Are you working for a manufacturing company and have learned that some of your manufacturing assets are still in operation but fully depreciated?

In this case, the original estimate of equipment life was incorrect. What can be done to fix this? And what's wrong with that?

The problem is that because these machines are used beyond their useful lives , they are fully depreciated and have a book value of zero .

In this case, can any depreciation expenses be recognized in profit or loss?

Of course not, since the book value of these fixed assets cannot be reduced to a negative value.

So you use the machines, but you can't recognize depreciation expense because there's nothing left of them. You have completely impaired these assets in previous reporting periods.

As a result, the accounting 'matching principle' does not apply here. The costs simply do not match the economic benefits obtained from these machines.

Documenting

The commission's decision to liquidate a fixed asset is formalized by an act on the write-off of a fixed asset item in form No. OS-4 (clause 78 of the Methodological Instructions). This form of the act can be used (from January 1, 2013 it is not mandatory) when deregistering all types of fixed assets, with the exception of vehicles. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets. When liquidating vehicles, an act in form No. OS-4a is used.

The object being written off must be clearly identified, therefore the act indicates data characterizing the asset: the date the fixed asset was accepted for accounting, the year of manufacture or construction, time of commissioning, useful life, initial cost and the amount of accrued depreciation, revaluations, repairs. The act must indicate the inexpediency of further operation of the facility and the irrationality of its modernization. In addition, the act describes the condition of the main parts, parts, assemblies, structural elements and indicates the possibility of their further use, for example, for the repair of other objects.

The act is drawn up in two copies, signed by the members of the commission and approved by the head of the organization. One copy of the executed act for write-off of the asset remains with the financially responsible person. The second copy is transferred to the accounting department for registration of accounts. Based on this document, a mark indicating its disposal is placed in the inventory card of the item being written off. Inventory cards for retired fixed assets are stored separately for at least five years. The actual shelf life of such cards is determined by the head of the company (clause 80 of the Guidelines).

Note that the procedure for documenting the write-off of a fixed asset does not depend on the amount of accrued depreciation and applies even if the object is fully depreciated. Only when a vehicle is written off does the paperwork increase slightly. After all, a document confirming the deregistration of the car with the State Traffic Inspectorate is sent to the accounting department along with the report.

How to draw up an act for writing off an instrument: sequence of actions

The standard form of the act is drawn up as follows:

- The resolution of the head of the organization “I approve” is placed in the upper right corner. Next, indicate the name of the organization, position and full name. its manager, date of approval.

- Next, indicate the full name of the document and the date of its preparation.

- The composition of the commission should be listed below. They write down the phrase “The Commission is composed of”, and then list the position and full name. its members.

- After this, you need to record the fact of writing off the instruments and indicate the reasons for their write-off.

- Information about unusable tools is usually displayed in the form of a table consisting of columns: tool name, quantity, unit cost and total amount. If the commission members have any comments on the items being written off, they can indicate them in a separate column.

- Below the table indicate the total cost of all inventory items.

After signing the act by all members of the commission and the financially responsible person, it is submitted to the head of the organization for approval.

Members of the commission are responsible for filling out the instrument write-off form. They must ensure that the procedure is carried out in accordance with legal norms and that only reliable data is displayed in the document. If financially responsible persons simply throw away unusable tools without carrying out the write-off procedure, the organization’s management may accuse them of theft. The director has the right to demand from them compensation for the cost of inventory items in full.

Supporting documentation must be attached to the act. These may be invoices confirming receipt of the tool, documents for internal movement.

Income tax

Expenses for the liquidation of fixed assets taken out of service, including the amount of depreciation underaccrued in accordance with the established useful life, are taken into account as part of non-operating expenses. The basis is subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

When a taxpayer uses the accrual method in tax accounting, expenses accepted for profit tax purposes are recognized as such in the reporting (tax) period to which they relate (Clause 1, Article 272 of the Tax Code of the Russian Federation). Since the cost of the object has been fully repaid, the expenses associated does not arise with the write-off of underaccrued depreciation. But the organization’s expenses incurred during the liquidation of depreciated fixed assets can be taken into account when calculating income tax. Moreover, not only costs incurred by the company itself are recognized, but also those associated with payment for the relevant services of third-party organizations. After all, a company cannot always dismantle and dispose of an object being liquidated on its own.

As already mentioned, the write-off of fixed assets is carried out on the basis of the order of the manager and the write-off act signed by the members of the commission. In this case, the act of decommissioning the object can be fully executed only after the completion of the liquidation work.

