Good day! Today I have another article and we will talk about reporting in business, namely the book of income and expenses (abbreviated KUDiR) in 2021

.

While preparing the article, I spent about 6 hours trying to figure out this topic. I just couldn’t figure out KUDiR for PSN, Unified Agricultural Tax and OSNO.

Selecting the necessary information about the book of income and expenses in 2017 from tons of materials, links, and outright misinformation turned out to be much more difficult.

But still, I managed to achieve the desired result, and I present it to your judgment.

What's new

Adjustments to the form of the book of income and expenses from 2021 were made by orders of the Ministry of Finance of Russia dated December 7, 2021 No. 227n. Let's look at them in detail. Let us remind you that it was adopted by order of the Ministry of Finance dated October 22, 2012 No. 135n.

Order of the Ministry of Finance of the Russian Federation dated December 7, 2016 No. 227n was officially published on December 30, 2021. The updated ledger for accounting income and expenses must be used from January 1, 2021. That is, from the beginning of the tax period according to the simplified tax system.

Trade fee

Based on paragraph 8 of Article 346.21 of the Tax Code of the Russian Federation, “simplifiers”, even with the object “income”, have the opportunity to reduce their tax through deductions from the trade tax where it is valid (so far only in Moscow).

For these purposes, they keep a book of income and expenses. Since 2017, a separate 5th section has been introduced. It looks like this:

As you can see, all payments for the trade fee are given in chronological order.

Note that before the appearance of this section, the book form did not imply a reflection of the trading fee at all. Accountants had to keep in mind the imputed tax amounts and reduce the simplified tax by them even before entering it into the book. Now such a need has disappeared.

Seal

Since 2021, the Ministry of Finance has directly indicated that the book does not need to be certified with a seal if a company or individual entrepreneur on the simplified tax system prefers to abandon its own stamp.

Let us remind you that such an opportunity appeared for business companies on April 7, 2015 thanks to the Federal Law of April 6, 2015 No. 82-FZ.

Let us note that previously the accounting department had to print out the entire electronic book of income and expenses on the simplified tax system at the end of the year and affix the company’s stamp and signatures on it. For the period 2021 and 2017, this will also have to be done, but without the obligatory company stamp.

Profit of controlled foreign companies

From 2021, only the income of the simplifier himself should appear in the book in question. Let us recall that they are shown in the fourth column of the 1st section.

In the rules for filling out the book, the Ministry of Finance clarified that the profits of foreign companies controlled by the domestic simplifier in the book of income and expenses under the simplified tax system since 2017 .

The catch was that a completely different tax is paid on the profits of CFCs - on profits, and the register in question is kept only for the purposes of the simplified tax system. Meanwhile, the rule that CFC profits do not need to be included in the book has not been recorded anywhere.

IP "Revenue" without staff

The updated rules for filling out the book of income and expenses since 2017 have significantly simplified the corresponding obligation for businessmen without employees who use the “income” object and pay insurance premiums only for themselves.

From January 1, 2021, Article 430 of the Tax Code comes into force. And under the name “insurance premiums in a fixed amount” she combined:

- contributions based on minimum wage

- contributions in the amount of 1% of income over 300,000 rubles

This suggests that businessmen using the simplified tax system will be able to easily list in the book all their deductions for compulsory insurance: both from the minimum wage and 1 percent of income above the specified level.

Note that until 2021, controllers often took hostility to reducing the tax on the simplified tax system due to one-percent contributions. Hence, problems arose with filling out the book of income and expenses.

Application of KUDiR

KUDiR - stands for a book of income and expenses under a simplified taxation system. Everyone who uses the simplified procedure is required to keep a book of income and expenses. In the book of income and expenses, organizations and individual entrepreneurs using the simplified tax system must reflect business transactions completed in the reporting (tax) period.

For each new tax period (year), you need to create a new accounting book (clause 1.4 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n). The book of income and expenses is compiled in a single copy. Starting from 2021, you need to open a new book using a new form.

Results

Maintaining KUDiR, according to which tax is calculated, is mandatory when applying the simplified tax system.

