02.01.2021

When purchasing real estate in 2013 (2012, 2011, 2010 and earlier), a property deduction is provided to buyers of an apartment, room, house or shares in them (for more information about what a deduction is and how it is applied, see the link). Having received a property deduction when purchasing an apartment, house, room (share in them), you can return the tax in the amount of 260,000 rubles. (or not pay it in the future). This is the income tax you have already paid or will be required to pay. For the procedure for providing a property deduction for real estate purchased after 2013 (for example, in 2021, 2020 and 2021), see the link.

How does property deduction work?

The amount of property deduction is equal to the cost of the purchased property. However, the maximum deduction amount is limited. Regardless of how much you paid, the deduction when purchasing an apartment (or other real estate) cannot exceed RUB 2,000,000. (excluding mortgage interest, if any). But we won’t stop there for now. Details below.

Let us illustrate the mechanism of how the deduction works. But first of all, you need to remember that income tax is calculated only at the end of the year. That is, at the end of each year you sum up all the income received, reduce them by deductions and calculate the tax amount. Then you compare it with the amount that you personally paid (or your employer paid for you). You either pay the difference to the budget (if you paid less than necessary), or return it from the budget (if you paid more than necessary).

Example Let's assume that your salary is 35,000 rubles. per month. The income tax that will be withheld from her will be: 35,000 rubles. x 13% = 4550 rub.

The company you work for will pay this amount to the budget monthly. Consequently, you will receive your salary in your hands minus tax, that is, only in the amount of 35,000 rubles. — 4550 rub. = 30,450 rub.

Accordingly, for the year you will receive a salary in the amount of: 35,000 rubles. x 12 months = 420,000 rub.

Tax will be withheld from her in the amount of: 420,000 rubles. x 13% = 54,600 rub.

So, the company where you work has withheld a tax from you in the amount of 54,600 rubles for the year. and paid it to the budget.

This year you received the right to a deduction when purchasing an apartment in the amount of 380,000 rubles. At the end of the year, your annual taxable income will be: RUB 420,000. (salary for the year) - 380,000 rubles. (deduction) = 40,000 rub. (taxable income)

Tax must be withheld from him in the amount of: RUB 40,000. (taxable income) x 13% = 5200 rub.

However, you have already been deducted 54,600 rubles. After all, the company that paid the tax for you calculated your income without this deduction. Consequently, you have the right to return part of the overpaid tax for you from the budget in “real” money. This part will be: 54,600 rubles. (tax already withheld) - 5200 rub. (tax to be paid) = RUB 49,400. (tax that the budget will have to return)

Accordingly, you have the right to claim a tax refund on this amount.

Read more about how to apply tax deductions by following the link.

Property deduction: when is there a right to it?

The right to a property deduction arises in the year when you bought real estate (house, apartment, room, etc.) and received ownership of it. Moreover, it does not matter what month of the year this happened. It is important that this happens no later than December 31st. Otherwise, the right to deduction will arise next year.

Please note that ownership of real estate appears after state registration of a transaction (for example, sale or purchase). State registration is the making of the necessary entries in the State Register of Rights to Real Estate and Transactions with It. Typically, the date of entry into the register and the date of issue of the Certificate of Registration of Property Rights do not coincide (the certificate, as a rule, is issued “in hand” a little later). So the date of issue of the certificate itself does not matter. If the transaction was registered, for example, on December 30, 2013, and the certificate was issued in January 2014, then ownership was received in 2013, not 2014. The date on which the transaction was registered is usually indicated on the Certificate of Title.

Example: You bought an apartment under a sales contract. The corresponding entry was made in the state register on December 25, 2013. You became eligible for the deduction in 2013. Accordingly, all income for 2013 (from January 1 to December 31) can be reduced by deduction.

An exception to this procedure is provided only for apartments purchased under an agreement of shared participation in construction (DDU). A deduction for such apartments can be obtained after concluding a DDU agreement, paying for it and issuing an acceptance certificate for the apartment from the developer to the buyer. Accordingly, you can count on the deduction before registering ownership of the apartment.

