Accounting: admission

In accounting, goods can be capitalized after their acceptance and verification of quantity has been completed (clause 2.1.13 of the Methodological Recommendations, approved by letter of the RF Committee on Trade dated July 10, 1996 No. 1-794/32-5).

The procedure for reflecting received goods in accounting depends on:

- method of receiving the goods;

- terms of the contract governing the procedure for transferring ownership of the goods from the seller to the buyer;

- the applied taxation system;

- methods of accounting for goods enshrined in the accounting policy for accounting purposes.

The accounting policy of the organization must include, at a minimum, the following points:

- the method of forming the cost of goods (including or without the costs of their acquisition);

- method of reflecting the cost of goods in accounting;

- method of accounting for trade margins.

If there is a need to keep records of goods according to a specially developed nomenclature, also indicate this in the organization’s accounting policy for accounting purposes. Note that the names of goods in receipt documents and accounting registers used in the organization may not match, and describe the technology for processing accounting information that comes from suppliers of goods. The legitimacy of this approach is confirmed by the letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-03-06/1/670.

Situation: how to reflect in accounting the receipt of goods and materials, some of which are intended for resale, and some for use in production? The amount of inventory items that will be used in different types of activities is unknown in advance.

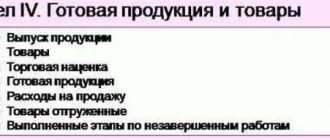

If inventory items are purchased for further sale, then they must be credited to account 41 “Goods”. If inventory items were purchased for use in production (administrative activities), then they must be capitalized on account 10 “Materials”.

However, regardless of the account in which inventory items are capitalized, in the future the organization will be able to either write them off for production or sell them.

If all received goods and materials are capitalized as goods, then when using them further as materials, make the following posting:

Debit 10 Credit 41

– part of the goods has been capitalized for use as materials.

If all received goods and materials are capitalized as materials, then upon further resale of these goods and materials, the appearance of other income and expenses must be reflected in accounting (paragraph 6, paragraph 7, PBU 9/99, paragraph 5, paragraph 11, PBU 10/99). In accounting, reflect the sale of materials with the following entries:

Debit 62 (76, 73...) Credit 91-1

– sales of materials are reflected (as of the date of transfer of ownership);

Debit 91-2 Credit 10

– the cost of materials sold is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on sales (if the transaction is subject to this tax).

For more information on how to sell excess materials, see How to record the sale of materials in accounting.

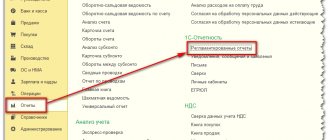

Accounting in wholesale trade

Let's begin our consideration of the practical application of accounting standards by trade organizations with wholesale. It uses slightly fewer accounts than retail, although wholesale itself involves larger volumes. Let us follow the postings of the path of a consignment of goods from the moment it arrives at the company until it is sold to the buyer. And let’s find out what features accounting in wholesale trade has.

So, let’s imagine that our Vesna LLC (operating on the general taxation system with VAT) purchased a batch of gardening equipment from another company for 150,000 rubles. The price includes VAT in the amount of 22,881.36 rubles. In addition, a car was hired to deliver the goods for 10,000 rubles excluding VAT. Let's move on to accounting. So, when posting this batch, the accountant will make the following entries:

- Dt 41 Kt 60 127 118, 64 - purchase of a consignment;

- Dt 19 Kt 60 22 881.36 - allocation of VAT;

- Dt 41 Kt 60 10,000 - delivery costs, which increase the cost of the purchased product.

There was already a buyer for this batch, so the organization sold it, as they say, “on the fly,” or in transit. But there could be another option when the goods arrived at the company’s warehouse. The batch was sold for 180,000 rubles, including VAT. The cost consists of the purchase price and overhead costs (in this example we will not take into account the costs of administration, business needs, utilities and other things that need to be taken into account in the case of trading from a warehouse). In fact, when selling, we need to write off products, charge VAT and write off cost. The accounting entries will be as follows:

- Dt 62 Kt 90 180 000 - sales revenue;

- Dt 90 Kt 68 27 457, 63 - VAT on sales;

- Dt 90 Kt 41 137 118, 64 - cost written off.

Unfortunately, it happens that defective products are discovered during storage or sale. Let's assume that its cost was 15,000 rubles or 10% of the cost of the batch with a natural loss rate of 7%. It cannot be sold, but it must be reflected in accounting. Defects in trade are written off; the wiring will look like this:

- Dt 94 Kt 41 15 000 - identification of defects;

- Dt 44 Kt 94 10 500 - write-off of losses within the limits of natural loss;

- Dt 91 Kt 94 4500 - write-off of losses in excess of the norms of natural loss.

