Home — Articles

In their activities, taxpayers often resort to the services of intermediaries as a profitable method when paying for goods (works, services). Intermediaries, using their contacts, experience and specializations, ensure wide availability of goods and bring them to a specific consumer. However, in the process of work, a lot of difficulties arise for both parties to the transaction, one of which is the preparation and issuance of invoices . This is the question we will address in this article.

Procedure for issuing invoices

What is common to all intermediaries (commission agent, agent, attorney) is that they act in the interests of the customer and at his expense; everything they receive from third parties is the property of the customer and is subject to transfer to him. Settlements between the customer and third parties can be made either directly with or without the participation of an intermediary. Acting within the framework of a commission agreement, the intermediary (commission agent), on his own behalf, writes out all the necessary documents related to the transaction when selling goods. The intermediary (agent) acts similarly, acting within the framework of the agency agreement on his own behalf and in the interests of the principal. They are required to follow a certain procedure for issuing invoices so that the principal (principal), being a VAT payer, can fulfill his obligations for VAT calculations. When selling goods (work, services), as well as upon receiving payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), appropriate invoices are issued (clause 3 of Article 168 of the Tax Code of the Russian Federation). The procedure for issuing invoices is regulated by the Rules for maintaining logs of received and issued invoices, purchase books and sales books for VAT calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914 (hereinafter referred to as the Rules).

Participants in the commission agreement

The first thing that needs to be noted regarding responsibilities is that they are established in Chapter 51 of the Civil Code of the Russian Federation. However, this is not a limitation; the parties, at their discretion, can add their own conditions to the contract. As for the standard ones, which cannot be excluded, it is worth talking about them in more detail.

Execution. If the terms of the contract are fulfilled, but not in favor of the customer, then this is a violation of Art. 992 of the Civil Code of the Russian Federation.

It should also be noted that such a technical specification is not expected. Such trading relationships within the framework of an agency or commission contract by default imply that the performer is a professional or acts in accordance with business custom.

Deviation from conditions. In cases where the contractor needs to deviate from the instructions given by the customer, this must also be done in favor of the principal. However, there are a number of restrictions:

- before deviating from the conditions, it is necessary to notify the committent and wait for his decision;

- if a decision has not been received, but actions have been taken, then report them and the results as soon as possible.

However, the contract may provide for such derogations. This means that the commission agent does not have to ask permission and notify about his actions.

Sale. Now regarding the difference in sales. If the executor sold the property at a price lower than it is actually worth, the commission agent will reimburse the difference. However, if he proves that such a purchase was necessary in order to prevent even greater losses, then no fee will be charged.

In the case where the purchase was made at a high cost, then the customer has the right to refuse this product. However, for this it is necessary to notify the contractor about this as soon as possible. Otherwise, refusal will not be possible. It will also be impossible when the commission agent, with a more expensive purchase, makes up the difference from his own funds.

It follows from this that all unforeseen transactions that in one way or another relate to the customer’s money must be discussed with him without fail. The only exceptions are those cases when there was no timely response from the customer, and the purchase prevented or justified all losses, or when this is provided for by the terms of the contract and the commission agent can act independently.

Sales of goods

To draw up an intermediary invoice, please refer to clause 24 of the Rules. The obligation to draw up an invoice for sales arises with the intermediary (commission agent, agent) when he acts on his own behalf . The commission agent (agent) draws up an invoice on his own behalf upon receipt of an advance payment (prepayment) for upcoming deliveries of goods in two copies. It operates similarly when selling goods. One copy is handed over to the buyer, the second is filed in the journal of issued invoices without registering it in the sales book. In turn, the principal (principal) issues an invoice in the name of the intermediary, registering it in the sales book. This invoice reflects the invoice figures issued by the intermediary to the buyer. The intermediary does not register this invoice in the purchase book. The intermediary issues a separate invoice to the principal (committee, principal) for the amount of his remuneration under the agency agreement (commission, agency agreement). This invoice is registered in the prescribed manner with the attorney (commission agent, agent) in the sales book, and with the principal (committee, principal) in the purchase book.

Dispute Resolution

All disputes related to the commission agreement are resolved in court. Situations that may result in going to court include:

- all the nuances that are associated with the integrity of the property when transferring it to the customer;

- liability of the contractor in case of damage to property that should have been transferred to the customer;

- issues of termination of the contract if there is inconsistency regarding its subject after the transfer of property;

- nuances of termination of obligations after the expiration of the contract;

- failure to comply with deadlines when transferring funds to the principal;

- payment of a penalty in the event that the terms of the contract are either not fulfilled or performed improperly;

- payment of costs for storing property that was issued to the commission agent.

