What does the 2021 payment order consist of?

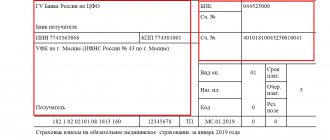

A payment order created to generate and reflect the amount required for the payment of taxes, fees and contributions for the purpose of insuring employees of an enterprise is carried out on form 0401060. Each field has a separate number. It is necessary to fill out the document, guided by the KBK for paying tax deductions and making contributions, which is carried out in 2021.

At the same time, in 2021 the following features should be taken into account:

- It is impossible to apply the BCCs in force in 2021; for example, the BCCs for contributions to the Pension Fund are outdated.

- The data on line 110 in the PDF has also changed.

In 2021, the information to be filled in regarding contributions and tax amounts is the same:

1. Paragraph 1 describes the name of the organization.

2. Next, the numbering of the form is indicated, which corresponds to the All-Russian standard-classifier of management documents, approved back in 1993.

3. In column 3, enter the payment number, which is written not in words, but in numbers.

4. Clause 4 consists of the date the notification was completed. Here you need to follow these rules:

- if the document is submitted on paper, the full date is entered, following the format DD.MM.YYYY;

- The electronic version involves recording the date in the format of the credit institution. The day is indicated by 2 digits, the month by two, and the year by four.

5. In paragraph 5, record one of the values: “urgent”, “by telegraph”, “by mail” or another indicator determined by the bank. You can leave the column empty if the bank allows it.

6. In paragraph 6, write the payment amount. In this case, rubles are written in words, and kopecks are listed in numbers. Rubles and kopecks are not reduced or rounded. If the amount to be paid is a whole amount and does not have small change, then pennies separated by commas may not be recorded. In the “Amount” line, the amount is set, followed by the equal sign “=”.

7. Clause 7 contains the amount to be paid, determined in numbers. Rubles are separated from change using a dash sign “–”. If the number is an integer, then an equal sign “=” is placed after it.

8. Paragraph “8” contains the name of the payer; if it is a legal entity, you need to write the name in full, without abbreviations or abbreviations.

9. In paragraph 9, enter the number of the payer’s account registered with the banking institution.

10. Contents of clause 10: name of the bank and address of its location.

11. Point 11 shows the bank code identifying the institution where the payer of taxes and contributions is served.

12. Paragraph 12 consists of the correspondent account number of the taxpayer’s bank.

13. Clause 13 determines the bank that will receive the transferred funds. Since 2014, the names of Bank of Russia branches have changed, so check this issue on the official website of the financial institution.

14. Point 14 consists of the bank identification code of the institution receiving the money.

15. In column 15 you should write down the number of the corresponding bank account to which contributions are transferred.

16. Line 16 contains the full or abbreviated name of the enterprise receiving the funds. If this is an individual entrepreneur, write down the full last name, first name and patronymic, as well as legal status. If this is not an individual entrepreneur, it is enough to indicate the citizen’s full name.

17. Column 17 records the account number of the financial institution receiving the money.

18. Props 18 always contains the encryption “01”.

19. As for detail 19, nothing is recorded here unless the bank makes a different decision.

20. 20 props also remain empty.

21. Line 21 requires determining the order of the amount to be paid in a figure corresponding to legislative documents.

22. Requisite 22 presupposes a classifier code for the amount to be paid, whether it be contributions or tax deductions. The code can consist of either 20 or 25 digits. The details exist if they are assigned by the recipient of the money and are known to the taxpayer. If an entrepreneur independently calculates how much money he should transfer, there is no need to use a unique identifier. The institution receiving the money determines payments based on the numbering of TIN, KPP, KBK, OKATO. Therefore, we indicate the code “0” in the line. The request of a credit institution is considered illegal if, when recording the TIN, you need to additionally write information about the code.

23. Leave field 23 blank.

24. In field 24, describe the purposes for which the payment is made and its purpose. It is also necessary to indicate the name of goods, works, services, numbering and numbers used in documents according to which payment is assigned. These can be agreements, acts, invoices for goods.

25. Requisite 43 includes affixing the IP seal.

26. Field 44 consists of the signature of an authorized employee of the organization, manager or corresponding authorized representative. To avoid misunderstandings, the authorized representative must be entered on the bank card.

27. Line 45 contains a stamp; if the document is certified by an authorized person, his signature is sufficient.

28. Requisite 60 records the taxpayer’s TIN, if available. Also, those who recorded SNILS in line 108 or the identifier in field 22 can enter information in this line.

29. The recipient’s TIN is determined in detail 61.

30. In line 62, the employee of the banking institution enters the date of submission of the notification to the financial institution related to the payer.