When dismantling a fixed asset, materials, assemblies and assemblies often remain that are suitable for further use or for disposal for scrap or scrap metal. The cost of such material assets is taken into account as part of non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation). The exception is the cases provided for (clause 18, clause 1, article 251 of the Tax Code of the Russian Federation). The date of recognition of such income is the date of signing the act on liquidation of depreciable property (subclause 8, clause 4, article 271 of the Tax Code of the Russian Federation). At the same time, the act reflects information about material assets obtained during the dismantling and disassembly of the object. Let us recall that the amount of the specified non-operating income is calculated as the current market value of the materials received (clause 5 of Article 274 and clause 1 of Article 40 of the Tax Code of the Russian Federation).

The fact that income arises does not depend on whether the capitalized materials received as a result of the liquidation of the asset will be subsequently used in business activities or not (see letter of the Ministry of Finance of Russia dated May 19, 2008 No. 03-03-06/2/58).

Subsequently, when using the material assets in question in business activities, the company will be able to take into account their value as part of material expenses in an amount equal to the amount of tax calculated on the income specified in paragraph 13 of Article 250 of the Tax Code of the Russian Federation (taken into account when recording these assets). This is stated in paragraph 2 of Article 254 of the Tax Code of the Russian Federation2.

How to document the write-off of illiquid inventory items

The procedure for writing off inventories is determined:

- based on materials - section. VI Guidelines for accounting of inventories (approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n) (hereinafter referred to as the Guidelines);

- on workwear and special equipment - section. IV Methodological guidelines for accounting of special tools, special devices, special equipment and special clothing (approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n).

To write off inventory items, by order of the head of the organization, a special commission is created, which includes financially responsible persons. These can be both employees of the organization and third parties.

https://www.youtube.com/watch?v=ytcreatorsru

The work of the commission should include sequentially the following stages (clause 125 of the Guidelines):

- inspection of inventory items;

- establishing the reasons why inventory items became illiquid;

- identification of persons responsible for damage to goods and materials;

- determining the suitability of inventory items for any further use (for its intended purpose, for another purpose, for sale, etc.);

- drawing up an act for writing off inventory items and its approval by management;

- determination of the residual (cost of scrap, scrap) or market value of inventory items;

- control over the disposal of unusable goods and materials.

It is necessary to draw up an act recording the damage to inventory items, as well as an act for their write-off. An organization may approve in its accounting policy the use of forms NN TORG-15 “Act on damage, damage, scrap of inventory items” and TORG-16 “Act on write-off of goods” (approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132) or others independently developed forms containing the mandatory details established by Part 2 of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (Part 4 of Article 9 of the Federal Law N 402-FZ).

We recommend paying attention to the following details:

- The name of the written off inventory items should be as detailed as possible. Otherwise, organizations may be subject to claims from tax authorities due to the inability to accurately identify inventories being written off.

- The act must indicate in detail the reason why inventory items are subject to write-off, which can confirm the economic justification of this fact of economic activity, which is the main requirement for recognizing an expense (paragraph 2, clause 1, article 252 of the Tax Code of the Russian Federation). For example, the requirement to write off a number of inventory items due to the expiration of their shelf life is directly provided for by current legislation and does not require any other additional grounds (clause 2, article 3 of the Federal Law of January 2, 2000 N 29-FZ “On the quality and safety of food products").

- Losses (shortages) within the limits of natural loss norms approved by law are part of material expenses and are subject to write-off for profit tax purposes in accordance with paragraphs. 2 clause 7 art. 254 Tax Code of the Russian Federation.

- To confirm the economic feasibility of writing off inventory items as a result of loss of physical qualities and properties, it is recommended to describe the defects that the inventory received. This information will also be required both to confirm the economic feasibility of the write-off, and, subsequently, to determine the residual (market) value of inventory items.

- Since the procedure for recognizing inventory items as illiquid, provided for by the Methodological Instructions, includes control over the disposal of unusable inventories (clause “h” of paragraph 125 of the Methodological Instructions), when writing them off, it is necessary to indicate information either about the document certifying the fact of disposal, or directly about the fact itself recycling, if the organization does not provide for the preparation of a separate document on this fact.

The act of writing off a tool that has become unusable is an important document, without which it is impossible to carry out further disposal. It must contain information about the inventory items being written off, the reason for the write-off, the quantity and value of the items being written off.

Accounting

Costs associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products are classified as other expenses (clause 11 of PBU 10/99).

The procedure for recognizing income and expenses associated with the write-off of fixed assets in accounting is similar to the procedure used for taxation of profits. In accordance with paragraph 31 of PBU 6/01, income and expenses from this operation are reflected in the reporting period to which they relate.