The resolution of disputes under a commission agreement in the Supreme Court may take a long time due to the fact that it itself is quite ambiguous.

You can speed up the process if you first enter into an agency agreement rather than a commission agreement.

Now that the nuances of the commission agreement have been sorted out, it is much easier to navigate its conceptual apparatus and operating principle. As a principal, you need to follow certain safety rules so as not to be deceived by the commission agent and not have problems with the tax authorities. In the case of the executor, it is required to fulfill his duties in good faith, which will a priori prevent legal disputes.

For more information about the parties to the commission agreement, see the video below.

Preparation of invoices for sales

As a rule, intermediaries did not have any questions regarding the preparation of invoices when selling goods. In this case, the general procedure provided for in paragraph 3 of Art. 168, art. 169 of the Tax Code of the Russian Federation and the Rules. In the Letter of the Federal Tax Service of Russia dated 02/04/2010 N ShS-22-3/ [email protected] (hereinafter referred to as Letter N ShS-22-3/ [email protected] ), the tax department indicated it again. The commission agent (agent), upon receipt of an advance payment (prepayment), fills out the invoice as follows : - in line 1 of the invoice, the commission agent (agent) indicates the date of issue and the serial number of the invoice in chronological order; — lines 2, 2a, 2b indicate the name and location of the commission agent (agent) in accordance with the constituent documents, as well as his tax identification number and checkpoint; — lines 3 and 4 contain dashes; — line 5 indicates the details (number and date) of the payment document or cash receipt (when making payments using payment documents or cash receipts to which the invoice is attached) about the buyer’s transfer of advance payment to the commission agent (agent). In case of prepayment in a non-cash form of payment, a dash is placed; — lines 6, 6a and 6b are filled in in the order specified in the Rules; — Column 1 indicates the name of the goods supplied (description of work, services), property rights; - in columns 2 - 6, dashes are placed; — Column 7 indicates the tax rate determined in accordance with clause 4 of Art. 164 Tax Code of the Russian Federation (10/110 or 18/118); — Column 8 indicates the amount of tax determined in accordance with clause 4 of Art. 164 of the Code. — in column 9 enter the amount of the prepayment received, taking into account the amount of VAT; — in columns 10 and 11, dashes are placed. For clarity, let's give an example.

Example. LLC "Commissioner" received a 100% prepayment from LLC "Buyer" by payment order dated December 7, 2010 N 77 in the amount of 118,000 rubles, including VAT - 18,000 rubles. for 10 units of product 1, purchasing it for Komitent LLC. The “commission agent”, having received the advance payment, will issue an invoice in the name of the buyer. When selling goods on December 17, the commission agent will issue an invoice in the name of the buyer. At the same time, he: - in line 1 indicates the date of issue and the serial number of the invoice in chronological order; - in lines 2, 2a, 2b indicates the name and location of the commission agent (agent) in accordance with the constituent documents, as well as his tax identification number and checkpoint; — line 5 is filled in in case of receiving an advance payment. The details (number and date) of the payment and settlement document or cash receipt (when making payments using payment documents or cash receipts to which the invoice is attached) are indicated regarding the transfer by the buyer of the advance payment to the commission agent (agent). In case of prepayment in a non-cash form of payment, a dash is placed; - lines 3, 4, 6, 6a and 6b, columns 1 - 11 are filled out according to the general rules. Invoices that the “Commission Agent” issues to the buyer (advance and upon sale) are signed by his authorized representatives. To illustrate the example of drawing up an invoice by the “Committent”, we will give an option when he issues an invoice in the name of the commission agent upon shipment of goods. As you can see, everything is not so complicated. All difficulties arise when purchasing goods (works, services) through an intermediary.

Example of filling out by an intermediary on his behalf to the buyer

| Line number/columns | Content |

| 1 | Date of issue of payment papers from the seller to the intermediary |

| 2 | Seller's name |

| 2a | Seller's address |

| 2b | Checkpoint, seller's tax identification number |

| 3 | Addresses, names of cargo sender |

| 4 | Name of cargo recipients |

| 5 | Dates, numbers of accounting papers issued to the intermediary by the customer, issued to the seller by the reseller are indicated through “;” |

| 6 | Buyer's name |

| 6a | Buyer's full address |

| 6b | KPP, recipient's TIN |

| 1 | Name of services, goods, works |

| 2 – 11 | Data of payment papers issued to the seller by an intermediary |

| Rest | For each item of goods, the corresponding indicators (VAT, cost, units of measurement, etc.) |

This option is simpler. The agreement concluded by the agent with the buyer specifies the action of the commission agent on behalf of the seller.

