Note! tax regime has been abolished since 2021 . Payers of UTII need to choose another taxation option.

Free tax consultation

When submitting an application to switch to UTII, the taxpayer must indicate the code of the type of business activity. This code is often confused with the codes of the economic activity classifier (OKVED), which is why the tax office does not accept the application.

From our article you will learn what code each type of activity has for individual entrepreneurs and LLCs that have switched to paying tax on imputed income.

What is UTII code

In order to make tax accounting easier and could be automated, the types of activities falling under UTII were coded. Each of them was assigned a conditional number - a combination of numbers under which it appears in legislative acts. Using this combination, it is possible to calculate from what source the given taxpayer receives income - individual entrepreneur. This code is entered into all necessary documents along with the name of the type of activity.

The list of UTII codes is established in Appendix 3 of the Order of the Federal Tax Service of the Russian Federation dated July 4, 2014.

NOTE! When registering, an entrepreneur can choose not just one, but an unlimited number of activities. The list can be expanded at any time by contacting the tax office with a corresponding application.

General information ↑

Let's consider what is said about physical indicators in the Tax Code.

Definitions

When determining tax amounts, several factors are taken into account, one of which is the physical indicator. This:

- area of retail premises;

- number of seats in the transport used for transportation;

- number of employees;

- the area of the premises that is designed for customer service;

- the amount of basic income per month.

This value may differ depending on the type of activity.

For example, indicating the number of personnel when calculating the single tax is necessary:

- when providing household services;

- when providing veterinary care to pets;

- when washing and servicing a car;

- when delivering products for retail trade

Calculation difficulties

The calculation of the single tax on imputed income will differ for each type of activity.

For example, when determining the amount of tax in retail trade, a number of difficulties arise, since it is difficult to clearly determine the physical indicator.

This is due to the fact that the taxpayer cannot always understand whether to take into account when calculating the area of the premises in which sales are carried out, or the area of the entire building that is intended for trade.

It is also worth considering that when selling excisable products, you cannot use UTII at all.

Problems may also arise when issuing an invoice to the buyer instead of sales receipts, since the tax office does not recognize such transactions as completed.

Another nuance when selling at retail is that if the hall is not suitable for conducting activities in this area, then a technical inventory will have to be carried out at the request of the authorized body.

This will determine the legal status of the premises. Such difficulties do not always arise.

So, when conducting retail distribution trade activities, a physical indicator is used to determine the number of employees who sell goods.

Legal grounds

The physical indicators that the taxpayer must use when calculating tax amounts are contained in document adopted on August 5, 2000 No. 117-FZ, as amended on March 8, 2021.

Changes in the physical indicator and deregistration of companies' UTII are stated in the Letter of the Ministry of Finance dated December 2, 2011 No. N 03-11-11/3026.

The amount of basic profitability and physical indicators are established by Art. 346.29 clause 3 of the Tax Code.

If a physical indicator has changed in the middle of the tax period, then when determining the amount, the changed indicators are taken into account from the month when such changes were made.

Physical parameters of a business according to UTII

If an entrepreneur has chosen one or more types of activities for his business, he needs to check whether he can count on UTII. For this purpose, the presence of this area in the relevant list of Tax Codes is not enough. It is necessary that it correspond to certain physical parameters of the business, which are taken into account in the same document:

- application in specific areas of business provided for by the Tax Code of the Russian Federation;

- the number of hired employees, including the entrepreneur himself - the owner of the business;

- restrictions on the area of territory or premises;

- the number of units involved (vehicles, etc.).

FOR EXAMPLE! If an individual entrepreneur decides to open a cafe, then the tax he must pay will depend on the area of the hall where visitors are served, and the imputed income will be calculated from the amount of 1000 rubles. per month. The UTII code for this type of activity is 11. If a service hall is not planned, as, for example, in cheburechnayas, then UTII will depend on the number of hired personnel, and the income rate will increase to 4,500 rubles. per month. The code for such activities is already different - 12, although both of them are related to the organization of public catering.

All physical parameters specified in the legislative act are mandatory and must be indicated in tax reporting.

Do not confuse with OKVED!

The General Classifier of Types of Economic Activities (OKVED) lists all possible forms of small and medium-sized businesses. Some of them may or may not fall within the parameters of UTII. These are different types of accounting, the basis of which lies in various legislative acts and provides for mention in different documentation.

