Almost all enterprises use one or another result of intellectual developments in their work: computer programs necessary for organizing accounting, utility models acceptable for production, industrial designs, etc. All these assets are regarded by law as products of intellectual activity, and an enterprise can use them only after receiving the appropriate rights. Let us remind you what agreement is used to formalize such a transaction and what tax benefits are guaranteed by the Tax Code of the Russian Federation.

BASIC: taking into account related expenses when calculating income tax

Please take into account associated costs associated with the conclusion and execution of a license agreement when calculating income tax as part of other production expenses, provided that the obligation to pay them is not assigned to the licensor under the agreement (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The order of their accounting depends on:

- on the type of expenses;

- method of calculating income tax.

This follows from paragraph 1 of Article 252, Article 272 and paragraph 3 of Article 273 of the Tax Code of the Russian Federation.

Depending on the type of expenses, their tax accounting may have specific features.

In particular, take into account notarial expenses for certification of documents differently, depending on where and by whom the notarial actions were performed (Article 22 of the Fundamentals of the Legislation of the Russian Federation on Notaries, subparagraph 16, paragraph 1, Article 264 and paragraph 39, Article 270 of the Tax Code of the Russian Federation).

The costs of paying the state fee for registering a license agreement for a computer program, database or integrated circuit topology should be taken into account in full as part of other expenses of the organization as a fee established by law (subclause 1, clause 1, article 264, clause 10, article 13 and subparagraph 4, paragraph 1, article 333.30 of the Tax Code of the Russian Federation).

The amount of patent and other fees for registration of licensing agreements for other types of intellectual property is established by the Regulations approved by Decree of the Government of the Russian Federation of December 10, 2008 No. 941. Take such fees into account when calculating income tax as other expenses associated with production and (or) sales (Subclause 49, Clause 1, Article 264 of the Tax Code of the Russian Federation). The fact is that they do not relate to taxes and fees (Articles 13–15 of the Tax Code of the Russian Federation).

The date of recognition of expenses associated with obtaining rights under a license agreement is determined depending on the method that the organization uses when calculating income tax.

If an organization uses the cash method, recognize expenses as they are paid (clause 3 of Article 273 of the Tax Code of the Russian Federation).

When using the accrual method, take into account the costs in the period to which they relate (paragraph 1, clause 1, article 272 of the Tax Code of the Russian Federation).

An example of how transactions to obtain a non-exclusive right to a trademark under a license agreement are reflected in tax accounting. The organization applies a general taxation system

In September, Torgovaya LLC (licensor) entered into a license agreement with Alpha LLC (licensee) for the right to use the Hermes trademark. The duration of the agreement is three years from the date of entry into force. The agreement comes into force from the moment of its state registration. Registration and payment of the fee for registering the agreement is the responsibility of the licensee.

The license agreement provides for a one-time remuneration to the licensor in the form of a one-time (lump sum) payment in the amount of 590,000 rubles. (including VAT - 90,000 rubles) after registration of the agreement.

In September, Alpha paid a fee of 10,000 rubles. for registration of the agreement.

The agreement was registered in October. Upon the entry into force of the agreement and the transfer of non-exclusive rights, the parties drew up an act of acceptance and transfer of non-exclusive rights to intellectual property.

Alpha calculates income tax on an accrual basis on a monthly basis.

In tax accounting, an organization distributes ongoing expenses in proportion to the number of days falling within the period to which such expenses relate.

When calculating income tax for October, Alpha’s accountant took into account part of the expenses:

- fees for registration of a license agreement in the amount of 128 rubles. (RUB 10,000: (366 days + 365 days + 365 days) × 14 days);

- one-time (lump sum) payment in the amount of 6387 rubles. (RUB 500,000: (366 days + 365 days + 365 days) × 14 days).

“Input” VAT related to a one-time (lump sum) payment in the amount of 90,000 rubles. accepted for deduction after signing the act of acceptance and transfer of the non-exclusive right to intellectual property.

GK about computer programs

The Civil Code of the Russian Federation classifies computer programs as objects of intellectual property - the results of intellectual activity (Article 1225 of the Civil Code of the Russian Federation). They are objects of copyright and are protected as literary works (clause 1 of Article 1259, 1261 of the Civil Code of the Russian Federation). Intellectual property rights are recognized for objects of intellectual property, the element of which is the exclusive right (property right) (Article 1226 of the Civil Code of the Russian Federation).

The copyright holder (licensor) may grant another person (licensee) the right to use the result of intellectual activity by concluding a license agreement within the limits established by this agreement (Clause 1 of Article 1235 of the Civil Code of the Russian Federation). This does not entail the transfer of the exclusive right to the licensee (clause 1 of Article 1233 of the Civil Code of the Russian Federation). Accordingly, the licensee can use the result of intellectual activity only within the limits of those rights and in the ways provided for in the license agreement.

