Liquidation commission

To make a decision on partial liquidation of a fixed asset, create a commission that should:

- determine the possibility and feasibility of restoring part of the fixed asset that is subject to liquidation;

- determine the possibility of using individual components, parts, materials of the retiring part of the fixed asset.

The commission should include the chief accountant, employees responsible for the safety of fixed assets, and other employees appointed by order of the head of the organization. The decision on partial liquidation of a fixed asset made by the commission is approved by order of the head of the organization. After the liquidation of part of the fixed asset, an act is drawn up. The commission can draw up an act on partial liquidation of a fixed asset using form No. OS-4 or No. OS-4a.

This procedure follows from paragraph 77 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Impact of liquidation of fixed assets on taxes

All transactions with fixed assets are displayed in the enterprise's balance sheet. Their write-off is no exception, but in this case it is necessary to correctly take into account the impact of these entries on the calculation of the tax base when calculating various payments to the state.

Impact on VAT:

- VAT cannot be calculated on fixed assets whose depreciation has been written off in full;

- if the balance of depreciation is still taken into account in the accounts, VAT can be restored;

- if dismantling of equipment or premises is carried out by a third-party organization, then, in accordance with the Tax Code of the Russian Federation, input VAT is accepted for deduction in the general manner;

- When selling the remaining parts on the basis of settlement documents, VAT will definitely need to be charged.

The remaining parts after dismantling the old equipment or premises are taken into account as part of non-operating income, regardless of whether they will continue to take part in production or not. Income will be considered received immediately after signing the decommissioning act. In this case, the tax base will increase by the cost of new parts.

Partial liquidation of the building

When a building (structure) is partially liquidated, its total area and other characteristics that were originally indicated during its state registration are reduced. For example, number of floors. Therefore, new characteristics of the building (structure) must be registered in the state register (clause 68 of the Rules, approved by order of the Ministry of Economic Development of Russia dated December 23, 2013 No. 765). In this case, the building (structure) is not re-registered, but only an entry is made in the register about changes in its characteristics.

To register changes, you need to submit to the territorial office of Rosreestr:

- application for amendments to the state register of rights to real estate and transactions with it;

- documents confirming changes in the relevant information previously entered into the state register (for example, a certificate from the BTI);

- payment order for payment of state duty in the amount of 1000 rubles. (Subclause 27, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

This is stated in paragraphs 4 and 5.1.1 of the Regulations approved by Decree of the Government of the Russian Federation dated June 1, 2009 No. 457, Section IX of the Methodological Instructions approved by Order of the Ministry of Justice of Russia dated July 1, 2002 No. 184.

Normative base

The accounting and reporting standards were approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34N. OS are classified as accounting items and rules for their evaluation are formulated.

The fixed assets group includes:

- material and tangible assets that are used as means of labor or for management during an interval longer than one year (buildings, equipment, instruments, vehicles, computers);

- investments in reclamation works;

- owned natural resources.

Repayment of the cost of fixed assets is carried out by calculating depreciation during the period of its SPI.

Regardless of the company’s performance, one of the write-off methods listed below is used:

- linear;

- cost reduction in proportion to production volume;

- reduction of balance;

- by the length of the period during which the object brings economic benefits.

Exceptions include the following situations:

- The fixed assets of a non-profit structure cannot be written off;

- the value of plots of land and resources of the natural world is not repaid.

The material assets remaining after the disposal of unusable assets are accounted for at the market price on the date of the transaction.

The disposal of fixed assets is regulated by Section V of Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n:

- the cost of an item that is not planned to be used in the economic activities of the enterprise, or is not capable of generating income in the future, is subject to write-off from accounting;

- if an asset is disposed of as a result of a purchase and sale transaction, then the proceeds are taken into account in the amount agreed upon by the parties;

- income and expenses from write-off of fixed assets are reflected in accounting in the same interval to which they relate and are credited to the profit and loss account as other.

Accounting: partial liquidation

The organization is obliged to keep records of fixed assets according to the degree of their use:

- in operation;

- in stock (reserve);

- in the stage of partial liquidation, etc.

