Taxes and fees

Natalya Vasilyeva

Certified Tax Advisor

Current as of November 2, 2019

Social security contributions for employees are paid to different budget classification codes depending on their type. Let's consider which KBKs need to transfer employees' social insurance contributions in 2021.

Where to pay in 2021

In 2021, the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries to the Social Insurance Fund) is controlled by the Federal Tax Service. These types of insurance premiums in 2021 must be paid to the Federal Tax Service, and not to the funds.

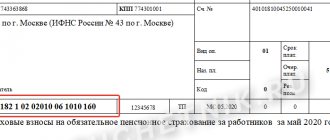

Accordingly, the payment order for the payment of contributions in 2020 must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the tax inspectorate;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service;

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.

Sometimes it happens that the KBK is indicated incorrectly in the payment order for the payment of insurance premiums. ConsultantPlus explains how the law interprets this and what to do

You can clarify the payment if no more than three years have passed since its transfer.

Penalties for the time until you have specified the payment must be recalculated, since it is considered paid from the date of the erroneous payment (clause 1, clause 3, clause 7, article 45, clause 1, article 75 of the Tax Code of the Russian Federation). View the complete solution.

Types of social insurance contributions for employees

Employee social insurance contributions are divided into 2 types:

- Contributions in case of temporary disability and maternity (VNiM).

They are paid to the Federal Tax Service on the same basis as contributions to pension and health insurance. The rate on them is 2.9%. If an employee’s income since the beginning of the year has exceeded the limit, then contributions are no longer accrued. In 2021 it is equal to 912,000 rubles. This means that for an employee’s income over 912,000 rubles. There is no need to accrue VNIM.

- Contributions for industrial accidents and occupational diseases (contributions for “injuries”).

The only type of contributions for employees that does not fall under the jurisdiction of the Federal Tax Service and is still transferred to the Social Insurance Fund. The rate of contributions for injuries depends on the type of economic activity (OKVED) and the professional risk class of the employer. The minimum tariff is set for risk class I - 0.2%, the maximum for risk class XXXII - 8.5%. There is no maximum base for these contributions: they are accrued on the employee’s entire income.

Social insurance contributions (VNIM and injuries) are obligatory paid only for employees with whom an employment contract has been concluded.

If a GPC agreement has been concluded with a person, and the obligation to pay these fees is not provided for in the agreement, they must be paid. For the self-employed (payers of professional income tax), no contributions, including social ones, are paid.

BCC for insurance premiums 2021 for basic deductions

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (List 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (List 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (List 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (List 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

KBK table for payment of pension contributions by employers at the additional tariff in 2018

| Payment | KBK payments on OPS | |

| the tariff does not depend on the special assessment | the tariff depends on the special assessment | |

| For insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

| For insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | ||

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0200 160 | |

| Fines | 182 1 0200 160 | |

BCC for penalties on insurance premiums from 01/01/2020

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (List 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (List 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (List 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (List 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Let's sum it up

- Social insurance contributions for employees include two types: for VNIM (paid to the Federal Tax Service) and for injuries (paid to the Social Insurance Fund).

- Both types of social insurance contributions must be paid by the 15th of each month.

- Contributions for VNiM and traumatism are paid to different CSCs; they have not changed in 2020.

- The injury contribution paid using incorrect details will have to be paid again.

- If an error is made in the KBK when paying the contribution to VNiM, the employer will not have any troubles.

If you find an error, please select a piece of text and press Ctrl+Enter.

KBC for fines on insurance premiums from 01/01/2020

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (List 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (List 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (List 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (List 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Some employers or employees themselves pay additional insurance contributions to a funded pension. In this case, the BCC depends, among other things, on whose funds the contributions are paid for. The corresponding three BCCs are indicated in ConsultantPlus:

Additional insurance premiums are paid by the employer and the insured person to separate CBCs. Employer: ... (view in full).

Results

The rules for calculating penalties on contributions from 2021 are subject to the requirements of the Tax Code of the Russian Federation. Compliance with the special requirements for payment documents for the transfer of fines is necessary when issuing a payment order for the payment of this payment. In some cases, errors made in the payment document do not prevent the payment from being credited to the correct treasury account.

Sources:

- Tax Code of the Russian Federation

- Federal Law of July 24, 1998 No. 125-FZ

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

KBC for individual entrepreneurs' insurance premiums “for themselves” 2021

We are talking about fixed contributions by entrepreneurs for themselves in 2020.

Also see “Fixed insurance premiums for individual entrepreneurs “for themselves” in 2021: new amounts.”

KBC for individual entrepreneur contributions for oneself 2020

| Payment Description | KBK contribution | KBK penalties | KBK fine |

| Contributions to an insurance pension (from income within 300,000 rubles) in a fixed amount | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Contributions to the FFOMS in a fixed amount | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for themselves) by 1 minimum wage for the entire 2021 - from 32,448 rubles. up to 20,318 rubles. An entrepreneur may have his own staff. From payments to them, the individual entrepreneur must deduct contributions to certain CBCs, which are listed in ConsultantPlus:

Insurance premiums that an individual entrepreneur pays from employee remuneration are transferred for billing periods starting from 01/01/2017 according to the following BCC: ... (view in full). Federal Law No. 172-FZ dated 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2020 - from payments to individuals accrued for April, May and June 2020.