The form of this book and the basic rules for filling it out are valid for both objects for calculating the simplified tax system. A peculiarity of the design of KUDiR under the simplified tax system “income minus expenses” is that 3 sections out of 5, forming the main part of the book, are intended for this taxable object. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Composition of the new form: sections of the book

Starting from 2021, you need to use a new form of income and expense accounting book. Changes to KUDiR from 2021 were made by order of the Ministry of Finance dated December 7, 2016 No. 227n.

The book of income and expenses, used since 2021, consists of a title page and five sections:

- Section I “Income and Expenses”

- Section II “Calculation of expenses for the acquisition (construction, production) of fixed assets and for the acquisition (creation by the taxpayer himself) of intangible assets taken into account when calculating the tax base for the tax for the reporting (tax) period”

- Section III “Calculation of the amount of loss that reduces the tax base for the tax paid in connection with the application of the simplified taxation system for the tax period”

- Section IV “Expenses provided for in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation, reducing the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) for the reporting (tax) period”

- Section V “The amount of the trade fee that reduces the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) calculated for the object of taxation from the type of business activity in respect of which the trade fee is established for the 20__ reporting (tax) period”

as amended by order of the Ministry of Finance dated December 7, 2016 No. 227n (including a new form of the income and expenses accounting book).

Completing Section 4 “Expenses that reduce the amount of tax”

In section 4, it is necessary to record the amounts of contributions paid quarterly and in the corresponding lines the data is given in cumulative totals for six and nine months, and the annual total is calculated. The columns of the table indicate each of the insurance premiums that must be specified. Contributions are also indicated for employees if they were hired by an individual entrepreneur during this period. Further, advance payments of taxes must be taken into account when calculating the taxable base within the established limits.

If an individual entrepreneur has hired workers, then the following payments must be indicated in the section:

- contributions made from employee salaries

- payments for sick leave paid from the individual entrepreneur’s own funds

- voluntary insurance payments

- fixed amounts of insurance premiums that were paid by the individual entrepreneur for himself

When comes into force: controversial point

Changes to the form of the book according to the simplified tax system were made by order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n. This Order comes into force after one month from the date of its official publication (published on December 30, 2016), but not earlier than the 1st day of the next tax period according to the simplified tax system. That is, from January 1, 2021. Some experts think so. However, we have a different opinion. Let me explain.

The calendar month after the publication of the said document is December 2021. This month ended December 31, 2021. The next day, January 2021 arrived. The changes come into force no earlier than the 1st day of the next tax period according to the simplified tax system. The tax period according to the simplified tax system is a calendar year. This means the new form of the book applies from January 1, 2021, and not from January 1, 2021.

Order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n states that it comes into force precisely after the expiration of a month. And the month of publication is December 2021.

Rules for filling out KUDiR under the simplified tax system

KUDiR is always filled out in a single copy. When a new tax period (TP), namely the year, begins, a new Book is opened. This document can be maintained in paper form, as well as electronically.

If the Book was kept by the taxpayer in paper form, then before the moment of making relevant entries in it, it is necessary to:

- Create a title page

- Don't forget about stapling and page numbering

- The last page of the Book, which is completely numbered and bound, is filled with information regarding the pages contained in it

- Get certification directly from the head of the company/organization/individual entrepreneur

- Apply the seal of the company/organization

When maintaining this document in electronic form, at the end of each reporting/tax period it will need to be printed, in other words, transferred to paper.

Upon completion of the NP, perform the following manipulations:

- Print the document in its entirety

- Stitch it well, remembering to number the pages and indicate their total number on the last page of the Book.

- Have the certification signed by the head of the organization/company/individual entrepreneur

- Securing the signature with the appropriate seal

Here it is imperative to pay attention to the fact that certification of the Book by the tax office is no longer necessary, since it is not provided for by the Procedure.

What are the fines for KUDiR under the simplified tax system?

If the Book was not kept or the indicators were incorrectly reflected in it, violators will face liability based on Article No. 120 of the Tax Code of the Russian Federation. The fine in this case can vary from 10 thousand rubles. up to 30 thousand rubles

If it so happens that certain violations that were committed led to a decrease in the tax base, then the fine will be 20% of the amount of tax that was not paid, but not less than 40 thousand rubles.