31. Field 71 contains the date when money is debited from the taxpayer’s account.

32. Field 101 records the payer status. If the organization is a legal entity, write down 01. If you are a tax agent, enter 02. Coding 14 applies to payers who settle obligations with individuals. This is just a small list of statuses; a more complete one can be found in Appendix 5 to the order of the Ministry of Finance of Russia, which was issued in November 2013 and registered in the register under number 107n.

33. Field 102 consists of the checkpoint of the payer of contributions and taxes. The combination includes 9 digits, the first of which are zeros.

34. Field 103 – checkpoint of the recipient of funds.

35. Line 104 indicates the BCC indicator, consisting of 20 consecutive digits.

36. Props 105 shows the OKTMO code - 8 or 11 digits, they can be recorded in the tax return.

37. In detail 106, when making customs and tax payments, record the basis of the payment. TP is indicated if the payment concerns the current reporting period (year). ZD means the voluntary contribution of money for obligations occurring in past reporting periods, if there are no requirements from the tax office for payment.

Where can I get a complete list of possible values? In paragraph 7 of Appendix 2 and paragraph 7 of Appendix 3 to the order of the Ministry of Finance of Russia, issued in 2013.

If other deductions are made or it is impossible to record a specific indicator, write “0”.

38. Requisite 107 is filled in in accordance with the purpose of the payment:

- if taxes are paid, the tax period is fixed, for example, MS 02.2014;

- if customs payments are made, the identification code of the customs unit is indicated;

- you need to deposit money in relation to other contributions - write “0”.

39. Payment of tax contributions involves entering a paper number, which serves as the basis for the payment.

40. What data is recorded in field 109?

- if tax revenues and deductions to the customs authorities are to be paid, determine the date of the paper that is the basis for the payment, pay attention to the presence of 10 digits in the encoding (the full list of indicators can be found in paragraph 10 of Appendix 2 and paragraph 10 of Appendix 3 to the order of the Ministry of Finance of Russia, registered in November 2013);

- if other money is transferred to state budget funds, write “0”.

- In field 110 there is no longer a need to fill in the type of deductions.

How to pay income tax

Payment of income tax depends on the amount of company income. If its revenue is less than 60 million rubles. four quarters before the reporting quarter, then advances on profits are made once a quarter. If the organization earned more than this amount, you can pay based on the following options:

- monthly during the quarter and quarterly advances;

- advance payments every month based on actual profits.

Record the payment method in your accounting policy. You can change it, but only from the new year. If for some reason you are no longer satisfied with paying income tax in 2021, do not forget to report this to your inspectorate no later than December 31, we will send them a notification (clause 2 of Article 286 of the Tax Code of the Russian Federation) and again, do not forget a new The procedure for paying advances should be specified in the accounting policy.

Features of drawing up line 107 in the payment slip for 2021

Accountants are interested in the subtleties of filling out line 107 in the payment document in 2021. Detail 107 indicates the tax period when the contribution or tax is paid. If it is not possible to determine the tax period, “0” is entered in column 107.

What components does the tax period indicator consist of and what does it indicate, experts shared:

- The 8 digits of the combination differ in their semantic meaning;

- 2 digits are considered separating digits and are therefore separated by a dot.

The value of detail 107 determines the frequency of payment:

- monthly regularity (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AP).

What do the signs mean?

- The first 2 characters indicate the frequency of payment of money.

- 4-5 characters provide information regarding the month number of the reporting period; if we are talking about quarterly payments, the quarter number is fixed; for semi-annual deductions, the semi-annual number applies. As for the monthly designation, it can be a figure from 01 to 12. The quarter number consists of the values 01–04. The half-year number is recorded as 01–02.

- 3-6 signs of props 107 are always separated by dots.

- Digits 7-10 contain the year in which contributions are paid.

- If the payment is made only once a year, then the 4th and 5th digits are represented by “0”.

Divide the payment to the regional budget into separate divisions

If there are separate divisions, transfer the “regional” part of the tax separately for the parent organization and for each separate division (subclauses 1, 2 of Article 288 of the Tax Code of the Russian Federation).

When paying quarterly advance payments, transfer the tax no later than the 28th day following the quarter. When paying monthly advance payments, transfer the tax no later than the 28th day of each month (Article 287 of the Tax Code of the Russian Federation). Additional payment for the quarter - no later than the 28th day of the month following the reporting month.

Tax reporting period in line 107 of the payment document

The tax period is recorded in payment slips in 3 cases:

- if payments are made in the current reporting period;

- if the reporting person independently discovers erroneously indicated data on the tax return;

- upon voluntary payment of additional tax amounts for the past reporting period, if a requirement has not yet been received from the tax authority regarding the need to pay fees;

The value of the tax period for which additional funds are deposited or paid is recorded.

