Excise tax

An excise tax is an indirect tax on the production of certain types of goods.

Economic meaning of excise duty

Excise tax is imposed on the production of such goods that create additional troubles for the state. Goods the production of which is subject to excise taxes are called excisable goods.

An excise tax is essentially a punitive tax. It is included in the price of those goods whose consumption causes harm to the state and its citizens. Thus, the state, as it were, fines consumers of such goods in advance, although many of them do not even know about it.

By introducing an excise tax on specific types of goods, the state recognizes that it considers it inappropriate or impossible to prohibit their production. But since the consumption of these goods leads to negative consequences for society, the government charges additional money to compensate for such consequences.

Excise taxes are imposed on the production of goods whose consumption:

• causes direct harm to the health of citizens;

• causes indirect harm to the health of citizens through damage to the environment.

These products include alcoholic beverages, beer, and tobacco products. Excise taxes are imposed on the production of oil and gas products (in particular, the production of gasoline) and the production of automobiles.

According to the state, the health of its citizens is not entirely their personal matter. Because individual citizens deliberately spoil their health, the state and society as a whole have additional problems that require money to solve. The excise tax on alcoholic beverages can be roughly called a tax on drunkenness, the excise tax on tobacco products can be called a tax on smoking, and the excise tax on gasoline can be called a tax on smoke from the exhaust pipe.

The excise tax rate is set per unit of measurement of the excisable product, which can be a kilogram, ton, liter, piece, 1000 pieces, etc.

The excise tax on vodka and other strong alcoholic drinks is periodically revised upward. In 2009 it amounted to 191 rubles. per liter of pure alcohol contained in the drink. It is easy to calculate that in a bottle of vodka with a capacity of 0.5 liters with an alcohol content of 40% of the volume there is 0.2 liters of pure alcohol. Accordingly, the excise tax on the cost of one bottle of vodka will be 38.2 rubles. And if we take into account that the price of vodka (together with excise tax) is subject to VAT at a rate of 18%, then the excise tax with the VAT calculated on it in the selling price of a bottle of vodka will be 45 rubles. The cost of vodka production is low. If it were not for the excise tax, then cheap varieties of vodka would cost no more than milk. Such a situation would not be very conducive to the health of Russians.

The manufacturer of excisable goods includes the excise tax in the cost of the finished product and pays the excise tax collected from buyers to the state.

If excisable goods are sold to a foreign buyer, no excise tax is collected. This is logical, since the harm from consuming excisable goods will be localized outside the territory of Russia.

Rules for calculating excise duty

We will consider issues related to excise tax reporting and accounting very briefly, since this concerns only those organizations that are directly related to the production of excisable goods.

Most Russian organizations consume excisable goods. To ensure their activities, they require gasoline, other fuels and lubricants, and other excisable goods. At the same time, the amounts of excise taxes paid when purchasing excisable goods are not shown separately in the accounting records of a regular organization. These amounts are added to the accounting value of acquired material assets.

An accountant of an organization that does not produce excisable goods has the right to simply forget about the existence of such a tax as excise tax, even if this organization consumes excisable goods.

If an organization is a manufacturer of excisable goods and for their production it has to buy other excisable goods, then the excise tax should be reflected in the accounting records separately from the cost of the purchased excisable goods. Excise tax amounts paid by an organization to its suppliers can be deducted from excise tax amounts received from customers, as is done when accounting for VAT.

An organization that produces an excisable product called vodka can purchase another excisable product - ethyl alcohol - as a raw material for its production. When calculating the amount of tax payable to the budget, the amounts of excise taxes associated with the purchase of ethyl alcohol are deducted from the amounts of excise taxes associated with the sale of vodka.

If a manufacturer of excisable goods sells them abroad, then he receives the right to a refund of excise tax amounts paid to his suppliers (the same as VAT).

Payment of excise duty on alcoholic beverages and tobacco products is confirmed by an excise stamp affixed directly to the packaging of the goods. At the same time, the payment of excise tax by their manufacturer partly represents the purchase of excise stamps from the state.

The excise stamp is a means of additional control by the state over the payment of excise taxes. This is useful in a situation where excisable goods pass through several intermediaries on the way from the manufacturer to the final consumer.