The period during which you can apply for a property deduction is not limited by law. For example, having bought an apartment in 2013, you can claim a deduction and reduce your income received in 2013, 2014, 2015, 2021, 2021. And it doesn’t matter how many years have passed since the purchase of the apartment. There are only two nuances.

First , the deduction will be provided according to the rules that were in force in the year the apartment was purchased.

Second , you can claim a refund of taxes that have not passed three years since payment.

For example, you bought an apartment in 2013. However, after the deduction, you applied only in 2021. In such a situation, you can claim a refund of taxes paid in 2021, 2021 and 2021. Tax transferred in 2021 and earlier years will not be returned to you (more than three years have passed since it was paid).

You also do not have the right to claim a refund of taxes that were paid in the years preceding the year you purchased the apartment. So, if you buy an apartment in 2021, you will not be able to return taxes for 2021, 2021 or 2018. An exception to this procedure is provided only for pensioners. They have such a right.

Annual property tax levy

Despite the fact that the process of acquiring living space itself is not subject to taxation, the presence of housing imposes an obligation on the owner to pay state tax every year until December 1. From 2021, when calculating payments for real estate, the cadastral price is used, which is often higher than the inventory price. This figure is analyzed and clarified once every five years based on the results of research by independent expert bureaus. For five years, Russians will face an annual increase in property taxes of 20 percent.

A citizen can control the cadastral valuation of his property using online resources of the World Wide Web, for example, Rosreestr (the payment receipt itself indicates the taxable base, taking into account all benefits). To do this, in the form that opens, you must enter the cadastral number of the object or its address and click “Generate a request.” You will be shown several sources of information about the property: State Property Committee and Unified State Register. You need to open information from the State Property Committee, where the current cadastral value (and the date of its approval) will be indicated. If the cadastral valuation of the premises is too high, in the owner’s opinion, then it can be challenged in court.

Sample extract from the Unified State Register

In 2021, the real estate tax was 0.1% of the cadastral value of real estate, while the state allowed the use of local reductions in coefficients, allowing Russians not to pay a fee for the area of housing that is considered the norm for living; the remainder is taxed. Regional authorities also approve their rates within the limits determined by federal legislation. The legal norm for one room is 10 m2, an apartment is 20 m2, a private house is 50 m2. The difference between the standard figures and the actual area of an individual’s housing is where the fee is charged.

Amount of property deduction

The amount of property deduction when purchasing an apartment is equal to the purchase price of the apartment or other real estate (house, room). This may include other purchase costs (more on these below). However, the maximum amount of property deduction is limited by law. Regardless of the cost of the apartment (other real estate), its amount cannot exceed 2,000,000 rubles.

For example, an apartment costs 1,300,000 rubles. Then the deduction when purchasing this apartment will be the same amount (it does not exceed the maximum). Another variant. The apartment costs 6,000,000 rubles. In such a situation, you will receive a deduction in its maximum amount - 2,000,000 rubles. The difference is 4,000,000 rubles. will not affect the amount of the property deduction.

The amount of property deduction when purchasing an apartment may exceed RUB 2,000,000. The fact is that it is subject to increase by the amount of interest on the mortgage loan that you received to purchase the real estate for which you receive a deduction (if, of course, you had such a loan). Moreover, the amount of these interests, which increases the amount of the deduction, is not limited by law.

For example, if you bought an apartment for 3,400,000 rubles. and paid interest on a mortgage loan in the amount of RUB 330,000, then you will be given a deduction:

- for the apartment itself within its maximum amount - 2,000,000 rubles;

- for interest in the amount of their actual amount - 330,000 rubles.

The total deduction amount will be: 2,000,000 + 330,000 = 2,330,000 rubles.

The amount of interest on targeted loans, which can increase the amount of the deduction, is not limited by law. You will receive a deduction on interest as long as you pay it to the bank. But this procedure only applies to real estate purchased before January 1, 2014.

Results

Individuals who pay personal income tax when purchasing an apartment can take advantage of the right to a refund of previously paid tax or benefits from exemption from the withholding of 13% on income received at the place of work. In order to exercise this right, you must collect a complete package of documents and submit them to your Federal Tax Service.

