Field and desk tax audits are one of the forms of tax control. Each tax audit has its own characteristics and rules of conduct.

Despite the common goal of on-site and desk tax audits - the correct calculation and payment of taxes (and, accordingly, the possibility of collecting fines for non-compliance), there are significant differences between them.

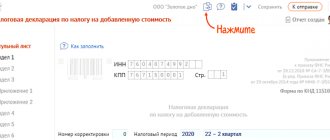

TAX DISPUTES REGARDING VAT

Legal regulation. What types of tax audits are provided for by the Tax Code of the Russian Federation?

Tax authorities are given the right to carry out control measures, including conducting audits.

Art. 87 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) allows for desk and field tax audits (hereinafter referred to as KNI and VNP) in relation to payers of taxes and fees, and tax agents. When assigning desk and field tax audits, the following are guided by:

- Ch. 14 Tax Code of the Russian Federation;

- by order of the Federal Tax Service of the Russian Federation dated May 30, 2007 No. MM-3-06/ [email protected] , approved. The concept of a planning system for on-site tax audits and parameters for assessing the activities of a taxpayer (hereinafter referred to as the Concept);

- letter of the Federal Tax Service of the Russian Federation dated July 25, 2013 No. AS-4-2/13622, giving general recommendations on the procedure for conducting GNP;

- letter of the Federal Tax Service of the Russian Federation dated July 16, 2013 No. AS-4-2/12705, explaining the KNI procedure;

- letter of the Federal Tax Service of the Russian Federation dated July 17, 2013 No. AS-4-2/12837, concerning the implementation of control measures during tax audits;

- Order of the Federal Tax Service of the Russian Federation dated 05/08/2015 No. ММВ-7-2/ [email protected] , which established the forms of documents used in the process of carrying out control measures, and other regulations.

Tax audits will not be canceled due to quarantine measures and other consequences of the COVID-19 pandemic. However, new on-site inspections will not be scheduled temporarily until 06/01/2020. The pandemic did not affect desk inspections. A ready-made solution to the questions of which inspections will be suspended, whether it will be possible to execute the order later or submit documents can be found in the ConsultantPlus system. We offer to open access to the system temporarily (link to free 2-day access) or permanently (price list).

Comparison

The main difference between an on-site inspection and a desk inspection, as can be understood from the names of the relevant events, is the location where they are held. In the first case, this is the territory of the controlled facility, in the second - the place of work of the department’s inspectors. Also, field and office events differ in content. The first type of checks is usually deeper and more comprehensive. As part of office activities, as a rule, only documents are studied - those that are provided by the organization to the regulatory agency in the reporting procedure.

Having considered the difference between an on-site and a desk audit, we will record the criteria we have identified in a small table.

What other tax audits are there?

Based on the volume of information studied, a tax audit can be comprehensive (data on all taxes for a certain period are analyzed) and thematic (the procedure for paying one tax is monitored). If CIT is carried out separately for each submitted declaration (clause 2 of Article 88 of the Tax Code of the Russian Federation), then GNP can be assigned for several taxes simultaneously (clause 3 of Article 89 of the Tax Code of the Russian Federation).

Based on the order of assignment, inspections can be divided into scheduled and unscheduled. KNI are carried out regularly, regardless of the presence of risk criteria in the payer’s activities. The inclusion of a taxpayer in the IRR plan is related to the indicators of the submitted reports and other collected documents. In accordance with paragraph 11 of Art. 89 of the Tax Code of the Russian Federation, in the event of reorganization or liquidation of a legal entity, it is necessary to conduct an unscheduled GNP.

IMPORTANT! The activities of the Federal Tax Service bodies do not fall within the scope of the Law “On the Protection of Rights...” dated December 26, 2008 No. 294-FZ, therefore information about future control activities is not publicly available and is not communicated to the taxpayer at the beginning of the year by posting it on the departments’ websites.

