Among other innovations, 2021 brought a fairly significant change in the procedure for paying insurance premiums. If until now these payments were transferred to two separate funds - the Pension Fund of the Russian Federation and the Social Insurance Fund, then from now on the Inspectorate of the Federal Tax Service will be the manager of these receipts. It is to the tax office that contributions for pension, health and social insurance must be transferred. The only exception remains the so-called deductions for injuries: they, as before, will need to be transferred to social insurance. For all other payments, payers will have to master the new procedure for processing payment documents.

Legal entity – “01”, individual entrepreneur – “09”, “14”

According to one opinion, individual entrepreneurs, when paying contributions for themselves, should put code “09” in field 101, and when paying contributions for employees, code “14”; organizations - code “01”. This opinion is based on the fact that the administration of insurance premiums has been transferred to the tax authorities, which, according to supporters of this point of view, makes it possible to put an equal sign between policyholders and taxpayers. The problem with this decision is that the current version of the Tax Code separates the concepts of “payer of insurance premiums” and “taxpayer”.

Features of payer status for individual entrepreneurs

It is necessary to clearly understand that the payment order in section 101 indicates the status of the legal entity or individual who executed this document. As for individual entrepreneurs, Order No. 107-N, which must be followed when filling out the payment form, contains 2 codes - 09 and 14.

It is very important to understand here that when making deductions for himself, an individual entrepreneur takes into account code 09 , but if deductions are planned for employees, then in this case code 14 is entered in section 101 , because an individual entrepreneur acts as a person making payments to individuals.

Status "08"

This status was applied when transferring insurance premiums in past years, and, according to a number of experts, should be applied now. In particular, payment orders with this particular payer status are accepted by Sberbank Online, rejecting payment orders that indicate other statuses. Let us remind you that status “08” is intended for individual entrepreneurs and organizations that transfer insurance contributions to the budget of the Russian Federation. The problem is that several regional branches of the Federal Tax Service of the Russian Federation gave official answers to policyholders the day before with a recommendation to indicate a different payer status, which is discussed below.

Several special cases of filling out details

The status of the preparer in the 2021 payment order may vary as follows:

- transfer of income tax. Income tax is paid by organizations - legal entities. Tax is paid on the profit received by the organization. The accountant should fill in the indicator “01” in field 101;

- transfer for compulsory pension insurance (hereinafter referred to as OPS) by the organization. Insurance companies on OPS are under the jurisdiction of the Tax Service. In field 101, the accountant must also indicate the indicator “01”;

- transfer of OPS IP. Compulsory insurance coverage for individual entrepreneurs, regardless of whether he pays them for himself or for his employees - the correct indicator is “09”;

- transfer of personal income tax. Personal income tax is a tax that organizations and individual entrepreneurs withhold from the income of their employees as a tax agent. The taxpayer status indicator in the payment order for 2020 personal income tax payments is “02”;

- transfer of sick leave to an employee. The payment goes to the employee, and not to the budget of the Russian Federation. Field 101 should be left blank;

- transfer of advance to employees. Advance payment is not made to the budget of the Russian Federation. Field 101 must be left blank;

- transfer to the counterparty for payment for information support services performed. The payment is not made to the budget of the Russian Federation. Field 101 is not filled in.

IMPORTANT!

Read more about registering a payment with the Pension Fund on our website.

Sample payment order form

What to do?

As we can see, at the moment it is impossible to say with certainty what the payer’s status should be in the payment order for insurance premiums in 2021. Without a doubt, we can only talk about the status of the payer when paying contributions “for injuries”. Their administration was not transferred to the Federal Tax Service, but remained under the control of the FSS. Therefore, in this case, it is necessary to indicate unambiguously, as in previous years, the code “08”.

As for “medical” and “pension” contributions, the possibility of error remains when indicating any of the statuses discussed above.