Attention! To have the right to use such manipulations, the seller must take care of issuing a power of attorney, ensuring the right to represent interests.

You will learn more about filling out an invoice in our article.

Purchasing goods

We have to admit the fact that in the important document on the procedure for accounting and drawing up invoices, the Rules, nothing is said about the procedure for maintaining document flow when purchasing goods under commission agreements and agency agreements. True, from time to time officials devoted their letters to this. Thus, in the Letter of the Ministry of Taxes of Russia dated May 21, 2001 N VG-6-03/404 (hereinafter referred to as the Letter of the Ministry of Taxes of Russia) it is said that when purchasing goods (work, services) through an attorney (agent), the basis for deducting VAT is from the principal (principal) for purchased goods (works, services) is an invoice issued by the seller in the name of the principal (principal). When an invoice is issued by the seller in the name of the commission agent (agent), the basis for the principal (principal) to accept VAT for deduction is the invoice received from the intermediary. In this case, the intermediary issues an invoice to the principal (principal) reflecting the indicators from the invoice issued by the seller to the intermediary. The intermediary does not register these invoices in the sales book. In addition, the later Letter of the Department of Tax Administration of Russia for Moscow dated September 17, 2004 N 21-09/60455 explains that the principal (principal) has the right to apply tax deductions for VAT on the basis of an invoice issued by the agent to the principal, whose indicators correspond to the indicators of the invoice issued by the seller (service provider) to the agent with the allocated VAT amount, as well as in the presence of the agent’s report and supporting documents. The Russian Ministry of Finance has a similar position. In its Letter dated November 14, 2006 N 03-04-09/20, the financial department emphasizes that in the case of the acquisition of goods (work, services) by a commission agent for the principal at the expense of the principal, when issuing invoices to the principal, a procedure similar to the procedure provided for para. 2 clause 24 of the Rules. In this situation, the commission agent issues an invoice for the principal reflecting the indicators of the invoice issued by the seller to the commission agent. However, such invoices are not registered by the commission agent in the purchase book and sales book. Based on the provisions of clause 8 of the Rules, for the purpose of applying tax deductions, the invoice received by the principal from the commission agent is registered by him in the purchase book. In this case, the VAT amounts indicated in the commission agent’s invoice addressed to the principal are subject to deduction from the latter if the conditions of Art. Art. 171, 172 of the Tax Code of the Russian Federation and in the presence of copies of primary accounting and settlement documents received from the commission agent. This emphasizes that an important document for the principal (principal) for the purpose of accepting VAT for deduction is the invoice of the commission agent (agent) in his name reflecting the indicators from the invoice issued by the seller in the name of the intermediary. Up to this point everything seems clear. We come to the most important thing! How are these invoices created?

Parties' reporting and interaction

Reporting is an imperative measure. It is enshrined in law in Art. 999 of the Civil Code of the Russian Federation and is designed to protect the rights of the principal. As a result, the parties cannot provide for an exemption from reporting, therefore, even if the reporting obligation is not stipulated in the terms of the agreement, it is stipulated in the legislation.

The absence of a detailed report may affect the entire activity of the principal.

The main problem is the impossibility of indicating in the accounting documents all transactions according to the commission agreement.

This may result in claims from tax authorities.

However, despite the statutory obligation to make reports, their form is in no way predetermined.

This is primarily due to the fact that it is impossible to predict all the information that will be indicated in it. There is no specific scheme for various purchase situations, but the basic minimum that the committent needs for tax purposes is required.

If the customer has objections to the report, he must voice them within 30 days. This period is established by Art. 999 of the Civil Code of the Russian Federation, however, the contract may provide for a different period at the discretion of the parties. If there are no complaints from the principal, the report is considered accepted.