The cost of materials received during disassembly and dismantling of liquidated fixed assets is reflected in other income (clause 7 of PBU 9/99). The amount of other income for accounting purposes is determined in the same way as for tax purposes - based on the current market value of capital assets (clause 9 of PBU 5/01).

Example 1

Favorit LLC has several depreciated fixed assets on its balance sheet. Moreover, the initial cost of these objects is completely written off both in accounting and tax accounting. To clarify their technical condition and determine their possible use, a special commission was created by order of the director. The commission examined the condition of assets with zero residual value and determined that the moral and physical condition of one of the inspected objects was such that it should be liquidated. The company carried out partial liquidation on its own in June 2009. In addition, for the final dismantling and disposal of this object, Favorit LLC used the services of a third-party company. The work was carried out in two stages, which was confirmed by acts dated 06/30/2009 and 07/31/2009.

When dismantling the fixed asset, parts remained that could be used to repair the production equipment of Favorit LLC. These material assets were capitalized in the warehouse in July 2009 at a market value of 40,000 rubles. and used in August 2009.

The initial cost of the written-off fixed asset is RUB 800,000. The company's costs for dismantling the fixed asset amounted to 35,000 rubles, in addition, the cost of the work of the company hired to dispose of the write-off asset was 180,000 rubles. (excluding VAT), as well as the cost of each stage of work - 90,000 rubles. (excluding VAT).

The act in form No. OS-4 was drawn up and signed after the completion of all work on the liquidation of the facility, that is, in July 2009. According to him, this fixed asset was written off from the register.

In tax accounting, the organization takes into account the expenses for the services of a third-party company involved in the dismantling of a liquidated object on the basis of certificates of work performed in June and July 2009 for 90,000 rubles. respectively. Costs for partial disassembly of the object, carried out on our own, in the amount of 35,000 rubles. Favorit LLC recognized it on the basis of the write-off act, that is, in July 2009.

In July, the organization reflected non-operating income in the amount of 40,000 rubles. in the form of the cost of capitalized parts. When using them in business activities in August 2009, the company included 8,000 rubles in expenses. (RUB 40,000 × 20%).

In accounting, the cost of parts received during the liquidation of a fixed asset and subsequently used in production is recognized as expenses in full. According to paragraph 7 of PBU 18/02, it is necessary to reflect a permanent tax liability in the amount of 6,400 rubles in accounting. [(RUB 40,000 – RUB 8,000) × 20%]. The listed operations are reflected in the following entries:

in June 2009:

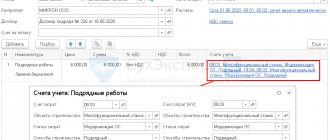

- debit 01 subaccount “disposal of fixed assets” credit 01 subaccount “fixed assets in operation” 800,000 rub. — the initial cost of the liquidated fixed asset is written off

- debit 02 credit 01 subaccount “disposal of fixed assets” 800,000 rub. — depreciation accrued on the liquidated object is written off

- debit 91-2 credit 69, 70 35,000 rub. — dismantling work done on our own is taken into account

- debit 91-2 credit 60 90,000 rub. — the first stage of dismantling and disposal work performed by the contractor was taken into account

in July 2009:

- debit 91-2 credit 60 90,000 rub. — the second stage of dismantling and disposal work performed by the contractor was taken into account

- debit 10 credit 91-1 40,000 rub. — parts received during dismantling of the fixed asset were capitalized

in August 2009:

- debit 20 credit 10 40,000 rub. — the cost of parts obtained as a result of dismantling the fixed asset is written off to production

- debit 99 credit 68 subaccount “income tax calculations” 6400 rub. — permanent tax liability is taken into account

Partial liquidation of property

It is not possible to write off a fixed asset completely from the balance sheet. The method is often used for real estate for the purpose of modernization, redevelopment or other uses. If we are talking about structures and buildings, then the part unsuitable for use can be demolished while the main part remains in place.

It turns out that in fact the fixed asset remains in the assets of the enterprise, but its value changes. In this regard, there is a need to revaluate the property, as well as recalculate depreciation charges. The amounts of expenses and income from partial liquidation are reflected in account 91.

How to write off fixed assets from the balance sheet correctly? To do this, you need to subtract the original value from the current value, the amount of depreciation and get the balance, which is then reflected in account 91 of the accounting.

Unforgivable Movie Mistakes You Probably Never Noticed There are probably very few people who don't enjoy watching movies. However, even in the best cinema there are mistakes that the viewer can notice.

Contrary to all stereotypes: a girl with a rare genetic disorder conquers the fashion world. This girl's name is Melanie Gaydos, and she burst into the fashion world quickly, shocking, inspiring and destroying stupid stereotypes.

