Home / Uncategorized / How to include a laptop in accounting for more than 100 thousand rubles

Initial data:

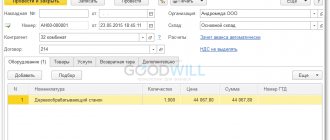

- The cost of the purchased computer (laptop) is 44,840 rubles, including VAT 6,840 rubles,

- The cost of the software is 5900 rubles, including VAT 900 rubles.

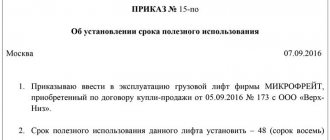

- The useful life of a computer in accounting and tax accounting is set at 25 months,

- Depreciation is calculated using the straight-line method.

ACCOUNTING and POSTING purchase of a laptop over 40,000-100,000 rubles

Thus, examples of fixed assets include buildings, structures, equipment, computers, cars, tools, perennial plantings, etc. But one more important criterion must be taken into account - the cost of fixed assets. It is different for accounting and tax accounting. In accounting, an asset is recognized as a fixed asset if its value exceeds 40,000 rubles. In tax accounting, the cost of acquiring fixed assets is more than 100,000 rubles (clause 5 of PBU 6/01, clause 1 of Article 256 of the Tax Code of the Russian Federation).

How to take into account a computer worth less than 20 thousand rubles.

Info

If, according to its provisions, the OS, when accepted for accounting, cannot cost less than 40,000 rubles, then any computer with a cost not exceeding this limit must be included in inventory accounts and, at the time of release into operation, taken into account on the balance sheet, for example on a self-opened account 012 “Equipment in operation” (with details by place of storage or use). If your accounting policy allows you to take into account any asset that meets the requirements of PBU 6/01 as part of the operating system, regardless of its value, then inexpensive computers can be safely attributed to account 01 “Fixed Assets”.

At the same time, accounting for fixed assets worth less than 40,000 rubles. will be no different from accounting for objects of higher value. Results The procedure for reflecting fixed assets worth up to 100,000 rubles.

What needs to be done from March 12 to 16 In order not to forget about important accounting matters, you can keep a diary, install a special program on your smartphone that will remind you of plans, or stick stickers covered with notes on your work monitor. But the easiest way is to read our reminders weekly. < < …

Individual entrepreneurs should not rush to pay 1% contributions for 2021. Firstly, because from this year the deadline for paying such contributions has been postponed from April 1 to July 1. Accordingly, 1% contributions for 2021 must be transferred to the budget no later than 07/02/2018 (July 1 - Sunday). <... The transition from one Federal Tax Service Inspectorate to another will not require mandatory reconciliation. The Tax Service has updated the regulations for organizing work with payers of taxes, fees, insurance contributions for compulsory pension insurance, as well as tax agents.

Accounting for fixed assets in 2021: cost, depreciation

Property

Features of depreciation calculation Basis

Movable property worth up to 10 thousand rubles. (except for library collection objects) Do not charge. The cost of these objects upon commissioning (acceptance for accounting) is immediately written off as expenses and reflected on the off-balance sheet account 21 Clause 39 of the standard “Fixed Assets”, clause 373 of Instruction No. 157n Movable and immovable property worth from 10 thousand to 100 thousand rubles. Charge 100% depreciation at a time when the facility is put into operation. Clause 39 of the standard “Fixed assets” Library fund worth up to 100 thousand rubles. (except for periodicals) Movable and immovable property, as well as objects of the library collection more than 100 thousand rubles. Accrue according to depreciation rates Subparagraph “a” of paragraph 39 of the standard “Fixed Assets”

Please note => Documents for Entering into Inheritance Under a Will for an Apartment

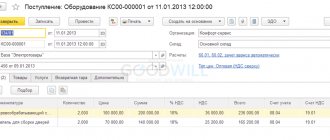

Accounting entries

Transactions with fixed assets are reflected in accounting with the following entries:

| Debit | Credit | Operation name |

| Receipt of fixed assets | ||

| 08 | 60, 10, 70, 69 | The expenses incurred for the acquisition or creation of OS are recorded in accounting |

| 07 | 60, 10, 70, 69 | The costs of preparing the installation of the OS and its installation are recorded in accounting |

| 08 | 07 | Installation costs transferred |

| 19 | 60 | Input VAT on fixed assets costs is recorded in accounting |

| 68 | 19 | Input VAT is accepted for deduction |

| 01 | 08 | The OS object is accepted for accounting |

| Depreciation | ||

| 20, 23, 25, 26, 29, 44 | 02 | Depreciation of fixed assets was calculated based on the direction of their use |

| Restoration, modernization, repair | ||

| 08 | 60 | The price of a third-party company for repairs and OS upgrades has been fixed |

| 19 | 60 | VAT recorded on contractor's work |

| 08 | 10, 70, 69 | Repairs and modernization of the OS were carried out on our own |

| 01 | 08 | All expenses incurred are written off to increase the cost of the operating system. |

| Sale | ||

| 62 | 91 | Income from the sale of fixed assets is recorded in accounting |

| 91 | 68 | VAT recorded on sales |

| 02 | 01 | Accrued depreciation written off |

| 91 | 01 | The residual value of the asset is written off |

| Liquidation | ||

| 02 | 01 | Depreciation on the liquidated asset has been written off |

| 91 | 01 | Residual value written off |

Which depreciation group should the server be assigned to?