This is stated in paragraph 20 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Accounting for fixed assets by degree of use can be carried out with or without reflection on account 01 (03). Thus, fixed assets that have been in the stage of partial liquidation for a long time should be accounted for in a separate subaccount “Fixed assets in the stage of partial liquidation.” This approach is consistent with paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Debit 01 (03) subaccount “Fixed assets in the stage of partial liquidation” Credit 01 (03) subaccount “Fixed assets in operation”

– work has begun on the partial liquidation of fixed assets.

Upon completion of partial liquidation, make the following entry:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 01 (03) subaccount “Fixed assets in the stage of partial liquidation”

– work on the partial liquidation of fixed assets has been completed.

This procedure follows from paragraph 2 of clause 14 of PBU 6/01 and the Instructions for the chart of accounts (account 01).

Main reasons

Buildings, vehicles, various equipment and other property that is directly related to fixed assets can be written off from the company’s balance sheet if it becomes unusable due to various accidents, physical wear and tear, natural disasters or, for example, violation of normal operating conditions.

In some cases, a company simply decides to replace outdated equipment with new ones in order to improve the productivity of its operations and provide itself with additional profits, while the old ones are simply written off.

It is best to write off property that falls into the category of fixed assets when its restoration is not possible or is not feasible from an economic point of view.

Accounting: depreciation during partial liquidation

Do not suspend depreciation on fixed assets that are in the stage of partial liquidation. There is an exception to this rule - if the liquidation of part of the fixed asset is carried out as part of reconstruction for more than 12 months (clause 23 of PBU 6/01, clause 63 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). For more information about this, see How to reflect the reconstruction of fixed assets in accounting.

Upon receipt of the act of partial liquidation, adjust the value of the fixed asset (paragraph 2, clause 14 of PBU 6/01). Calculate the monthly amount of depreciation after partial liquidation based on the adjusted initial (residual) value of the fixed asset and the previous depreciation rate.

Do not revise the useful life of a fixed asset. An exception to this rule is the partial liquidation of a fixed asset carried out as part of reconstruction. Reconstruction work can lead to an increase in the useful life of the fixed asset. In this case, for accounting purposes, the remaining useful life of the reconstructed fixed asset must be revised. For more information about this, see How to reflect the reconstruction of fixed assets in accounting.

This procedure follows from paragraph 20 of PBU 6/01 and paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: how to determine at the end of the partial liquidation of a fixed asset the amount by which its initial cost should be reduced and the amount of accrued depreciation?

The procedure for reducing the value of a fixed asset after its partial liquidation is not established by law. Therefore, the organization must develop it independently.

The best way is to determine the initial cost of the liquidated part of the fixed asset using accounting data. For example, if in the primary documents submitted by the supplier when purchasing a fixed asset, the cost of the liquidated part is highlighted as a separate line, in this case the amount of depreciation charges attributable to the liquidated part can be calculated using the formula:

| Depreciation charges attributable to the liquidated part of the fixed asset | = | Initial cost of the liquidated part of the fixed asset | : | Initial cost of the entire fixed asset | × | Accrued depreciation at the end of liquidation |

If it is impossible to determine the initial cost of the liquidated part of the fixed asset based on accounting data, it can be calculated:

- a commission created from employees of the organization;

- independent appraiser.

In this case, the share of liquidated property must be determined as a percentage of any physical indicator characterizing the fixed asset. Taking into account this share, the cost and amount of depreciation attributable to the liquidated property are calculated.

For example, for buildings (structures), the initial cost and depreciation charges attributable to the liquidated part can be determined by calculation:

| Initial cost attributable to the liquidated part of the building (structure) | = | Area of the liquidated part of the building (structure) | : | Total area of the building (structure) before liquidation | × | Initial cost of the building (structure) |

| Depreciation charges attributable to the liquidated part of the building (structure) | = | Area of the liquidated part of the building (structure) | : | Total area of the building (structure) before liquidation | × | Accrued depreciation at the end of liquidation |

The applied option for adjusting the initial cost and the amount of accrued depreciation after partial liquidation of a fixed asset should be fixed in the accounting policy for accounting and tax purposes.

After partial liquidation, depreciation on the fixed asset continues to be calculated based on its value adjusted to the cost of the liquidated part.

This procedure is confirmed by letter of the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479. Although this letter contains references to the old version of the Tax Code of the Russian Federation, the conclusions drawn in it can still be applied now, as amended by the current rules of law.

