The accounting system in agricultural organizations is regulated by a standard set of regulations. Among them:

- Law of December 6, 2011 No. 402-FZ, regulating the general rules and principles for the implementation of accounting operations;

- Chart of accounts from Order of the Ministry of Finance dated October 31, 2000 No. 94n, on the basis of which the working chart of accounts of the enterprise is developed and approved;

- a set of accounting provisions;

- Tax Code and other legislative acts.

How to take into account the received subsidies for agricultural development ?

Accounting in crop production. Cost accounting

The plant growing industry has its own specifics. The costs of obtaining products are incurred over a long period of time, and their reimbursement is associated with the timing of crop ripening. Accounting must reflect expenses for the current year's harvest and the future harvest separately. Accounting for expenses and receipt of crop products helps to solve the following main problems: increasing the gross harvest and increasing plant yields, increasing feed production. In the article we will look at how accounting is kept in crop production, costs are calculated for synthetic and analytical accounting.

Accounting tasks in agriculture

According to the laws of the Russian Federation, accounting at agricultural enterprises helps solve the following problems: (click to expand)

- Creation of a complete and true picture of the operation of the farm, the state of its property, and the accounting reports that users need.

- Compliance with the laws of the Russian Federation in the course of business management, use of property, material, monetary, labor funds and fulfillment of obligations in accordance with established standards.

- Preventing negative phenomena in production and in managing the organization’s financial resources.

- Identification and activation of internal reserves necessary for financial comfort.

- Assessment of the use of found reserves after the fact.

Administrative and managerial personnel perform the following functions at agricultural enterprises:

| Job title | Responsibilities |

| Supervisor | Compliance with laws; Organization of accounting service; Control over the operation of the enterprise. |

| Chief Accountant | Development of accounting policies; Accounting; Accounting management; Preparation and presentation of reports. |

Primary accounting in accounting

Accounting for costs, working and fixed assets, and production in the crop production sector is carried out using primary documentation. It is divided into accounting blocks:

- Labor costs and their payment: accounting and waybills by mode of transport, foremen’s books, orders for transactions, time sheets.

- Subjects of labor: acts of write-off of seed material, use of fertilizers, equipment, limit and intake cards. At the end of the month, the data from the listed documents is included in the inventory movement report, form MX-20a. (old form 265-APK)

- Instruments of labor: calculations of depreciation and statements of its distribution.

- Receipt of products: registers for sending goods from the field, accumulative statements of their receipt, acts of sorting, acceptance and transfer, movement, receipt of products and feed.

Registration of the movement of seeds with primary documents serves to correctly record their sowing. Accounting is designed to provide control over sowing rates. Before this, the chief agronomist develops a scheme for obtaining planting material from storage points to structural units.

Information from groups of papers is processed according to certain criteria in accordance with the approved document flow procedure for accounting objects, types of work and agricultural crops. Cumulative registers are used for this.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Documents for accounting

Accounting on farms is carried out according to the approved chart of accounts in accordance with primary documentation, inventory procedures, methods for assessing property and liabilities, document flow rules, technology for processing accounting data and the procedure for controlling business cycles.

The circulation of documents in the farm is carried out according to the approved schedule. It is compiled by the chief accountant and approved by the director. It contains information about the timing of preparation and submission of documents, the procedure for their processing, registration and grouping.

All accounting documentation can be divided into three main groups. (click to expand)

| Document group | Purpose |

| Primary | Movement of inventories, products, materials, etc. |

| Synthetic accounting registers | Accumulate data from primary documentation |

| main book | Groups data from accounting registers |

For convenience in work, the organization can independently approve the form of the primary document. Mainly approved forms are used. They exist for accounting sections:

- Agricultural products and raw materials;

- Wages (⊕ example of calculation and procedure for calculating wages with postings);

- Fixed assets (FPE), materials, intangible assets;

- Work in capital construction and motor transport;

- Construction equipment works;

- Inventory results;

- Cash register and trading operations.

Registers are books, cards, sheets of paper, machine documents. Their list is determined by the form of accounting in the economy. They use memorial or journal-order forms and use accounting automation tools.

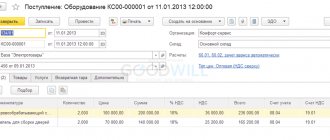

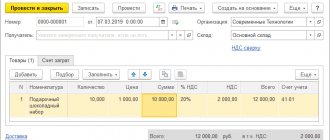

Today, most agricultural enterprises use computers for accounting, and order journals are also common. Data is entered into them from accumulation sheets, which are formed on the basis of primary documents.

Cost classification

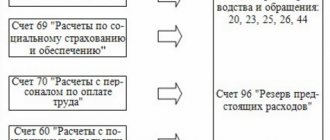

The grouping of production costs is presented in the form of a diagram.