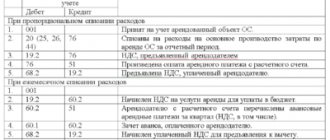

Accounting for excise duties in organizations producing excisable goods is similar to accounting for VAT. The amounts of excise taxes are reflected in the subaccounts of accounts 68 “Calculations for taxes and fees” and 76 “Settlements with various debtors and creditors”.

Share on the page

Next chapter >

Excise tax accounting. Features of accounting for excise taxes on alcohol and alcohol-containing products

The following persons are recognized as taxpayers if they carry out transactions subject to excise taxes: Organizations, individual entrepreneurs, Persons recognized as taxpayers in connection with the movement of goods across the customs border.

To reflect in accounting transactions related to excise taxes paid to suppliers of excisable goods, account 19 subaccount “Excise taxes on paid materials and valuables” is intended. Debit 19 of the account reflects the amount of excise taxes paid to the supplier for excisable goods used as raw materials for the production of excisable goods D 19 K 60 – excise tax allocation. If non-excisable products are produced from excisable raw materials, then the excise tax is not allocated, but is included in the cost of the purchased raw materials Dt 10.20 - Kt 19.

Excise goods: ethyl alcohol from all types of raw materials; alcoholic products with a share of ethyl alcohol of more than 1.5%, with the exception of wine materials; beer; tobacco products; auto and motorcycle; petroleum products; alcohol-containing with a volume fraction of alcohol over 9%.

The tax base for excise taxes is the volume, quantity, and other indicators of imported marked goods in physical terms, in respect of which fixed (specific) excise tax rates are established, or the cost of imported excisable goods, in respect of which ad valorem excise tax rates are established, or the volume of imported marked goods in in kind for calculating excise taxes when applying a fixed (specific) tax rate and the estimated cost of imported excisable goods, calculated on the basis of maximum retail prices, for calculating excise taxes when applying an ad valorem (in percentage) tax rate in relation to goods for which combined excise tax rates are established, consisting of fixed (specific) and ad valorem (percentage) rates.

The amount of excise duty on excisable goods for which fixed tax rates is calculated as the product of the corresponding tax rate and the tax base in natural units. The amount of excise duty on excisable goods for which ad valorem (in percentage) tax rates are established is calculated as the corresponding tax rate is a percentage of the tax base. The amount of excise duty on excisable goods in respect of which combined tax rates are established is calculated as the amount obtained as a result of the addition of excise duty amounts calculated as the product of a fixed tax rate and the volume of excisable goods sold in kind and as the corresponding ad valorem (in percentage) tax interest rate share of the maximum retail price of such goods. The total amount of excise tax when carrying out transactions with excisable petroleum products is determined separately from the amount of excise tax on other excisable goods.

The amount of excise tax is calculated based on the results of each tax period in relation to all transactions for the sale of excisable goods, the date of sale (transfer) of which relates to the corresponding tax period. Tax period Calendar month.

Tax deductions for excise duties are made when the following is carried out.

Highlights ↑

The specificity of the excise tax is that it is adapted to state regulation of the production of consumer goods.

As a result, its payment is mandatory for the production of specific products. In other words, excise tax falls under the category of individual indirect taxes.

However, do not forget that this tax does not apply to the performance of work and provision of services. Mandatory elements of taxation include:

- Subject and object of taxation.

- Cost characteristics of the above object.

- Taxable period.

- Tax rate.

- Method of calculation.

- Tax payment deadlines.

The circle of persons who are payers of excise duty is determined by Article 179 of the Tax Code of the Russian Federation. The object of taxation is:

- sale of goods produced in the Russian Federation;

- alienation of confiscated products;

- transfer of manufactured goods to the owners of the provided raw materials;

- transfer of manufactured products for subsequent production of non-excise goods, except ethyl alcohol;

- transfer of goods for own needs within the country;

- provision of products to the authorized capital of the organization;

- transfer by a legal entity of manufactured products to a participant who leaves the founders of the enterprise;

- transfer of manufactured products for the purpose of their subsequent processing;

- import of products into Russia;

- obtaining ethyl alcohol by an enterprise that has a certificate for the manufacture of non-alcohol-containing products;

- acceptance of straight-run gasoline by an enterprise that has a certificate for its processing.

The indicated operations apply only to excisable goods. The following are not subject to excise duty:

- Transfer of products between structural divisions of the enterprise for the further production of new goods.

- Alienation of products placed under the customs procedure for export outside Russia.

- Primary sale of confiscated goods, for which a refusal has been declared in favor of the state and which are designated for industrial processing.

