Representation expenses under the simplified tax system

Almost no major deal goes through without discussing its terms at the negotiating table. Regardless of whether it is a large company or a small business, it pays income tax or tax according to the simplified tax system. Negotiations usually take place in restaurants, cafes, boardrooms, or simply in the director’s office over a cup of tea.

Sometimes expenses for business meetings reach quite significant amounts. Therefore, simplified taxpayers often have a question: is it possible to reduce income for entertainment expenses?

Legal entities and individuals who apply the simplified tax system “income minus expenses” have the right to reduce the tax base by the amount of expenses. However, not everything off, but only what is indicated in paragraph 1 of Art. 346.16 of the Internal Revenue Code. Expenses not listed in this article do not reduce the tax base during simplification. Unfortunately, entertainment expenses in Art. 346.16 of the Tax Code of the Russian Federation are not named .

The list of “allowed” expenses under the simplified tax system is closed . And any deviation from it is regarded by the inspection authorities as an offense . This is the main difference between the costs of the basic and simplified taxation systems. In practice, accountants, forgetting about this rule, include in the simplified tax base expenses that are taken into account only under the regular taxation system, but are not subject to tax accounting when applying this special regime.

To summarize:

- entertainment expenses under the simplified tax system “income minus expenses” are not included in the reduction of the tax base, since they are not included in the closed list under Art. 346.16 Tax Code of the Russian Federation.

- entertainment expenses under the simplified tax system “income” also cannot reduce the tax base, since practically no expenses reduce it.

It should be noted that input VAT on representative tax on the simplified tax system cannot be taken into account in expenses, since in this case the conditions of sub-clause are not met. 8 clause 1 art. 346.16 Tax Code of the Russian Federation.

List of entertainment expenses

First of all, you need to remember that there is a clearly defined list of expenses that can be classified as entertainment expenses for income tax purposes. It is contained in paragraph 2 of Art. 264 Tax Code of the Russian Federation. In general, these are expenses “for the official reception and (or) service of representatives of other organizations participating in negotiations in order to establish and (or) maintain mutual cooperation, as well as participants who arrived at meetings of the board of directors (board) or other governing body taxpayer, regardless of the location of these events.”

To be more specific, expenses for an official reception mean expenses directly for its holding, that is, for holding a breakfast, lunch or other similar event. It turns out that a business event can take place in a cafe or restaurant. The main thing is to confirm that the dinner at the restaurant was business-oriented. Moreover, with proper registration, a representative event can be a dinner in a restaurant, including the consumption of alcoholic beverages (letter of the Ministry of Finance of the Russian Federation dated November 1, 2010 No. 03-03-06/1/675). Officials also allow the cost of alcohol to be classified as entertainment expenses (letter of the Ministry of Finance of the Russian Federation dated January 22, 2019 No. 03-03-06/1/3120).

As for the expenses for servicing invited persons, which also relate to entertainment expenses, they do not mean absolutely all expenses, but only:

- for transport support for the delivery of persons to the venue of the entertainment event and back;

- buffet service during negotiations;

- payment for the services of translators who are not on the taxpayer’s staff.

At the same time, in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation directly states that expenses for organizing entertainment, recreation, prevention or treatment of diseases cannot be considered entertainment expenses.

Next, we present the necessary package of documents that will help companies avoid questions from inspectors, and also consider the most common violations.

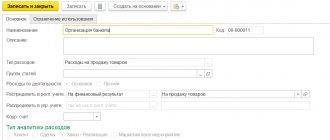

An example of accounting for representative offices on the simplified tax system

For understanding, let's give an example.

LLC "Raduga" expenses for business negotiations with a business partner amounted to 10,000.00 rubles. (including VAT 20% - 1666.67 rubles). Expenses are confirmed by a restaurant invoice and an online receipt. The meeting is of an official nature and was held before the conclusion of an important contract for the supply of imported equipment. The company expects to conclude a deal on favorable terms.