Another type of tax audit under the Tax Code of the Russian Federation is repeated GNP, carried out to monitor the activities of lower-level inspectorates or when submitting an updated declaration that reduces the amount of tax payable.

How can you protect yourself when scheduling inspections?

- There must be order in financial and economic documents. The documents between you and your counterparties must be identical.

- It makes sense to warn counterparties so that they are also prepared.

- Before the inspection, it is necessary to brief employees.

Tax audits are an unpleasant and dangerous business. From year to year, tax audits are only getting tougher. To keep the risks minimal, you need to be prepared, as they say, fully armed. A reasonable solution is to engage a law firm that specializes in supporting tax audits.

By what criteria do KNP and GNP differ?

The main differences between desk and field tax audits, in addition to the timing and location of control activities, are the scope of powers granted to employees of the Federal Tax Service:

During the internal inspection, inspectors have the opportunity to use alternative sources and methods of obtaining information. For example, data on the property of an enterprise can be confirmed by the results of an inventory and inspection of premises and documents.

The list of information that can be requested from the KNI is specified in Art. 88 Tax Code of the Russian Federation. As a general rule, only a declaration is submitted. If inconsistencies are identified, the taxpayer additionally confirms the legality of the declared deductions and benefits, the correctness of the calculations with explanations, appendices to the declaration and documents at his discretion (clauses 3, 4, 7 of Article 88 of the Tax Code of the Russian Federation).

For VNP, the following can be studied:

- tax reporting;

- constituent documents;

- contracts, licenses, orders;

- accounting registers, primary accounting documents, etc.

The list is not closed (clause 5.1 of the letter of the Federal Tax Service of the Russian Federation dated July 25, 2013 No. AS-4-2/13622).

The conduct of the VNP may be suspended while receiving responses from third parties, conducting an examination, and translating documents. The timing of the submission of the requested information and the need for additional activities and the involvement of specialists do not affect the progress of the KNI.

Below is a table comparing desk and field tax audits.

Prepared by: lawyer of Practice Kanaeva A.S.

The Tax Code of the Russian Federation gives the Federal Tax Service of Russia the authority to conduct inspections of taxpayers in order to monitor compliance with legislation on taxes and fees. In this case, tax audits can be carried out both at the location of the tax authority without traveling (desk audit) and at the location of the taxpayer (on-site).

Table: differences between desk and field inspections

| Criterion | Cameral (Article 88 of the Tax Code of the Russian Federation) | Travel (Article 89 of the Tax Code of the Russian Federation) |

| Location | At the location of the tax authority (without traveling) | On the territory (premises) of the taxpayer’s location: at legal or actual address |

| Reason for holding | Submission by the taxpayer of a tax return (calculation) and other documents to the inspectorate | Decision of the head (his deputy) of the tax authority |

| Dates | Within 3 months from the date the taxpayer submits the declaration (calculation) | One tax authority (if there is a separate independent audit of one branch/representative office) - no more than 1 audit during a calendar year for the same taxes for the same period In relation to one taxpayer (branch/representative office during a comprehensive audit) – no more than 2 inspections during a calendar year (exception: decision of the head of the tax authority) |

| Duration | — | No more than 2 months (can be extended up to 4 months, in exceptional cases - up to 6 months) |

| Subject of inspection | Errors in the tax return (calculation), contradictions or inconsistencies between the information in the declaration and other documents (or information from the tax authority) | Correct calculation and timely payment of taxes Period up to 3 calendar years before the year in which the audit is carried out |

| Powers of representatives of the Federal Tax Service | Requesting explanations (explanatory note) from the taxpayer (other documents can be presented only at the discretion of the payer), as well as documents confirming the right to tax benefits | Familiarization with the tax reporting of the payer at his location (access to the territory, premises, storage facilities), requesting documents related to the subject of the audit Property inventory Inspection of premises and territories Seizure of documents and items - on the basis of a resolution approved by the head of the tax authority Involve an expert (specialist) to participate in the inspection |

| Result of checking | Inspection report (if violations are detected) - within 10 days from the end | Certificate of inspection (drawn up on the last day of the inspection) Tax audit report (within 2 months from the date of preparation of the certificate) |

Principles for selecting taxpayers for on-site audits

The criteria and procedure for selecting taxpayers for conducting on-site tax audits are established by the Concept of the planning system for on-site tax audits, established by Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333. This Concept defines a unified approach to planning on-site audits and indicates only the general criteria for selecting taxpayers for inclusion in the on-site tax audit plan.