KUDiR in electronic version

Today, there is an excellent opportunity to maintain a Book on the simplified tax system in electronic form (for example, in Excel). Alternatively, you can also use an online service that can be found on the Internet. This development is very convenient in that all Book data is stored not in accessible form, but in encrypted form. If necessary, you can log into the service using your password and login and print the document.

KUDiR sections

The book consists of four sections:

- Section No. 1: “Income and Expenses”

- Section No. 2: reflection of Expenses for the creation / acquisition of fixed assets, intangible assets

- Section No. 3: filled out by those who received any losses based on the results of previous tax periods

- Section No. 4: filled in only with “simplified” ones, distinguished by the “Income” object. This reflects insurance premiums paid by employees for benefits due to temporary disability, as well as payments based on a voluntary personal insurance agreement

Section No. 1 is supplemented with Help.

When filling out the first section, you must provide the following information:

- Column 1 – entering the serial number of the transaction that is being registered

- Column 2 – designation of the date, number of the primary document, which is the basis for receiving Income / registration of Expenses

- Column No. 3 – indicates the content of the operation that is being registered

- Column No. 4 – enter the amount of Income, which is taken into account during the calculation of the single tax

- Column No. 5 – enter the amount of Expenses, which is taken into account during the calculation of the single tax (necessary for those who pay tax on the difference between D/R). Those companies/organizations that use the “Income” object, based on the general rule, do not enter data regarding Expenses into the Book. However, since 2013, an exception to the above rule has been introduced. For simplified people who have an “Income” object, according to the new rules, it is necessary to reflect the amounts spent on subsidies (those that were allocated by companies / firms from the budget for certain purposes). Clause 2.5 of the Procedure provides for two types of such financing: the state is allowed to partially reimburse the Costs of creating additional jobs, and the budget can also allocate funds for the development of small/medium businesses

In other cases, based on the general rules, organizations / firms / individual entrepreneurs that pay a single tax on income must fill out exclusively the first section and only that part of it that concerns income.

Making corrections to KUDiR

Certain changes may be made to this document, but they must be supported by an appropriate basis for this. To carry out this operation, the organization must have strong arguments that can confirm the legality of the changes made (for example, primary documents, accounting statements, etc.). If the Book is maintained in paper form, then to correct the error you will need:

- Carefully cross out the mistake you made.

- Enter the correct value of the indicator next to it

- Add the change with the date of the manipulations performed

- Corrections must be certified by the signature of the head of the organization/company and sealed with the appropriate seal

The rules for adjusting KUDiR, which is maintained electronically, have not been officially established. However, in practice it looks like this: if this document was maintained electronically on a computer, you will need to delete incorrect values and enter others (correct ones).

Correct reflection of income in KUDiR

It is known that under the simplified tax system one should take into account income from sales, as well as non-operating income (their composition should be determined based on Articles No. 249, No. 250 of the Tax Code of the Russian Federation). Thus, only these amounts should be entered in column No. 4 of Section No. 1 of KUDiR.

This document does not require reflection of the revenues listed in Article No. 251 of the Tax Code of the Russian Federation. Also, if an organization / company is engaged in combining UTII and simplified tax system, then it should not show income from the activities that were transferred to pay UTII.

Income that was received in kind must be accounted for based on market prices. Thus, the market value of the property is entered in column No. 4, Section No. 1 of the Book. In this case, supporting documents will be considered acts of acceptance/transfer of property, accounting certificates in which calculations of the market value of the property were made.

Reflection of income in kind in KUDiR (example)

Liven LLC applies the simplified tax system and has the object “Income minus expenses.” The organization provides furniture repair and sale services.

The company entered into an exchange agreement, according to which it is obliged to ship a batch of tables for a total cost of 14.8 thousand rubles, in return for this, arrange for the receipt of materials (screws / screws / nails / nuts, etc.). Both parties transferred the property on January 16, 2017. The company’s accountant determined that the market value of the materials that were received was equal to the amount of 7,540 rubles. Since the property was recognized as unequal, the party transferring the materials transferred the difference in money on January 19, 2017. The income received should be reflected in the tax accounting of Liven LLC.