Variable costs are direct costs. They are attributed to the cost of production of the sub-industry in which they arose. They change in proportion to the volume of production, therefore they are called proportional.

Conditional variables are assigned to certain products if it is known that the need for special equipment will be higher than their availability as a result of the expansion of production.

The profitability of an organization is shown by marginal income. It is equal to the amount of revenue minus proportional costs.

Synthetic accounting

For synthetic accounting, journal order No. 10-APK is used. It contains revs. 20.1 and summarizes the cost information. Values are entered into it from personal accounts, and numbers from it are entered into the General Ledger.

The results of analytical accounts for costs and product output for the month should be equal to the account turnover. 20.1 in f. 10-APK and the General Ledger.

In automated accounting, the registers are: account analysis, balance sheet and chess sheet.

Balances in the accounts for the production and sale of crop products at the end of the year are entered from the General Ledger into the accounting reporting forms.

Analytical accounting in crop production

Analytics of crop production costs has a characteristic difference. First, they are reflected by structural units: teams, workshops, departments, and then grouped by farm.

The objects of analytical cost accounting include:

- Types of crops with identical cultivation methods;

- Types of work in progress;

- Distribution costs;

- Others.

The main register of analytics is the production report of the division f. 83-APK. It includes the following sections: on costs (DT 20.1), on receipt of products (Kt 20.1), on turnover on the account loan. 20.1. It is opened for an annual period for each structural unit.

In section 1, each accounting object is entered in a separate column. The nomenclature of costs is indicated line by line. Costs are allocated according to corresponding accounts. Information is reflected in total and quantitative terms. Figures are recorded from work and cost journals, primary records and accumulation sheets.

Distributed costs are shown as negative values in the report because they correspond to a specific culture. These are the costs of soil irrigation, drainage, and unfinished production upon completion of the process.

To avoid accounting for identical costs twice, amounts with a minus sign are subtracted from the totals of the f. 83-APK horizontally and vertically.

Section 2 reflects the quantity and planned cost of products received during the month and since the beginning of the year. Here the costs of crop destruction are written off.

Section 3 contains monthly turnover according to Kt 20.1. They are entered into form 10-APK (→).

Data from f. 83-APK fall into a similar summary document for the enterprise. Each line and column contains an indicator summed up from all personal accounts of structural units.

Analytics of the production process is divided into harvest costs of adjacent years by type of work and crop.

Costs and products received are taken into account in the account. 20 by article:

- Salary and accruals;

- Seeds for planting;

- Fertilizers: organic and mineral;

- Pest control products;

- Maintenance of fixed assets;

- Works, services;

- Production management procedure;

- Loan transfers;

- Other.

According to Dt 20.1, they show the actual costs of receiving crop products and the balance of unfinished work at the beginning of the reporting interval, according to Kt 20.1 - its output at the planned cost, write-off of differences in calculations at the end of the year and damage from natural disasters.

Calculation difference

The harvest of crop products is received according to the planned cost of primary production and summary documentation.

Actual costs are calculated at the end of the year. To do this, they close costly accounts for auxiliary industries, general business and general production expenses, calculate expenses for dead plants, and distribute costs for land improvement.

Based on the results of the reporting period, 20.1 is closed by writing off the calculation difference.

The cost is calculated by type of crop per 1 c. main and secondary products.

By-products are not calculated. Its cost is determined by standards calculated based on the costs of cleaning, transportation, stacking and other work.

When determining the cost of output, the costs of minor items are deducted from the total costs of cultivation.

The calculation difference is written off as a reversal entry (the plan is greater than the actual) or an additional posting - in case of overspending (the actual is greater than the plan).

Example #2. Accounting and calculation of calculation differences

The annual costs of growing rye amounted to 2,538,700 rubles. 10,418 quintals were received from the harvest. full grain at a standard cost of 203 rubles per centner, as well as 6,040 centners of waste containing 25% of a full-fledged product at 58 rubles per centner and straw for 230,500 rubles.

Actual costs will be: RUB 2,308,200. (2,538,700 – 230,500);

The waste contains 1,510 centners of complete grain (6,040 * 25%);

Total whole grain: 11,928 c (10,418 + 1,510);

Cost 1 c. grains in fact: 212.84 rub. (2,538,700 / 11,928);

Cost 1 c. grain waste amounted to 66.14 rubles.

The calculation difference is determined:

for grain: 102,513.12 rub. ((212.84 – 203) * 10,418);

for grain waste: 49,165.60 rub. ((66.14 – 58) * 6,040).