Therefore, the only recommendation that can be given is not to rush into paying insurance premiums, but to wait for official clarification. As soon as they appear, we will promptly make changes to this page.

Meanwhile, the practice of past years shows that Federal Tax Service inspectors count payments with an incorrectly indicated payer status. The main thing is that the details of the recipient and the KBK, which have changed in 2021, are correctly indicated. If you have already made the payment, and after the publication of official clarifications it turns out that the payer status in the payment order in 2021 is indicated incorrectly, in order to fully protect yourself from arrears in insurance premiums, you should submit an application to clarify the payment (based on the letter of the Federal Tax Service of the Russian Federation No. SA -4-7/19125). A copy of the payment order must be attached to the application.

Update 02/08/2017 - clarification of the Federal Tax Service on the issue of payer status

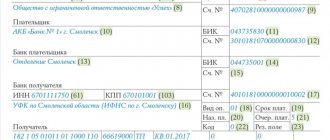

Some regional Federal Tax Service Inspectors have sent out clarifications to policyholders regarding filling out payment orders for the payment of insurance premiums in 2021. They, along with samples of filling out payment slips, are contained in the following document:

According to the document, the payer status is indicated as follows:

- Status 01 – indicated when paying insurance premiums by a legal entity;

- Status 09 – indicated when paying insurance premiums by an individual entrepreneur;

- Status 10 – indicated when paying insurance premiums by a notary engaged in private practice;

- Status 11 – indicated when paying insurance premiums by the lawyer who established the law office;

- Status 12 – indicated when paying insurance premiums by the head of a peasant (farm) enterprise;

- Status 13 - indicated when paying insurance premiums for employees by an individual (who is not an individual entrepreneur).

What should the tax authorities do if the payer discovers an error in the status?

The tax authority, after receiving an application from the taxpayer with a request to clarify the status, based on Article 45 of the Tax Code of the Russian Federation, will take the following actions:

- will require from the bank a copy of the payment order on the basis of which the funds were transferred. In this case, the bank does not have the right to refuse to provide this document within 5 days;

- after verification activities, a decision will be made to clarify the date of payment;

- within 5 days after the decision is made, the Federal Tax Service will notify the taxpayer about it.

This might also be useful:

- Deadline for submitting a declaration under the simplified tax system for 2021

- Property tax deductions in 2021

- Payment for negative environmental impact in 2020

- Declaration 3-NDFL 2021 for 2021

- Which OKVED code should be indicated in the reporting for 2021?

- Reduced insurance premium rates in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

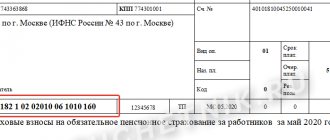

Completed sample payment order with status

| 0401060 | |||||||||||||||||||||||||||||

| Admission to the bank of payments. | Debited from account plat. | ||||||||||||||||||||||||||||

| 02 | |||||||||||||||||||||||||||||

| PAYMENT ORDER No. 18 | 11.03.2017 | ||||||||||||||||||||||||||||

| date | Payment type | ||||||||||||||||||||||||||||

| Suma in cuirsive | Three thousand one hundred rubles 08 kopecks | ||||||||||||||||||||||||||||

| TIN 663312345 | Gearbox 663301001 | Sum | 3100-08 | ||||||||||||||||||||||||||

| ABV LLC | |||||||||||||||||||||||||||||

| Account No. | 40702810094000009876 | ||||||||||||||||||||||||||||

| Payer | |||||||||||||||||||||||||||||

| PJSC "UBRD" | BIC | 044030002 | |||||||||||||||||||||||||||

| Account No. | |||||||||||||||||||||||||||||

| Payer's bank | |||||||||||||||||||||||||||||

| North-Western State Administration of the Bank of Russia, St. Petersburg | BIC | 044030001 | |||||||||||||||||||||||||||