Thus, LLC “Liven” on January 16, 2017 must record in column 4 of section No. 1 KUDiR the market value of materials that were received within the specified time frame (RUB 7,540), and on January 19, 2017 – the amount of funds received from counterparty (that is, 14.8 thousand rubles - 7540 rubles).

Income that was received during the offset of mutual claims must be reflected in the KUDiR by the date of signing the act regarding the offset of mutual claims. According to Article No. 410 of the Civil Code of the Russian Federation, at the moment the buyer signs the act, his obligation is extinguished directly to the seller. Thus, the date of repayment of the obligation is the date of receipt of the corresponding income (Article No. 346.17, paragraph 1 of the Tax Code of the Russian Federation). The act of offsetting mutual claims is the basis for making certain entries in the KUDiR.

| Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base | ||

| 1 | 2 | 3 | 4 | 5 |

| … | … | … | … | … |

| 69 | Property acceptance and transfer certificate No. 13 dated 01/16/2017, accounting certificate No. 38 dated 01/16/2017 | The market value of materials is reflected in income | 7540 | — |

| 70 | Bank statement No. 41 dated January 19, 2017 | The amount transferred under the exchange agreement is reflected in income | 7260 | — |

| … | … | … | … | … |

Correct reflection of expenses in KUDiR

In column 5 of section No. 1 of KUDiR, “simplified” residents with the object “Income minus expenses” should enter the expenses that are listed in article No. 346.16, paragraph 1 of the Tax Code of the Russian Federation.

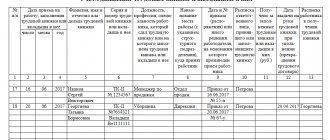

Reflection in KUDiR personal income tax in kind (example)

Liven LLC uses the simplified tax system and has the “D-R” facility. On 02/05/2017, the organization paid the second part of the salary to employees for January 2021 in the amount of 430.9 thousand rubles. The wages were paid from cash proceeds. On 02/06/2017, personal income tax withheld from employee income was transferred in the amount of 110,552 thousand rubles. The listed operations should be correctly reflected in the KUDiR.

The company/organization has every right on 02/05/2017 to take into account in the item of labor costs the amount of wages that were issued, without personal income tax (that is, 430.9 thousand rubles), and on 02/06/2017 - personal income tax, which was withheld and transferred to the budget (that is, 110,552 thousand rubles).

Since wages and personal income tax were transferred on different days, they must be reflected in separate entries in KUDiR.

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| … | … | … | … | … |

| 123 | Payroll No. 7 dated 02/05/2017 | The paid salary is taken into account in expenses | — | 430 900 |

| 124 | Payment order No. 389 dated 02/06/2017 | Included in personal income tax expenses | — | 110 552 |

| … | … | … | … | … |

When reflecting in the KUDiR expenses for writing off the cost of certain goods, in addition to the payment order / cash receipt, which confirms payment for the corresponding goods, you should reflect the details of the accounting certificate justifying the date of writing off the cost of a particular product as an expense item. This rule is confirmed by Article No. 346.17, paragraph 2 of the Tax Code of the Russian Federation.

Reflection in KUDiR of the cost of goods sold (example)

LLC "Liven" applies the simplified tax system, has the object "Income minus expenses", and sells children's toys. On 03/06/2017, the store purchased construction sets (30 pieces) at a cost of 800 rubles. excluding VAT / piece. The selling price of one set is set at 1,400 rubles.

On March 13, 2017, 5 sets of this toy were sold. Cash for the goods sold was received from the buyer on March 16, 2017.

The previously mentioned transactions should be reflected in tax accounting. Thus, the purchase price of goods sold should be written off as an expense item after payment has been made to the supplier and sales to the buyer. For this reason, on March 13, 2017, the company has the right to include 4 thousand rubles in the expense item. (800 rub. x 5 pieces).

