Current as of December 20, 2016

As you know, organizations and entrepreneurs wishing to switch to the simplified tax system, as well as those who are already working under this special regime, must comply with certain tax restrictions. In particular, the “simplifier” (potential and current) must comply with the income limit . The taxpayer will lose the right to transfer or apply the simplified tax system if his income goes “outside the limits”. Let's see what changes await the simplified people in 2021 , and whether they affect the income limit under the simplified tax system .

Maximum income to maintain the right to the simplified tax system

One of the innovations affects organizations and individual entrepreneurs that are already using “simplified language”. So, the Tax Code of the Russian Federation states that if, after the end of the reporting (tax) period, the income of a company or businessman exceeds a certain (maximum) amount, then he no longer has the right to continue to apply the simplified system. We are talking about the income that the “simplified man” actually received (Letter of the Ministry of Finance of Russia dated July 1, 2013 No. 03-11-06/2/24984).

After the publication of this article, legislators once again changed the limits on the simplified tax system for 2021. The most current figures for “simplified people” are given in the review “Changes to the simplified tax system since 2017: what an accountant needs to know.”

The maximum income limit is now 60 million rubles. It is this fixed amount that is stated in paragraph 4 of clause 4 of Art. 346.13 Tax Code of the Russian Federation. However, it must be increased every year by the approved deflator coefficient. For the current year (2016), the coefficient is 1.329 (Order of the Ministry of Economic Development of Russia dated October 20, 2015 No. 772).

As a result, the upper limit of earnings under the simplified tax system in 2021 is RUB 79,740,000. (RUB 60,000,000 × 1.329). You cannot receive more than this amount from business and remain on the simplified tax system. Therefore, it is advisable for companies or individual entrepreneurs to check that their income for the first quarter, half of the year, 9 months, and 2021 does not exceed 79,740,000 rubles. Otherwise, they will be deprived of the right to the simplified tax system from the beginning of the quarter in which income “exceeded” the allowable amount.

However, from 2021, even more firms and businessmen will be able to remain on the simplified tax system. The new law doubles this limit - to 120 million rubles.

At the same time, we recommend that you keep in mind that the effect of deflator coefficients will be suspended from next year until January 1, 2021. That is, there will be no need to index 120 million rubles to coefficients from 2021.

Also see “Tax calculator for simplified tax system”

The amendment to increase the maximum income at which one can remain on the simplified tax system comes into force on January 1, 2021. The new limit cannot yet be applied in 2016

Object of taxation and interest rate

As an object of taxation, an entrepreneur can select the item “Income” or “Income minus expenses”.

You can change your position only at the end of the tax period. Therefore, you should be careful when choosing an item.

The amount that the taxpayer pays at the end of the reporting period is determined depending on the object.

The following is a table where you can compare the interest rate and tax base for different objects.

| Interest rate | The tax base | Tax deduction | |

| "Income" | 6% | Amount of income in monetary terms | Tax payments are reduced by the amount of insurance premiums, transfers for temporary disability of an employee or payments under voluntary personal insurance |

| "Income minus expenses" | 15% (depending on local legislation, the rate can be differentiated from 5 to 15%) | The amount of income reduced by the amount of costs (the list of such costs is specified in Chapter 25 and Article 346.16 of the Tax Code) | There are no tax deductions as such, but insurance premiums are included in the list of expenses when determining the tax base |

For individual entrepreneurs with employees and for LLCs, there is a restriction: the tax amount can be reduced by no more than half.

However, if an individual entrepreneur works without employees, he can reduce tax payments by the entire amount of insurance premiums.

back to menu ↑

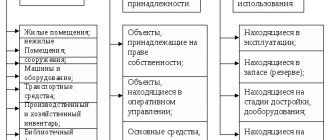

Limit on residual value of fixed assets

In 2021, a company can use the simplified tax system if the residual value of its fixed assets does not exceed 100 million rubles. This value must be determined according to the accounting rules (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). Also see “Accounting on the simplified tax system”.

Moreover, it is necessary to make a reservation that monitoring the residual value limit is required for companies both planning to apply the simplified tax system from the beginning of the new year, and those already using this special regime.

