An interesting situation arose among our clients who approached us to optimize their tax base.

As is known from tax legislation, a payer of value added tax, unlike those who are subject to the VAT tax system, can be absolutely any person or any company.

When buying products in stores, citizens see on receipts information about 18% VAT, which is included in the price.

Consequently, even without carrying out business activities, buyers ease the tax burden of mega-corporations by paying for them the value added tax, which they include in the price. But that's not what we're talking about.

Having understood the essence, we can trace who is the VAT payer. The answer is simple! Who has it “in his pocket”. The VAT holder must give it to the state. This is the state’s income, which it protects with its entire fiscal apparatus.

VAT return: is tax reporting considered a trade secret?

The Law “On Trade Secrets” dated July 29, 2004 No. 98-FZ (hereinafter referred to as Law No. 98-FZ) does not classify information about tax payments as data that cannot represent a trade secret of an organization (Article 5 of Law No. 98-FZ) .

Thus, an organization, if it deems it necessary, can stipulate in a local document - a provision on trade secrets - that such information is confidential (see paragraph 1 of Article 10 of Law No. 98-FZ).

You can read more about this document in our other article: “Regulations on trade secrets - sample”).

If the counterparty asks the organization to submit this document in order to check the reliability of the future partner, then the title page and section 1 of the VAT return with marks from the Federal Tax Service can be submitted for analysis, which will already serve as confirmation of the organization’s fulfillment of its obligations regarding tax payment.

If the declaration is submitted electronically, the counterparty can submit notifications from the tax authority downloaded from the personal account in the reporting system used (for example, through the Federal Tax Service website) about the entry of data into the general database of the Federal Tax Service or about the receipt of the declaration by the named government agency.

The counterparty, in turn, can request information about the payment of VAT by this legal entity or individual entrepreneur from the tax office itself, since this data does not relate to tax secrets (subclause 3, clause 1, article 102 of the Tax Code of the Russian Federation). The same conclusion is confirmed by the official explanations of the Ministry of Finance of Russia (see letter of the department dated 06/04/2012 No. 03-02-07/1-134 ).

If the counterparty suddenly turns out to be neither a friend nor an enemy, but... clarified the declaration

Indeed, due to the fact that the tax office has adjusted the concept of “interdependence” and introduced a new concept of a “controlled person,” the only remaining official way to escape taxes suggests that the counterparty must “cover the lid of the coffin,” but not everyone agrees with this.

Now, the task of the tax office comes down to one thing - to determine the figure in the tax audit report, and then it’s a matter of “technique”. I believe that everyone understands everything with the “technique”, but if not, then I recommend reading the book “Tax Audits: How to Come Out a Winner!” or play a board game with a similar name. And that’s why for many, there seems to be only one solution - to reset the declarations and go abroad or hide (that’s the effect of AKS VAT-2).

But what should those who in good faith bought a product and took VAT credit on it do, and then, out of nowhere, a call from the tax service or a requirement under the TKS - to pay as a result of an “update” from the counterparty for the past few years?

The first possible action is to submit the “clarification” yourself. At the same time, you need to understand the consequences and be prepared for them. Namely, if your customers use a special mode or are individuals, then there will be no problems. But if your customers are the same VAT payers as your company, then they can either refuse to cooperate with you or also submit an updated declaration. According to the legal position of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 668/04 of May 25, 2004, if it is impossible to establish one of the components (expenditure or revenue part), “the amount of taxes should be determined by calculation, creating additional guarantees for the taxpayer and ensuring the balance of public and private interests..." Simply put, if the tax office removes VAT from your expenses and purchases, then it should remove VAT from your revenue. This point of view is indirectly confirmed in a more recent court decision, set out in the Resolution of the Federal Antimonopoly Service of the East Siberian District dated January 28, 2011 No. A19-25394/09.

The second possible action is to try to prove the reality of the transaction. In this matter, of course, the new Article 54.1 of the Tax Code of the Russian Federation is indispensable. Its usefulness lies in the fact that it contains a list of specific actions of the taxpayer, which, in the opinion of the tax service, are recognized as abuse of rights, and the conditions that must be met by the taxpayer in order to be able to account for expenses and claim a tax deduction for transactions (operations) that have taken place. What to do if your suppliers and counterparties do not communicate? If the amount of expenses or purchases is more than 5 million rubles, one of the options would be to write a statement to the police (it is not a fact, of course, that it will be accepted). The second possible solution is to hire a private detective who will conduct interrogations and prepare a report that will describe the entire supply chain and name its participants. A private detective can use a polygraph during interrogations to increase the level of confidence of the tax authorities in the results of such an audit.

If you want to know more about VAT, I recommend the new books “250 tax decisions on VAT” and the best-selling tax consulting book, a book that passed a prosecutor’s audit and linguistic examination (it turned out that it does not contain calls for tax evasion) - “Black and White Tax Optimization - 3800", 2021 release.

I cannot help but note the increasingly growing role of the company's internal security service. Taxes cannot be left only to the chief accountant. A completely new system of tax collection, based on total control and mutual responsibility, has been built against taxpayers. Our chief accountants may simply not be able to cope with this alone (they may not be ready either psychologically or physically). So times have changed. Today we live in a new reality, which requires a rethinking of what is happening and the development of a different model of existence, this is what I will talk about at my upcoming seminars.