Thus, according to the Concept, all information about taxpayers received by the tax authority must be subject to constant, thorough, comprehensive analysis.

Priority for inclusion in the plan of on-site tax audits are those taxpayers in respect of whom the tax authority has information about their participation in tax evasion schemes or schemes to minimize tax liabilities, and (or) the results of the analysis of the financial and economic activities of the taxpayer indicate expected tax offenses.

Based on the information received, a pre-test analysis of the financial and economic indicators of their activities is carried out, which consists of several levels:

— analysis of the amounts of calculated tax payments and their dynamics, which makes it possible to identify taxpayers whose tax payment amounts are decreasing;

— analysis of the amounts of paid tax payments and their dynamics, carried out for each type of tax (collection) in order to control the completeness and timeliness of the transfer of tax payments;

— analysis of indicators of tax and (or) accounting statements of taxpayers, allowing to determine significant deviations in the indicators of financial and economic activity of the current period from similar indicators for previous periods or deviations from the average statistical indicators of reporting of similar business entities for a certain period of time, as well as to identify contradictions between information contained in the submitted documents, and (or) discrepancy with the information held by the tax authority;

— analysis of factors and reasons influencing the formation of the tax base.

To assess the feasibility of an on-site audit, the tax authority must objectively evaluate all identified risk criteria for the payer’s activities in the aggregate. If the tax inspector sees a tax evasion scheme in the payer’s activities, he includes the payer in the on-site inspection plan.

If an object is selected for conducting an on-site tax audit, the tax authority also determines the advisability of conducting on-site tax audits in relation to counterparties and (or) affiliates of the taxpayer being inspected.

Self-assessment of risks

The concept establishes criteria by which a taxpayer can independently assess the likelihood of being included in the on-site inspection plan:

1. The tax burden of a given taxpayer is below its average level for business entities in a specific industry (type of economic activity). Federal Tax Service practice: a low tax burden is acceptable for newly created organizations during the first 3 years of activity. Even if such taxpayers are included in the on-site inspection list, sanctions are usually not applied if they violate the laws on taxes and fees.

2. Reflection of losses in accounting or tax reporting over several tax periods (more than 5 years in a row).

3. Reflection in tax reporting of significant amounts of tax deductions for a certain period (more than 89%).

4. The growth rate of expenses exceeds the growth rate of income from the sale of goods (works, services) – more than 84%.

5. Payment of average monthly wages per employee below the average level for the type of economic activity in the constituent entity of the Russian Federation.

6. Repeatedly approaching the maximum value of the indicators established by the Tax Code of the Russian Federation that grant taxpayers the right to apply special tax regimes.

7. Reflection by an individual entrepreneur of the amount of expenses as close as possible to the amount of his income received for the calendar year.

8. Construction of financial and economic activities based on concluding agreements with counterparties-resellers or intermediaries (“chains of counterparties”) without reasonable economic or other reasons (business purpose). The criterion also includes cases of the payer conducting contractual activities with intermediaries (counterparties) that have signs of “problem”: no contact with the executive bodies of these persons, signs of “one-day companies”, no information about them in the media and the Internet, goods, works or services they are purchased at inflated prices, etc.

9. Failure by the taxpayer to provide explanations to the notification of the tax authority about the identification of discrepancies in performance indicators, and (or) failure to provide the tax authority with the requested documents, and (or) the availability of information about their destruction, damage, etc.