In the accounting of Raduga LLC, operating on the simplified tax system (income minus expenses), representative expenses in the form of restaurant expenses will be reflected with the following entries:

Dt 26(44) Kt 71 – 10,000.00 rub. – entertainment expenses were allocated based on the director’s advance report;

Dt 71 Kt 51(50) – 10,000.00 rub. – money was paid for reporting to the director.

In tax accounting, entertainment expenses amount to RUB 10,000.00. will not be taken into account . Expenses that are not listed in paragraph 1 of Art. 346.16, cannot reduce taxable profit under the simplified tax system (letter of the Ministry of Finance dated March 23, 2017 No. 03-11-11/16982).

Other expenses not included

In addition to entertainment expenses, the tax base cannot be reduced by the following expenses:

- for marketing services;

- for disinfection;

- to connect water and electricity supplies;

- for various promotions for clients;

- for drinking water for company personnel;

- for various printed publications subscribed by the organization;

- to attract workers from other companies (engaged in other activities);

- for the arrangement of the company's office;

- for advertising;

- for staff pensions;

- VAT amounts;

- for certification of workplaces;

- to purchase property rights;

- customs duties when importing goods from abroad;

- penalty for violation of contract terms;

- registration costs.

Similar articles

- Selling expenses in the income statement

- Expenses under simplified tax system 15: recognition procedure 2017

- Direct material costs

- Normalized expenses in 2016-2017 (advertising, entertainment, insurance)

- USN expenses accepted for taxation 2017

Corporate for employees - accounting for an accountant

From the article you will learn:

1. Is it necessary to charge personal income tax and insurance premiums on the cost of participation in a corporate event?

2. Is it possible to accept expenses for corporate events for tax accounting?

3. How to reflect the holding of a festive event for employees in accounting.

Holding corporate entertainment events is a great way to combine business with pleasure. On the one hand, this is an opportunity to relax and escape from everyday work, and on the other hand, such events help strengthen team spirit and improve relationships within the team. Therefore, almost all employers organize New Year’s banquets, organization “birthdays”, sports competitions, etc. for their employees. – There are a great many options to suit every taste and budget. Moreover, many employers spend quite significant sums on corporate events for employees. In this regard, the issues of accounting and taxation of such costs arise especially acutely, because inspectors are unlikely to ignore the “big party” holiday. Is participation in a corporate event considered employee income? Is it possible to reduce taxes due to “holiday” expenses? – we will consider these and other questions in this article.

Personal income tax on employee income from participation in a corporate event

In order to understand whether participation in a corporate event is the income of an employee from whom personal income tax must be withheld, let us turn to the Tax Code of the Russian Federation:

- when determining the tax base for personal income tax, all income of the taxpayer received by him both in cash and in kind is taken into account (clause 1 of article 210 of the Tax Code of the Russian Federation);

- An employee’s income in kind includes payment (in whole or in part) by the employer for goods (work, services) or property rights, including food and rest. The tax base is defined as the cost of such goods (work, services) (clauses 1, 2 of Article 211 of the Tax Code of the Russian Federation).

When organizing a corporate party for employees, the employer pays for the rental of the hall, banquet services and meals, entertainment services, travel arrangements to the event venue and other expenses. Thus, employees taking part in a corporate event receive a material benefit equal to the cost of the specified services (goods) per person. From this amount the employer, as a tax agent, must calculate and withhold personal income tax.

This position is adhered to by the Ministry of Finance of the Russian Federation; moreover, representatives of the department explain that the employer must take all possible measures to assess and take into account the economic benefits (income) received by employees from participating in corporate events (Letters of the Ministry of Finance of the Russian Federation dated August 14, 2013 No. 03-04- 06/33039, dated 04/03/2013 No. 03-04-05/6-333, dated 03/06/2013 No. 03-04-06/6715). Such measures include compiling last name lists of employees actually present at the corporate event, using rented transport to travel to the event venue, etc. In this case, the taxable income of each employee is calculated by dividing the total amount of expenses for holding a corporate event by the number of participants.