Physical indicators and basic profitability for calculating the amount of UTII

Types of entrepreneurial activity UTII | Physical indicators of UTII | Basic income of UTII per month (rub.) |

| 1 | 2 | 3 |

| Provision of household services | Number of employees, including individual entrepreneurs | 7 500 |

| Provision of veterinary services | Number of employees, including individual entrepreneurs | 7 500 |

| Providing repair, maintenance and washing services for motor vehicles | Number of employees, including individual entrepreneurs | 12 000 |

| Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots | Total parking area (in square meters) | 50 |

| Provision of motor transport services for the transportation of goods | Number of vehicles used to transport goods | 6 000 |

| Provision of motor transport services for the transportation of passengers | Number of seats | 1 500 |

| Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1 800 |

| Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters | Number of retail places | 9 000 |

| Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters | Area of retail space (in square meters) | 1 800 |

| Delivery and distribution retail trade | Number of employees, including individual entrepreneurs | 4 500 |

| Sales of goods using vending machines | Number of vending machines | 4 500 |

| Provision of public catering services through a public catering facility with a customer service hall | Area of the visitor service hall (in square meters) | 1 000 |

| Provision of public catering services through a public catering facility that does not have a customer service hall | Number of employees, including individual entrepreneurs | 4 500 |

| Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) | Area intended for printing (in square meters) | 3 000 |

| Distribution of outdoor advertising using advertising structures with automatic image changes | Exposure surface area (in square meters) | 4 000 |

| Distribution of outdoor advertising using electronic signs | Light emitting surface area (in square meters) | 5 000 |

| Advertising using external and internal surfaces of vehicles | Number of vehicles used for advertising | 10 000 |

| Provision of temporary accommodation and accommodation services | Total area of premises for temporary accommodation and living (in square meters) | 1 000 |

| Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters | Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use | 6 000 |

| Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters | Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) | 1 200 |

| Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters | Number of land plots transferred for temporary possession and (or) use | 10 000 |

| Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters | Area of land transferred for temporary possession and (or) use (in square meters) | 1 000 |

Codes of types of entrepreneurial activities of UTII (used in the application for the transition to UTII and filling out the UTII declaration).

For more information about the single tax on imputed income, see the UTII link .

Where are UTII codes indicated?

Entrepreneurs must indicate the code for the type of entrepreneurial activity according to UTII in the following documentation:

- in the tax return submitted during the reporting period;

- in applications drawn up in the form of UTII 1 and UTII 3 (for LLC);

- in applications of individual entrepreneurs (UTII form 2 and UTII 4).

The tax report for UTII must include the following data:

- Name of the type of economic activity.

- Its UTII code (see Appendix 3 to the Order of the Federal Tax Service of the Russian Federation).

- Physical parameters of activity, if they are specified in the legislative act.

Features of types of activities for UTII

It would seem that from the table of codes it is absolutely clear whether the type of activity you have chosen fits into the UTII, but this is not entirely true. To finally be convinced of this, you still need to look at Article 346.27 of the Tax Code.

You need to pay attention to the following nuances:

- Household services are not the same as services to the public. Previously, household services were those services that were indicated in the OKUN classifier. Now OKUN has been cancelled, so the type of activity “household services” for UTII 2021 with a decoding must be found in Order of the Government of the Russian Federation of November 24, 2021 N 2496-r.

- Retail trade, as a type of economic activity for UTII, does not allow the sale of some excisable goods (for example, motor oils), home-made products, food and drinks in catering facilities, etc.

- The provision of repair, maintenance and vehicle washing services does not include warranty repair and maintenance services, as well as refueling and storage.

- Motor vehicles for transporting passengers and cargo include only buses of any type, cars and trucks.

Are you planning to open your own business? Don’t forget about a current account - it will simplify doing business, paying taxes and insurance premiums. Moreover, now many banks offer favorable conditions for opening and maintaining a current account. You can view the offers on our website.

What is the new basic yield for UTII in 2020?

Basic profitability is a conditional monthly profitability in value terms for one or another unit of a physical indicator that characterizes a certain type of business activity in various comparable conditions (Article 346.27 of the Tax Code of the Russian Federation). In other words, this is the estimated income that an imputed individual entrepreneur is considered to receive per month when conducting a certain type of activity per employee (for example, when providing household services), per seat (when providing passenger transportation services), per 1 sq.m. area of the trading floor (for retail trade through stationary retail chain facilities that have trading floors), etc.

Basic UTII profitability is a fixed indicator established by clause 3 of Art. 346.29 Tax Code of the Russian Federation. When calculating the tax base, the basic profitability is multiplied by the adjustment coefficients K1 and K2, as well as by the value of physical indicators for each month of work.

Also see “UTII Coefficients in 2021“.

Accounting for physical indicators ↑

To correctly calculate UTII tax amounts, it is necessary to accurately determine the physical indicator that is used in the activity that the entrepreneur conducts.

If a physical indicator is involved only in one type of activity and does not in any way affect the calculation of amounts payable for other types of activity, then problems in maintaining separate records will not arise.

After all, the taxpayer will think about how documents confirm the fact that a physical indicator is involved in carrying out certain operations.

