Natalia Adamovich, tax expert, Natalia Voronaya , editor, Natalia Chernyshova, tax expert.

“Debt” is an unpleasant word. However, for businesses and entrepreneurs, debt is commonplace. In this case, economic entities can act as both creditors and debtors. We will look into the intricacies of “debt” issues in this special issue. In particular, we will tell you how debt differs from debt, remember how to create a reserve for doubtful debts and discount debt, and also explain how to take into account the write-off of forgiven and bad debts. We will also talk about the statute of limitations, tax debt and the nuances of accounting for trade credit.

At first glance, “debt” and “debt” are two identical concepts. After all, in both cases, an enterprise can act as a debtor to its creditor. However, the absence of debt in the company's accounting records is far from a guarantee that the company is not a debtor in the legal sense. Let's look at the legal and accounting concepts of debt and indebtedness from both the debtor (debtor) side and the creditor side.

Settlement of mutual claims

Contractual obligations are the amount of creditor or debtor arrears, formed based on the results of settlements, delivery of goods, budget allocations, etc. Debts are accounted for by the accounting department in the following accounts: 60, 62, 66, 67, 68, 69, 70, 71, 73, 76 ,58.

The procedure for terminating mutual arrears through offset is regulated by Art. 410 of the Civil Code of the Russian Federation, involves repaying loan turnover with a debit balance. That is, neither party to the relationship makes an actual payment of funds, and the debt ceases to exist.

This event has many subtleties, legal nuances, and requires detailed study, consideration and agreement with qualified specialists. It is important to understand that unilateral manipulations are unacceptable; the transaction must be concluded in writing by mutual agreement of the parties. An additional aspect can be noted that the main contracts contain no conditions prohibiting similar actions by counterparties.

To repay the debt, two basic rules must be observed: the parties do not dispute the existence and size of the arrears, the claims are uniform. The creditor and debtor must have on hand primary documents drawn up in accordance with accounting standards. A signed bilateral reconciliation report without objections will indicate the consistency of the settlement status of both companies.

The parties to the relationship may agree to terminate the existence of debts

To assess the legality and correctness of the transaction, the debts to be offset must be of the same nature. For example, a company has a payable for electricity to a supplier, and the counterparty leases transport from this organization, for which money has not yet been transferred. Debt settlement will be the best option for resolving the dispute and continuing productive cooperation.

Based on Art. 411 of the Civil Code of the Russian Federation, it is impossible to repay arrears according to the following requirements:

- Compensation for damage caused to the life, health, and property of an individual.

- Expenses for the lifelong provision of a certain citizen.

- Cash payments for the maintenance of children and disabled relatives.

- If the debt has expired, etc.

Documenting

Any party to contractual obligations may initiate the procedure by sending a letter to the counterparty. To do this, it is enough to wait until the arrears repayment deadlines specified in the basic contract are missed.

The addressee of the application considers the intention and enters into negotiations. If the outcome of the case is positive, the parties to the relationship sign the agreement in duplicate. To eliminate potential risks and unfounded claims, it is recommended to indicate the following details on the form:

- Name of the form.

- Date and place of compilation.

- Name of the parties' authorized representatives.

- Identification data of the main contracts (number, date, subject).

- The amount of claims to be paid.

- The essence of the agreement.

- Details of the parties.

- Signatures, seals (for legal entities).

Proper documentation of the procedure will avoid various problems in the future.

Business transaction in accounting

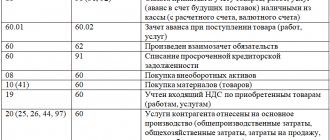

The accountant of each party must reflect the entries for closing debts on the basis of the form signed by the parties. The procedure is formalized by a certificate or adjustment of the debt. The accounting registers reflect correspondence postings of accounts 60, 62,76.

Transactions must be reflected on the day of the offset. For an enterprise under the general taxation regime, such measures do not in any way affect the tax base for personal income or profit. Companies using the simplified tax system are required to increase income, and the amount of receivables for purchased goods and materials must be included in costs.