However, in real life, determining the income of each employee from participation in a corporate event is often quite problematic. The most common case is the lack of reliable information about the number and composition of participants. In such situations, when it is impossible to personify and evaluate the economic benefit received by each specific employee, income subject to personal income tax does not arise. This opinion is shared by the Ministry of Finance (Letters of the Ministry of Finance of the Russian Federation dated 08/14/2013 No. 03-04-06/33039, dated 04/03/2013 No. 03-04-05/6-333, dated 03/06/2013 No. 03-04-06/6715) and judicial authorities (Resolutions of the Federal Antimonopoly Service of the Northern Territory of February 21, 2008 No. A56-30516/2006, Federal Antimonopoly Service of the Moscow Region of September 23, 2009 No. KA-A40/8528-09).

! Please note: To ensure that tax inspectors do not have grounds to charge additional personal income tax on employee income from participation in a corporate event, it is better to avoid directly indicating the quantity in documents related to its holding (contracts, invoices for payment, certificates of services rendered, etc.) participants of the event, cost per person, and even more detailed lists of those present.

Insurance premiums from the cost of participation in a corporate event

Insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund are levied on payments and other remuneration made within the framework of labor relations (clause 1, article 7 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation”). Federation, Federal Compulsory Medical Insurance Fund"). Such payments include wages and other accruals included in the remuneration system, such as bonuses and gifts given as incentives for work. At the same time, the base for calculating contributions includes payments and rewards not only in cash, but also in kind.

However, there is no need to charge insurance premiums for the cost of employee participation in a corporate event. This clarification was given by the Ministry of Labor in Letter No. 14-1-1061 dated May 24, 2013. According to paragraph 4 of this letter, the organization’s expenses for holding corporate events on the occasion of holidays are not targeted payments in favor of specific employees. Therefore, contributions to extra-budgetary funds are not subject to taxation.

Accounting for corporate expenses when calculating income tax, simplified tax system

The costs of organizing and holding a festive corporate party can be very significant. Therefore, the question of including these amounts in tax expenses worries many accountants. Let's figure it out.

In accordance with the Tax Code of the Russian Federation, expenses for tax accounting purposes are recognized as justified, that is, economically justified, and documented expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation). In addition, the expenses must relate to activities aimed at generating income. It is obvious that the costs of corporate entertainment events are not justified from an economic point of view and are not associated with generating income. Therefore, when calculating income tax, expenses for holding a corporate event do not reduce the tax base.

When calculating tax according to the simplified tax system (with the object of taxation “income-expenses”), expenses for holding a corporate event also cannot be taken into account, since they are not included in the closed list of accepted expenses established in Art. 346.16 Tax Code of the Russian Federation.

Thus, the costs associated with holding entertainment corporate events are not taken into account either when calculating income tax or the simplified tax system. This position was expressed many years ago by representatives of the Ministry of Finance (Letters of the Ministry of Finance of Russia dated December 20, 2005 No. 03-03-04/1/430, dated September 11, 2006 No. 03-03-04/2/206).

What to do in this case? There are at least two options: do not accept corporate expenses for tax accounting and sleep peacefully, or try to “disguise” these expenses as accepted ones.

The most common option for disguising expenses for a corporate event is to register them and record them as entertainment expenses. Let me make a reservation right away that this option is not suitable for organizations using the simplified tax system, since entertainment expenses, like expenses for a corporate event, do not reduce the tax base for the single tax. But organizations that pay income tax have the right to take entertainment expenses into tax accounting (clause 1, paragraph 22, article 264 of the Tax Code of the Russian Federation), but their amount should not exceed 4% of labor costs.

! Please note: When choosing this option for accounting for expenses for a corporate event, you need to make sure that the documents “clearly” show the fact of holding a representative event, that is

- Representatives of other organizations (business partners, clients, potential clients, etc.) are invited.

- The event is official and not entertainment in nature. Entertainment expenses include expenses for an official reception (breakfast, lunch or other similar event) of representatives of other organizations and representatives of the taxpayer, transportation support for the delivery of these persons to the venue of the event, and buffet service. But expenses for organizing entertainment and recreation do not apply to entertainment expenses (clause 2 of Article 264 of the Tax Code of the Russian Federation).