How to look younger: the best haircuts for those over 30, 40, 50, 60 Girls in their 20s don’t worry about the shape and length of their hair. It seems that youth is created for experiments with appearance and daring curls. However, already last.

Charlie Gard Died A Week Before His First Birthday Charlie Gard, the terminally ill baby the world is talking about, died on July 28, a week before his first birthday.

15 Cancer Symptoms Women Most Often Ignore Many signs of cancer are similar to symptoms of other diseases or conditions, which is why they are often ignored. Pay attention to your body. If you notice.

Never do this in church! If you are not sure whether you are behaving correctly in church or not, then you are probably not acting as you should. Here's a list of terrible ones.

Sale of fixed assets

The fact that a fixed asset is fully depreciated does not mean that this asset cannot be used in the organization's activities. After all, the suitability of an object for operation is determined by its technical and economic indicators. And if these indicators do not meet the requirements of one enterprise, they may suit another. Therefore, there is a chance to sell outdated equipment. In this case, the fixed asset item is also subject to deregistration (clause 76 of the Methodological Instructions).

Documenting

The sale of a fixed asset (its disposal for other reasons) is documented with the relevant primary accounting documents (clause 7 of the Methodological Instructions).

Thus, to reflect the disposal of an asset, a transfer and acceptance certificate is used in form No. OS-1, and if a building or structure is disposed of - (clause 81 of the Methodological Instructions). The document is drawn up in at least two copies, one for each party. The usual requirements for drawing up the act are: all fields must be filled out and the document must be signed by members of the commission. Section 1 of the act, which is filled out based on the data of the transferring party, indicates information about the disposed object, including the amount of depreciation accrued from the beginning of operation.

The transfer by an organization of an object of fixed assets into the ownership of other persons is formalized by an act of acceptance and transfer of fixed assets in form No. OS-1 [comment: Sale of fixed assets] Operations for the receipt of fixed assets in the organization, their internal movement and disposal relate to operations for the movement of fixed assets [ /a comment]/

Section 2 of the act in form No. OS-1 is filled out only by the purchasing organization in one copy (that is, the seller does not fill it out).

The act must reflect information characterizing the object being sold, and also include a note from the accounting department that the disposal of the asset is recorded on the inventory card. The entry is made on the date of approval of the act by the heads of the companies of the seller and the buyer and is certified by the signature of the chief accountant of the seller’s organization. Based on this act, the seller’s accounting records the write-off of the fixed asset.

An inventory card for the sold fixed asset is attached to the transfer and acceptance certificate. A note about the seizure of the inventory card for a retired object is made in a document opened at the location of the object.

Features of drawing up an act for writing off an instrument

The act can be drawn up on a sheet of A4 paper or on the organization’s letterhead. In most cases, it is compiled in one copy, which is then transferred to the accounting department. If necessary, additional copies can be made. Since this document relates to the internal document flow of the organization, there is no need to certify it with a seal. But it will require recording in a special journal.

The act of writing off an instrument that has become unusable must contain:

- name of the legal entity;

- FULL NAME. and the signature of the manager under the heading “I approve”;

- information about the members of the commission (positions, full names);

- a detailed list of instruments to be written off;

- quantity and cost of tools;

- reason for write-off.

The composition of the commission is determined by a separate order of the director of the enterprise. When the act of writing off the instruments is drawn up, all members of the commission must sign it. This confirms that the information entered is correct. After completing the procedure, the document must be approved by the head of the enterprise. An approximate act for writing off a tool that has become unusable (sample) can be found below.

Income tax

Proceeds from the sale of fixed assets, including fully depreciated ones, are recognized as income from sales (clause 1 of Article 249 of the Tax Code of the Russian Federation). At the same time, tax legislation gives the company the right to reduce the income received by the residual value of depreciable property (subclause 1, clause 1, article 268 of the Tax Code of the Russian Federation). If the residual value of an asset is zero, this does not mean that the company has no costs when selling it. The company can reduce income for expenses directly related to its implementation (clause 1 of Article 253 and clause 1 of Article 268 of the Tax Code of the Russian Federation). Such expenses are, for example, the costs of valuation, storage or delivery of an item of fixed assets.

When selling a fixed asset, the corresponding technical documentation is transferred along with it, as indicated in the transfer and acceptance certificate. After all, the buyer will not be able to properly operate the object without the necessary instructions. Suppose the costs associated with the sale of a fixed asset exceed the proceeds from its sale, then the difference between these values can be recognized as a loss from the sale, which is taken into account for tax purposes as part of other expenses. The basis is paragraph 3 of Article 268 of the Tax Code of the Russian Federation. Let us recall that, according to this norm, the resulting loss is written off evenly over the remaining useful life of the asset. However, the useful life of the depreciated fixed asset has been fully exhausted. Consequently, the amount of loss is recognized as a lump sum.