The actual cost of both types of products is higher than planned, so the cost difference must be taken into account by additional posting:

Dt 10, 43 Kt 20.1 in the amount of 151,678.72 rubles. (102,513.12 + 49,165.60).

Answers to questions about accounting in crop production

Question No. 1. How to reflect the loss from the sale of seeds due to a fall in market prices for them?

Dt 99 Kt 90 - loss from sale taken into account;

Dt 84 Kt 99 - the loss is written off.

Question No. 2. How to calculate the labor productivity of a combine operator?

It is necessary to determine how much time the employee actually spent producing a unit of product. It is necessary to calculate how much area the combine operator removed and how much product he threshed from it. The data is taken from the primary data.

Productivity is analyzed based on days actually worked and production per day as a percentage of the norm.

Question No. 3. How to write off the costs of purchasing apple and pear seedlings?

The purchased plants are used to grow perennial fruit trees, so their cost is charged to the fixed assets account.

Question No. 4. What is the peculiarity of determining the cost of industrial crops?

The output of flax and cotton products occurs in stages. Its cost is calculated using the transfer method. Direct costs are accumulated not by type, but by product processing cycles (processing stages). They represent accounting objects.

Question No. 5. How to write off losses within the limits and in excess of the norms of natural loss?

Dt 20 Kt 94 - within limits;

Dt 91 Kt 94 - above the norm in the absence of the culprit.

So, based on the characteristics of the production cycle for obtaining crop products, accounting in this area is necessary to obtain information about costs for adjacent years, types of work, cost items, and business units.

Principles of accounting for the production and sale of agricultural products

Accounting for the production and sale of agricultural products is based on the following principles:

- conclusion of an agreement. In the absence of this clause, it will be impossible to hold the financially responsible person or any other person liable;

— selection of a method for accounting for production and sales of products that is more convenient in the operating conditions of a particular organization;

— write-off, disposal, and capitalization of products must be carried out according to a single assessment;

— filling out reports on the availability and movement of products by financially responsible persons must be carried out in a timely manner;

— carrying out inventories of actual product balances and comparing them with accounting data is carried out by the organization to ensure the safety of valuables;

— control over the actions of financially responsible persons through cross-reconciliation of documents. For example, all write-offs from the warehouses of an agricultural enterprise must coincide with the receipt of these values at points of sale.

Debit 90.2 Credit 43

Cost of sales. Finished products

- The write-off of finished products for sale is reflected; It is carried out, depending on the adopted accounting policy, at actual cost (see below for postings Option A) or planned/standard (see Options B and C).

Wiring diagrams:

Option A. If finished products are delivered to the GP warehouse at actual (production) cost

- Dt 20 Kt 02, 05, 10, 68, 69, 70, etc. – production costs are collected;

- Dt 43 Kt 20 – finished products are delivered to the finished products warehouse; Balance Dt 20 – products at the WIP stage.

- Dt 90.2 Kt 43 – write-off of finished products for sale, at actual cost;

- Dt 62 Kt 90.1 – invoice presented to the customer;

- Dt 90.3 Kt 68 – VAT

- Dt 90.9 Kt 99 – financial result.

Option B. If finished products are delivered to the GP warehouse at standard/planned cost. Scheme without using count 40

- Dt 20 Kt 02, 05, 10, 68, 69, 70, etc. – production costs are collected;

- Dt 43 Kt 20 - finished products are delivered to the finished products warehouse, where they are capitalized at the accounting (planned or standard) cost; Next, at the end of the month, a calculation is made of the deviations of the actual value from the accounting value and the corresponding amount is written off with an additional entry:

- Dt 43 Kt 20 - in case of overexpenditure, or the same entry in red reverse in case of savings. Balance Dt 20 – products at the WIP stage.

- Dt 90.2 Kt 43 – write-off of finished products for sale, at actual cost;

- Dt 62 Kt 90.1 – invoice presented to the customer;

- Dt 90.3 Kt 68 – VAT

- Dt 90.9 Kt 99 – financial result.

Option B. If finished products are delivered to the GP warehouse at standard/planned cost. Scheme using count 40

- Dt 20 Kt 02, 10, 69, 70... etc. – production costs are collected;

- Dt 40 Kt 20 – actual production costs are written off;

- Dt 43 Kt 40 – products are written off to the finished goods warehouse at standard/planned cost;

- Dt 62 Kt 90.1 – shipment (transfer) of products to the buyer;

- Dt 90.2 Kt 43 – write-off for sale at standard (accounting) value;

- Dt 90.2 Kt 40 - write-off of the amount of deviations attributable to the cost of products sold, in the case where the actual cost turned out to be higher than the standard cost; in the opposite case (when the actual cost is lower than the standard cost), this is reflected by reverse posting: Dt 40 Kt 90.2 or also Dt 90.2 Kt 40, but reversed in red.

