Who pays for what?

VAT stands for value added tax. Accrued upon the sale of goods, works, services to the buyer. Belongs to the group of indirect taxes. This means that the real payer is not the one who transfers money to the budget and fills out the declaration, but the end consumer of the product/work/service, i.e. you and me.

The last statement requires clarification. To do this, you need to understand the mechanism of VAT formation. A simple “producer-consumer” chain looks like this:

- Papa Carlo bought a log from Giuseppe to make a wooden doll. It cost 240 rubles. At the same time, 40 ₽ is the 20% VAT accrued by Giuseppe.

- Papa Carlo made a doll and sold it for 600 ₽, including 100 ₽ tax.

- Mom bought her daughter a toy for 600 rubles, paying dad Carlo including tax. She is the final VAT payer.

- Papa Carlo must transfer an amount of 60 rubles (100 – 40) to the budget.

The bottom line is that the state wants to receive 20% of the price of the product. In our case, my mother bought a doll for 600 ₽. This is the price (500 ₽) + 20% VAT (100 ₽). Then why did Papa Carlo pay the tax office only 60 rubles? The fact is that the remaining 40 rubles were already transferred to the state by Giuseppe.

Let's go through the chain again. Where will Papa Carlo get the money to transfer to the budget:

- his mother will pay him 100 ₽ when buying a doll;

- Papa Carlo will give 40 ₽ to Giuseppe;

- the remaining 60 ₽ will be transferred to the budget;

- in total, dad Carlo will pay 100 rubles (60 to the state and 40 to Giuseppe), which is exactly how much the girl’s mother gave him.

Value added tax is called indirect tax. Unlike a direct tax, it is financed by the final buyer (in our case, the girl’s mother), and the seller (in our case, Giuseppe and Carlo’s dad) transfers it. Excise taxes work on the same principle.

VAT came to us from France. It was invented by Maurice Lauret in the mid-20th century. In Russia it has been valid since January 1, 1992.

Now let’s turn to the official source, let’s look at who pays VAT and what it is charged on. The procedure for calculation and payment is defined in Chapter 21 of the Tax Code.

Payers:

- Enterprises and organizations of all forms of ownership, including non-profit ones.

- Individual entrepreneurs.

These two groups have one requirement in common - they must be on a common taxation system. But there is a third group, which includes payers regardless of the taxation system they use. They are required to pay tax when importing goods from abroad (import).

After reading, you will understand how to stop working for pennies at a job you don’t like and start LIVING truly freely and with pleasure!

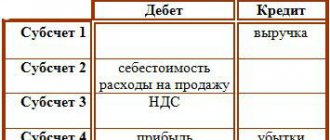

The objects of taxation are:

- sale of goods, works, services on the territory of the Russian Federation, including free of charge;

- import of goods;

- performing construction and installation work for one’s own needs;

- transfer of goods (performance of work, provision of services) for one’s own needs, the costs of which are not taken into account when calculating income tax.

Supply agreement vs agency agreement

A common option for calculating the minimum VAT can be considered the replacement of a standard contract for the supply of goods with an agency contract. As soon as the seller becomes an agent, the tax base will be calculated not from the sales amount, but from the amount of remuneration specified in the contract.

Remember: to prevent tax inspectors from reclassifying an agency agreement into a supply agreement and, accordingly, imposing significant penalties, special attention should be paid to the proper execution of documents attached to the agency agreement.

This scheme is most relevant if the partner (supplier) works according to the simplified tax system or another taxation method that does not provide for the allocation of VAT in invoices. Using an agency agreement, the supplier, called the principal, instructs the buyer (agent) to purchase and further sell a certain

batch of goods. For this service, the principal will be obliged to pay the agent a premium, which will become the object of VAT taxation.

To avoid tax complications, you need to protect yourself with the following documents:

- an order to the agent from the principal with a precise indication of the task for the purchase/sale of goods or provision of services;

- agent's report with attached papers confirming high-quality performance and expenses incurred;

- invoices for the purchase of entrusted goods and their shipment;

- documents for payment;

- other papers with a link to a specific agency agreement.

Keep in mind: if the agent’s actual expenses reimbursed by the principal exceeded the amount of remuneration, then they must be included in the VAT tax base.

Tax benefits

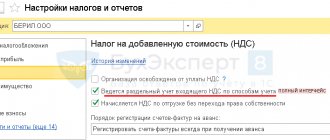

Since there are those who pay, it means that there are those who are exempt from this obligation. Benefits will be received by legal entities and individual entrepreneurs:

- whose revenue for the previous 3 months did not exceed a total of 2 million rubles (exemption is given for 1 year);

- that use special tax regimes (Unified Agricultural Tax, simplified tax system, patent system, UTII);

- received the status of participant in the Skolkovo project.

Article 149 of the Tax Code of the Russian Federation provides a detailed list of transactions that are not subject to VAT. Among them, for example, the implementation:

- medical and prosthetic and orthopedic products, technical means for the prevention and rehabilitation of disabled people, glasses, frames and lenses for vision correction;

- medical services (there are exceptions);

- care services for the elderly, disabled, and sick;

- services for maintaining children in kindergartens, classes in clubs, sections, etc.;

- transport services (with the exception of taxis, including minibuses);

- funeral services;

- coins made of precious metals.