Chapter 25 of the Tax Code allows the taxpayer to take into account as expenses part of the cost of a fixed asset at a time when it is put into operation (depreciation bonus). The relevant provisions are established in paragraph 2 of paragraph 9 of Article 258 of the Tax Code of the Russian Federation3.

Read about the specifics of using the depreciation bonus in 2009 in the article “How to apply the depreciation bonus in 2009” // RNA, 2009, No. 8. - Note. ed. Let's say an organization sells a fully depreciated fixed asset, in respect of which a depreciation bonus was previously applied. Then you need to take into account the requirements contained in paragraph 4 of paragraph 9 of Article 258 of the Tax Code of the Russian Federation. So, if the asset being sold was used by the organization for less than five years, then the depreciation bonus must be restored and included in the tax base for income tax. Naturally, we are talking about objects with a short service life, that is, included in the first - third depreciation groups.

From January 1, 2009, the amount of the depreciation bonus is for fixed assets belonging to the third - seventh depreciation groups, no more than 30%, for other fixed assets - no more than 10% of the cost. The restored depreciation bonus is included in non-operating income in that reporting (tax) period , in which the main tool is implemented. Similar explanations are given in the letter of the Ministry of Finance of Russia dated April 30, 2009 No. 03-03-06/1/291. Moreover, the amount of the restored depreciation bonus cannot be taken into account as expenses either during the restoration period or later. This opinion was expressed by the Russian Ministry of Finance in letters dated March 16, 2009 No. 0303-05/37 and dated March 16, 2009 No. 03-03-06/2/142.

When restoring the depreciation bonus, the amount of accrued depreciation for previous tax periods (before the sale of the object) is not recalculated. The considered procedure for restoring the depreciation bonus is applicable not only to the cost of a fixed asset, but also to the costs of its reconstruction, modernization and other improvements.

Gvmp

Contents Are you working for a manufacturing company and have learned that some of your manufacturing assets are still in operation but fully depreciated? In this case, the original estimate of equipment life was incorrect. What can be done to fix this?

And what's wrong with that? The problem is that because these machines are used beyond their useful life, they are fully depreciated and have a book value of zero. In this case, can any depreciation expenses be recognized in profit or loss? Of course not, since the book value of these fixed assets cannot be reduced to a negative value.

So you use the machines, but you can't recognize depreciation expense because there's nothing left of them. You have completely impaired these assets in previous reporting periods. As a result, the accounting 'matching principle' does not apply here.

The costs simply do not match the economic benefits obtained from these machines.

Standard IAS 16 “Property, Plant and Equipment” defines the useful life (or useful life of an asset, from the English.

'useful life') like this:

- The period over which the company is expected to be able to use the asset; or

- The quantity of production or similar units that the company is expected to receive from the asset.

It is not the potential resource of the asset or the economic life of the asset.

The two are often different! For example, the normal economic life of a vehicle is 4 years, but the company's policy is to renew its fleet every 2 years. In this case, the useful life of the car is only 2 years.

Or, for example, the economic life of a machine is 6 years, but after 3 years the company’s experts decide that the machine can be used for another 5 years.

In this case, the total useful life is 8 years. IAS 16 requires companies to review the useful lives of assets at least every financial year. Many companies simply forget about this!

We recommend reading: The hospital issued a certificate on how to pay for it

They simply charge annual depreciation based on rates determined for some group of assets, and that's it.

They do not review the useful life of their assets, and as a result, they end up using fully depreciated assets in the production process. In this situation, two possible corrective actions can be proposed.

Corrective actions for fully depreciated assets.

The useful resource of an asset is its accounting value.

And if you find that it is different from what you originally estimated, you need to account for this change in accordance with IAS 8

"Accounting Policies, Changes in Accounting Estimates and Errors"

. This means you simply establish a new remaining useful life, take the carrying amount and recognize the depreciation cost based on the carrying amount and the new remaining useful life.

Accounting

Proceeds from the sale of fixed assets are recognized as other income of the organization (clause 7 of PBU 9/99). In this case, the residual value of the disposed object is written off from accounting as other expenses of the organization (clause 11 of PBU 10/99). Other expenses also include costs associated with the sale of fixed assets. It is clear that when selling a depreciated object, there are no expenses in the form of residual value.