The maximum amount of property deduction provided once for life is 260 thousand rubles, and you can use your right to it as many times as you like until the limit is completely exhausted. This applies to residential real estate purchased since 2014, or cases where the property was purchased earlier, but the taxpayer did not use the right to such a deduction at all.

The waiting period for personal income tax reimbursement when purchasing an apartment is no more than 4 months, and the amount of tax declared as subject to reimbursement in the form of a payment to the taxpayer’s account will be transferred to him immediately, and receiving a deduction from the employer will take longer.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What expenses are taken into account when providing a property deduction?

Such expenses can be divided into three groups. The first is for construction or purchase:

- residential building (shares in it);

- apartments (shares in it);

- rooms (shares in it);

- a plot of land provided for housing construction or a plot on which a residential building is located (share in it).

The second is to pay interest on loans and credits that were provided for the construction and purchase of the above-mentioned objects (residential building, apartment, room, etc.). The third is interest on bank loans received for on-lending of the mentioned loans and credits.

The costs of constructing or purchasing a residential building (share in it) include your costs:

- for the purchase of the residential building itself (including unfinished construction);

- for the development of design and estimate documentation;

- for the purchase of construction and finishing materials;

- for construction work or services (completion of a house that has not been completed) and finishing;

- for connection to electricity, water, gas supply and sewerage networks or the creation of autonomous sources of electricity, water, gas supply and sewerage.

The costs of purchasing an apartment or room (share in them) include your costs:

- to purchase the apartment, room or share itself, or the rights to them in a house under construction;

- for the purchase of finishing materials;

- for work related to the finishing of this property

- for the development of design and estimate documentation for finishing work.

Attention! As you can see, these expenses include not only the direct cost of the house or apartment itself, but also the costs of completing or finishing them. So, such costs can be included in the deduction provided that you are purchasing, for example, a house that has not been completed with capital construction (that is, unfinished). And for such objects they issue a special certificate of state registration. Therefore, if you bought a house that has been completed, you will be prohibited from including these expenses in the deduction.

Regarding the apartment, it must be purchased in a new building (preferably under an agreement of shared participation in construction). If the apartment was purchased on the secondary housing market, then it will not be possible to include the costs of finishing it in the deduction (see letter of the Federal Tax Service of Russia dated August 15, 2013 No. AS-4-11/14910). One more requirement. If you are buying a house or apartment that needs finishing, this should be clearly stated in the purchase and sale agreement or DDU. At the same time, we remind you once again that regardless of the amount of such expenses, the deduction cannot exceed 2,000,000 rubles.

Example A person purchases an apartment and applies for a property deduction.

Situation 1 The apartment costs 2,400,000 rubles. It needs finishing. Finishing costs amounted to 340,000 rubles. In this case, the deduction will be provided in the maximum amount - 2,000,000 rubles. Moreover, finishing costs do not need to be documented. They will not be included in the deduction amount anyway.

Situation 2 The apartment costs 1,800,000 rubles. It needs finishing. Finishing costs amounted to 560,000 rubles. In this case, the deduction will be provided again in the maximum amount - 2,000,000 rubles. Finishing costs must be documented in a minimum amount of 200,000 rubles.

Situation 3 The apartment costs 1,250,000 rubles. It needs finishing. Finishing costs amounted to 480,000 rubles. In this case, the deduction will be provided in the amount of: 1,250,000 + 480,000 = 1,730,000 rubles.

Finishing costs must be documented for the full amount included in the deduction in the amount of 480,000 rubles.

Attention! Interest on the mortgage loan taken out to purchase this apartment will increase the amount of the property deduction.

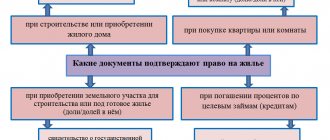

What documents are needed to obtain a property deduction?

To receive a property deduction when purchasing an apartment (other real estate), you must provide the tax authorities with a declaration of Form 3-NDFL and a special application for the deduction. You can view the application form for property deduction by following the link. All expenses that you include in the property deduction amount must be supported by documents. The Form 3-NDFL declaration is accompanied by all documents that confirm the costs of paying for real estate (or interest on a mortgage loan) and your right to a tax refund. For more information on how the 3-NDFL declaration should be submitted, see the link.