Here is a typical entry when a short-term loan debt to a bank is repaid using the debtor's contribution: D-66, K-51.

Accounts payable

KZ is a kind of opposite of DZ. It shows all of your company's outstanding payments to contractors. This may include:

- housing and communal services;

- salary arrears;

- credit penalties;

- fines, state duties, taxes;

- mandatory contributions to the authorized capital of the organization by persons having a share;

- obligations to shareholders;

- retained earnings;

- outstanding payments to suppliers of services or products.

The coefficient of increasing or decreasing KZ reflects the real state of affairs in the organization. For ease of tracking and control, the company's accountants record each transaction in the reporting documentation, recording the cash flow with transactions. Each of them corresponds to a specific financial action. Using them you can quickly and easily find the necessary information and make the necessary calculations.

The reasons for the growth of the creditor may be:

- Increase in remote sensing.

- Disproportionately high obligations assumed by the company, which it cannot cope with.

- The assets are not owned by the company and the debts are mounting.

- Bad marketing job.

If accountants carefully analyze financial flows, marketers work efficiently, then the cost ratio almost always remains within reasonable limits, and the company is doing well. The consequences of improper work by specialists in this area lead to serious problems, so you should be as careful as possible about your obligations to creditors.

An organization's debts to other persons form accounts payable

How does an increase in short circuit affect

An increase in accounts payable, as in the case of accounts receivable, leads to a weakening of the enterprise’s economy. This is due to the increased credit burden on the budget, which the company is unable to cope with. If you fail to pay off your debts on time, many negative consequences arise, the main of which are:

- Statements of claim from counterparties (FSSP, management company, lessors, partners, etc.), which lead to confiscation of property and seizure of accounts.

- A decrease in investment attractiveness, which causes an outflow of financial investments.

- Decline in the authority of the enterprise and a negative reputation, which provokes a decrease in demand and turnover.

To avoid these problems, it is recommended to take measures to eliminate debts at the first sign of a deterioration in the situation. However, it is even more important to carry out prevention, regularly test the success and efficiency of work in this area, and also in no case be late in payments. With a competent approach, high-quality implementation of its work by the accounting department and control by management, the company will be able to avoid difficulties with the budget balance.

How does reducing short circuit affect

The answer to this question is simple: reducing accounts payable has the opposite effect compared to increasing this indicator. If the amount of the contract decreases, this indicates the financial well-being of the company and its solvency. Due to this, the interest of third-party investors and creditors in the enterprise increases, since they see potential in the company and are ready to invest heavily.

When a company is able to reduce its debts by paying them on time, it gains a positive reputation and status. Therefore, it is necessary to reduce obligations to creditors to a safe level so that the economic position of the organization is at a good level.

If the company does not have the opportunity to keep a permanent accountant on staff, you can use the services of private individual specialists or agencies engaged in this type of activity. This will allow you to save a lot on an employee’s salary, since one-time work will cost the company less.

The growth and decline of the creditor indicates the financial condition of the enterprise

How to analyze a creditor

Before calculating the debts under the contract and the rate of their changes, it is necessary to calculate the turnover. This is done using the B/C formula, where “B” is the revenue received – the loan balance. Based on the results, conclusions can be drawn and measures necessary to improve the situation can be taken. Of course, the calculations in reality are much more complicated, so only an experienced accountant can carry them out without errors; beginners often make mistakes due to inattention or lack of practice in such calculations.

Thanks to this, specialists working in the company can find out how effective or failed the actions to solve debt problems were. If accounts payable were reduced, the result is positive. And if the indicator continues to increase or remains at the same level, then it is necessary to reconsider your approach and change something in the economic policy of the organization.

Debt update

Art. 414 of the Civil Code of the Russian Federation determines the possibility of repaying loan obligations under one contract with arrears under a new agreement, i.e., novation. Under the terms of the agreement, the amount of debt remains the same, but the terms of the transaction change.

