Payments for insurance premiums are a document by which the payer instructs the bank to transfer funds in accordance with the specified BCC. In 2021, the Federal Tax Service continues to administer payments from all organizations and individual entrepreneurs for compulsory pension insurance, compulsory medical insurance, as well as compulsory social insurance in case of temporary disability and in connection with maternity. Let's figure out how to fill out payment orders correctly and what has changed in the order of their preparation.

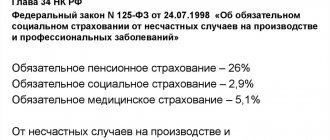

The basis for such changes was a new section of the Tax Code of the Russian Federation under number XI - “Insurance premiums in the Russian Federation” and Chapter 34.

Payments for compulsory social insurance against industrial accidents and occupational diseases remained under the jurisdiction of the FSS. Their payment is made in the same way as in previous periods.

The passions over the misunderstanding regarding the status of the taxpayer have subsided: the Central Bank, the Ministry of Finance and the Federal Tax Service have agreed that the status in the payment for insurance premiums in 2021 for legal entities is indicated as 01, when paid by an individual entrepreneur - 09.

Payment period

This year, payment documents for the transfer of insurance premiums are processed within the same deadlines. Insurance payments must be transferred to legal entities before the 15th day of the month following the reporting month. If this day falls on a weekend or holiday, the payment date is postponed to the next business day. For example, in 2021, April 15 is Wednesday, therefore, there will be no postponements.

Other deadlines have been established for individual entrepreneurs:

- OPS from income up to 300,000 rubles. — until December 31, 2019;

- OPS for income above 300,000 rubles. - until July 1 of the year following the reporting year;

- Compulsory medical insurance - until December 31, 2019.

FAQ

If, when filling out the policy offer, an error was made in the name of the Policyholder (not a completely different name/address, but a really obvious mistake), then you need to notify the insurance company about this using a statement (“due to an error made in the policy, please consider faithful.

"). The application must be sent to the address: Moscow, st. Pavlovskaya. d. 7 115093

- A 100% refund of the premium is possible if termination documents are submitted within the first 14 calendar days. in the event that the probability of the occurrence of the insurance risk has ceased (refund is made in proportion to the period remaining until the end of the insurance contract. In case of unilateral refusal of the insurance contract after the expiration of 14 calendar days from the date of entry into force of the policy, but no refund of the insurance premium is made

https://www.youtube.com/watch{q}v=ytbhg5P_bYs

Within 14 calendar days, you need to visit the Sberbank office and fill out a standard application form for termination of the insurance contract.

You must also have with you: As the 2nd option: To terminate the insurance contract Within 14 calendar days, you must send a letter to the insurance company with a Termination Application. Address for sending the Application: Full name of the Applicant; passport details of the Applicant; contact details of the Applicant (telephone and/or email address); number of the insurance contract and the date of its execution; bank details (recipient's personal account and bank BIC) to which the insurance company can transfer insurance premium funds. Yes, the insurance policy is subject to termination, but a refund of the insurance premium is due if the application is made within 14 calendar days (until the policy comes into force).

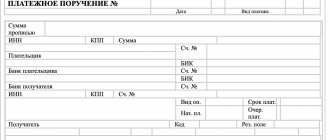

What to pay attention to when filling out payment orders

When filling out payment orders, you must follow some rules:

- Regardless of what period the payments relate to, in 2020 payments for compulsory insurance are sent to the Federal Tax Service.

- The amount in bills for compulsory insurance is indicated in rubles and kopecks.

- Don't forget to indicate the period to which the payment relates! For legal entities, this is always a MONTH, the format is presented in the example of a payment for insurance transfers. To avoid mistakes, do not copy the previous payment. Create insurance premium payments anew each time and carefully fill out all the data, then carefully check in the printed form format, since otherwise you may miss, for example, an incorrect taxpayer status.

- Incorrect indication of the Treasury current account where payments are sent is a reason not to credit the money for its intended purpose. Be careful, use the sample payment slip for insurance premiums 2021 as a hint.

- Particular attention should be paid to field 104, where the BCC is entered. These codes change quite frequently, so please make sure they are up to date.

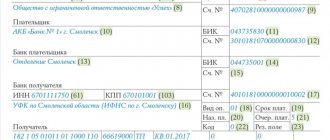

To avoid mistakes when filling out the document, use the example of a payment order for insurance premiums 2021 shown below.