Such documents include copies of:

— property deduction when purchasing an apartment or room on the secondary market:

- agreement for the purchase of an apartment (room) with all additional agreements and annexes to it;

- documents confirming the fact of payment for an apartment or room (for example, a receipt from the seller for receiving money from you, payment orders, etc.);

- certificates of ownership of the apartment (room);

- agreements on the distribution of deductions if an apartment or room was purchased as joint property (original!).

— property deduction when purchasing an apartment or room in a new building under an agreement on shared participation in construction or an agreement on the assignment of rights:

- an agreement for shared participation in construction (investment) or an agreement for the assignment of the right of claim with all additional agreements and appendices thereto;

- a document confirming the fact of transfer of an apartment or room (for example, an acceptance certificate);

- documents confirming the fact of payment for an apartment or room (for example, a receipt from the seller for receiving money from you, payment orders, etc.);

- agreements on the distribution of deductions if an apartment or room was purchased as joint property (original!).

— property deduction when purchasing a residential building and land plot:

- agreement for the purchase of a residential building and land plot with all additional agreements and annexes thereto;

- documents confirming the fact of payment for a residential building and land plot (for example, a receipt from the seller for receiving money from you, payment orders, etc.);

- certificates of ownership of a residential building and land plot;

- agreements on the distribution of deductions if a residential building and a land plot were purchased as joint property (original!).

- property deduction when paying interest on a mortgage loan spent on purchasing real estate:

- loan agreement with all additional agreements and appendices thereto;

- documents confirming the fact of payment of interest on the loan (for example, a bank certificate, account statement, etc.).

Attention! The specified list of documents is given in the letter of the Federal Tax Service of Russia dated November 22, 2012 No. ED-4-3/19630. It is comprehensive. This means that tax authorities have no right to demand documents not named in this list. This letter is mandatory for use by all Russian tax inspectorates.

If, in addition to the costs of purchasing the apartment or house itself, you include in the deduction the costs of finishing it (completing the house), then you will also need documents that confirm them. These may be contract agreements with builders for finishing work, cash register receipts confirming payment for these works, sales receipts for the purchase of building materials and cash register receipts confirming their payment. If there are no documents, then the amount of such expenses cannot be included in the deduction.

If you are a real estate buyer

If you are a buyer of real estate for cash or with a consumer loan, then the personal income tax will be paid by the seller, because it was he who received the income from the sale of the real estate. Note that the tax is often included in the price of a residential property from the very beginning, so the future owner, at his own expense (in whole or in part), sometimes without even realizing it, compensates the seller for the costs of paying the tax, often even for the costs of a realtor. However, such a compromise is beneficial to both parties: the seller will pay taxes and sleep peacefully, and the buyer will receive the apartment he dreamed of.

If you are a buyer of real estate using maternity capital received for the birth (adoption) of a second child. In such a situation, there is also no need to send money to the budget, but it will not be possible to use the tax benefit in the form of a property deduction from these funds. The borrower's personal funds used to purchase housing are eligible for the benefit.

If you are a buyer of real estate using a mortgage loan (direct loan). In such a situation, the buyer also does not pay tax; moreover, the owner of the property can use all tax benefits: receive a deduction not only from the funds spent on the purchase of real estate (but not more than two million), but also from the interest paid on the mortgage loan (no more than three million rubles).

If you are a buyer of real estate with money from a refinanced target loan. The buyer also does not pay the tax on the income of individuals in such a situation, except for the case when, according to Russian legislators, he received a material benefit from on-lending. At the same time, the citizen retains the right to claim tax deductions from the amount spent on the purchase of real estate and payment of interest.

Tax on material benefits when refinancing a mortgage loan can be charged:

- when the rate is reduced to 9% within the framework of a dollar loan;

- if the bank transfers a foreign currency debt at a preferential rate into ruble debt, partially writing off the debt;

- when the target loan is restructured at a rate lower than 2/3 of the current Central Bank refinancing rate;

- if the bank partially writes off the debt during the restructuring of a mortgage that has government support, or simply forgives the client (partially or completely) the debt.

