At the end of March - beginning of April 2021, due to the spread of coronavirus, many legislative changes occurred, including those relating to the issuance of sick leave and the calculation and payment of temporary disability benefits. 1C experts, using the example of “1C: Salaries and Personnel Management 8” edition 3, tell what has changed in the algorithm for calculating such benefits, who is affected, how sick leave is issued for insured persons who arrived from abroad and are in quarantine, as well as for employees over 65 years old.

Sick leave and a new virus

Currently, there are two versions of the certificate of incapacity for work: regular (paper) and electronic BL. Regardless of the form, the document is drawn up when seeking medical help. In the column the disease code is written:

- 01 – in the case when the patient himself is diagnosed with a coronavirus infection;

- 03 – if a person was in forced quarantine after contact with people infected with COVID-19, or upon arrival from a region with an unfavorable epidemic situation for coronavirus.

Any corrections to the sick leave certificate are prohibited by law. The medical institution must transfer information about the document issued on the basis of an examination and laboratory examination to the Social Insurance Fund (FSS) the next day.

Temporary disability benefit

The basis for payment of temporary disability benefits is an insured event.

The benefit is paid when:

- the employee is sick;

- the employee was injured due to loss of ability to work;

- the employee was undergoing follow-up treatment in a sanatorium immediately after receiving medical care in a hospital;

- a member of the employee’s family gets sick and needs care;

- the employee is placed in a specialized hospital for prosthetics for medical reasons;

- the employee and any member of his family were in quarantine;

- the employee suffered as a result of an accident at work or received an occupational disease.

But these are all reasons for disability.

When issuing sick leave, the doctor enters a special code to indicate the cause of disability. For example, illness – 01, injury – 02, quarantine – 03, etc.

What is an insured event?

Registration of a certificate of incapacity for work remotely

You can issue an electronic certificate of incapacity for work without a personal visit to a doctor during quarantine. The reason is considered to be returning from a territory unfavorable due to the coronavirus situation or contact with patients with COVID-19. To complete the procedure, you must have a verified account on the Social Insurance Fund website.

To register an electronic ballot, you need to go to your personal account, fill out an application and attach photographs of supporting documents:

- travel tickets;

- the first page of the international passport and the border crossing mark;

- travel certificates (for a work trip);

- certificates of joint residence with people who were abroad.

Depending on your specific situation, electronic copies of other documents may be required. Then the FSS interacts with the medical institution that issues the sick leave and determines the employer.

Next, personal information about the employee is requested. The information must be provided to the Social Insurance Fund within two days of receiving the request. BC on home self-isolation is opened for a period of 2 weeks.

What is an insured event

Now let's figure out what an insured event is.

The definition of an insured event under the legislation on compulsory social insurance in case of temporary disability and in connection with maternity was given by the FSS in a letter dated August 18, 2004 No. 02-18/11-5676.

An insured event, which is the basis for payment of benefits, should be considered a case of temporary disability:

- completed by one completed period of incapacity;

- certified by a certificate of incapacity for work, taking into account all certificates of incapacity for work issued in continuation of the initial one.

Part 1 of Article 6 of Federal Law No. 255-FZ of December 29, 2006 provides that benefits are paid for the entire period of temporary disability from the moment it begins until the day of restoration of working capacity.

Read in the berator “Practical Encyclopedia of an Accountant”

How to determine the period of temporary disability

But it also happens that within the framework of one insured event there is a change in the cause of disability. For example, an employee was first in quarantine, and then fell ill himself.

How to pay benefits in this case?

Payment of sick leave for COVID-19

If all formalities are completed correctly, the Foundation will pay for sick leave for COVID-19 at its own expense. The amount of payment for a whole month, according to the new rules, cannot be less than the minimum wage for a full-time employee (rate). Regional coefficients for charges are also taken into account.

If an employee provides a paper BC with code “01”, received on a general basis (when diagnosing coronavirus in a clinic), payment will be made:

- by the employer - the first three days of incapacity for work;

- SS Fund – remaining days.

The minimum wage (minimum wage) from January of this year is 12,130 rubles.