BASIS: VAT

Input VAT related to license payments and expenses associated with the conclusion of a license agreement are deductible at a time if an invoice is available and other mandatory conditions are met (clause 1 of Article 172 of the Tax Code of the Russian Federation).

If an organization has received an invoice with an allocated amount of VAT on license payments that are not subject to this tax, do not apply the deduction (clause 2 of Article 169 of the Tax Code of the Russian Federation). For more information about this, as well as about the arguments that will allow the licensee to recover the “input” tax, see Under what conditions can input VAT be deducted.

To check whether the licensor issued an invoice correctly, use the table.

Situation: will the licensee be a tax agent for VAT on payments under a license agreement concluded with a foreign licensor organization that is not registered in Russia?

An organization is required to withhold and transfer tax to the budget only if license payments are subject to VAT.

Thus, the answer to this question depends on what type of intellectual property the organization receives.

Regardless of the applied taxation regime, an organization that transfers license payments to a foreign licensor organization that is not registered in Russia is a tax agent for VAT (clause 1 of Article 161 of the Tax Code of the Russian Federation).

However, the organization is obliged to withhold and transfer tax to the budget only if license payments are subject to VAT. If license payments are not subject to VAT, there is no need to withhold this tax from them. This procedure follows from paragraph 2 of Article 161 of the Tax Code of the Russian Federation.

License payments are subject to VAT or not subject to this tax, depending on the type of intellectual property, the right to use which is transferred (subclause 1, clause 1, article 146 and subclause 26, clause 2, article 149 of the Tax Code of the Russian Federation). To determine this, see the table.

For information on the specifics of VAT withholding from license payments depending on the moment of conclusion of the license agreement, see Who is recognized as a tax agent for VAT.

Introduction of a 20% VAT rate for foreign software

Federal Law No. 265-FZ dated July 31, 2020, as part of the tax maneuver, provided a number of preferences to Russian companies in the field of IT technologies.

In particular, the VAT benefit for foreign software not included in the unified register of Russian programs for electronic computers and databases was cancelled.

From January 1, 2021, VAT exemption applies only to:

- when exercising exclusive rights to computer programs and databases included in the unified register of Russian computer programs;

- rights to use computer software and databases, including updates to them, implemented, inter alia, by providing remote access to them via the Internet.

Services for the transfer of exclusive rights to computer software and databases, as well as the rights to use such programs and databases, will be exempt from VAT only from the moment such programs are included in a special Register.

The Ministry of Finance drew attention to this in a letter dated November 16, 2020 No. 03-07-08/99545.

As for foreign software not included in this Register, from January 1, 2021, its sale or transfer of rights to use such software is subject to a VAT rate of 20%.

At the same time, services for the transfer of rights to use software are subject to VAT, regardless of the date and conditions of concluding contracts for the provision of these services.

The Ministry of Finance made this conclusion in a letter dated November 20, 2020 No. 03-07-08/101332.

More on the topic:

What is the essence of the tax maneuver for IT companies in 2021?

What tax and contribution benefits will IT industry organizations receive in 2021?

simplified tax system

If an organization pays a single tax on the difference between income and expenses, then take into account the costs associated with the acquisition of rights under a license agreement when calculating the single tax, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

Consider the licensor's remuneration in the form of periodic (current) payments as expenses, regardless of the type of intellectual property used (subclause 32, clause 1, article 346.16 of the Tax Code of the Russian Federation).

A one-time (fixed, lump-sum) payment can be taken into account when calculating the single tax only for certain types of intellectual property: computer programs and databases, topologies of integrated circuits, inventions, utility models and industrial designs, trade secrets (know-how) (subclause 2.1 p. 1 Article 346.16 of the Tax Code of the Russian Federation). For more information about which license payments are taken into account during simplification and which are not and on what basis, see the table.

Other costs associated with obtaining rights under a license agreement should be taken into account when calculating the single tax, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

However, please note that some of them can be recognized only if the requirements provided for them by Chapter 25 of the Tax Code of the Russian Federation are met. In particular, this applies to notary expenses (subclause 4, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

State fees for registration of licensing agreements for any type of intellectual property can be taken into account when calculating the single tax (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

However, do not take into account other fees associated with state registration of a license agreement when calculating the single tax. Such expenses are not mentioned in Article 346.16 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 22, 2010 No. 03-11-06/2/66).

Do not deduct input VAT related to the listed license payments. Include it in expenses when calculating the single tax. Provided that the amount of the license fee, to which VAT applies, is taken into account in expenses. This procedure follows from subparagraph 8 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

Consider expenses as they are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization pays a single tax on income, then license payments for acquiring the right to use intellectual property will not affect taxation. Since with such a taxation object no expenses are taken into account. This procedure is established by paragraph 1 of Article 346.18 of the Tax Code of the Russian Federation.