In accordance with the provisions of paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, property and other objects of intellectual property that are the property of the taxpayer are recognized as depreciable if they are used to generate income, their useful life is more than 12 months, and the original cost exceeds 40,000 rubles. Therefore, depreciable property includes intangible assets with a lifespan! useful life more than 12 months and an initial cost of more than 40,000 rubles. used in activities to generate income.

Acceptance for registration of a computer worth more than 40,000

Add to favoritesSend by email Accounting for fixed assets worth up to 100,000 rubles has a number of nuances. Let's look at what causes them and consider accounting for such objects from the point of view of accounting and tax laws.

Formation of the initial cost of a fixed asset Accounting for fixed assets in accounting and tax registers Accounting for a computer worth less than 40,000 rubles. Results Formation of the initial cost of a fixed asset The procedure for accounting for fixed assets (FPE) is regulated by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n).

In this normative act (p.

Quite often, accountants have a question: is it necessary and how to take into account property that meets the characteristics of fixed assets, but is worth less than the established limit, after actually writing off its value in accounting and tax accounting?

In accordance with clause 5 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved. by order of the Ministry of Finance of the Russian Federation dated March 30, 2001. No. 26n, assets that meet all the characteristics of fixed assets, but whose cost per unit is less than the limit established by the organization’s accounting policy, can be taken into account as part of inventories. Since 2011, the limit has been 40,000 rubles. According to Art. 256 of the Tax Code of the Russian Federation, property worth less than 40,000 rubles. is not taken into account as part of depreciable property. For property registered before 01/01/2011, the value limit is 20,000 rubles. both in accounting and for the purposes of calculating income tax.

Thus, the organization has the right to write off as expenses at a time the cost of property included in inventories and put into operation. Write-offs are made in the manner established by the organization’s accounting policy regarding accounting for material expenses.

PBU 6/01 obliges to organize proper control over the movement of these objects in order to ensure their safety in production and during operation.

The need to account for decommissioned but in operation objects arises not only because of the requirements of regulations. If an organization is interested in economical and rational spending of its funds, then correct accounting of decommissioned but operated facilities will allow:

- monitor the safety and serviceability of property, compliance with the rules of operation of property by employees of the organization;

- document and justify the costs of repairing and operating the property, purchasing consumables, purchasing new similar property;

- ensure compliance of the actual availability of property and accounting data when conducting an inventory and correctly take into account the results of the inventory of property;

- if necessary, make claims to persons responsible for damage, destruction or loss of property for compensation for damage caused to the organization (damage in this case may be expressed in the costs of repair and restoration of property, early acquisition of similar property).

If an organization does not keep records of written-off but exploited property, then the consequences may be: the likelihood of proving the validity of expenses for repairs and operation of unaccounted for property; uncontrolled acquisition of new property similar to the one written off, and the likelihood of proving the validity of such expenses; the obligation to register unaccounted property identified as surplus as a result of inventory, and accordingly increase taxable income; the impossibility of bringing to justice those responsible for damage and destruction of the organization’s property.

Methods of monitoring decommissioned but used property worth less than 40,000 rubles. accounting rules are not defined, therefore the organization has the right to independently develop methods for accounting for this property, based on general accounting principles. Unified forms of primary documents for accounting for such property have not been approved. Paragraph 5 of PBU 6/01 determines that these assets can be accounted for as part of inventories. In the rules for accounting for inventories set out in the Accounting Regulations “Accounting for inventories” PBU 5/01, approved. by order of the Ministry of Finance of the Russian Federation dated 07/09/2001 No. 44n, and Methodological guidelines for accounting of inventories, approved. by order of the Ministry of Finance of the Russian Federation dated December 28, 2001. No. 119n in the current edition, there are also no specific instructions on organizing the accounting of written-off but in use property. Based on the general requirements of these regulations, we can conclude that the organization must approve in its accounting policy an account for accounting for this property, forms of primary documents for property accounting, and document flow rules. Separate orders of the head of the organization approve:

- a list of officials responsible for the safety and operation of property;

- norms of consumption (operation) of property.

Primary documents can be: an object registration card (inventory card); acts on property repairs performed; acts declaring property unsuitable for further use; property disposal acts.

Consumption (operation) rates can be established based on the manufacturer’s data on the service life of the object, operating conditions (load volume, temperature factors, etc.).

Some departmental accounting regulations provide recommendations for accounting for such property and provide samples of primary documents. For example, Order of the Ministry of Agriculture of the Russian Federation dated May 16, 2003 N 750 “On approval of specialized forms of primary accounting documentation” approves the forms of primary documents for recording inventory and household supplies, which can be used as the basis for developing your own primary documents.