Accounting in agriculture: general principles

For agricultural enterprises, all general principles and accounting rules in force in the Russian Federation are applicable. This:

- Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ;

- chart of accounts approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n;

- PBU complex;

- other regulatory documents governing accounting in the Russian Federation.

Features of reflecting agricultural operations in accounting are associated with their special characteristics:

- seasonality;

- long production cycles;

- a large share of turnover within the enterprise, etc.

Land as the main means of production in agriculture

Land holds a special place in agriculture. This is the main object of fixed assets and the main subject of labor application. At the same time, land has significant differences from other means of production:

- does not wear out or depreciate;

- when used correctly, it can improve its properties (for example, in terms of increasing fertility);

- is not a human-made object;

- the land plot cannot be manufactured, replaced, or moved.

All this leads to the peculiarities of land accounting:

- Land plots can be used by an enterprise on the right of ownership, use or lease. Accordingly, accounting should be conducted in such a way that analytics on this aspect are provided both on the balance sheet and on off-balance sheet accounts.

- When registering the land, it is valued:

- by purchase costs;

- the value of the property exchanged for the land plot (in case of exchange);

- market value on the date of capitalization (if received free of charge);

- agreement of the parties (with a contribution to the management company).

If none of the above methods are suitable, the land is valued at the standard price.

IMPORTANT! The definition of the standard price of land is given in Art. 25 of the Law of the Russian Federation “On Payment for Land” dated October 11, 1991 No. 1738-I. The standard price is a value that is determined based on the potential income from a specific land plot over the estimated payback period.

- Land analytics is provided in terms of at least:

- existing agricultural land (they, in turn, are divided by use: arable land, perennial crops (orchards, vineyards), pastures, hayfields, etc.);

- fallow lands (resting to restore fertility);

- areas of forests and tree and shrub plantings (protective strips for other land use objects);

- lands under water and at the stage of reclamation;

- lands under roads, runs and clearings;

- lands for public buildings;

- other lands depending on their purpose and use.

In relation to agricultural land plots, the land tax rate is set by municipalities. It cannot exceed 0.3% (clause 1, clause 1, article 394 of the Tax Code of the Russian Federation). The rate is significantly lower than for other categories of land. Is the reduced rate maintained if the land is leased? What if the land is idle? Find out the expert opinion of ConsultantPlus by getting trial access to the system for free.

For the formula for calculating land tax, see.

- Accounting is carried out using standard accounts and postings for non-current assets. For example, the acquisition of a plot of land into ownership is reflected as follows:

- Dt 08 Kt 60, 76, 75, 98 - ownership of land acquired;

- Dt 01 Kt 08 - the land was accepted for balance according to the act.

NOTE! For operations with land, there are separate forms of primary registration, approved by order of the Ministry of Agriculture of the Russian Federation dated May 16, 2003 No. 750. For example, for the capitalization of agricultural land (land), form 401-APK is used.

Stages of analysis of production and sales of products

A graphical diagram of the main stages of production and sales of agricultural enterprise products is presented in Figure 1.

Figure 1 – Stages of analysis of production and sales of products

The process of analysis (stages) of production and sales of products of an agricultural enterprise is identical to the process of analysis of production and sales of products of enterprises in other fields of activity. So, during the analysis, the volumes of production and sales of products are compared with planned indicators and with actual indicators over the past years

Fulfillment of contractual obligations is an important factor that determines not only the quantitative efficiency of production and marketing activities, but also allows us to judge the image of the enterprise and its competitive position.

General indicators characterizing the efficiency of production and sales of agricultural enterprise products are indicators of production profitability and profitability of sales. These indicators are calculated both for the entire enterprise as a whole, and also in the context of industries (crop farming, livestock farming, poultry farming, vegetable growing, etc.).

The presented indicators of profitability of production and profitability of sales of agricultural products will allow us to determine the level of profit per unit of revenue and costs of manufactured products, both in general by industry and in the context of its items. When analyzing production and sales of products, various academic economists offer different methods. In our opinion, N.I. proposes to conduct a very detailed analysis of production and sales of products. Dubinin. The author proposes the following scheme for analyzing the production and sale of agricultural products (Fig. 2)

Figure 2 – Methodology for analyzing the production and sale of agricultural products

This scheme, in our opinion, is very relevant, since the analysis of production and sales of products within the framework of this methodology is carried out comprehensively. Not only quantitative indicators of production and sales of products are calculated, but also qualitative indicators, analysis of the market, prices, competitors, external and internal environment of the enterprise.