Results

A fixed asset that has become unusable is written off based on the decision of the commission and the order of the director. There is no need to restore VAT. Materials remaining after the liquidation of the fixed assets must be capitalized at market value as part of inventories.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting: cost adjustment

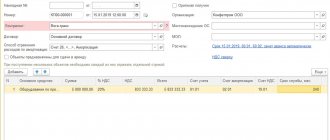

In accounting, reflect the adjustment in the value of a fixed asset after its partial liquidation with the following entries:

Debit 01 (03) subaccount “Retirement of fixed assets” Credit 01 (03) subaccount “Fixed assets in operation”

– the initial (replacement) cost of the liquidated part of the fixed asset is taken into account;

Debit 02 Credit 01 (03) subaccount “Disposal of fixed assets”

– the amount of depreciation charges attributable to the liquidated part of the fixed asset is written off;

Debit 91-2 Credit 01 (03) subaccount “Disposal of fixed assets”

– the residual value of the liquidated part of the fixed asset is written off.

This procedure follows from the Instructions for the chart of accounts (account 01).

The amount by which the initial value of the fixed asset was adjusted after partial liquidation is reflected in the inventory record card in form No. OS-6 (No. OS-6a) or in the inventory book in form No. OS-6b (used by small enterprises).

Provided reasons for disposal of fixed assets

An organization loses fixed assets for various possible reasons:

- moral and/or physical wear and tear of the property fund;

- destruction as a result of an emergency (accident, natural disaster, catastrophe, etc.);

- irreparable damage (intentional or accidental);

- theft of a fixed asset;

- loss of an object identified during inventory;

- completing a purchase and sale transaction, the object of which is OS;

- conclusion regarding the object of a gift or barter agreement;

- transfer to another legal entity or individual free of charge;

- the fixed asset has become a contribution or part of a contribution to the authorized capital of another legal entity;

- The redemption period has come for the property leased on a leasing basis.

ATTENTION! There may be other reasons for the disposal of fixed assets; the main condition for carrying out the procedure is the absence or impossibility of using the object based on the results of the next inventory.

If an object was simply moved between structural divisions within the same organization, this is not considered a disposal.

Collection and work of the commission

In order to carry out all planned activities, it is mandatory that a commission be formed in advance, which will be able to complete the assigned tasks.

Only relevant persons can confirm that the property cannot be used due to its insufficient characteristics, can be transferred to another company or sold on the basis of an appropriate agreement.

A liquidation commission must be created and subsequently confirmed. Only after the specialists have completed the assigned tasks can the entrepreneur make a final decision regarding the property and reflect this in practice.

You can learn about the procedure for checking a company for bankruptcy.

The commission for writing off fixed assets must necessarily include the chief accountant, as well as financially responsible employees. The full composition is determined by the head using an order.

Subsequently, designated persons must carry out certain activities:

- viewing the object taking into account all existing requirements. At the same time, the subject of the event must be accessible;

- assessment of opportunities for restoration work in order to return to previous operational parameters;

- determining the reasons for liquidation, which is carried out in most cases;

- identification of those responsible if premature liquidation occurs. In this case, the standard service life of the item is taken into account.

- assessment of the possibilities for using any equipment components in work activities.

Subsequently, a special conclusion is expected to be drawn up, the form for which is not established by law.

For this reason, the documentation form must be developed independently, but all details must be indicated.

Service memo

A memo is an internal document with the help of which subordinates convey the necessary information to management.

The note is formatted differently in different companies. A special form (template) may be provided for it, or employees may design it at their own discretion.

Principles for drawing up a memo:

- you need to write a note addressed to the manager (or according to the hierarchy accepted in the company);

- information should be presented without excessive detail, but reflecting the necessary facts;

- The note must be completed by indicating your position, full name, personal signature and date of preparation.

The note is presented in the manner that is accepted in the company for such papers (given personally to the manager, sent by e-mail, transmitted through the secretary with recording of received correspondence in the journal, etc.).

Following these principles will give the note the status of an official document and will relieve its compiler from the need to provide additional explanations on the information contained in the note.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Sample memo:

The main purpose of the memo is to promptly inform management about the existing problem and thereby start the process of writing off fixed assets from the balance sheet.

Features of the procedure ↑

In order to comply with legal requirements, it is worth knowing how to organize and write off fixed assets. We will determine for what reason an object may be disposed of and how to reflect such a process in accounting and what documents to base it on.