Please note: accounting does not provide for the use of bonus depreciation. Accordingly, if in tax accounting upon the sale of a fixed asset the depreciation bonus is restored, the provisions of PBU 18/02 must be applied in accounting and the permanent difference must be reflected, which leads to the emergence of a permanent tax liability (clauses 4 and 7 of PBU 18/02).

Example 2

Alpha LLC has decommissioned equipment on its balance sheet. A commission appointed by order of the general director of Alpha LLC determined that it could be sold. The specified fixed asset belongs to the first depreciation group, its initial cost is 200,000 rubles. The asset was accepted for accounting on February 1, 2009 and fully depreciated in April 2010. For profit tax purposes, the organization, when accepting the object for accounting, applied a depreciation bonus in the amount of 10%, which amounted to 20,000 rubles. Let's say a fixed asset was sold in May 2010 for RUB 82,600. (including VAT RUB 12,600).

Since at the time of sale the property had been used by the organization for less than five years, the depreciation bonus must be restored. That is, in tax accounting in May 2010, 90,000 rubles must be taken into account as income. (RUB 82,600 - RUB 12,600 + RUB 20,000).

For the amount of the restored depreciation bonus, the organization will accrue a permanent tax liability in the amount of 4,000 rubles. (RUB 20,000 × 20%).

When selling an object, the following entries will be made in accounting:

- Debit 01 subaccount “disposal of fixed assets” credit 01 subaccount “fixed assets in operation” RUB 200,000. — the original cost of the fixed asset being sold is written off

- Debit 02 credit 01 subaccount “disposal of fixed assets” 200,000 rub. — depreciation accrued on the property being sold is written off

- Debit 62 credit 91-1 82,600 rub. — income from the sale of fixed assets is reflected

- Debit 91-2 credit 68 subaccount “VAT calculations” 12,600 rubles. — VAT accrued

- Debit 99 credit 68 subaccount “income tax calculations” 4,000 rubles. — a permanent tax liability is reflected

Accounting for revaluation results when writing off an object

A special group of fixed assets consists of objects that have been revalued because their value differs from the original value (paragraph 3 of clause 15 of PBU 6/01). Therefore, when writing off such fixed assets from accounting, it is necessary to write off the amounts of their revaluation (paragraph 7, clause 15 of PBU 6/01). The procedure for writing off revaluation amounts due to liquidation or sale of fixed assets is the same.

As a rule, revaluation consists of increasing the original cost of a fixed asset and the amount of depreciation accrued on it (revaluation). It is not profitable for the company to reduce the value of assets and thereby demonstrate the use of low-quality equipment. After all, only low-quality and obsolete equipment has a market value that decreases so rapidly that it has to be discounted.

Let us remind you that when carrying out an additional valuation, no income appears in accounting, since the amount of the additional valuation is attributed to the increase in additional capital. Accordingly, when an object is disposed of, no expense arises; the amount of its revaluation is transferred from additional capital to the company’s retained earnings. Please note: the results of revaluation are reflected only in accounting, because tax legislation does not provide for such an operation. Therefore, when deregistering a fully depreciated fixed asset, no entries are made in tax accounting. The rules of PBU 18/02 also do not apply in this case, since writing off revaluation amounts does not affect income tax calculations.

Disposal due to wear and tear

How to write off depreciated fixed assets from the balance sheet? This is perhaps the easiest case for an accountant. If the period of expected useful use completely coincides with the actual one, then the residual value is equal to zero and after drawing up a write-off act, the object ceases to be included in the assets of the enterprise.

When moral or physical wear and tear occurs earlier than planned, it is necessary to make calculations that will require data on:

- initial cost of the object (purchase price + installation + delivery);

- accumulated depreciation for the period worked (credit to the corresponding subaccount 02);

- residual value equal to the difference between the original cost and accumulated depreciation.

The last value is written off from account 01. The final result of the liquidation of property is included in the financial result.

The sequence of entries characterizing the write-off from the balance sheet of fixed assets that have become unusable due to wear and tear can be seen in the table:

The compiled entries fully show how to write off fixed assets from the balance sheet. If a positive liquidation value is formed, its value is credited to account 91.1.

Documenting

Just like other business transactions, the modernization of fixed assets is formalized with primary documents. The set of documents that must be completed when carrying out modernization is similar to the documents drawn up when carrying out repairs (see box on page 38). The only exception is that there is no need to fill out a defective statement, because the modification is carried out not in order to eliminate the breakdown of the fixed asset, but to improve its technical and economic indicators.

Upon completion of work on the modernization of a fixed asset, the amounts of costs incurred are indicated in the inventory card for this object. The procedure for maintaining inventory cards depends on the method chosen by the company for accounting for costs to improve the operational performance of fixed assets (clause 43 of the Methodological Instructions).