The first two types of transactions are exempt from taxation only if there is separate accounting associated with the manufacture and sale of excisable products.

The tax base is determined as follows:

| Type of bets | Description |

| At fixed tax rates | The volume of products sold is multiplied by the unit of measurement |

| At ad valorem tax rates | The cost of goods sold, excluding excise tax and VAT, is multiplied by the unit of measurement |

| According to combined tax rates | Both previous methods related to calculating the tax amount are used |

The tax period is considered to be a calendar month (Article 192 of the Tax Code of the Russian Federation). In some cases, such a period is considered a quarter (Article 204 of the Tax Code of the Russian Federation).

The full list of tax rates for excisable products is enshrined in Article 193 of the Tax Code of the Russian Federation. The method of excise tax calculations depends on the type of excisable products (Article 194 of the Tax Code of the Russian Federation).

General information

Like any other indirect tax, the excise tax is not related to the receipt of benefits by the manufacturer of the product, but is aimed exclusively at filling budgets at all levels.

This type of tax is widely used in different countries of the world. In Russian legislation, Chapter 22 of the Tax Code of the Russian Federation is devoted to excise tax.

The list of excisable goods is fixed in Article 181 of the Tax Code of the Russian Federation. The tax base is determined for each product item separately (Article 187 of the Tax Code of the Russian Federation).

Regardless of the similarity to VAT, excise duty is applied to the entire cost of products sold. While VAT applies only to part of the price of the product.

Excise tax is one of three indirect taxes responsible for filling the state budget. However, it applies only to a limited number of excisable products.

In addition, excise duty rates are divided by product groups. According to statistics, the volume of excise duty paid is about 20% of all tax revenues to the state budget.

However, some experts say that such indicators indicate one-sidedness in the work of the domestic tax system.

Because in developed countries the government usually uses the potential of direct taxes. In practice, this is approximately 2/3 of the state budget.

This approach is explained by the fact that indirect taxes slow down the development of the state’s economy. However, indirect taxes are good to collect when the country has a high level of inflation.

Because the volume of tax revenue depends on the cost of goods, and not on the income of organizations. In this way, the government significantly reduces the loss in value of tax revenue.

As for accounting, it is characterized by a system of collecting, registering and systematizing information received about the income and property of organizations.

Accounting involves ensuring continuous and documented records of all business transactions. The obligation to ensure it is assigned to all enterprises in the country, unless the law provides for another procedure for exercising control over their activities.

In addition, accounting allows you to reduce production costs and eliminate identified non-production expenses.

For the procedure for calculating excise taxes and the deadlines for payment to the budget, see the article: procedure for calculating and paying excise taxes. Read an example of excise duty calculation on cigarettes here.

Responsibility for maintaining and submitting financial statements to regulatory authorities lies with the head of the enterprise.

Late submission of reports or distortion of data in them may result in administrative or criminal liability. Basic accounting requirements:

- data is displayed exclusively in rubles;

- the enterprise's own property must be registered separately;

- the enterprise is obliged to conduct continuous documentation of business transactions, starting from the moment of registration;

- legal entities keep accounting of property and liabilities by double entry on interconnected accounts;

- current production costs and capital investments are displayed separately;

- entries in accounting registers are carried out solely on the basis of primary documents;

- primary accounting documentation must contain all mandatory details.

The economic activities of enterprises, which are accounting subjects, include:

- acquisition of inventory items;

- production of products;

- sale of commodity mass.

Who should pay

Excise tax must be paid:

- Enterprises.

- Individual entrepreneurs.

- Taxpayers who transport products across the customs border.

Normative base

The main regulatory act regulating the issue of taxation is the Tax Code of the Russian Federation. The procedure for calculating excise duty is regulated by Chapter 22 of the Tax Code of the Russian Federation.

The procedure for reimbursement from the budget of excise duty amounts for ethyl alcohol was approved by Government Decree No. 800 dated July 12, 1996.

The accounting procedure was approved by the Federal Law “On Accounting” dated December 6, 2011 N 402-FZ. An additional regulatory document on accounting is Order of the Ministry of Finance dated July 29, 1998 N 34n.

How to record excise taxes in accounting?

conditions:

-Purchased goods are intended for implementation. transactions subject to excise tax.