Possible reasons(reasons)

Buildings, equipment, materials, transport can be written off from the company's balance sheet, which is considered fixed assets, if they have become unusable when the following occurs:

- physical wear and tear, when an object becomes unsuitable for further use;

- emergency situation;

- disaster;

- violation of normal conditions of use, etc.

Objects that have become obsolete during the construction, expansion, reconstruction and technical re-equipment of a company, workshop and other facilities are also written off.

Property assets should be written off even when they cannot be restored, or this would be an inappropriate action in economic terms.

There are also other reasons for write-off:

- the object is sold to a third party or individual;

- The OS is transferred to third parties free of charge or exchanged for other property;

- the authorized capital of another company is replenished from OS accounts;

- the object is rented or leased.

You cannot write off the OS in this case:

| Capital buildings and other types of property | Must be modernized or reconstructed, and do not participate in the work of the company, also in the case of temporary conservation |

| The object is transferred from some units | To others within the same enterprise (preparing an acceptance certificate) |

In such situations, the objects continue to be considered the company’s fixed assets, and there is no reason to carry out the write-off procedure

Documenting

Stages of the procedure:

- A commission is created to dispose of the object, which must be approved by order of the head of the enterprise.

- A corresponding conclusion is drawn up by the members of the commission when the retiring facility is inspected.

- An order for write-off or partial liquidation is signed by management.

- An act is drawn up stating that the OS is written off (based on the director’s order).

- Change information in OS inventory cards.

- The operation is reflected in accounting.

When disposing of property, the following documents may be drawn up:

| Act OS-1 | For any OS, except for capital buildings |

| OS-1a | For structures and buildings |

| OS-1b | If a group transfer of objects is carried out (Resolution No. 7 dated January 21, 2003) |

| Form OS 4, 4a, etc. | — |

That is, documents must be prepared that can confirm the write-off of the OS, and will also reflect arguments regarding the lack of possibilities for further use of the object.

The write-off act is drawn up after the object is liquidated (clause 78 of the Guidelines). A note that the OS is being retired is made on the OS inventory cards (form OS-6, , ).

The acts are prepared in 2 copies. The signature of the commission members is affixed, which is appointed by the management. The first sample will be handed over to the accountant, the second will remain with the person who is responsible for the safety of the OS.

This is also the basis for putting the object into storage and selling the items that remain after being written off. If a vehicle is written off, then it is worth submitting to the accounting department not only the act, but also a certificate that will confirm the deregistration of the car with the traffic police.

If materials and elements of the asset being written off are received, an invoice (form M-11) is drawn up, as well as an act (form M-35).

Defective statement

The defective statement is compiled as follows:

| Rationale | The fact that write-off is economically feasible |

| Source of information within the company | So that you can analyze the cause of the OS failure |

| A document reflecting the expert’s justification | For write-off for the owner of the enterprise, investor, other interested party |

The statement reflects data that will confirm the fact that it is impossible to operate the property.

Provide the following information:

| Company name | Structural divisions in which the operating system was registered |

| Information about the technical specialist | Which conducts an examination of the object and determines that it cannot be further used |

| OS list | What were examined by an expert, inventory and serial number |

| Data | About malfunction and defect |

| Expert opinion | About the fact that it is advisable to write off the OS |

| Expert signatures | — |

Service memo (sample)

Another document that must be drawn up is a memo. It can be written arbitrarily, but taking into account the following recommendations:

- on the right, reflect the position and full name of the addressee;

- write down the title of the document;

- enter the date and registration number;

- reflect the subject of the note;

- describe the situation;

- Then the signature of the official is affixed.

The memo is formatted like this:

- use A4 sheet, font - Times New Roman, size 14;

- the date is written in Arabic numerals;

- The title of the document is displayed in the middle or on the left.

An official note to write off an operating system is needed if the object is damaged or the material and technical base is outdated. Such documents are related to purchase notes and are similar in specification.

A note is drawn up by the head of the department:

Commission conclusion (example)

To determine the unsuitability and impossibility of using the operating system, as well as to draw up the necessary documents for writing off, a commission must be created at the enterprise.

It should include:

- chief engineer or deputy management;

- chairman of the commission;

- heads of department;

- chief accountant or his deputy;

- persons who are responsible for the safety of the OS;

- other persons at the discretion of the director.