Tracking the limit on fixed assets

| The organization applies the simplified tax system | If, at the end of a reporting period (for example, a quarter or half a year), the residual value limit is exceeded, the organization will switch to OSN from the beginning of the quarter in which the excess occurred. |

| The organization plans to switch to the simplified tax system | To switch to the simplified tax system from the beginning of the new year, it is necessary that the limit on the residual value of fixed assets not be exceeded as of December 31 of the year preceding the start of application of the simplified tax system. |

Individual entrepreneurs do not have the obligation to control the residual value of their assets when switching to the simplified tax system. But if an individual entrepreneur is already running a business using a “simplified” system, then they are obliged to monitor these indicators in the same way as organizations (letter of the Ministry of Finance of Russia dated January 20, 2016 No. 03-11-11/1656).

From 2021, the maximum value of assets will increase from 100 to 150 million rubles. Accordingly, from January 1, 2017, companies and individual entrepreneurs will have the right to rely on the new maximum limit on the residual value of their fixed assets.

Changes for the simplified tax system in 2021

Federal Law No. 401-FZ dated November 30, 2016 (hereinafter referred to as Law No. 401-FZ) amended the provisions of Chapter 26.2 “Simplified Taxation System” of the Tax Code of the Russian Federation (Article 2, Clause 47 of Law No. 401-FZ). So from 01/01/2017:

- The income limit for switching to the simplified tax system will increase from 45 million rubles. up to 112.5 million rubles. ;

- The income limit for applying the simplified tax system will increase from 60 million rubles. up to 150 million rubles ;

- the limit on the residual value of fixed assets will increase from 100 million rubles. up to 150 million rubles

This means that the “simplified” regime will become available to more companies and individual entrepreneurs.

Notice! This is already the second increase in income limits limiting the right to transition and use the simplified tax system for the current year (2016). Let us recall that in accordance with Federal Law No. 243-FZ dated July 3, 2016 (hereinafter referred to as Law No. 243-FZ), from January 1, 2021, they should have amounted to 90 million rubles. and 120 million rubles. respectively. But already in November, legislators approved new, higher income indicators.

At the same time, the authorities suspended the indexation of the above limits for the period from 2021 to 2021 (clause 4 of article 5 of Law No. 243-FZ). Now let's figure out how to apply them correctly.

Maximum income for switching to simplified tax system

Existing companies and individual entrepreneurs have the right to change one tax system to the simplified tax system. However, switching to a special regime is allowed only from the beginning of the next year (clause 1 of Article 346.13 of the Tax Code of the Russian Federation). To do this, you need to submit to the tax office by December 31, form No. 26.2-1, approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. MMV-7-3/829. Also see “Moving from “imputation” to “simplified””.

Moreover, if an organization wants to switch to the simplified tax system from the new year, then its income for 9 months of the previous year should not exceed 45 million rubles excluding VAT, increased by the deflator coefficient (clause 1 of article 248, clause 2 of article 346.12 of the Tax Code RF).

As we have already said, for 2021 the deflator coefficient is defined as 1.329 (Order of the Ministry of Economic Development dated October 20, 2015 No. 772). Accordingly, if an organization is going to switch to the simplified tax system from 2017, then its income for January – September 2021 should not exceed 59,805,000 rubles. (45,000,000 × 1.329).

However, from 2021 this limit will increase. Organizations will be able to switch to the simplified system if their income for 9 months of the previous year did not exceed 90 million rubles. Moreover, the deflator coefficient will be suspended until January 1, 2021. Accordingly, there is no need to apply a deflator to 90 million rubles.

The increased limit (90 million rubles) can only be applied from January 1, 2021. Accordingly, if an organization wishes to switch to the simplified tax system from 2021, then its income for January – September 2017 will not have to exceed 90 million rubles. Thus, thanks to the changes, more organizations will be able to switch to the “simplified” system from 2021. However, you cannot rely on the new limit in 2016 to switch to the simplified tax system from 2021.

Please note: individual entrepreneurs do not take into account the income limit for the previous year to switch to the simplified tax system. Entrepreneurs have the right to switch to the simplified tax system even if their income for 9 months exceeds the limit (from 2021 - 90 million rubles).