-the amount of excise tax is actually paid to the supplier of the goods

- purchased goods must be accepted for accounting, i.e. capitalized on the balance sheet of the enterprise

— the company has documents, confirmed. Right to deduction (invoices, invoices)

In accounting, the tax deduction of excise duty is reflected by the posting: D68 K19 The accrual of excise duty on sold excisable goods in accounting is reflected in the same way as the accrual of VAT: D 90 K 68.

Features of accounting for excise taxes on alcohol products. For alcoholic products, the amount of the refundable excise tax depends on the amount of alcohol dispensed into the production. If non-excise products are produced from raw materials, then the excise tax amount is written off to cost accounts 20-19. Reimbursement of excise duty on alcoholic beverages is made on the basis of the following conditions : the alcohol is processed. The products produced are sold, the alcohol must be paid for, and the excise tax must be paid. The amount of excise tax calculated on the basis of the volume fraction of alcohol used for the production of wine materials or other products is subject to deductions. The deduction is made when the taxpayer provides the following documents to the tax authorities: purchase and sale agreement; payment documents with a bank mark; waybill and invoice; blending acts; acts for writing off wine materials in production. If excess alcohol losses occur: 91-19 excise tax write-off; 20-19 Alcoholic products are labeled specially. Federal stamps.. List of stamps. on the increase article of production, i.e. on s/s. Dt10 – Kt 60 – purchase of brand Dt19 – Kt 60; Dt 20 - Kt 10 - after selling products with the brand, the cost of the brand is included in expenses; Dt 68 – Kt 19. For alcohol-containing products, the accrual of excise duty depends on the availability of the purchaser and purchaser of the sales certificate for operations with denatured ethyl alcohol. From August 1, 2011, the excise tax rate on ethyl alcohol from all types of raw materials (including raw alcohol) and cognac alcohol depends on whether the organization pays an advance payment of excise tax (clause 1 of Article 193 of the Tax Code of the Russian Federation). Thus, when shipping or transferring alcohol within one organization, producers of alcoholic or alcohol-containing products who pay an advance payment are provided with a zero excise tax rate. The same rate is applied by manufacturers of perfumes, cosmetics and household chemicals in metal aerosol packaging.

If manufacturers use alcohol-containing products as raw materials, the amount of deduction will be less than the amount of excise tax actually paid when purchasing alcohol-containing products. In this case, the amount of deduction will be determined based on the excise tax rate on ethyl alcohol. Excise tax rate on alcohol-containing products. set at the same level as the excise tax rate on alcohol products with a volume fraction of ethyl alcohol up to 9%. Payment of excise duty upon the sale (transfer) by taxpayers of excisable goods produced by them is made based on the actual sale (transfer) of goods for the expired tax period no later than the 25th day of the month following the expired tax period. Taxpayers are required to submit a tax return to the tax authorities at their location and at the location of separate divisions no later than the 25th day of the month following the expired tax period.

The excise tax amount is calculated by applying the established excise tax rate to the tax base.

The amount of excise tax on the gambling business is calculated by applying the excise tax rate established for the tax period to the number of objects of taxation.

If the number of taxable objects changes in the tax period, the amount of excise tax on the introduced (retired) object is paid in full;

For excisable goods produced from customer-supplied raw materials and materials, excise duty is paid on the day the product is transferred to the customer or the person specified by the customer.

When transferring crude oil or gas condensate produced on the territory of the Republic of Kazakhstan for industrial processing, excise tax is paid on the day of its transfer .

Excise taxes on other excisable goods are subject to transfer to the budget no later than:

1) on the thirteenth day of the month for transactions made during the first ten days of the tax period;

2) on the twenty-third day of the month for transactions made during the second ten days of the tax period;

3) on the third day of the month following the reporting month, for transactions completed during the remaining days of the tax period.

When producing excisable goods from own raw materials, which are subject to excise duty, the excise tax on these raw materials is paid within the time limits established for the payment of excise duty on finished excisable goods.

The excise tax on the gambling business is paid in conjunction with a fixed total tax (patent) monthly later than the 20th day of the month following the reporting one.

Accounting algorithms for excise taxes on operations with straight-run gasoline

Accounting for excise taxes when carrying out operations with straight-run gasoline (PG) is carried out:

- PB manufacturer,

- buyer of PB.