Sample payment form for compulsory medical insurance for legal entities

Sample payment form for insurance premiums (individual entrepreneur, medical insurance)

Individual entrepreneur payment to the Pension Fund

All inclusive!

A unique offer that has no analogues in the insurance market - insurance of your property, life and health against unforeseen situations in one policy. It has now become incredibly easy to insure your apartment and civil liability to neighbors, your health and your bank card, personal belongings and unexpected medical expenses when traveling outside your permanent residence:

- A convenient registration procedure does not require documents at the time of purchase;

- the widest possible insurance coverage, with insurance protection valid 24 hours a day throughout the year;

- optimal ratio of insurance cost to payment amount

- To receive unique comprehensive protection, you do not need to go to the office of the insurance company.

- The ability to insure all your bank cards in one policy;

- Guarantee of stability - maintaining the usual level of income in the event of injury or disability as a result of an accident;

- The ability to choose the most suitable insurance coverage option for you;

- Reimbursement for unforeseen medical expenses incurred when traveling outside the place of residence;

- Protection of movable and immovable property and civil liability to neighbors;

- Protection of personal belongings that are with you in case of illegal actions of third parties;

By phone - Call (toll-free within Russia) or 495 788 0 999 (in Moscow) and, following the voice menu, go to the section dedicated to the “All inclusive!” product. Provide the operator with your unique policy number and other information. Values his time; Worried about his real estate; Owns bank cards; Commits

KBK relevant in 2021 for legal entities

In 2021, when paying insurance premiums, it is necessary to use the new BCC.

For legal entities, when paying insurance contributions from employee salaries, the following codes are used:

- OPS - 182 1 0210 160;

- Compulsory medical insurance - 182 1 0213 160;

- compulsory social insurance in case of temporary disability and in connection with maternity - 182 1 02 02090 07 1010 160;

- compulsory social insurance against industrial accidents and occupational diseases - 393 1 02 02050 07 1000 160 (paid to the Social Insurance Fund).

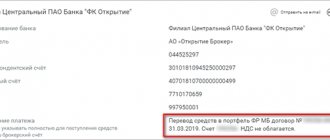

Procedure for payment of insurance premium

From the moment the payment of the next insurance premium under the Insurance Agreement becomes due, you need to contact the employees of the Insurance Company in which your risks are insured in accordance with the terms of the Loan Agreement.

After payment, you need to provide the Bank with documents confirming payment of the next insurance premium (payment receipt, letter from the insurance company confirming payment, payment order, etc.)

- Bring it in person to the Operations Department of the Bank with a note to the SSKFO;

- By fax with a note to the North Caucasian Federal District;

- Send a scanned document to an email address

Dear Borrower, we ask you to pay special attention to the importance of providing a document confirming payment of the insurance premium.

If you paid the insurance premium and did not report it, the Bank will be forced to apply penalties in accordance with the terms of the loan agreement.

2.1. The insurance premium is calculated by the insurer in accordance with the insurance tariffs determined by the insurer taking into account the requirements established by the Bank of Russia.

We invite you to familiarize yourself with: The employee’s right to copies of documents

The calculation of the insurance premium under a compulsory insurance contract is carried out by the insurer based on the information provided by the policyholder in a written application for concluding a compulsory insurance contract or an application sent to the insurer in the form of an electronic document, information about insurance, taking into account the information contained in the automated compulsory insurance information system.

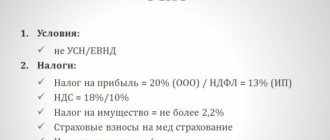

Fixed payments for individual entrepreneurs

According to subparagraph 2 of paragraph 1 of Article 419 and paragraph 1 of Article 430 of the Tax Code of the Russian Federation, an individual entrepreneur is obliged to pay contributions for compulsory health insurance and compulsory medical insurance. Individual entrepreneurs are not required to pay payments in case of temporary disability and maternity, but can do so on a voluntary basis.

The Tax Code clearly defines the amounts of transfers for compulsory medical insurance and compulsory health insurance. If a businessman’s income does not exceed 300,000 rubles, he will pay for the needs of the OPS:

- RUB 29,354 - in 2021;

- RUB 32,448 — in 2021

If the income exceeds 300,000 rubles, then in addition to the indicated amounts it is necessary to add 1% of the amount exceeding 300,000. The amount of deductions for mandatory pension insurance cannot exceed:

- RUB 234,832 — 2021;

- RUB 259,584 — 2021

As for fixed payments for compulsory medical insurance for individual entrepreneurs, they will be:

- 6884 rub. — 2021;

- 8426 rub. — 2021

Tariff "Car loan"

Providing a loan for the purchase of a used vehicle is possible provided that at the end of the loan agreement, the vehicle must be no older than 8 years. The down payment of 30% is indicated on the cost of the purchased new/used passenger vehicle with the condition that the insurance premium under the CASCO Policy is paid by the Borrower at his own expense.

