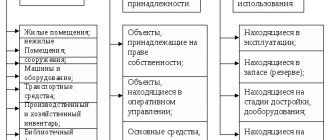

Fixed assets are company assets that serve for a long time and are replaced with others only as they wear out. Depreciation of fixed assets is considered to be the gradual loss of property's own use value. During operation or, conversely, downtime, any object of production assets consistently wears out - buildings are destroyed, spare parts and parts wear out, machines, vehicles and equipment fail. We will discuss OS wear, its types and calculations that allow us to determine the percentage of wear of an object in our article.

Who charges depreciation?

Depreciation on fixed assets belonging to them is charged to non-profit organizations (paragraph 3 of clause 17 of PBU 6/01).

Situation: can a commercial organization charge depreciation on its fixed assets in accounting?

According to the current legislation, as a general rule, commercial organizations in accounting do not charge depreciation on their fixed assets (section III of PBU 6/01). The exceptions are:

- housing facilities used for the organization’s own needs;

- external improvement objects;

- productive livestock and domesticated wild animals;

- specialized shipping facilities;

- forestry or road facilities.

For these objects, charge depreciation if the following conditions are simultaneously met:

- the fixed asset item was accepted for accounting before January 1, 2006;

- for an object, after it was accepted for accounting, depreciation was accrued in accordance with the norms of accounting legislation that were in force on the date of its acceptance for accounting.

It is explained this way. Since 2006, by order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n, the condition on the accrual of depreciation by commercial organizations for a number of objects has been excluded from paragraph 17 of PBU 6/01. However, this order did not provide for the procedure for reflecting the consequences of such changes in accounting policies in accounting and reporting. Therefore, the new approach to charging depreciation instead of depreciation could only be applied to those fixed assets that were accepted for accounting after January 1, 2006. And for previously accounted for fixed assets, the previous procedure for calculating depreciation was retained.

This conclusion is confirmed by letters from the Ministry of Finance of Russia dated July 6, 2006 No. 03-06-01-04/141, dated June 7, 2006 No. 03-06-01-04/129, dated September 20, 2006 No. 03-06 -01-02/41 and the Federal Tax Service of Russia dated November 2, 2006 No. ШТ-6-21/1062. Although they clarify the issue of accounting for housing assets, the conclusions drawn in them can be extended to other fixed assets for which depreciation was accrued before 2006.

The procedure for calculating depreciation in accounting for commercial organizations in this case is similar to the current procedure for calculating depreciation for non-profit organizations.

It should be noted that depreciation accrued in accounting affects the calculation of property tax. When calculating property tax, fixed assets are accounted for at their residual value, which is determined according to accounting rules. If an organization accrues depreciation on the fixed assets it owns, then when calculating the tax base for property tax, such fixed assets must be included at their original cost minus depreciation. To determine the average annual value of property, the amount of depreciation that must be accrued for the year is distributed evenly across the months of the tax period. This procedure is established by paragraph 1 of Article 375 of the Tax Code of the Russian Federation and is explained in the letter of the Ministry of Finance of Russia dated April 18, 2005 No. 03-06-01-04/204. The procedure for calculating depreciation in accounting does not affect the calculation of other taxes.

Features of physical deterioration

There is a physical deterioration in the quality characteristics of the OS due to:

- operation (equipment parts wear out, break and otherwise wear out);

- natural phenomena (corrosion from moisture, sunburn, weathering, etc.).

Physical wear and tear has a productive subtype, when wear and tear is caused by the production process. In the non-productive subspecies, wear and tear is not due to active use. It develops due to downtime (preservation). Only the productive subspecies are subject to compensation from the cost of production, and the unproductive subspecies is a loss.

Wear and tear in physical manifestation is calculated in the following ways:

- The depreciation coefficient is equal to the ratio of the total expression of depreciation to the purchase price:

Ki = I * 100 / First

- Objects whose service life is shorter than the standard wear out as follows:

Ki = Tf * 100 / Tn

Where Tf is the actual duration of use, and Tn is normal.

