Inventory cards of fixed assets in 1C reflect all information about the object - characteristics, whether there has been modernization, movement since its acceptance for accounting, etc. At the same time, in 1C cards, most of the data is transferred automatically from fixed asset accounting documents. Let's look at how to create, assign a number and, finally, print inventory cards in 1C: Enterprise Accounting 3.0. If you still have questions related to the work of the directories, please contact the 1C consultation line, and also leave requests on our website. Our specialists will contact you as soon as possible.

You can generate a card from the directory “Fixed assets” (menu section “Directories” - “OS and intangible assets”).

Fig. 1 “Directories” - “OS and intangible assets”

Let's open the directory element and see what data is displayed in it, and what we can add additionally.

Fig.2 System and manually entered data

Data on acceptance for accounting, location, and method of reflecting depreciation expenses are reflected automatically from the document of receipt or acceptance of an asset for accounting. The user should fill out some of them “by hand” - this is the data in the “Information for the inventory card” section, such as manufacturer, serial number, object passport number, date of issue or construction (for the property).

Fig.3 Information for the inventory card

Having filled in the necessary data, print the card using the “OS Inventory Card (OS-6)” button.

Fig.4 OS inventory card (OS-6)

Fig.5 Printing form OS-6

If working with inventory cards causes you difficulties, contact our technical support line for 1C users by phone or leave a request on the website.

How to view data about an OS object for a specific date

The card reflects data about the object as of the current date. But there is a need to see what the data was before any changes, on a certain date. To do this, in the inventory card, by clicking the “More” button, select the “Change form” command.

Fig.6 Select the “Change Shape” command

Having opened the form settings, we see that among the form header details there is an unchecked “Information date” attribute.

Fig.7 Information date

By checking this box, in the form of an OS directory element we will see an additional field where we can set the date for which we want to view information about our object.

Fig.8 Setting the date

General drafting rules

The legislation does not provide for a special procedure for assigning numbers. The organization has the right to independently develop these regulations. The procedure is prescribed in the accounting policy of the enterprise or another act.

The main requirement is to indicate a unique number for each object. It is unacceptable for designations to be repeated. If a fixed asset is deregistered, its number can be assigned to another object after at least 5 years.

The numbers must be sequential. In large organizations, it is better to develop guidelines for assigning codes. The number may consist of several parts: a company branch, a division, a code within a division. When transferring funds to other branches, they will not be lost. Small firms can use simple numbering starting from 1.

Reflecting object movements

The card has to be printed for any changes in data about the object - movement, disposal, modernization, revaluation, etc., since all changes are recorded in the inventory card. For example, a transfer from one person to another is displayed in the section “Information on acceptance, internal movements, disposal (write-off) of a fixed asset item.”

Fig.9 Reflection of object movements

Inventory cards in 1C: Accounting departments of government institutions, 8th edition. 2.0

In this article, we will look at what an inventory card is, what it is used for, and how to correctly fill out an inventory card in the 1C: Public Institutions Accounting program, 8th edition. 2.0

Inventory card - what is it and what is it for?

An inventory card is maintained for each fixed asset item (non-financial asset). You can call it a “passport” of the fixed asset; it contains all the information about it. Today, the current form for the OKUD inventory card for accounting for non-financial assets is 0504031 (approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, applied from December 29, 2021). For a group of homogeneous objects of fixed assets (software, library collections, stage and production equipment (scenery, furniture and props, props)), items of production and household equipment worth up to 40,000 rubles inclusive, the form according to OKUD 0504032 is used.

A card in 1C:BGU (f. 0504031) is opened by the institution for each inventory item, filled out on the basis of the Acceptance and Transfer Certificate of fixed assets, passports of manufacturers, technical and other documentation characterizing the object, reflecting the date of acceptance for accounting and the transaction log number .

Form 0504031 consists of 5 sections:

- Information about the object.

- The cost of the object, changes in book value, depreciation.

- Information about acceptance for accounting and disposal of an object.

- Information about internal movement of the object and repairs.

- Brief individual characteristics.

How to fill out an inventory card in the 1C program: BGU 2.0

When creating an object in the “Fixed Assets” directory, fill in its name, as well as additional information that is important. We recommend that you immediately select the OKOF code so that this data is automatically applied at subsequent stages (Fig. 1).

An inventory card is opened and a serial number is assigned to it when it is accepted for accounting. You must tick the “Inv. card". The inventory card number is generated automatically, but can be adjusted manually if necessary (Fig. 2).