For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

BCC values for compulsory medical insurance contributions: table for 2021

Now we present a table that summarizes the current BCC for 2021 when paying medical contributions, which organizations and individual entrepreneurs transfer for their employees, and entrepreneurs also transfer for themselves in a fixed amount.

| Assignment of contributions for compulsory medical insurance | Basic payment | Penalty | Fines |

| Organizations and individual entrepreneurs for their employees | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| Individual entrepreneur in a fixed amount for himself | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

Changes to the BCC in 2021

In 2021, new budget classification codes are in effect for excise taxes, fines for tax violations and violations in business activities. The remaining codes (in particular, for insurance premiums) have not been changed.

BCC for insurance premiums for 2021 was established by orders of the Ministry of Finance of Russia dated November 29, 2019 No. 207n and dated June 6, 2019 No. 85n.

Read also

23.08.2017

If you made a mistake in the KBK: what to do

When indicating the BCC for insurance premiums for compulsory medical insurance in 2021, there is always a possibility that some accountants will transfer the payment for medical premiums for employees to an outdated budget classification code or make an inaccuracy when indicating the BCC that is current for 2021. And if the error only crept into the KBK, then nothing terrible happened. Payment of compulsory medical insurance contributions can be clarified.

To clarify the payment details for medical contributions for compulsory medical insurance, submit to the tax office an application in any form and documents that confirm the transfer of the payment to the budget. Based on this information, the Federal Tax Service will decide to clarify the payment.

Also see the article “Deadlines for payment of insurance premiums in 2021: table.”

SAMPLE OF SUCH APPLICATION FOR CLARIFICATION OF PAYMENT IN 2021

Read also

28.03.2018

Paying off debts from previous years

Debts and arrears on tax payments for previous years are not new. Quite often, regulatory authorities send requests to pay for previous years. If no questions arise when filling out payments for basic taxes, then how to pay social security debts, for example, for 2021. Let's define it using a specific example.

Let’s say that inspectors conducted another inspection, and as a result, arrears were discovered for VNIM for 2015 and 2021. But in these reporting periods, policyholders transferred insurance premiums directly to an extra-budgetary fund, namely to the Social Insurance Fund. How to pay off debt correctly?

IMPORTANT!

In such a situation, transfer compulsory health insurance, compulsory medical insurance and VniM contributions, even for previous periods until 2021, exclusively to the Federal Tax Service. If debts were identified for earlier years, for example, for 2013 or 2007, then in field 104 of the KBK, indicate the codes in accordance with Letter of the Federal Tax Service of Russia dated December 30, 2016 No. PA-4-1/25563.

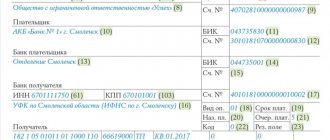

Fill in the fields:

- Recipient - Federal Tax Service Inspectorate (first indicate the Treasury authority, then the name of the inspection in brackets). TIN and KPP - assigned to the tax authority.

- Field 101 - indicate code 01.

- Field 104 - indicate the insurance premiums for compulsory social insurance 2021 corresponding to the KBK. We take into account the category: basic payment, penalty or fine.

- Field 106 - TR - if we pay the Federal Tax Service upon request from regulatory authorities, AP - if debts are identified as a result of inspections, ZD - if underpayments are transferred voluntarily (without waiting for the requirements of controllers).

- Field 107 - set 0 if no demands for payment of debts have been received from the Federal Tax Service. If we transfer on request, then we fill out the field in accordance with the document.

- Fields 108 and 109 of the payment order are the document number and date, respectively. If we pay on demand or an audit report, then indicate the relevant details of this document. When paying off debts voluntarily, enter 0 in the fields.

Please note that an error in filling out payment order details can lead to significant trouble for the organization. Therefore, be careful!

Reporting to the Social Insurance Fund in 2021: deadlines

In 2021, you must report pension, medical and compulsory insurance contributions in case of temporary disability and in connection with maternity to the tax authorities. And for contributions “for injuries” - to the Social Insurance Fund. Below are the deadlines for submitting reports to the Social Insurance Fund in 2021:

4 – FSS in electronic form

- for 2021 – 01/25/2021;

- 1st quarter 2021 – 04/26/2021;

- half year 2021 – 07/26/2021;

- 9 months 2021 – 10/25/2021;

- 2021 – 01/25/2022.

4 – FSS on paper

- for 2021 – 01/20/2021;

- 1st quarter 2021 – 04/20/2021;

- half year 2021 – 07/20/2021;

- 9 months 2021 – 10/20/2021;

- 2021 – 01/20/2022.