- If the period of use of the OS exceeds the norm, then the wear and tear is calculated as follows:

Ki = Tf * 100 / Tn + TV

At the same time, TV is the expected period of use, beyond the standard period.

- The deterioration of buildings can be calculated as follows:

Ki = ∑di * ai

di is the share of the i-th structural element of the building in its price, and ai is its % deterioration.

Types of activities of non-profit organizations

A non-profit organization can have several types of activities:

- statutory (non-profit), for which the organization was created and which is aimed at solving social, cultural and other socially significant problems;

- entrepreneurial (commercial), which is of an auxiliary nature and the results of which (profit) should be aimed at achieving statutory (non-commercial) goals. As part of this activity, a non-profit organization has the right to engage in production, trade, participate in the authorized capital of other organizations, as well as conduct other operations not prohibited by law.

This follows from the provisions of paragraph 2 of Article 2 and paragraph 2 of Article 24 of the Law of January 12, 1996 No. 7-FZ.

A non-profit organization must take into account income and expenses related to business activities separately (clause 3 of Article 24 of the Law of January 12, 1996 No. 7-FZ).

Obsolescence of fixed assets

Obsolescence does not depend on the technical serviceability of the OS. It is due to the progress of science and technology, which reduces the benefits from the use of outdated technologies.

In this case, there are 2 types of wear associated with:

- the inexpediency and economic inefficiency of using the OS associated with the appearance on the market of similar equipment with a lower cost;

- obsolescence of the facility's technology.

Formula for determining obsolescence in the first case:

Kmi = First – Svost * 100 / First

Where First and First are the acquisition price and replacement cost.

In the second case, the formula looks like this:

Sust = Ssovr * Pust / Psovr

Sust and Ssovr are the replacement cost of a modern and obsolete object, and Psovr and Pust are the corresponding OS productivity.

Removable physical wear and tear can be eliminated through repair, restoration or reconstruction. It makes no sense to eliminate wear and tear if the cost of making it suitable is more expensive than the increase in the price of the OS.

The consequences of obsolescence can be eliminated by modernization or reconstruction.

Accounting

Non-profit organizations can conduct accounting in a simplified way. But, if the receipt of funds and property for the previous reporting year exceeds 3,000,000 rubles, accounting should be kept in full.

This procedure is established by paragraph 1 of Article 32 of the Law of January 12, 1996 No. 7-FZ, paragraph 1 of Part 1 of Article 2 and paragraph 2 of Part 4 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

See additional reporting forms for non-profit organizations

Consequently, non-profit organizations must comply with the procedure for accounting for fixed assets established by PBU 6/01.

Unlike depreciation, depreciation of fixed assets is not included in expenses. Depreciation amounts are reflected on the balance sheet in account 010 “Depreciation of fixed assets.” When accruing depreciation, the following is posted monthly:

Debit 010

– depreciation has been accrued on the fixed assets of a non-profit organization.

Such rules are established by paragraph 17 of PBU 6/01.

Complete, partial and accelerated wear

An OS that is not completely (partially) worn out can still be used in some production processes. 100% depreciation of fixed assets is not followed by automatic write-off of actual working property. Obsolescence occurs in a hidden form. This phenomenon is observed when there is reliable information about the release in the near future of new equipment with greater productivity and improved characteristics.

For many operating systems (active part), accelerated wear parameters can be applied (more than 2 times faster than normal) after approval from the authorized bodies of the constituent entities of the Russian Federation. In addition, for small businesses there is the possibility of accelerating the wear and tear of the OS (2 times faster than normal).

Calculation of depreciation amount

To calculate your monthly depreciation amount, you first need to determine your annual depreciation rate. To do this, use the formula:

| Annual wear rate | = | 1 | : | Useful life of a fixed asset, years | × | 100% |

Then calculate the annual depreciation amount. To do this, use the formula:

| Annual depreciation amount | = | Annual wear rate | × | Initial (replacement) cost of fixed assets |

Every month in accounting you need to reflect accrued depreciation in the amount of 1/12 of the annual amount.