10. Repeated deregistration and registration with the tax authorities of the taxpayer in connection with a change in location (“migration” between tax authorities).

11. Significant deviation of the level of profitability according to accounting data from the level of profitability for a given field of activity according to statistics.

12. Conducting financial and economic activities with high tax risk.

Representatives of the tax authorities explain that in practice, an on-site tax audit (or at least a pre-audit analysis of financial and economic indicators) is strictly mandatory only in three cases: the taxpayer submits an application for liquidation, the receipt of a complaint from a third party about the taxpayer’s violation of tax legislation, and “ migration" between tax authorities (even one-time).

When assessing the above indicators, the tax authority must necessarily analyze the possibility of extracting or the presence of an unjustified tax benefit, including under the circumstances specified in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53.

Systematic self-assessment of risks based on the results of its financial and economic activities will allow the taxpayer to timely assess tax risks and clarify their tax obligations.

The payer can avoid conducting an on-site audit against him simply by submitting explanatory documents to the tax authority. Thus, if the tax authority receives a notification about discrepancies in the information in the submitted declaration, the payer must submit an updated declaration with an explanatory note. In practice, an updated declaration does not exclude the possibility of an inspection, but the inspection is carried out desk-based and not on-site.

In practice, voluntary substantive correspondence with the tax authority, telephone or personal conversations with officials of the Federal Tax Service more often end in a positive way than if it were the payer’s silent inaction.

On-site inspection: procedure, powers of the inspector, rights and obligations of the payer

The on-site inspection plan most likely refers to information that constitutes a tax secret, although this is not expressly stated in the law.

“According to the Concept, planning on-site tax audits is an open process built on the selection of taxpayers for on-site control based on publicly available criteria for the risk of committing a tax offense. This process is open. A taxpayer who meets these criteria will most likely be included in the on-site tax audit plan,” says the official website of the Federal Tax Service of Russia. However, lists of payers for whom on-site tax audits are scheduled are never disclosed or posted in the public domain.

Five days before the audit, the tax authority notifies the payer of the audit carried out against him (Notification of the need to ensure familiarization with documents related to the calculation and payment of taxes, of the need to ensure familiarization with documents related to the calculation and payment of taxes, approved by Letter Federal Tax Service dated October 8, 2010 No. AS-37-2/12931).

Having received the notification, the taxpayer is obliged, by the day and time of the on-site inspection, to ensure access for representatives of the tax authority to the territory and premises where its activities are conducted and accounting documentation is stored. If the payer does not provide access to the territory or otherwise interferes with the audit, representatives of the tax authority have the right to draw up an act of opposition to the tax audit (failure to ensure the right of officials to familiarize themselves with the original documents). A copy of such an act is handed over to the representative of the organization against signature (in case of refusal to sign the act, a corresponding note is made in it).

The payer has the right to demand that representatives of the tax authority provide him with official identification and a decision of the tax authority to conduct an on-site tax audit; if they are not provided, he can quite rightfully prohibit visitors from entering the territory and premises where his activities are carried out.

Typically, a visiting commission consists of 1-3 tax officials.

Based on the results of the audit, officials draw up a tax audit report, which reflects all the essential information about the audit carried out (Part 2 of Article 100 of the Tax Code of the Russian Federation). Within 5 days from issuance, the specified act is handed over against receipt to the payer in respect of whom the audit was carried out, or his representative, or sent by registered mail to the address of the location of the organization or residence of the individual. In the latter case, the date of delivery of the act will be the sixth day from the date of sending the letter.

If the payer does not agree with the facts reflected in the tax audit report, he has the right, within 15 days from the date of receipt of the report, to submit written objections to the tax authority at his location (on the act as a whole or on its individual provisions), with an attachment according to at the discretion of the payer, originals or copies of documents confirming his objections.

After the payer submits objections (or the deadline for submitting them expires), the head of the tax authority is obliged, within 10 days, to review the tax audit report and objections, as well as other tax control materials, and make a decision to hold the payer accountable or to refuse to bring the person to justice to responsibility.