After the document “Acceptance for accounting of fixed assets” is completed, the relevant data is filled in, which will be reflected in sections 2 and 3 (Fig. 3).

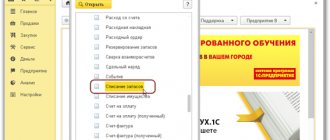

Using the “Change the composition of additional details” function (Fig. 4, Fig. 5), we can independently supplement the individual characteristics with the necessary parameters.

The inventory card can be presented in the form of an electronic document or in printed form, as stated in paragraph 19 of Instruction No. 157n: “With comprehensive automation of accounting, information about accounting objects is generated in the databases of the software package used. The formation of accounting registers is carried out in the form of an electronic register, and in the absence of technical capabilities - on paper.

The formation of accounting registers on paper in the event that it is not possible to store them in the form of electronic documents signed with an electronic signature and (or) the need to ensure their storage on paper is carried out with the frequency established within the framework of the formation of accounting policies by the subject of accounting, but not less frequently than the frequency established for the preparation and presentation by the accounting entity of accounting (financial) statements generated on the basis of data from the relevant accounting registers.”

The inventory card is generated when you select the “Print” button (Fig. 6).

All inventory cards are registered in the “Inventory” - form according to OKUD 0504033, which can be generated in the section Reports on Fixed Assets, Intangible Assets, Legal Entities.

If the inventory card number is not assigned in 1C:BGU 2.0

Often an accountant has a situation where, when accepting a fixed asset for accounting, a serial number was not assigned to the inventory card. This can be corrected using the operation “Change data of OS, intangible assets, legal acts” (Fig. 7).

Select the fixed asset, set the number and opening date of the inventory card and post the document (Fig. 8):

If you need expert advice on filling out or adjusting inventory cards in 1C:BSU or on other issues of accounting and tax accounting in budgetary institutions, write a question in the chat on this page, the first consultation is free.

Receipt of fixed assets

Let's move directly to accounting for fixed assets and create the first document related to the receipt of fixed assets in our company.

Go to the “OS and Intangible Materials” section of the “Equipment Receipts” magazine. Let's create our first document:

We receive equipment from the supplier:

- Invoice 1501 dated 01/15/2015, invoice 1501 dated 01/15/2015

- Supplier LLC "KVADROKOM" INN/KPP: 5027147377/ 770301001

- OGRN: 1095027003367

- Address 123242, Moscow, Sadovaya-Kudrinskaya street, building No. 11, building 1, apartment Room 2P-14

- Automatic striping machine. EXS 108 1 pc. RUB 1,180,000.00 each

Total: RUB 1,180,000.00 incl. VAT 180,000.00

Inventory card OS-6

Let's consider an example of compiling an inventory card in 1C 8.3 for a KIA RIO passenger car, which is the main vehicle.

First of all, let's go to the fixed assets directory card. As shown in the figure below, here you need to fill in the main characteristics of our car.

At the very bottom of the form there are some permanent characteristics that we indicate only once when the vehicle is received by our organization. These include manufacturer, serial number, production date and others.

Of course, accounting and tax accounting data, as well as depreciation data, are stored in the car card, but it is not their primary source. All such information is automatically filled in from primary documents. In our case, after accepting the KIA RIO car for registration.

OS depreciation in 1C 8.3

Let's look at depreciation using the example of month-end closing. In the "Operations" menu, go to the "Month Closing" item.

Please note that setting up depreciation rules and methods is configured in the organization's accounting policy. Depreciation is calculated every month, starting from the month following the acceptance of the asset for accounting.

When performing a routine operation on depreciation and wear and tear of the operating system, a posting was generated in the amount of 2950 rubles. The settings indicate the linear method of calculating depreciation. The lathe in our example has a service life of 60 months. Depreciation is calculated by the cost of the asset divided by its service life. Everything was calculated correctly.

An example of depreciation is discussed in this video:

Inventory document

To carry out an inventory, there is a special document - “Inventory of goods in the warehouse”.

Using this document, you can reflect in the program the fact of an inventory, indicate the current balances of goods and see the discrepancies between actual and accounting balances. This document is widely used in the practice of specialists involved in trade automation when transferring data between different 1C databases. Menu: Documents – Inventory (warehouse) – Inventory of goods Let’s create a new inventory document. First of all, the document indicates the warehouse where the inventory is carried out and the organization that owns the goods:

Inventory of goods can be carried out immediately for all product items. If the number of goods is very large and it is difficult to take inventory of them at one time, you can create several inventory documents. In this case, each document can be made for a specific group of goods.