Changing the algorithm for calculating sick leave benefits for workers with short experience

The current Federal Law No. 104-FZ dated April 1, 2020 establishes the specifics of determining the amount of temporary disability benefits. Law No. 104-FZ is aimed at supporting workers with short work experience or low wages in the previous two years (in particular, university and college graduates) for the period from April 1 to the end of the current year. During this period, the disability benefit paid in any case should not be less than the minimum wage calculated for a full calendar month.

According to the Russian Ministry of Labor, the new rule on improving the terms of payment for sick leave may affect 2.3 million people.

Paragraph 1 of Article 1 of Law No. 104-FZ provides for the following temporary procedure for calculating benefits:

- calculate the amount of temporary disability benefits according to the usual rules;

- compare the amount of daily benefit with the minimum wage calculation;

- if the result is not less than calculated according to the minimum wage, then there are no changes in the calculation;

- provided that the result is less than calculated according to the minimum wage, the benefit should be calculated based on the minimum wage.

The features of the new calculation procedure should be taken into account.

The new procedure applies to sick leave for reasons of incapacity for work:

- illness or injury, except for injuries at work (01, 02, 10, 11);

- quarantine (code 03);

- caring for a sick child (codes 09, 12, 13, 14, 15);

- caring for a sick adult family member (code 09);

- prosthetics in a hospital (code 06).

The new procedure for calculating payment for temporary disability is valid starting from 04/01/2020. If the sick leave was opened earlier, then in the months before 04/01/2020 the calculation is made according to the usual rules. In regions where regional coefficients (RC) are applied in accordance with the established procedure, the minimum wage should be used to calculate benefits, taking into account the RC.

For employees working part-time at the time of the insured event, the amount of benefits calculated on the basis of the minimum wage is determined in proportion to the duration of working hours.

The question arises: in what cases the amount of the daily benefit calculated according to the usual rules may be less than the benefit calculated from the minimum wage. In accordance with Federal Law No. 255-FZ of December 29, 2006 (hereinafter referred to as Law No. 255-FZ), when calculating benefits according to the usual rules for choosing the average daily earnings used to calculate the amount of sick leave payment, you need to compare the employee’s actual average daily earnings with the minimum and maximum values of average daily earnings established by law.

Let us remind you that according to the usual rules, the minimum value of average daily earnings is calculated as follows.

As monthly earnings for the previous two years, it is supposed to take into account the minimum wage. From 01/01/2020, the minimum average daily earnings from the minimum wage (Article 1 of the Federal Law of June 19, 2000 No. 82-FZ) is 12,130 rubles, i.e. the total minimum earnings for two years in 2021 is 291,120 rubles. (RUB 12,130 x 24 months).

To obtain the minimum average daily earnings, the minimum earnings for two years should be divided by 730 days. Thus, in 2021 the minimum average daily earnings is 398.79 rubles. (RUB 291,120 / 730 days).

However, according to the rules of Part 1 of Article 7 of Law No. 255-FZ, temporary disability benefits are paid depending on the employee’s insurance length and amount to 100% only for cases of 8 years or more. Thus, it is obvious that changes in legislation improve the conditions for paying sick leave, for example, for young people with low earnings and experience. But even with 100% payment for sick leave, paid on the basis of the minimum average daily earnings, new calculation rules sometimes increase the amount of the benefit.

The new procedure for calculating the minimum wage proposed in Law No. 104-FZ involves dividing the minimum wage by the number of days in the month of incapacity. In months with 30 days (April, June, September and November), the amount calculated based on the minimum wage for one day is 404.33 rubles. (RUB 12,130 / 30 days). In months with 31 days (May, July, August, October, December) - 391.29 rubles. (12,130 rubles / 31 days), which is less than calculated according to the usual rules - 398.79 rubles.

Based on the above calculations, we can conclude that the minimum daily benefit in thirty-day months is 404.33 rubles. In other months it depends on length of service (February does not fall within the period of validity of the new rules from 04/01/2020 to 12/31/2020 of the current year). With an experience of 8 years or more, the usual calculation of the minimum average daily earnings leads to a higher result of 398.79 rubles. With less experience, a new procedure is applied, and the minimum average daily earnings are set at 391.29 rubles.