Accounting for decommissioned but operating objects worth less than 40,000 rubles. may be maintained in an off-balance sheet account. The Chart of Accounts, in its current version, does not provide for an account for accounting for such property, but in practice it is common to use either an unused account (for example, account 006) or the opening of a new account. In the 1C program, account MTs.04 is used for these purposes. Accounting for the off-balance sheet account is carried out using a simple system, i.e. the account entry is made without correspondence with any other account. The debit of the account reflects the receipt and availability of property, and the credit reflects the disposal of property. Property is accounted for according to nomenclature, and, if necessary, also according to materially responsible persons or in another manner established by the organization. Accounting is carried out by quantity. The cost for accounting purposes may be reflected in the card of this object. Data on this property are not reflected in the financial statements, since in fact their value has already been written off, and further accounting of this property does not affect information about the financial condition of the organization.

For the purpose of calculating income tax, expenses for the maintenance, repair and operation of this property are classified as other expenses, as reported in the letter of the Ministry of Finance of the Russian Federation dated June 30, 2008 N 03-03-06/1/37: “expenses for repairing property worth less than 20,000 rubles (for example, furniture, computers, office equipment) that meet the criteria provided for in Article 252 of the Code may be taken into account for profit tax purposes as other expenses and recognized in the reporting (tax) period in which they were incurred in the amount of actual expenses "

Difference between accounting and tax accounting

- As an OS - if the server is more expensive than 100,000 rubles. In this case, you need to determine the depreciation group and depreciation method. Thus, accounting for property more expensive than 100,000 rubles. coincides both in accounting (BU) and in tax accounting (TA).

- Property less than 100,000 rubles. in tax accounting, the company does not have the right to depreciate - this is a gross violation of accounting rules (Article 120 of the Tax Code of the Russian Federation). But such property can be classified as material expenses and written off evenly, taking into account its useful life. In this case, when taking into account the operating system, it is more expensive than 40,000 rubles. but cheaper than 100,000 rubles. NU and BU of the company will coincide.

- The company can write off property worth less than RUB 100,000. to material expenses immediately - this method is convenient to choose if the server costs less than 40,000 rubles. Then the NU and BU will also coincide. Otherwise, temporary differences will arise in accordance with clause 4 of PBU 18/02.

Please note => Accounting for the issuance of rent for a land share in grain

31.01.2020

by order of the Ministry of Finance of the Russian Federation dated 07/09/2001 No. 44n, and Methodological guidelines for accounting of inventories, approved. by order of the Ministry of Finance of the Russian Federation dated December 28, 2001. No. 119n in the current edition, there are also no specific instructions on organizing the accounting of written-off but in use property. Based on the general requirements of these regulations, we can conclude that the organization must approve in its accounting policy an account for accounting for this property, forms of primary documents for property accounting, and document flow rules.

Postings for the purchase of equipment or other operating systems

For the purpose of calculating income tax, expenses for the maintenance, repair and operation of this property are classified as other expenses, as reported in the letter of the Ministry of Finance of the Russian Federation dated June 30, 2008 N 03-03-06/1/37: “expenses for repairing property worth less than 20,000 rubles (for example, furniture, computers, office equipment) that meet the criteria provided for in Article 252 of the Code may be taken into account for profit tax purposes as other expenses and recognized in the reporting (tax) period in which they were incurred in the amount of actual expenses "

Consultations: corporate property tax

Thus, the organization has the right to write off as expenses at a time the cost of property included in inventories and put into operation. Write-offs are made in the manner established by the organization’s accounting policy regarding accounting for material expenses.

PBU 6/01 obliges to organize proper control over the movement of these objects in order to ensure their safety in production and during operation. The need to account for decommissioned but in operation objects arises not only because of the requirements of regulations.

When temporary differences occur

For each object that is reflected differently in accounting than in tax accounting, it is necessary to show the difference. This requirement is established in PBU 18/02 “Accounting for calculations of corporate income tax.”

In this case, the difference will be temporary, because at the end of the useful life the initial cost of the object will be written off both in the NU and in the accounting book. Consequently, the discrepancies between both types of accounting will eventually be reduced to zero (read more about this in the article “How to apply PBU 18/02 “Accounting for corporate income tax calculations” in practice)”).

This applies to all fixed assets without exception, the initial cost of which falls in the range from 40 thousand rubles to 100 thousand rubles inclusive. Also, temporary differences appear if in the company’s accounting, objects worth less than 40 thousand rubles are reflected as part of fixed assets, and not as part of inventories.

Consultations: corporate property tax

- Accounting for the receipt of fixed assets when contributing to the authorized capital When contributing a fixed asset to the authorized capital, the founders jointly agree on the cost at which the object will be accepted for accounting and register it in the constituent documents. It should be noted that if the cost exceeds 200 minimum wages, then an independent assessment is required. Accounting entries upon receipt of fixed assets in the form of a contribution to the authorized capital:

- Debit Credit Name of transaction 08 75 Receipt of fixed assets in the form of a contribution to the authorized capital 01 08 Commissioning of fixed assets

- Accounting for receipt of fixed assets during construction

During construction, an object is accounted for at its cost, which consists of all costs associated with the purchase of materials for construction, transportation and contract work.