Excise tax is paid by the manufacturer of industrial products

The accounting algorithms are based on the following conditions:

- the manufacturer of industrial products charges excise tax when selling industrial products in the Russian Federation;

- the moment of accrual of excise duty is the day of shipment of the industrial product to the buyer;

- for the calculation of excise tax, the presence or absence of a certificate of registration of the person performing transactions with the food product at the manufacturer of the product does not matter;

- The amount of excise tax on industrial goods (APB) is determined by the formula:

APB = VPB × SAPB,

Where:

VPB—volume of sold PB in tons;

SAPB is the excise tax rate for 1 ton of PB.

Accounting for the excise tax accrued by the manufacturer of a food product depends on the presence or absence of a certificate for the production of food products.

Certificate available

- The presence of a certificate allows the manufacturer of PB to deduct the calculated excise tax: if the PB is sold to a company that has a certificate for processing PB;

- if the manufacturer of PB transfers PB to the owner of the raw materials used in its production, and if the owner subsequently sells PB to a company that has a certificate for processing PB.

| Debit | Credit |

| Accrual of excise duty on the sale of industrial goods |

No certificate

The absence of a certificate requires the manufacturer of the protective equipment:

- excise tax to be presented to the buyer,

- highlight the accrued excise tax in the documents.

In this case, it does not matter whether the buyer has a certificate for processing PB.

The following is recorded in accounting:

| Debit | Credit |

| 90.4 (91.2) | Accrual of excise tax on the sale of industrial goods (excise tax is taken into account by the debit of the account in which the amounts of proceeds from the sale of industrial goods are recorded) |

A similar scheme for reflecting excise tax is applied if:

- the buyer of PB does not have a certificate for processing PB;

- the purchased PB will not be used for the production of petrochemical products.

Excise tax is paid by the buyer of the PB

The buyer has an obligation to charge excise duty if:

- the company has a certificate for processing PB;

- the received PB belongs to her by right of ownership.

In accounting, excise tax must be charged to the buyer when purchasing industrial goods (at the time of its capitalization):

| Debit | Credit |

| Accrual of excise tax upon receipt of industrial goods |

Reflection of income from industrial goods and excise tax amounts depends on the intention of the company. For example, if a company intends to use the resulting industrial product as a raw material for the manufacture of petrochemical products within the company, excise tax is not charged, and the following is recorded in accounting:

| Debit | Credit |

| PB received from the supplier as a raw material for the production of petrochemical products was capitalized |

The subsequent write-off of PB in the form of raw materials for the manufacture of petrochemical products does not require the inclusion of accrued excise tax in the cost of consumed PB - it is accepted for deduction (if there are all documents confirming the fact of transfer of PB to production).

The following entries are made in accounting:

| Debit | Credit |

| Reflection of the deduction for excise tax accrued upon receipt of industrial goods |

If the purpose of acquiring the industrial product is not the manufacture of petrochemical products, the excise tax accrued upon receipt of the industrial product is included in its cost:

| Debit | Credit |

| The cost of industrial goods includes the excise tax accrued upon its acquisition. |

In a situation where a company does not have a certificate for processing PB, the following accounting algorithm applies:

- excise tax is not charged upon receipt of industrial goods;

- The manufacturer of the industrial product does not have the right to an “excise” deduction, so he includes the excise tax in the price of the sold industrial product and presents it to the buyer.

Service Temporarily Unavailable

If the payer has several gambling establishments in the region (city), the excise tax is paid separately for each facility.

Excise tax on the activities of organizing and conducting lotteries is paid before or on the day of registration of the issue of the sale of lottery tickets.

Payment of excise tax is made at the place of registration of the excise payer, with the exception of the following cases.

Excise tax payers who have structural divisions pay excise tax at the location of the structural divisions in the prescribed manner if they:

1) production of alcoholic products and all types of alcohol and (or) bottling them;

2) carry out wholesale and retail sales of gasoline (except for aviation) and diesel fuel.

1. At the end of each tax period, the taxpayer is obliged to submit an excise tax declaration to the tax authorities at the place of his registration no later than the 20th day of the month following the tax period.

2. Excise tax payers who have structural units simultaneously with the declaration submit excise tax calculations for structural units.

3. The declaration and calculations for excise duty for structural units are submitted to the tax authority no later than the 20th day of the month following the tax period.

Deadlines for paying excise duty on imported excisable goods

Excise taxes on imported goods are paid on the day determined by the customs legislation of the Republic of Kazakhstan for the payment of customs duties.

Excise duty on imported excisable goods subject to marking is paid before or on the day of receipt of excise stamps.