Evgeniy Sivkov

Evgeniy Sivkov, Ph.D., certified auditor, general director of Audit, author of more than 90 books and manuals on accounting and taxation, author of several hundred articles on taxes (sivkov.biz). He has more than 20 years of experience as a chief accountant, auditor and consultant, and has extensive experience in arbitration practice. Former chairman of the political party "Party of Taxpayers of Russia", chairman of the arbitration court. Developer of the software product “Intelligent tax consulting system “Sivkov NK” (esivkov.com). The founder of the new literary genre “tax thriller”, author of the widely known books “Auditor”, “Consultant”, “Advisor”. Winner of the National Golden Phoenix Award in the Tax Consultant of the Year category.

* Advertising

Is the charter a trade secret?

The contents of the constituent documentation cannot be a commercial secret of the organization, as is expressly stated in Law No. 98-FZ (see paragraph 2 of Article 5 of the said law).

In addition, documents such as TIN and OGRN, licenses, are also unacceptable to hide and designate as confidential information. The law obliges the listed documents to be placed in the public domain for review, for example, by consumers - in the buyer’s corner (Clause 1, Article 9 of the Russian Federation Law “On the Protection of Consumer Rights” dated 02/07/1999 No. 2300-1).

We recommend reading our article “List of documents for the consumer corner.”

In addition, some legal entities are required by law to post their charter on their website on the Internet. For example, state and municipal institutions have such an obligation (see clause 6 of Order No. 86n of the Ministry of Finance of the Russian Federation dated July 21, 2011).

Reasons for VAT gaps

Discrepancies between the declarations of sellers and buyers can arise for various reasons:

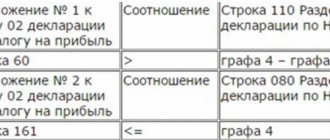

- Technical errors. For example, when filling out a declaration, an accountant made a typo in the invoice number or TIN of the counterparty. Then the program will not be able to compare the documents and will display a message about the VAT gap.

- Deviation by dates. In many cases, the buyer has the right to reimburse VAT not immediately upon receipt of the invoice, but within three years (clause 1.1 of Article 172 of the Tax Code of the Russian Federation). Therefore, a situation may arise where a document currently included in the buyer’s declaration was reflected in the supplier’s reporting several months earlier.

- The supplier organization did not include the VAT deducted by the businessman in its declaration or did not report VAT at all.

Is the balance sheet a trade secret or not?

In relation to accounting (financial) reporting, the establishment of a trade secret regime is unacceptable (Clause 11, Article 13 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

The balance sheet is one of the components of accounting (clause 5 of Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n), accordingly, it cannot constitute a commercial secret. The same order also confirms the publicity of accounting records and establishes the organization’s obligation to ensure that users can familiarize themselves with it (clause 42).

In some cases, the law establishes an obligation to disclose financial statements, an integral part of which is the balance sheet, by publishing it on the Internet (for example, this obligation is established for joint-stock companies in Chapter 71 of the Regulations on Information Disclosure, approved by the Bank of Russia on December 30, 2014 No. 454-P ).

Court verdict: non-payment of VAT by counterparties is not a reason for refusal to deduct

The Supreme Court of the Russian Federation, in ruling No. 307-ES19-27597 dated May 14, 2020, confirmed that if an organization has proven the fact of purchasing goods, then tax authorities do not have the right to refuse to deduct VAT even if its counterparty (supplier) has the characteristics of a fly-by-night company and does not pay VAT to the budget.

Subject of dispute

: an organization was denied a VAT deduction due to its counterparty’s failure to pay VAT and failure to exercise due diligence when concluding a supply agreement. The lower courts recognized the refusal to deduct as legal. At the same time, the courts proceeded from the fact that the organization’s counterparty could not fulfill the concluded agreement, had signs of a one-day transaction and did not pay VAT to the budget. The organization challenged these court decisions in the Supreme Court of the Russian Federation.

What were they arguing about?

: 14,423,367 rubles.

Who did win

: organization.

The Supreme Court of the Russian Federation found that the main reason for the refusal to deduct VAT was that the supplier of the organization did not pay VAT to the budget. Thus, a source for tax reimbursement was not created in the budget. However, this fact in itself is not a sufficient basis for refusing a deduction.

Fulfilling the obligation to pay taxes does not imply holding the taxpayer responsible for the actions of all his counterparties in transactions. The right to deduction cannot be conditioned by the fulfillment by direct counterparties (sellers, suppliers) and their predecessors of their obligation to pay VAT, as well as the financial and economic situation and behavior of third parties.

Denial of the right to deduct “input” VAT in the event of non-payment of tax by counterparties is possible only in cases where the Federal Tax Service proves that the purchasing organization had the intent to evade taxation and illegally reimburse the tax.

The mere fact of the absence of an economic source for tax deduction cannot be sufficient to consider the use of deductions by the buyer unlawful.

Deprivation of the right to deduct VAT from a taxpayer-buyer who did not pursue the goal of tax evasion would mean the application of penalties for non-payment of taxes committed by other persons.

Also, claims from tax authorities and lower courts were caused by the fact that the organization’s counterparty had the characteristics of a fly-by-night company and could not fulfill the concluded deal for the supply of products. So, the counterparty did not have employees or vehicles.

However, the organization proved that it exercised caution when choosing a counterparty. Its counterparty acted as a real subject of economic activity. He had a warehouse, and also incurred the costs of paying for transport services of various forwarding organizations and the cost of renting premises.

The general director of the counterparty, when questioned as a witness, also confirmed the activities of the organization he heads. The transaction was executed with the involvement of third parties (forwarders).

The organization proved the fact of actual purchase of products. The goods purchased from the counterparty were fully paid for, capitalized and used in production activities.

In this regard, the Supreme Court of the Russian Federation recognized the refusal to deduct VAT as unfounded, canceled the previously adopted court decisions and sent the case for a new trial.