The imputator must take into account that indicators need to be distributed to perform the following tasks:

- for the correct calculation of UTII;

- for the correct determination of the amounts of insurance premiums, also those that are taken into account when reducing taxes.

The company's internal documentation must contain information about what physical indicators and in what quantities are used in certain activities.

Sometimes physical indicators may change. In this case, you should be guided by the information in Art. 346.29 clause 9 of the Tax Code.

Here is a table that shows how physical indicators are divided in the documentation:

| Physical indicator | Document | What is reflected |

| Employees | Agreement with personnel; Instructions for workers; Staffing table | Obligations of the employee that he is engaged in a certain type of activity; Information that the employee is engaged in this particular type of activity; Information about the place of work |

| Square | Title or inventory document | What is the area used for? What space is allocated for the implementation of activities? |

| Transport | Orders on accounting of transport at the enterprise; List of cars that are involved in the activity; List of rules for using objects; Driving instructions | A list of machines that are used in the activity and are assigned to a specific employee; Rules for using a car; Obligations imposed on the driver |

| Seating | List of vehicles used in passenger transportation; Vehicle registration certificate | — |

| Trading place | Lease agreement; Registers of lease agreements for points that are rented out; Trade employee instructions; Agreement with personnel; List of business rules | List of retail outlets, showing location; Job responsibilities for this type of activity, location of work |

| Vending machine | Agreement on the purchase and sale, rental of a vending machine | — |

It happens that physical indicators are difficult to separate. The legislation does not stipulate the conditions for separation when they cannot be attributed to one type of activity. This means that the physical indicator will have to be taken into account completely.

If you have to separate indicators that cannot be separated (when calculating tax amounts), choose a method that will not be related to revenue and other values of value. It is worth relying on a methodology based on constant indicators.

For example, if administration employees are distributed who are involved in several types of activities, when calculating UTII, you need to use the distribution method in proportion to the average number of personnel, and not to revenue.

Separate accounting can be carried out taking into account how long the staff worked, what they are involved in different types of activities.

This is possible in this case:

- the company has introduced a system of schedules for recording work time or work orders, which reflects the timing of certain operations;

- work is organized in such a way that part of the day the employee is associated with one type of activity, and part with another.

If employees do not fulfill obligations in relation to only one type of activity (this applies to AUP and VP), the physical indicator is determined based on the total number of employees.

UTII: code of type of entrepreneurial activity

The business activity code for UTII-2, UTII-4 (for entrepreneurs) and UTII-1, UTII-3 (for organizations) should be indicated in accordance with the appendix to the procedure for filling out a tax return for the single tax on imputed income for certain types of activities (Order Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/). Appendix 5 to this order contains UTII codes for each type of activity defined in clause 3 of Art. 346.29 Tax Code of the Russian Federation.

Changes to UTII

The basic UTII tax yield for 2021 has remained unchanged, but this does not mean at all that the amount of tax that will need to be paid this year will be the same as in 2021. This is due to the fact that the formula for calculating the imputed tax contains coefficients K1 and K2, which may change. K1 is set by the Government, and K2 by local authorities. Also, regional authorities determine the tax rate, it can be from 15% to 7.5%.

These authorities include:

- municipal districts are a representative body;

- city districts - a representative body;

- legislative bodies - authorities of federal cities.

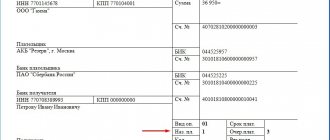

How to calculate the Single tax on imputed income in 2020

To calculate UTII tax, you need to use a special formula:

UTII = BD × FP × K1 × K2 × 15%

UTII - the amount of tax in rubles per month; BD - basic profitability for a specific activity; FP - physical indicator (number of employees, building area, etc.); K1 - deflator coefficient, established by the Government of the Russian Federation; K2 - correction factor, established by local authorities for each type of service; 15% - tax rate (may be reduced by decision of local officials).

In 2021, the K1 coefficient is 2.005; in 2019 it was 1.915. This means that the tax burden on entrepreneurs on UTII will increase. The K2 coefficient in 2021 can be from 0.005 to 1, it is set by the regions, find out the value from your tax office.

Important! For reporting, the amount of tax calculated using the formula must be multiplied by 3 months, since individual entrepreneurs provide reports on UTII every quarter.

Reducing contributions for UTII

If an individual entrepreneur does not have employees, he reduces the tax on insurance premiums paid “for himself”. An individual entrepreneur who has hired workers can reduce the tax by the amount of contributions paid (for himself + for employees) to the funds in the amount of 50% of the calculated UTII.

Author of the article: Alexandra Averyanova

Pay UTII and report taxes from the cloud service for small businesses Kontur.Accounting. We have simple accounting, payroll, taxes, reporting, expert help, reminders and automatic updates. Use the service for free for the first 14 days.