When actually importing excisable goods, the amount of excise tax is subject to clarification.

| Debit | Credit | Contents of business transactions | Source documents |

| Excise taxes are assessed when petroleum products are received by an organization that has a certificate. | Invoices | ||

| 90-2 | 19, 41 | Excise tax has been assessed on the transfer of petroleum products to persons who do not have a certificate. | Invoices |

| Excise taxes are presented for deduction when transferring petroleum products to persons who do not have a certificate. | Invoices | ||

| 41, 43 | Excise taxes are accrued when an organization that does not have a certificate takes into account oil products produced independently or received as payment for services related to their production. | Invoices | |

| Excise taxes have been accrued on advance payments received for the upcoming shipment of products (goods), the date of sale of which for the purpose of calculating excise taxes is the date of payment. | Invoices | ||

| The amount of excise tax is deducted from the advance payment upon shipment of products (goods). | Invoices | ||

| 90-4 | Excise taxes are charged on the sale of excisable goods. |

Payment of excise tax ↑

Regardless of taxable transactions, the amount of excise duty is calculated based on the results of the tax period. The taxpayer carries out all necessary calculations independently.

In addition, organizations engaged in the production of alcoholic beverages are required to make advance payments of excise tax..

As for manufacturers of alcohol-containing perfumes and cosmetics, the legislator exempted them from paying advance payments.

The amount of the advance payment is determined based on the total volume of purchased products and the corresponding tax rate. The advance must be paid no later than the 15th of the tax period.

Whereas, by the 18th, taxpayers are required to submit the following documents to the Federal Tax Service:

- payment document confirming the transfer of money (order, receipt);

- bank statement confirming the debit;

- advance payment notice (4 copies).

In tax accounting, the payment order must necessarily reflect the intended purpose of payment “Advance payment of excise tax.”

Whereas the notice must contain the following information:

- full name of the buyer and seller of alcohol-containing products;

- volume of purchased goods;

- advance payment amount;

- advance payment date.

Upon the sale of excisable products, the taxpayer must pay the excise duty no later than the 25th day of the month that follows the previous tax period (Article 204 of the Tax Code of the Russian Federation). In some cases, the tax is paid once a quarter.

The amount of tax that must be paid for wine is reduced by the amount of the fee that was previously paid on the territory of Russia for ethyl alcohol produced from raw materials that were used to make wine materials from which this wine was produced.

Payment of excise duty occurs at the place of registration of the taxpayer or at the place of production of excisable products.

Accounting entries for excise taxes

Invoices91-2 Excise taxes are accrued upon the transfer of excisable products as a contribution under a simple partnership agreement (joint activity) or a contribution to the authorized capital of other organizations. Invoices Excise taxes are accrued upon the transfer of natural gas for processing on a toll basis and (or) in the structure of the organization for manufacture of other types of products. Invoices Accrued excise taxes on the use of excisable products for one's own needs in the main production. Invoices Accrued excise taxes on the transfer of natural gas for use for one's own needs in the main production. Invoices Transferred excise taxes to the budget. Payment order (0401060), Bank statement on current account.Accounting entries for accounting for payments for the use of natural resources

| Debit | Credit | Contents of business transactions | Source documents |

| 20, 23, 25, 26 | Fees have been charged for the use of water resources. | Tax return for fees for the use of water bodies, Accounting certificate. | |

| Fees for the use of water resources are listed. | Payment order (0401060), Bank statement on current account. | ||

| 20, 23, 25, 26 | A fee has been charged for the negative impact on the environment. | Accounting information | |

| A fee for negative impact on the environment is listed. | Payment order (0401060), Bank statement on current account. |

Accounting entries for accounting for mineral extraction tax

| Debit | Credit | Contents of business transactions | Source documents |

| 20, 23, 25, 26 | Mineral extraction tax accrued | Tax return for mineral extraction tax, Accounting certificate. | |

| Advance payments for mineral extraction tax have been paid. | Payment order (0401060), Bank statement on current account. | ||

| Mineral extraction tax has been paid. | Payment order (0401060), Bank statement on current account. |

Accounting entries for accounting for regional taxes and fees

| Debit | Credit | Contents of business transactions | Source documents |

| 91-2 | Property tax has been assessed. | Tax return for property tax, Accounting certificate. | |

| Property tax has been paid. | Payment order (0401060), Bank statement on current account. | ||

| Transport tax has been charged. | Tax return for transport tax, Accounting certificate. | ||

| Transport tax has been paid. | Payment order (0401060), Bank statement on current account. | ||

| 91-2 | Regional licensing fees have been assessed. | Accounting information. | |

| Regional license fees have been paid. | Payment order (0401060), Bank statement on current account. |