Example 1

| Employee M.S. Gorbunkov began his working career on 02/01/2020. In April of this year, he fell ill and received sick leave. For simplicity of calculations, we assume that the sick leave was issued for 1 day, for example, 04/01/2020. The total amount for sick leave is calculated by multiplying the amount of payment for 1 day by the number of days. |

In accordance with the new rules, we perform calculations using the following algorithm:

- calculation of the amount of temporary disability benefits according to the usual rules. The employee's work experience is less than six months, and the benefit is calculated based on the minimum average daily earnings of 398.79 rubles. The employee's work experience is less than 5 years, so a coefficient of 0.6 is applied. The benefit amount calculated according to ordinary rules is 239.27 rubles;

- the minimum daily benefit in April is 404.33 rubles, which is more than 239.27 rubles;

- temporary disability benefit for M.S. Gorbunkov for 04/01/2020 is assigned in the amount of 404.33 rubles. (Fig. 1).

Rice. 1. Calculation of benefits in the program

Example 2

| Employee M.S. Gorbunkov began his working career on 02/01/2020. In May of this year he fell ill and received sick leave. To simplify the calculations, let’s assume that the sick leave was issued for 1 day, for example, 05/15/2020. The total amount for sick leave is calculated by multiplying the amount of payment for 1 day by the number of days. |

In accordance with the new rules, we perform calculations using the following algorithm:

- calculation of the amount of temporary disability benefits according to the usual rules. The employee's work experience is less than six months, and the benefit is calculated based on the minimum average daily earnings of 398.79 rubles. The employee's work experience is less than 5 years, so a coefficient of 0.6 is applied. The benefit amount calculated according to ordinary rules is 239.27 rubles;

- the minimum daily benefit in May is 391.29 rubles, which is more than 239.27 rubles;

- temporary disability benefit for M.S. Gorbunkov for 05/15/2020 is assigned in the amount of 391.29 rubles.

Example 3

| Employee M.S. Gorbunkov began his working career on 02/01/2020. In March of this year, he fell ill and received sick leave. To simplify the calculations, we assume that the sick leave was issued for 2 days, for example, from 03/31/2020 to 04/01/2020. |

For March, benefits are calculated according to the usual rules:

- The employee's length of service is less than six months, and the benefit is calculated based on the minimum average daily earnings of 398.79 rubles. The employee's work experience is less than 5 years, so a coefficient of 0.6 is applied. The benefit amount calculated according to ordinary rules is 239.27 rubles.

For April, in accordance with the new rules, we calculate according to the algorithm:

- the benefit amount calculated according to ordinary rules is 239.27 rubles;

- the minimum daily benefit in April is 404.33 rubles, which is more than 239.27 rubles;

- temporary disability benefit for M.S. Gorbunkov for 04/01/2020 is assigned in the amount of 404.33 rubles.

Thus, the amount of benefit for days from 03/31/2020 to 04/01/2020 is 643.60 rubles. (RUB 239.27 + RUB 404.33).

Example 4

| Employee V.S. Ivy began her working career on September 1, 2000. Total earnings for the previous two years amounted to 200,000 rubles. In April of this year, she fell ill and received sick leave. To simplify the calculations, let’s assume that the sick leave was issued for 1 day, for example, 04/01/2020. The total amount for sick leave is calculated by multiplying the amount of payment for 1 day by the number of days. |

In accordance with the new rules, we perform calculations using the following algorithm:

- calculation of the amount of temporary disability benefits according to the usual rules. The average daily earnings according to the calculation amounted to 273.97 rubles. (200,000 rubles / 730 days), which is less than the minimum average daily earnings of 398.79 rubles. The employee has more than 8 years of service and 100% of the calculated benefit is paid. The benefit amount calculated according to ordinary rules is 398.79 rubles;

- the minimum daily benefit in April is 404.33 rubles, which is more than 398.79 rubles;

- temporary disability benefit V.S. Ivy for 04/01/2020 is assigned in the amount of 404.33 rubles.