The current economic state of processing organizations is largely due to insufficient utilization of processing lines, the main reasons for which are “eroded” raw material zones and non-compliance with the discipline of fulfilling contractual obligations. The current situation directs the state towards more active intervention in the formation and redistribution of raw material flows with the aim of preferentially using the capacities of enterprises that efficiently use raw materials and enterprises that produce more competitive products.

The current state of the livestock subcomplex of the agro-industrial complex requires the adoption of a whole set of measures to improve existing and form new production and economic relations between agricultural organizations, processing enterprises and trade in order to create a sustainable system for providing the population of the republic with high-quality livestock products. The state should play an active role in the formation of these integration ties. To do this, he needs to constantly create a favorable economic situation in the market for livestock products, timely create an adequate regulatory framework, a system of benefits, direct financial support, etc.

How differences in agricultural industries affect accounting in them

Industry differences lead to the fact that the classification of the same types of activities for accounting purposes in agriculture may differ.

For example, for an enterprise producing compound feed, sowing and harvesting the corresponding crops, hay production will be the main activities. And for an enterprise specializing in fattening cattle, the same production of hay on existing hayfields will become an auxiliary production.

Accordingly, accounting will be provided in different ways:

- the feed manufacturer will take into account its costs for harvesting hay on account 20;

- and the owner of a meat farm - on account 23;

- Accounting for milk in agriculture is carried out on sub-accounts opened to accounts 20 “Milk Processing” and 10 “Milk” as a raw material.

Features of inventory

Inventory has a positive effect on farm performance. It allows you to identify problem areas not only in warehouse, but also in accounting. It is carried out annually or more often by decision of management. Unscheduled inventories are effective. An audit is necessary when there is a change in responsible persons, in case of natural disasters, theft, and in the event of closure or reorganization of an enterprise.

Inventory at agricultural enterprises has some features. This is due to the presence of a large share of work in progress in this industry. For example, next year's harvest, livestock for fattening and growing, crops before winter, eggs in incubators, honey in hives, etc. These products are not considered finished, but are subject to accounting as work in progress.

The cost of each such position is determined differently. For example, the cost of feed straw is equal to its weight per cubic meter, multiplied by the size of the stack. Productive and working livestock are inventoried along with the fixed assets to which they belong.

Inspection of finished agricultural products reduces the percentage of misgrading, limits fraudulent actions of responsible persons, and improves the quality of product storage.

The nuances of accounting for seasonal production

Due to climatic conditions, the activities of most agricultural enterprises are seasonal. This leads to the fact that the enterprise has periods of activity and downtime. And if everything is more or less clear with the lack of income during the off-season, then what about expenses?

During the downtime period, it is important to correctly classify expense items for accounting purposes:

- on assets;

- expenses related to future periods;

- current expenses.

As can be seen from this classification, it is assumed that during the idle period the agricultural enterprise has no direct costs associated with the sale of products, since there is no sales. Note that direct costs in agriculture include:

- direct material costs for the production process;

- expenses for remuneration of employees employed in the main production (including contributions for their compulsory insurance);

- depreciation of fixed assets used in the main production.

Thus, all expenses incurred during the shutdown period to support operations in the next season are accounted for either as assets or as expenses incurred in the current period but related to future ones.

The exception is permanent indirect costs, such as administration salaries. They are expensed monthly.

Example 1

Kombikorm LLC, operating in central Russia, incurred the following expenses in February 2021:

- purchased a new combine;

- repaired 2 existing combines using our own resources;

- purchased seeds of a new variety of fodder corn;

- paid salaries to the manager and accountant.

The following entries were made in the LLC accounting:

- Dt 08 Kt 60 - the purchase of a new combine is reflected;

- Dt 97 Kt 60 - spare parts and materials were purchased for the repair of 2 old combines;

- Dt 97 Kt 70 - salaries were accrued to the technicians who carried out the repairs;

- Dt 97 Kt 69 - insurance premiums are charged on amounts related to equipment repair;

- Dt 10 Kt 60 - planting material (seeds) has been capitalized;

- Dt 26 Kt 70, 69 - administration salaries and insurance premiums are accrued.

Regarding wages, it should be borne in mind that labor relations with seasonal workers also have their own specifics. In our article we will not dwell in detail on seasonal workers.

You can read more in the article “Art. 59 of the Labor Code of the Russian Federation: questions and answers.”

To conclude the topic of seasonality, we cannot help but touch upon the calculation of depreciation in agriculture.

For accounting purposes, depreciation of fixed assets used seasonally must be accrued during the season. That is, the annual norm must be invested in the season (clause 19 of PBU 6/01, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n). For example, if the activity is carried out for 5 months a year, then for each month of the season you need to write off 1/5 of the annual depreciation rate.

