What is a payment order

A payment order is an order drawn up in a document of a certain form from the account owner to the bank servicing this account to write off a specific amount of money to the recipient’s account opened with the same bank or other financial institution. The payment order form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. It is used to transfer funds:

- for delivered (performed, rendered) goods (work, services);

- to budgets of all levels, as well as the social insurance fund;

- for the purpose of returning/placing credits (loans), deposits and paying interest on them;

- for other purposes provided for by law or agreement.

The payment order form and a sample of how to fill it out can be found here.

From January 1, 2021 (new BCC for personal income tax - 15%)

New budget classification codes have been introduced for personal income tax, calculated at an increased rate (see “New personal income tax rate and other innovations: what awaits individuals and tax agents in 2021”).

Let us remind you that the following personal income tax rates have been established for 2021:

- 13% if income for the year is 5 million rubles. or less;

- (650 thousand rubles + 15% of income exceeding 5 million rubles), if income for the year is more than 5 million rubles.

The Ministry of Finance, by order No. 236n dated October 12, 2020, added new codes to the BCC list (Table 1).

Table 1

KBC for transferring personal income tax on income exceeding 5 million rubles. in year

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fines | 182 1 0100 110 |

Also see “How to pay personal income tax at a rate of 15% and fill out 6‑personal income tax: read the explanations of the tax authorities.”

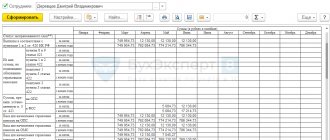

Generate personal income tax payment slips with current details

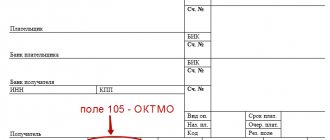

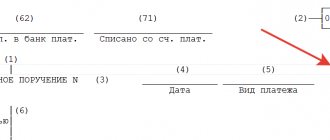

Procedure for filling out a payment order

The content of the payment order and its form must comply with the requirements prescribed by law. The document regulating the procedure for filling out the fields of payment orders is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, which describes in detail the algorithm for filling out each field.

You can find samples of filling out payment forms for different types of taxes in the Ready-made solution from ConsultantPlus. Try K+ for free and get samples from the experts.

For information about which details are basic for a payment order, read the article “Basic details of a payment order”. And how the list of details to fill out depends on who the transferred funds are intended for, read here.

If you still have questions about filling out payment forms, ask them on our forum. For example, you can find out how to fill out a payment order for a fine on the thread.

What is a requirement to pay a tax, fee, penalty or fine?

According to Article 69 of the Tax Code of the Russian Federation, the Federal Tax Service may send a demand for payment of a tax, fee, penalty, or fine if the taxpayer incorrectly calculated the amount of tax, did not pay the tax or did it later than the established deadline, as well as in other cases of tax offenses.

The requirement is drawn up in the form of a table indicating the amount of tax debt, the amount of penalties and fines. It also provides the deadline for fulfilling the requirement, as well as measures to collect the tax and ensure the fulfillment of the obligation to pay the tax if the taxpayer does not repay the debt. The form of request for payment of tax, fee, penalty, fine was approved by Order of the Federal Tax Service of the Russian Federation dated December 1, 2006 N SAE-3-19/ [email protected]

Example of a request for payment of arrears and penalties

Field 107 “Tax period” in the payment order for 2020–2021

Let us consider in detail the rules for filling out the tax period in the payment order (field 107 “Tax period”) in 2020–2021.

Check whether you have correctly determined the tax period for your case, with the help of explanations from ConsultantPlus experts. Get trial access to K+ for free.

This field is filled in when generating payment orders for the payment of taxes and contributions:

- To indicate the period for which the tax (contribution) is paid.

- To indicate a specific payment date - in exceptional cases established by law.

Field 107 has 10 characters, 8 of them are indicated in a specific order, and the remaining 2 are used for separation and are filled with periods. Signs 1 and 2 indicate the frequency of tax (contribution) payment, which can take the following values:

- menstruation (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AH).

The 4th and 5th digits of the indicator correspond to the number of the selected period:

- for monthly payments, the number of the month of the reporting period is indicated - such a number can take a value from 01 to 12 according to the number of months in the year;

- for quarterly payments, the quarter number is given - the number takes a value from 01 to 04 according to the number of quarters;

- for a half-year, the half-year number is indicated, it has 2 values: 01 and 02;

- for payments made once a year, zeros are entered.

The 3rd and 6th characters correspond to the “dot” symbol and are separating characters.

Characters 7 to 10 are reserved for indicating the reporting year. If the law specifies the exact date for tax payment, then this date is indicated in the “Tax period” field of the payment order.