This procedure is provided for in paragraph 19 of PBU 6/01.

An example of reflecting depreciation on a fixed asset of a non-profit organization in accounting

The non-profit organization "Alpha" purchased a car for use in its statutory (non-commercial) activities. Its initial cost, formed in accounting, is 200,000 rubles. When commissioned, the vehicle had a useful life of 4 years.

The annual depreciation rate for a car is: (1: 4 years) × 100% = 25%.

The annual depreciation amount is: RUB 200,000. × 25% = 50,000 rub.

The monthly depreciation amount is: RUB 50,000. : 12 months = 4167 rub.

Starting from the month following the commissioning of the vehicle, the Alpha accountant reflects the accrual of depreciation on a monthly basis by posting:

Debit 010 – 4167 rub. – depreciation has been accrued for the vehicle for the current month.

BASIC

In tax accounting, non-profit organizations must reflect only those income and expenses that are associated with their entrepreneurial (commercial) activities. Targeted revenues and expenses associated with non-commercial (statutory) activities are not taken into account when calculating income tax. This follows from the provisions of subparagraph 14 of paragraph 1, paragraph 2 of Article 251 and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Fixed assets used in commercial (entrepreneurial) activities and acquired from income from this activity can be depreciated in tax accounting (subclause 2, clause 2, article 256 of the Tax Code of the Russian Federation). Depreciation accrued on these fixed assets is included in expenses and reduces the tax base for income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation). Since depreciation is accrued in accounting for these fixed assets, a constant difference will appear, with which organizations applying PBU 18/02 must calculate a permanent tax asset (clauses 4, 7 PBU 18/02). Reflect its appearance with wiring:

Debit 68 subaccount “Calculations for income tax” Credit 99

– a permanent tax asset is reflected from the difference between the amounts of depreciation and amortization reflected in accounting and tax accounting.

However, non-profit organizations have the right not to use PBU 18/02, which must be enshrined in the accounting policy for accounting purposes (clause 2 of PBU 18/02). Therefore, if an organization does not apply PBU 18/02, there is no need to reflect permanent and temporary differences in accounting.

An example of reflection in accounting and taxation of depreciation and amortization for fixed assets of a non-profit organization. According to the accounting policy for accounting purposes, the organization applies PBU 18/02

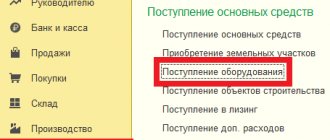

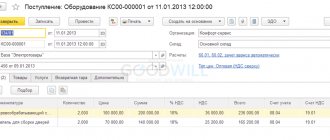

Using income from business activities, the non-profit organization "Alpha" purchased sewing equipment, which is used exclusively in business activities. The initial cost of equipment in accounting and tax accounting is 175,000 rubles. The useful life established according to the Classification approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 is 4 years (48 months). According to the accounting policy, for tax purposes, depreciation on fixed assets used in business activities is calculated using the straight-line method.

The monthly amount of depreciation of sewing equipment in tax accounting is equal to the monthly amount of depreciation in accounting and amounts to: 175,000 rubles. : 48 months = 3646 rub./month.

Starting from the month following the commissioning of the sewing equipment, the accountant monthly includes the amount of accrued depreciation in expenses when calculating income tax. At the same time, he makes the following entries in accounting:

Debit 010 – 3646 rub. – depreciation has been accrued for sewing equipment for the current month;

Debit 68 subaccount “Calculations for income tax” Credit 99 – 729 rub. (RUB 3,646 × 20%) – a permanent tax asset is reflected from the difference between the amounts of depreciation and depreciation for sewing equipment.

Fixed assets that are purchased using targeted proceeds (targeted financing funds) are not depreciated. It does not matter whether they are used in statutory (non-commercial) activities or not. Depreciation accrued for these objects in accounting does not affect the calculation of income tax. This procedure follows from subparagraphs 2 and 7 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation. It is confirmed by the Federal Tax Service of Russia in a letter dated December 8, 2009 No. 3-2-13/236.