An agreement will be recognized as a novation if at least two conditions are met: the order of mutual settlements has changed, the counterparties are connected by a new subject of the transaction. Examples of innovative contracts include the replacement of a service agreement with a loan agreement, as well as the performance of work using previously supplied materials.

Changing some conditions, for example, granting a deferment, debt restructuring, applying a discount, are not recognized as types of innovation, because the previous obligation continues to exist, but the criteria for its fulfillment change.

According to paragraph 2 of Art. 414 of the Code, the updated contract generally covers the main arrears and all related expenses: penalties, penalties, fees for the gratuitous circulation of borrowed funds. In the debtor's accounting in the context of subconto, the debt is completely closed and the balance is reset to zero.

Entering into a new agreement can help pay off old debt

Agreement of the parties

The new contract comes into force upon the signing of two copies of the document by the counterparties. The participants in the settlements acknowledge the existence of the debt, confirm its repayment and the occurrence of another obligation. It is important to understand that the innovation terminates the limitation period for the previous transaction, and for the current one, the claim period is calculated from the moment the agreement is signed (Article 203 of the Civil Code of the Russian Federation).

The legislation does not define a strict form for registration of innovations, but it is worth recording some information:

- Data on the contract being terminated.

- Amount of repayment, innovation debt.

- Terms of the agreement.

It is allowed to nominate the debt by signing a separate document by each party if there is confirmation of one party’s acceptance of the offer and the other’s acceptance (Clause 2 of Article 432 of the Civil Code of the Russian Federation).

Process registration

In accounting (AC), innovations are reflected in registers for reflecting information about business transactions. The correspondence of accounts is determined by the type of transaction: accounts 62, 60, 66, 67, 76.

A posting is generated for debt repayment with the simultaneous reflection of a similar amount in another account in the context of a new subaccount. For example, the customer transferred an advance to the contractor in the amount of 2 million rubles, after a certain time the parties came to an agreement to enter into an innovation in the form of converting the payment amount into a long-term loan. The debtor will have a posting made for debit account 62 and credit account 67.

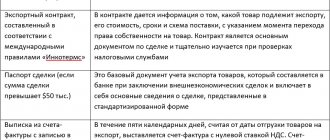

Let us give an additional example when, under a novation transaction, the creditor for shipped materials is replaced by a loan debt, with the provision of a bill of exchange. Typical wiring is shown in the table.

1.1. Debt vs debt

Duty

Debt is usually understood as an obligation under which one party (the debtor) undertakes to perform (refrain from performing) a particular action. This could be the transfer of a certain product, the transfer of a certain amount of money, etc.

Debt may arise:

1) on the basis of an agreement. Let us remind you: bilateral agreements can be concluded between individuals and legal entities. These could be credits, loans, agreements for the supply of goods or services;

2) based on the law (for example, fines, taxes, tax debt).

Thus, in understanding the norms of the Civil Code of Ukraine , a debt can arise even when there is an obligation to carry out certain actions in favor of another person (transfer property, perform work, provide a service, pay funds) or refrain from a certain action. Therefore, even the presence of only a concluded agreement - an agreement of two or more parties aimed at establishing, changing or terminating civil rights and obligations ( Part 1 of Article 626 of the Civil Code of Ukraine

), - can give rise to obligations of the parties, and therefore the emergence of debt.

Debt

Debt is a specific amount of money (or other assets) that must be paid towards an existing debt. The main reason for the occurrence of debt is different dates for the fulfillment of their obligations by the parties to the contract.

For example, the supplier has already shipped the products, but the buyer has not yet transferred the money.

Debt (as opposed to debt in the legal sense) arises only on the basis of the implementation of a certain business transaction, which must be reflected in accounting.

Let us illustrate this with an example.

Example 1.1. On 04/01/2020, the enterprise enters into a contract for the supply of goods, which provides for the supplier’s obligation to deliver goods for a total amount of 64 thousand UAH by 04/14/2020. In fact, before the specified date, goods worth 48 thousand UAH were delivered.