Example 5

| Employee V.S. Ivy began her working career on September 1, 2000. Total earnings for the previous two years amounted to 200,000 rubles. In April of this year, she fell ill and received sick leave. To simplify the calculations, let’s assume that the sick leave was issued for 1 day, for example, 05/15/2020. The total amount for sick leave is calculated by multiplying the amount of payment for 1 day by the number of days. |

In accordance with the new rules, we perform calculations using the following algorithm:

- calculation of the amount of temporary disability benefits according to the usual rules. The average daily earnings according to the calculation amounted to 273.97 rubles. (200,000 rubles / 730 days), which is less than the minimum average daily earnings of 398.79 rubles. The employee has more than 8 years of service and 100% of the calculated benefit is paid. The benefit amount calculated according to ordinary rules is 398.79 rubles;

- the minimum daily benefit in April is 391.29 rubles, which is less than 398.79 rubles;

- temporary disability benefit V.S. Plyushch for 04/01/2020 remains in the amount of 398.79 rubles.

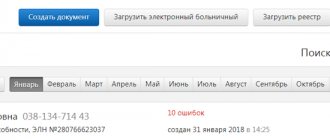

In the 1C: Salary and Personnel Management 8 program, edition 3, a new calculation procedure has been implemented starting with version 3.1.10.376.

What does their decoding mean?

The certificate of incapacity uses two types of classification:

- The classification of sick leave is always used, since it is it that encrypts the reason why the citizen did not work.

- Classification of diseases.

Causes of disability and deciphering the diagnosis from hospital codes:

- Disease-01.

- Domestic injury (not at work)-02.

- Quarantine (infectious)-03.

- , which means work-related injury.

- Decree-05.

- Prosthetics-06.

- Occupational disease-07.

- San. treatment-08.

- Caring for a family member, cause of disability -09.

- Poisoning-10.

- Due to illness of a child-12.

- 11, which means social. significant diseases.

In addition, three-digit additional codes can be specified:

Treatment in a special sanatorium-017.- Presence at NII-019.

- Additional decree-020.

- Diseases caused by alcohol intoxication-021.

Is the diagnosis written with code 11? When code 11 is indicated on the disability certificate as the cause of the illness, you need to understand that this means that the illness is very serious and can be dangerous, which can cause serious harm to a person’s health. The coding of such diseases must be in accordance with Resolution No. 715 of 2014.

To summarize information on diseases, the ICD was created - the international classification of diseases. When compiling certificates of incapacity for work, only the most important information about diseases of a dangerous nature is used.

The codes themselves are not indicated on the sick leave, but code 11 should raise suspicion.

Dangerous diseases are divided into 2 groups according to codes:

- Socially significant diseases.

- Diseases dangerous to others.

Socially significant diseases:

- Tuberculosis A15-A19.

- Sexual infections A50-A64.

Hepatitis B B16, B18.0, B18.1.- Hepatitis C B17.1, B18.2.

- HIV B20-B24.

- Oncological diseases C00-C97.

- Diabetes E10-E14.

- Psychological disorders F00-F99.

- Hypertension I10-I13.9.

Dangerous diseases:

- Tuberculosis A15-A19.

- Sexual infections A50-A64.

- Hepatitis B B16, B18.0, B18.1.

- Hepatitis C B17.1, B18.2.

- HIV B20-B24.

- Viral fevers A90-A99.

- Helminthiasis B65-B83.

- Diphtheria A36.

- Leprosy (leprosy) A30.

- Malaria B50-B54.

- Pediculosis B85-B89.

- SAP A24.

- Anthrax A22.

- Cholera A00.

- Plague A20.

The “other” line may contain information about the employee’s disability.

In addition, you need to look at the disease codes: 32 - recognition of disability, 33 - change in disability group. The problem is that a disabled person may not notify the company about his disability; this is his right. But if it happens that his rights as a person with disabilities are not respected, this may entail liability for the company.

What should an employee do?

A citizen sent to the ITU is informed about its results. People who are sick often ask the question: if the sick leave code is 32, do they need to start work? Not necessary. As a general rule, the certificate of incapacity for work is closed on a date preceding the date of registration of documents sent for medical and social examination. But if the illness continues after disability is established, then a new certificate of incapacity for work is issued.