We also invite you to watch a video regarding the basic principles of applying the simplified tax system

Read also

15.12.2016

This might also be useful:

- Production calendar for 2021

- UTII tax extended until 2021

- What will the minimum wage be in 2021?

- Application of a zero rate under the simplified tax system and PSN for individual entrepreneurs in Moscow

- What taxes does the individual entrepreneur pay?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Ways to reduce your income

“Simplers” will not be able to legally avoid paying a single tax to the budget at all. But it is still quite possible to minimize its amount. You can choose one of the following paths:

- Reduce the tax base.

- Include all possible costs in expenses. This does not mean that they should necessarily be increased. You just need to not skip those costs that can officially be posted as expenses.

Both methods are feasible if the entrepreneur applies a tax rate of 15% on what remains after subtracting the amount of expenses from income. When the entrepreneur has settled on paying 6% of income, the amount intended for transfer to the budget can be reduced by resorting only to the first method.

Why would a “simplified” person reduce taxable income? There are the following reasons for this:

- To meet the limit and not exceed it. If a “simplifier” earns more than 150 million rubles, he will have to say goodbye to the simplified tax system and switch back to the traditional basic tax system.

- A legal reduction in the amount of income allows you to pay less single tax, that is, save a certain amount of money.

Possible ways to reduce income include those in which the “simplified” becomes:

- intermediary;

- borrower;

- partner in simple partnership agreements.

An understatement of income becomes possible both when turnover decreases and when it increases.

Acting as a mediator

This way of minimizing income is suitable for entrepreneurs whose business consists of reselling goods in bulk. To reduce income, the company does not need to enter into purchase and sale agreements. Instead, it is beneficial for the company to draw up a commission agreement with the buyer of the goods. As a result, the “simplifier” turns into a mediator.

The scheme works like this:

- The company, using the funds of the counterparty, purchases the required quantity of goods, which it takes under its own responsibility.

- The intermediary is entitled to a commission for the service performed. Its size is specified in the contract and corresponds to the profit expected from the transaction.

- Of the amount of income received by the "simplified" counterparty, only commissions are recognized as the company's revenue.

Income included and not included in the calculation

To determine the income limit, not all funds earned by a company or individual entrepreneur are included in the calculation. The table contains the corresponding list:

| Income that is taken into account | |

| turn on | don't turn on |

| from sales | not related to entrepreneurship |

| non-operating | from the sale of non-commercial real estate acquired before obtaining individual entrepreneur status |

| taken into account when switching to simplified taxation system from OSNO | amount of loans and borrowings (borrowed funds received) |

| received under the PSN (patent taxation system) | on deposits (income of individual entrepreneurs, which are subject to personal income tax at the rates provided for in Article 224 of the Tax Code) |

| from the sale of property rights | value of property as a contribution to the authorized capital |

| funds received from the Social Insurance Fund (to pay for sick leave, maternity leave) | |

| erroneously listed by the counterparty | |

| funds returned: – due to incorrectly specified details; – as a VAT refund; – as previously overpaid taxes and fees; – prepayments and advances; – deposit after the auction ends | |

Important! Each enterprise has its own operating characteristics, so the list of receipts that are or are not counted as income should be studied in detail.

How taxes are paid according to the simplified tax system

Tax payments under the simplified system, as before, include:

- Advance payments. They are carried out based on the results of the quarter, they are paid before the 25th day of the month following the reporting period. Funds are transferred for the 1st, 2nd and 3rd quarters.

- Final payment. Carried out based on the results of the year.

Organizations pay tax under the simplified tax system until March 31 of the year following the reporting year.

For individual entrepreneurs, the period during which the tax contribution must be transferred is slightly longer - until April 30.

Payment details can always be found on the official tax website - www.nalog.ru.

It is worth considering that organizations need to transfer tax payments according to the details of the branch at the location of the company.

Individual entrepreneurs contact the inspectorate at their place of residence.

back to menu ↑

About KBK codes for payments under the simplified tax system

KBK codes differ depending on the applied tax object.