On March 16, 2017, income should be reflected in the amount of 7 thousand rubles. (1400 RUR x 5 pieces).

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| … | … | … | … | … |

| 92 | Payment order No. 38 dated 03/06/2017, accounting certificate No. 15 dated 03/13/2017 | The purchase price of sold constructors is reflected in expenses | — | 4000 |

| 93 | Bank statement No. 118 dated March 16, 2017 | Revenue from the sale of constructors is included in income | 7000 | — |

| … | … | … | … | … |

When making an entry in KUDiR regarding normalized expenses, in addition to the payment order, you should also indicate the details of the bank certificate, since on its basis the amount that relates to expenses was calculated.

The cost of materials / raw materials of companies and organizations working on the simplified tax system have the opportunity to be taken into account in the expense item immediately after they have been capitalized and paid. Thus, waiting for goods/raw materials to be released into production becomes unnecessary. The above explanations are supported by letter No. 03-11-11/284 of the Ministry of Finance of the Russian Federation dated October 27, 2010.

Correctly filling out section No. 3 of KUDiR according to the simplified tax system

Completing section No. 3 KUDiR is required only if the following conditions are simultaneously met:

- Object of taxation – “Income that is reduced by expenses”

- Presence of losses in the reporting year / previous years

So, if one or another, “Income minus expenses,” but there were no losses, you do not need to fill out this section.

To begin with, experts recommend understanding why section No. 3 of KUDiR is provided for. Since companies/organizations working on the simplified tax system and having the object “Income minus expenses” should, at the end of the year, reduce the tax base under the simplified tax system by the amount of past losses that were received during the application of this special regime. Here you should immediately pay attention to the fact that this is not a right, but an obligation. If a reduction in the current year’s income by the amount of last year’s losses is unprofitable for someone, then the reduction in the tax base can not be reduced, but the losses can be carried forward to future periods (any loss can be written off within ten years).

For clarification, experts remind that losses include the amount of excess expenses that were taken into account directly over the amount of income received for the same period. And since writing off last year’s losses to reduce the current tax base under the simplified tax system is possible only based on the results of the year, section No. 3 of KUDiR should also be filled out only based on the results of the year. How to do this correctly?

Line 010 indicates the total amount of losses that were transferred from previous periods.

This amount is distributed in detail in lines 020-110, namely by year of occurrence.

Line 120 records the value of the tax base for the tax under the simplified tax system, the period is the current reporting year.

Line 130 indicates the amount of losses by which the organization/firm will reduce the current tax base. By the way, the indicator in this line must be less than the indicator recorded in line 010.

For reference, line 140 records the amount of losses for the current period. This amount can be determined by paying attention to line 041 of the certificate to section No. 1 of KUDiR. Companies/organizations can use this amount to reduce their tax base for the next year.

If in the current year the company/organization did not write off losses in full, then the total amount of unused losses should be indicated in line 150.

In lines 160-250 it is necessary to enter this amount by year of occurrence of certain losses.

An example of filling out Section III of the Income and Expense Accounting Book

Zvezda LLC has been applying the simplified tax system with the object of taxation being income minus expenses since 2012. For 2014 and 2015, the organization received losses in the amount of 110,500 rubles. and 183,400 rub. respectively. For 2017, the tax base under the simplified tax system (that is, the excess of income over expenses) amounted to 285,500 rubles. The organization decided to reduce the 2021 tax base by the amount of past losses. In previous years of application of the simplified tax system, the tax base for losses was not reduced. Let's fill out section III of the Accounting Book.

In line 010 we will show the total amount of past losses received when applying the simplified tax system. It is equal to 293,900 rubles. (RUB 110,500 + RUB 183,400).

In lines 020 and 030 we will write down the amounts of losses for 2014 and 2015.

In line 120 we will reflect the tax base for 2021 - 285,500 rubles. This is less than the amount of losses, and the accountant of Zvezda LLC decided to reduce the tax base to zero, that is, by 285,500 rubles. We will indicate this amount in line 130.

There will be a dash in line 140, since there are no losses for 2021.