Accordingly, the supplier, as of April 14, 2020, in a legal sense, has a debt in the amount of 16 thousand UAH (64 thousand UAH - 48 thousand UAH), i.e. the obligation to supply goods for the specified amount. But in accounting there are accounts receivable (i.e., an asset of the enterprise) in the amount of 48 thousand UAH.

So it turns out that the debtor in the understanding of the Civil Code

not quite the same as a debtor in accounting. That is, it does not necessarily have accounts payable in its accounting.

Naturally, the accountant is more interested in the debt reflected in accounting, which, as is known, is divided into two types: accounts payable and accounts receivable. Let's look at each of them.

Assignment of arrears

According to the requirements of Chapter 21 of the Civil Code of the Russian Federation, a contract is a certain volume of obligations of one counterparty to the second, expressed in the shipment of goods and materials, products, execution of agency orders, work, etc. The prerogative of debt collection can pass from one collector to another through an assignment transaction.

The participants in the assignment are the current and new claimant, called the assignor and assignee, respectively. In this case, the former lender is finally deprived of the right to bring claims against the debtor, and the debt ceases to exist.

Assignment of debts is possible in a situation where this event is not prohibited by the basic provisions of the contract. Additionally Art. 383 of the Civil Code of the Russian Federation imposes a ban on replacing persons in obligations for rights inextricably linked with the personality of the claimant, payment of alimony, compensation for harm caused to the life or health of a citizen.

It is allowed to transfer claims from one person to another in full or in part, if such an event does not bring additional burdens or social difficulties to the defendant. The transaction can be completed unilaterally without the participation of the defaulter. The latter has the right not to fulfill the terms of the contract until it receives official confirmation of succession from the main creditor.

According to Art. 389 of the Civil Code of the Russian Federation, the assignment of a claim is made in the same form as the main transaction and is subject to registration in cases determined by law. When rights are transferred from the assignor to the assignee, all documents confirming the fact of the debt are transferred.

The right to claim a debt may be transferred to a third party

Debt assignment is popular under lending agreements, when a citizen borrows money from a bank and then pays off with the collector. The former creditor is responsible to the successor for the openness and legality of the transaction, but is not responsible for the failure of the defaulter to fulfill contractual obligations.

Entries in accounting registers

The right to claim debts, receivable arrears is one of the types of assets of an enterprise that a legal entity has the right to dispose of at its own discretion. According to norms 249, 271, 273 of the Tax Code of the Russian Federation, PBU 9/99, proceeds from the sale of debt obligations are recognized as income and are to be reflected as a credit to account 91, debit to 76. The costs of repaying debt through assignment are included in production and sales costs (Article 253 Tax Code of the Russian Federation, PBU 10/99).

Let's give an example of a transaction when money is transferred from the debtor's current account to suppliers to repay the debt under the assignment: D-51, K-76.

The tax base when a company uses the accrual method is determined in accordance with the provisions of Art. 279 of the Code, a separate tax register must be maintained for such transactions. In accordance with the requirements of PBU 19/02, the new creditor’s subject of assignment is taken into account as part of financial investments in the debit of account 58. The defaulter’s accounting policy for the assignment of rights does not change, with the exception of analytics.

Accounts receivable: invoice and movement reflection

The table provides a list of accounting accounts in which receivables can be accounted for (which account to use depends on who the debtor is).

| Number | Name |

| 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers |

| 68 | Calculations for taxes and fees |

| 69 | Social insurance calculations |

| 70 | Payments to personnel regarding wages |

| 71 | Accounting for imprest amounts |

| 73 | Accounting for other personnel transactions |

| 75 | Settlements with founders |

| 76 | Settlements with various debtors and creditors |

The amount of increase in the liability is reflected in the debit, and the decrease - in the credit. At the reporting date, the amount that the company's counterparties are obliged to pay to it is reflected as a debit balance.