The “Tax period” field can be filled in for payments not only of the current year, but also of past periods, if the taxpayer himself has discovered errors in the reports already submitted and independently pays additional tax (contribution). In this case, field 107 should reflect the tax period in which the changes were made.

There are a number of situations in which a specific date is indicated in the “Tax period” field . This occurs when the associated Payment Basis field 106 has a specific encoding. A specific date in such situations means for the basis of payment:

- TP - payment deadline established by the tax authority;

- RS - date of payment of part of the installment tax amount, based on the existing installment schedule;

- FROM - the date when the deferred payment ends;

- RT - date of payment of part of the restructured debt based on the existing restructuring schedule;

- PB - the end date of the procedure that is applied in a bankruptcy case;

- PR—end date of suspension of collection;

- IN - date of payment of part of the investment tax credit.

In the event that payment is made for a debt identified during a tax audit or according to a writ of execution, a zero value is indicated in the “Tax period” field.

In case of advance payment of tax, field 107 indicates the tax period for which payment is made.

Please note that when making payments to customs, field 107 is filled in completely differently.

ConsultantPlus experts provided detailed comments on filling out all fields of the payment order for the payment of taxes. If you don't have access to K+, get it for free and follow the directions.

How to fill

To fill out a payment document through Sberbank Online, the client must undergo authorization. During initial registration, select the “New Document” tab and fill in the payment details. When making a repeated payment, select the necessary details from the filters that are suitable for your transaction. The “Tax period” field is filled in automatically when repeating a payment to Sberbank Online.

Important. Be sure to check that all data is entered correctly, especially in field 106.

Next, click “Create” and determine the order of payments. Confirmation is carried out via SMS notification to the number of the head of the organization or accountant.

The code looks like this: NN.NN.NNNN. It contains 8 characters of letters and numbers and two dots to separate items.

The letters (first and second) are the period code for timely payment of tax (MS - month, CV - quarter, PL - half-year, GD - payment for the year).

The third sign is a dot. The fourth and fifth indicate a specific payment period:

- monthly payment - enter the numbers 01 - 12 (01 - January, 02 - February, 03 - March, etc.);

- quarterly payment – numbers indicating the current quarter (01 – first, 02 – second, 03 – third, 04 – fourth);

- payment for half a year (01 – first half of the year, 02 – second half of the year);

- 00 is entered when making payments for the year.

The sixth character is a comma for separation. The seventh, eighth, ninth and tenth indicate the year (for example, 2020).

Note. The payment for June 2021 to the Social Insurance Fund will look like this: “MS.06.2018”.

The “00” icon is entered when paying an advance payment, fee or tax for the current period when an inaccuracy is detected in the declaration, when the taxpayer independently decided to pay the difference in tax.

Important. When transferring an advance payment, fill in the appropriate signs for the future period, not the current one.

If an individual entrepreneur is subject to simplified taxation and has received a patent, he can pay for it through Sberbank Online.

Insurance premiums

The data in column 107 depends on the recipient:

- to transfer insurance contributions to the Social Insurance Fund, indicate “0”;

- for any other contributions indicate data in the format “NN.NN.NNNN”.

Insurance premiums are transferred to the tax service from 01/01/2017. Contributions to the Social Insurance Fund for compensation for injuries caused while performing work duties are called “injury contributions.”

Payment order functions and fields 107

A payment order is a document with the help of which a legal entity or individual entrepreneur transfers funds for various purposes.

The order is accepted on paper with a blue seal or in electronic form. Funds are debited from the counterparty's current account.

Column 107, indicating the payment period, must be filled out in accordance with the rules.

Specifying the exact date

Options for indicating the exact date in field 107 “Tax period” are determined by the Legislation of the Russian Federation:

- if in cell 106 “Basic payment” the codes of the basis for paying tax to the budget are entered: TP, ZD, BF, TR, RS, OT, RT, PB, PR, AP, AR, TL, ZT, O, then in column 107 in In this case, write the exact date and current deadline.

Important. When filling out the exact date in column 107 based on the requirements of the Federal Tax Service or Enforcement Proceedings, enter the value “00”.

- if in cell 106 “Main payment” for payment of customs duties and fees the following values are entered: DE, PO, CT, TD, IP, TU, BD, KP, DK, PC, KK, TK, 0, then in this case indicate the customs code organ in field 107 of 8 digits.

Important! In column 107, it is permissible to manually enter the date in the value “Tax. period" or code in the meaning "Customs code. authority" in the case when the ID value is indicated in field 106.

Procedure for filling out field 107 when paying personal income tax

Personal income tax is not only levied on wages. Vacation and sick pay are also subject to personal income tax. The frequency of payment is specified in the Tax Code of the Russian Federation. It is different for each payment:

- for salaries, the transfer period is the day following the issuance in cash or transfer to a card;

- when transferring vacation pay, sick leave payments - on the last day of the month of settlement with the counterparty.