- there are all the necessary primary accounting documents (contracts, certificates of services rendered, etc.), as well as supporting documents (an order for a hospitality event, an estimate of entertainment expenses, a report on the event, indicating the purpose and results achieved, etc.). d.) (Letter of the Ministry of Finance of the Russian Federation dated November 1, 2010 No. 03-03-06/1/675).

For example, a New Year's banquet, if in addition to employees, representatives of business partners are also invited to it, it is quite possible to register and record it as a representative event, the purpose of which is to sum up the results of the outgoing year and discuss plans for cooperation for the next year. In this case, of course, the conditions listed above must be met, otherwise inspectors will have every reason to reclassify such expenses and charge additional income tax.

VAT on the cost of the corporate event

Organizations and individual entrepreneurs that are VAT payers have the right to reduce the calculated tax by the amount of input VAT. In this case, only those amounts of tax that were presented to the taxpayer in connection with the purchase of goods and services intended for carrying out transactions recognized as objects of taxation under VAT are subject to deduction (clause 2 of Article 171 of the Tax Code of the Russian Federation). Therefore, it is impossible to deduct VAT on the cost of goods and services purchased for a corporate event. When carrying out corporate events, the object of VAT taxation, and, accordingly, the right to deduction, does not arise (Letters of the Ministry of Finance of Russia dated December 13, 2012 No. 03-07-07/133 and dated March 28, 2011 No. 03-07-07/11) .

Accounting

In accounting, unlike tax accounting, expenses for holding a corporate event must be reflected in full, as part of other expenses. In this regard, organizations that are taxpayers for income tax and apply PBU 18/02 “Accounting for calculations for income tax of organizations” have a permanent tax difference in the amount of costs for carrying out the event and, accordingly, a permanent tax liability. Let me remind you that small businesses are not required to apply the specified PBU.

I propose to consider the accounting procedure for corporate events using an example.

Example. The head of Snezhinka LLC decided to organize a New Year's corporate party for employees. For this purpose, cafe services for banquet services and hall rental were purchased in the amount of 118,000 (including VAT 18,000), as well as the services of a toastmaster - an individual not registered as an individual entrepreneur, in the amount of 25,000. The LLC entered into an agreement with the toastmaster civil contract. LLC applies the general taxation system. According to the accounting policy for tax accounting purposes, the LLC applies PBU 18/02.

| Debit | Credit | Sum | Contents of operation |

| Cafe services | |||

| 91/2 | 60 | 100,000 rub. | Cafe services for banquet services and hall rental were accepted for accounting on the basis of an act of services rendered |

| 19 | 60 | 18,000 rub. | The amount of VAT on the cost of cafe services has been taken into account |

| 91/2 | 19 | 18,000 rub. | The VAT amount is written off for other expenses |

| 60 | 51 | 118,000 rub. | Funds were transferred to pay for cafe services |

| 99 | 68/Income tax | RUB 23,600 | A permanent tax liability is reflected (118,000 x 20%) |

| Toastmaster services | |||

| 91/2 | 76 | 25,000 rub. | Toastmaster's services are accepted for accounting on the basis of the act of services rendered and the contract. |

| 76 | 68/NDFL | RUB 3,250 | Personal income tax withheld from the amount of remuneration to an individual (25,000 x 13%) |

| 76 | 51 | RUB 21,750 | Remuneration transferred to an individual for the services of a toastmaster |

| 91/2 | 69 | RUB 6,775 | Insurance premiums are calculated from the amount of remuneration under a civil contract * (25,000 x (22% + 5.1%)) |

| 99 | 68/Income tax | 5,000 rub. | A permanent tax liability is reflected (25,000 x 20%) |

* Please note: Despite the fact that expenses for holding an entertainment corporate event are not taken into account for tax purposes, expenses in the form of insurance premiums from the amounts of remuneration under civil contracts related to the holding of such an event can be taken into account for tax purposes (clause 1 clause 1 article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated March 20, 2013 No. 03-04-06/8592).