The amount of unused losses is RUB 8,400. (293,900 rubles - 285,500 rubles) will be written in line 150. It can be kept in mind when calculating the tax base for the following periods. The losses received earlier are used first. Therefore, we will assume that the loss for 2014 has been fully utilized. And in line 160 we indicate the year 2015 and repeat the value of 8400 rubles.

Situation. The organization worked under the simplified tax system, then under the general regime, and then returned to the “simplified” regime. How to fill out section III of the Accounting Book

The tax base under the simplified system can be reduced only by losses received when applying the simplified tax system with the object of income minus expenses. Thus, losses incurred under the general regime for organizations and entrepreneurs who switched to the “simplified system” are not taken into account.

But sometimes it also happens that an organization worked on the simplified tax system with the object income minus expenses, then switched to the general regime, and then returned to the “simplified system” with the object income minus expenses. Question: is it possible to reduce the tax base for those losses that were received during the previous application of the simplified tax system? The answer is yes. If ten years have not passed since the receipt of losses, then it is allowed to reduce the tax base for them under the simplified tax system (clause 7 of article 346.18 of the Tax Code of the Russian Federation). It does not matter that they were obtained during the previous application of the “simplified procedure”, the main thing is that these were losses not of the general regime. namely the simplified tax system. The Russian Ministry of Finance shares the same opinion in letter dated January 28, 2011 No. 03-11-11/18.

The procedure for filling out KUDiR from 2021: changes made

The changes include the cancellation of certification of KUDiR with the seal of an individual entrepreneur if it is not available. There is also a clarification that in section No. 5 of the Book, entrepreneurs should indicate all insurance costs: contributions from the minimum wage / contributions from income.

Among other things, section No. 6 was added to the document. It should be filled out exclusively by trade tax (TC) payers with the “Revenue” object.

Section No. 6. The value of the TS, which reduces the amount of tax paid due to the application of the simplified tax system, calculated for the object of taxation directly from the type of business activity in relation to which the TS was established.

| No. | Date and number of the primary document | The period for which the trade fee was | trade fee paid |

| 1 | 2 | 3 | 4 |

| … | … | … | … |

| … | … | … | … |

| … | … | … | … |

| Total for the first quarter | … | ||

| … | … | … | … |

| … | … | … | … |

| … | … | … | … |

| Total for the second quarter | … | ||

| Total for the half year | … | ||

| … | … | … | … |

| … | … | … | … |

| … | … | … | … |

| Total for the third quarter | … | ||

| Total for 9 months | … | ||

| … | … | … | … |

| … | … | … | … |

| … | … | … | … |

| Total for the fourth quarter | … | ||

| Total for the year | … | ||

Section No. 6 KUDiR should be filled out by firms/organizations on the simplified tax system for “Revenue” objects. The amount of the vehicle that was paid is entered here.

Column 1 contains the serial number of the transaction that is being registered.

Column 2 is filled in with information regarding the date and number of the primary document on the basis of which the registered transaction was carried out.

In column 3 you should enter information about the period for which the vehicle payment was made.

In column 4, enter the amount of the vehicle that was paid.

Certification of KUDiR for 2021 and 2021 in the inspection: is it necessary?

Thus, it became known that the certification of the Book for 2021 and 2021 should not be done at the tax office.

Let us remind you that in the old KUDiR forms there were columns on the title page - tax officials’ marks were placed in them. The new form, which has been used since 2021, does not contain a corresponding line on the title page in which a representative of the tax office must sign.

These forms were approved by order No. 135n dated October 22, 2012 by the Ministry of Finance. Already from 01/01/2017, the changes described above will be made to the Book, but they do not at all affect its certification by tax authorities. In other words, the Book for 2021 is not certified by the Federal Tax Service.

KUDiR in 2021 (sample)

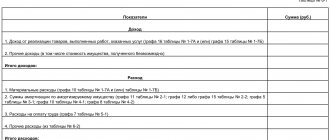

An example of calculating the simplified tax system 15% “income minus expenses”

In the 1st quarter of 2021, the cash register of an individual entrepreneur without employees received revenue in the amount of 18,000 rubles, an advance was received from the buyer - 10,000 rubles, goods were purchased with a purchase price of 11,000 rubles, which the individual entrepreneur sold for 16,000 rubles, and The individual entrepreneur also paid for his training in the course in the amount of 4,000 rubles.

