Federal standard "Fixed assets".

What basic concepts does the standard contain? What is the procedure for accounting for fixed assets in institutions in accordance with this standard? How is the initial cost of the OS determined? What new depreciation provisions are included in the standard? How should disposal of fixed assets be accounted for and what is the procedure for disclosing information about them in reporting?

The Federal Standard “Fixed Assets” (hereinafter referred to as the Standard) establishes uniform requirements for accounting of assets classified as fixed assets, as well as requirements for information about them disclosed in accounting (financial) statements.

The standard is applied when maintaining accounting records of fixed assets, including those received within the framework of lease relations, but on the basis of the provisions of the federal standard “Lease”.

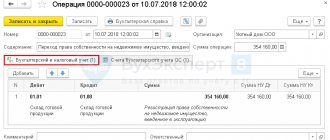

Changes in the chart of accounts

New analytical codes will be introduced into the chart of accounts for accounting for intangible assets: N, R, I, D for accounts 102 00, 104 00, 106 00, 114 00. For the rights to use intangible assets, a separate group “60” will be provided for accounts 104 00, 106 00, 114 000, 111 00.

Corrections to last year's errors that controllers found will need to be displayed using new accounts and analytical codes for accounts 304 06, 401 10 and 401 20. To account for investments in property, the treasury has provided an account 106 50.

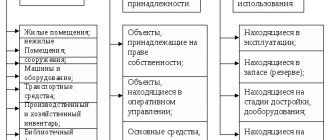

RECOGNITION OF OBJECTS OF FIXED ASSETS.

In Section III of the Standard, the acceptance of fixed assets for accounting in institutions is designated by the concept of “recognition”. This does not change the essence of the provisions presented in it, which are partly similar to some provisions of Instruction No. 157n. Let's look at the main points of this section.

The unit of accounting for fixed assets in institutions (OS) is an inventory object. Each inventory item is assigned an inventory number in the manner established by the accounting policy of the institution, taking into account the provisions of the Standard and Instruction No. 157n. The inventory number is retained by the object for the entire period of its stay in the institution. After disposal of an object, the inventory number assigned to it is not assigned to anyone.

An OS object is recognized as an object of property with all fixtures and accessories, or a separate structurally isolated object intended to perform certain independent functions, or a separate complex of structurally articulated objects that constitute a single whole and are intended to perform a specific job.

A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted in a single complex (on the same foundation), as a result of which each object included in the complex can perform its functions only as part of the complex , and not independently.

Fixed assets whose useful life is the same, and the cost is not significant (for example, library collections, peripheral devices and computer equipment, furniture used for the same period of time (tables, chairs, cabinets, other furniture used for furnishings) one room)), according to Instruction No. 157n, can be combined into one inventory object - a complex of OS objects.

A unit of fixed assets accounting can also be recognized as a part of a property. This is possible if part of the object has a different useful life from the remaining parts and its cost is significant.

A property (or part thereof) leased and intended for sublease may be recognized as investment property.

A cultural heritage asset is taken into account as part of the asset if it can be used to obtain economic benefits or useful potential, or if its useful potential is not limited to cultural value.

In other cases, a cultural heritage asset is reflected in off-balance sheet accounts at a conditional valuation of one ruble.

OS objects can be moved from one group to another (reclassified). The disposal of an object from one group and its inclusion in another group must be reflected in accounting simultaneously. Reclassification does not lead to a change in the value of fixed assets.

How to get started with the new standard

To properly implement FSBU, an institution must take several steps. And you should start with an inventory, which will give an idea of the state of fixed assets balances for correct accounting and application of the chosen depreciation method. It is necessary to check the property that was accounted for before January 1, 2021 on account 0 10100 000 for compliance with the standard. Having received data on objects that were previously reflected in off-balance sheet accounts or, according to some criteria, were not included in the fixed assets group, the accountant must put them on the balance sheet at their original cost.

Inventory results are standardly reflected in the Inventory List in the section on non-financial assets (form 0504087). It is important to mention that leasing objects, long-term lease with the right to buy, free (indefinite) use, and other rental payments are classified as NFA. For this purpose, by order of the Ministry of Finance of Russia dated November 17, 2017 No. 194n, additional columns were introduced into the inventory form: status of the accounting object, target function of the asset. New columns in the inventory have also appeared for objects that, after the introduction of the standard, do not meet the criteria of an asset. They are also entered into the Statement of Discrepancies based on the inventory results (form 0504092).