So, in this article we found out how the costs of holding a corporate event are reflected in accounting and tax accounting. If, in addition to organizing a festive event, employees are paid bonuses or given gifts, then I recommend reading the articles Bonuses for employees in accordance with labor and tax laws and Gifts for employees: registration, taxation, accounting.

Now, dear colleagues, the main question for you, I hope, will be what outfit to choose for the holiday.

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any comments or questions, write to us and we’ll discuss them!

Normative base

- Tax Code of the Russian Federation

- Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

- Resolutions of the Federal Antimonopoly Service of the Northern Territory of February 21, 2008 No. A56-30516/2006, of the Federal Antimonopoly Service of the Moscow Region of September 23, 2009 No. KA-A40/8528-09

- Letter of the Ministry of Labor of the Russian Federation dated May 24, 2013 No. 14-1-1061

- Letters from the Ministry of Finance of the Russian Federation:

- dated 08/14/2013 No. 03-04-06/33039,

- dated 04/03/2013 No. 03-04-05/6-333,

- dated 03/06/2013 No. 03-04-06/6715,

- dated December 20, 2005 No. 03-03-04/1/430,

- dated 11.09.2006 No. 03-03-04/2/206,

- dated 01.11.2010 No. 03-03-06/1/675,

- dated December 13, 2012 No. 03-07-07/133,

- dated March 28, 2011 No. 03-07-07/11,

- dated March 20, 2013 No. 03-04-06/8592

Find out how to read the official texts of these documents in the Useful sites section

Payment of bonuses to pay for corporate events

Not the best, but a common way to pay for a New Year's party. This option is used often. The company pays the employee a production bonus. Then the workers deposit this money into the company's cash desk to pay for the New Year's banquet. But don’t forget: having received a bonus, an employee may refuse to participate in the New Year’s holiday, and you have no right to force him to return the money to the cash register. If the company nevertheless decides to take a risk and pay such bonuses to employees, in this case one must not forget that they will be subject to personal income tax and insurance contributions.

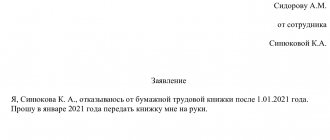

Features of documentation

Any company expenses taken into account for taxation must be justified and documented. Entertainment expenses should be properly documented. Moreover, no special forms are provided. Provide templates and a list of supporting documentation in your accounting policies.

It is recommended to use the following documents:

- Order of the head of the organization to hold a representative event. Be sure to indicate in the order the date, place and time of the reception. Also outline the goals of the event.

- Program for hosting guests or board members. Prepare the event program as an appendix to the order. Separately, the paper will not have much weight.

- Cost estimates for events. Indicate in detail all categories of costs that are aimed at hosting guests.

- Report on the event. Compiled in any form by the person responsible for organizing and conducting the reception. It is required to indicate the results of the event.

- Act on write-off of expenses and payment documents. Please note that the write-off act must be signed by the chief accountant. And the manager approves the act.

Documentation is required. During an on-site inspection by the Federal Tax Service, inspectors will definitely request forms.

How to calculate the simplified tax system “income minus expenses”

The calculation requires two indicators: income and expenses. Income is income from business activities.

Expenses must meet a number of conditions specified in Article 346.16 of the Tax Code of the Russian Federation.

1

They must be economically justified, that is, aimed at generating income within the scope of business activities. The purchase of a fur coat for a manager or a soft toy for an employee’s child will not be considered expenses.

2

Documents confirming expenses are needed: cash receipt, payment order, invoice, certificate of completion of work, etc.

3

Expenses must be closed: what you received in full is paid; prepayment for a service or product is not considered an expense

Remuneration: how to calculate the standard

It is possible to correctly calculate the standard only by determining what exactly is included in labor costs. When resolving the issue, you should be guided by Article 255 of the Tax Code of the Russian Federation.

The list of company expenses related to wages is open. That is, it can be any expenses that meet the required conditions:

- accruals in favor of the company's employees are made on the basis of current legislation;

- the conditions and amounts of payment are fixed in employment contracts, the calculation rules are established in the regulations on remuneration and the collective agreement;

- all types of accruals in favor of employees must be documented and have an economic justification (Article 252 of the Tax Code of the Russian Federation).