If any type of debt that has arisen is being repaid, be it an installment debt, deferred or restructured, and a bankruptcy case is being considered for an enterprise with debts or an outstanding loan, it is necessary to record a specific number indicating the day on which the amount of money was deposited. The payment deadline is indicated as follows:

- TR – fixes the payment period, which is determined in the notification received from the tax authority to pay the required amount;

- RS – the number when part of the installment debt in relation to tax contributions is paid, taking into account the installment schedule;

- OT – focuses on the end date of the deferment period.

- RT is the number when a certain share of the restructured debt is paid, which corresponds to the schedule.

- PB is the number when the procedure comes to an end, which occurs when the organization goes bankrupt.

- PR – the number when the suspension of debt collection ends.

- In – fixes the date of payment of the share of the investment loan for taxes.

If the payment intends to repay the debt and is carried out in accordance with the audit report or according to the writ of execution, “0” is recorded in the value of the tax reporting period. If the tax amount is transferred before the due date, then the head of the enterprise fixes the future tax period in which the payment of fees and tax deductions is planned.

The order of deductions in the 2021 payment order

What order the payer follows is reflected in the payment slip, namely in column 21. What is the order of deducted amounts? This is the sequence of money debits that a financial institution follows when processing requests from a client. The issue of monitoring the queue is settled by the bank, but the accountant should not completely rely on outsiders; oversee this process yourself.

In each payment order, in field 21, write down the order from 1 to 5. To which order can current deductions be attributed? No less than the fifth stage, because they are carried out on a voluntary basis. As for payment orders from tax authorities and control authorities, they are classified as the third priority. That is, in field 21 you need to write 3.

Current earnings accrued to the organization's employees are also a third-priority payment. Experts spoke in more detail about the order of payments:

- The first priority is assigned to payments made under writs of execution that provide for payment for compensation for damage that resulted in deterioration of health and life. This also includes the transfer of money for collection of alimony payments.

- Secondly, payments related to severance pay and salaries to former and current employees, and remuneration to authors of intellectual activity are recorded.

- The third priority applies to deductions for wages paid to employees. Also, in the third place, it is allowed to write off the debt incurred in relation to the payment of taxes and fees in connection with a notification received from the tax service. Insurance premiums paid on behalf of regulatory and audit authorities also occupy third place.

- Other monetary claims are distributed in the fourth order.

- The remaining deductions adhere to the calendar queue - the current amounts of deductions that are directly related to taxes and contributions.

Expenses to reduce income

Can all expenses be taken into account when reducing the tax base? The grouping is fixed by the code. The main thing is that they are not only well-founded, but also professionally confirmed by primary documentation. Otherwise, when checking, the tax authorities will simply “throw out” them from the costs, and the tax base will become larger, therefore, it will turn out that you have underpaid taxes and advance payments, and this is fraught with fines and penalties.

The division of expenses is as follows:

- spent on production

- spent on implementation

- wage

- costs of purchasing raw materials

- material expenses

- depreciation

There may be other expenses recognized. These include negative differences in changing exchange rates, arbitration fees, and court fees. The main thing is not to forget that the legislator introduced a closed list. This indicates expenses that are never taken into account when determining the tax base. An example is payments to the management company, amounts of repayment of credits/loans, dividends payable. It will not be possible to reduce BUT by these amounts.

PLEASE NOTE: direct production costs must be divided into written-off and work in progress every month; only actual raw materials and materials used will reduce the base.

Direct costs are those that reduce revenue as products are produced and sold. In practice, they should be taken into account according to the rules of Article 319 of the Code, but a taxpayer enterprise can independently, through its accounting policy, establish a list of expenses that are considered direct, if the list does not contradict the norms of the Tax Code of the Russian Federation.

Regarding indirect expenses, the rule is simple: they are fully included in the expenses of the current period, which reduce the profit subject to taxation.

IMPORTANT: expenses that are directly named by the legislator in Article 270 of the Code never reduce income; moreover, a closed list is not subject to broad interpretation.