IMPORTANT! For tax accounting purposes, the situation with depreciation of fixed assets is different. Clause 3 Art. 256 of the Tax Code of the Russian Federation does not provide for the exclusion of fixed assets from depreciable property due to their seasonal use. Just as the Tax Code of the Russian Federation does not provide for seasonal depreciation using the method used in accounting. For tax purposes, depreciation in agriculture is calculated in accordance with the Tax Code of the Russian Federation, which leads to the formation of temporary tax differences during seasonal work.

Unified Agricultural Tax (USAT)

Producers of agricultural products with a share of income from their sales of at least 70% have the right to apply the unified agricultural tax. The transition to paying this tax occurs voluntarily by submitting a notification to the Federal Tax Service.

The Unified Agricultural Tax replaces a number of taxes and simplifies the organization's taxation system. Its interest rate is 6%. The advance payment is made for six months, and the final payment is made for the year. Unified agricultural tax can be applied by: individual entrepreneurs, LLCs or peasant farms (see → Application of unified agricultural tax for peasant farms in 2021).

Example No. 1. Calculation of Unified Agricultural Tax for agricultural enterprises

Smena LLC for the half-year had income in the amount of 985 thousand rubles, expenses amounted to 318 thousand rubles. For the second half of the year, income is 714 thousand rubles, expenses are 302 thousand rubles.

The accountant calculated the payments as follows:

Advance: (985,000 – 318,000) * 6% = 40,020 rub.

For the year, tax is calculated on the entire amount of income and expenses minus the advance payment.

Annual payment: (1,699,000 – 620,000) * 6% – 40,020 = 24,720 rub.

For additional examples of calculating the Unified Agricultural Tax, read the article: → Unified agricultural tax in 2021: example of calculation

Separation by production cycles

Another feature of agriculture is that the production cycle often does not coincide with the reporting year. An example is the cultivation of winter crops, which are sown in the fall of one year and harvested in the spring or summer of the next.

As a result, in the accounting of agricultural organizations, it is accepted to differentiate production costs by periods (years):

- costs of past periods (years) for the current harvest;

- expenses of the current period for the future harvest;

- expenses of the current period for the harvest in it.

To organize the distribution of direct costs, analytical subaccounts are opened on account 20. For example, 20/production of the reporting year and 20/production of the next year.

An additional nuance exists for distributed expenses. They are independent intermediate objects of cost accounting (see paragraph 44 of the methodological recommendations of the Ministry of Agriculture of Russia, approved by Order of the Ministry of Agriculture dated 06.06.2003 No. 792). That is, during the year, these expenses are taken into account in separate analytical accounts, and at the end they are distributed to cost analytics by year - for the harvest of the current year and the future.

Another nuance of cost formation, arising from the biological characteristics of agriculture, is the use of planned and actual costs.

A shifted production cycle is characterized by cost accounting at planned costs during the calendar year. The actual cost is determined once on the last day of the year through a special calculation. Identified deviations between fact and plan include:

- for products already sold in the reporting year - to the account of 90;

- the balance of finished products in warehouses - to account 43.

Example 2

Agronom LLC decided to sow winter wheat in 2021. In addition, the LLC also sows other grain crops. In 2021, it was discovered that about 20% of the winter crop crop was lost as a result of frost.

In September 2021, the LLC made the following entries: Dt 20 (harvest 2019) Kt 10, 70, 69 - for the amount of direct actual costs for sowing winter crops - 1,000,000 rubles.

In December 2021, the LLC calculated the actual cost for 2021:

- Dt 20 (harvest 2019) Kt 20 (depreciation of fixed assets) - 200,000 rubles. (depreciation of used fixed assets distributed among types of crops for the current year’s harvest is written off);

- Dt 20 (harvest 2020) Kt 20 (depreciation of fixed assets) - 100,000 rubles. (distributed depreciation is written off for next year’s harvest);

- Dt 43 Kt 20 (harvest 2019) - 200,000 rubles. (deviations of the fact from the plan are written off to the account of finished products of the current year).

In May 2021:

- Dt 20 (harvest 2020) Kt 10, 60, 70, 69 — 400,000 rub. (the costs of harvesting winter crops are taken into account at the planned cost);

- Dt 43 Kt 20 (harvest 2019) - 1,500,000 (1,000,000 + 100,000 + 400,000) rub. (the current cost of the winter crop harvest in 2018 has been formed);

- Dt 91 Kt 20 (crop loss - 2020) - RUB 300,000. (the loss from the destruction of crops is reflected in the accounting);

- Dt 90 Kt 43 - 1,500,000 rub. (the cost of sold winter crops has been written off).