If those responsible for the incident have been identified, for example, a storekeeper, the losses can be attributed to them. The main thing is that the procedure prescribed by law is followed. In this case, the accountant will make the following entry:

Dt 73 Kt 94 15 000 - losses due to marriage are attributed to the guilty party.

Receipt under a purchase and sale agreement

If the organization received the goods under a purchase and sale agreement, then the actual cost of the goods consists of the amount paid to the seller and the costs associated with the acquisition (delivery, commissions to intermediaries, etc.). Such rules are established by paragraph 6 of PBU 5/01.

Typically, ownership of a product passes from the seller to the buyer at the time of its acceptance and delivery. At this point, reflect the receipt of goods in accounting by posting:

Debit 41 (15) Credit 60 (76...)

– goods have been received under paid contracts.

This procedure is established by the Instructions for the chart of accounts (accounts 60, 76).

Situation: can a trade organization include in the cost of purchased goods the costs of their packaging and pre-sale preparation?

Maybe. The legislation allows two options for accounting for the costs of packaging goods:

– reflected in sales costs;

– include in the initial cost of goods.

Prepackaging (packing) of goods purchased for resale is one of the mandatory elements of trading activities. This follows from the provisions of Article 481 of the Civil Code of the Russian Federation. In addition, when selling certain goods, a trading organization must carry out pre-sale preparation. The list of works that can be carried out as part of pre-sale preparation depends on the type of product and is established by the relevant sections of the Rules approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55.

Thus, costs associated with packaging (packing) and pre-sale preparation of goods affect the financial result of a trading organization. However, the accounting procedure for these expenses is not regulated by law.

On the one hand, after purchasing (posting) goods, their actual cost cannot be changed (clause 12 of PBU 5/01). Packaging (packing) and pre-sale preparation of goods occurs after they have been accepted for accounting. Based on this, the costs of packaging (packaging) and pre-sale preparation of goods should be reflected in account 44 “Sales expenses”.

On the other hand, paragraph 6 of PBU 5/01 provides for the inclusion in the actual cost of inventories of expenses for their processing, packaging, and improvement of technical characteristics. Consequently, for both materials and goods, an increase in their cost by the amount of such costs is possible (clauses 68, 71, 224 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

Since the legislation allows two accounting options, the organization has the right to choose one of them. Fix the selected option in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

An example of reflecting in accounting the receipt of goods under a purchase and sale (supply) agreement. The cost of goods is formed on account 41

JSC "Proizvodstvennaya" received goods worth 118,000 rubles. (including VAT – 18,000 rubles). Costs for delivery of goods amounted to 59,000 rubles. (including VAT – 9000 rubles). The organization records goods on account 41 at actual cost (without using accounts 15 and 16).

The Master's accountant made the following entries in the accounting:

Debit 41 Credit 60 – 150,000 rub. (RUB 100,000 + RUB 50,000) – reflects the receipt of goods (including delivery costs);

Debit 19 Credit 60 – 27,000 rub. (RUB 18,000 + RUB 9,000) – “input” VAT is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 27,000 rub. – accepted for VAT deduction;

Debit 60 Credit 51 – 177,000 rub. (RUB 118,000 + RUB 59,000) – goods paid for (including delivery costs).

Concept and types of trade

Trade is a separate branch of the economy associated with the process of transferring inventory, initially purchased for subsequent resale, for a fee from the seller to the buyer and includes a set of specific operations performed in this case.

There are 2 types of trade: wholesale and retail.

Wholesale trade is the transfer of goods and materials for a fee from the manufacturer (seller) to another seller for subsequent retail sale. Carried out in large quantities, usually at a lower price than retail.

Retail trade - single (piece) transfer of goods and materials for a fee to the end consumer.

Accounting in trade, retail and wholesale, differs both in its legislative approach and in the algorithm for reflecting business transactions. Let's look at these differences in more detail.

Free admission

When goods are received free of charge, their value (to be reflected in accounting) is determined based on the market price. The market price is the amount of money that can be received from their sale. Such rules are established in paragraph 9 of PBU 5/01. The market price can be set based on the price level prevailing on the day the asset was received. Information about the level of current market prices must be confirmed by documents or through an examination. This follows from paragraph 10.3 of PBU 9/99.

The actual cost of goods received free of charge, in addition to the market value of the goods, may also include other costs associated with the acquisition (transport, commissions to intermediaries, etc.) (clause 11 of PBU 5/01).

In accounting, reflect the gratuitous receipt of goods by posting:

Debit 41(15) Credit 98-2

– goods received free of charge are taken into account.