Table. Status of payer of contributions and taxes in 2021

Column 101 of the payment order contains information about the status of the payer of funds. The status can be determined based on the information specified in Appendix 5 to the order of the Ministry of Finance, registered under number 107n. We have already talked about the main statuses above, the rest are reflected in the following table:

| 01 | taxpayer (payer of fees) - legal entity |

| 02 | tax agent |

| 03 | federal postal service organization that drew up an order for the transfer of funds for each payment by an individual |

| 04 | tax authority |

| 05 | Federal Bailiff Service and its territorial bodies |

| 06 | participant in foreign economic activity - legal entity |

| 07 | customs Department |

| 08 | payer - a legal entity (individual entrepreneur, lawyer, notary, head of a farm) that transfers funds to pay insurance premiums and other payments to the budget |

| 09 | taxpayer - individual entrepreneur |

| 10 | taxpayer is a notary engaged in private practice |

| 11 | taxpayer is a lawyer who has established a law office |

| 12 | taxpayer - head of a peasant (farm) enterprise |

| 13 | taxpayer - another individual - bank client (account holder) |

| 14 | taxpayer making payments to individuals |

| 15 | a credit organization (a branch of a credit organization), a payment agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals |

| 16 | participant in foreign economic activity - individual |

| 17 | participant in foreign economic activity - individual entrepreneur |

| 18 | a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties |

| 19 | organizations and their branches transferring funds withheld from the wages (income) of a debtor - an individual to repay debts on payments to the budget on the basis of an executive document |

| 20 | credit organization (branch of a credit organization), payment agent, who drew up an order for the transfer of funds for each payment by an individual |

| 21 | responsible member of a consolidated group of taxpayers |

| 22 | member of a consolidated group of taxpayers |

| 23 | authorities monitoring the payment of insurance premiums |

| 24 | payer - individual person who transfers funds to pay insurance premiums and other payments to the budget |

| 25 | guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax excessively received by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation , and excise taxes on alcohol and (or) excisable alcohol-containing products |

| 26 | Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case |

How to fill out field 101 in a payment slip in 2021?

A sample of how to correctly fill out all lines of a payment order in 2021 is presented below.

Let’s say a limited liability company with the name “Success” uses a simplified taxation system and operates in the Elninsky district of the Smolensk region. The final indicators for the 1st quarter of 2021 reflected the company’s revenue within 350,000 rubles. There are no preferential tax rates for the income share in the region.

Therefore, the advance amount passing through the simplified tax system, due for the transfer on the completion of the organization’s activities in the 1st quarter of 2017, is:

350,000 * 6% = 21,000 rubles.

This means that the payment order registered under number 71 on April 14, 2021 will talk about the transfer of money to the tax authority in the form of an advance payment under the simplified tax system for the 1st quarter of 2017 in the amount of 21,000 rubles. An accountant or other accountable person must correctly fill out a payment order for this amount.

So, in accordance with the transfer of tax, the fifth order of payment for tax deductions, insurance premiums and other types of payments is entered in field 21.

In line 101, record 01, because the company transfers tax revenues. In field 104, set the KBK for payment of tax amounts according to the simplified taxation format for income - 18210501011011000110. In line number 105 we write - OKTMO Elninsky district of the Smolensk region - 66619000. In line 106, record TP, and in rook 07 - KV 01.2017, which means movement funds for the 1st quarter of 2021. In section 108 set “0”, in field 109 – also “0”.

Line 22 indicates the LLC’s payment of current tax deductions and contributions, which the enterprise calculated on its own, so we write “0”. The UIN in this case is not recorded. On line 24, provide additional information regarding the transfer of money.

A clear example of what is correct from the point of view of tax accounting and reflection of the cash flow of an enterprise is given below. In a green shade - line numbers of the payment order.

Sample income tax payment form 2021

Each advance payment is transferred in a separate payment order. Carefully check OKTMO, KBK and the recipient.

Sample payment order for income tax in 2016:

- Type of transaction (101) – if the organization pays, put “01”. If a tax agent, put “02”.

- Code (field 22) - if available, indicate the UIN. Usually it is not there, since the UIN is only available if the payment is made at the request of the Federal Tax Service. Therefore we set it to 0.

- KBK (field 104) – all KBK can be viewed in our table.

- OKTMO (field 105) - provides the code assigned to the territory of the municipality. You can find out your OKTMO on the website of the Federal Tax Service of Russia.

- Reason for payment (field 106). If we pay without delay, we set the current payment as “TP”. If arrears transferred independently are “ZD”, arrears transferred upon request are “TR”, arrears based on an inspection report before the Federal Tax Service Inspectorate issues a requirement are “AP”.

- Tax period (field 107) – set as shown in the picture, depending on the quarter of payment.

- Document number (field 108) - if field 106 is “TP” or “ZD”, put “0”.

- Document date (field 109) – date of signing of the income tax return. If we pay before filing the declaration, enter 0.

The legislation establishes the need to prepare special payment documents. A complete list of all documents required for drawing up is reflected in the legislation.

At the same time, special rules for the generation of documentation of this type have been established. This is especially true for preparing income tax payments.

If possible, you should carefully read all the rules, as well as a sample document. This will allow you to avoid a large number of different problems and difficulties.