The person must be notified of the time and place of consideration of the materials. The failure of the person subject to a tax audit to appear is not an obstacle to the consideration of the tax audit materials (except for cases where the participation of the person was recognized as mandatory by the head (deputy) of the tax authority). When considering the tax audit materials, they are disclosed and examined in full.

The decision to prosecute for a tax offense comes into force 10 days from the date of delivery to the person (his representative) in respect of whom it was made. If the payer appeals this decision to a higher tax authority, the effective date is extended until a satisfactory decision is made by the higher tax authority. The procedure and consequences of an appeal are established by Article 101.2 of the Tax Code of the Russian Federation.

It should be noted that from the moment the decision is made to bring the taxpayer to justice, the head of the tax authority has the right to make a decision to take interim measures in relation to the taxpayer’s property, which comes into force immediately from the moment it is made. This includes the seizure of the payer’s real estate, vehicles, finished products, raw materials and supplies, and the seizure of current accounts.

Read more https://www.yurliga-business.ru/we-are-wrighting/analitic/viezdniyenalogovyeproverki

Are the results of KNI mandatory for the following control activities?

KNI and GNP are types of tax audits, while KNI may precede GNP. If, during the conduct of the tax inspection, obtaining any information is difficult or impossible and there are grounds to suspect the taxpayer of tax evasion, the information is transferred to the planning department to resolve the issue of assigning an income tax (clause 13 of the letter of the Federal Tax Service of the Russian Federation dated July 16, 2013 No. AS-4- 2/12705).

Carrying out control measures in relation to declarations (periods and taxes) previously studied during the KNI cannot be considered the purpose of repeated inspections. GNP is an in-depth form of tax control. In the decision of the Constitutional Court of the Russian Federation dated December 20, 2016 No. 2672-O, the revision of the results of the KNI during a subsequent on-site audit does not infringe on the rights of the taxpayer, but guarantees compliance with the balance of public and private interests.

Even if a person successfully challenged the results of the tax assessment in court and was exempted from additional assessments, but during the conduct of the tax return previously undetected violations were discovered, when considering the results of the tax return, the court can support the tax authority, citing new evidence (definition of the Constitutional Court of the Russian Federation dated March 10, 2016 No. 571 -ABOUT). If inspectors use the legal IRR mechanism solely for the purpose of correcting their own mistakes made during the IRR, the court may side with the taxpayer (resolution of the Federal Arbitration Court ZSO dated November 29, 2012 in case No. A46-17546/2012).

Comparative analysis of types of inspections

The table will help you analyze the main types of tax control in the Russian Federation.

| Criterion | Cameral | Visiting | Transactions of related parties |

| Permission to conduct | No need | Head (Deputy) of the Federal Tax Service | |

| start date | Day of submission of the declaration | By decision of the Federal Tax Service | |

| Location | Inspectorate of the Federal Tax Service | Taxpayer's territory | Inspectorate of the Federal Tax Service |

| Verification period | 3 months | 2 months | 6 months |

| Extension of deadline | Not renewed | Up to 4-6 months. | Up to 12 months |

| Verified period | Period for which the report was submitted | No more than 3 years preceding the year of audit | |

| Verifiable taxes | Indicated in the declaration | Enshrined in the decision | Personal income tax, VAT, income taxes and mineral extraction taxes |

| Coverage | All declarations submitted to the Federal Tax Service | Selectively appointed | |

| The right of the Federal Tax Service to request documents | Not eligible (except for exceptions) | Has the right | Has no right |

An on-site audit is aimed at identifying those violations of the Tax Code that cannot always be detected during an on-site inspection. At the same time, documents are studied in more depth and additional measures are taken.

With cameras, errors in reporting are identified quickly and responded to immediately. Thanks to this, the consequences for taxpayers from violations of the Tax Code are less serious.