In the 2nd quarter of 2021, part of the advance received in the 1st quarter was returned to the buyer - 5,000 rubles; goods were purchased in the amount of 1,0000 rubles, which the individual entrepreneur sold for 15,000 rubles.

We will calculate the advance payments of individual entrepreneurs for the 1st quarter and half of the year.

In the 1st quarter, taxable income amounted to 44,000 rubles. Expenses reducing the tax base amounted to 11,000 rubles.

Everything that is considered expenses under the simplified tax system of 15% is listed in Art. 346.16 Tax Code of the Russian Federation. Paying for an individual entrepreneur’s training is not such an expense, so 4,000 rubles. are not accepted for deduction and are not included in KUDiR (letter of the Ministry of Finance of the Russian Federation dated August 1, 2013 No. ED-3-3/2730).

Tax base for the 1st quarter of 2021 = 44,000 rub. – 11,000 rub. = 33,000 rub.

Advance payment for the 1st quarter = 33,000 rubles. x 15% = 4950 rub.

In the 2nd quarter, taxable income will decrease due to the return of part of the advance payment to the buyer and will amount to 10,000 rubles. Expenses amounted to 10,000 rubles.

Tax base for the first half of 2021 = RUB 33,000. + (10,000 rub. – 10,000 rub.) = 33,000 rub.

Since the tax base for the 2nd quarter is zero, and the advance payment was paid for the 1st quarter, the individual entrepreneur does not have to pay an advance tax for the first half of the year.

Filling out KUDiR

Basic rules for conducting KUDiR:

- For each tax period, a new book of income and expenses is opened.

- Each operation is entered in chronological order on a separate line and confirmed by the appropriate document (agreement, check, invoice, payment order, etc.)

- Replenishment of the account, increase in the authorized capital are not recognized as income and, accordingly, are not entered into the KUDiR.

- KUDiR can be used in paper or electronic form. When maintaining a book in electronic form, at the end of the tax period, KUDiR must be transferred to paper media

- The book must be laced, numbered and confirmed by the manager’s signature and seal (if any)

- Unfilled sections of KUDiR are still printed and stapled in the general order

- In the absence of activity, profit or expenses, individual entrepreneurs and organizations must still have zero KUDiR

Completing Section 1 “Income and Expenses”

In section 1 of the accounting book, individual entrepreneurs who are under the income tax regime record their income. The form is designed to be completed quarterly and contains 4 tables. Each operation is recorded on a separate line; you can add more lines if necessary. The tables have five vertical columns that need to be filled out, as follows:

- transaction numbers, transactions are in chronological order

- date and number of the document that forms the basis of the transaction; dates of invoices, bills, etc. are indicated here.

- content of the operation - it is necessary to briefly reflect its essence

- in the income column – write down the amount of income received

- the expenses column - for individual entrepreneurs with taxation of only income, is not filled in.

And so, section 1 is filled out sequentially throughout the year.

Let us only note that, for example, cash revenue is summed up for the day and reflected in one entry; the basis of the operation is the Z-report. Thus, we enter the date and number of this cash report into the table. You can do the same with other similar income. When a stream of payments arrives in your current account, you can rely on the daily bank statement.

Note that sometimes there are cases when it is necessary to make a chargeback, then an entry is made in the book in the income column, as usual, but with a minus.

After the completion of each quarter, the section summarizes the total numerical results in the corresponding rows of the tables. In specially designated lines, cumulative cumulative totals for six and nine months are reflected, and the annual total is calculated.

In the expenses column, entries for this taxation system are made extremely rarely, for example, if expenses were incurred using funds received under the SME support program from government subsidies. These amounts must be reflected in both income and expense columns so that they do not contribute to the tax base.

Note that there are other non-taxable incomes; they do not need to be recorded in KUDIR. Often individual entrepreneurs receive income from sales and income “outside sales”; these concepts must be separated.