| Account No. | |||||||||||||||||||||||||||||

| payee's bank | |||||||||||||||||||||||||||||

| INN 7820027250 | Gearbox 782001001 | Account No. | 40101810200000010001 | ||||||||||||||||||||||||||

| UFC in St. Petersburg | |||||||||||||||||||||||||||||

| Type op. | 01 | Payment deadline. | |||||||||||||||||||||||||||

| Name pl. | Outline of boards | 5 | |||||||||||||||||||||||||||

| 0 | |||||||||||||||||||||||||||||

| Recipient | Code | Res.field | |||||||||||||||||||||||||||

| 18210102010011000110 | 40307000 | TP | MS.02.2017 | 0 | 0 | ||||||||||||||||||||||||

| Personal income tax for February 2021. | |||||||||||||||||||||||||||||

| Purpose of payment | |||||||||||||||||||||||||||||

| Signatures | Bank marks | ||||||||||||||||||||||||||||

| Ivanova | |||||||||||||||||||||||||||||

| M.P. | |||||||||||||||||||||||||||||

| Petrova | |||||||||||||||||||||||||||||

What should I do if an error was made when specifying the status code?

If an error was made when specifying the code, the fact that the payment was not transferred to the budget will be recorded. That is, even if money is debited from the sender’s account, it will not be credited to the recipient’s account. In accordance with tax legislation, the tax will be considered unpaid, and this may result in penalties for the payer.

To avoid disputes with the tax service, you should proceed in the following order:

- Check your payment for errors.

- If errors are found, submit an application to the tax office, which will clarify the payer’s status in the payment invoice.

- It is best to reconcile with the tax office on previously paid taxes and contributions. Based on the results of this process, an act will be generated, which is signed by both parties - the taxpayer and the tax service employee.

Method number 2: find out offline

How can I find out the payer code if I don’t have a receipt at hand or access to the Internet? We offer you several simple ways:

- Having grabbed your passport and, just in case, a document on ownership, you can go to your housing office or management company - they should provide you with this code.

- If you don’t want to leave your home, how can you find out the housing and communal services payer code at the address? Make a call to the EIRC (Unified Information and Settlement Center) or to the Criminal Code. Be prepared to dictate your passport details and information about your place of registration, for which you need to know the code.

Why do you need to know the CP?

The payer code is the same identification number as the TIN, SNILS code, policy, passport, etc. It allows you to identify all payers.

Why are many people interested in how to find out the payer code? There is only one answer - this information helps to save your time significantly! For example:

- The code is needed to pay for housing and communal services in all electronic systems for accepting such payments, payment terminals, and ATMs.

- This code is needed in order to receive on the popular useful resource “GosSberbank-Online” also requests this code to make instant payments from a bank card linked to it using only your smartphone or PC.

Among other things, this code helps you find out whether the receipt that arrived in your mailbox is genuine or whether it is a trick of scammers. The latter can skillfully falsify many data, but instead of the payer code they write a random set of numbers. Remember - this number can only be changed by the management company! It is easy to find out about past transformations by simply calling her.

How to find out the debt by payer code?

The housing and communal services payer code is not only the “key” to quick payment for services, but also a way to quickly become familiar with the amount of your debt to the management company. The code will help you on the following resources:

- “State Accruals” of your personal account, link the payer number to your account. In the “Accounts” tab, your debt will be displayed, which can be paid immediately.

- Bank of Moscow service. You enter the payer code, and then you can choose what debt you are interested in - for today, for the current month, for the last six months, etc.

Alternative ways to find out about utility debt

If for some reason you were unable to determine your payer number, we will tell you how to find out the debt in other ways:

- Contact the housing office or management company. Be sure to take your passport with you, a document confirming your ownership of the property. However, be careful - this way you will only find out your rent debts! To find out the debt for electricity, you need to contact the customer service of the corresponding energy company, for gas - from the providers of this service, etc.

- Go to the EIRC without forgetting your documents. The employee will inform you of the total amount owed.