Preparation of invoices for purchases

Let us turn again to Letter N ШС-22-3/ [email protected] First of all, the tax department refers taxpayers to clause 24 of the Rules and notes that the procedure provided for therein is advisable to apply when purchasing goods, works, services for the principal (principal) , property rights under a commission agreement (agency agreement), providing for the acquisition of goods (work, services), property rights on behalf of the commission agent (agent). An invoice for goods sold to a commission agent (agent) by the seller is drawn up in accordance with the generally established procedure. In turn, the commission agent (agent) must transfer the invoice information received from the seller of the goods to the commission customer (principal). For this purpose, he draws up an invoice to the commission agent (principal) reflecting the indicators from the invoice issued by the seller to the intermediary . The date of issue of the specified documents must match, the serial number of the document drawn up by the commission agent (agent) is indicated in chronological order (line 1 of the invoice). Filling out lines 2, 2a, 2b is strictly prescribed and is surprising. The thing is that in these lines, in accordance with the requirements of the Federal Tax Service of Russia, the name and location of the seller are indicated in accordance with the constituent documents, as well as his tax identification number and checkpoint. That is, the details of the seller of the goods are entered, while he is not connected with the principal (principal) by any contractual relations. Lines 6, 6a, 6b indicate information about the buyer (principal, principal) in accordance with the Rules. And such an invoice must be signed by the manager and chief accountant (or other authorized persons) of the intermediary (commission agent, agent). A strange situation arises. This invoice does not contain a word (data) about the intermediary, and the signatures are affixed by its responsible persons. But the tax authorities insist on their own. This is the procedure for filling out an invoice that must be followed by an intermediary when issuing an invoice to the principal (principal). Otherwise, the latter will not be able to accept the amount of VAT for deduction indicated in the commission agent’s invoice addressed to the principal. The customer (principal, principal), having received the goods, as well as such an invoice, registers this document in the purchase book and in the journal of received invoices. He does the same with the intermediary’s invoice for his remuneration. Please note the special procedure for filling out line 5 of the invoice. It indicates: - details (number and date of preparation) of the payment and settlement document or cash receipt (when paying using payment documents or cash receipts to which the invoice is attached), corresponding to the details specified in the seller's invoice ( i.e. payment and settlement document or cash receipt confirming the transfer by the intermediary to the seller); — details (number and date of preparation) of the payment and settlement document or cash receipt confirming the transfer by the customer-committent (principal) of the advance payment to the intermediary commission agent (agent). We remind you that in case the seller receives payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights using a non-cash form of payment, a dash is entered in line 5 of the invoice drawn up by the commission agent (agent). To explain this, let’s use the data from the example above. Only with the change that LLC “Commissioner” acquires for LLC “Committent”. The “Commission Agent” made a 100% prepayment according to the payment order dated December 7, 2010 N 71 from the seller for the goods. He, in turn, issued an invoice for prepayment to the “Commission Agent”. The “Commission Agent” issues an invoice to the “Committent”, which reflects the indicators of the invoice issued by LLC “Seller” to the “Commission Agent”. Upon receipt from the SELLER of an invoice dated December 17, 2010 for the shipped goods, Komissioner LLC issues an invoice to Komitent LLC. The example shows all, to put it mildly, the “strangeness” of filling out invoices by an intermediary to the principal (agent). Not every manager, as a person responsible in accordance with the law, will immediately be able to understand that he needs to sign a document that does not contain information (data) about his company. And counter checks on such invoices, as practice has shown, are not so easy to pass. What is the way out of this situation, how can the taxpayer’s situation be alleviated? Let's try to figure it out and give the arguments below.

Conducting a transaction under a commission agreement

Now it is worth noting some nuances that are associated with conducting transactions under a commission agreement.

Conditions. A commission contract is either open-ended or has a specific term. It may also indicate a certain territory for fulfilling the conditions and restrictions on concluding a subcommission agreement. Additionally, it is worth noting the presence or absence of conditions governing the range of goods, which is the subject of the commission.

Reward. When the commission agent has fulfilled all the terms of the contract, he is entitled to a reward. In the event of a successful subcommission contract, an addition to the main remuneration is due.

However, if the primary contract does not provide for the amount and procedure for payment of remuneration, then it is determined in accordance with Art. 424 Civil Code of the Russian Federation.

In the event that fulfillment of all the terms of the contract has become impossible due to the principal, the commission agent is paid a remuneration and, if necessary, compensation for expenses incurred.

Presence of third parties. The commission agent can hire a third party - a sub-commission agent, taking on the duties of the principal. This creates a chain: principal - commission agent - sub-commission agent. However, this does not mean that all rights of the commission agent are transferred to the latter - on the contrary, a separate contract is concluded with him. Based on this agreement, the commission agent has the rights of a principal in relation to the sub-commissioner. However, the conclusion of such an agreement without the prior consent of the principal is prohibited.

If the sub-commission agent does not fulfill all the agreed conditions, then the commission agent informs the principal about this and, if he requests, transfers to him all rights to the contract with the sub-commission agent. However, there is no release from liability after the transfer of rights.

Commission agent's sales report: sample

January 10, 2019

If one party has undertaken obligations to sell the goods to the other, based on the results of the sale, it is necessary to draw up a commission agent's sales report . This must be done in order to receive a reward.

Get a sample for free!

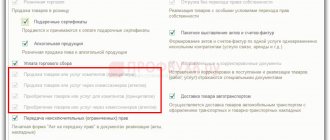

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the sample you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)