If a financial institution carried out a refinancing operation as a write-off of debt obligations, then the Federal Tax Service will charge the Russian citizen 13 percent on the saved amount; when the client won on the amount of interest, then in this situation the base indicated in the payment receipt is subject to a 35% tax. The algorithm of actions for the resident will be prompted by the codes indicated in it: for example, the number 2610 means that when refinancing the citizen saved on interest, and 4800 means a forgiven debt. In the first scenario, the buyer will still pay the personal income tax, but he still has the chance to return or make the base by which the tax is calculated smaller with the help of various deductions; in the second case, when the mortgager presents a certificate confirming the right to a property deduction , even used, there is no need to pay 35% tax.

Who is a tax resident of the Russian Federation? Our article will help you figure this out. In it we will look at what the tax status depends on, documents for confirmation, as well as the regulatory framework for residents and non-residents.

Of course, the mortgage client should collect additional information about how bank financiers formalized the procedure for refinancing a target loan and writing off debt, because the inspectorate assesses tax based on information received from the credit institution. It is advisable to do this at the stage of deciding the need to refinance the mortgage, so as not to end up in a situation where the citizen also finds himself in debt to the state for a mythical benefit. Therefore, you need to send a letter to the bank demanding clarification of the procedure for removing debt obligations and the scheme for calculating material benefits. It is also worth asking bank employees to refer to the legislative acts that guide them in such cases.

Advice: when refinancing a loan, you need to pay attention to the date of the loan agreement. If the consumer entered into an agreement before October 1, 2014, therefore, such a transaction falls under clause 65 of Article 217 of the Tax Code of Russia: since January 2016, a rule has been in force that allows one not to pay a tax fee when a mortgage debt is partially written off.

Clause 65 Article 217. Income not subject to taxation (exempt from taxation)

If you are a buyer of real estate under an agreement on the assignment of collateral rights. Here the buyer does not become the owner of the property, but receives the obligation to repay the debt to the credit institution. Only after repaying the loan will he become the owner. He does not pay any taxes.

If you are a property exchange buyer. In such a situation, the algorithm for paying fees is not precisely defined by law, but the Ministry of Finance and the Tax Service have finally developed an agreed position on this issue.

When calculating the amount of the fee, the price of the residential premises and the period of its ownership are taken into account

When performing an exchange transaction, the parties, in accordance with Article 567 of the Civil Code of the Russian Federation, carry out two counter sales transactions with payment in kind, where each participant acts as both a seller and a buyer of real estate, and, therefore, both derive income. If the housing is of equal value, then the parties, when concluding an agreement, receive the same profit in kind. If one apartment costs less than another, then the owner of the less valuable property pays the difference. Therefore, the income of the seller of more valuable housing consists of the cost of the apartment and additional payments, the total amount of which is subsequently taxed, as in the normal sale of housing:

- when exchanging residential premises with different periods of ownership, the seller of an apartment owned by him for more than three years and purchased before January 1, 2021 does not pay tax (according to Article 220 of the Tax Code of the Russian Federation);

- if housing is exchanged, which both parties have owned for less than three years and its price does not exceed 1 million rubles, the fee is also not paid, and it makes no difference how the property came into hands - by inheritance, privatization agreement, gift, purchasing, etc.;

- when they exchange property that has been owned for less than three years and is worth more than a million, the tax is calculated on the actual cost of the apartment.

Example: you changed your living space (its cost is 4.5 million rubles) to another at a cost of 3.7 million + an additional payment of eight hundred thousand rubles. In this way, the taxable basis of your profit will be 4.5 million rubles. There are several ways to shorten it:

- or by withholding a standard “million dollar” deduction: then the basis for calculating the tax will be 3.5 million rubles;

- or confirmed costs associated with the acquisition of another residential property: then the amount of income from which the fee must be paid will depend on the amount of expenses. If, after the completed exchange, you buy an apartment at the same price as the previous one, then the tax basis will become zero;

- By exchanging housing, a Russian, among other things, does not lose the right to a tax deduction, because the law does not impose restrictions on the method of purchasing a house (cash, loan or in kind). 13% of the monetary limit indicated in the regulations will be returned - two million. The opportunity to return the tax arises when the buyer receives an acceptance certificate or an extract from the Unified State Register.