We suggest you read: What to do if your license is revoked for drunkenness

If the down payment is at least 40% of the cost of the purchased new/used passenger vehicle, then it is possible to include the insurance premium under the CASCO Policy for the first year of insurance and/or voluntary life and health insurance of the Borrower in the loan amount (in this case, the maximum the loan amount, which includes the amount for the purchase of a vehicle and the amount for paying the insurance premium under the CASCO Policy for the first year of insurance and/or voluntary life and health insurance of the Borrower, cannot exceed 75% of the cost of the purchased vehicle).

If the Borrower violates the obligations to insure the purchased vehicle for CASCO risks during the loan period, the Bank has the right to decide to increase the interest rate for using the loan by 7.0% per annum, starting from the first day of the second billing period following the billing period in which The Borrower had to pay the insurance premium under the CASCO Insurance Agreement (policy) for the next term, except for cases when before the last day of the billing period (inclusive) following the billing period in which the Borrower had to pay the insurance premium under the Agreement (policy) ) CASCO insurance for the next term, the Borrower has documented the fulfillment of obligations to insure the vehicle for CASCO risks.

Dear Borrower, we ask you to pay special attention to the importance of providing a document confirming payment of the insurance premium. Compensation of the insurance premium under the MTPL agreement for disabled people who received vehicles through social protection authorities. Performing certain functions to provide social support measures as prescribed for disabled people (including disabled children) who have vehicles in accordance with medical indications, or their legal representatives for insurance compensation premiums under the contract of compulsory civil liability insurance of vehicle owners. Assignment of payment of compensation for the insurance premium under the contract of compulsory civil liability insurance of vehicle owners or refusal to assign payment of compensation.

No more than 45 working days from the date of submission of the application with all documents necessary for the provision of public services. The decision to assign payment of compensation or to refuse the appointment is made by the district administration within 10 working days from the date of submission of the application and documents. Payment of compensation is carried out in a lump sum no later than 30 days from the date of the decision to assign compensation.

Disabled people (including disabled children) who received vehicles in accordance with current legislation free of charge or on preferential terms. Citizens entitled to receive public services in accordance with paragraph I; Representatives of citizens entitled to receive public services, acting on the basis of a power of attorney issued in accordance with the legislation of the Russian Federation; Representatives of incapacitated (limited legal capacity) citizens who have the right to receive public services.

Penalties for insurance premiums: sample payment order

For violation of payment deadlines, penalties may be charged, which will also have to be paid using payment slips. There are special KBKs for their payment.

| For legal entities | |

| OPS | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 |

| VNiM | 182 1 0210 160 |

| OSS from accidents | 393 1 0200 160 |

| For individual entrepreneurs | |

| OPS | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 |

Cash payments for insurance transactions: receipt in form No. A-7

When making cash payments, organizations are required to use cash register equipment.

At the same time, insurance organizations, when accepting cash to pay an insurance premium instead of a cashier's check, have the right to issue a receipt in Form N A-7.

According to paragraph 2 of Art. 2 of this Law, organizations and individual entrepreneurs, in accordance with the procedure determined by the Government of the Russian Federation, in the case of providing services to the population, can carry out cash payments and (or) payments using payment cards without the use of cash register equipment, subject to the issuance of appropriate strict reporting forms.

Cooling off period

PJSC IC "Rosgosstrakh" notifies that in accordance with the requirements of the Directive of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U "On the minimum (standard) requirements for the conditions and procedure for the implementation of certain types of voluntary insurance" (cooling period), the treatment procedure set out below applies only to to insurance contracts concluded with individuals and does not apply to the following types of insurance:

- Insurance contracts for persons traveling abroad

- Voluntary health insurance contracts concluded on the basis of rules No. 195, No. 208 and No. 220

- Liability insurance contracts, except those concluded under Rules No. 153 and No. 92

- All compulsory types of insurance (including OSAGO and Green Card)

Please note that if you submit an application for termination within 5 days from the date of conclusion, your insurance contract will terminate and PJSC IC Rosgosstrakh will not have any legal obligations directly or indirectly related to this insurance contract, including the settlement of losses.