If there is a risk of non-repayment of the debt by the debtor, it is necessary to create a reserve in accordance with clause 70 of Order of the Ministry of Finance dated July 29, 1998 No. 34n.

The amount of the reserve is reflected in account 63. When created, the amount of doubtful debt is included in other expenses:

Debit 91 Credit 63.

More information about creating a reserve can be found in the article “Provisions for doubtful debts in accounting.”

Third party participants

The creditor legally has the right to instruct his debtor to transfer money according to the demands of other counterparties. According to Article 313 of the Civil Code of the Russian Federation, the recipient of funds includes them in payment of debt. To confirm the validity and targeted direction of finances, the supplier will need a copy of the letter of authorization.

When repaying debts, third parties may be involved

When a payment is made without a prior instruction, the recipient of the finance is obliged to make a credit if the following circumstances exist:

- There is a violation of the payment deadline under the contract.

- There is a risk of losing the right to reimbursement of expenses by a third party.

The recipient of funds may refuse to credit and make a return if the agreement with the debtor stipulates the condition of direct repayment and fulfillment of obligations.

If there are no identifying elements in the payment order, the debtor has not received information about entrusting this obligation to a third party, the creditor receives the money in the current account as an outstanding payment. The defaulter risks receiving penalties and being involved in legal proceedings.

When receiving an advance, the accountant must register an invoice and reflect the accrual of VAT payable. At the same time, the fact of prepayment may arise from the debtor to the executor; in this case, VAT should also be calculated and paid to the budget.

This method is currently used quite often in situations where the debtor experiences a shortage of working capital or finds itself in a difficult financial situation. It is important to accompany such actions with correctly executed documents so that the inspection authorities do not have any questions.

Inspectors especially carefully study transactions when a company violates the order of payments for current obligations, namely, pays suppliers first, and not staff and not debts to the budget.

Payment of bills by a third party is carried out through account 76. For example, in accounting, an entry with the content “debt to the budget has been repaid from the current account of a third party” will look like this: D-68, K-76.

Reflection in financial statements

The currently used accounting reporting forms are approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. Reports are submitted to regulatory authorities once a year as of December 31.

Every year, before reporting, all obligations must be inventoried, including accounts receivable (which accounts are included, we wrote above). All obligations that are overdue for collection must be written off. The loss from write-off must be reflected in the income statement on line 2350 “Other expenses”.

The balance of accounts receivable is reflected in the balance sheet asset in the “Current assets” section. Line 1230 of the same name is intended for this. The liability is reflected minus the amount of the accrued reserve for doubtful debts. And also minus the value added tax calculated from the amounts of advance payments to suppliers (credit balance - subaccount 76 “VAT on advances to suppliers”).

Accounts receivable on the balance sheet are what accounts:

Paying off debt through exchange

Barter transactions (exchange agreements) involve the emergence of mutual obligations of one person to another for the supply and purchase of inventory items. The event is regulated by Art. 567-570 of the Civil Code of the Russian Federation, implies the application of general provisions for purchase and sale transactions.

Ownership of the goods passes to the participants only after full fulfillment of the terms of the agreement, unless otherwise provided by the agreement. The transaction is concluded in writing with a detailed description of the magnitude, nature of the obligations, the moment of transfer of ownership, and the proportionality of the value of the items.

In the accounting system, barter is reflected in the same way as standard trading operations: revenue is recognized and reflected in the account. 90, 91, costs reduce the tax base, profit is not generated. The credit of accounts is determined depending on the type of inventory transferred under a barter transaction: 10, 41, 43. A similar account will be used for the posting of purchased goods from the other party. At the same time, counterparties formalize the closure of debt on the debit and credit of the account. 60.62.

Barter is one of the ways to repay emerging debts

Resumption of arrears

Among the legal grounds for the repayment of unfulfilled contractual obligations are the expiration of the limitation period, situations where debts are recognized as bad on the basis of Art. 266 Tax Code of the Russian Federation. Repayment includes creditor and debtor arrears.