Date added: 2017-01-21; | Copyright infringement

Recommended content:

Related information:

Search on the site:

“Excise” entries when transferring excisable goods to a structural unit

If a structural unit of a company is allocated to a separate balance sheet and PT for the manufacture of non-excisable goods is transferred to it, the following entries are made in accounting:

| Debit | Credit | Contents of operation |

| 79.2 | 43 | The transfer of PT produced by the company to its division is reflected |

| 79.2 | 68 | Accrual of excise duty when transferring PT to your division for the manufacture of goods that are not classified as excisable |

Find out what you need to know when opening a separate division from the articles posted on our portal:

“Registration of a separate division - step-by-step instructions 2016”;

“We are opening a separate division under the simplified tax system”.

If the division is not allocated to a separate balance sheet, the accounting entries will be different:

| Debit | Credit | Contents of operation |

| 20 | 10 | The transfer of PT to the unit is reflected |

| 20 | 68 | Accrual of excise tax upon transfer of PT to a unit |

PT can be used not only for the manufacture of products, but also for its internal needs. In such a situation, the excise tax, together with the cost of spent PT, is taken into account as part of expenses for ordinary activities (clauses 5, 7 of PBU 10/99):

| Debit | Credit | Contents of operation |

| 20 (23, 26…) | 43 | The transfer of PT to a unit for its own needs is reflected |

| 20 (23, 26…) | 68 | Accrual of excise tax upon transfer of PT to a unit for its own purposes |

Budget payments, taxes and fees

Accounting for value added tax calculations.

To reflect in the accounting of business transactions related to VAT, accounts 19 “Value added tax on acquired assets” and 68 “Calculations for taxes and fees”, subaccount “Calculations for value added tax” are intended.

Account 19 has the following subaccounts:

- 19-1 “Value added tax on the acquisition of fixed assets”;

- 19-2 “Value added tax on acquired intangible assets”;

- 19-3 “Value added tax on purchased inventories.”

In the debit of account 19 for the corresponding subaccounts, the customer organization reflects the tax amounts on purchased material resources, fixed assets, intangible assets in correspondence with the credit of accounts 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”, etc.

For fixed assets, intangible assets and inventories, after they are registered, the amount of VAT recorded on account 19 is written off from the credit of this account depending on the direction of use of the acquired objects to the debit of the accounts:

- 68 “Calculations for taxes and fees” - for production use; accounting for sources of covering costs for non-productive needs (29, 91, 86) - when used for non-productive needs;

- 91 “Other income and expenses” - when selling this property.

Tax amounts on fixed assets, intangible assets, other property, as well as on goods and material resources (work, services) to be used in the manufacture of products and operations exempt from tax are written off as a debit to production cost accounts (20 “Basic production", 23 "Auxiliary production", etc.), and for fixed assets and intangible assets - taken into account along with the costs of their acquisition.

When selling products or other property, the calculated tax amount is reflected in the debit of accounts 9012021087 “Sales” and 91 “Other income and expenses” and the credit of account 68, subaccount “Calculations for value added tax” (for sales “on shipment”), or 76 “Settlements with various debtors and creditors” (when selling “on payment”). When using account 76, the amount of VAT as a debt to the budget will be accrued after the buyer pays for the products (debit account 76, credit account 68). Repayment of debt to the budget for VAT is reflected in the debit of account 68 and the credit of cash accounting accounts.

Accounting for excise taxes, income taxes, property taxes and personal income taxes

Excise tax accounting is carried out basically in the same way as VAT accounting using accounts 19 and 68.

When calculating income tax, account 99 “Profits and losses” is debited and account 68 “Calculations for taxes and fees” is credited. Tax penalties due are recorded in the same accounting entry. The listed amounts of tax payments are written off from the current account or other similar accounts to the debit of account 68.

Accounting for personal income tax. The procedure for calculating and paying this tax is discussed in Chapter 12, and the procedure for accounting for the unified social tax is also set out there (see clause 12.8).

Property tax accounting. Accounting for settlements of organizations with the budget for corporate property tax is kept on account 68 “Calculations for taxes and fees”, in the subaccount “Calculations for property tax”.