This needs to be done in order to divide the fixed assets into groups, including highlighting the objects of the “Investment Real Estate” group (currently they are taken into account according to separate analytics on account 101 and behind the balance on accounts 25 and 26).

In conclusion, I would like to note that the reform in public sector accounting and all the accompanying changes are associated with a change in the key task. If previously it was important to build control over settlements with the budget, now the assessment of the capitalization of organizations and the quality of the assets themselves comes to the fore.

DEPRECIATION OF FIXED ASSETS.

As for the procedure for calculating depreciation, the Standard contains differences from the norms of the current Instruction No. 157n. Let's consider the main provisions of the Standard.

Through straight-line depreciation, the cost of an asset during its useful life is transferred to expenses (to reduce the financial result).

Depreciation begins to accrue on the 1st day of the month following the month the asset was accepted for accounting. Accrual stops on the 1st day of the month following the month in which the residual value of the object becomes zero.

If an object is idle or not in use, but has a residual value, depreciation is not suspended.

The useful life of the OS is determined by:

a) based on the expected period of receipt of economic benefits and (or) useful potential of the object;

b) based on the recommendations contained in the manufacturer’s documents and (or) on the basis of the decision of the commission on the receipt and disposal of assets, taken taking into account:

- expected period of use of the object;

- expected physical wear, depending on the operating mode, natural conditions and the influence of an aggressive environment, the repair system;

- regulatory and other restrictions of the facility;

- warranty period for use of the object;

- terms of actual operation and previously accrued amount of depreciation - for objects received free of charge from other accounting entities, state (municipal) organizations.

The Standard further proposes three methods for calculating depreciation.

The institution selects the method that most accurately reflects how the future economic benefits or service potential of the asset is expected to be realized.

The selected method is applied consistently from period to period.

Next, it should be said about the new provisions for calculating depreciation depending on the cost of the fixed asset. Now they are closest to tax accounting and are as follows:

- for objects worth over 100,000 rubles. depreciation is calculated in accordance with calculated rates;

- for objects worth up to 10,000 rubles. inclusive, with the exception of the library collection, depreciation is not accrued. When commissioning movable property worth up to 10,000 rubles. their initial cost is written off from the balance sheet while simultaneously reflecting the object on an off-balance sheet account;

- for library collection objects worth up to 100,000 rubles. inclusive, depreciation is charged in the amount of 100% of the original cost when they are put into operation;

- for fixed assets costing from 10,000 to 100,000 rubles. depreciation is charged at 100% of the original cost when they are put into operation.

Depreciation upon revaluation. When revaluing an asset, the amount of accumulated depreciation as of the date of revaluation is taken into account in one of the following ways:

- recalculated in proportion to the change in the original value so that the residual value of the object after revaluation is equal to its revalued value. That is, book value and accumulated depreciation are multiplied by the same factor;

- deducted from the carrying amount, after which the residual value is restated to the revalued amount of the asset.

The amount of the adjustment that occurs when recalculating or excluding accumulated depreciation amounts forms part of the amount of increase or decrease in the residual value of fixed assets to be reflected in accounting.

Cost criterion

Current rules

PBU 6/01 allows organizations to set the maximum cost of an object that is classified as fixed assets.

In this case, the limit cannot exceed 40,000 rubles. for a unit. In practice, this rule is applied as follows. If an object meets all OS criteria, but costs no more than 40,000 rubles, it can be included in inventory. And write off the costs of it upon commissioning. If the cost of the object is more than this amount, there is no choice - it must be recognized as a fixed asset.

New rules

FSBU 6/2020 also gives companies the right to independently determine the threshold value of fixed assets. But there are two significant innovations:

- There is no limit. It can be anything, for example, 100,000 or 150,000 rubles.

- Objects that are below the specified limit are not recognized by the OS. Their costs are immediately written off as current expenses.

IMPORTANT

Currently, low-value property should be reflected in tax accounting differently than in accounting. If in BU the cost limit is 40,000 rubles, then in NU it is 100 thousand rubles. (Clause 1 of Article 257 of the Tax Code of the Russian Federation). This creates temporary differences for those who apply PBU 18/02 “Accounting for calculations of corporate income tax” (for more details, see “Instructions for the new edition of PBU 18/02 “Accounting for calculations of corporate income tax”, which must be applied from 2020 of the year"). Thanks to the new rules, this will be avoided. It is enough to set the same threshold value in accounting as in NU, that is, 100,000 rubles.

Maintain tax and accounting records of fixed assets according to the new rules

DISPOSAL OF FIXED ASSETS.