The debt to the creditor will be restored to the books only on his own initiative. In practice, such situations are extremely rare. In relation to the receivable after write-off, off-balance sheet accounting is maintained, which makes it possible to track changes in the financial situation of the defaulter over a period of five years.

If the debtor, after the expiration of the period for collecting the arrears under the contract, confirms the presence of unfulfilled obligations, the accounting is restored on the balance sheet accounts according to the type of transactions on accounts 60, 62, 76, reflecting other income in accounting, and non-operating income in tax accounting. Off-balance sheet accounting is closed by the credit turnover of the account. 007.

At the time of renewal of accounting, the creditor is not obliged to pay VAT to the budget, since the obligation was fulfilled at the time of sale. If the tax amount has not previously been transferred from the current account to repay the debt to the budget, it is necessary to make the payment as soon as possible.

A business transaction is reflected in the accounting registers on the day the debt is confirmed by the debtor. For example, an approved reconciliation act, letters, notifications, proposals to revise the terms of the transaction, etc. can be considered an option for such actions by the debtor.

There are certain nuances of accounting for restored debts of individuals, since at the time of write-off personal income tax was calculated, therefore the Federal Tax Service will need to submit an adjustment to the 2-personal income tax information with an explanatory note. Write-off bad debts of citizens are not covered by insurance, so correction of reporting to extra-budgetary funds will not be required.

Statutory debt can be renewed

1.2. Accounts receivable and its classification

Definition

Accounts receivable is the amount of debt owed by debtors to an enterprise as of a certain date.

The methodological principles for the formation of information on accounts receivable in accounting and its disclosure in financial statements are determined by P(S)BU 10

.

In this case, the features of the assessment and disclosure of information about receivables established by other P(S) Accounting Regulations

.

Note! Debtors can be (1) legal entities and (2) individuals who, as a result of past events, owe the enterprise certain amounts of cash , cash equivalents or other assets . That is, accounts receivable represent the counterparty's to repay the debt to the enterprise that arose as a result of past events.

In accounting, such debt is recognized as an asset of the enterprise if there is a likelihood that it will receive future economic benefits and its amount can be reliably determined ( clause 5 P(S)BU 10

).

Accounts receivable are classified according to certain criteria:

- according to the established repayment period (in connection with the normal operating cycle);

- by method of repayment;

- on timely repayment.

Receivable by specified repayment period

Depending on the maturity period (up to 12 months or more) and the relationship with the normal operating cycle, receivables are classified as long-term and current (short-term).

Current accounts receivable is the amount of accounts receivable that are incurred during the normal operating cycle* or will be settled within 12 months from the balance sheet date .

* Operating cycle - the period of time between the acquisition of inventories for carrying out activities and the receipt of money and their equivalents from the sale of products or goods and services made from them ( clause 3 of NP(S)BU 1 ).

class 3 , provided for by Instruction No. 291, are mainly used

(see table 1.1):

Table 1.1. Subaccounts used to account for current receivables

| Subaccount number | Subaccount name |

| 361 | Settlements with domestic buyers |

| 362 | Settlements with foreign buyers |

| 341 | Short-term bills received in national currency |

| 342 | Short-term bills received in foreign currency |

| 371 | Calculations for advances issued |

| 373 | Calculations for accrued income |

| 374 | Claims settlements |

| 377 | Settlements with other debtors |

Please note: in order to correctly classify receivables, you need to clearly know when exactly the debt will be repaid. To do this, it is necessary to analyze the terms of the relevant agreement.

So, if the contract clearly states the deadline for fulfilling the obligation (on a certain date after shipment of the goods, transfer of an advance payment, receipt of a loan, etc.), then when calculating the repayment period of receivables, we focus on this date. At the same time, to calculate the 12-month period, we rely not on the date of reflection of receivables in accounting, but on the nearest balance sheet date.

If the contract does not indicate the deadline for fulfilling the obligation or is determined by the moment of presentation of the claim , then the creditor has the right to present the claim at any time ( Article 530 of the Civil Code of Ukraine

).