The accrued tax amount is reflected in the credit of account 68 “Calculations for taxes and fees” and the debit of account 91 “Other income and expenses”. The transfer of the amount of property tax to the budget is reflected in accounting as the debit of account 68 “Calculations for taxes and fees” and the credit of account 51 “Current account”.

Sales tax accounting.

Sales tax is calculated using the following accounting entry:

Debit account 90 “Sales” | Credit to account 68 “Calculations for taxes and fees”, | subaccount “Sales tax calculations” |

The transfer of sales tax to the budget is reflected in the debit of account 68 from the credit of cash accounting accounts.

Input excise tax

When accounting for incoming excise tax, it was necessary to solve the problem of accounting for losses* that are inevitable at different stages of the receipt and processing of alcohol, so that in the future it would be possible to reduce the amount of excise tax payable to the budget by the amount attributable to standard production losses.

Note:

* Consumption and loss standards are specified in the “Collection of standards for alcohol and alcoholic beverages, approved by the Ministry of Agriculture and Food of Russia on November 24, 1999. Let us recall that the problem with the use of natural loss norms, adopted before the entry into force of Chapter 25 of the Tax Code of the Russian Federation, was solved by Federal Law No. 58-FZ dated 06.06.2005 (read more here).

Possible losses in the following areas:

- When transported from the supplier;

- When stored in an alcohol storage facility;

- When preparing a blend;

- When bottling finished products;

- When carrying out analyses;

- When storing finished products in an excise warehouse.

Calculation of the amount of excise tax to be reimbursed

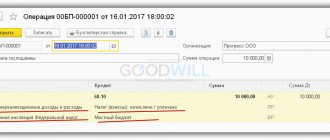

To calculate the amount of alcohol excise tax for reimbursement, a document “Calculation of alcohol excise tax for reimbursement” was created (see Fig. 5), which is created at the end of each month. It analyzes the amount of sales losses (information on the auxiliary accounts of the SA group) within the limits of the payment for alcohol (account 19.5), in proportion to the shipped products in the context of the KBK and the region.

Rice. 5

Calculation algorithm:

- analyzes the amount of paid excise tax (account 19.5) - 881,236.08;

- analyzes the amount of incoming excise tax on shipments (account SA.OT) - 140,472.00;

- analyzes off-balance sheet loss accounts (SA.NP account) - 2,110.32.

Thus, the amount of alcohol excise tax to be reimbursed will be 140,472.00 + 2110.32 = 142,582.32

As a result of this document, the following transactions will be generated:

Debit 68.3 “Excise taxes” Credit 19.5 “Excise taxes on paid MC” - 142,582.32 rubles; Credit SA.NP “Alcohol excise tax of regulatory losses” - 2,110.32 rubles; Credit SA.OT “Alcohol excise tax on shipped products” - RUB 140,472.00.

| This article examined all stages of accounting for excise duty at an enterprise, starting with the receipt of alcohol and ending with the calculation of alcohol excise duty for reimbursement. The work was performed by IMC-PROF LLC tel. (095) 506-1705 fax (095) 452-6491 e-mai www.imc-prof.ru |

Changes in the chart of accounts

To solve the problems of automating excise duty accounting in the chart of accounts, the following changes were made to the standard configuration of “1C: Accounting 7.7”.

Tax and accounting accounts have been added to detail the accounting of incoming excise tax:

- SA.OT “Alcohol excise tax on shipped products” - serves to account for the excise tax on alcohol contained in shipped products;

- SA.NP “Alcohol excise tax on standard losses” - serves to account for the excise tax on alcohol contained in production standard losses of alcohol, alcohol-containing semi-finished products and finished products;

- SA.SP “Alcohol excise tax on excess losses” - serves to account for the excise tax on alcohol contained in production excess losses of alcohol, alcohol-containing semi-finished products and finished products;

- 18 “Excise taxes on unpaid material assets” - serves to record the amount of excise duty on accepted, unpaid alcohol.

In the future, data from these accounts will be used when calculating the excise tax deduction.

To account for the accrued excise tax, account 68.3 “Excise taxes” was changed, to which new accounting sections were added: “Budget classification codes” (order of the Ministry of Finance of Russia dated August 27, 2004 No. 72n) and “Regions” (letter of the Ministry of Taxes of Russia dated March 10, 2004 No. 07-0 -13/888). In this case, region means the region where the excise warehouse is located.