If a fixed asset was acquired at the expense of targeted proceeds (targeted financing funds), but is intended for use in business activities, its cost must be included in non-operating income subject to income tax (subclause 14, clause 1, clause 2, article 251 , paragraph 14 of Article 250 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated December 8, 2009 No. 3-2-13/236).

Such property is recognized as received free of charge, therefore the amount of income must be determined as the market value of the object, taking into account the restrictions provided for in paragraph 8 of Article 250 of the Tax Code of the Russian Federation. The amount of recognized income cannot be lower than the residual value of the fixed asset. But since depreciation was not accrued for such an object, non-operating income must include:

- the initial cost of the fixed asset (if it is higher than the market value);

- market value of the fixed asset (if it is higher than the original).

Closer to reality

But what is the physical and moral wear and tear of funds in reality? Let's reinforce theoretical knowledge with specific examples.

Suppose we have a company engaged in metal processing, engraving and artistic forging. That is, working capital in this situation will include:

- the metals themselves, purchased from manufacturing plants;

- various accessories for the operation of the engraving machine;

- consumables for blacksmithing.

Whereas fixed assets are:

- vehicles that have already delivered resources from factories, and a little later will transport goods to distribution stores;

- buildings in which the production itself is located,

- all technical equipment - even the most primitive tools, such as a saw and a hammer, will also be considered fixed capital.

Our enterprise has been operating for a year, two, three - of course, the machines require some care. By replacing some parts that have worn out during operation or eliminating the consequences of difficult working conditions, we eliminate the damage caused by physical wear.

Obsolescence, in turn, will appear when new machines that perform the same functions enter the market, or someone finds a way to modernize existing ones in such a way that this will make a real revolution in production, significantly affecting the cost of equipment and leading to its depreciation .

Property tax

Non-profit organizations that apply the general tax system are recognized as payers of property tax (Clause 1, Article 373 of the Tax Code of the Russian Federation). When calculating property taxes, consider:

- objects of movable property registered before January 1, 2013 and reflected in the balance sheet in accounts 01 “Fixed Assets” and 03 “Profitable Investments in Material Assets”;

- real estate objects reflected in the balance sheet in accounts 01 “Fixed Assets” and 03 “Profitable Investments in Material Assets”.

When calculating this tax, fixed assets are taken into account at their residual value, determined according to accounting rules. Since fixed assets of non-profit organizations are not depreciated in accounting, they must be included in the calculation of the tax base at their original cost minus depreciation. To determine the average annual value of property, the amount of depreciation that must be accrued for the year is distributed evenly over the months of the tax period. This procedure is established by paragraph 1 of Article 375 of the Tax Code of the Russian Federation and is explained in the letter of the Ministry of Finance of Russia dated April 18, 2005 No. 03-06-01-04/204.

Some non-profit organizations are eligible for property tax relief. The list of benefits and conditions for their application are given in the table.

simplified tax system

Subject to the restrictions established by Article 346.12 of the Tax Code of the Russian Federation, non-profit organizations have the right to apply a simplified tax regime. Unlike other organizations, non-profit organizations can apply a simplified tax system even if the share of participation of other organizations in it exceeds 25 percent (subclause 14, clause 3, article 346.12 of the Tax Code of the Russian Federation).

If a non-profit organization conducts business activities, then it is obliged to keep separate records of income and expenses for statutory and business activities (clause 1 of article 346.15, clause 2 of article 251 of the Tax Code of the Russian Federation).