Features of filling out a payment order

If you look at the KBK for 2021, the changes did not affect insurance premiums. So this year there will be fewer mistakes. However, they may occur in the process of filling out other fields in the payment order. Let's look at the most important points:

- Regardless of the type of insurance (pension, medical or social), we indicate as the recipient not the corresponding fund, but the tax office. The exception is deductions for injuries.

- The recipient is not the service itself, but the Federal Treasury Department of the subject of the Federation. The territorial tax authority is given in brackets. For example, the Federal Tax Service for the Leningrad Region (Inspectorate of the Federal Tax Service of Russia for the city of Luga, Leningrad Region).

- We enter the budget classification code in field 104 - immediately below the recipient. We fill it out carefully, since an error leads to non-crediting of money and the accrual of penalties.

Although new BCCs for insurance premiums have not been introduced since 2021, changes should be closely monitored in the future.

Even if the codes are slightly mixed up (for example, pension contributions went to health insurance), no one will redistribute them. The payer must find out this himself and inform the authority. It is advisable to do this before the expiration of the payment deadline, otherwise you will have to pay penalties and fines.

Must pay

Contribution to health insurance is mandatory for all categories of insurers. Let us remind you that the insurers are employers - organizations, entrepreneurs and ordinary citizens. Regardless of the nature of the relationship between the employer and the employee, compulsory medical insurance will have to be paid in any case. In principle, the same as insurance contributions for compulsory pension insurance.

You will have to pay from all types of remuneration accrued in favor of employees. Please note that we are talking not only about labor relations, but also about civil law ones. That is, when concluding an employment contract or a civil contract, it is mandatory to pay compulsory medical insurance contributions.

However, there are certain types of payments that are not subject to taxation. Exclude the following types of payments from the taxable base:

- All types of government benefits. For example, temporary disability benefits, child care benefits, lump sum payment at birth.

- Material support for employees, or, as it is also called, financial assistance. However, there are limits beyond which compulsory medical insurance contributions will have to be calculated.

- Compensation payments, for example, compensation for layoffs of employees, severance pay, compensation related to damages to health, and others. However, vacation compensation upon dismissal is subject to taxation.

- Other types of payments in favor of employees, referred to in Art. 20.2 Ch. 34 Tax Code of the Russian Federation.

If the policyholder incorrectly determines the basis for the accrual or is late in payments, then the inspectors of the Federal Tax Service will charge penalties and fines. Please note that the BCC penalties for insurance premiums for compulsory health insurance differ from the code for basic payments. We will tell you how to fill out the payment form correctly below.

Responsibility for non-payment of insurance premiums

Article 122 of the Tax Code of the Russian Federation establishes liability for non-payment (incomplete payment) of taxes, fees and insurance premiums. Sanctions are applied if such an act is caused by an understatement of the tax base (contribution base), other incorrect calculation of a tax (fee, contribution) or other illegal actions (inaction).

Source:

Magazine "Accountant's Time"

Heading:

Insurance premiums

KBK insurance premiums

- Tatyana Suchkova

Sign up 7800

9750 ₽

–20%

Tax is defined as a percentage of the tax base corresponding to the tax rate.Based on the results of the reporting (tax) period, taxpayers calculate the amount of the advance payment based on the tax rate and profit calculated on an accrual basis.

During the reporting period, taxpayers calculate the amount of the monthly advance payment:

- in the 1st quarter of the year = advance payment due in the last quarter of the previous year.

- in the 2nd quarter of the year = 1/3 * advance payment for the first quarter

- in the 3rd quarter of the year = 1/3 * (advance payment for the first half of the year - advance payment for the first quarter).

- in the 4th quarter of the year = 1/3 * (advance payment for nine months - advance payment for half a year)

Taxpayers have the right to switch to calculating monthly advance payments based on actual profit received by notifying the tax authority no later than December 31 of the year preceding the year of transition.

In this case, advance payments are calculated based on the tax rate and the actual profit received, calculated on an accrual basis from the beginning of the tax period to the end of the corresponding month.

Only quarterly advance payments based on the results of the reporting period are paid by:

- organizations whose sales income over the previous 4 quarters did not exceed an average of 3,000,000 rubles for each quarter,

- budgetary institutions,

- foreign organizations operating in the Russian Federation through a permanent representative office,

- non-profit organizations that do not have income from sales,

- members of simple partnerships,

- investors in production sharing agreements,

- beneficiaries under trust management agreements.

The tax at the end of the year is paid no later than March 28 of the following year.

Advance payments based on the results of the reporting period are paid no later than 28 days from the end of the reporting period.

Monthly advance payments are paid no later than the 28th day of each month.

Taxpayers who calculate monthly advance payments based on actually received profits pay them no later than the 28th day of the month following the month for which the tax is calculated.

The amounts of paid monthly advance payments are counted when paying advance payments at the end of the reporting period. Advance payments based on the results of the reporting period are counted against the payment of tax based on the results of the tax period.

Features of tax calculation and payment:

- organizations with separate divisions

- residents of the Special Economic Zone in the Kaliningrad region