Find out for free in ConsultantPlus what to do if an employee has hidden a disability.

Common mistakes and questions

- Is sick leave social benefit with code 04 subject to insurance contributions? Is personal income tax withheld? In accordance with Art. 422 of the Tax Code of the Russian Federation, the amounts established for the payment of compensation in the event of harm or other damage to health are not subject to an insurance premium. However, the entire amount of sick leave with this code is subject to income tax.

- What is the difference between compensation for a domestic injury and a work-related injury? Domestic injuries include all those received by an employee outside of work. That is, at home or while on vacation. In such cases, an internal investigation is not carried out by the organization.

- Can the amount of benefits for a work injury be reduced? If the injured employee violates the regime established by his attending physician, the amount of the benefit may be reduced to the minimum wage for a calendar month. This reduction in size is established from the day the violation is noted until the end of the sick leave.

How to decipher the first numeric code

The first two cells contain codes that reflect:

| Code | What does it mean |

| 01 | The presence of an illness due to which the patient is released from work |

| 02 | The patient is unable to work due to injury |

| 03 | Establishment of quarantine - its presence prevents visiting the workplace |

| 04 | The patient had an accident directly at the enterprise, or suffered painful results |

| 05 | Assignment of leave according to BiR |

| 06 | The patient undergoes prosthetics in an inpatient setting |

| 07 | An employee has been diagnosed with an occupational illness or an exacerbation of a previously identified illness occurs. |

| 08 | The patient recovers the residual manifestations of the disease in a sanatorium setting |

| 09 | Exemption from attending work due to caring for a sick loved one (child, parents) |

| 10 | Other condition, including patient intoxication, manipulation measures |

| 11 | An illness from a special List. The list, for example, includes diabetes, tuberculosis, hepatitis, mental disorders |

| 12 | Caring for a baby who has contracted an illness that is on the list of diseases defined by the Ministry of Health and Social Development |

| 13 | Caring for a child with a disability |

| 14 | The baby has a complication after vaccination or has a malignant disease |

| 15 | The need to care for a baby with HIV infection |

Important! The doctor can enter codes 14 and 15 only after receiving the “okay” of the insured employee.

What additional three-digit numbers are used and what do they mean?

In addition to the main columns for indicating the cause of disability, the ballot contains additional fields in which the following codes are indicated:

- 017 – treatment in a specialized sanatorium;

- 018 – sanatorium treatment, which is associated with an injury received at work;

- 019 – rehabilitation at the Research Institute of Balneology;

- 021 – injury or illness that occurred due to alcohol or drug intoxication.

Code 021 reduces the amount of insurance payments for the entire duration of treatment. In this case, the calculation is based not on the average person’s earnings, but on the minimum wage.

Types of codes on a sick leave form

All numerical codes reflecting the grounds for disability were developed and prescribed by a special order of the Ministry of Health and Social Development of the Russian Federation. The code is indicated in four places on the hospital form. They contain:

- Root causes of employee disability.

- Types of kinship.

- Indications of violations of the regimen prescribed by the doctor.

- Other.

- Calculation conditions.

All codes, except the last one, are entered by the doctor. The conditions for calculating benefits are fixed by the employer.

Rules for filling out sick leave

The certificate of incapacity for work performs a dual function:

- confirms the fact of the employee’s illness and his visit to the doctor;

- serves as the basis for payment for the period of incapacity.

In this case, the employer pays only for the first three days of illness, the rest of the period is financed from the Social Insurance Fund, which compensates the organization for the payments made. This happens after checking the sick leave certificate - its authenticity and correctness of completion.

The sick leave sheet consists of two sections:

To be completed by the attending physician

Primary requirements:

- The certificate of incapacity for work can be filled out by hand or typewritten:

- if entries are made manually, they are made only with black gel paste, capillary or fountain pen. Filling with other colors or ballpoint pen is not acceptable;

- if the provided number of cells is not enough for a complete record (for example, a doctor’s specialty), abbreviations are allowed that do not affect the understanding of the meaning;

- the name of the disease is not indicated; it is replaced by a code.