Income tax

The initial cost of a fixed asset changes in the case of modernization of the relevant facilities (clause 2 of Article 257 of the Tax Code of the Russian Federation). That’s why it’s so important to correctly classify the work performed—whether it’s repair or modernization. In the first case, the value of the asset does not change and all costs incurred are taken into account when calculating profit at a time. In the second, the cost of the object increases by the amount of modernization costs incurred.

Modernization operations include work caused by a change in the technological or service purpose of a fixed asset item. This follows from paragraph 2 of Article 257 of the Tax Code of the Russian Federation

After the modernization, the company can increase the useful life of a fixed asset, but only within the limits established for the depreciation group in which it was included upon commissioning. If a maximum useful life has been established for an object, then this period does not increase. The specified procedure is also applicable to fully depreciated fixed assets (see letters of the Ministry of Finance of Russia dated March 13, 2006 No. 03-03-04/1/216 and March 2, 2006 No. 03-03-04/1/168).

Increasing the useful life of a fixed asset as a result of modernization is a right, not an obligation of the taxpayer. Most likely, the organization will not increase the useful life of a fully depreciated object. This means that the amount of depreciation should be calculated according to the standards established when this facility was put into operation.

Let’s assume that after modernization, the organization nevertheless increased the useful life of the facility. Then the amount of depreciation is calculated based on the new useful life.

Depreciation on a modernized fixed asset item is accrued from the 1st day of the month following the month of completion of the modernization (paragraph 2, paragraph 2, article 259 of the Tax Code of the Russian Federation). The amount of accrued depreciation is recognized as expenses on a monthly basis (subclause 3, clause 2, article 253 and clause 3, article 272 of the Tax Code of the Russian Federation).

Accounting

In accounting, when modernizing fixed assets, their initial (replacement) cost changes (clause 14 of PBU 6/01). It is also possible to increase the useful life of the modernized facility (clause 20 of PBU 6/01). But in this case, the useful life limits are not limited; the company has the right to set them independently. Depreciation is calculated from the 1st day of the month following the month in which modernization expenses are recognized (clause 21 of PBU 6/01). The amounts of accrued depreciation are expenses for ordinary activities (clause 5 of PBU 10/99) and are recognized monthly.

In accounting, modernization is understood as an improvement (increase) of the initially adopted standard indicators of the functioning of a fixed asset object (clause 20 of PBU 6/01)

Unlike tax in accounting, the amount of depreciation is determined based on the residual value of the object, taking into account the costs of modernization and the remaining useful life (clause 60 of the Guidelines). Different accounting procedures lead to the formation of temporary differences and, accordingly, deferred income tax (clauses 8 and 9 of PBU 18/02).

How to properly deregister an object that has not yet been depreciated?

Below is a step-by-step instruction that will tell you how to proceed in order to correctly write off an under-depreciated fixed asset that has become unusable.

Step-by-step write-off algorithm:

Step 1. Create a commission.

This group of persons is formed by order of the manager for the purpose of inspecting fixed assets to identify objects that have fallen into disrepair and are subject to write-off.

Step 2. Inventory and inspection of the OS.

During the inspection, the commission assesses the condition of existing assets, determines the degree of wear and tear, damage and makes a decision on the advisability of further use or write-off.

In carrying out their duties, the members of the commission are:

- OS inspection report;

- defective statement;

- conclusion on the condition of the object and the need for write-off;

- protocol.

Step 3. Issuing an order.

Based on the decision of the commission members to write off an under-depreciated object that has fallen into disrepair, an order is issued.

The order indicates the reason for removal from the balance sheet, the type of property, the timing of the write-off, and the persons responsible for the process.

Step 4. Drawing up a write-off act.

It is possible to use the standard form OS-4 (for a single object), OS-4a (for road transport), OS-4b (for groups of similar objects).

Step 5. Reflection of transactions in accounting.

To make double entries for write-off operations on assets that have become unusable, a documentary justification is required. This is the act of write-off.

Step 6. Disposal of fixed assets.

Dismantling, partial or complete destruction may be carried out.

Step 7. Capitalization of components and parts remaining from dismantling.

These values are included in the warehouse as materials at market value.

Documentation of disposal of under-depreciated fixed assets

To write off a fixed asset for which the depreciation process has not completed, but which has become unusable, the following documents must be completed:

- Order on the creation of a commission for writing off fixed assets.

- Fixed asset inspection report.

- A statement of defects identified, if any.

- Conclusion and protocol of the commission on write-off.

- An order to remove a fixed asset that has become unusable from the balance sheet.

- Write-off act.

