000160 - insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for the payment of an insurance pension (recalculations, arrears and debt on the corresponding payment, including canceled ones).

Instead, KBK is introduced:

39210202010061100160 - insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for the payment of insurance pensions (paid at a rate within the established maximum base for calculating insurance contributions);

39210202010061200160 - insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for the payment of insurance pensions (paid at a rate above the established maximum base for calculating insurance contributions).

The list of KBK has been supplemented with a new budget classification code: 39210202103080000160 - insurance premiums for compulsory health insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (with the corresponding subtype codes).

Annex 1.

Where is the code used?

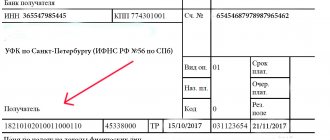

Individual entrepreneurs, as well as trustees who transfer payments on behalf of an organization, are faced with the concept of BCC when filling out payment orders, which always accompany the transfer of funds in various directions.

The fact is that the payment order contains field 140, reserved specifically for KBK, and without filling it out the payment cannot be made. Moreover, it is very important to correctly indicate the BCC, since no matter what is indicated in the description, the translation will be carried out precisely according to this detail.

An error in this field will cause the payment to not be credited in the correct direction, and the funds themselves that are to be transferred will have to be searched for a long time and returned. Bank employees do not have the obligation to provide valid BCCs, nor to check whether this field is filled out correctly, so responsibility for sending the payment lies entirely on the shoulders of the person who made it.

Insurance contributions for compulsory pension insurance

Budget classification codes for payment of insurance premiums since 2010

PENSION FUND

| I. Legal entities | |

| Code | Name of KBK |

| 39210202010061000160 | insurance premiums |

| 39210202010062000160 | penalties |

| 39210202010063000160 | fines for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 39210202020061000160 | insurance premiums |

| 39210202020062000160 | penalties |

| 39210202020063000160 | fines for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for payment of the funded part of the labor pension |

| 39210202080061000160 | insurance premiums |

| 39210202080062000160 | penalties |

| 39210202080063000160 | fines for organizations using the labor of flight crew members of civil aviation aircraft to pay supplements to pensions |

| 39210202041061000160 | Additional contributions to the funded part of the labor pension and employer contributions in favor of insured persons paying additional insurance contributions |

| II. Individuals | |

| Code | Name of KBK |

| 39210202030061000160 | insurance premiums |

| 39210202030062000160 | penalties |

| 39210202030063000160 | fines in the form of a fixed payment credited to the Pension Fund for payment of the insurance part of the labor pension |

| 39210202040061000160 | insurance premiums |

| 39210202040062000160 | penalties |

| 39210202040063000160 | fines in the form of a fixed payment credited to the Pension Fund for the payment of the funded part of the labor pension |

| 39210202100061000160 | insurance premiums |

| 39210202100062000160 | penalties |

| 39210202100063000160 | fines for compulsory pension insurance in the amount determined based on the cost of the insurance year for payment of the insurance part of the labor pension |

| 39210202110061000160 | insurance premiums |

| 39210202110062000160 | penalties |

| 39210202110063000160 | fines for compulsory pension insurance in the amount determined based on the cost of the insurance year, penalties, fines for the payment of the funded part of the labor pension |

| 39210202041061000160 | Additional contributions to the funded part of the labor pension and employer contributions in favor of insured persons paying additional payments. insurance premiums |

| III. Legal entities and individuals | |

| Code | Name of KBK |

| 39210202100081000160 | insurance premiums |

| 39210202100082000160 | penalties |

| 39210202100083000160 | fines for compulsory health insurance to the federal budget of the Compulsory Medical Insurance Fund |

| 39210202110091000160 | insurance premiums |

| 39210202110092000160 | penalties |

| 39210202110093000160 | fines for compulsory health insurance, to the budgets of territorial compulsory health insurance funds |

| IV. Penalties, fines | |

| Code | Name of KBK |

| 39211620010060000140 | Fines for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation |

| 39211620050010000140 | Fines imposed by the Pension Fund of the Russian Federation and its territorial ones in accordance with Articles 48-51 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” |

SOCIAL INSURANCE FUND

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity | |

| 393 1 0200 160 | insurance premiums |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

| Contributions for compulsory social insurance against accidents at work and occupational diseases | |

| 393 1 0200 160 | insurance premiums |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

Pension Fund insurance premium rates

The branch of the Pension Fund of the Russian Federation informs about changes

c Instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, coming into force

on January 1, 2021 in accordance with order of the Ministry of Finance of Russia dated June 8, 2015 No. 90n.

We draw your attention to the fact that for all BCCs for insurance premiums for compulsory pension insurance

(except for canceled KBK), the income subtype code “2000” (14-17 KBK categories) is excluded, instead of which two subtype codes are introduced:

2100 - penalties on the corresponding payment;

2200 - interest on the corresponding payment.

Excludes KBK 39210202010061000160 - insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for the payment of an insurance pension (recalculations, arrears and debt on the corresponding payment, including canceled ones).

Instead, KBK is introduced:

39210202010061100160 - insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for the payment of insurance pensions (paid at a rate within the established maximum base for calculating insurance contributions);

39210202010061200160 - insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for the payment of insurance pensions (paid at a rate above the established maximum base for calculating insurance contributions).

The list of KBK has been supplemented with a new budget classification code: 39210202103080000160 - insurance premiums for compulsory health insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (with the corresponding subtype codes).

Annex 1.