Counter audits by tax authorities

Counter checks are not considered types of checks. This definition conceals the right to demand the submission of documents about the taxpayer or a specific transaction from counterparties in accordance with Art. 93.1 Tax Code of the Russian Federation.

The authorized person conducting the inspection contacts the tax authority at the place of registration of the counterparty with an order to request documents. The requested information is submitted by the taxpayer to his inspectorate on the basis of a copy of the order and the request made on its basis.

The Tax Code of the Russian Federation does not contain a closed list of documents that may be required during control activities. The person being checked must independently analyze the volume of the requested data to determine its compliance with the instructions and requirements.

Documents must be submitted no later than 5 working days (Clause 5, Article 93.1 of the Tax Code of the Russian Federation). If there is a lack of information or the need for more time to make copies of documents, the taxpayer must notify the tax authority about this under threat of liability under Art. 126 of the Tax Code of the Russian Federation.

Since countering is one of the methods of control, the number of requests about the activities of counterparties is unlimited.

Conclusion

Inspection of a company by the tax inspectorate is an integral part of the work of a business entity, because as a taxpayer, you will inevitably be under the close attention of supervisory authorities. Yes, indeed, inspections can have the most serious consequences, but you have the power to minimize the risks. For this:

- submit reports on time and without errors;

- pay taxes on time and in full;

- do not ignore tax requests, provide the required documentation, give explanations;

- correctly draw up and store documents confirming expenses;

- hire competent accountants or enter into a service agreement with a third-party organization;

- Choose your business partners carefully.

If an audit could not be avoided, and tax officials assessed additional large sums, contact tax lawyers for help.

In order to receive professional advice from specialists, get acquainted with prices for tax optimization services and tax support for business, please call +7 (843) 200-08-90.

Features of inspections of separate divisions of legal entities

CIT and GNP can be carried out in relation to registered separate divisions of legal entities (branches and representative offices) that submit declarations (calculations) and pay taxes at their location.

If the activities of a branch (representative office) are investigated within the framework of the GNP together with the activities of the parent organization, control activities are carried out by the tax authority at the location of the organization with the participation of inspection staff at the location of the unit. The Federal Tax Service has the right to carry out an independent IRR at the location of the branch (representative office). In this case, its period cannot exceed 1 month.

IMPORTANT! The number of individual GNP branches (representative offices) is not taken into account when calculating the total number of inspections carried out in relation to a person (clause 5 of Article 89 of the Tax Code of the Russian Federation).

Table

| On-site inspection | Desk inspection |

| What do they have in common? | |

| Can be carried out by the same inspection agency | |

| Assumes studying documents | |

| What is the difference between them? | |

| Conducted on the territory of a controlled organization | Conducted at the place of work of inspectors of inspection agencies |

| Involves studying a wide range of documents, as well as the content of various financial and business transactions | Limited to studying documents - mainly reporting |

Results of KNP and GNP

In the absence of claims from the tax authority, the tax return will end without notifying the payer, except in the case of a VAT refund based on the results of a desk audit of the declaration. The GNP will end with the drawing up of an act.

| Comparison criterion | KNP | GNP |

| Informing the taxpayer about the end | No, the exception is checking the declaration for VAT refund | Yes, drawing up a certificate of the inspection performed on the day of its completion |

| Drawing up the final act | No, the exception is detection of violations no later than 10 days from the end of the inspection | Yes, no later than 2 months from the end of the inspection |

| Making a decision | Within 10 days from the end of the 30-day period for filing objections | Within 10 days from the end of the 30-day period for filing objections |

If violations are detected, CNI and VNP have similar negative consequences for the person. The procedure for making a decision and appeal is the same and is provided for in Art. 101 Tax Code of the Russian Federation. For information on how and why to challenge a tax audit report, read the article Objection to a desk tax audit report – sample. The tax authority has the right to apply interim measures (impose a ban on the alienation of property, suspend transactions on bank accounts) until the decision enters into legal force.