In turn, the debtor must fulfill such an obligation within 7 days from the date of presentation of the demand, if the obligation of immediate execution does not follow from the contract or acts of civil legislation. Although we note: for some obligations the deadline for fulfillment may be different. So, for example, under a loan agreement, the loan must be repaid by the borrower within 30 days from the date the lender submits a request for this, unless otherwise established by the agreement ( clause 1 of Article 1049 of the Civil Code of Ukraine

).

Attention! Under such agreements, debt is usually not classified as long-term, because a demand for repayment can be made at any time before the expiration of 12 months from the balance sheet date.

Thus, debt with an indefinite maturity is classified as current in accounting.

Current receivables for products, goods, works, services are recognized as an asset simultaneously with the recognition of income from the sale of products, goods, works or services and are assessed at historical cost ( clause 6 P(S)BU 10

).

In case of deferment of payment for products, goods, works, services resulting in the formation of a difference between the fair value of receivables and the nominal amount of cash and/or their equivalents to be received for products, goods, works, services, such a difference is recognized as receivables accrued income (interest) in the period of its accrual.

At the same time, according to clause 7 P(S)BU 10

Current cash receivables, which are financial assets (except for acquired debt and debt intended for sale), are reflected in the balance sheet at

net realizable value *.

To determine it, as of the balance sheet date, the reserve for doubtful debts (hereinafter referred to as RSD) is calculated. For more information about this reserve, see section 3 on p. 23. But current (short-term) receivables are not subject to discounting. * Net realizable value is the amount of current accounts receivable minus the reserve for doubtful debts ( clause 4 of P(S)BU 10 ).

Long-term accounts receivable are the amount of accounts receivable that do not arise during the normal operating cycle and will be settled after 12 months from the balance sheet date .

What subaccounts of class 1 are provided for by Instruction No. 291

to account for long-term accounts receivable, you can find out from table. 1.2 (see p. 6).

Table 1.2. Long-term accounts receivable subaccounts

| Subaccount number | Subaccount name |

| 181 | Debt for property transferred under financial lease |

| 182 | Long-term bills received |

| 183 | Other receivables |

Long-term receivables are reflected in the balance sheet at their present (current) value. At the same time, the determination of the present value depends on the type of debt and the terms of its repayment.

Please keep this in mind! The part of long-term receivables due to be repaid within 12 months from the balance sheet date is reflected on the same date as part of current receivables ( clause 12 P(S)BU 10

).

Receivable by payment method

According to the method of repayment, receivables are divided into cash and goods .

Monetary. This is called a receivable if its repayment is expected in cash (in hryvnia or foreign currency) or their equivalents. In particular, this is debt for goods shipped, work performed, services provided, for which the company must be paid money. By their nature, such receivables are nothing more than a financial asset for which a special accounting procedure is provided (for more details, see Section 3 on p. 23).

Let us recall that financial assets are ( clause 4 P(S)BU 13

):

a) cash and cash equivalents;

b) a contract giving the right to receive funds or another financial asset;

c) a contract giving the right to exchange financial instruments with another enterprise on potentially favorable terms;

D) an instrument of equity of another enterprise.

Thus, cash receivables should be considered: cash debts for the supply of goods with subsequent payment (with deferred/installment payment), loans issued, bills received, bonds purchased, etc.

Commodity . If it is expected that the receivables will be repaid in goods, works, services, and not in money, then it is called commodity. An example here is the transfer by an enterprise acting in the status of a buyer of an advance payment against which the supplier (contractor, performer) must supply goods (perform work or provide services).

Receivables by timely repayment

Depending on the timeliness of payment, accounts receivable are divided into regular, doubtful and bad.

Regular accounts receivable

are accounts receivable that are not yet contractually due for payment.