Targeted revenues and expenses paid from these revenues do not affect the calculation of the single tax during simplification. When calculating the single tax, take into account only those incomes and expenses that are associated with business activities. This follows from the provisions of paragraph 1.1 of Article 346.15, paragraph 2 of Article 251, paragraph 2 of Article 346.16, paragraph 1 of Article 252 of the Tax Code of the Russian Federation. Moreover, if an organization pays a single tax on income, then when calculating the tax base it does not have the right to take into account any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, then the cost of acquired (created) fixed assets reduces the tax base in the manner prescribed by paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation. For more information about this, see How to take into account the receipt of fixed assets and intangible assets during simplification. This procedure can only be applied to paid (partially paid) fixed assets, which are recognized as depreciable property for calculating income tax (clause 4 of Article 346.16 of the Tax Code of the Russian Federation). This means that the organization does not have the right to write off as expenses fixed assets acquired from targeted revenues (targeted financing funds). It does not matter whether they are used in statutory (non-commercial) activities or not. This procedure follows from subparagraphs 2, 7 of paragraph 2 of Article 256 and subparagraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation. It is confirmed by the Federal Tax Service of Russia in a letter dated December 8, 2009 No. 3-2-13/236. Despite the fact that the letter concerns organizations using the general tax system, the conclusions drawn in it can also be extended to organizations using the simplified tax system (clause 4 of Article 346.16 of the Tax Code of the Russian Federation).

Thus, expenses for the acquisition of fixed assets will reduce the tax base while simultaneously meeting two conditions:

- fixed assets have been paid (in whole or in part);

- fixed assets were acquired from income from business activities and are used exclusively in this activity.

If the costs of purchasing depreciable property are partially paid, they can be taken into account in reducing the tax base in the payment amount. There is no need to wait for the full repayment of the cost of fixed assets (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation).

If a fixed asset was acquired using income from business activities, but is used in statutory (non-commercial) activities, its cost is not taken into account when calculating the single tax. This follows from the provisions of subparagraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

If the organization uses a fixed asset acquired at the expense of targeted revenues in business activities, then in fact there is an inappropriate use of the received property (clause 1 of article 346.15, subclause 14 of clause 1, clause 2 of article 251, clause 14 of art. 250 Tax Code of the Russian Federation). This is confirmed by the letter of the Federal Tax Service of Russia dated December 8, 2009 No. 3-2-13/236. Although it concerns organizations on the general taxation system, the conclusions drawn in it can be extended to organizations on the simplified tax system.

In this case, the organization must recognize non-operating income in the amount of the market value of this fixed asset (clause 1 of Article 346.15, clause 8 of Article 250 of the Tax Code of the Russian Federation). Despite the fact that such property is depreciable (clause 1 of Article 256 of the Tax Code of the Russian Federation), its value cannot be written off as expenses. The object is considered to have been received free of charge, therefore, the organization did not have expenses for its creation or acquisition, which could be taken into account when calculating the single tax (clause 3 of Article 346.16 of the Tax Code of the Russian Federation).

Organizations using the simplified system are required to keep accounting records in full, including fixed assets (Part 1, Article 2 of Law No. 402-FZ of December 6, 2011). However, depreciation accrued on fixed assets of non-profit organizations in accounting is not taken into account when calculating the single tax.

Accrued depreciation does not affect the calculation of property taxes. Non-profit organizations using the simplified tax regime do not pay this tax either on fixed assets used in statutory activities, or on fixed assets used in business activities (clause 2 of Article 346.11 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 30, 2007 No. 03 -05-06-04/18).

Even closer

You can try to analyze the entire situation with the current state of funds from the point of view of an active television user. Of course, government channels will talk about how huge amounts of money are being spent on improving production conditions, replacing outdated equipment, and funding research in this area. But is this really so?

Yes, the USSR died almost thirty years ago, but some industrial enterprises, especially state-owned ones, still use equipment that was not entirely new even then. A private business, which relies entirely on its own strength, cannot afford such luxury - it is forced to constantly take into account the physical and moral wear and tear of fixed assets, otherwise it will not withstand the competition and will be forced to leave the market.

At industrial giants, especially those that experienced their heyday in Soviet times, production means have not changed for decades, which is often the main cause of problems with product quality, which entail difficulties in sales and, as a result, a decline in production.

Only those companies that keep up with the times, update their production assets, follow scientific and technological progress, picking up new trends that are constantly developing, will be able to withstand all the difficulties that have to be encountered in the process of economic relations.

In no case should you concentrate solely on establishing business relationships or selling products - everything starts with production, and it is unlikely that it will be able to maintain its high level, based on outdated and faulty equipment.