Paying personal income tax through Sberbank Online requires creating different payment orders; cell 107 is filled out the same way for each transfer.

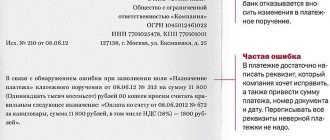

Errors when filling out field 107

Article 4 of the Tax Code of the Russian Federation explains that if cell 107 is filled in incorrectly, the funds will be credited to the budget.

Important. An error in field 107 does not constitute evasion of tax contributions; accordingly, no fine or penalty will be charged.

Submit an application for correction to the tax authority and attach a copy of the payment order or payment receipt in which the error was made.

When field 106 is filled in

“Regulations on the rules for transferring funds” No. 383-P explains the procedure for filling out bank payment documents. Compliance with the rules helps to avoid disputes with regulatory authorities.

Cell 106 must be completed regardless of the type of document carrier. It indicates the basis for the current payment, for example, IN - repayment of an investment loan agreement, AR - repayment of debt under an executive document. The symbols and their interpretation can be found on the website of the Federal Tax Service or Sberbank.

Filling example

The screenshot below shows an example of filling out a payment order.

Examples of filling out field 107

Let's look at the rules for filling out the “Tax period” field in the 2021 payment order using examples.

Example 1

The organization transfers an advance payment for property tax for the 3rd quarter of 2021, therefore, in field 107 it will be indicated: KV.03.2020.

Example 2

An individual entrepreneur pays tax in connection with the application of the simplified tax system for 2021, in accordance with the declaration submitted to the tax authority; field value 107 - GD.00.2020.

Example 3

The organization pays the monthly personal income tax payment for September 2020; field value 107 - MS.09.2020.

Example 4

The organization pays tax at the request of the tax authority, which contains a specific deadline for payment - 09.26.2020; field value 107 - 09/26/2020.

What design errors lead to and how to avoid them

If one of the fields of the tax payment document is filled in incorrectly, there is a risk of non-fulfillment of the tax obligation. Even if all bank details are filled out correctly, the funds will not be credited as intended within the prescribed period. This entails the accrual of penalties (not fines).

To ensure that the payment order in field 106 (payment basis) is filled out correctly, it is recommended to use specialized accounting programs. Creating new documents using the correct source is highly likely to eliminate errors. An additional check to ensure that the payment form is filled out correctly will take place in the remote banking system. If fields 106 and 107 contain errors, settlement documents will be rejected until all comments are corrected.

Consequences of incorrectly filling out field 107

Filling out field 107 “Tax period” incorrectly does not result in the payment to the budget being recognized as not transferred. Consequently, the payer can clarify the payment provided that he independently discovers the error (clause 7 of Article 45 of the Tax Code of the Russian Federation).

To clarify the payment, you must submit to the Federal Tax Service a statement of the error, drawn up in any form, and attach a copy of the payment order to it. If necessary, a joint reconciliation of paid taxes is carried out, based on the results of which a report is drawn up. Based on this act and a written statement about the error, the tax authority makes a decision to clarify the payment.

Results

A payment order is a document used to transfer funds to the recipient. Field 107 “Tax period” is filled in when paying taxes or contributions and contains key information about the period for which the payment is made. The accuracy of identification of the payment by the regulatory authority and, as a consequence, the unambiguity of its assignment to the corresponding tax period depends on the correctness of filling out this field.

Sources:

- Tax Code of the Russian Federation

- Regulation of the Bank of Russia dated June 19, 2012 N 383-P

- Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Special cases

Officials determined what a tax period is when paying tax and how to indicate it in a payment order for certain situations:

- State duty. If an enterprise needs to pay a state fee to the budget, then in paragraph 107 indicate a specific date, that is, the date of transfer of funds.

- Customs. To pay customs duties and other fees, in paragraph 107, indicate the code of the customs authority. Such instructions were provided by the Treasury of the Russian Federation in a letter dated August 10, 2017 No. 07-04-05/05-660.

- Payment on demand. If a company transfers money to the Federal Tax Service upon request, which contains specific payment terms, then in paragraph 107 indicate the specific date of transfer.

- According to writs of execution and inspection reports. If money is transferred to the budget based on the results of inspections (for example, the arrears are indicated in the act), then in paragraph 107 indicate 0.

If you are unsure which code to indicate, check the information with the Federal Tax Service. Please note that if there is an error in clause 107, the funds will still be credited to the budget. In such a situation, you will have to contact the Federal Tax Service to clarify the payment details. How to do this - read the special material “How to write a letter to the tax office about clarification of payment.”