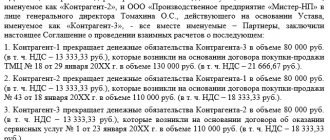

Recognition of an asset is terminated in the event of disposal of property as a result of sale, conclusion of a lease agreement providing for the transfer of significant operational risks and benefits to the user (lessee), transfer to another public sector organization, other organizations free of charge, on other grounds involving termination of the right to operational management of property , as well as in case of disposal of property as a result of write-off.

Disposal of fixed assets is reflected in the credit of the corresponding balance sheet accounts of fixed assets.

When recording the disposal of fixed assets, the following criteria must be met:

1. The accounting entity has transferred all significant operational risks and benefits associated with the disposal (ownership, use) of the property reflected in the fixed assets.

2. The accounting entity no longer participates either in the disposal of the retired asset or in its actual use.

3. The amount of income (expense) from disposal of an asset can be reliably estimated.

4. The projected economic benefits or utility potential associated with the asset, and the costs incurred or expected, can be estimated reliably.

Income receivable on disposal of fixed assets is subject to initial recognition at fair value.

The financial result arising from the disposal of an asset is reflected as part of the financial result of the current period. It is defined as the difference between the disposal proceeds, if any, and the residual value of the fixed asset.

Treasury payment system

From January 1, 2021, all settlements on personal accounts opened with the Treasury and financial authorities will go through the Treasury. Accounts of financial authorities with the Central Bank of the Russian Federation will be closed.

The Treasury will have a single treasury account No. 401 02, and several treasury accounts will be opened for the Treasury and financial authorities, differing in types of funds and transactions. Personal accounts of budgetary and autonomous institutions, PBS, revenue administrators, etc. will be opened for them.

The Treasury will independently conduct transactions between personal accounts, without issuing payment orders. However, the Central Bank will handle settlements with organizations that do not have such personal accounts.

Submit reports to regulatory authorities on time and without errors! We are giving access for 3 months to Kontur.Ektern!

DISCLOSURE OF INFORMATION ABOUT PE IN THE REPORTING.

For each group of fixed assets, the following information is disclosed in the accounting (financial) statements:

a) the methods used to calculate depreciation;

b) applied methods for determining useful life;

c) the amount of the book value, as well as the amount of accumulated depreciation in combination with the amount of accumulated losses from impairment of fixed assets at the beginning and at the end of the period by groups of fixed assets;

d) reconciliation of the residual value at the beginning and end of the period.

Additionally, for each group of fixed assets, the following information is disclosed in the reporting:

- the presence and size of restrictions on property rights or other rights granted, including the value of real estate and especially valuable movable property that cannot be used by the accounting entity as security for obligations, as well as the residual value of fixed assets transferred as security at the beginning and end of the reporting period period;

- the amount of costs included in the cost of fixed assets during construction at the beginning and end of the reporting period;

- the amount of contractual obligations for the acquisition (construction) of fixed assets at the end of the reporting period;

- the amount of compensation due from third parties in connection with the impairment, loss or transfer of fixed assets included in income of the current period.

The following information is disclosed in relation to investment properties:

- description of investment properties;

- criteria for distinguishing between investment property and property occupied by an institution and property held for sale in the ordinary course of business;

- amounts recognized as income from the rental of investment property;

- amounts recognized as expenses (including repairs and ongoing operation) associated with investment real estate, income from the rental of which is reflected in the financial result of the reporting period;

- amounts recognized as expenses (including repairs and ongoing maintenance) associated with investment property that was not leased;

- the presence of restrictions regarding the possibility of selling investment real estate or receipts of economic benefits (income) from disposal, as well as the amount of these restrictions.

The explanatory note presented as part of the accounting (financial) statements additionally reflects the following information:

- on the balance sheet and residual value of temporarily idle fixed assets;

- on the book value of fixed assets that are in operation and have zero residual value;

- on the book value and residual value of fixed assets withdrawn from operation and held until their disposal.

Changes in KBK

In the order of formation of BCC No. 85n, new codes for types of expenses appeared. New lists of KBK No. 99n have also been approved, which replace the current order No. 207n.

Amendments have been made to the procedure for applying KOSGU No. 209n. Income from reimbursement of costs for measures to reduce injuries and occupational diseases, as well as sanatorium and resort treatment, is now reflected in subsection 139 of KOSGU. When taking into account the costs of purchasing the rights to use intangible assets, it is still necessary to apply subarticle 226 of KOSGU. There are other innovations as well.