The declaration when filing a tax refund may contain both personal and borrowed financial resources - all of this, according to the judgment of legislators, is a citizen’s expenses

The right to deduction can be exercised only once, but the following condition applies to housing exchanged after January 1, 2014: when the benefit has not been used in full, its balance is taken into account when purchasing a second premises or land. Thus, the acquirer, by filing an exchange of an apartment, can take advantage of the tax privilege given to him by law by reducing the tax base in addition to one of the methods described above (it is enough to indicate in the declaration not only the profit received, but also the maximum deduction amount). For example, in combination with the first method, the tax base in our example will be reduced to one and a half million rubles.

Restrictions on property deduction

There are few such restrictions. But they exist.

First , a property deduction is not provided if the property was purchased from a related party. Those persons listed in Article 105.1 of the Tax Code are recognized as interdependent. For example, these are your close relatives. Therefore, if you bought an apartment from your wife/husband (parents, brother, sister), then you will be denied the deduction.

Secondly , property deductions are not provided if the property was paid for by other persons for you and you have no obligations to them. For example, you were so liked at work that your employer bought you an apartment. There is an apartment - there are no obligations. Your deduction will be denied. However, if the same employer gave you money to buy an apartment on credit, then you will receive a deduction. You will also retain the right to it if you buy an apartment using a bank loan. After all, you still have the obligation to return the money in both the first and second cases.

Third , the property deduction cannot include expenses for the purchase of an apartment (other real estate) that were paid from maternal (family) capital or through payments from the federal, regional or local budget. Accordingly, if, for example, an apartment costs 1,800,000 rubles. and an amount of 250,000 rubles. paid from maternity capital, the deduction will be only 1,550,000 rubles. (1,800,000 - 250,000).

Property deduction for joint purchase of an apartment (house)

The best option if you are the sole buyer of the property and all documents are issued in your name. But, as a rule, apartments are bought by families (for everyone). In this situation, there are two options:

- the first - into joint ownership (that is, the apartment becomes the common property of all buyers and shares in it are not distributed between them);

- the second - in shared ownership, indicating in the documents to whom and in what amount this or that share belongs.

In both options, the total amount of the property deduction remains unchanged (RUB 2,000,000 plus interest on the mortgage). At the same time, it is distributed among all buyers. In the first case (joint ownership), buyers decide independently how to distribute it. They write statements to the tax office and indicate in what proportion and to whom the deduction is due. For a sample application for distribution of deductions, see the link.

Example A wife and husband bought an apartment worth RUB 1,900,000. into joint ownership.

Situation 1 According to the spouses, the deduction is distributed as follows:

- wife - 50%;

- husband - 50%.

Accordingly, each buyer has the right to claim a deduction in the amount of 950,000 rubles. (1,900,000 x 50%).

Situation 2 According to the spouses, the deduction is distributed as follows:

- wife - 30%;

- husband - 70%.

Accordingly, each buyer has the right to claim a deduction in the amount of:

- wife 570,000 rub. (1,900,000 x 30%);

- husband 1,330,000 rub. (1,900,000 x 70%).

Situation 3 According to the spouses, the deduction is distributed as follows:

- wife - 0%;

- husband - 100%.

Accordingly, the entire deduction amount in the amount of RUB 1,900,000. declared by the husband. The wife has no right to deduction.

In the second case (shared ownership), the deduction is distributed among the co-owners in proportion to their shares. Moreover, if the apartment becomes the property of not only the spouses, but also their minor children, their parents have the right to receive a deduction for children (that is, they can increase their expenses by the amount of costs for purchasing shares for children).

Example An apartment worth RUB 1,900,000 was purchased. into shared ownership.

Situation 1 An apartment was purchased by a husband and wife in equal ownership (1/2 each). In this case, each spouse has the right to claim a deduction in the amount of 950,000 rubles. (1,900,000 x 1/2).