The company has the right to determine costs either on an accrual basis or on a cash basis. The decision must be fixed in the accounting policy.

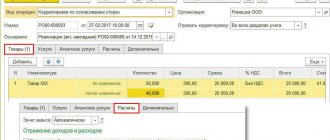

Example: income tax and entertainment expenses

Vesna LLC uses OSNO. In the 2nd quarter of 2021, the company received business partners to conclude a new contract for the supply of products. A total of 250,000 rubles were spent on the event, including:

- transportation costs for delivering guests to the event venue - 20,000 rubles, including VAT - 4,000 rubles;

- catering (breakfast, coffee break, gala lunch, dinner) - 100,000 rubles, VAT - 20,000 rubles;

- services of buffet staff - 30,000 rubles;

- tickets for the theater premiere - 10,000 rubles, VAT - 2,000 rubles;

- accommodation for guests in a luxury hotel - 40,000 rubles;

- excursion by boat to local attractions - 50,000 rubles.

The amount of VAT on all costs for the event is 26,000 rubles.

The wage fund for the 2nd quarter of 2021 amounted to 7,000,000 rubles. 4% of payroll - 280,000 rubles.

Consequently, the company, according to the established limit, has the right to offset entertainment expenses in the 2nd quarter in the amount of no more than 280,000 rubles. But the entire cost of holding events cannot be taken into account! Since not all expenses are representative.

Vesna LLC can accept for tax accounting only the amount of costs for transport delivery of guests, buffet services and meals - 150,000 rubles. But expenses for theatrical performances, boat excursions and hotel rooms cannot be taken into account. These expenses must be paid from the company's net profit. That is, from the money that will remain in the company after income tax.

Input VAT can only be refunded in the amount of 24,000 rubles. That is, only from hospitality expenses (transportation services and food). But you cannot get a deduction from theater tickets.

Entertainment expenses - how are these expenses reflected in the report?

The report on the representative event reflects:

- date of the event;

- the purpose of the official event;

- program and composition of event participants;

- the results of the relevant event;

- the amount of costs associated with the event;

- other significant facts about the event.

Note that in practice, many enterprises prefer to reflect the program of an official event not as part of a report, but in a separate document.

Entertainment expenses - what are these expenses, according to the judges?

There are known precedents when expenses incurred on the basis of an agreement for the provision of consulting services concluded between a company and its partner were recognized as representative expenses (Resolution of the Federal Antimonopoly Service of the North-Western District dated January 27, 2006 No. A42-8823/04-28).

Firms also have a chance to be recognized as representatives of the expenses incurred in organizing presentations for media representatives. Thus, the Federal Antimonopoly Service of the Central District, in its resolution dated January 12, 2006 No. A62-817/2005, established that the company organizing a business seminar rightfully attributed to PR the costs of transportation services for journalists of various media outlets who were invited to this seminar, while The Federal Tax Service refused to classify these expenses as representative expenses. However, in this case, what mattered was the purpose for which media representatives were invited - to establish business cooperation with print media and television companies, within the framework of which it was supposed to place advertisements and articles on the relevant media platforms.

The position of the Federal Tax Service and the courts is also different with regard to the recognition by the PR of payment for the accommodation of persons invited to an official event in a hotel. Tax authorities do not consider these expenses to be representative expenses due to the fact that they are not included in the list of expenses defined in clause 2 of Art. 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 16, 2007 No. 03-03-06/1/235). But the judicial precedent, according to which the FAS of the West Siberian District issued a resolution dated March 1, 2007 No. F04-9370/2006 (30552-A81-27), indicates that the arbitration may have a different opinion on this issue. Then the court considered that payment for hotel accommodation of invited persons is still a PR, since the concept of “service”, fixed in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, can be interpreted more broadly than in the context of the types of PR listed in the Tax Code of the Russian Federation, including payment for hotel accommodations for guests of an official event.