This procedure follows from the Instructions for the chart of accounts (accounts 41, 98).

When selling goods received free of charge, reflect the income:

Debit 98-2 Credit 91-1

– income from the sale of goods received free of charge is recognized (in the amount of goods actually sold).

This procedure is provided for in the Instructions for the chart of accounts.

An example of reflecting in accounting transactions related to the gratuitous receipt of goods and their sale

In March, Alfa CJSC received free goods with a market value of 100,000 rubles. In April, some goods worth 60,000 rubles. was sold wholesale for RUB 74,340. (including VAT – 11,340 rubles). The remaining part of the goods (worth 40,000 rubles) was sold in May for 49,560 rubles. (including VAT - 7560 rubles). “Alpha” accounts for goods on account 41 at actual cost (without using accounts 15 and 16).

Alpha's accountant made the following entries in accounting.

March:

Debit 41 Credit 98-2 – 100,000 rub. – the receipt of goods is reflected at market value.

April:

Debit 90-2 Credit 41 – 60,000 rub. – the cost of goods received free of charge is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 11,340 rubles. – VAT is charged on goods sold;

Debit 62 Credit 90-1 – 74,340 rub. – sales of goods are reflected;

Debit 98-2 Credit 91-1 – 60,000 rubles. – income is reflected in the form of the value of goods received free of charge at the time of their sale.

May:

Debit 90-2 Credit 41 – 40,000 rub. – the cost of goods received free of charge is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 7560 rubles. – VAT is charged on goods sold;

Debit 62 Credit 90-1 – 49,560 rub. – sales of goods are reflected;

Debit 98-2 Credit 91-1 – 40,000 rubles. – income is reflected in the form of the value of goods received free of charge at the time of their sale.

Capital contribution

Accept goods received as a contribution to the authorized capital for accounting in the valuation agreed upon by the founders (participants, shareholders) (clause 8 of PBU 5/01).

To confirm the conformity of the assessment of the founders (participants, shareholders) with the market value of the contribution, involve independent appraisers. For an LLC, an independent assessment of the property contribution is mandatory only if its size exceeds 20,000 rubles. A joint stock company must engage an independent appraiser, regardless of the value of the contribution. The founders (shareholders) can approve the value of the property contributed to the authorized capital not higher than the assessment of an independent expert (i.e. lower or in the same amount). Such rules are established by paragraph 2 of Article 15 of the Law of February 8, 1998 No. 14-FZ and paragraph 3 of Article 34 of the Law of December 26, 1995 No. 208-FZ.

Reflect the receipt of goods as a contribution to the authorized capital by posting:

Debit 41 (15) Credit 75-1

– goods were received as a contribution to the authorized capital.

This procedure is established by the Instructions for the chart of accounts.

Situation: is it possible in accounting to increase the cost of goods received as a contribution to the authorized capital by the amount of costs incurred by the organization in connection with the receipt of goods?

Answer: yes, you can.

When receiving goods as a contribution to the authorized capital, you can take into account the costs associated with their receipt (clauses 11 and 8 of PBU 5/01). At the same time, keep in mind that the obligation to transfer the contribution to the authorized capital lies with the founder (participant, shareholder). Therefore, the costs associated with such a transfer must be borne by the transferring party, and not by the receiving party (clause 1 of Article 16 of the Law of February 8, 1998 No. 14-FZ, clause 1 of Article 34 of the Law of December 26, 1995 No. 208-FZ). In particular, this means that such expenses will not reduce the taxable profit of the organization (clause 1 of Article 252 of the Tax Code of the Russian Federation).

An example of reflecting in accounting the receipt of goods as a contribution to the authorized capital of an organization

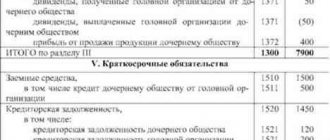

CJSC "Alfa" is the founder of LLC "Torgovaya". Alpha's share is 118,000 rubles. As a contribution to the authorized capital of Hermes, Alpha contributed goods worth 118,000 rubles. (including VAT – 18,000 rubles). The cost of these goods is confirmed by the appraiser's report and approved by the decision of the founders. The organization records goods on account 41 at actual cost (without using accounts 15 and 16).

The Hermes accountant made the following entries in the accounting:

Debit 75-1 Credit 80 – 118,000 rub. – Alpha’s debt for its contribution to the authorized capital of Hermes is reflected;

Debit 41 Credit 75-1 – 100,000 rub. – goods were received as a contribution to the authorized capital;

Debit 19 Credit 75-1 – 18,000 rubles. – VAT is allocated on the cost of goods received as a contribution to the authorized capital.