The commission is obliged to inspect the fixed asset, which must be written off, using data from the technical passport, floor plan, and other documentation.

She:

| Defines | For what reason can an object be written off? |

| Installs | Is it possible to operate individual components, parts, materials? |

| Controls the withdrawal | Valid unit, materials from the object |

| Draws up acts | To write off a specific object |

That is, in order to carry out the write-off procedure, an appropriate decision of the commission must be made.

Based on the results of the work carried out, the commission must draw up a conclusion, which can be presented in the form of a separate document or act on the write-off of fixed assets

For a classifier of fixed assets by depreciation groups, see the article: classifier of fixed assets. Read about depreciation of fixed assets here.

There is no legal requirement to prepare such a document. But in order to provide a detailed justification for the write-off, it is better to issue an independent certificate.

Example of a commission conclusion:

The requirements for preparing orders for write-off of fixed assets are not specified in the regulatory documentation. But the act should reflect the basis for its preparation, and the tax authorities may request an order during an audit.

Sample order:

Based on the order, it is worth preparing an act of form OS-4, , . Next, an entry will be made in the inventory card about the disposal of the object, which is stored at the company for 5 years.

A protocol for the commission on write-off of fixed assets may be drawn up, a sample of which you will find on the Internet.

Reflection of postings in accounting

All costs associated with the disposal or write-off of fixed assets must be included in operating costs (clause 11 of PBU 10/99).

When disposing of old equipment, an organization may receive certain spare parts or materials. The commission evaluates them in accordance with the market price. The accountant also includes such profit in operating profits.

If a machine or other type of equipment is written off from the balance sheet, the depreciation charge is first written off according to Dt 02 Kt 01.

So, according to account 01, the residual value of the retiring fixed assets is formed. Such amounts are included in Dt 91 (Dt 91/2 Kt 01). In Dt 91 it is worth recording other costs associated with dismantling.

The financial results of the write-off are reflected in account 99. To keep track of machines, the specialist opens a sub-account for the disposal of fixed assets to account 01.

With zero residual value

If the company continues to use the asset, which has a zero residual value, then no additional accounting entry is made.

Such property assets will continue to be listed on the company’s balance sheet at a zero price. If the enterprise does not operate such property, it will be liquidated and written off (Dt 91 Kt 01).

If an object is fully depreciated, then its price is included in the costs. When indicators in tax accounting are equal to zero, such funds do not participate when expenses for income tax are generated.

This means that the fixed assets should be taken into account in tax accounting (Article 313 of the Tax Code). The residual value of fixed assets and expenses associated with liquidation should be reflected as part of other expenses in the period to which they are attributed (clause 11 of PBU 10/99).

Current wiring. Let's imagine the use of entries in the table:

| Dt 01 Kt 01 | The initial price of the OS is written off |

| Dt 02 Kt 01 | The entire amount of depreciation charge is written off |

| Dt 91/2 Kt 01 | Write-off of the residual value of the fixed assets that are transferred |

| Dt 58 Kt 91/1 | Monetary value of the contribution to the authorized capital, as agreed by the parties |

| Dt 91/9 Kt 99 | Income reflected |

| Dt 99 Kt 91/1 | Lesion |

If the liquidation of an operating system is carried out by a special division of the company, then the costs of such work are reflected using the following entries:

| Dt 23 Kt 70, 68, 69 | Costs incurred during the liquidation of the facility |

| Dt 91/2 Kt 23 | Write-off of costs upon liquidation of property |

| Dt 91/2 Kt 70, 69, 68, 10 | The costs of liquidating an operating system are taken into account if there are no auxiliary units |

| Dt 91/2 Kt 60 | The costs of the liquidation procedure, which was carried out by the contractor, were taken into account |

| Dt 19 Kt 60 | VAT taken into account, which the contractor presented, that he carried out the liquidation |

Depreciation of fixed assets

The depreciable property of the company is objects of the following type:

- fixed assets that are transferred to the enterprise free of charge;

- objects classified as housing stock;

- OS of a non-profit company;

- perennial planting, etc.

Depreciation is charged from the time production assets are registered until the cost is fully repaid or the asset is written off when worn out.

All depreciation postings are made to account 02 of accounting. In Kt, balance sheet and passive accounts reflect the amount of accruals for a certain fixed asset.