For the “Income” option with a tax rate of 6%, the code for the main tax is 182 1 0500 110.

If the “Income minus expenses” option is selected, where the rate is 15%, the code looks like 182 1 05 01021 01 1000 110.

The same KBK codes are used for individual entrepreneurs and LLCs. The only difference is in the selected objects of taxation.

As you can see, they differ only in the tenth digit. Numbers 9 to 11 indicate the income sub-item.

Important: when filling out forms, you need to check that the numbers are entered correctly.

If the BCC is entered incorrectly, this will complicate tax payment. If there is an error in the code, the order is returned to the payer or is considered unclear.

Due to such a delay, payment may be late, and this will lead to the accrual of penalties.

Since the purpose of the contribution without the BCC cannot be recognized, it may go to another account as a payment of another tax.

In this case, you will have to make the payment again and pay additional late fees.

However, there is a way out: write a written application so that the amount of overpayment for another tax is transferred to the desired account.

Even in such a situation, penalties will be charged. But if, despite the erroneously specified code, the payment was received as intended, you will not have to pay penalties.

Also, if you overpay, you can apply for a tax refund.

back to menu ↑

Features of income restrictions under mixed taxation regimes

When different taxation systems are combined in one company, for example, the simplified tax system and the UTII, there is a need to maintain separate records of both income and costs for each regime separately. In the event that, due to the nature of doing business, this is impossible to do, expenses when calculating the tax base are distributed in proportion to the shares of income (Article 346.18 of the Tax Code).

This year, this procedure can be applied not only to UTII, but also when combined with the patent system. Income and expenses on them should not be taken into account when calculating the tax base under the simplified tax system. The proceeds that an individual entrepreneur receives under “imputation” or a patent cannot in any way increase the amount of the single tax under the simplified tax system.

Overestimating the amount of possible expenses

The tax amount will decrease when the result of deducting expenses from income decreases. Its value is half dependent on the company's costs. The higher they are, the larger the amount withdrawn from income. It is possible to inflate official expenses through the payment of high salaries. Its amount, together with contributions to the Pension Fund, is included in the costs.

When a company calculates tax based on income, contributions to the Pension Fund reduce it. But reducing the amount by more than half is not allowed. Therefore, you should carefully calculate everything and find the best option. It is necessary to plan the payment of a salary fund in which the amount of social contributions was at the level of 0.5 of the single tax.

simplified tax system and benefits for business

It is beneficial to use the simplified tax system for running your business, and therefore this taxation system is widespread among legal entities. It has several advantages that set it apart from other taxation methods.

Before you start using the simplified tax system, you have the right to choose one of two tax rates:

- 6%, if your activity contains income items and minimizes expenses (in this case, the entrepreneur pays only 6% of the profit amount);

- 15% if the company has both income and expenses (first the difference between the profits and expenses received for the year is calculated, and then 15% is deducted from the amount received - this is the tax payable).

These rates can be differentiated in different regions and reduced to a minimum of 1% for some types of activities.

Business owners using the simplified tax system pay only one tax instead of:

- Income tax (for founders of organizations);

- personal income tax;

- VAT (although there are exceptions. For example, if you enter into a transaction with non-residents, you are still required to pay VAT).

The simplified tax system has a rather simplified reporting system: paying a single tax makes running your business easier.

There are also the following features for companies using the simplified tax system:

- You can transfer the payment of insurance premiums, transport tax and other expenses to expenses (for the simplified tax system with a tax rate of 15%);

- The simplified tax system does not limit a company from having a representative office.

What is the simplified tax system

There are six taxation systems in Russia, which differ in the amount of taxes and the amount of reporting.

The simplified system or simplified tax system is the most common among small businesses. It suits almost everyone and makes the life of an entrepreneur easier: one tax replaces several, you need to report once a year and there are ways to pay less. We talked about other systems and the benefits of each of them in the article “How to choose a taxation system.”

Video explanations about taxation systems - watch in the course of a young individual entrepreneur. The course contains 11 free lessons, tests and practice; in addition to calculating taxes, it will help you understand the preparation of documents, the use of online cash registers, choosing a bank and preparing for audits.