- Depending on the further fate of the decommissioned OS - an act of dismantling, an act of recycling, or destruction.

Postings in accounting

The process of deregistration of any fixed asset - depreciated or for which the depreciation period has not expired - is always accompanied by a transfer of the cost of fixed assets and accumulated depreciation charges to a separate subaccount of account 01.

Since the object has not yet been depreciated, it has a residual value, which is considered as a balance in an open subaccount on account 01. This value is written off as expenses of the organization.

Also, the organization’s expenses may include expenses for dismantling and destruction of the facility - payment for the services of third-party companies, contractors, payment of its own workers, and other related expenses.

All expenses associated with write-offs are collected on the debit of account 91. The cost of incoming parts is reflected on the credit of account 91.

If it is decided to sell the written-off object, then the sale value is also shown on the credit of account 91.

As a result, account 91 generates the financial result from writing off the operating system that has become unusable. Typically this is a loss.

The table below shows the entries made by the accountant during this procedure:

| Postings | Operation description | |

| Dt | CT | |

| 01.1 | 01.2 | The initial cost of the asset that has fallen into disrepair is transferred to a separate sub-account for write-off |

| 02 | 01.2 | Current accrued depreciation is reflected |

| 91.2 | 01.2 | The residual value of the unsuitable OS has been written off |

| 91.2 | 70, 76, 60, 69, 23 | Costs associated with write-off are reflected |

| 10 | 91.1 | Parts, components, mechanisms remaining after dismantling the OS have been capitalized |

From the month following the month of disposal, the accountant stops accruing depreciation on this asset.

The last posting for depreciation charges occurs on the first day of the month in which the object that has become unusable is disposed of.

Example 3

In March 2007, Fortuna LLC put the equipment into operation. In accounting and tax accounting, the initial cost of this object was 180,000 rubles, the useful life was set at 25 months (second depreciation group), and the linear depreciation method was used. In April 2009, the fixed asset was fully depreciated. As a result of examining the equipment, the commission came to the conclusion that for its further use it would be advisable to modernize it in order to improve its technical characteristics. The head of the company issued an order to carry out the relevant work by a contractor, the cost of the work is 120,000 rubles. (excluding VAT). The modernization work was completed in May 2009, which means that depreciation is accrued from June 2009.

In tax accounting, the organization after modernization did not increase the useful life of the equipment. That is, depreciation is calculated based on the norm established when putting the facility into operation - 4% (1 ÷ 25 months × 100%), as well as the new initial cost - 300,000 rubles. (RUB 180,000 + RUB 120,000). The monthly depreciation amount after modernization is 12,000 rubles. (RUB 300,000 × 4%). Thus, expenses will be taken into account for 10 months (RUB 120,000 ÷ RUB 12,000/month).

In accounting, after modernization, the useful life of the object was increased by 20 months. The monthly depreciation amount is calculated based on the residual value equal to the costs of modernization (RUB 120,000) and the remaining useful life of 20 months. Its amount is 6000 rubles. (RUB 120,000 ÷ 20 months). The following entries were made in the organization's accounting records:

in May 2009:

- debit 08 credit 60,120,000 rub. — the costs of modernizing a fixed asset facility by a third party are reflected

- debit 01 credit 08 120 000 rub. — the initial cost of a fixed asset item was increased by the amount of modernization costs; monthly from June 2009 to January 2011

- debit 20 credit 02 6000 rub. — depreciation was accrued on the modernized fixed asset item

In accounting and tax accounting, the same amount is included in expenses for different periods of time. Since depreciation is calculated in a larger amount each month for profit tax purposes, a taxable temporary difference is created in accounting. Therefore, it is necessary to reflect the deferred tax liability (clauses 12 and 15 of PBU 18/02). It is accrued monthly at 1200 rubles. [(12,000 rubles - 6,000 rubles) × 20%] for ten months, that is, until the end of depreciation in tax accounting. The total deferred tax liability will be RUB 12,000. (1200 rubles × 10 months).

From the 11th to the 12th month inclusive, the deferred tax liability will gradually decrease and will be completely repaid at the end of depreciation in accounting.

These transactions are reflected in the following entries:

monthly from June 2009 to March 2010:

- debit 68 subaccount “income tax calculations” credit 77 1200 rub. — deferred tax liability accrued

monthly from April 2009 to January 2011:

- debit 77 credit 68 subaccount “income tax calculations” 1200 rub. — deferred tax liability has been repaid

The opposite situation is also possible, when in accounting the modernized object will be depreciated faster than in tax accounting. Then deductible temporary differences and, accordingly, a deferred tax asset are formed (clauses 11 and 14 of PBU 18/02).