In December 2021, the LLC will need to complete calculations for the 2021 winter crop harvest:

- Dt 20 (harvest 2020) Kt 20 (depreciation of fixed assets) - 100,000 rubles. (distributed depreciation of fixed assets for the 2021 season was written off);

- Dt 90 Kt 20 (destruction of crops) - 300,000 rubles. (the cost of the sold crop was reversed for the amount of loss from the loss of crops);

- Dt 90 Kt 20 (harvest 2020) - 100,000 rub. (the cost of the sold crop was adjusted by the amount of distributed expenses).

Since crop production in the Russian Federation does not always lead to profit, the state provides financial support to this category of agricultural producers. Subsidies are allocated for specific purposes and must be accounted for separately from other financial flows. How to properly organize such accounting and what nuances to take into account in order to avoid unnecessary taxes and claims from fiscal officials? Get free trial access to the ConsultantPlus system and read the answers to these and other questions in expert advice.

Features of accounting at agricultural enterprises

The specificity of the agricultural industry is due to a natural factor: the inextricable connection of production with the land and living organisms and social: the diversity of organizational and legal forms of management. Therefore, accounting for agricultural enterprises has a number of features:

- Land is the main means of production. It is taken into account by type of land in natural units - hectares, and capital investments - in monetary terms.

- A variety of industries, each of which requires specific accounting.

- Seasonality of production due to changing climatic conditions affects the volume of accounting work throughout the year.

- Division of costs by type of product obtained from one type of animal or one variety of plant.

- Splitting costs by production periods other than the calendar year: past years - for the current year's harvest, current years - for the next year's harvest.

- Reflection of the movement of agricultural products intended for own use.

- Accounting for agricultural machinery (see → accounting of machine and tractor fleet).

- Accounting by structural units: teams, farms, etc.

Accounting in the agricultural sector is carried out on the basis of unified accounts and depends on the form of ownership, specialization, and the order of the production cycle.

On-farm turnover in agriculture

Agricultural enterprises often use the results of a production cycle in the next or parallel production cycle. For example, part of the agricultural crop, which is a finished crop product, can be left as seed material. Some of the vegetables grown for sale can be used as an additive to animal feed during growing and fattening.

Such operations require special reflection in the accounting accounts of on-farm turnover. A part of the cost of the main production or finished product is transferred back to the same production cycle or another main production.

Atypical wiring is as follows:

- Dt 20 (analytics 1) Kt 20 (analytics 2);

- Dt 20 (analytics 2) Kt 43 (analytics 1).

Read more about accounting for intra-farm turnover.

Accounting in agriculture has a large number of nuances. Despite the fact that it is maintained using general principles and a general chart of accounts, the accounting procedure for individual items may differ significantly from the procedure in other industries. This is primarily due to the specifics of agricultural activities, which depend on natural biological cycles, climatic conditions and the use of land as the main asset.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

One of the most important indicators of the production activity of an enterprise is the sale of finished products, since it completes the turnover of funds that were spent on its production. In addition, it is the sale of finished products that allows us to resume a new cycle of the production process. Therefore, it is important to correctly keep records of sales of finished products and correctly form accounting entries.

Results

Accounting in agriculture has a large number of nuances.

Despite the fact that it is maintained using general principles and a general chart of accounts, the accounting procedure for individual items may differ significantly from the procedure in other industries. This is primarily due to the specifics of agricultural activities, which depend on natural biological cycles, climatic conditions and the use of land as the main asset. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sale of finished products or change of ownership

Finished products are considered to be products that represent the final result of the production cycle, are fully processed, completed, have passed the necessary tests, meet standards or technical parameters, have been shipped to customers or delivered to a warehouse.

Sales of finished products can be carried out:

- Based on the conclusion of a supply agreement.

- Through our own sales divisions (shops, kiosks).

The date of transfer of ownership of manufactured products is the date of their transfer to the buyer. When transferring finished products, accompanying documentation is drawn up - invoices and delivery notes, acceptance certificates, which confirm the change of ownership.

The purpose and objectives of analyzing the production and sale of agricultural products

In general, the main goal of analyzing the production and sales of products of an agricultural enterprise is to determine the reserves for growth of profit and profitability indicators.

In the course of analyzing the production and sale of products of an agricultural enterprise, the following tasks :

- the implementation of the production and sales plan is assessed;

- the efficiency of production and marketing activities is determined;

- Factors influencing the efficiency of production and sales of products are determined.

Basic rules for creating transactions when selling products

The procedure for generating transactions for the sale of finished products depends on two circumstances:

- The first operation was shipping;

- The first transaction was payment.

The first option entails the occurrence of receivables from the manufacturer, since the moment of payment for the product occurs later than its actual shipment.