An example of accounting for expenses in the form of license payments for the acquired right to use a trademark when calculating a single tax. The organization applies simplification

Torgovaya LLC (licensor) entered into a license agreement with Alpha LLC (licensee) for the right to use the Hermes trademark. The duration of the agreement is three years from the date of entry into force.

The license agreement provides for a one-time remuneration to the licensor in the form of a one-time (lump sum) payment in the amount of 590,000 rubles. (including VAT - 90,000 rubles), as well as periodic license payments in the amount of 5,900 rubles. (including VAT - 900 rubles) starting from the month following the month of conclusion of the contract.

The agreement comes into force from the moment of its state registration. The agreement was registered on January 14. Upon the entry into force of the agreement and the transfer of non-exclusive rights, the parties drew up an act of acceptance and transfer of non-exclusive rights to intellectual property. On the same day, Alpha transferred the lump sum payment.

On February 9 and March 10, Alpha transferred periodic license payments in full to Hermes.

"Alpha" calculates a single tax on the difference between income and expenses.

Alpha's accountant did not include the amount of a one-time (lump sum) payment in the amount of 500,000 rubles. (RUB 590,000 – RUB 90,000) included in expenses for the first quarter. Since this type of expenses under a license agreement for a trademark is not provided for in Article 346.16 of the Tax Code of the Russian Federation. And also did not take into account the amount of VAT in the amount of 90,000 rubles related to this remuneration.

The accountant took into account periodic license payments in monthly expenses (in February and March) in the amount of 5,900 rubles.

Thus, license payments in the amount of 11,800 rubles were taken into account as part of the expenses for the first quarter. (5900 rubles × 2 months).

When is the acquisition of software rights subject to taxation?

But purchase transactions, for example, of commercially available computer programs, so-called “boxed” products, are subject to VAT (letter of the Ministry of Finance of the Russian Federation dated September 4, 2017 No. 03-07-07/56481). This happens because the user first purchases a product, such as software, and then (when installing it on his PC) enters into a license agreement. In this case, a simplified version of the license agreement applies - an accession agreement, the terms of which are usually placed on the packaging of the products sold. It is recognized as concluded at the moment of starting to use the purchased product, and, therefore, later than the acquisition, since when purchasing the software the buyer has not yet begun to use it. At the same time, the seller has no reason to consider that a license agreement for the software has been concluded - he will have to pay VAT.

OSNO and UTII

The calculation of taxes when transferring license payments for the right to use intellectual property depends on the type of activity for which the intellectual property is used.

If the right is used only within the framework of activities on the general taxation system, then take into account the license payments according to the rules in force when calculating income tax and VAT (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

If the right is used only within the framework of activities on UTII, then do not take into account any expenses in the single tax base. Since the object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Moreover, if a license agreement is concluded for the purpose of carrying out both types of activities, expenses in the form of license fees and related expenses must be distributed (clause 9 of Article 274 and clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Input VAT relating to such payments must also be allocated. Distribute VAT according to the methodology established in paragraphs 4, 4.1 of Article 170 of the Tax Code of the Russian Federation.

The amount of VAT that cannot be deducted should be added to the expenses for the activities of the organization subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

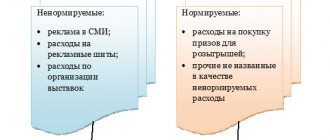

Preferential treatment for paying taxes on the sale of a license

In order to legally avoid paying tax on the sale of a license, a special license agreement must be duly drawn up. According to the resolution of the Ministry of Finance, transactions involving the transfer of rights under sublicense agreements are not subject to taxation.

Important:

exit from the preferential regime occurs when organizations cooperate under mixed-type contracts, where intellectual property is not the main object of the contract. Such transactions must be reflected in the organization's sales book.

Register now and get a free consultation from Specialists

Accounting for various types of intellectual property

For more information on accounting and taxation of rights to certain types of intellectual property, see:

- How to reflect the purchase of a computer program in accounting;

- How to reflect the purchase of a computer program in tax accounting;

- How to record the costs of purchasing a trademark.

If an organization has received the right to use intellectual property from a citizen, for more information about accounting for license payments, see:

- How to record remuneration under copyright agreements;

- How can a licensee record remuneration under a license agreement with a citizen?

License sales tax for individuals

The content of copyright is described in detail in Art. 1255 Civil Code. The owner of an intellectual product may own both the rights to the objects and the opportunity to receive a certain remuneration for their use—royalties. By virtue of the Law, it is the license that confirms the non-transferability and inalienability of rights, except in cases where the exclusive right is sold.

The Tax Code considers royalties as an object of taxation. This is stated in Art. 226. It turns out that organizations that enter into such relations are obliged to perform their direct function as a tax agent. An individual will receive his income minus a state fee of 13% of the income.