It is recommended to fill out the form in capital block letters. However, if the responsible person, out of ignorance or absent-mindedness, makes an entry in capitals, this will not be an error, provided that the text is easy to read and does not allow double interpretation.

Error during correction

The employer must always ensure that corrections are made correctly, otherwise he may lose compensation. But there is a situation when the responsible specialist made the corrections incorrectly. Is it possible to correct the certificate of incapacity for work again?

For example, the accountant entered the correct data directly above the crossed out line, and not on the back of the document. This is considered a serious drawback; it will be difficult for the Social Insurance Fund to compensate the employer for expenses, since the information from the cells simply cannot be displayed when read.

That is, if, when filled out in handwriting, all the information on the temporary disability certificate is readable and does not interfere with the identification of the register, then you just need to make the corrections correctly: indicate the correct information on the back of the sheet and certify it with a signature and seal.

Mistakes made by the doctor

According to the law, no errors or corrections in the part filled out by the medical institution are allowed. Previously, it was allowed to confirm changes with an additional record certified by the signature and seal of the responsible person, so some doctors still make corrections.

However, now a certificate of incapacity for work incorrectly filled out by a medical institution is considered invalid, and a duplicate is issued instead. All data in it must be similar to the original document (except for those that led to the replacement), the only difference is a mark in the appropriate field indicating the re-issuance of sick leave.

Other codes on the hospital form

The health worker can enter one of seven codes in a separate line of the document (“Other”):

| Code | Explanation |

| 31 | It is recorded when the patient has not yet recovered and is still ill. As a rule, this sick leave is closed and a second one is issued. |

| 32 | The disability group is established |

| 33 | A person who already has a disability has its group changed based on his current health condition. |

| 34 | Death. The patient in whose name the document was issued died |

| 35 | The patient refuses to undergo MSE |

| 36 | The patient is recognized as able to work |

| 37 | After therapeutic procedures, the patient is sent for further treatment of the disease |

Errors in codes. What to do?

When filling out the sick leave form, you must adhere to the following requirements:

- all entries are made in block letters;

- you cannot go beyond the boundaries of the cells;

- Blots, strikeouts, and corrections are not allowed in the codes.

You cannot use a corrector or cover up incorrectly written codes. If a medical institution employee makes a mistake, he will have to issue a duplicate certificate of incapacity for work.

Acceptable errors

Some technical defects when filling out a certificate of incapacity for work are allowed, provided that all other information is entered correctly. These include:

- incorrect sequence of data in the address of the medical institution;

- letters slightly extend beyond the boundaries of the cells;

- filling out the form in capital letters;

- extra spaces between the doctor's initials;

- minor blots that do not affect the overall understanding of what is written;

- a combination of handwritten and computer filling.

According to the FSS Letter, all these errors are of a technical nature and are not grounds for re-issuing sick leave or refusing to pay for it. The only condition is that all information must be read.

Since the list is not exhaustive, disputes often arise between the employer and the Social Insurance Fund regarding sick leave payment. Sometimes it goes to court.

To save time, you can send a copy of the document to the local FSS unit in advance and check with its employees whether they will accept sick leave with specific shortcomings. In some cases, it is easier to ask an employee to take a duplicate than to seek compensation for payments made from the Social Insurance Fund through the court.

Subordination code on sick leave

The employer must write down the subordination code. It is assigned by the FSS upon registration of an enterprise or company as an insurer. The Social Insurance Fund sends a notice. It indicates the company's registration number and its subordination code. The latter serves to indicate the insured’s affiliation with a specific territorial branch of the fund.

The code consists of five digits. The first four contain the code of the territorial branch of the Social Insurance Fund to which the insurance company belongs. Fifth digit for:

- enterprises (legal entities) – 1;

- separate divisions – 2;

- individuals and merchants – 3;

- Individual entrepreneurs who registered with the Social Insurance Fund voluntarily – 4.

The subordination code is indicated by the policyholder on the title page of the report according to f. 4-FSS.