The second option demonstrates the occurrence of accounts payable on the part of the manufacturer, since the shipment is carried out much later than the payment made.

Please note that the procedure for writing off finished products depends on the chosen method:

- at actual cost;

- at planned (standard) cost.

Postings for accounting for sales of finished products

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Sales of finished products after payment | ||||

| Write-off at actual cost | ||||

| 62 | 90-1 | 93 600,00 | Finished products are shipped (sold) to the buyer | Invoice (commodity) invoice, acceptance certificate |

| 90-3 | 68 | 16 848,00 | The accrued VAT amount is reflected | Check |

| 90-2 | 43 | 52 000,00 | Write-off of finished products at their actual cost | Invoice (commodity) invoice, acceptance certificate |

| 90-2 | 44 | 10 000,00 | Write-off of other business expenses associated with the sale of products | Invoice, invoice |

| 51 | 62 | 93 600,00 | Revenue received from sales of products posting | Bank statement |

| 90-9 | 99 | 14 752,00 | Accrued profit from sales of finished products | |

| Write-off at standard cost | ||||

| 43 | 40 | 52 000,00 | Finished products are accepted for accounting at planned cost | |

| 90-2 | 43 | 52 000,00 | Write-off of finished products at planned cost | Invoice (commodity) invoice, acceptance certificate |

| 40 | 20 | 48 000,00 | Accrual of actual cost of products sold | |

| 90-2 | 40 | 4 000,00 | Write-off of deviation – fact “minus” norm (if there was a deviation in favor of savings, then using the red reversal method) | |

| Shipment of finished products on prepayment | ||||

| 51 (50) | 62 | 46 800,00 | Received 50% advance payment from the buyer | Bank statement |

| 76AB | 68-02 | 8 424,00 | The accrued VAT amount is reflected | Check |

| 90-2 | 43 | 52 000,00 | Write-off of finished products at their actual cost | Invoice (commodity) invoice, acceptance certificate |

| 90-2 | 44 | 10 000,00 | Write-off of other business expenses associated with the sale of products | Invoice, invoice |

| 62 | 90-1 | 93 600,00 | Finished products shipped (sold) wiring | Invoice (commodity) invoice, acceptance certificate |

| 90-3 | 68-02 | 16 848,00 | The accrued VAT amount is reflected | Check |

| 62-02 | 62-01 | 46 800,00 | Crediting the received prepayment | Accounting information |

| 68-02 | 76AB | 8 424,00 | VAT accounting based on prepayment | Check |

| Transfer of finished products to a warehouse or retail store | ||||

| 43 | 20 | 250 000,00 | Receipt of finished products to the warehouse | Purchase Invoice |

| 43-1 | 43 | 150 000,00 | Some of the finished products were transferred for sale to a retail store | |

| 62 | 90-1 | 205 000,00 | Finished products shipped (sold) wholesale | Invoice (commodity) invoice, acceptance certificate |

| 90-3 | 68 | 36 900,00 | The accrued VAT amount is reflected | Check |

| 90-2 | 43 | 100 000,00 | Write-off of the cost of finished products sold in bulk | Invoice (commodity) invoice, acceptance certificate |

| 90-9 | 99 | 68 100,00 | Accrued profit from sales of finished products | |

| 50 | 90-1 | 300 000,00 | Finished products sold in retail store | Invoice (commodity) invoice, acceptance certificate |

| 90-3 | 68 | 45 000,00 | The accrued VAT amount is reflected | Check |

| 90-2 | 43-1 | 150 000,00 | Write-off of the cost of finished products sold at retail | Invoice (commodity) invoice, acceptance certificate |

| 90-2 | 44 | 20 000,00 | Write-off of other commercial Write-off of store expenses | Invoice, invoice |

| 90-9 | 99 | 85 000,00 | Accrued profit from sales of finished products | |

Example of postings in a poultry farm

Let's say the incubator produced 10,000 chicks, of which 9,000 chicks survived. 15 tons of grain, 1000 rubles each, were spent on feed. for 1 ton (total 15,000 rubles), grown broiler sold wholesale. The operations of raising, selling and writing off poultry mortality must be reflected as follows:

- D 11 K 20 per 10,000 units. – chicks were received from the incubator at cost.

- D 20 K 10 (43) for 15,000 rubles. – the cost of grain is included in feed.

- D 20 K 69, 70, 26, 23, 02 – other costs are included in cost.

- D 62 K 90 – broiler sales carried out.

- D 90 K 11 – the cost of the bird is written off.

- D 94 K 11 per 1000 units. – the mortality of chicks is reflected.

- D 20 K 94 – reflects the write-off of poultry deaths due to illness (it is necessary to draw up an act in accordance with form SP-54).