Such debt is also called normal. That is, if an enterprise has transferred funds (delivered goods) and the counterparty has not yet fulfilled its obligations, then until the deadline for fulfilling contractual obligations is violated, the receivables are considered normal

In such a situation, the counterparty has not yet violated anything and the creditor has no reason to doubt the repayment of the debt. Therefore, ordinary receivables are taken into account in the general manner: their occurrence is reflected in the debit, and repayment (write-off) is reflected in the credit of the corresponding subaccount.

Normal accounts can be either long-term accounts receivable or current.

But the next two types of receivables relate only to current receivables.

Doubtful accounts receivable are current accounts receivable for which there is uncertainty about their repayment by the debtor ( clause 4 P(S)BU 10

).

Note that any current receivable can be classified as doubtful, including long-term receivables that have become current due to the fact that there are less than 12 months left until their repayment.

As a rule, a current receivable becomes doubtful at the moment when the counterparty did not fulfill its obligations on time and did not provide any guarantees for their fulfillment. Let us remind you: Part 1 of Art. 612 GKU

it is determined that the debtor is considered overdue if he has not begun to fulfill the obligation or has not fulfilled it within the period established by the contract or law.

At the same time, this is not always a debt that is already overdue. An enterprise can transfer an ordinary receivable to the category of doubtful even before it is actually overdue - as soon as it doubts its repayment.

According to the explanations of the Ministry of Finance (see letter dated December 9, 2003 No. 31-04200-30-5/7021

),

Classification of receivables as doubtful depends on the circumstances and is supported by professional judgment

For example, the debt of a debtor against whom bankruptcy proceedings have been initiated may be recognized as doubtful. Typically, the company prescribes the reasons for which receivables are classified as doubtful in the order on accounting policies.

Important! From the date on which cash receivables meet the definition of doubtful, the enterprise must reflect it in accordance with clause 7 P(S)BU 10

, i.e. at

net realizable value . To determine this value as of the balance sheet date, the RSD (see p. 24).

Uncollectible accounts receivable. This should be considered current receivables, in relation to which (1) there is confidence about its non-repayment by the debtor or (2) for which the statute of limitations has expired ( clause 4 P(S)BU 10

).

Attention! A current receivable becomes hopeless when at least one of the above conditions is met.

Confidence in the non-repayment of receivables is based on circumstances from which it can be said unequivocally (i.e. 100%) that it will not be returned by the debtor (repaid). For example, the debtor company was liquidated without a legal successor or the court made a final decision in favor of the debtor.

The expiration of the limitation period does not depend on the date the receivables arose. In accordance with Art. 261

and

530 of the

Civil Code of Ukraine, the limitation period should be counted based on the deadlines for fulfilling obligations specified in the contract.

If the obligation sets a deadline for its fulfillment, it is subject to fulfillment within this period ( Part 1 of Article 530 of the Civil Code of Ukraine

). If the contract does not establish a deadline for the fulfillment of obligations or is determined by the moment the claim is presented, the limitation period, as a rule, is counted from the 8th day after the creditor sends a demand for fulfillment of the obligation (see p. 58).

When a current receivable is recognized as uncollectible, it should be written off , since it does not meet the criteria for recognition as an asset, i.e., there is confidence that the enterprise will not receive future economic benefits ( clause 5 of P(S)BU 10

).

Write off bad receivables ( clause 11 P(S)BU 10

):

- for which the RSD was created - at the expense of the amount of such created RSD;

- for which RSD is not created (or the amount of RSD is not enough) - included in other operating expenses.

Note! For tax purposes, there are specific criteria for classifying receivables as bad.

For tax accounting, a bad receivable is a debt that corresponds to at least one of the characteristics listed in paragraphs 14.1.11 NKU

.

So, for example, one of the signs for recognizing a debt as bad according to paragraphs.

"a" p.p. 14.1.11 GCU is the expiration of the limitation period for obligations, regardless of whether the creditor went to court to collect it or not. For more information on the tax criteria for hopelessness, see subsection 4.1 on p. 36. Note that tax criteria for hopelessness are important for high-income earners and low-income volunteers. But low-income earners do not need to compare accounting and tax definitions of bad debt.