Situation 2 An apartment was bought by a husband and wife, while the husband owns 3/4 and the wife 1/4 of the apartment. Accordingly, each buyer has the right to claim a deduction in the amount of:

- husband 1,425,000 rub. (1,900,000 x 3/4);

- wife 475,000 rub. (1,900,000 x 1/4).

Situation 3 An apartment was purchased by a husband, wife and minor child in equal ownership (1/3 each). In this case, each buyer has the right to claim a deduction in the amount of 633,333 rubles. (1,900,000 x 1/3). In this case, one of the spouses can receive a deduction for the child themselves.

In this situation, he will receive a deduction in the amount of: 633,333 (his deduction) + 633,333 (deduction for the child) = 1,266,666 rubles.

Calculating tax

Before calculating the fee, you should look at the Federal Tax Service website and find out the rate for your region. You can view it here.

How is property tax calculated?

Example: Ivan Petrov’s apartment is 46 square meters, the cadastre authority valued it at 1.2 million rubles.

- We calculate the tax base: since we are talking about an apartment, we therefore subtract 20 square meters from the total housing area. m. tax is calculated from 26 m2;

- Let’s calculate the price of one square meter of the entire real estate area: in our case it will be 26,086 rubles;

- Now we multiply the resulting amount by the number of square meters subject to tax calculation using a rate of 0.1%. Thus, the amount of property tax for individuals will be 678.23 rubles.

There are a sufficient number of citizens living in Russia who have the right to apply for tax benefits. At the federal level, the benefit is for disabled people of the first and second groups, from childhood; old-age pensioners, WWII veterans, Hero of the Soviet Union and the Russian Federation, holders of the Order of Glory of three degrees also apply for it; The law did not bypass the liquidators of radiation accidents, and various categories of military personnel and members of their families. Regional administrations are also adding to the list of benefit recipients. But, if, according to the cadastre, the property is worth more than three hundred million rubles, then its owner does not have any relief.

To apply for the benefit, you must write an application to the local Federal Tax Service before the beginning of April. Since 01/01/2018, homeowners have the right not to prove their advantages by collecting certificates and checks - tax inspectors themselves will check the category of real estate and what the corresponding social status of its owner is. If the benefit is suddenly not confirmed, the taxpayer will be notified about this immediately. Then he will prove his rights with his own documents.

Please note that if an old-age pensioner has several apartments, but has not submitted an application to the local inspectorate to select a property for which he will be exempt from tax, then the benefit will be applied to the premises where the amount of the fee is maximum.

Tax notices

How to get a property deduction

There are two ways to get a deduction. The first provides that the amount of tax that was withheld from you, for example, at work, is returned to you from the budget. The second provides that no tax is withheld from you at work.

The first method is the simplest. To use it at the end of the calendar year in which the apartment was purchased (or subsequent years), you need to submit to the tax office:

- Personal income tax return (form 3-NDFL) for the corresponding year. You can download the 3-NDFL declaration for 2011, the 3-NDFL declaration for 2012 and the 3-NDFL declaration for 2013 using the links. For more information on how the 3-NDFL declaration should be submitted, see the link.;

- copies of documents that confirm your expenses for purchasing real estate and paying interest on a bank loan (we wrote about these documents above) - that is, the amount of property deduction;

- application for property deduction and tax refund. You can download the deduction application in a convenient format, recommended by tax authorities, from our website (see link);

The second method requires that you receive a special notification from the tax office. It confirms the fact that you purchased the property and are entitled to the deduction. The notification also indicates its amount. You submit this notification to the accounting department of the company where you work. Based on this document, income taxes are simply stopped being withheld from you. You can apply for notification after purchasing an apartment. To do this, you need to provide the inspection:

- copies of documents that confirm your expenses for purchasing real estate and paying interest on a bank loan (we wrote about these documents above) - that is, the amount of property deduction;

- an application to issue you a notice to receive a property deduction at your place of work.

Portal "Your taxes" 2021

When will they start paying out money?

After submitting documents to the tax office, 140 days or more may pass:

- 90 days the tax office checks the declaration: whether the information corresponds to reality;

- 10 days the tax office decides whether you are legally entitled to a deduction or not;

- 30 days are allotted for the money to be transferred to your bank account.

If tax authorities are late in payments, they are required to pay a penalty.