According to Dt, the depreciation amount is written off upon disposal of non-current assets. Depreciation can be calculated using the following methods:

- linear;

- write-off according to the period during which the object will be useful;

- by reducing balance;

- write-off in proportion to the volume of production of goods.

The methods are chosen by the enterprise independently and are reflected in the accounting policies. Postings are made to calculate depreciation:

Dt 20, 23, 25, 26, 29, 44 Kt 02

Taking into account the chosen accrual scheme, the amount determined for the inventory assets of the fund is carried out according to Kt 02. At the same time, such expenses can increase the cost of goods of the departments where the fixed asset is operated.

A trading company must include depreciation charges in costs. And then the use of Dt 44 is relevant. For all types of objects, it is advisable to maintain analytical accounting according to account 01, and such accounting of inventory units according to Kt 02.

The procedure for writing off depreciation of property is reflected by entries in each necessary register and accounting account, accounting for management and tax plans when removing it from the company’s balance sheet.

Non-current intangible assets (patent, trademark, right to invention, etc.) are accepted and registered by the commission, which must sign the acceptance certificate.

She will also set the primary price, reflecting it in the balance sheet asset. Accounting for intangible assets is carried out on account 04 – the active account.

In this case, the accounting is the same as when conducting operations on fixed asset accounts. When using assets of such a plan, depreciation is charged when the objects become obsolete. Accruals are made every month.

The financial result does not matter. The calculation is carried out on the basis of primary indicators, according to which intangible assets are entered into accounting.

Depreciation is reflected in passive account 05, the amount is accumulated according to Kt 05, and written off when assets are disposed of (Dt 20, 23, 26, 29 Kt 05).

Fallen into disrepair

The procedure for writing off an object that has fallen into disrepair has its own accounting features, taking into account:

- write-off standard;

- there is evidence that an employee of the enterprise or another person is guilty that the materials are damaged.

The price of damaged assets is written off within the normal loss standard to production expenses, and above the standard - at the expense of the person at fault or for other costs.

Accountants can write off low-value and wear-and-tear items when they are put into use, or keep records evenly. The selected methods are indicated in the accounting policy.

The value indicator of 100,000 rubles, which has been approved for tax accounting since 2021 in order to distinguish between fixed assets and low-value ones, is not valid in accounting. Accounting low value - objects whose price does not exceed 40,000.

The same write-off procedure should be followed for inventory and household supplies, the composition of which is not reflected in legislative documents.

In general cases it is:

- office furniture;

- kitchen appliances;

- electrical equipment;

- other objects (equipment used for cleaning the area, fire extinguishing agent).

The material is written off according to Kt account 10. By debit it will be account 20, 23, 25, 26, 91, 99.

| Dt 20 Kt 10 | Write off the price of the material that is used in the main production |

| Dt 23 Kt 10 | Take into account the costs of material released for auxiliary production |

| Dt 94 Kt 10 | The book value of the material is written off in case of damage or obsolescence |

| Dt 99 Kt 10 | Materials that are lost in a natural disaster are written off |

| Dt 91.2 Kt 10 | Objects are disposed of (they are transferred free of charge) |

To determine whether it is advisable to continue to use the OS, it is worth creating a commission (clause 77 of Methodology No. 91n). To write off an object that has become unusable, appropriate documentation is prepared.

The residual price of objects is written off from Kt 01 subaccount for disposal of fixed assets in Dt 91 subaccount for other costs. In such a situation, the residual value is zero, since depreciation has been fully charged.

Costs associated with the liquidation of equipment are written off in Dt 91/2 Kt 23.

The material assets that remained after the write-off of the OS, which is unsuitable for restoration and further use, must be at the market price at the time of write-off. The corresponding amount will be credited to the financial result.

Such accounting rules are established by clause 54 of Regulation No. 34n. Unusable spare parts should be taken into account; scrap metal costs Dt 10 Kt 91/1.

Depreciated object

If the object is worn out, the following operation will be carried out during write-off:

- write-off of initial cost;

- write-off of depreciation;

- write-offs from depreciated objects.

| Dt 01.09 Tt 01.01 | Reflection of initial cost |

| Dt 02.01 Tt 01.09 | Reflection of depreciation |

| Dt 91.01 Tt 01.09 | Reflection of the amount after depreciation |