- In some cases, having entered the necessary information, you can find out about your debt at home by going to your manager’s website; it is not necessary to enter the payer code. Go to “Payments”, then “Payment for housing and communal services” and find the required item in the menu. Enter the information requested by the site.

- You can also find out about your debt in Sberbank payment terminals - be prepared to indicate your personal account. Please note that the invoice symbols for rent, electricity, gas, water, Internet and TV payments are different.

You can easily find out your payer code, which is so necessary in modern times, without even leaving your home. In addition to paying receipts, he will help you complete other transactions - for example, determine your debt on utility bills.

Method No. 1: by receipt

The surest way to tell you how to find out the payer code is to look at the receipt for payment for housing and communal services. They are dropped into mailboxes and handed over personally to the concierge, the entrance manager, etc.

Typically, in receipts this information is contained in the upper right corner of the “header” of the sheet in the corresponding line - “Payer code”. Next door will be information about you, a barcode, and the total cost. If the receipt does not contain a code, then this is a reason to doubt its authenticity.

Status in land tax payments: nuances

How the status should be indicated in land tax payments is explained by the letter of the Ministry of Finance of Russia dated January 16, 2015 No. 02-08-10/800. It depends on who is making the transfer:

- Individual.

- Entity.

Individuals are recommended to record their status:

- 03 - for legal entities classified as a federal postal service organization (or FPS) and generating orders for the transfer of funds for payments by individuals;

- 09 - for individual entrepreneurs;

- 10 - for notaries who are engaged in private practice;

- 11 - for lawyers who have their own office;

- 13 - for individuals who are clients of a financial institution and account holders;

- 15 - for banks, their branches, payment agents, FPS organizations that generate payment orders for a certain total amount with a register for the transaction of funds accepted from payers in the status of individuals;

- 16 - for participants in foreign economic activities in the status of an individual;

- 17 - for participants in foreign economic activities in the status of individual entrepreneurs;

- 19 - for legal entities and their branches that have issued an order for the transaction of funds that are withheld from the salary of a debtor in the status of an individual to account for debts under obligations to the budget system of the Russian Federation on the basis of a received executive document;

- 20 - for credit institutions and their branches, payment agents who form orders for cash transactions for individual payments by individuals.

For legal entities, the status may be as follows:

- 01 - for taxpayers with the status of a legal entity;

- 02 - for tax agents;

- 04 - for tax authorities;

- 05 - for territorial structures of the Federal Bailiff Service;

- 06 - for participants in foreign economic activities in the status of legal entities;

- 07 - for customs structures;

- 26 - for the founders of a debtor company, owners of property of a company in the status of a unitary enterprise, or third parties who have issued an order to conduct a transaction of financial resources aimed at repaying the claims of creditors in the bankruptcy process.

For information on preparing a land tax payment, see the article “Payment order for payment of land tax (sample)” .

Rules for filling out payment orders in 2017

The rules for filling out payment orders for the payment of taxes and insurance contributions were approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. These rules continue to apply in 2021.

However, from 2021, instead of taxpayers and payers of insurance premiums, taxes and contributions can be paid by third parties: organizations, individual entrepreneurs or ordinary individuals (Clause 1 of Article 45 of the Tax Code of the Russian Federation). When filling out payment slips, third parties are also required to follow the rules approved by the Order of the Ministry of Finance of Russia dated November 12. 2013 No. 107n. See “Third parties now have the right to pay taxes, fees and insurance premiums for others.”

Method number 3: find out online

The easiest way to find out the payer code at the apartment address is via the Internet, both through a PC, and outside the home - through the same smartphone. This is done simply:

- Go to the Moscow State Housing and Communal Services resource. Among other things, it will help you decide on your payer code.

- If you have ever made similar payments through GosSberbank-Online, then simply find the corresponding electronic checks in the transfer history - the payer code will be indicated in them. Mobile banks of other credit institutions can also save slips with such information in their history.